REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 18.72 Billion by 2030 | 7 % | North America |

| by Dielectric Material | by Application |

|---|---|

|

|

SCOPE OF THE REPORT

High Frequency Ceramic Capacitor Market Overview

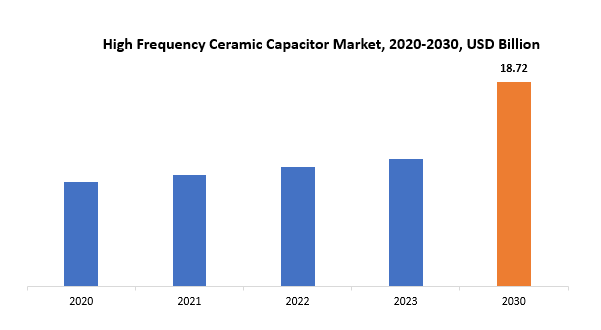

The global High Frequency Ceramic Capacitor market is anticipated to grow from USD 11.66 Billion in 2023 to USD 18.72 Billion by 2030, at a CAGR of 7 % during the forecast period.

The segment of the electronics industry devoted to the manufacture, distribution, and application of ceramic capacitors engineered to function effectively at high frequencies is known as the high-frequency ceramic capacitor market. Electrical energy is stored and released by capacitors, which are basic electronic components. To meet the strict performance requirements in high-frequency applications, where data transmission and rapid signal oscillations occur, specialized capacitors are needed. The capacity to handle signals in the radio frequency (RF) and microwave ranges, usually above 1 megahertz (MHz), is a defining feature of high-frequency ceramic capacitors.

These capacitors are essential parts of many electronic systems and devices, such as high-speed data communication systems, radar systems, wireless communication devices, medical equipment, and telecommunications equipment. With the development of technologies like 5G communication, the Internet of Things (IoT), and sophisticated medical imaging equipment, which all require effective signal processing at higher frequencies, the market for high-frequency ceramic capacitors has expanded dramatically. The small size and high capacitance values that high-frequency ceramic capacitors can provide in a tiny package are two of their main characteristics. This is especially crucial for contemporary electronic designs where space efficiency and miniaturization are top priorities. Intense research and development is being done in the high-frequency ceramic capacitor market to improve the products’ affordability, dependability, and performance. High-frequency ceramic capacitor technology is constantly evolving due to the need for better communication system functionality and the ongoing evolution of electronic applications. As a result, these capacitors are essential to the smooth operation of a wide range of electronic devices in our globally connected world.

First of all, the miniaturization of electronic devices depends on high frequency ceramic capacitors. A high frequency capability has become more and more in demand as devices get smaller and more compact and technology advances. These capacitors support the trend of miniaturization observed in smartphones, tablets, wearables, and other portable devices by enabling manufacturers to create smaller and more effective electronic products.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Dielectric Material, Application and Region |

| By Dielectric Material |

|

| By Application |

|

|

By Region

|

|

High Frequency Ceramic Capacitor Market Segmentation Analysis

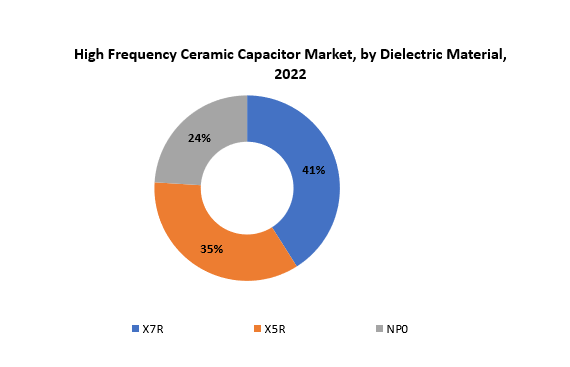

The global High Frequency Ceramic Capacitor market is divided into three segments Dielectric Material, application and region. By type it is divided as X7R, X5R, NP0. X7R segment holds the market share. Popular high frequency ceramic capacitor types that fall under the class II category are X7R and X5R. Their exceptional capacitance stability across a broad temperature range is well known. They are temperature-compensating ceramics, as indicated by the “X” in their names. Applications requiring high capacitance stability, dependability, and moderate capacitance values frequently employ X7R and X5R capacitors. These kinds are used in filtering applications in electronic devices, decoupling circuits, and power supplies.

However, NP0 capacitors, sometimes referred to as C0G capacitors, are class I capacitors. The excellent temperature stability, low dielectric losses, and high Q factor of NP0 capacitors are their distinguishing features. Because of these characteristics, NP0 capacitors can be used in high-precision and high-stable applications like high-frequency filters, oscillators, and radio frequency (RF) circuits. When it’s crucial to maintain consistent performance over a wide temperature range, the NP0 capacitors are especially recommended.

The particular requirements of the application determine the type of capacitor to use. The selection of X7R and X5R capacitors in a range of electronic systems is based on their ability to combine affordability and performance. On the other hand, when ultra-stable capacitance values and low signal distortion are crucial, NP0 capacitors are recommended.

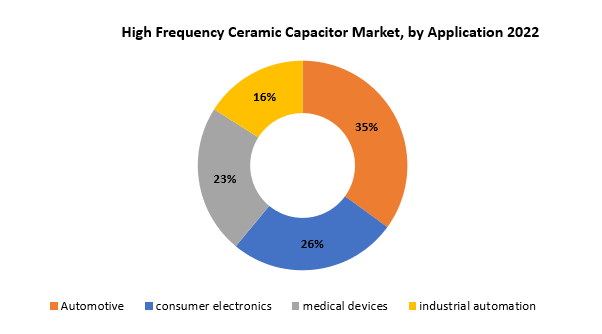

By application it is divided into Automotive, consumer electronics, medical devices, industrial automation. In this Automotive holds the largest market share. High-frequency ceramic capacitors’ application-specific division into automotive, consumer electronics, medical devices, and industrial automation highlights how versatile these parts are for a range of industrial applications. Every application area has different needs, and high-frequency ceramic capacitors have unique properties that make them suitable for a variety of electronic applications. High-frequency ceramic capacitors are essential to the automotive industry because they support a variety of electronic components found in automobiles. They are used in infotainment systems, engine control units, and other electronic modules as well as advanced driver assistance systems (ADAS). In the automotive environment, the capacitors’ resistance to high temperatures and challenging operating conditions is especially important. Their use enhances the effectiveness, dependability, and functionality of electronic systems in contemporary automobiles.

Another significant industry that makes extensive use of high-frequency ceramic capacitors is consumer electronics. These capacitors are essential parts of gadgets like wearables, laptops, tablets, and cellphones. High-frequency ceramic capacitors’ ability to be smaller is particularly useful in the consumer electronics industry, where the need for lightweight, portable devices and space restrictions are major motivators. These devices’ electronic circuits function and perform better thanks to capacitors. High-frequency ceramic capacitors are used in a wide range of medical device applications, from patient monitoring devices to diagnostic equipment. In medical electronics, where precise signal processing and data transmission are necessary for diagnostic and therapeutic purposes, their accuracy and dependability are crucial. The stability and effectiveness of electronic components are enhanced by capacitors in medical devices.

High Frequency Ceramic Capacitor Market Dynamics

Driver

The deployment of 5G technology and the ongoing expansion of telecommunications networks have increased the demand for high-frequency ceramic capacitors.

In comparison to 4G networks, 5G networks use higher frequencies to function. Applications in the radio frequency (RF) modules of 5G base stations and other communication infrastructure are a good fit for high-frequency ceramic capacitors. The high-frequency operations needed for quicker data transmission are supported by these capacitors. In order to improve signal strength and reliability, 5G networks frequently make use of beamforming techniques and sophisticated antenna systems. In RF front-end modules and antenna systems, high-frequency ceramic capacitors are essential components that aid in impedance matching and filtering for effective signal transmission. Miniaturization is frequently required in the design of 5G-enabled devices, such as smartphones and other communication equipment, in order to accommodate the increased component complexity. Due to their small size and excellent performance, high-frequency ceramic capacitors are crucial for fulfilling the miniaturization demands of 5G devices.

Massive MIMO, a crucial technology for 5G networks, uses a lot of antennas to boost data throughput and improve spectral efficiency. In the RF front-end of Massive MIMO systems, high-frequency ceramic capacitors are used to support the intricate signal processing and communication needs.

Restraint

Advances in technology can sometimes outpace the development of certain components.

Devices increasingly need components with higher performance specifications as technology develops. For example, the development of specific supporting components like capacitors or resistors may not keep up with the demand for faster processors, higher data transfer rates, or increased energy efficiency. Components for the increasingly compact and integrated electronic devices must be both smaller in size and able to fulfill the performance requirements of the smaller systems. For some components, miniaturization and performance can be difficult to achieve simultaneously. The emergence of completely new technologies, like 5G, quantum computing, or sophisticated artificial intelligence, may bring about demands that are beyond the capacity of already-existing parts. It can be difficult to design components that are both compatible with and optimized for these cutting-edge technologies.

Novel materials with distinctive characteristics may be found as a result of developments in materials science. To properly comprehend these materials’ behavior and possible uses, research and development work may be necessary before integrating them into electronic components. Components that offer high performance, exceptional durability, and reliability are in greater demand as devices become more complex and are used in critical applications. Certain component technologies may face difficulties in meeting these strict requirements. Changing environmental laws and an increasing emphasis on sustainability may have an effect on the materials and production methods used to make electronic components. It can be difficult to adjust to these changes while preserving or enhancing performance.

Opportunities

The rollout of 5G networks requires advanced electronic components, including high-frequency ceramic capacitors.

In comparison to earlier generations, 5G networks use higher frequencies to function. Components that are capable of handling these higher frequencies effectively are needed for 5G’s usage of millimeter-wave frequencies. For these kinds of uses, ceramic capacitors operating at high frequencies are ideal. Compact and integrated designs are frequently utilized in 5G infrastructure, particularly when it comes to small cells and sophisticated antenna systems. Because of their high capacitance and compact size, high-frequency ceramic capacitors are well suited for electronic circuits that are tightly packed and miniature. It’s critical to minimize signal loss in high-frequency applications. Low parasitic losses characterize high-frequency ceramic capacitors, which makes them perfect for preserving signal integrity in 5G communication systems.

High-frequency signal-handling components are needed for radio frequency (RF) front-end modules in 5G devices, such as base stations and smartphones. In RF front-end modules, high-frequency ceramic capacitors are frequently used for signal management, tuning, and filtering. For increased data rates and coverage, 5G networks frequently make use of cutting-edge technologies like beamforming and multiple-input multiple-output (MIMO). Ceramic capacitors with high frequencies are essential parts of the radio frequency chains that drive these technologies.

High Frequency Ceramic Capacitor Market Trends

-

One of the main factors propelling the high-frequency ceramic capacitor market is the rollout of 5G networks. These capacitors support the high-frequency and high-speed data transmission requirements, making them essential parts of the 5G infrastructure. The demand for high-frequency ceramic capacitors is anticipated to increase significantly as 5G adoption spreads throughout the world.

-

The demand for high-frequency ceramic capacitors is increasing due to the automotive industry’s shift to electric vehicles (EVs) and the incorporation of sophisticated electronics in conventional vehicles. These parts are essential to the power electronics, sensors, and communication systems found in contemporary cars.

-

Miniaturized high-frequency ceramic capacitors are in high demand due to the trend toward smaller and more compact electronic devices as well as the requirement for high-performance components.

-

The need for high-frequency ceramic capacitors is rising due to the increasing use of IoT devices in a variety of industries. These capacitors are used in IoT devices’ sensors and communication modules, which advances the creation of smart cities, smart homes, and industrial automation.

-

High-frequency ceramic capacitors are among the sophisticated electronic components needed for the development and application of autonomous driving and advanced driver-assistance systems (ADAS) in the automotive industry.

-

The demand for high-frequency ceramic capacitors in power electronics for solar inverters, wind turbines, and energy storage systems is driven by the focus on renewable energy sources and green technologies.

Competitive Landscape

The competitive landscape of the High Frequency Ceramic Capacitor market was dynamic, with several prominent companies competing to provide innovative and advanced High Frequency Ceramic Capacitor solutions.

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- Vishay Intertechnology, Inc.

- Samsung Electro-Mechanics

- Kyocera Corporation

- Taiyo Yuden Co., Ltd.

- AVX Corporation

- KEMET Corporation

- Yageo Corporation

- Würth Elektronik GmbH & Co. KG

- Nippon Chemi-Con Corporation

- KOA Corporation

- Darfon Electronics Corp.

- Holy Stone Enterprise Co., Ltd.

- AFM Microelectronics, Inc.

- Johanson Dielectrics Inc.

- API Technologies Corp.

- Parker Chomerics

- Illinois Capacitor, Inc.

- Dielectric Laboratories

Recent Developments:

December 21, 2023: Economic and social activities based on mass production and consumption create a society based on mass waste and impede healthy material circulation. They are also closely related to various environmental problems such as climate change, depletion of natural resources, and destruction of biodiversity caused by large-scale resource extraction. The demand for resources, energy, and food, as well as the amount of waste generated, are becoming increasingly serious worldwide.

July 12, 2023: Murata has announced its new Parasitic Element Coupling Device. This state-of-the-art solution improves antenna efficiency by magnetically coupling the parasitic element with the antenna and is the world’s first solution designed for Wi-Fi 6E and Wi-Fi 7 products. For designers of smartphones, tablets, network routers, game consoles, and other compact electronics, it enables them to build more efficient antennas – a key requirement for many modern space-constrained devices. To develop products conforming to Wi-Fi 6E and Wi-Fi 7 standards, which utilize high-speed wireless communication, multiple high-performance antennas must be installed in electronic devices to improve communication speed and quality.

Regional Analysis

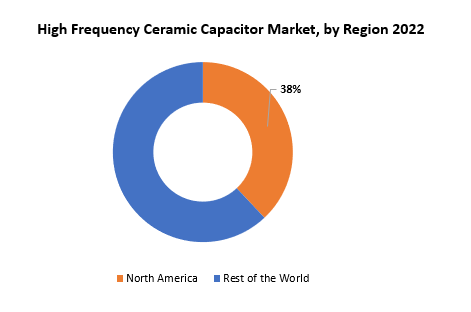

North America accounted for the largest market in the High Frequency Ceramic Capacitor market. North America accounted for 38% of the worldwide market value. Ceramic capacitors with high frequencies are integral to electronic devices, serving a multitude of purposes in various geographical areas. The market for these capacitors exhibits unique trends and dynamics that affect demand and usage, according to a regional study of the industry. The strong presence of the electronics and telecommunications industries drives the market for high-frequency ceramic capacitors in North America. The United States, with its booming technology sector, stands out as a major consumer of these capacitors. The growing use of sophisticated electronic components in communication infrastructure, automobile applications, and medical devices is driving up demand for them. High-frequency ceramic capacitors are innovative and are used in cutting-edge technologies because of the region’s emphasis on research and development.

Europe’s high-frequency ceramic capacitor market is steadily expanding due to the continent’s robust automotive sector and growing industrial electronics usage. The demand for these capacitors is largely driven by nations like Germany, France, and the UK. High-performance electronic components, such as high-frequency ceramic capacitors, are becoming more and more necessary as a result of strict laws encouraging energy efficiency and the shift to electric vehicles. The market for high-frequency ceramic capacitors is becoming increasingly dominated by Asia-Pacific, with Taiwan, South Korea, China, and Japan at the forefront. The region’s prominence is a result of its standing as a center for the production of electronics worldwide. The booming consumer electronics market and the quick development of 5G infrastructure are driving up demand for high-frequency ceramic capacitors.

Target Audience for High Frequency Ceramic Capacitor Market

- Electronics Manufacturers

- Automotive Industry

- Telecommunications Companies

- Renewable Energy Sector

- Consumer Electronics Manufacturers

- IoT (Internet of Things) Device Manufacturers

- Aerospace and Defense Industry

- Medical Device Manufacturers

- Power Electronics Manufacturers

- Research and Development Institutions

Import & Export Data for High Frequency Ceramic Capacitor Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the High Frequency Ceramic Capacitor market. This knowledge equips businesses with strategic advantages, such as:

Identifying emerging markets with untapped potential. Adapting supply chain strategies to optimize cost-efficiency and market responsiveness. Navigating competition by assessing major players’ trade dynamics.

Key insights

-

Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global High Frequency Ceramic Capacitor market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

-

Market players: gain insights into the leading players driving the High Frequency Ceramic Capacitor trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

-

Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

-

Product breakdown: by segmenting data based on High Frequency Ceramic Capacitor types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids government in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the High Frequency Ceramic Capacitor Market Report

High Frequency Ceramic Capacitor Market by Dielectric Material, 2020-2030, (USD Billion) (Thousand Units)

- X7R

- X5R

- NP0

High Frequency Ceramic Capacitor Market by Application, 2020-2030, (USD Billion) (Thousand Units)

- Automotive

- Consumer Electronics

- Medical Devices

- Industrial Automation

High Frequency Ceramic Capacitor Market by Region, 2020-2030, (USD Billion) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

-

What is the expected growth rate of the High Frequency Ceramic Capacitor market over the next 7 years?

-

Who are the major players in the High Frequency Ceramic Capacitor market and what is their market share?

-

What are the end-user industries driving market demand and what is their outlook?

-

What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

-

How is the economic environment affecting the High Frequency Ceramic Capacitor market, including factors such as interest rates, inflation, and exchange rates?

-

What is the expected impact of government policies and regulations on the High Frequency Ceramic Capacitor market?

-

What is the current and forecasted size and growth rate of the global High Frequency Ceramic Capacitor market?

-

What are the key drivers of growth in the High Frequency Ceramic Capacitor market?

-

Who are the major players in the market and what is their market share?

-

What are the distribution channels and supply chain dynamics in the High Frequency Ceramic Capacitor market?

-

What are the technological advancements and innovations in the High Frequency Ceramic Capacitor market and their impact on product development and growth?

-

What are the regulatory considerations and their impact on the market?

-

What are the challenges faced by players in the High Frequency Ceramic Capacitor market and how are they addressing these challenges?

-

What are the opportunities for growth and expansion in the High Frequency Ceramic Capacitor market?

-

What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON HIGH FREQUENCY CERAMIC CAPACITOR MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET OUTLOOK

- GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- X7R

- X5R

- NP0

- GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- AUTOMOTIVE

- CONSUMER ELECTRONICS

- MEDICAL DEVICES

- INDUSTRIAL AUTOMATION

- GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCT OFFERED, RECENT DEVELOPMENTS)

- MURATA MANUFACTURING CO., LTD.

- TDK CORPORATION

- VISHAY INTERTECHNOLOGY, INC.

- SAMSUNG ELECTRO-MECHANICS

- KYOCERA CORPORATION

- TAIYO YUDEN CO., LTD.

- AVX CORPORATION

- KEMET CORPORATION

- YAGEO CORPORATION

- WÜRTH ELEKTRONIK GMBH & CO. KG

- NIPPON CHEMI-CON CORPORATION

- KOA CORPORATION

- DARFON ELECTRONICS CORP.

- HOLY STONE ENTERPRISE CO., LTD.

- AFM MICROELECTRONICS, INC.

- JOHANSON DIELECTRICS INC.

- API TECHNOLOGIES CORP.

- PARKER CHOMERICS

- ILLINOIS CAPACITOR, INC.

- DIELECTRIC LABORATORIES *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 2 GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 4 GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 13 US HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 14 US HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 15 US HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 16 US HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 18 CANADA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 CANADA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 22 MEXICO HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 24 MEXICO HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 32 BRAZIL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 34 BRAZIL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 36 ARGENTINA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 38 ARGENTINA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 40 COLOMBIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 42 COLOMBIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 54 INDIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 56 INDIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 58 CHINA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 60 CHINA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 62 JAPAN HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 64 JAPAN HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 84 EUROPE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 86 EUROPE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 88 GERMANY HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 90 GERMANY HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 91 UK HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 92 UK HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 93 UK HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 94 UK HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 96 FRANCE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 98 FRANCE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 100 ITALY HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 102 ITALY HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 104 SPAIN HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 106 SPAIN HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 108 RUSSIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 110 RUSSIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 121 UAE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 122 UAE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 123 UAE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 124 UAE HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2020-2030

FIGURE 9 GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2020-2030

FIGURE 11 GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY DIELECTRIC MATERIAL (USD BILLION) 2022

FIGURE 14 GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY APPLICATION (USD BILLION) 2022

FIGURE 16 GLOBAL HIGH FREQUENCY CERAMIC CAPACITOR MARKET BY REGION (USD BILLION) 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 MURATA MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

FIGURE 19 TDK CORPORATION: COMPANY SNAPSHOT

FIGURE 20 VISHAY INTERTECHNOLOGY, INC.: COMPANY SNAPSHOT

FIGURE 21 SAMSUNG ELECTRO-MECHANICS: COMPANY SNAPSHOT

FIGURE 22 KYOCERA CORPORATION: COMPANY SNAPSHOT

FIGURE 23 TAIYO YUDEN CO., LTD.: COMPANY SNAPSHOT

FIGURE 24 AVX CORPORATION: COMPANY SNAPSHOT

FIGURE 25 KEMET CORPORATION: COMPANY SNAPSHOT

FIGURE 26 YAGEO CORPORATION: COMPANY SNAPSHOT

FIGURE 27 WÜRTH ELEKTRONIK GMBH & CO. KG: COMPANY SNAPSHOT

FIGURE 28 NIPPON CHEMI-CON CORPORATION: COMPANY SNAPSHOT

FIGURE 29 KOA CORPORATION: COMPANY SNAPSHOT

FIGURE 30 DARFON ELECTRONICS CORP.: COMPANY SNAPSHOT

FIGURE 31 HOLY STONE ENTERPRISE CO., LTD.: COMPANY SNAPSHOT

FIGURE 32 AFM MICROELECTRONICS, INC.: COMPANY SNAPSHOT

FIGURE 33 JOHANSON DIELECTRICS INC.: COMPANY SNAPSHOT

FIGURE 34 API TECHNOLOGIES CORP.: COMPANY SNAPSHOT

FIGURE 35 PARKER CHOMERICS: COMPANY SNAPSHOT

FIGURE 36 ILLINOIS CAPACITOR, INC.: COMPANY SNAPSHOT

FIGURE 37 DIELECTRIC LABORATORIES: COMPANY SNAPSHOT

FAQ

The global High Frequency Ceramic Capacitor market is anticipated to grow from USD 11.66 Billion in 2023 to USD 18.72 Billion by 2030, at a CAGR of 7 % during the forecast period.

North America accounted for the largest market in the High Frequency Ceramic Capacitor market. North America accounted for 38 % market share of the global market value.

Murata Manufacturing Co., Ltd.,TDK Corporation,Vishay Intertechnology, Inc.,Samsung Electro-Mechanics,Kyocera Corporation,Taiyo Yuden Co., Ltd.,AVX Corporation,KEMET Corporation,Yageo Corporation,Würth Elektronik GmbH & Co. KG,Nippon Chemi-Con Corporation,KOA Corporation

One of the main factors propelling the high-frequency ceramic capacitor market is the rollout of 5G networks. These capacitors support the high-frequency and high-speed data transmission requirements, making them essential parts of the 5G infrastructure. The demand for high-frequency ceramic capacitors is anticipated to increase significantly as 5G adoption spreads throughout the world. The demand for high-frequency ceramic capacitors is increasing due to the automotive industry’s shift to electric vehicles (EVs) and the incorporation of sophisticated electronics in conventional vehicles. These parts are essential to the power electronics, sensors, and communication systems found in contemporary cars.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.