REPORT OUTLOOK

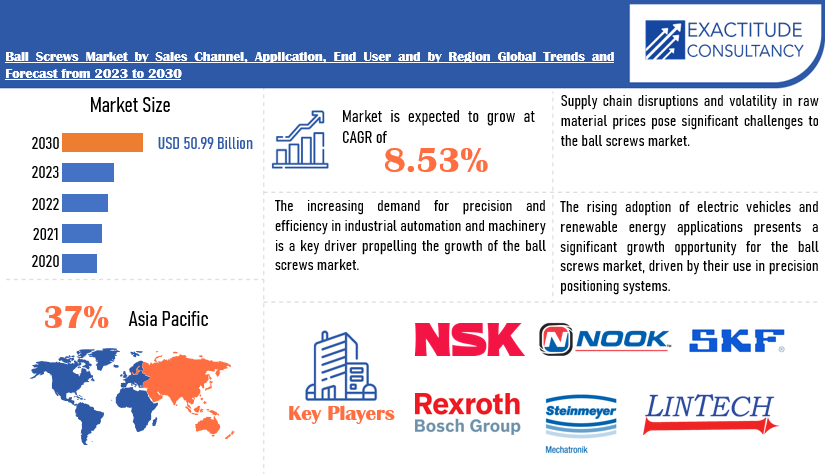

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 50.99 Billion by 2030 | 8.53% | Asia Pacific |

| by Sales Channel | by Application | by End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Ball Screws Market Overview

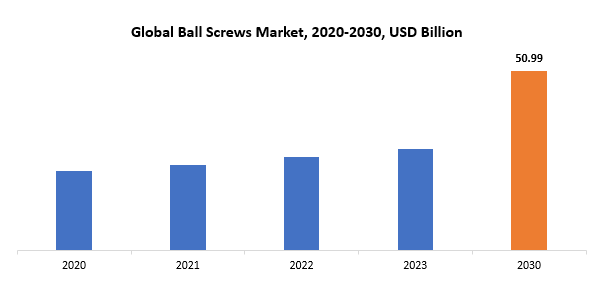

The global ball screws market is anticipated to grow from USD 28.75 Billion in 2023 to USD 50.99 Billion by 2030, at a CAGR of 8.53% during the forecast period.

A mechanical component called a ball screw is used to translate rotational motion into linear motion. It is constructed with a threaded rod, sometimes referred to as a screw, and a nut that rolls with the rotation of the screw thread. The nut is made out of many ball bearings. The nut moves along the screw length as a result of the balls’ helical route movement during the screw rotation, producing a linear motion. The design, production, and marketing of vital mechanical items as well as related goods and services are under the purview of the ball screw business. Support bearings, lubricants, and ball screw assemblies are a few other items that are offered in addition to ball screws. They’re employed in several industries including computer numerical control (CNC) machines, robotics, medical devices, aerospace equipment, and automotive manufacturing. During the forecast period, the industry may grow at a steady rate.

The majority of items using cutting edge technologies employ ball screws. The use of ball screws in aeroplanes flaps is widespread. Ball screws are also utilized in various activities, including airports, airline passenger service units, PAXWAY, chemical plant pipe control systems, nuclear power plant control rod control systems, and pressure tube inspection systems. The aforementioned sectors and goods are essential to today’s society and have been growing over time, which will in turn increase demand for ball screws. For human convenience, industrial automation and robots are being used more and more over the world. This kind of equipment also uses a lot of ball screws. Ball screws’ high cost can only be a possible restraint for ball screw market in developing countries otherwise the requirement and usage of ball screw has limited substitute which makes it a demanding product.

The increasing utilization of ball screws in airplane flaps and aircraft passenger boarding bridges is expected to drive demand for ball screws. The significant mechanical efficiency of transforming circular motion into linear motion, attributed to low friction, is a primary factor contributing to heightened demand across various industries. The thriving aviation sector, coupled with a growing preference for luxury vehicles, is poised to propel market growth in the foreseeable future. Furthermore, the rising adoption of ball screws in robotics and precision machining tools, aimed at enhancing accuracy and minimizing errors, is a key factor fueling the demand for the product.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Sales Channel, By Application, By End User, and By Region |

| By Sales Channel |

|

| By Application |

|

| By End User |

|

|

By Region

|

|

Ball Screws Market Segmentation Analysis

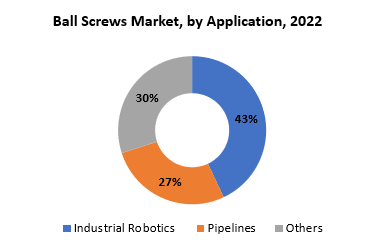

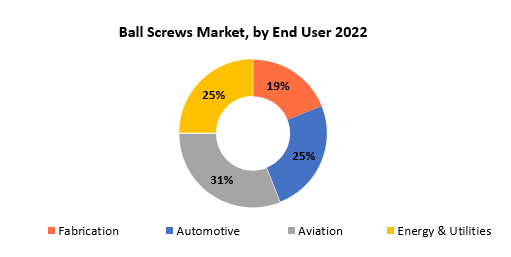

The market for Ball Screws is divided into four segments according to sales channel, application, end user and region The ball screw market, categorized by sales channels as OEM and aftermarket, applications encompassing industrial robotics, pipelines, and others, and catering to end-users in fabrication, automotive, aviation, and energy & utilities, reflects a diverse industry landscape with varied applications and customer segments.

The worldwide market is divided into groups based on applications, such as pipelines and industrial robotics. The industrial robot’s category saw the most increase in 2022 and is expected to maintain its leadership throughout the projection period. These sophisticated robots are utilized for motion control and precise placement in a wide range of sectors, including aerospace, electronics, and automotive. Ball screw demand is expected to soar to new heights due to the end-user verticals’ increasing revenue and application, as well as the increased deployment of industrial robots in these quickly expanding industries. Pipelines are another essential area of high income where they are employed to manufacture inspection robots or pigs. More than 2.76 million industrial robots, according to the International Federation of Robotics (IFR), were in operation as of 2021.

Pipelines have become a major participant in the ball screws industry, holding the second-largest share at 27% in 2022. This significance is explained by the vital function ball screws play in providing accurate linear motion, which is essential for pipeline construction and maintenance. The requirement for precise and effective control mechanisms in pipeline systems to improve overall dependability is what is driving the need. Due in large part to their great mechanical efficiency and low friction, ball screws have a significant market share in the year in question. These qualities are especially important in guaranteeing the seamless functioning of pipeline infrastructure.

The worldwide market is segmented into fabrication, automotive, aviation, and energy & utilities based on the end-user. Given that the aviation sector needs a steady supply of ball screws with high precision and efficiency, it had the greatest compound annual growth rate (CAGR) in 2022. Furthermore, the growing usage of industrial robots on assembly lines in the automobile industry is generating more money for the industry. With more industrial robots being produced for welding, material handling, and assembly applications, the fabrication and energy & utilities sectors are expected to see a notable increase in market share throughout the projection period. The aviation industry in India accounted for 2.5% of the country’s GDP in 2020, according to the Ministry of Civil Aviation in India.

Both the automotive and energy & utilities sectors are well-represented in the end-user segmented ball screw market, with respective market shares of 25%. Ball screws are widely used in the automobile sector, where they improve efficiency and precision in a variety of vehicle components. Ball screws are simultaneously used by the utilities and energy sectors for precise motion mechanisms and control in vital infrastructure. Ball screws play a varied role in satisfying the specific demands of both key industries, as seen by their equal market share. This highlights the importance of ball screws in both automobile production and energy-related applications.

Ball Screws Market Dynamics

Driver

The growing need for automation in sectors like manufacturing, aerospace, and automobiles is expected to fuel growth in the worldwide ball screw market.

The growing need for automation in important industries like manufacturing, aerospace, and autos is what is expected to propel the growth of the worldwide ball screw market. The rising need of efficiency, accuracy, and speed in industry processes makes the use of ball screws essential. Ball screws are essential components of automated machinery that provide precise and dependable linear motion in production. Ball screws are used in the aerospace industry for applications like aeroplanes control surfaces where accuracy is critical. Ball screws also help automate a number of activities in the automobile sector, such as robotic systems and assembly lines. Ball screws are seen as critical components in various industries because to the general trend towards automation, which is driving their market expansion internationally. The motivation for more productivity, reduced manual intervention, and enhanced operational efficiency further propels the utilization of ball screws, shaping the market’s trajectory in the foreseeable future.

Restraint

The global ball screw market is expected to come across growth restrictions owing to the complex maintenance requirements of ball screws.

The anticipated growth of the global ball screw market may encounter limitations due to the intricate maintenance requirements associated with ball screws. While these precision components offer high mechanical efficiency and accuracy, their intricate design demands meticulous maintenance practices. The need for regular lubrication, monitoring, and potential replacements can contribute to increased operational costs and downtime for end-users. Complex maintenance procedures may pose challenges for industries, particularly those without specialized expertise or resources for upkeep. As a result, potential buyers may weigh these maintenance complexities against the benefits of using ball screws, impacting the market growth. Manufacturers and end-users alike will need to address these challenges through innovations in design, materials, or maintenance technologies to mitigate the perceived limitations and sustain the growth trajectory of the ball screw market.

Opportunities

The growing adoption of electric actuators in some of the fastest-growing sectors provides opportunities to the ball screws market.

The ball screws market is poised to capitalize on opportunities arising from the increasing adoption of electric actuators in rapidly growing sectors. As industries across manufacturing, automotive, aerospace, and robotics embrace automation, electric actuators become integral components, driving the demand for precision motion control systems like ball screws. The superior performance, efficiency, and accuracy of ball screws make them well-suited for electric actuators, enhancing the overall functionality of automated systems. In the automotive sector, electric actuators utilizing ball screws contribute to advancements in electric vehicles and autonomous driving technologies. Similarly, in aerospace, the integration of electric actuators with ball screws enhances the precision of critical aircraft control systems. The expanding role of robotics in various industries further amplifies the demand for electric actuators, propelling the growth of the ball screws market. This trend underscores the symbiotic relationship between the rising adoption of electric actuators and the opportunities presented to the ball screws market in powering efficient and precise motion control mechanisms across diverse sectors.

Ball Screws Market Trends

-

Miniaturization: There is a growing demand for smaller and lighter ball screws, particularly in the medical device and semiconductor industries. This is being driven by the need for more compact and portable equipment.

-

Increased use of rolled threads: Rolled threads are becoming more popular than ground threads because they are more cost-effective and can be produced faster. However, ground threads offer better precision and are still preferred for some applications.

-

Development of new materials: Ball screw manufacturers are developing new materials that are lighter, stronger, and more wear-resistant. This is making ball screws more suitable for demanding applications.

-

Adoption of Industry 4.0 technologies: Ball screw manufacturers are increasingly adopting Industry 4.0 technologies, such as artificial intelligence and the Internet of Things (IoT), to improve the efficiency and productivity of their operations.

-

Growing demand for custom ball screws: There is a growing demand for custom ball screws that are designed to meet the specific needs of individual applications. This is being driven by the increasing complexity of machinery and equipment.

Competitive Landscape

The competitive landscape of the Ball Screws market was dynamic, with several prominent companies competing to provide innovative and advanced Ball Screws.

- THK Co. Ltd.

- NSK Ltd.

- HIWIN Corporation

- Bosch Rexroth AG

- Kuroda Precision Industries Ltd.

- NTN Corporation

- PMI Group

- Nook Industries Inc.

- TBI MOTION Technology Co. Ltd.

- Steinmeyer Mechatronik GmbH

- Schaeffler Technologies AG & Co. KG

- Parker Hannifin Corporation

- The Timken Company

- Lintech Motion

- HepcoMotion

- Helix Linear Technologies

- AB SKF

- SKF Motion Technologies

- Bishop-Wisecarver

- Isel Germany AG

- Oriental Motor USA Corp.

- Barnes Industries Inc.

- Roton Products Inc.

- Dynatect Manufacturing Inc.

- Rolled Ball Screws Co. Ltd.

Recent Developments:

09 January, 2024 – As part of its industry-leading efforts to electrify critical off-highway machinery, Bosch Rexroth announced a partnership with leading thermal management manufacturer Modine. The two organizations are collaborating to bring Modine EVantage (™) thermal management systems to the Bosch Rexroth portfolio of eLION products for electrified off-highway machinery worldwide.

04 January 2013 – Nook industries, a leading manufacturer of linear motion control systems and components, announced the formation of helix linear technologies, a wholly owned subsidiary and production facility that dramatically expands the capacity and medical industry focus of the company’s lead screw operations.

Regional Analysis

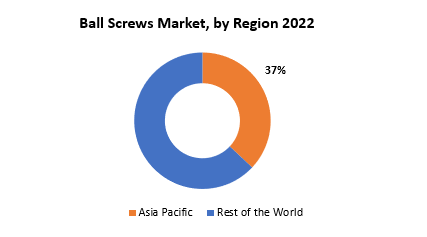

Asia-Pacific accounted for the greatest market share of 37% in 2022, with a market value of USD 865.92 Million, and is predicted to expand at the highest CAGR of 7.11% during the forecast period. Over the course of the forecast period, the Asia Pacific market is expected to develop at the quickest rate in the worldwide ball screw market. The market is expected to increase during the forecast period due to the existence of regional companies producing ball screws and the growing usage of these screws for manufacturing a variety of goods, including semiconductors, medical devices, and industrial robots. Additionally, these ball screws are employed in the production of automotive-related components. Thus, the region’s expanding need for ball screws is being driven by the need for automobiles.

With the second-largest share of 21% in the ball screw market in 2022, North America is a major participant. The region’s strong industrial environment, cutting-edge technical infrastructure, and the presence of important end-user sectors including manufacturing, aerospace, and automotive are all considered contributing factors to its significance. The need for ball screws is further driven by these industries’ ongoing emphasis on automation and accuracy. North America is a crucial hub for industrial applications and technical innovation in the given year, as evidenced by its considerable market share, which highlights its important role in setting the trajectory of the Ball Screws market.

Target Audience for Ball Screws

- Manufacturers of Ball Screws

- Automotive Industry

- Aerospace Sector

- Energy and Utilities

- Industrial Robotics Companies

- Machinery and Equipment Manufacturers

- Automation Solution Providers

- Research and Development Institutions

- Regulatory Authorities

- Investors and Financial Institutions

- End-Users in Manufacturing

Segments Covered in the Ball Screws Market Report

Ball Screws Market by Sales Channel

- OEM

- Aftermarket

Ball Screws Market by Application

- Industrial Robotics

- Pipelines

- Others

Ball Screws Market by End User

- Fabrication

- Automotive

- Aviation

- Energy & Utilities

Ball Screws Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Ball Screws market over the next 7 years?

- Who are the major players in the Ball Screws market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and Africa?

- How is the economic environment affecting the Ball Screws market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Ball Screws market?

- What is the current and forecasted size and growth rate of the global Ball Screws market?

- What are the key drivers of growth in the Ball Screws market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Ball Screws market?

- What are the technological advancements and innovations in the Ball Screws market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Ball Screws market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Ball Screws market?

- What are the services offered and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- SALES CHANNELS

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- BALL SCREWS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON BALL SCREWS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- BALL SCREWS MARKET OUTLOOK

- GLOBAL BALL SCREWS MARKET BY SALES CHANNEL, 2020-2030, (USD BILLION)

- OEM

- AFTERMARKET

- GLOBAL BALL SCREWS MARKET BY APPLICATION, 2020-2030, (USD BILLION)

- INDUSTRIAL ROBOTICS

- PIPELINES

- OTHERS

- GLOBAL BALL SCREWS MARKET BY END USER, 2020-2030, (USD BILLION)

- FABRICATION

- AUTOMOTIVE

- AVIATION

- ENERGY & UTILITIES

- GLOBAL BALL SCREWS MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- THK CO. LTD.

- NSK LTD.

- HIWIN CORPORATION

- BOSCH REXROTH AG

- KURODA PRECISION INDUSTRIES LTD.

- NTN CORPORATION

- PMI GROUP

- NOOK INDUSTRIES INC.

- TBI MOTION TECHNOLOGY CO. LTD.

- STEINMEYER MECHATRONIK GMBH

- SCHAEFFLER TECHNOLOGIES AG & CO. KG

- PARKER HANNIFIN CORPORATION

- THE TIMKEN COMPANY

- LINTECH MOTION

- HEPCOMOTION

- HELIX LINEAR TECHNOLOGIES

- AB SKF

- SKF MOTION TECHNOLOGIES

- BISHOP-WISECARVER

- ISEL GERMANY AG *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 2 GLOBAL BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 3 GLOBAL BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 4 GLOBAL BALL SCREWS MARKET BY REGIONS (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA BALL SCREWS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 10 US BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 11 US BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 12 CANADA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 13 CANADA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 14 CANADA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 15 MEXICO BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 16 MEXICO BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 17 MEXICO BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA BALL SCREWS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 23 BRAZIL BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 24 BRAZIL BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 25 ARGENTINA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 26 ARGENTINA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 27 ARGENTINA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 28 COLOMBIA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 29 COLOMBIA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 30 COLOMBIA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC BALL SCREWS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 39 INDIA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 40 INDIA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 41 CHINA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 42 CHINA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 43 CHINA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 44 JAPAN BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 45 JAPAN BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 JAPAN BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 59 EUROPE BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 60 EUROPE BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 61 EUROPE BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 62 EUROPE BALL SCREWS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 64 GERMANY BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 65 GERMANY BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 66 UK BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 67 UK BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 68 UK BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 69 FRANCE BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 70 FRANCE BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 71 FRANCE BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 72 ITALY BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 73 ITALY BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 74 ITALY BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 75 SPAIN BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 76 SPAIN BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 77 SPAIN BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 78 RUSSIA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 79 RUSSIA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 80 RUSSIA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA BALL SCREWS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 89 UAE BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 90 UAE BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-203

TABLE 94 SOUTH AFRICA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-203

TABLE 97 REST OF MIDDLE EAST AND AFRICA BALL SCREWS MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA BALL SCREWS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA BALL SCREWS MARKET BY END USER (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BALL SCREWS BY SALES CHANNEL, USD BILLION, 2020-2030

FIGURE 9 GLOBAL BALL SCREWS BY APPLICATION, USD BILLION, 2020-2030

FIGURE 10 GLOBAL BALL SCREWS BY END USER, USD BILLION, 2020-2030

FIGURE 11 GLOBAL BALL SCREWS BY REGION, USD BILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL BALL SCREWS BY SALES CHANNEL, USD BILLION, 2022

FIGURE 14 GLOBAL BALL SCREWS BY APPLICATION, USD BILLION, 2022

FIGURE 15 GLOBAL BALL SCREWS BY END USER, USD BILLION, 2022

FIGURE 16 GLOBAL BALL SCREWS BY REGION, USD BILLION, 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 THK CO. LTD.: COMPANY SNAPSHOT

FIGURE 19 NSK LTD.: COMPANY SNAPSHOT

FIGURE 20 HIWIN CORPORATION: COMPANY SNAPSHOT

FIGURE 21 BOSCH REXROTH AG: COMPANY SNAPSHOT

FIGURE 22 KURODA PRECISION INDUSTRIES LTD.: COMPANY SNAPSHOT

FIGURE 23 NTN CORPORATION: COMPANY SNAPSHOT

FIGURE 24 PMI GROUP: COMPANY SNAPSHOT

FIGURE 25 NOOK INDUSTRIES INC.: COMPANY SNAPSHOT

FIGURE 26 TBI MOTION TECHNOLOGY CO. LTD.: COMPANY SNAPSHOT

FIGURE 27 STEINMEYER MECHATRONIK GMBH: COMPANY SNAPSHOT

FIGURE 28 SCHAEFFLER TECHNOLOGIES AG & CO. KG: COMPANY SNAPSHOT

FIGURE 29 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT

FIGURE 30 THE TIMKEN COMPANY: COMPANY SNAPSHOT

FIGURE 31 LINTECH MOTION: COMPANY SNAPSHOT

FIGURE 32 HEPCOMOTION: COMPANY SNAPSHOT

FIGURE 33 HELIX LINEAR TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 34 AB SKF: COMPANY SNAPSHOT

FIGURE 35 SKF MOTION TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 36 BISHOP-WISECARVER: COMPANY SNAPSHOT

FIGURE 37 ISEL GERMANY AG: COMPANY SNAPSHOT

FAQ

The global ball screws market is anticipated to grow from USD 28.75 Billion in 2023 to USD 50.99 Billion by 2030, at a CAGR of 8.53% during the forecast period.

Asia Pacific accounted for the largest market in the Ball Screws market. Asia Pacific accounted for 37% market share of the global market value.

THK Co. Ltd., NSK Ltd., HIWIN Corporation, Bosch Rexroth AG, Kuroda Precision Industries Ltd., NTN Corporation, PMI Group, Nook Industries Inc., TBI MOTION Technology Co. Ltd., Steinmeyer Mechatronik GmbH, Schaeffler Technologies AG & Co. KG, Parker Hannifin Corporation, The Timken Company, Lintech Motion, HepcoMotion, Helix Linear Technologies, AB SKF, SKF Motion Technologies, Bishop-Wisecarver, Isel Germany AG

Increased use of rolled threads: Rolled threads are becoming more popular than ground threads because they are more cost-effective and can be produced faster. However, ground threads offer better precision and are still preferred for some applications.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.