REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 10.06 Billion by 2030 | 8.80 % | North America |

| by Product Type | by Resin Type | by Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

3D Print Photopolymer Parts Market Overview

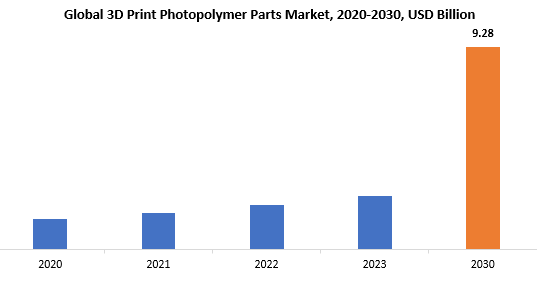

The global 3D print photopolymer parts market is anticipated to grow from USD 5.58 Billion in 2023 to USD 10.06 Billion by 2030, at a CAGR of 8.80 % during the forecast period.

3D print photopolymer parts stand as a sophisticated and innovative application within additive manufacturing. The key process, photopolymerization, involves selectively exposing liquid resin, typically a photopolymer, to ultraviolet (UV) light layer by layer, solidifying the material and constructing the desired object. This method allows for the creation of intricate and highly precise parts. Photopolymer resins offer properties like rapid curing, facilitating faster printing speeds and the production of objects with a smooth surface finish.

Widely used in industries such as aerospace, healthcare, automotive, and consumer goods, this technology meets the demand for intricate and customized parts. Its applications span from prototyping and product development to the manufacturing of end-use parts. The 3D print photopolymer parts market remains dynamic, evolving with ongoing advancements in material science, printing technologies, and the exploration of more sustainable and biocompatible resin options.

3D print photopolymer parts refer to objects created through a specific additive manufacturing process using photopolymer resins. In this technique, a liquid resin that reacts to light, typically ultraviolet (UV) light, is exposed layer by layer to form a solid, three-dimensional object. Photopolymerization occurs when the resin is exposed to light, causing it to harden and solidify. This method enables the precise and detailed production of parts with intricate geometries, smooth surfaces, and high resolution.

3D print photopolymer parts find extensive applications in various industries, including manufacturing, prototyping, and product design. The technology’s ability to produce detailed and complex structures makes it particularly suitable for creating prototypes, intricate components, and customized products. Additionally, the use of photopolymer materials allows for the fabrication of parts with specific material properties, such as flexibility, transparency, or rigidity, depending on the intended application.

The 3D Print Photopolymer Parts market is pivotal in additive manufacturing, revolutionizing product development and design innovation. Its importance lies in delivering precise, customizable solutions for complex parts and prototypes using photopolymer resins. Accelerating the product development cycle, it allows rapid iteration and testing, particularly beneficial in aerospace, automotive, healthcare, and consumer goods industries. Its versatility in offering various material properties enhances its appeal for designers seeking efficient and customizable prototyping solutions. As industries increasingly adopt additive manufacturing, this market is instrumental in driving innovation and transforming traditional manufacturing methods.

The surge in the adoption of 3D printing technologies across diverse industries is a key driver for the 3D Print Photopolymer Parts market. The capability of photopolymer-based printing to produce intricate and highly precise parts is a major contributor to this widespread acceptance. The market is further fueled by the growing demand for rapid prototyping and agile product development, facilitated by the quick iteration and testing capabilities of photopolymer resins. This is particularly critical in industries like aerospace and automotive, where swift prototyping significantly accelerates the product development cycle.

The versatility of photopolymer materials, offering properties such as flexibility, transparency, and durability, plays a pivotal role in influencing market dynamics. This adaptability makes photopolymer-based printing suitable for a broad spectrum of applications, ranging from creating detailed medical models to producing functional components in various industries.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Product Type, Resin Type, Application and Region |

|

By Product Type |

|

|

By Resin Type |

|

|

By Application |

|

|

By Region

|

|

3D print photopolymer parts Market Segmentation Analysis

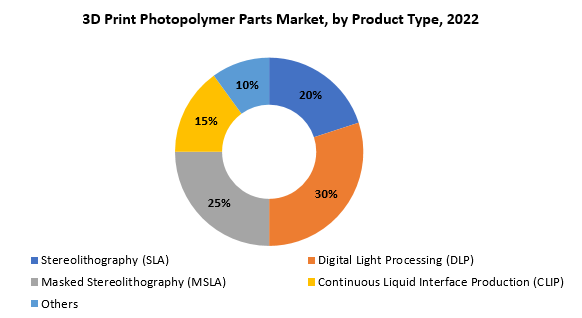

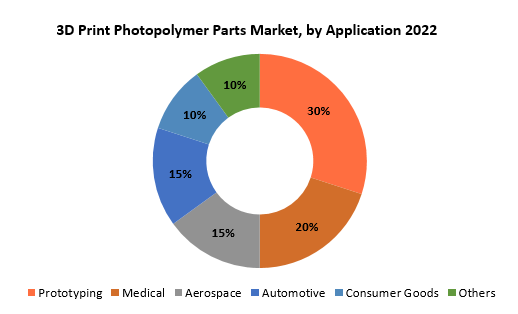

The global 3D print photopolymer parts market is divided into three segments, product type, resin type, application and region. By product Type the market is divided into Stereolithography (SLA), Digital Light Processing (DLP), Masked Stereolithography (MSLA), Continuous Liquid Interface Production (CLIP), Others. By resin type the market is classified into Standard Resins, Engineering Resins, Biocompatible Resins, High-Temperature Resins, Others. By application the market is classified into Prototyping, Medical, Aerospace, Automotive, Consumer Goods, Others.

Based on product type, digital light processing (DLP) segment dominating in the 3D print photopolymer parts market. The 3D Print Photopolymer Parts market sees the Digital Light Processing (DLP) segment as a leading force, exemplifying excellence in photopolymer-based 3D printing technologies. DLP utilizes a digital light projector to selectively cure layers of liquid photopolymer resin, swiftly solidifying them into the intended shape. This segment’s dominance is rooted in several advantages, including the simultaneous curing of entire layers, leading to accelerated print times compared to alternative methods. DLP’s exceptional resolution and precision make it particularly suitable for applications demanding intricate and detailed components, such as dental models, jewelry prototypes, and complex industrial parts.

Moreover, DLP’s versatility extends to its compatibility with various photopolymer resins, enabling the production of parts with diverse material properties. This adaptability positions DLP as the preferred choice for applications requiring specific characteristics like flexibility, transparency, or toughness. The segment’s leadership is further strengthened by ongoing advancements in projector technology, materials, and software, augmenting its capabilities and broadening its applicability across a wide range of industries.

the diverse 3D Print Photopolymer Parts market, various printing technologies cater to distinct needs, each with its strengths. Stereolithography (SLA) is a pioneering method using a laser to solidify liquid resin layers, ideal for intricate geometries. Masked Stereolithography (MSLA) enhances SLA by curing entire layers simultaneously, boosting speed for rapid prototyping and production. Continuous Liquid Interface Production (CLIP) revolutionizes with a continuous liquid interface, yielding smoother surfaces and quicker printing times. CLIP excels in creating detailed functional prototypes and end-use parts.

Based on application prototyping segment dominating in the 3D print photopolymer parts market. The Prototyping segment is a key player in the 3D Print Photopolymer Parts market, serving as a crucial element in the product development cycles of various industries. This application harnesses the precision and adaptability of photopolymer-based 3D printing technologies to craft detailed and precise prototypes, essential for validating and refining designs. Industries such as aerospace, automotive, and consumer goods heavily rely on prototyping to test product concepts, assess designs, and make necessary adjustments before moving into full-scale production.

The ability of photopolymer parts to capture intricate details and generate complex geometries makes them particularly well-suited for prototyping purposes. Beyond expediting product development, the Prototyping segment contributes to cost savings by identifying and addressing design flaws early in the production process. Moreover, the increasing demand for rapid prototyping in industries requiring swift iteration and design validation solidifies the Prototyping segment’s dominance in the 3D Print Photopolymer Parts market.

Photopolymer-based 3D printing technologies exhibit versatile applications across diverse industries. In the Medical sector, they are integral for crafting precise and customized medical models, prosthetics, and dental components with exceptional accuracy, meeting stringent medical requirements. In Aerospace, these technologies play a crucial role in manufacturing intricate and lightweight components, aligning with the sector’s need for precision-engineered parts and contributing to advancements in aircraft design. The Automotive industry relies on photopolymer parts for rapid prototyping, facilitating quick iteration and design validation, thereby streamlining the product development cycle. Similarly, in the Consumer Goods sector, these technologies are employed to create detailed prototypes for various products, ranging from electronics to household items.

3D Print Photopolymer Parts Market Dynamics

Driver

Advancements in 3D printing technology is a significant driver of 3D print photopolymer parts market during the forecast period.

The ongoing advancements in 3D printing technology play a crucial role in driving the growth of the 3D Print Photopolymer Parts market in the forecast period. The continuous evolution of 3D printing techniques, such as Digital Light Processing (DLP), Stereolithography (SLA), and Masked Stereolithography (MSLA), brings about improvements in precision, speed, and versatility for creating photopolymer-based parts. These technological innovations have significantly transformed the industry, offering faster printing speeds, greater accuracy, and expanded material capabilities.

These advancements address key aspects of 3D printing, including layer resolution, printing speed, and material diversity, making the technology more accessible and applicable across diverse industries. Improved hardware components, such as high-resolution projectors and more efficient curing mechanisms, contribute to producing finer details and smoother surfaces in printed parts. Additionally, the development of innovative photopolymer resins with diverse material properties expands the potential applications, ranging from functional prototypes to end-use components.

Ongoing research and development efforts in the 3D printing technology field continually push the boundaries of what is achievable. This involves exploring new printing methodologies, optimizing existing processes, and discovering novel materials to enhance the overall performance of photopolymer-based 3D printing.

Restraint

High cost of equipment and materials projected to hinder the 3D print photopolymer parts market during the forecast period.

The growth of the 3D Print Photopolymer Parts market faces a significant challenge due to the high costs associated with both equipment and materials, potentially hindering market expansion in the forecast period. Acquiring advanced 3D printing equipment, such as Digital Light Processing (DLP) and Stereolithography (SLA) machines, requires substantial capital investment, placing a financial burden on businesses and manufacturers. Additionally, the specialized photopolymer resins used in the printing process often come with a premium price tag, contributing to the overall expensive nature of 3D printing operations.

For small and medium-sized enterprises (SMEs) seeking to adopt this technology, the cost of 3D printing equipment and materials remains a significant barrier. The initial investment and ongoing operational expenses, including maintenance, calibration, and material procurement, can strain the financial resources of businesses. This challenge is particularly pronounced in industries where cost-effectiveness is a crucial factor, limiting the widespread adoption of 3D printing technology for photopolymer parts.

Furthermore, the high entry cost into the 3D Print Photopolymer Parts market may impede its penetration into certain sectors, restricting accessibility and adoption across diverse industries. Efforts to overcome this challenge involve ongoing research and development aimed at creating more cost-effective 3D printing solutions, including affordable equipment and materials.

Opportunities

Growing demand for personalized products is projected to boost the demand for 3D print photopolymer parts market.

The 3D Print Photopolymer Parts market is set for substantial growth, fueled by the rising demand for personalized products across a variety of industries. The increasing interest in customized solutions is pushing the adoption of 3D printing technologies, particularly those using photopolymer resins. This demand is especially notable in sectors like healthcare, where precise and personalized medical models, implants, and prosthetics can be crafted to meet the unique needs of individual patients.

In the consumer goods sector, the want for personalized products, including custom electronic devices and unique household items, is driving the integration of 3D print photopolymer parts. The technology’s capability to create intricate prototypes allows for the development of personalized designs tailored to specific preferences and requirements.

Moreover, the automotive and aerospace industries are utilizing 3D printing to provide personalized features in vehicles and aircraft components. Whether it’s personalized car interiors or bespoke aircraft cabin components, photopolymer-based 3D printing enables the production of unique items with intricate details.

This trend aligns with the broader movement towards consumer-centric and customizable manufacturing, where end-users seek products that match their individual tastes and needs. The flexibility of photopolymer-based 3D printing allows for the incorporation of various material properties, providing versatility in creating personalized items with specific characteristics. As the demand for personalized products continues to surge, the 3D Print Photopolymer Parts market is well-poised to capitalize on this trend.

3D Print Photopolymer Parts Market Trends

-

There is a growing trend towards personalized and customized manufacturing across various industries. The ability of 3D printing, especially using photopolymer resins, to create intricate and tailored designs is driving its adoption in sectors such as healthcare, consumer goods, automotive, and aerospace.

-

The healthcare industry is witnessing an increased adoption of 3D printing for creating personalized medical models, implants, and prosthetics.

-

In the consumer goods sector, there is a notable demand for personalized products. 3D print photopolymer parts are being integrated into the manufacturing process to produce customized electronic devices and unique household items.

-

The automotive and aerospace industries are leveraging 3D printing to offer personalized features in vehicles and aircraft components.

-

Photopolymer-based 3D printing offers versatility in incorporating various material properties. This flexibility allows for the creation of personalized items with specific characteristics, contributing to the trend of consumer-centric manufacturing.

-

There is a growing focus on developing sustainable photopolymers that are made from renewable or recycled materials. This is in line with the overall trend towards more sustainable manufacturing practices.

-

New photopolymer resins are being developed with improved properties such as faster curing times, higher heat resistance, and better biocompatibility. This is making them even more attractive for a wider range of applications.

Competitive Landscape

The competitive landscape of the 3D print photopolymer parts market was dynamic, with several prominent companies competing to provide innovative and advanced 3D print photopolymer parts solutions.

- Stratasys

- 3D Systems

- Formlabs

- Carbon

- EOS

- Desktop Metal

- Proto Labs

- Materialise

- Markforged

- EnvisionTEC

- SLM Solutions

- Voxeljet

- HP

- Ultimaker

- XYZprinting

- Renishaw

- Nano Dimension

- Photocentric

- Adaptive3D

- DSM

Recent Developments: September 27, 2023 –3D Systems announced a partnership with Klarity , a world leader in solutions for radiation therapy, to expand the distribution of its FDA-cleared VSP® Bolus solution. Klarity will offer VSP Bolus within its new line of high-quality patient-specific 3D printed products called Klarity Prints™.

November 27, 2023: Stratasys Ltd., a leader in polymer 3D printing and additive manufacturing solutions, announced it has partnered with Siemens Healthineers to carry out a landmark research project designed to develop new state-of-the-art solutions for the advancement of medical imaging phantoms for computed tomography (CT) imaging.

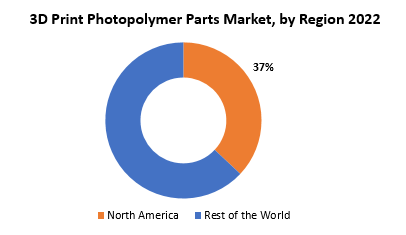

Regional Analysis

North America accounted for the largest market in the 3D print photopolymer parts market. North America accounted for the 37% market share of the global market value. The 3D Print Photopolymer Parts industry is predominantly led by North America, holding the largest market share, and several factors contribute to its prominent position. North America boasts a well-established and mature manufacturing sector that readily embraces advanced technologies. The region’s market leadership is further fueled by the presence of major industry players and a robust ecosystem for research and development, facilitating the rapid adoption of 3D printing technologies, particularly those involving photopolymer parts.

Additionally, North America hosts a diverse array of industries, including healthcare, automotive, aerospace, and consumer goods, all extensively leveraging 3D printing for precision manufacturing and customization. The region’s emphasis on innovation and technological advancements, coupled with substantial investments in research and development, positions it as a frontrunner in the 3D print photopolymer parts market. Furthermore, a favorable regulatory environment and a high level of awareness among end-users regarding the benefits of 3D printing contribute significantly to North America’s market dominance.

In Asia-Pacific, rapid industrialization, a growing emphasis on technology, and a robust manufacturing sector in countries like China, Japan, and South Korea contribute to their leadership in integrating 3D printing, including photopolymer parts, across diverse industries.

Europe, with established industrial bases in countries like Germany and the UK, is a key player, benefitting from a strong focus on research and development and a supportive regulatory framework. Both regions experience a rising demand for customized and high-precision manufacturing, driving the adoption of 3D print photopolymer parts and influencing the global market dynamics.

Target Audience for 3D Print Photopolymer Parts Market

- Manufacturing Companies

- Research and Development Centers

- Technology and Innovation Hubs

- Automotive Industry

- Aerospace Sector

- Healthcare Institutions

- Consumer Goods Manufacturers

- Regulatory Bodies

- Small and Medium-sized Enterprises (SMEs)

- Investors and Venture Capital Firms

Segments Covered in the 3D Print Photopolymer Parts Market Report

3D Print Photopolymer Parts Market by Product Type

- Stereolithography (SLA)

- Digital Light Processing (DLP)

- Masked Stereolithography (MSLA)

- Continuous Liquid Interface Production (CLIP)

- Others

3D Print Photopolymer Parts Market by Resin Type

- Standard Resins

- Engineering Resins

- Biocompatible Resins

- High-Temperature Resins

- Others

3D Print Photopolymer Parts Market by Application

- Prototyping

- Medical

- Aerospace

- Automotive

- Consumer Goods

- Others

3D Print Photopolymer Parts Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the 3D print photopolymer parts market over the next 7 years?

- Who are the major players in the 3D print photopolymer parts market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the 3D print photopolymer parts market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the 3D print photopolymer parts market?

- What is the current and forecasted size and growth rate of the global 3D print photopolymer parts market?

- What are the key drivers of growth in the 3D print photopolymer parts market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the 3D print photopolymer parts market?

- What are the technological advancements and innovations in the 3D print photopolymer parts market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the 3D print photopolymer parts market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the 3D print photopolymer parts market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON 3D PRINT PHOTOPOLYMER PARTS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET OUTLOOK

- GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE, 2020-2030, (USD BILLION)

- STEREOLITHOGRAPHY (SLA)

- DIGITAL LIGHT PROCESSING (DLP)

- MASKED STEREOLITHOGRAPHY (MSLA)

- CONTINUOUS LIQUID INTERFACE PRODUCTION (CLIP)

- OTHERS

- GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE, 2020-2030, (USD BILLION)

- STANDARD RESINS

- ENGINEERING RESINS

- BIOCOMPATIBLE RESINS

- HIGH-TEMPERATURE RESINS

- OTHERS

- GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION, 2020-2030, (USD BILLION)

- PROTOTYPING

- MEDICAL

- AEROSPACE

- AUTOMOTIVE

- CONSUMER GOODS

- OTHERS

- GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- STRATASYS

- 3D SYSTEMS

- FORMLABS

- CARBON

- EOS

- DESKTOP METAL

- PROTO LABS

- MATERIALISE

- MARKFORGED

- ENVISIONTEC

- SLM SOLUTIONS

- VOXELJET

- HP

- ULTIMAKER

- XYZPRINTING

- RENISHAW

- NANO DIMENSION

- PHOTOCENTRIC

- ADAPTIVE3D

- DSM *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 3 GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 4 GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 10 US 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 11 US 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 12 CANADA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 13 CANADA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 14 CANADA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 15 MEXICO 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 16 MEXICO 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 17 MEXICO 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 23 BRAZIL 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 24 BRAZIL 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 25 ARGENTINA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 26 ARGENTINA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 27 ARGENTINA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 28 COLOMBIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 29 COLOMBIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 30 COLOMBIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC 3D PRINT PHOTOPOLYMER PARTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 39 INDIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 40 INDIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 41 CHINA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 42 CHINA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 43 CHINA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 44 JAPAN 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 45 JAPAN 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 46 JAPAN 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 59 EUROPE 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 60 EUROPE 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 61 EUROPE 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 62 EUROPE 3D PRINT PHOTOPOLYMER PARTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 64 GERMANY 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 65 GERMANY 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 66 UK 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 67 UK 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 68 UK 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 69 FRANCE 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 70 FRANCE 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 71 FRANCE 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 72 ITALY 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 73 ITALY 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 74 ITALY 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 75 SPAIN 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 76 SPAIN 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 77 SPAIN 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 78 RUSSIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 79 RUSSIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 80 RUSSIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 89 UAE 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 90 UAE 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2020-2030

FIGURE 10 GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2020-2030

FIGURE 11 GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY PRODUCT TYPE (USD BILLION) 2022

FIGURE 14 GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY RESIN TYPE (USD BILLION) 2022

FIGURE 15 GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY APPLICATION (USD BILLION) 2022

FIGURE 16 GLOBAL 3D PRINT PHOTOPOLYMER PARTS MARKET BY REGION (USD BILLION) 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 STRATASYS: COMPANY SNAPSHOT

FIGURE 19 3D SYSTEMS: COMPANY SNAPSHOT

FIGURE 20 FORMLABS: COMPANY SNAPSHOT

FIGURE 21 CARBON: COMPANY SNAPSHOT

FIGURE 22 EOS: COMPANY SNAPSHOT

FIGURE 23 DESKTOP METAL: COMPANY SNAPSHOT

FIGURE 24 PROTO LABS: COMPANY SNAPSHOT

FIGURE 25 MATERIALISE: COMPANY SNAPSHOT

FIGURE 26 MARKFORGED: COMPANY SNAPSHOT

FIGURE 27 ENVISIONTEC: COMPANY SNAPSHOT

FIGURE 28 SLM SOLUTIONS: COMPANY SNAPSHOT

FIGURE 29 VOXELJET: COMPANY SNAPSHOT

FIGURE 30 HP: COMPANY SNAPSHOT

FIGURE 31 ULTIMAKER: COMPANY SNAPSHOT

FIGURE 32 XYZPRINTING: COMPANY SNAPSHOT

FIGURE 33 RENISHAW: COMPANY SNAPSHOT

FIGURE 34 NANO DIMENSION: COMPANY SNAPSHOT

FIGURE 35 PHOTOCENTRIC: COMPANY SNAPSHOT

FIGURE 36 ADAPTIVE3D: COMPANY SNAPSHOT

FIGURE 37 DSM: COMPANY SNAPSHOT

FAQ

The global 3D print photopolymer parts market is anticipated to grow from USD 5.58 Billion in 2023 to USD 10.06 Billion by 2030, at a CAGR of 8.80 % during the forecast period.

North America accounted for the largest market in the 3D print photopolymer parts market. North America accounted for 37 % market share of the global market value.

Stratasys, 3D Systems, Formlabs, Carbon, EOS, Desktop Metal, Proto Labs, Materialise, Markforged, EnvisionTEC, SLM Solutions, Voxeljet, HP, Ultimaker, XYZprinting, Renishaw, Nano Dimension, Photocentric, Adaptive3D, DSM.

The 3D print photopolymer parts market includes a growing demand for personalized manufacturing across industries such as healthcare, automotive, and consumer goods. The industry is witnessing advancements in 3D printing technology, particularly in techniques like Digital Light Processing (DLP) and Stereolithography (SLA), enhancing precision, speed, and material capabilities. Additionally, there is an increased focus on innovation, with ongoing research and development pushing the boundaries of achievable applications and materials in the photopolymer-based 3D printing landscape.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.