REPORT OUTLOOK

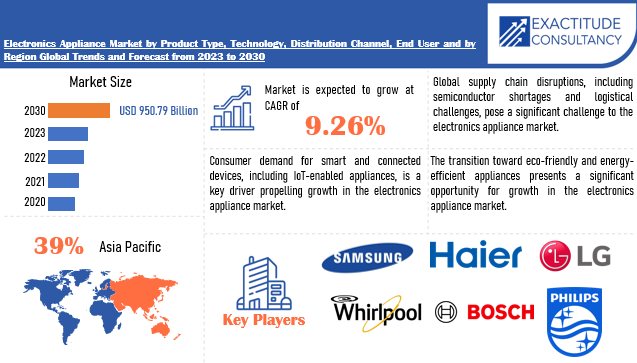

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 950.79 Billion by 2030 | 9.26% | Asia Pacific |

| by Component | by Technology | by Sales Channel | by End User |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Electronics Appliance Market Overview

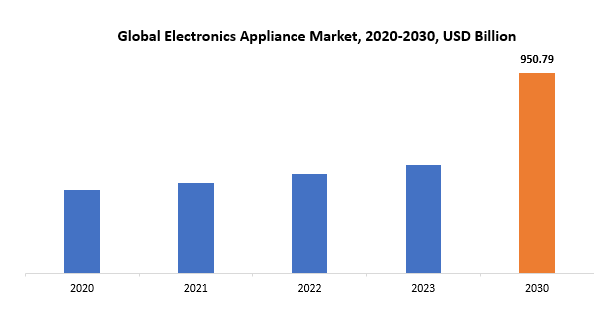

The global electronics appliance market is anticipated to grow from USD 511.51 Billion in 2023 to USD 950.79 Billion by 2030, at a CAGR of 9.26% during the forecast period.

The term “electronic appliances” refers to a broad group of electronic gadgets made for use in the home and business to carry out particular functions, improve convenience, or offer entertainment. These include a broad variety of goods such home entertainment systems (TVs, audio systems), hair dryers, electric shavers, and other personal care items, as well as kitchen appliances (microwaves, refrigerators, etc.). Advanced technologies, such as smart features and networking choices, are frequently integrated into electronics appliances to enhance user experience and efficiency. They are essential to contemporary lives because they provide comfort, entertainment, and answers to everyday problems in both home and business environments.

The market for electronics appliances is a vibrant sector that includes a broad range of electronic products intended for use in homes, businesses, and industries. Products in this category include personal care items, home entertainment systems, and kitchen equipment, among others. Technological developments, the need for smart and connected devices, and the growing focus on sustainability and energy efficiency are the main factors driving the industry. The constraints posed by global supply chain dynamics, economic volatility, and swift technical advancements are noteworthy. On the other hand, new developments in smart technology, the incorporation of wellness and health, and the exploration of uncharted territory present prospects. Asia Pacific is a significant participant in the market, fostering its expansion with a sizable customer base and centers of technical innovation.

The market for electronics appliances is driven by several factors, such as the quick development of technology that results in novel product offers. One major driver is the increasing demand for smart and connected products, such Internet of Things (IoT)-enabled appliances, which offer better functionality and convenience. The development of eco-friendly appliances is fueled by rising consumer awareness of and attention on sustainability and energy efficiency. Rising disposable incomes and the global transition towards a digital lifestyle are driving consumer expenditure on contemporary electronic gadgets. The rise of global supply chains and e-commerce both help to make electrical appliances more accessible and available, which in turn drives up demand in the industry.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Product Type, By Technology, By Sales Channel, by End User and By Region |

| By Product Type |

|

| By Technology |

|

| By Sales Channel |

|

| By End User |

|

| By Region

|

|

Electronics Appliance Market Segmentation Analysis

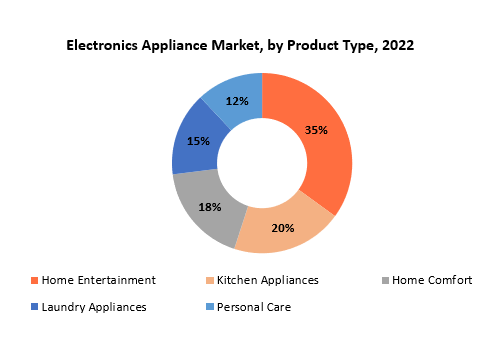

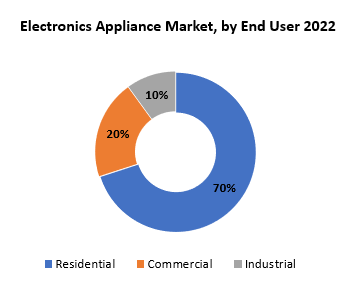

The global Electronics Appliance market is divided into 5 segments product type, technology, sales channel, end user and region. The electronics appliance market is characterized by diverse product types, including home entertainment, kitchen appliances, home comfort, laundry appliances, and personal care. The market is further segmented based on technology, with offerings ranging from smart appliances with advanced connectivity to non-smart traditional devices. Various sales channels, such as retail stores, e-commerce platforms, specialty stores, and direct sales, play a role in product distribution. Additionally, the market caters to different end users, encompassing residential, commercial, and industrial sectors, reflecting the multifaceted nature of the industry.

With 35% of the market, the Home Entertainment sector is the largest in the market segmentation of electronics appliances based on product kinds. Products like audio systems, TVs, and other entertainment-related gadgets fall under this category. The popularity of home entertainment items is a reflection of the ongoing desire from consumers for state-of-the-art home theatre setups and audio-visual experiences. With the development of technology comes innovations like smart TVs and surround sound systems, and producers in this market are always trying to adapt to the changing needs of consumers looking for better home entertainment alternatives. The market dominance of Home Entertainment highlights the significance of leisure and recreation in the consumer electronics space, impacting marketing tactics as well as product development in this ever-evolving industry.

Dishwashers, microwaves, refrigerators, and other kitchen appliances make for 20% of the market for segmented electronics appliances. Home Comfort, which includes heaters, fans, and air conditioners, comes in second at 18%. Personal care items, such as electric shavers and hair dryers, make up 12% of the market, while laundry appliances, such as washers and dryers, account for 15%. This breakdown shows how a diverse market serves a range of daily needs for customers. While home comfort and laundry appliances take care of cleanliness and comfort in the home, kitchen appliances emphasize ease in culinary operations. The convergence of technology and personal grooming is emphasized by personal care products, which together present a complete picture that caters to various lifestyle demands.

The market for electronics appliances is dominated by the domestic segment, which accounts for 70% of sales and emphasizes how ingrained electronic gadgets are in people’s everyday lives. A vast array of goods falls within this category, such as smart home technology, personal care items, home entertainment systems, and kitchen equipment. The high proportion shows how popular appliances that improve comfort, convenience, and entertainment in homes continue to be. Energy-efficient appliances, ongoing innovation in smart home solutions, and changing customer desires for cutting-edge, networked electronics to fulfil a variety of demands are major factors driving the residential market. Recognizing the considerable impact of consumer habits and preferences in forming the electronics appliance market landscape, manufacturers and marketers deliberately concentrate on this market niche.

Twenty percent of the market for electronics appliances is made up of the commercial segment, which serves non-industrial business environments including restaurants, hotels, and offices. This category contains a wide variety of appliances, including audio-visual systems for public areas, office equipment, and commercial kitchen appliances. The industrial section, which receives 10% of the total, highlights the importance of electronics appliances in manufacturing and industrial processes. This includes heavy-duty equipment and technology. The industrial segment caters to the specific needs of manufacturing processes, while the commercial sector focuses on improving customer experiences and operational efficiency in a variety of business contexts. This indicates the wide range of applications of electronics appliances in both commercial and industrial settings.

Electronics Appliance Market Dynamics

Driver

Evolving consumer lifestyles, characterized by busier schedules and a desire for convenience increases demand for electronic appliances.

The rising demand for electronic goods is mostly being driven by changing consumer lifestyles, which are characterized by busier schedules and a strong need for convenience. As people struggle with time restrictions in their everyday lives, there is a noticeable trend towards products that increase overall efficiency and streamline chores. Time-saving features in kitchen appliances, such as dishwashers and microwaves, are particularly popular with customers who want convenience without sacrificing quality. Moreover, customers can now manage their homes more effectively while on the road thanks to smart home technologies, such as Internet of Things (IoT)-enabled products, which meet the demand for seamless integration and management. Electronic appliances are in high demand because they represent a desire for a more automated and pleasant lifestyle in which gadgets work in unison. This trend underscores the pivotal role that convenience plays in shaping the consumer electronics landscape, prompting manufacturers to continually innovate and adapt their products to meet the evolving needs of contemporary living.

Restraint

Electronic appliance disposal presents environmental issues, and worries about managing e-waste impede industry expansion.

Electronic appliance disposal presents serious environmental problems, and worries about handling e-waste are a major barrier to the industry’s growth. When electronic equipment is disposed of improperly, their harmful contents—which include heavy metals and poisonous chemicals—can seep into the ground and water. The problem of e-waste is made worse by the quick speed at which technology is developing, which results in shorter product lifetimes. Furthermore, poor disposal procedures and insufficient recycling infrastructure lead to the buildup of electronic trash in landfills, endangering ecosystems and public health. The industry is under increasing pressure to implement sustainable practices, such as using eco-friendly and recyclable materials, prolonging the life of products, and implementing effective e-waste management systems. Addressing these environmental concerns is crucial for fostering industry growth, as consumers increasingly prioritize eco-conscious choices, and regulatory bodies impose stricter standards on electronic waste disposal.

Opportunities

Electronic appliance makers may accommodate the unique desires of their customers by providing features that can be customized and personalized.

Electronic appliance makers can enhance customer satisfaction by offering features that are customizable and personalized, addressing the unique desires of individual consumers. Providing customizable options, such as color variations, design elements, and user interface preferences, allows customers to tailor appliances to their specific tastes and preferences, fostering a sense of ownership. Personalization extends beyond aesthetics, with smart appliances allowing users to customize settings, create personalized routines, and integrate seamlessly with their daily lives. This not only enhances user experience but also cultivates brand loyalty as consumers feel a deeper connection to their personalized devices. The trend aligns with the broader consumer demand for products that cater to individual lifestyles, reflecting a shift from one-size-fits-all to personalized and user-centric design. As technology continues to advance, the ability to offer customizable and personalized features positions electronic appliance makers at the forefront of meeting evolving consumer expectations and enhancing the overall appeal of their products.

Electronics Appliance Market Trends

-

Smart Appliances: Appliances equipped with Wi-Fi connectivity and smart features are becoming increasingly popular. These features allow users to control their appliances remotely, monitor energy consumption, and receive alerts.

-

Sustainability and Energy Efficiency: Consumers are becoming more environmentally conscious and are looking for appliances that are energy-efficient and sustainable. This trend is driving demand for appliances with features like smart energy management, water conservation technologies, and eco-friendly materials.

-

Personalization and Customization: Appliances are becoming more customizable, allowing users to tailor them to their specific needs and preferences. This includes features like adjustable settings, personalized cooking programs, and voice-activated controls.

-

Rise of E-commerce: Online shopping is increasingly popular for purchasing electronics appliances. This trend is driven by convenience, competitive pricing, and a wider selection of products.

-

Voice-Activated Control: Voice assistants like Amazon Alexa and Google Assistant are being integrated into appliances, allowing users to control them with their voice. This hands-free approach is making appliances more user-friendly and convenient.

-

Artificial Intelligence (AI): AI is being used in appliances to optimize performance, predict maintenance needs, and personalize user experiences. This trend is still in its early stages, but it has the potential to revolutionize the appliance industry.

Competitive Landscape

The competitive landscape of the Electronics Appliance market was dynamic, with several prominent companies competing to provide innovative and advanced Electronics Appliance.

- Samsung Electronics

- Haier Group

- Whirlpool Corporation

- LG Electronics

- Electrolux AB

- Bosch

- Panasonic Corporation

- Midea Group

- Sony Group Corporation

- Koninklijke Philips N.V.

- Hisense Group

- Arcelik A.S.

- TCL Technology Group

- SEB Group

- BSH Hausgeräte GmbH

- Xiaomi Corporation

- Whirlpool China

- Spectrum Brands Holdings

- Changhong Holding Group

- Gree Electric Appliances Inc. of Zhuhai

Recent Developments:

19 December 2023 – Samsung Electronics, a world leader in advanced semiconductor technology, introduced two new ISOCELL Vizion sensors — a time-of-flight (ToF) sensor, the ISOCELL Vizion 63D and a global shutter sensor, the ISOCELL Vizion 931. First introduced in 2020, Samsung’s ISOCELL Vizion lineup includes ToF and global shutter sensors specifically designed to offer visual capabilities across an extensive range of next-generation mobile, commercial and industrial use cases.

18 January 2023 – Royal Philips a global leader in health technology, and Masimo a global medical technology company, announced an expansion of their partnership to augment patient monitoring capabilities in home telehealth applications with the Masimo W1™ advanced health tracking watch. The W1 will integrate with Philips’s enterprise patient monitoring ecosystem to advance the forefront of telemonitoring and telehealth.

Regional Analysis

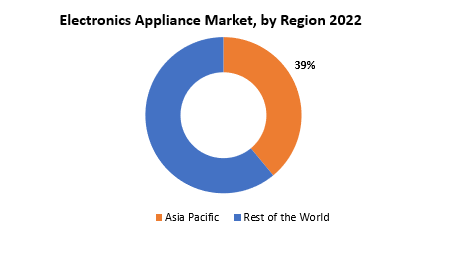

In the electronics appliance industry, the Asia-Pacific area has continuously distinguished itself as a prominent participant, holding a sizeable proportion that frequently amounts to around 39%. Numerous reasons contribute to its domination, such as the region’s fast urbanization, powerful economic growth, and big and diversified population. China, Japan, South Korea, and India are significant contributors to this share, with a populous that is tech-savvy and a growing consumer electronics sector. Asia-Pacific’s market is buoyant due in part to consumer desire for cutting-edge appliances that reflect changing lifestyle tastes and a strong focus on smart and connected devices. Furthermore, the area has a crucial role in determining the dynamics of the global supply chain due to its industrial capabilities and key location in the global supply chain.

North America, which includes both the United States and Canada, continues to hold a substantial market share of around 24% for electronics appliances. This strong market presence is evidence of the region’s highly technologically savvy customer base, which is demonstrated by the rapid pace at which cutting-edge appliances are adopted. North America holds a significant influence due to the ubiquity of energy-efficient technology, smart home solutions, and robust consumer spending power. The need for high-end, feature-rich products and a culture of constant technical advancements further serve to reinforce the region’s significant position in the changing electronics appliance market.

Target Audience for Electronics Appliance

- Residential Consumers

- Commercial Businesses

- Industrial Enterprises

- Tech Enthusiasts

- Homeowners

- Office Spaces

- Hospitality Industry

- Healthcare Facilities

- Educational Institutions

- Retailers

- E-commerce Platforms

- Smart Home Enthusiasts

Import & Export Data for Electronics Appliance Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Electronics Appliance market. This knowledge equips businesses with strategic advantages, such as:

-

Identifying emerging markets with untapped potential.

-

Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

-

Navigating competition by assessing major players’ trade dynamics.

Key insights

-

Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Electronics Appliance market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

-

Market players: gain insights into the leading players driving the AI devices trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

-

Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

-

Product breakdown: by segmenting data based on Electronics Appliance types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids governments in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Electronics Appliance Market Report

Electronics Appliance Market by Component

- Home Entertainment

- Kitchen Appliances

- Home Comfort

- Laundry Appliances

- Personal Care

Electronics Appliance Market by Technology

- Smart Appliances

- Non-Smart

Electronics Appliance Market by Sales Channel

- Retail Stores

- E-commerce Platforms

- Specialty Stores

- Direct Sales

Electronics Appliance Market by End User

- Residential

- Commercial

- Industrial

Electronics Appliance Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

-

What is the expected growth rate of the Electronics Appliance market over the next 7 years?

-

Who are the major players in the Electronics Appliance market and what is their market share?

-

What are the end-user industries driving market demand and what is their outlook?

-

What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and Africa?

-

How is the economic environment affecting the Electronics Appliance market, including factors such as interest rates, inflation, and exchange rates?

-

What is the expected impact of government policies and regulations on the Electronics Appliance market?

-

What is the current and forecasted size and growth rate of the Electronics Appliance market?

-

What are the key drivers of growth in the Electronics Appliance market?

- Who are the major players in the market and what is their market share?

-

What are the distribution channels and supply chain dynamics in the Electronics Appliance market?

-

What are the technological advancements and innovations in the Electronics Appliance market and their impact on product development and growth?

-

What are the regulatory considerations and their impact on the market?

-

What are the challenges faced by players in the Electronics Appliance market and how are they addressing these challenges?

-

What are the opportunities for growth and expansion in the Electronics Appliance market?

-

What is the product offered and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- ELECTRONICS APPLIANCE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ELECTRONICS APPLIANCE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- ELECTRONICS APPLIANCE MARKET OUTLOOK

- GLOBAL ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- HOME ENTERTAINMENT

- KITCHEN APPLIANCES

- HOME COMFORT

- LAUNDRY APPLIANCES

- PERSONAL CARE

- GLOBAL ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- SMART APPLIANCES

- NON-SMART

- GLOBAL ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- RETAIL STORES

- E-COMMERCE PLATFORMS

- SPECIALTY STORES

- DIRECT SALES

- GLOBAL ELECTRONICS APPLIANCE MARKET BY END USER, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- RESIDENTIAL

- COMMERCIAL

- INDUSTRIAL

- GLOBAL ELECTRONICS APPLIANCE MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- SAMSUNG ELECTRONICS

- HAIER GROUP

- WHIRLPOOL CORPORATION

- LG ELECTRONICS

- ELECTROLUX AB

- BOSCH

- PANASONIC CORPORATION

- MIDEA GROUP

- SONY GROUP CORPORATION

- KONINKLIJKE PHILIPS N.V.

- HISENSE GROUP

- ARCELIK A.S.

- TCL TECHNOLOGY GROUP

- SEB GROUP

- BSH HAUSGERÄTE GMBH

- XIAOMI CORPORATION

- WHIRLPOOL CHINA

- SPECTRUM BRANDS HOLDINGS

- CHANGHONG HOLDING GROUP

- GREE ELECTRIC APPLIANCES INC. OF ZHUHAI *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 4 GLOBAL ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 6 GLOBAL ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 7 GLOBAL ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 8 GLOBAL ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 9 GLOBAL ELECTRONICS APPLIANCE MARKET BY REGION (USD BILLION) 2020-2030

TABLE 10 GLOBAL ELECTRONICS APPLIANCE MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA ELECTRONICS APPLIANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA ELECTRONICS APPLIANCE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 13 NORTH AMERICA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 15 NORTH AMERICA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 17 NORTH AMERICA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 18 NORTH AMERICA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 19 NORTH AMERICA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 20 NORTH AMERICA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 21 US ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 22 US ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 23 US ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 24 US ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 25 US ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 26 US ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 27 US ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 28 US ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 29 CANADA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 30 CANADA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 31 CANADA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 32 CANADA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 33 CANADA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 34 CANADA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 35 CANADA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 36 CANADA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 37 MEXICO ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 38 MEXICO ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 39 MEXICO ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 40 MEXICO ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 41 MEXICO ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 42 MEXICO ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 43 MEXICO ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 44 MEXICO ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 45 SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 46 SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 47 SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 48 SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 49 SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 50 SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 51 SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 52 SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 53 SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 54 SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 55 BRAZIL ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 56 BRAZIL ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 57 BRAZIL ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 58 BRAZIL ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 59 BRAZIL ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 60 BRAZIL ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 61 BRAZIL ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 62 BRAZIL ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 63 ARGENTINA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 64 ARGENTINA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 65 ARGENTINA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 66 ARGENTINA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 67 ARGENTINA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 68 ARGENTINA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 69 ARGENTINA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 70 ARGENTINA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 71 COLOMBIA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 72 COLOMBIA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 73 COLOMBIA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 74 COLOMBIA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 75 COLOMBIA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 76 COLOMBIA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 77 COLOMBIA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 78 COLOMBIA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 80 REST OF SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 81 REST OF SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 82 REST OF SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 83 REST OF SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 84 REST OF SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 85 REST OF SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 86 REST OF SOUTH AMERICA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 87 ASIA-PACIFIC ELECTRONICS APPLIANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 ASIA-PACIFIC ELECTRONICS APPLIANCE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 89 ASIA-PACIFIC ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 90 ASIA-PACIFIC ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 91 ASIA-PACIFIC ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 92 ASIA-PACIFIC ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 93 ASIA-PACIFIC ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 94 ASIA-PACIFIC ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 95 ASIA-PACIFIC ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 96 ASIA-PACIFIC ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 97 INDIA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 98 INDIA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 99 INDIA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 100 INDIA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 101 INDIA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 102 INDIA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 103 INDIA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 104 INDIA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 105 CHINA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 106 CHINA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 107 CHINA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 108 CHINA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 109 CHINA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 110 CHINA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 111 CHINA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 112 CHINA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 113 JAPAN ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 114 JAPAN ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 115 JAPAN ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 116 JAPAN ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 117 JAPAN ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 118 JAPAN ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 119 JAPAN ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 120 JAPAN ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 121 SOUTH KOREA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 122 SOUTH KOREA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 123 SOUTH KOREA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 124 SOUTH KOREA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 125 SOUTH KOREA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 126 SOUTH KOREA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 127 SOUTH KOREA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 128 SOUTH KOREA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 129 AUSTRALIA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 130 AUSTRALIA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 131 AUSTRALIA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 132 AUSTRALIA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 133 AUSTRALIA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 134 AUSTRALIA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 135 AUSTRALIA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 136 AUSTRALIA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 137 SOUTH-EAST ASIA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 138 SOUTH-EAST ASIA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 139 SOUTH-EAST ASIA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 140 SOUTH-EAST ASIA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 141 SOUTH-EAST ASIA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 142 SOUTH-EAST ASIA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 143 SOUTH-EAST ASIA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 144 SOUTH-EAST ASIA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 145 REST OF ASIA PACIFIC ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 146 REST OF ASIA PACIFIC ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 147 REST OF ASIA PACIFIC ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 148 REST OF ASIA PACIFIC ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 149 REST OF ASIA PACIFIC ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 150 REST OF ASIA PACIFIC ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 151 REST OF ASIA PACIFIC ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 152 REST OF ASIA PACIFIC ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 153 EUROPE ELECTRONICS APPLIANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 154 EUROPE ELECTRONICS APPLIANCE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 155 EUROPE ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 156 EUROPE ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 157 EUROPE ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 158 EUROPE ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 159 EUROPE ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 160 EUROPE ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 161 EUROPE ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 162 EUROPE ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 163 GERMANY ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 164 GERMANY ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 165 GERMANY ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 166 GERMANY ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 167 GERMANY ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 168 GERMANY ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 169 GERMANY ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 170 GERMANY ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 171 UK ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 172 UK ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 173 UK ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 174 UK ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 175 UK ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 176 UK ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 177 UK ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 178 UK ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 179 FRANCE ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 180 FRANCE ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 181 FRANCE ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 182 FRANCE ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 183 FRANCE ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 184 FRANCE ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 185 FRANCE ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 186 FRANCE ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 187 ITALY ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 188 ITALY ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 189 ITALY ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 190 ITALY ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 191 ITALY ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 192 ITALY ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 193 ITALY ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 194 ITALY ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 195 SPAIN ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 196 SPAIN ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 197 SPAIN ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 198 SPAIN ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 199 SPAIN ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 200 SPAIN ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 201 SPAIN ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 202 SPAIN ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 203 RUSSIA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 204 RUSSIA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 205 RUSSIA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 206 RUSSIA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 207 RUSSIA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 208 RUSSIA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 209 RUSSIA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 210 RUSSIA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 211 REST OF EUROPE ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 212 REST OF EUROPE ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 213 REST OF EUROPE ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 214 REST OF EUROPE ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 215 REST OF EUROPE ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 216 REST OF EUROPE ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 217 REST OF EUROPE ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 218 REST OF EUROPE ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 219 MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 220 MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 221 MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 222 MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 223 MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 224 MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 225 MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 226 MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 227 MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 228 MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 229 UAE ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 230 UAE ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 231 UAE ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 232 UAE ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 233 UAE ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 234 UAE ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 235 UAE ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 236 UAE ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 237 SAUDI ARABIA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 238 SAUDI ARABIA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 239 SAUDI ARABIA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 240 SAUDI ARABIA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 241 SAUDI ARABIA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 242 SAUDI ARABIA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 243 SAUDI ARABIA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 244 SAUDI ARABIA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 245 SOUTH AFRICA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 246 SOUTH AFRICA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 247 SOUTH AFRICA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 248 SOUTH AFRICA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 249 SOUTH AFRICA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 250 SOUTH AFRICA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 251 SOUTH AFRICA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 252 SOUTH AFRICA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 253 REST OF MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 254 REST OF MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 255 REST OF MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 256 REST OF MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 257 REST OF MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 258 REST OF MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 259 REST OF MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 260 REST OF MIDDLE EAST AND AFRICA ELECTRONICS APPLIANCE MARKET BY END USER (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE, USD BILLION, 2020-2030

FIGURE 9 GLOBAL ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY, USD BILLION, 2020-2030

FIGURE 10 GLOBAL ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL, USD BILLION, 2020-2030

FIGURE 11 GLOBAL ELECTRONICS APPLIANCE MARKET BY END USER, USD BILLION, 2020-2030

FIGURE 12 GLOBAL ELECTRONICS APPLIANCE MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL ELECTRONICS APPLIANCE MARKET BY PRODUCT TYPE, USD BILLION, 2022

FIGURE 15 GLOBAL ELECTRONICS APPLIANCE MARKET BY TECHNOLOGY, USD BILLION, 2022

FIGURE 16 GLOBAL ELECTRONICS APPLIANCE MARKET BY SALES CHANNEL, USD BILLION, 2022

FIGURE 17 GLOBAL ELECTRONICS APPLIANCE MARKET BY END USER, USD BILLION, 2022

FIGURE 18 GLOBAL ELECTRONICS APPLIANCE MARKET BY REGION, USD BILLION, 2022

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

FIGURE 21 HAIER GROUP: COMPANY SNAPSHOT

FIGURE 22 WHIRLPOOL CORPORATION: COMPANY SNAPSHOT

FIGURE 23 LG ELECTRONICS: COMPANY SNAPSHOT

FIGURE 24 ELECTROLUX AB: COMPANY SNAPSHOT

FIGURE 25 BOSCH: COMPANY SNAPSHOT

FIGURE 26 PANASONIC CORPORATION: COMPANY SNAPSHOT

FIGURE 27 MIDEA GROUP: COMPANY SNAPSHOT

FIGURE 28 SONY GROUP CORPORATION: COMPANY SNAPSHOT

FIGURE 29 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

FIGURE 30 HISENSE GROUP: COMPANY SNAPSHOT

FIGURE 31 ARCELIK A.S.: COMPANY SNAPSHOT

FIGURE 32 TCL TECHNOLOGY GROUP: COMPANY SNAPSHOT

FIGURE 33 SEB GROUP: COMPANY SNAPSHOT

FIGURE 34 BSH HAUSGERÄTE GMBH: COMPANY SNAPSHOT

FIGURE 35 XIAOMI CORPORATION: COMPANY SNAPSHOT

FIGURE 36 WHIRLPOOL CHINA: COMPANY SNAPSHOT

FIGURE 37 SPECTRUM BRANDS HOLDINGS: COMPANY SNAPSHOT

FIGURE 38 CHANGHONG HOLDING GROUP: COMPANY SNAPSHOT

FIGURE 39 GREE ELECTRIC APPLIANCES INC. OF ZHUHAI: COMPANY SNAPSHOT

FAQ

The global electronics appliance market is anticipated to grow from USD 511.51 Billion in 2023 to USD 950.79 Billion by 2030, at a CAGR of 9.26% during the forecast period.

Asia Pacific accounted for the largest market in the electronics appliance Market. Asia Pacific accounted for 39% market share of the global market value.

Samsung Electronics, Haier Group, Whirlpool Corporation, LG Electronics, Electrolux AB, Bosch, Panasonic Corporation, Midea Group, Sony Group Corporation, Koninklijke Philips N.V., Hisense Group, Arcelik A.S., TCL Technology Group, SEB Group, BSH Hausgeräte GmbH, Xiaomi Corporation, Whirlpool China, Spectrum Brands Holdings, Changhong Holding Group, Gree Electric Appliances Inc. of Zhuhai

Voice-Activated Control: Voice assistants like Amazon Alexa and Google Assistant are being integrated into appliances, allowing users to control them with their voice. This hands-free approach is making appliances more user-friendly and convenient.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.