REPORT OUTLOOK

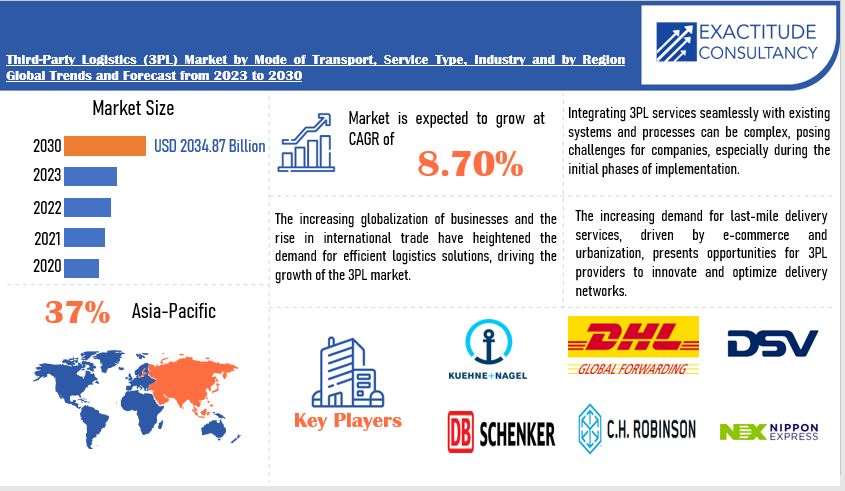

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 2034.87 Billion by 2030 | 8.70 % | Asia Pacific |

| by Mode | by Industry | by Service Type |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Third-Party Logistics (3PL) Market Overview

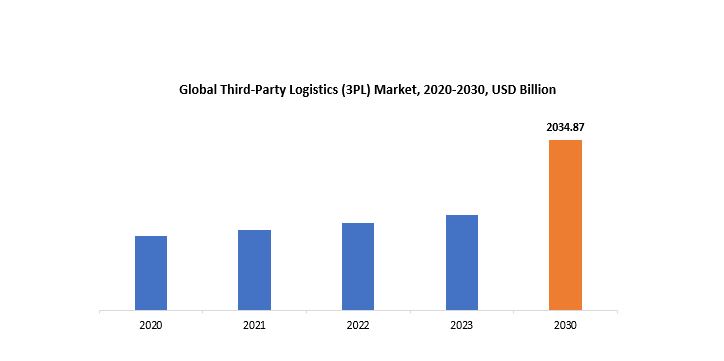

The global third-party logistics (3PL) market is anticipated to grow from USD 1134.83 Billion in 2023 to USD 2034.87 Billion by 2030, at a CAGR of 8.70 % during the forecast period.

Third-party logistics (3PL) refers to the practice of contracting out various logistics and supply chain tasks to third-party service providers. These specialist suppliers handle a wide range of tasks, including transportation, warehousing, distribution, and inventory management. Businesses frequently use 3PL services to improve supply chain operations, reduce costs, and increase overall efficiency. These services include product transportation, warehousing, order fulfillment, and value-added jobs such as packing and assembly.

The 3PL strategy is adaptable and scalable, allowing organizations to adjust to market changes and order volume variations. 3PL providers play a critical role in addressing the changing requirements of contemporary supply chain management, guaranteeing the efficient movement of products from producers to end-users in a timely and cost-effective way by using technology for greater visibility and control.

The organization outsources parts of its warehousing and distribution operations to third-party logistics companies. When inventory outsourcing or the delivery of products to certain locations is required, the company contracts a Third-Party Logistics Company. These companies specialize in transportation and storage, ensuring that items are delivered properly, on schedule, and in sufficient quantities to fulfill market demand. Aside from logistics, these organizations frequently provide value-added services such as supply chain component integration. Companies may focus on their core capabilities by outsourcing logistical activities, resulting in lower capital investment and decreased transportation hazards.

The rising necessity of effective inventory management, combined with the use of modern technologies such as cloud-based platforms, transportation management systems, and RFID for shipment monitoring, is moving the third-party logistics industry ahead. Automation and the rising prevalence of IoT-based services contribute to the market’s development, which is driven by customer expectations, expanding urbanization, and a thriving e-commerce industry.

The increasing complexity of worldwide supply chains coupled with the rising need for efficient logistics solutions has led companies to seek out the specialist services provided by Third-Party Logistics (3PL) providers. There is a significant demand for third-party logistics (3PL) services as a result of the growth in online retail operations within the burgeoning e-commerce industry, which has increased the need for strong logistical assistance, particularly in assuring timely delivery. Simultaneously, companies are choosing more and more to outsource their logistical needs in an effort to increase overall efficiency, save expenses, and streamline operations.

The basic features of flexibility and scalability built into the 3PL model, which enable companies to effectively grow their logistical operations and adapt to changing market needs, are major factors driving the 3PL market. Furthermore, enhancing the visibility and effectiveness of supply chains through the integration of technical innovations like IoT, AI, and data analytics gives 3PL providers a competitive edge. Businesses are becoming more globalized, and new markets are opening up opportunities for 3PL providers to expand globally and meet a range of logistical demands.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Mode of Transport, Industry ,Service Type and Region |

|

By Mode of Transport |

|

|

By Industry |

|

|

By Service Type |

|

|

By Region |

|

Third-Party Logistics (3PL) Market Segmentation Analysis

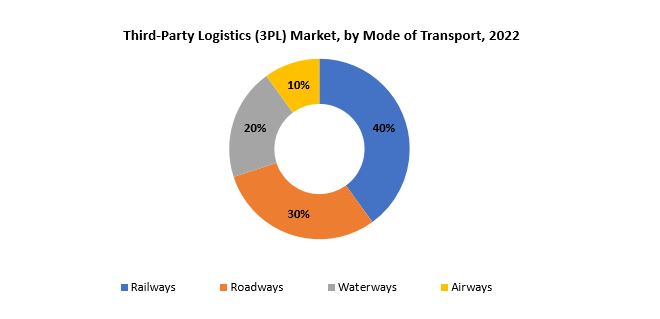

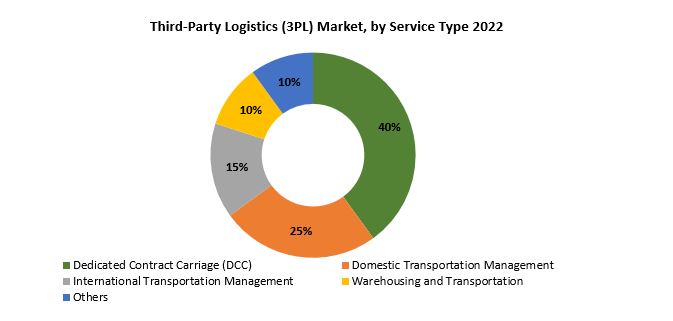

The global Third-Party Logistics (3PL) market is divided into three segments, mode of transport, industry, service type and region. By Mode of Transport the market is divided into railways, roadways, waterways, airways. By Service Type the market is classified into dedicated contract carriage (DCC), domestic transportation management, international transportation management, warehousing and transportation, others. By Industry the market is classified into technological, automotive, retailing, elements, food and beverages, healthcare, others.

Based on mode of transport, railway segment dominating in the third-party logistics (3PL) market. The railway segment is developing as the leading force in the Third-Party Logistics (3PL) market within the method of transportation category. This supremacy is due to the efficiency, dependability, and cost-effectiveness inherent in railway transit for freight moving. Rail transport’s ecologically benign aspect adds to its attractiveness, coinciding with the aspirations of businesses seeking to lessen their carbon impact. Railways excel at carrying big amounts of products over long distances, giving them a competitive advantage in supply chain logistics. The railway component of the 3PL industry is especially important for companies dealing in bulk commodities, manufacturing, and distribution. Railways are the primary form of transport for 3PL due to their capacity to handle large freight weights and vast network coverage.

Roadways also play a vital role in the movement of products across short to medium distances by offering accessibility and flexibility along with effective last-mile connection. Waterways, by virtue of their wide network of rivers, canals, and seas, offer a cost-effective alternative for international and bulk cargo when it comes to marine transport. Because of their speed and worldwide reach, airplanes are essential for long-distance and accelerated shipping, especially for valuable and time-sensitive cargo. Every mode has distinct benefits, and the wide range enables Third-Party Logistics (3PL) providers to tailor logistics solutions to particular customer requirements, improving the overall effectiveness of supply chain operations.

Based on service type, dedicated contract carriage (DCC) segment dominating in the third-party logistics (3PL) market. DCC is a strategic cooperation between the 3PL provider and the customer in which the logistics business assumes total responsibility for the client’s transportation operations. This includes the provision of dedicated cars, drivers, and customized managerial skills. The DCC concept provides clients with a dedicated fleet while eliminating the complications of ownership and operational administration. DCC’s extensive acceptance in the 3PL industry may be due to its ability to increase efficiency, reduce costs, and provide dependable and consistent transportation services. DCC is especially advantageous for firms with predictable and steady shipping demands since it streamlines processes and improves visibility across the supply chain.

The third-party logistics (3PL) industry also includes a wide range of service types that are essential for optimizing supply chain and logistics operations. In particular, “Domestic Transportation Management” entails firms outsourcing domestic transportation tasks to a professional 3PL supplier, leading in increased efficiency and cost savings. “International Transportation Management” specializes in negotiating cross-border complications, providing simplified logistics operations for worldwide trade. Another essential service, “Warehousing and Transportation,” integrates storage and transportation solutions, allowing 3PL providers to manage inventory, order fulfillment, and transportation. This integrated strategy improves operational efficiency by lowering lead times and providing organizations with end-to-end logistical assistance.

Third-Party Logistics (3PL) Market Dynamics

Driver

Increasing cross-border trade volume fuels demand for efficient and cost-effective logistics solutions offered by Third-party logistics (3PL) market during the forecast period.

The third-party logistics (3PL) market is seeing increased demand, owing to an increase in the amount of cross-border commerce, particularly over the projection period. The ever-changing global commerce landscape has created a demand for efficient and cost-effective logistics solutions, which the 3PL industry is well-positioned to provide.

The growing intensity of cross-border trade, which involves the flow of products and services across varied international marketplaces, creates logistical complications that need specialist knowledge. 3PL companies give tailored solutions to problems such as international shipping, customs clearance, and a variety of regulatory frameworks. With firms actively engaged in global commerce to gain access to larger markets and diversified client bases, the function of 3PL becomes increasingly important in guaranteeing the seamless movement of goods across borders.

These logistics providers streamline supply chain operations, cut transit times, and increase overall cost efficiency by using their wealth of knowledge, technology skills, and wide networks. The predicted timeframe highlights an increasing reliance on 3PL services as organizations actively seek strategic alliances to expertly handle the complexities of cross-border logistics, contributing considerably to the 3PL market’s continuous development and change.

Restraint

Increasing reliance on technology also exposes 3PLs to cyberattacks that can disrupt operations and jeopardize sensitive data is projected to hinder the third-party logistics (3PL) market during the forecast period.

The third-party logistics (3PL) industry faces a significant challenge throughout the projection period due to its increased dependence on technology, exposing these logistics providers to an increasing risk of cyberattacks. Because of the integration of new technology for increased efficiency and real-time tracking, 3PLs are vulnerable to hostile cyber actions that can interrupt critical operations and compromise sensitive data.

The range of cybersecurity risks, which includes ransomware, data breaches, and other types of cyberattacks, poses a significant danger to the smooth running of 3PL activities. Successful hacks not only cause operational interruption, but also compromise sensitive information such as shipping details, customer data, and supply chain strategy. Beyond immediate operational delays, the possible implications include reputational harm and financial losses.

Considering the critical relevance of data security, third-party logistics companies must emphasize comprehensive cybersecurity measures such as frequent assessments, personnel training, and the use of modern encryption technology. As the sector grapples with an ever-changing array of cyber threats, addressing cybersecurity vulnerabilities becomes critical to ensuring the resilience and continuity of 3PL operations in an increasingly digitalized logistics market.

Opportunities

The advancement in technologies is projected to boost the demand for third-party logistics (3PL) market.

The third-party logistics (3PL) industry is poised for rapid expansion, spurred by ongoing technology developments. As technology evolves, its integration with the logistics industry emerges as a critical driver for the 3PL market’s rise. Automation, artificial intelligence, real-time tracking, and data analytics are key technology advancements that are altering traditional logistics operations.

Automation simplifies operations, reducing manual mistakes and increasing overall efficiency. Predictive analytics and optimization are made easier by artificial intelligence, particularly in areas like as route planning and inventory management. Real-time monitoring solutions provide full insight across the whole supply chain, allowing for proactive problem resolution and enhanced adaptability to changes. As organizations recognize the need of keeping competitive in an increasingly digital market, the demand for 3PL services grows.

Businesses may improve their supply chain capabilities, cut costs, and increase customer satisfaction by embracing the latest technology supplied by 3PL providers. The predicted increase in demand for the 3PL market is consistent with the industry’s commitment to embracing and exploiting technology’s revolutionary capacity to address the shifting needs of modern supply chain dynamics.

Third-Party Logistics (3PL) Market Trends

-

Artificial intelligence, the Internet of Things (IoT), and blockchain are increasingly being used to improve supply chain visibility, efficiency, and overall logistical operations.

-

E-commerce’s ongoing expansion has been a significant driver for the 3PL market, with firms seeking effective logistics solutions to manage rising order quantities and fulfill customer expectations for faster and more dependable deliveries.

-

There is a growing emphasis on sustainability and ecologically friendly practices, with 3PL suppliers adopting eco-friendly solutions and optimizing transportation routes to decrease carbon footprints.

-

Demand for efficient and adaptable 3PL solutions, such as fulfillment centers, last-mile delivery, and returns management, is increasing as e-commerce grows.

-

Green warehouses, electric transportation, and carbon-neutral solutions are becoming more popular as consumers and organizations prioritize eco-friendly logistics.

-

Increasing dependence on data analytics tools and real-time visibility platforms to make educated decisions, optimize routes, and improve overall supply chain transparency.

-

The emphasis on enhancing last-mile delivery services, including the use of alternative delivery techniques such as drones and self-driving cars to handle urban logistical difficulties.

Competitive Landscape

The competitive landscape of the Third-Party Logistics (3PL) market was dynamic, with several prominent companies competing to provide innovative and advanced Third-Party Logistics (3PL) solutions.

- Kuehne + Nagel

- DHL Supply Chain & Global Forwarding

- DSV

- DB Schenker

- SF Logistics/Kerry Logistics

- H. Robinson Worldwide, Inc.

- Nippon Express

- CEVA Logistics

- Expeditors

- Sinotrans

- Maersk Logistics

- UPS Supply Chain Solutions

- B. Hunt

- GEODIS

- GXO Logistics

- DACHSER

- Total Quality Logistics

- Kintetsu World Express

- LX Pantos

- Bolloré Logistics

Recent Developments:

- November 29, 2023: DB Schenker, a prominent player in the global logistics industry, has taken a significant stride in airfreight operations through a collaborative effort with American Airlines Cargo. The unveiling of an Application Programming Interface (API) connection on November 14th, 2023, signifies a pivotal advancement in the digitization and optimization of airfreight booking procedures. This move is expected to enhance efficiency and streamline processes in the realm of airfreight logistics.

- 28November2023: Kuehne+Nagel has announced to acquire Farrow, a reputable customs broker based in Canada. This strategic move is aligned with Kuehne+Nagel’s commitment to enhancing its service portfolio, particularly for businesses reliant on customs clearance services. The acquisition is positioned to cater to the escalating demand within an environment marked by progressively intricate international trade regulations.

Regional Analysis

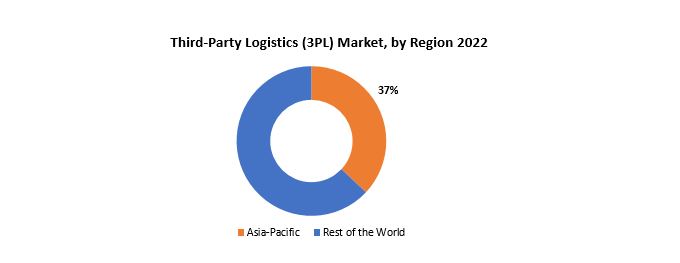

Asia-Pacific accounted for the largest market in the third-party logistics (3PL) market. Asia-Pacific accounted for 37 % market share of the global market value. The Asia-Pacific region leads the third-party logistics (3PL) industry, owing to a number of variables that contribute to its logistical significance. Robust economic development, a burgeoning e-commerce industry, and increased manufacturing activity have all contributed to a considerable need for effective and optimized logistics solutions.

In addition, firms in many sectors attempt to improve their supply chain operations, 3PL providers in Asia-Pacific play an important role by providing a broad range of services that include shipping, warehousing, and distribution. The region’s strategic geographical situation raises its relevance in global trade routes, establishing it as a vital center for logistics and supply chain activities. Furthermore, the rapid use of modern technologies such as artificial intelligence and the Internet of Things (IoT) in the logistics sector improves efficiency and responsiveness.

North America contributes the way in third-party logistics (3PL), owing to increased coordination among 3PL providers. These service providers handle approximately 12.4% of overall logistical activities in the area, with a rising emphasis on contract carriage services in the United States. Major companies such as UPS Supply Chain Solutions Inc. and XPO Logistics, Inc. help to drive the market’s rapid expansion. Government measures targeted at improving market-influencing technology bolster the growth of the North American 3PL sector.

Europe is poised for tremendous expansion, fueled in part by its major retail and e-commerce industries, both of which rely significantly on 3PL services. Rapid delivery of goods is crucial for both brick-and-mortar and online merchants in strongly competitive countries like the United Kingdom. Businesses of all sizes may compete with quick, on-demand delivery services by outsourcing logistics to professional delivery providers. The need of effective logistics is heightened by the United Kingdom’s standing as a major trade nation, sending commodities to numerous European nations. The freight and logistics sector in the United Kingdom has built a solid foundation over the years, due to well-developed infrastructure, a sophisticated supply chain network, and the presence of multinational firms.

Target Audience for Third-Party Logistics (3PL) Market

- Manufacturing Industries

- Retail Industries

- Healthcare Industries

- Automotive Industries

- Research & Consulting Firms

Segments Covered in the Third-Party Logistics (3PL) Market Report

Third-Party Logistics (3PL) Market by Mode of Transport

- Railways

- Roadways

- Waterways

- Airways

Third-Party Logistics (3PL) Market by Industry

- Technological

- Automotive

- Retailing

- Elements

- Food and Beverages

- Healthcare

- Others

Third-Party Logistics (3PL) Market by Service Type

- Dedicated Contract Carriage (DCC)

- Domestic Transportation Management

- International Transportation Management

- Warehousing and Transportation

- Others

Third-Party Logistics (3PL) Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

-

What is the expected growth rate of the Third-Party Logistics (3PL) market over the next 7 years?

-

Who are the major players in the Third-Party Logistics (3PL) market and what is their market share?

-

What are the Industry industries driving market demand and what is their outlook?

-

What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

-

How is the economic environment affecting the Third-Party Logistics (3PL) market, including factors such as interest rates, inflation, and exchange rates?

-

What is the expected impact of government policies and regulations on the Third-Party Logistics (3PL) market?

-

What is the current and forecasted size and growth rate of the global Third-Party Logistics (3PL) market?

-

What are the key drivers of growth in the Third-Party Logistics (3PL) market?

-

Who are the major players in the market and what is their market share?

-

What are the distribution channels and supply chain dynamics in the Third-Party Logistics (3PL) market?

-

What are the technological advancements and innovations in the Third-Party Logistics (3PL) market and their impact on product development and growth?

-

What are the regulatory considerations and their impact on the market?

-

What are the challenges faced by players in the third-party logistics (3PL) market and how are they addressing these challenges?

-

What are the opportunities for growth and expansion in the Third-Party Logistics (3PL) market?

-

What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON THIRD-PARTY LOGISTICS (3PL) MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET OUTLOOK

- GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT, 2020-2030, (USD BILLION)

- DISTILLED THIRD-PARTY LOGISTICS (3PL)

- DILUTED THIRD-PARTY LOGISTICS (3PL)

- FLAVORED THIRD-PARTY LOGISTICS (3PL)

- FUNCTIONAL THIRD-PARTY LOGISTICS (3PL)

- PREMIUM THIRD-PARTY LOGISTICS (3PL)

- GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE, 2020-2030, (USD BILLION)

- CONVENIENCE STORES

- SUPERMARKETS/HYPERMARKETS

- ONLINE RETAIL

- BARS AND RESTAURANTS

- GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY, 2020-2030, (USD BILLION)

- BELOW 20 YEARS OLD

- 20-40 YEARS OLD

- 40-60 YEARS OLD

- ABOVE 60 YEARS OLD

- GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- KUEHNE + NAGEL

- DHL SUPPLY CHAIN & GLOBAL FORWARDING

- DSV

- DB SCHENKER

- SF LOGISTICS/KERRY LOGISTICS

- H. ROBINSON WORLDWIDE, INC.

- NIPPON EXPRESS

- CEVA LOGISTICS

- EXPEDITORS

- SINOTRANS

- MAERSK LOGISTICS

- UPS SUPPLY CHAIN SOLUTIONS

- B. HUNT

- GEODIS

- GXO LOGISTICS

- DACHSER

- TOTAL QUALITY LOGISTICS

- KINTETSU WORLD EXPRESS

- LX PANTOS

- BOLLORÉ LOGISTICS

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 2 GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 3 GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 4 GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY REGION (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA THIRD-PARTY LOGISTICS (3PL) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 10 US THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 11 US THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 12 CANADA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 13 CANADA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 14 CANADA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 15 MEXICO THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 16 MEXICO THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 17 MEXICO THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA THIRD-PARTY LOGISTICS (3PL) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 23 BRAZIL THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 24 BRAZIL THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 25 ARGENTINA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 26 ARGENTINA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 27 ARGENTINA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 28 COLOMBIA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 29 COLOMBIA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 30 COLOMBIA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC THIRD-PARTY LOGISTICS (3PL) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 39 INDIA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 40 INDIA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 41 CHINA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 42 CHINA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 43 CHINA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 44 JAPAN THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 45 JAPAN THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 46 JAPAN THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 59 EUROPE THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 60 EUROPE THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 61 EUROPE THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 62 EUROPE THIRD-PARTY LOGISTICS (3PL) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 64 GERMANY THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 65 GERMANY THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 66 UK THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 67 UK THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 68 UK THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 69 FRANCE THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 70 FRANCE THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 71 FRANCE THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 72 ITALY THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 73 ITALY THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 74 ITALY THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 75 SPAIN THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 76 SPAIN THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 77 SPAIN THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 78 RUSSIA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 79 RUSSIA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 80 RUSSIA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA THIRD-PARTY LOGISTICS (3PL) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 89 UAE THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 90 UAE THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2020-2030

FIGURE 9 GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2020-2030

FIGURE 10 GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2020-2030

FIGURE 11 GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY MODE OF TRANSPORT (USD BILLION) 2022

FIGURE 14 GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY SERVICE TYPE (USD BILLION) 2022

FIGURE 15 GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY INDUSTRY (USD BILLION) 2022

FIGURE 16 GLOBAL THIRD-PARTY LOGISTICS (3PL) MARKET BY REGION (USD BILLION) 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 KUEHNE + NAGEL: COMPANY SNAPSHOT

FIGURE 19 DHL SUPPLY CHAIN & GLOBAL FORWARDING: COMPANY SNAPSHOT

FIGURE 20 DSV: COMPANY SNAPSHOT

FIGURE 21 DB SCHENKER: COMPANY SNAPSHOT

FIGURE 22 SF LOGISTICS/KERRY LOGISTICS: COMPANY SNAPSHOT

FIGURE 23 C.H. ROBINSON WORLDWIDE, INC.: COMPANY SNAPSHOT

FIGURE 24 NIPPON EXPRESS: COMPANY SNAPSHOT

FIGURE 25 CEVA LOGISTICS: COMPANY SNAPSHOT

FIGURE 26 EXPEDITORS: COMPANY SNAPSHOT

FIGURE 27 SINOTRANS: COMPANY SNAPSHOT

FIGURE 28 MAERSK LOGISTICS: COMPANY SNAPSHOT

FIGURE 29 UPS SUPPLY CHAIN SOLUTIONS: COMPANY SNAPSHOT

FIGURE 30 J.B. HUNT: COMPANY SNAPSHOT

FIGURE 31 GEODIS: COMPANY SNAPSHOT

FIGURE 32 GXO LOGISTICS: COMPANY SNAPSHOT

FIGURE 33 DACHSER: COMPANY SNAPSHOT

FIGURE 34 TOTAL QUALITY LOGISTICS: COMPANY SNAPSHOT

FIGURE 35 KINTETSU WORLD EXPRESS: COMPANY SNAPSHOT

FIGURE 36 LX PANTOS: COMPANY SNAPSHOT

FIGURE 37 BOLLORÉ LOGISTICS: COMPANY SNAPSHOT

FAQ

The global third-party logistics (3PL) market is anticipated to grow from USD 1134.83 Billion in 2023 to USD 2034.87 Billion by 2030, at a CAGR of 8.70 % during the forecast period.

Asia-Pacific accounted for the largest market in the third-party logistics (3PL) market. Asia-Pacific accounted for 37 % market share of the global market value.

Kuehne + Nagel, DHL Supply Chain & Global Forwarding, DSV, DB Schenker, SF Logistics/Kerry Logistics, C.H. Robinson Worldwide, Inc., Nippon Express, CEVA Logistics, Expeditors, Sinotrans, Maersk Logistics, UPS Supply Chain Solutions, J.B. Hunt, GEODIS, GXO Logistics, DACHSER, Total Quality Logistics, Kintetsu World Express, LX Pantos, Bolloré Logistics

The third-party logistics (3PL) market include the growing integration of advanced technologies like artificial intelligence and IoT to enhance operational efficiency. Additionally, a rising focus on sustainability and green logistics practices is shaping the industry, with 3PL providers adopting eco-friendly initiatives and emphasizing environmentally conscious supply chain solutions. Lastly, the increasing demand for e-commerce logistics, driven by the surge in online shopping, is reshaping 3PL strategies, emphasizing speed, flexibility, and last-mile delivery capabilities.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.