REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 5.37 billion by 2030 | 15.5% | North America |

| by Type | by Technology | by Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

MEMS Microphone Market Overview

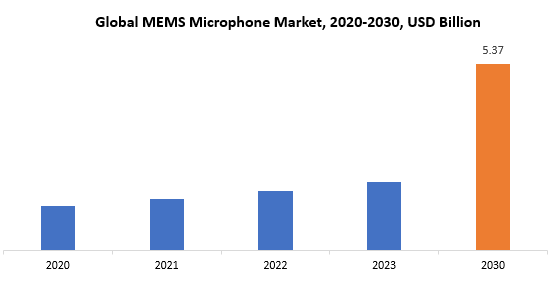

The global MEMS Microphone market size is projected to grow from USD 1.96 billion in 2023 to USD 5.37 billion by 2030, exhibiting a CAGR of 15.5% during the forecast period.

MEMS (Micro-Electro-Mechanical Systems) microphones are a form of microphone that uses microfabrication technology to integrate mechanical parts, sensors, and electronics on a single silicon chip. Unlike typical condenser or dynamic microphones, MEMS microphones employ microfabrication methods to construct small structures on the microscale. A diaphragm responds to sound waves, transforming acoustic impulses into electrical signals. This diaphragm is normally suspended above a back plate, and the movement induced by sound waves generates a change in capacitance, which is subsequently translated into an electrical signal by integrated electronics.

MEMS microphones provide a number of benefits, including tiny size, low power consumption, and excellent sensitivity. Due to their small size and efficiency, they are extensively utilized in a variety of applications including as smartphones, tablets, wearable devices, and IoT (Internet of Things) devices. MEMS technology incorporation into microphones has helped to the downsizing and improved performance of audio recording devices across a wide range of consumer electronics and industrial applications. The MEMS microphone industry plays an essential role in audio technologies and consumer electronics. Because of their small size, low power consumption, and outstanding performance, MEMS microphones have become commonplace in a wide range of devices. MEMS microphones are rapidly being used in smartphones, tablets, laptops, wearables, and Internet of Things devices for high-quality audio recording and voice recognition applications. Because of its tiny size, manufacturers may create stylish and compact products without sacrificing audio quality. Furthermore, MEMS microphones help to enhance upcoming technologies like virtual assistants, voice-activated controls, and communication systems. The rising need for smart and connected devices that rely on voice input and audio sensing capabilities is driving market expansion. Furthermore, the automotive industry has seen an increase in the integration of MEMS microphones for in-car communication, voice commands, and hands-free calling, broadening the market’s reach. The MEMS microphone market’s significance is highlighted by its role in improving user experience across a wide range of applications, from communication devices to smart home systems. As technology advances, the MEMS microphone market will play a critical role in determining the audio capabilities of next-generation devices, resulting in a more immersive and engaging user experience.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Type, Technology, Application and Region |

|

By Type |

|

| By Technology |

|

| By Application |

|

|

By Region

|

|

MEMS Microphone market Segmentation Analysis

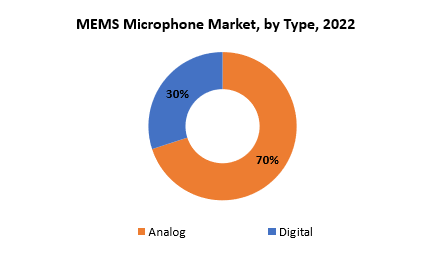

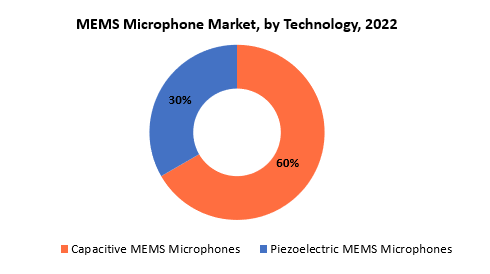

The global MEMS Microphone market is bifurcated three segments, by type, technology and region. By type, the market is bifurcated into digital and analog. By technology, the market is bifurcated piezoelectric mems microphones, capacitive mems microphones and region.

In the MEMS microphone market, type segmentation largely differs between Analog and Digital MEMS microphones, each with its own set of capabilities and applications. Analog MEMS microphones transform sound waves into analog electrical signals, producing a continuous voltage output proportional to the magnitude of the incoming audio input. These microphones are popular because to their ease of use, low power consumption, and applicability for applications that need a continuous signal. Digital MEMS microphones, on the other hand, integrate an analog-to-digital converter (ADC) right on the microphone chip, transforming the analog signal into a digital format before transmission. Digital MEMS microphones include advantages such as increased signal-to-noise ratio, more signal processing flexibility, and resistance to analog signal deterioration over extended distances. As a result, they are well suited for applications requiring improved audio quality, such as speech recognition, high-fidelity audio recording, and other digital communication systems. The application’s particular requirements determine whether Analog or Digital MEMS microphones are used. While Analog MEMS microphones are simpler and more power-efficient, Digital MEMS microphones are designed for applications that need extensive signal processing capabilities and greater audio quality. This segmentation of the MEMS microphone industry enables producers and users to pick the most appropriate microphone type depending on the necessary performance parameters for a specific application.

The MEMS microphone market is further subdivided by technology, with Piezoelectric MEMS Microphones and Capacitive MEMS Microphones being the two most important categories. Piezoelectric MEMS microphones make use of the piezoelectric phenomenon, which occurs when mechanical stress creates an electric charge in specific materials, such as piezoelectric crystals. The mechanical vibrations induced by sound waves generate electrical impulses in these microphones. Piezoelectric MEMS microphones are well known for their durability, excellent signal-to-noise ratio, and adaptability for certain applications such as extreme weather conditions. Capacitive MEMS microphones, on the other hand, rely on fluctuations in capacitance to transform sound waves into electrical impulses. These microphones are made up of a diaphragm suspended above a back plate, and when the diaphragm moves in response to sound, the capacitance between the diaphragm and back plate varies. Capacitive MEMS microphones provide features such as high sensitivity, low power consumption, and compatibility with miniaturized designs, making them ideal alternatives for applications where tiny size is critical, such as consumer electronics such as smartphones and wearables. Technology segmentation enables for varied applications that cater to unique demands. While Piezoelectric MEMS microphones are used in specialized applications that need durability, Capacitive MEMS microphones are used in applications that favor small form factors and high sensitivity. The availability of numerous technology alternatives allows manufacturers and designers to pick the best MEMS microphone for their specific applications.

MEMS Microphone market Dynamics

Driver

The growing demand for consumer electronics has been a pivotal driver for the widespread adoption of MEMS (Micro-Electro-Mechanical Systems) microphones.

This rise in demand is most seen in gadgets such as smartphones, tablets, smart speakers, wearables, and other consumer electronic items. The key driver of this development is changing customer expectations for better functionality and improved audio capabilities in these devices.

Smartphones, which have become an indispensable aspect of modern life, have rapidly included voice-activated features, voice assistants, and high-quality audio recording capabilities. As customers depend increasingly on voice commands and anticipate superior audio experiences, the need for sophisticated microphones becomes important. MEMS microphones, with their small size, energy economy, and great performance, are ideal for current consumer devices. Voice-controlled functions are also increasingly being integrated into tablets and wearables, such as smartwatches and fitness trackers. MEMS microphones are critical in allowing good speech recognition and efficient audio input in these devices while maintaining their tiny form factors. Another area where MEMS microphones have gained traction is the growth of smart speakers, a key category within the smart home ecosystem. These gadgets rely primarily on voice instructions and require microphones that can record and analyze speech inputs properly. MEMS microphones, which are tiny yet powerful, have played an important role in providing the smooth and responsive voice interactions that customers expect.

Restraint

The MEMS microphone market has witnessed intense competition among manufacturers, leading to pricing pressures.

The fierce competition in the MEMS microphone industry has been a distinguishing feature, bringing both possibilities and problems for producers. As demand for MEMS microphones has increased, more businesses have joined the market, resulting in increased competition and pricing pressures. This fierce competitiveness has had significant ramifications for profit margins and, to a lesser extent, the market’s overall development trajectory. MEMS microphone manufacturers have used aggressive pricing techniques to obtain a competitive advantage and acquire market share. Because consumers have so many alternatives, businesses may feel obligated to offer competitive prices in order to stay appealing to customers. While this can assist end users by lowering the cost of MEMS microphones, it puts producers’ profit margins under strain. The influence of pricing pressures is especially substantial in a market where technical developments are constant and manufacturing efficiency is critical. Makers may have difficulties in balancing the requirement for innovation while maintaining competitive costs in order to obtain contracts and collaborations with device makers. As a result, profit margins may be compressed, hurting the financial viability of enterprises operating in this field.

Opportunities

The growing demand for voice-enabled devices provides a tremendous potential for MEMS microphones, driven by the extensive integration of voice-activated features.

From consumer electronics to automotive systems to IoT (Internet of Things) devices, the increasing dependence on voice recognition technology places MEMS microphones at the center of assuring clear and precise voice recording. Smartphones, smart speakers, tablets, and wearables have become focus areas for voice-activated functions in the consumer electronics market. Voice commands, dictation, and virtual assistants are becoming increasingly popular ways for consumers to connect with their gadgets in a smooth and natural manner. MEMS microphones are well-suited to satisfy the needs of these voice-centric applications due to their compact form factor, energy efficiency, and great performance. MEMS microphones play an important role in correctly recording and processing spoken instructions as speech recognition technology progresses, adding to a better user experience.

MEMS Microphone market Trends

- MEMS microphones continue to shrink in size, making them easier to integrate into tiny devices such as smartphones, wearables, and IoT devices. The drive toward miniaturization corresponds to consumer electronics desire for smaller and more portable devices.

- The expanding popularity of audio applications in consumer electronics, as well as the increasing prominence of voice-activated technologies and virtual assistants, all contribute to the growing acceptance of MEMS microphones. Smartphones, smart speakers, and other voice-controlled gadgets are creating a lot of interest.

- Digital MEMS microphones, which provide advantages such as enhanced signal processing and greater audio quality, continue to gain popularity. The industry is seeing developments in digital MEMS technology to support applications demanding increased audio capabilities, such as high-fidelity audio recording and speech recognition.

- MEMS microphones are important components in the development of IoT devices and smart home applications. Voice control and recognition functions in smart home systems are driving up demand for MEMS microphones.

- MEMS microphones are being used in areas other than consumer electronics, such as environmental monitoring and industrial environments. Because of their small size and dependability, they are well suited for a variety of environmental sensing and monitoring applications.

- With a focus on energy-efficient gadgets, there is a trend toward designing MEMS microphones that consume less power. This is especially important for battery-powered devices, where power efficiency is critical.

Competitive Landscape

The competitive landscape of the MEMS Microphone market was dynamic, with several prominent companies competing to provide innovative and advanced MEMS Microphone solutions.

- AAC Technologies

- Akustica Inc.

- Analog Devices, Inc.

- BSE Co. Ltd.

- CUI Inc.

- Goertek

- Hosiden Corporation

- Infineon Technologies AG

- Knowles Electronics

- Mouser Electronics, Inc.

- NeoMEMS Technologies Inc.

- New Japan Radio Company Ltd.

- STMicroelectronics NV

- TDK Corporation

- Vesper Technologies Inc.

- ON Semiconductor

- InvenSense

- Cirrus Logic, Inc

- Molex

Recent Developments:

March 22, 2023– Analog Devices, Inc. (ADI) introduced today a super low noise dual output DC/DC μModule regulator with patented silicon, layout, and packaging innovations.

May 15, 2023- onsemi , a leader in intelligent power and sensing technologies, today announced that Sineng Electric will integrate onsemi EliteSiC silicon carbide (SiC) MOSFETs and IGBT-based high-density power integrated modules (PIMs) into its utility-scale solar inverter and industry-first 200kW energy storage system (ESS).

Regional Analysis

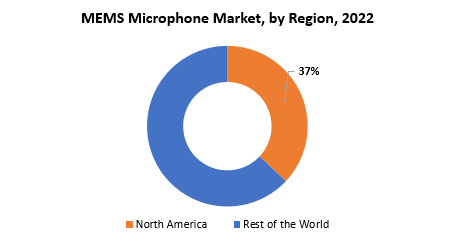

The dominant region in the MEMS microphone market is North America, holding a significant share of approximately 37%.

North America has one of the highest smartphone penetration rates in the world, with devices such as smartphones and tablets highly depending on MEMS microphones for audio recording. Because the region is home to major consumer electronics manufacturers such as Apple and Samsung, there is a stronger demand for MEMS microphones in various gadgets. North America sees tremendous investment in MEMS technology research & development, which contributes to breakthroughs and market growth. Because of factors such as the availability of established production, facilities and a fast increasing consumer electronics industry, this area is expected to become the leading market in the future. North America’s significance is also fueled by the broad use of voice-enabled technology and the growing need for high-quality audio experiences in a variety of applications. The region’s early adoption of smart devices, combined with a tech-savvy customer base, has contributed to the MEMS microphone market’s consistent expansion. Furthermore, North America has been a vital focus for R&D efforts, encouraging innovation in MEMS microphone technology and applications.

Target Audience for MEMS Microphone market

- Consumer Electronics Manufacturers

- Automotive Industry

- Industrial Applications

- Healthcare Sector

- Audio System Manufacturers

- Semiconductor and Component Suppliers

- Telecommunications Companies

- Research and Development Professionals

- End Consumers

Segments Covered in the MEMS Microphone market Report

MEMS Microphone market by Type

- Analog

- Digital

MEMS Microphone market by Technology

- Capacitive MEMS Microphones

- Piezoelectric MEMS Microphones

MEMS Microphone market by Application

- Consumer Electronics (Mobile Phones, Others)

- IoT & VR

- Hearing Aids

- Others

MEMS Microphone market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the MEMS Microphone market over the next 7 years?

- Who are the key market participants in MEMS Microphone, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the MEMS Microphone market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the MEMS Microphone market?

- What is the current and forecasted size and growth rate of the global MEMS Microphone market?

- What are the key drivers of growth in the MEMS Microphone market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the MEMS Microphone market?

- What are the technological advancements and innovations in the MEMS Microphone market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the MEMS Microphone market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the MEMS Microphone market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA TYPES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL MEMS MICROPHONE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON MEMS MICROPHONE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL MEMS MICROPHONE MARKET OUTLOOK

- GLOBAL MEMS MICROPHONE MARKET BY TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- ANALOG

- DIGITAL

- GLOBAL MEMS MICROPHONE MARKET BY TECHNOLOGY, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- CAPACITIVE MEMS MICROPHONES

- PIEZOELECTRIC MEMS MICROPHONES

- GLOBAL MEMS MICROPHONE MARKET BY APPLICATION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- CONSUMER ELECTRONICS

- IOT & VR

- HEARING AIDS

- OTHERS

- GLOBAL MEMS MICROPHONE MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCT OFFERED, RECENT DEVELOPMENTS)

- AAC TECHNOLOGIES

- AKUSTICA INC.

- ANALOG DEVICES, INC.

- BSE CO. LTD.

- CUI INC.

- GOERTEK

- HOSIDEN CORPORATION

- INFINEON TECHNOLOGIES AG

- KNOWLES ELECTRONICS

- MOUSER ELECTRONICS, INC.

- NEOMEMS TECHNOLOGIES INC.

- NEW JAPAN RADIO COMPANY LTD.

- STMICROELECTRONICS NV

- TDK CORPORATION

- VESPER TECHNOLOGIES INC.

- ON SEMICONDUCTOR

- INVENSENSE

- CIRRUS LOGIC, INC

- MOLEX

- *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 4 GLOBAL MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 6 GLOBAL MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 7 GLOBAL MEMS MICROPHONE MARKET BY REGION (USD BILLION) 2020-2030

TABLE 8 GLOBAL MEMS MICROPHONE MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA MEMS MICROPHONE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA MEMS MICROPHONE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 13 NORTH AMERICA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 15 NORTH AMERICA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 17 US MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 18 US MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 US MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 20 US MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 21 US MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 22 US MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 23 CANADA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 24 CANADA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 25 CANADA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 26 CANADA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 27 CANADA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 28 CANADA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 29 MEXICO MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 30 MEXICO MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 31 MEXICO MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 32 MEXICO MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 33 MEXICO MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 34 MEXICO MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 35 SOUTH AMERICA MEMS MICROPHONE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 36 SOUTH AMERICA MEMS MICROPHONE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 37 SOUTH AMERICA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 38 SOUTH AMERICA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 39 SOUTH AMERICA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 40 SOUTH AMERICA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 41 SOUTH AMERICA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 42 SOUTH AMERICA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 43 BRAZIL MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 44 BRAZIL MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 BRAZIL MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 46 BRAZIL MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 47 BRAZIL MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 48 BRAZIL MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 49 ARGENTINA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 50 ARGENTINA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ARGENTINA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 52 ARGENTINA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 53 ARGENTINA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 54 ARGENTINA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 55 COLOMBIA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 56 COLOMBIA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 57 COLOMBIA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 58 COLOMBIA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 59 COLOMBIA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 60 COLOMBIA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 61 REST OF SOUTH AMERICA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 REST OF SOUTH AMERICA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 65 REST OF SOUTH AMERICA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 66 REST OF SOUTH AMERICA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 67 ASIA-PACIFIC MEMS MICROPHONE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 68 ASIA-PACIFIC MEMS MICROPHONE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 69 ASIA-PACIFIC MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 70 ASIA-PACIFIC MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 ASIA-PACIFIC MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 72 ASIA-PACIFIC MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 73 ASIA-PACIFIC MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 74 ASIA-PACIFIC MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 75 INDIA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 76 INDIA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 77 INDIA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 78 INDIA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 79 INDIA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 80 INDIA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 81 CHINA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 82 CHINA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 83 CHINA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 84 CHINA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 85 CHINA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 86 CHINA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 87 JAPAN MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 88 JAPAN MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 JAPAN MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 90 JAPAN MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 91 JAPAN MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 92 JAPAN MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 93 SOUTH KOREA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 94 SOUTH KOREA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 95 SOUTH KOREA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 96 SOUTH KOREA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 97 SOUTH KOREA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 98 SOUTH KOREA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 99 AUSTRALIA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 100 AUSTRALIA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 AUSTRALIA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 102 AUSTRALIA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 103 AUSTRALIA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 104 AUSTRALIA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 105 SOUTH-EAST ASIA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 107 SOUTH-EAST ASIA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 108 SOUTH-EAST ASIA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 109 SOUTH-EAST ASIA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 110 SOUTH-EAST ASIA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF ASIA PACIFIC MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF ASIA PACIFIC MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 114 REST OF ASIA PACIFIC MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 115 REST OF ASIA PACIFIC MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 116 REST OF ASIA PACIFIC MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 117 EUROPE MEMS MICROPHONE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 118 EUROPE MEMS MICROPHONE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 119 EUROPE MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 120 EUROPE MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 121 EUROPE MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 122 EUROPE MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 123 EUROPE MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 124 EUROPE MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 125 GERMANY MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 126 GERMANY MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 GERMANY MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 128 GERMANY MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 129 GERMANY MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 130 GERMANY MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 131 UK MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 132 UK MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 133 UK MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 134 UK MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 135 UK MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 136 UK MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 137 FRANCE MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 138 FRANCE MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 139 FRANCE MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 140 FRANCE MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 141 FRANCE MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 142 FRANCE MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 143 ITALY MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 144 ITALY MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 145 ITALY MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 146 ITALY MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 147 ITALY MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 148 ITALY MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 149 SPAIN MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 150 SPAIN MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 151 SPAIN MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 152 SPAIN MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 153 SPAIN MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 154 SPAIN MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 155 RUSSIA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 156 RUSSIA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 157 RUSSIA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 158 RUSSIA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 159 RUSSIA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 160 RUSSIA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 161 REST OF EUROPE MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 162 REST OF EUROPE MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 163 REST OF EUROPE MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 164 REST OF EUROPE MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 165 REST OF EUROPE MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 166 REST OF EUROPE MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA MEMS MICROPHONE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA MEMS MICROPHONE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 170 MIDDLE EAST AND AFRICA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 171 MIDDLE EAST AND AFRICA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 172 MIDDLE EAST AND AFRICA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 173 MIDDLE EAST AND AFRICA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 174 MIDDLE EAST AND AFRICA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 175 UAE MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 176 UAE MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 177 UAE MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 178 UAE MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 179 UAE MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 180 UAE MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 181 SAUDI ARABIA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 182 SAUDI ARABIA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 183 SAUDI ARABIA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 184 SAUDI ARABIA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 185 SAUDI ARABIA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 186 SAUDI ARABIA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 187 SOUTH AFRICA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 188 SOUTH AFRICA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 189 SOUTH AFRICA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 190 SOUTH AFRICA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 191 SOUTH AFRICA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 192 SOUTH AFRICA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 194 REST OF MIDDLE EAST AND AFRICA MEMS MICROPHONE MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 195 REST OF MIDDLE EAST AND AFRICA MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 196 REST OF MIDDLE EAST AND AFRICA MEMS MICROPHONE MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2030

TABLE 197 REST OF MIDDLE EAST AND AFRICA MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 198 REST OF MIDDLE EAST AND AFRICA MEMS MICROPHONE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

FIGURE 10 GLOBAL MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2020-2030

FIGURE 11 GLOBAL MEMS MICROPHONE MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL MEMS MICROPHONE MARKET BY TYPE (USD BILLION) 2022

FIGURE 14 GLOBAL MEMS MICROPHONE MARKET BY TECHNOLOGY (USD BILLION) 2022

FIGURE 15 GLOBAL MEMS MICROPHONE MARKET BY APPLICATION (USD BILLION) 2022

FIGURE 16 GLOBAL MEMS MICROPHONE MARKET BY REGION (USD BILLION) 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 AAC TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 19 AKUSTICA INC.: COMPANY SNAPSHOT

FIGURE 20 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

FIGURE 21 BSE CO. LTD.: COMPANY SNAPSHOT

FIGURE 22 CUI INC.: COMPANY SNAPSHOT

FIGURE 23 GOERTEK: COMPANY SNAPSHOT

FIGURE 24 HOSIDEN CORPORATION: COMPANY SNAPSHOT

FIGURE 25 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

FIGURE 26 KNOWLES ELECTRONICS: COMPANY SNAPSHOT

FIGURE 27 MOUSER ELECTRONICS, INC.: COMPANY SNAPSHOT

FIGURE 28 NEOMEMS TECHNOLOGIES INC.: COMPANY SNAPSHOT

FIGURE 29 NEW JAPAN RADIO COMPANY LTD.: COMPANY SNAPSHOT

FIGURE 30 STMICROELECTRONICS NV: COMPANY SNAPSHOT

FIGURE 31 TDK CORPORATION: COMPANY SNAPSHOT

FIGURE 32 VESPER TECHNOLOGIES INC.: COMPANY SNAPSHOT

FIGURE 33 ON SEMICONDUCTOR: COMPANY SNAPSHOT

FIGURE 34 INVENSENSE: COMPANY SNAPSHOT

FIGURE 35 CIRRUS LOGIC, INC: COMPANY SNAPSHOT

FIGURE 36 MOLEX: COMPANY SNAPSHOT

FAQ

The global MEMS Microphone market size is projected to grow from USD 1.96 billion in 2023 to USD 5.37 billion by 2030, exhibiting a CAGR of 15.5% during the forecast period.

North America accounted for the largest market in the MEMS Microphone market.

AAC Technologies, Akustica Inc., Analog Devices, Inc.,BSE Co. Ltd., CUI Inc.,Goertek, Hosiden Corporation, Infineon Technologies AG, Knowles Electronics, Mouser Electronics, Inc., NeoMEMS Technologies Inc., New Japan Radio Company Ltd., STMicroelectronics NV,TDK Corporation, Vesper Technologies Inc., ON Semiconductor, InvenSense ,Cirrus Logic, Inc, Molexies Inc.

Due to its benefits, such as durability, excellent signal-to-noise ratio, and adaptability for certain applications in demanding situations, piezoelectric MEMS microphone technology is gaining popularity.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.