REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 4.32 Billion by 2030 | 5 % | North America |

| by Type | by Application |

|---|---|

|

|

SCOPE OF THE REPORT

Hinge for Furniture Market Overview

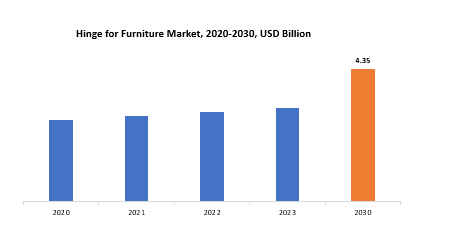

The global Hinge for Furniture market is anticipated to grow from USD 3.09 Billion in 2023 to USD 4.32 Billion by 2030, at a CAGR of 5 % during the forecast period.

A furniture hinge is a mechanical component that allows two connected objects to move or rotate; usually, it permits one part to swing or pivot in relation to the other. Hinges are essential for making it easier for doors, lids, and other movable parts of furniture to open and close. These elements can be anything from desk lids and table leaves to wardrobe panels and cabinet doors. A furniture hinge’s main purpose is to create a flexible joint between two surfaces so that motion can be smoothly and deliberately executed. Since they make furniture easier to use and access, hinges are crucial to the practical functionality of many types of furniture. To accommodate a range of uses and aesthetic tastes, furniture hinges are available in an assortment of forms and patterns. Butt hinges, hidden hinges, piano hinges, and continuous hinges are a few examples of common hinge types.

The kind of furniture, the intended range of motion, and general design considerations all influence the hinge selection. Furniture hinges serve a practical purpose as well as enhancing the piece’s overall aesthetic. While some hinges are hidden for a neater, more streamlined appearance, others are visible and may function as decorative elements. For designers and manufacturers, the hinge’s material and finish are crucial because they can affect the furniture’s aesthetic appeal.

For doors, cabinets, and other furniture pieces to open and close smoothly, hinges are essential. They offer the required pivot point, enabling smooth and easy movement. It is important to select the appropriate hinge for the intended function because the type of hinge can have a significant impact on range of motion. Hinges make sure that moving parts are firmly fastened, which adds to the furniture’s structural integrity. Strong, well-made hinges help keep furniture from sagging, shifting, or breaking over time. For large, frequently used cabinets or heavy doors, this structural support is extremely crucial.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Type, Application and Region |

| By Type |

|

| By Application |

|

|

By Region

|

|

Hinge for Furniture Market Segmentation Analysis

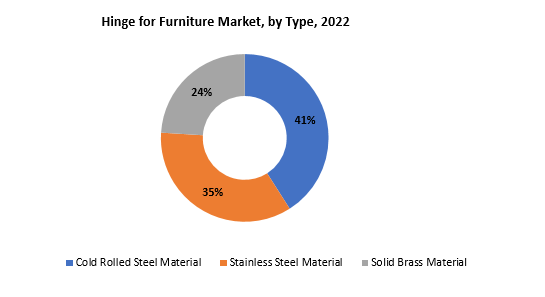

The global Hinge for Furniture market is divided into three segments Type, application and region. By type it is divided as Cold Rolled Steel Material, Stainless Steel Material, And, Solid Brass Material. Hinges made of cold-rolled steel are renowned for their robustness and longevity. The material’s structural integrity is improved through the cold rolling process, which increases its resistance to bending and warping.

Cold Rolled Steel hinges are a great choice for heavy-duty furniture, like cabinets or doors that are used frequently. This material also offers a smooth finish, which adds to a polished and expert appearance. It is a well-liked option in both residential and commercial settings due to its strength and dependability. Because of their superior resistance to corrosion, stainless steel hinges are perfect for applications where exposure to moisture or harsh environments is a concern. As this material can tolerate moisture, humidity, and other environmental conditions, it is especially well-suited for outdoor furniture, kitchen cabinets, or bathroom fixtures. Solid brass hinges are prized for their classic elegance and visual appeal. Furniture pieces are given a sophisticated touch by the warm, golden hue of brass. Solid brass is aesthetically pleasing, but it also resists corrosion, which makes it useful for both indoor and outdoor applications. Brass hinges are frequently used on furniture that is intended to have a traditional and opulent appearance, such as high-end cabinetry or replica antique furniture. It’s important to remember, though, that brass might need occasional upkeep to maintain its appearance.

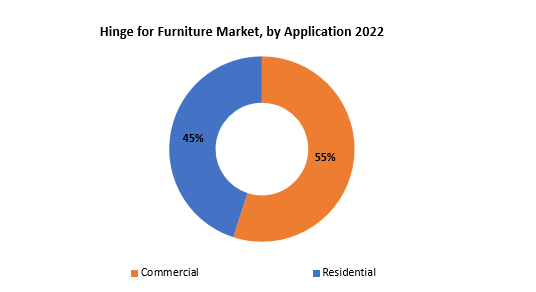

By application it is divided into Commercial, And Residential. In this Automotive holds the largest market share. Furniture in commercial settings is frequently used more frequently and holds heavier loads. For commercial use, hinges must be strong and long-lasting to tolerate frequent opening and closing. This is especially important for doors, cabinets, and other storage options in businesses like restaurants, retail stores, and offices. Commercial applications frequently utilize cold-rolled steel hinges because of their robustness and capacity to support large weights. Stainless steel can also be selected because of its resistance to corrosion, which makes it appropriate for settings with high levels of humidity and moisture. Most of the time, durability and functionality are chosen over aesthetic considerations. Because of their sleek appearance, hidden hinges may be chosen in some commercial settings, particularly in contemporary office buildings or upscale retail establishments. From kitchen cabinets to bedroom wardrobes, there is a vast array of styles and purposes for furniture used in homes. Functionality and aesthetics are two factors that frequently influence hinge selection in residential applications.

Although furniture for homes still needs to be functional, there is more room for decorative elements. In homes, solid brass hinges are common, particularly for furniture that wants to have an elegant or vintage appearance. Because of their sleek appearance, stainless steel hinges are also a popular choice for contemporary kitchens and bathrooms. Depending on style preferences, residential furniture may use both types of hinges. While exposed hinges might be preferred for their decorative elements in some traditional or rustic designs, concealed hinges are frequently preferred for a sleek and modern appearance. Furniture used in residential settings usually sees lighter loads and less frequent usage than furniture used in commercial settings. While hinges in these applications might not need to be as robustly constructed as those in commercial settings, they are still expected to operate dependably.

Hinge for Furniture Market Dynamics

Driver

The overall growth of the furniture industry directly affects the hinge market. As more furniture is manufactured and sold, the demand for hinges increases.

The production volume of various furniture types, such as cabinets, wardrobes, doors, and other items that depend on hinges for functionality, is increasing as the furniture industry grows. The construction industry has a direct impact on the demand for furniture hinges. There is a greater demand for furniture during times of increased construction, whether it be new residential or commercial buildings or renovations, which adds to the need for hinges. An increasing number of hinge applications are being driven by the growing demand for a variety of furniture types, such as office furniture, bedroom sets, and kitchen cabinets. The designs and functions of hinges may vary depending on the type of furniture. A higher frequency of furniture replacement and upgrading is frequently the result of economic growth and increased consumer spending. Manufacturers can now serve a larger market thanks to the globalization of the furniture industry.

The demand for hinges may rise globally as a result of this expansion’s potential to boost production and sales. The furniture industry grows as a result of contributions from both the residential and commercial sectors. Not only do residential construction and renovations require a large amount of furniture, but so do commercial projects like office buildings, hotels, and retail spaces. Design and technological advancements are frequently correlated with growth in the furniture sector. Advanced hinge technologies, like hidden hinges or soft-close mechanisms, may be incorporated into new furniture designs, increasing the demand for these specialized hinge types.

Restraint

Changes in consumer preferences for furniture styles or materials may impact the demand for certain types of hinges.

Customers may favor sleek and contemporary designs, classic or vintage styles, or minimalist aesthetics as furniture styles change. Achieving the desired look may depend in part on the hinge selection. For a sleek and efficient look, for instance, hidden or concealed hinges might be chosen, whereas decorative hinges might be selected for a more elaborate design. The preference of consumers for environmentally friendly and sustainable materials can affect hinge selection. In order to satisfy customer values, manufacturers might have to provide hinges that are low-impact on the environment or made from recycled materials. Likewise, hinges with a raw or distressed metal finish may be in demand if rustic or industrial furniture is trending. The need for particular furniture features may change in response to modifications in housing and lifestyle trends. For example, hinges facilitating smooth folding, unfolding, or modular configurations may gain popularity if consumers are choosing more and more multipurpose or space-saving furniture.

There might be an increase in demand for hinges that interface with electronic systems as smart homes become more common. These might be hinges that are compatible with home automation systems or have sensors integrated into them for automated opening and closing. The inclination towards customization and the prevalence of do-it-yourself (DIY) projects could impact hinge selection. Customers who customize furniture might search for hinges that are simple to install and can fit different design arrangements.

Opportunities

Smart furniture is gaining popularity with the rise of the Internet of Things (IoT).

A larger connected home ecosystem, in which different devices communicate with one another, may include smart furniture. This covers device integration for security systems, thermostats, smart lighting, and other Internet of things devices. Manufacturers of hinges might look into collaborating or being compatible with other smart home technologies. Create hinges that have IoT connectivity or embedded sensors. For instance, hinges that can communicate to a central smart home system whether a cabinet or door is open or closed. This could make features like automation possible or improve security. Furniture hinges should incorporate gesture or voice control functionality. Simple commands or gestures can be used by users to open or close furniture elements, giving the pieces a futuristic and convenient touch. Include hinges as a point of connectivity when integrating wireless charging into furniture. This is especially important for furniture pieces like desks and tables, where users can charge their devices by just setting them on the surface. Make use of data analytics to comprehend user preferences and behavior. Manufacturers can improve design and functionality by gaining insights into how users interact with their products through the collection and analysis of data from smart furniture.

Hinge for Furniture Market Trends

-

The incorporation of intelligent technology into furniture, encompassing hinges, remains a noteworthy development. This includes attributes like sensor-based functions, automated opening and closing, and integration with smart home systems.

-

The market for eco-friendly and sustainable materials for furniture is expanding, and hinges are no exception. Customers’ growing awareness of how products affect the environment is driving the use of low-emission finishes, recycled materials, and sustainable sourcing methods.

-

Customers are looking for individualized and distinctive furniture options. Furniture options can be made more aesthetically pleasing and personalized with hinges that can be customized in terms of size, design, and finish.

-

Soft-close hinge technology is a well-liked feature that enables doors and drawers to close with control and gentleness.

-

Hinges are also influenced by the trend toward streamlined and minimalist furniture designs. There is a growing demand for hinges that are hidden or concealed and add to a neat and uncluttered appearance.

-

Matte finishes are becoming more and more common in hardware, such as hinges, and furniture. Matte surfaces give off a sleek, contemporary look.

-

Modular and multipurpose furniture is becoming more and more popular as living spaces get smaller. Such furniture pieces’ flexibility and adaptability are made possible in large part by hinges.

Competitive Landscape

The competitive landscape of the Hinge for Furniture market was dynamic, with several prominent companies competing to provide innovative and advanced Hinge for Furniture solutions.

- Blum Inc.

- Hettich Holding GmbH & Co. oHG

- Grass America Inc.

- Salice America Inc.

- FGV Holdings Sdn Bhd

- Häfele GmbH & Co KG

- Otlav S.p.A.

- SUGATSUNE KOGYO CO., LTD.

- Titus Group

- Würth Group

- Spectrum Brands Holdings, Inc.

- Dormakaba Group

- Richelieu Hardware Ltd.

- EMKA Beschlagteile GmbH & Co. KG

- Sanwa Company Ltd.

- SOSS Door Hardware

- Simonswerk GmbH

- Archdale Quickset Ltd.

- Mepla-Alfit Inc.

- Roto Frank AG

Recent Developments:

May 21, 2023: To preserve natural resources for future generations – a promise anchored in Blum’s fundamental orientation statement. The family business therefore largely focuses on the 17 Sustainable Development Goals, established by the United Nations, in their day-to-day activities. In order to demonstrate and substantiate these efforts, the Austrian fittings specialist is showing its visitors at interzum 2023 concrete examples of sustainable action. Measures from areas such as energy and resources, transport and mobility as well as product sustainability are presented in a separate stand area on the North Boulevard of the trade fair centre, which this year has been christened the “Boulevard of Sustainability”.

September 13, 2023: Titus Group will be attending Intermob 2023 in Istanbul, Turkey. Intermob is the leading specialised fair for the furniture sub-industry, accessories, forestry products and wood technologies in Eurasia. We welcome you to visit us in Hall 12, Stand 1222B where you will be able to learn more about our latest product offerings and discover how they can boost your competitiveness.

Regional Analysis

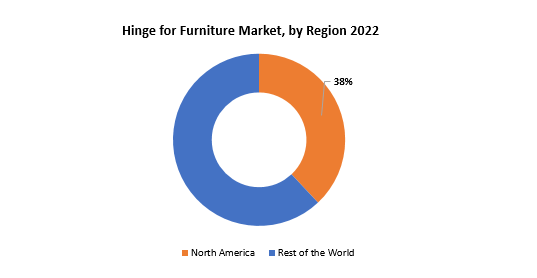

North America accounted for the largest market in the Hinge for Furniture market. North America accounted for 38% of the worldwide market value. Different trends and dynamics can be observed in different parts of the world by conducting a regional analysis of the hinge for the furniture market. The market in North America is distinguished by a strong focus on sustainability and technological innovation. IoT-enabled hinges are one example of smart technology integration that is becoming more popular as customers look for furniture with cutting-edge features. Furthermore, as people’s awareness of environmental issues has grown, so has the demand for eco-friendly materials, which has encouraged hinge manufacturers in this area to implement sustainable practices. European design places a strong emphasis on both functionality and aesthetics. Customers favor minimalist, high-quality designs, and hidden hinges that add to a sleek, elegant appearance are preferred.

The dynamics and overall growth of the furniture industry have an impact on the hinge for the furniture market in North America. The demand for creative and superior furniture solutions has been steady in the area, and this also applies to the parts used to make furniture. North American hinge producers frequently follow international trends, utilizing cutting-edge materials and technologies to satisfy the changing demands of the home and business furniture industries. The North American furniture market has made sustainability a top priority, which directly affects consumer demand for environmentally friendly hinges. Environmentally conscious manufacturing practices are becoming more and more popular among consumers in the region when it comes to furniture. In response to this trend, hinge producers emphasize the use of recycled materials, encouraging energy-efficient production techniques, and obtaining relevant certifications to appeal to the environmentally conscious consumer base.

Target Audience for Hinge for Furniture Market

- Furniture manufacturers

- Cabinet makers

- Interior designers

- Homebuilders

- Architects

- Retailers

- E-commerce platforms

- Homeowners

Import & Export Data for Hinge for Furniture Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Hinge for Furniture market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

-

Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Hinge for Furniture market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

-

Market players: gain insights into the leading players driving the Hinge for Furniture trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

-

Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

-

Product breakdown: by segmenting data based on Hinge for Furniture types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids government in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Hinge for Furniture Market Report

Hinge for Furniture Market by Type, 2020-2030, (USD Billion) (Thousand Units)

- Cold Rolled Steel Material

- Stainless Steel Material

- Solid Brass Material

Hinge for Furniture Market by Application, 2020-2030, (USD Billion) (Thousand Units)

- Commercial

- Residential

Hinge for Furniture Market by Region, 2020-2030, (USD Billion) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Hinge for Furniture market over the next 7 years?

- Who are the major players in the Hinge for Furniture market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the Hinge for Furniture market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Hinge for Furniture market?

- What is the current and forecasted size and growth rate of the global Hinge for Furniture market?

- What are the key drivers of growth in the Hinge for Furniture market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Hinge for Furniture market?

- What are the technological advancements and innovations in the Hinge for Furniture market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Hinge for Furniture market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Hinge for Furniture market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL HINGE FOR FURNITURE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON HINGE FOR FURNITURE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL HINGE FOR FURNITURE MARKET OUTLOOK

- GLOBAL HINGE FOR FURNITURE MARKET BY TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- COLD ROLLED STEEL MATERIAL

- STAINLESS STEEL MATERIAL

- SOLID BRASS MATERIAL

- GLOBAL HINGE FOR FURNITURE MARKET BY APPLICATION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- COMMERCIAL

- RESIDENTIAL

- GLOBAL HINGE FOR FURNITURE MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCT OFFERED, RECENT DEVELOPMENTS)

- BLUM INC.

- HETTICH HOLDING GMBH & CO. OHG

- GRASS AMERICA INC.

- SALICE AMERICA INC.

- FGV HOLDINGS SDN BHD

- HÄFELE GMBH & CO KG

- OTLAV S.P.A.

- SUGATSUNE KOGYO CO., LTD.

- TITUS GROUP

- WÜRTH GROUP

- SPECTRUM BRANDS HOLDINGS, INC.

- DORMAKABA GROUP

- RICHELIEU HARDWARE LTD.

- EMKA BESCHLAGTEILE GMBH & CO. KG

- SANWA COMPANY LTD.

- SOSS DOOR HARDWARE

- SIMONSWERK GMBH

- ARCHDALE QUICKSET LTD.

- MEPLA-ALFIT INC.

- ROTO FRANK AG *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 4 GLOBAL HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL HINGE FOR FURNITURE MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL HINGE FOR FURNITURE MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA HINGE FOR FURNITURE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA HINGE FOR FURNITURE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 13 US HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 14 US HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 15 US HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 16 US HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 18 CANADA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 CANADA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 22 MEXICO HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 24 MEXICO HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA HINGE FOR FURNITURE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA HINGE FOR FURNITURE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 32 BRAZIL HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 34 BRAZIL HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 36 ARGENTINA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 38 ARGENTINA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 40 COLOMBIA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 42 COLOMBIA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC HINGE FOR FURNITURE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC HINGE FOR FURNITURE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 54 INDIA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 56 INDIA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 58 CHINA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 60 CHINA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 62 JAPAN HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 64 JAPAN HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE HINGE FOR FURNITURE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE HINGE FOR FURNITURE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 84 EUROPE HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 86 EUROPE HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 88 GERMANY HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 90 GERMANY HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 91 UK HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 92 UK HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 93 UK HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 94 UK HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 96 FRANCE HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 98 FRANCE HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 100 ITALY HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 102 ITALY HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 104 SPAIN HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 106 SPAIN HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 108 RUSSIA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 110 RUSSIA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA HINGE FOR FURNITURE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA HINGE FOR FURNITURE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 121 UAE HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 122 UAE HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 123 UAE HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 124 UAE HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA HINGE FOR FURNITURE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA HINGE FOR FURNITURE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2020-2030

FIGURE 11 GLOBAL HINGE FOR FURNITURE MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL HINGE FOR FURNITURE MARKET BY TYPE (USD BILLION) 2022

FIGURE 14 GLOBAL HINGE FOR FURNITURE MARKET BY APPLICATION (USD BILLION) 2022

FIGURE 16 GLOBAL HINGE FOR FURNITURE MARKET BY REGION (USD BILLION) 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 BLUM INC.: COMPANY SNAPSHOT

FIGURE 19 HETTICH HOLDING GMBH & CO. OHG: COMPANY SNAPSHOT

FIGURE 20 GRASS AMERICA INC.: COMPANY SNAPSHOT

FIGURE 21 SALICE AMERICA INC.: COMPANY SNAPSHOT

FIGURE 22 FGV HOLDINGS SDN BHD: COMPANY SNAPSHOT

FIGURE 23 HÄFELE GMBH & CO KG: COMPANY SNAPSHOT

FIGURE 24 OTLAV S.P.A.: COMPANY SNAPSHOT

FIGURE 25 SUGATSUNE KOGYO CO., LTD.: COMPANY SNAPSHOT

FIGURE 26 TITUS GROUP: COMPANY SNAPSHOT

FIGURE 27 WÜRTH GROUP: COMPANY SNAPSHOT

FIGURE 28 SPECTRUM BRANDS HOLDINGS, INC.: COMPANY SNAPSHOT

FIGURE 29 DORMAKABA GROUP: COMPANY SNAPSHOT

FIGURE 30 RICHELIEU HARDWARE LTD.: COMPANY SNAPSHOT

FIGURE 31 EMKA BESCHLAGTEILE GMBH & CO. KG: COMPANY SNAPSHOT

FIGURE 32 SANWA COMPANY LTD.: COMPANY SNAPSHOT

FIGURE 33 SOSS DOOR HARDWARE: COMPANY SNAPSHOT

FIGURE 34 SIMONSWERK GMBH: COMPANY SNAPSHOT

FIGURE 35 ARCHDALE QUICKSET LTD.: COMPANY SNAPSHOT

FIGURE 36 MEPLA-ALFIT INC.: COMPANY SNAPSHOT

FIGURE 37 ROTO FRANK AG: COMPANY SNAPSHOT

FAQ

The global Hinge for Furniture market is anticipated to grow from USD 3.09 Billion in 2023 to USD 4.32 Billion by 2030, at a CAGR of 5 % during the forecast period.

North America accounted for the largest market in the Hinge for Furniture market. North America accounted for 38 % market share of the global market value.

Blum Inc.,Hettich Holding GmbH & Co. oHG,Grass America Inc.,Salice America Inc.,FGV Holdings Sdn Bhd,Häfele GmbH & Co KG,Otlav S.p.A.,SUGATSUNE KOGYO CO., LTD.,Titus Group,Würth Group,Spectrum Brands Holdings, Inc.,Dormakaba Group

Hinges are also influenced by the trend toward streamlined and minimalist furniture designs. There is a growing demand for hinges that are hidden or concealed and add to a neat and uncluttered appearance. Matte finishes are becoming more and more common in hardware, such as hinges, and furniture. Matte surfaces give off a sleek, contemporary look. Modular and multipurpose furniture is becoming more and more popular as living spaces get smaller. Such furniture pieces’ flexibility and adaptability are made possible in large part by hinges.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.