REPORT OUTLOOK

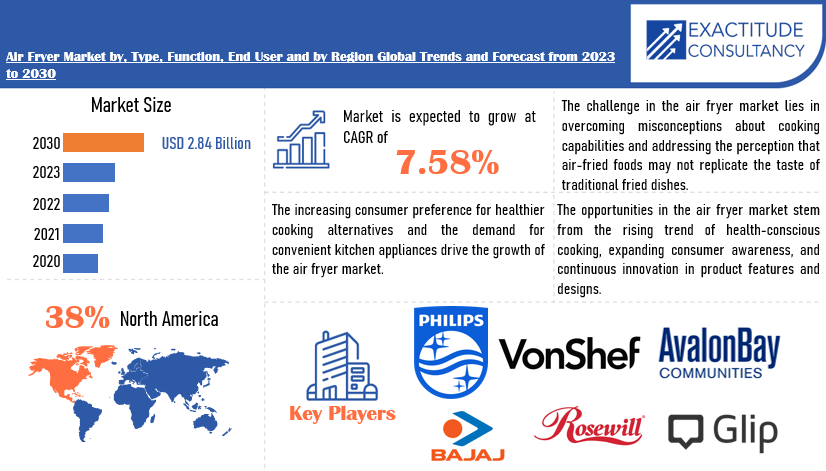

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 2.84 Billion by 2030 | 7.58% | North America |

| by Type | By Distribution Channel: | By Component | By Wattage | By End-User: |

|---|---|---|---|---|

|

|

|

|

|

SCOPE OF THE REPORT

Air Fryer Market Overview

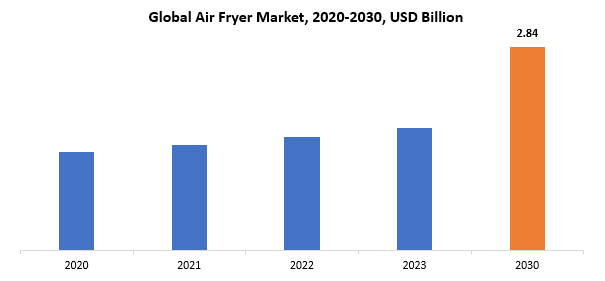

The global air fryer market is anticipated to grow from USD 1.71 Billion in 2023 to USD 2.84 Billion by 2030, at a CAGR of 7.58% during the forecast period.

The term air fryer convection oven refers to an air fryer. It’s a countertop appliance that fries food until it’s crispy and golden brown without using an oil-filled pot or skillet. The greatest appliances for steaming and frying veggies to add taste to a dish are air fryers. They’re also utilized for cooking meats with minimal fat. Fresh dishes including chicken, steak, pork chops, seafood, and veggies may be prepared with air fryers. A modest pinch of salt and your choice herbs and spices are all that are required to finish. air fryers Use Less Oil: This is a guilt-free way for health-conscious customers to cook and enjoy their favorite foods. It provides a sanitary. The dish comes out crispy and crunchy. It keeps the nutrients as well. Air fryers are Easy to Clean, store and maintain.

Foods fried using convection heat in an air fryer have a crispy, browned outside and a juicy, soft within. Cooking using an air fryer is faster and less messy than deep frying or traditional oven roasting. When it comes to calories and fat content, air-frying beats deep-frying. The hot air circulation speeds up food cooking, therefore cooking times are significantly reduced as compared to traditional techniques. It’s easy to operate, easy to clean, and uses less fat. By cutting back on fat, people may still enjoy their favorite foods and reach their weight reduction objectives. An additional safe household appliance is an air fryer.

Growing consumer health consciousness has been identified as a key driver of the air fryer market’s expansion. Air fryer cooking is getting more and more popular as people become more health conscious and aware of what they eat. It’s a simple and nutritious cooking method. Conventional deep-frying techniques utilize dangerous trans fats and an excessive amount of oil, which raises the risk of heart disease and obesity among other health problems. Conversely, food cooked in an air fryer retains its crispy texture and delicious fried taste while using less oil. Users who use less oil when cooking consume less calories and are less vulnerable to the dangers of eating greasy meals. Because they use less oil, air fryers have become more and more popular among health-conscious residents globally. Air fryers offer the versatility to cook a wide range of dishes, from guilt-free french fries to baked chicken, which increases the appeal of the equipment. Therefore, consumers are prioritizing their health while indulging in their favorite dishes more healthily and cautiously. This is projected to augment the growth of the air fryer market.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Product, By Gender Type, By Distribution Channel and By Region |

| By Product |

|

| By Gender Type |

|

| By End User |

|

| By Region

|

|

Air Fryer Market Segmentation Analysis

Globally, the Air Fryers market can be segmented on the basis of type, function, end user, and region. The air fryer market analysis encompasses various types, including drawer type, lid type, and others, while considering functions such as manual and digital, catering to a diverse range of end users, including residential, commercial, and others.

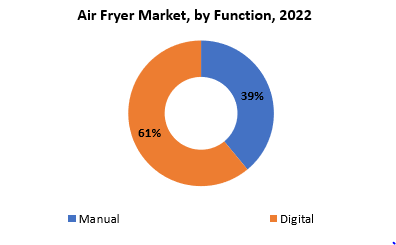

The manual and digital product types are separated out in this division. In 2022, the digital category held a dominant market share of around 61%. An LED display and digital touchscreen provide access to the control panel of a digital air fryer. The temperature and time can be changed, but the control panel can do more. The digital air fryer has convenient pre-defined features and is simple to operate. Numerous pre-programmed cooking settings are available with digital air fryers. Because today’s tech-savvy youth prefer digital air fryers over manual ones, demand for the digital category is expected to rise throughout the projection period.

With a significant share of over 39% of the total sales, the manual product category held the second position in the global air fryer market in 2022. This suggests that users greatly prefer manual control features in air fryers, placing a strong emphasis on hands-on cooking. The popularity of manual models points to a desire on the part of consumers for more control over cooking parameters and involvement in the process. Although digital alternatives could be more convenient, manual air fryers continue to be quite popular, which highlights the variety of consumer tastes and the importance of traditional cooking techniques in food selection.

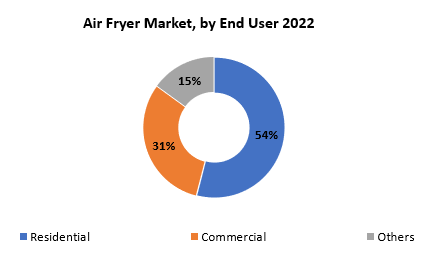

There are two categories for end users: residential and commercial. In 2022, the residential category held a dominant market share of around 54%. The growing consciousness of food and nutrition has progressively changed consumer preferences in favor of healthier eating. Customers are using air fryers more and more frequently as a healthier substitute for cooking meals with less oil and consuming less fat. The industry is expanding thanks to the rising social media influence and increased visibility of air fryers utilized by chefs, food bloggers, and home cooks. Given the growing number of market participants supplying these items through supermarkets, retail stores, and online sales channels, air fryers are becoming more and more accessible.

With a significant 31% share, the commercial sector emerged as the second-largest in the end-user segmentation of the air fryer market. This suggests that air fryers are in high demand in commercial environments, including hotels, restaurants, and other foodservice businesses. The commercial air fryer’s popularity can be ascribed to its effectiveness, adaptability, and capacity to generate healthier substitutes for fried foods. The increasing demand from commercial kitchens is evidence that air fryers are becoming recognized as indispensable kitchen tools that not only accommodate health-conscious consumers’ dietary choices but also expedite the cooking process in professional settings.

Air Fryer Market Dynamics

Driver

One of the major factors driving the growth of the global air fryer market is the growing demand for air fryers in hospitals, hotels, and restaurants.

The growing need for air fryers in a range of commercial settings, such as hospitals, hotels, and restaurants, is driving significant expansion in the worldwide air fryer market. The increased demand in commercial kitchens may be ascribed to the several advantages that air fryers provide. These restaurants are implementing air fryers as effective kitchenware that offer healthier substitutes for conventional frying techniques. The focus on providing wholesome, low-fat meal alternatives in hospitals is consistent with air fryers’ ability to prepare food that is health-conscious. The adaptability of air fryers enables the creation of a broad variety of foods with lower oil content in hotels and restaurants, satisfying the rising customer desire for healthier meals. Furthermore, the time-saving capabilities and energy-saving nature of air fryers contribute to their appeal in busy commercial kitchen environments. As the culinary industry continues to prioritize healthier cooking practices, the demand for air fryers in these commercial settings is expected to be a key driver propelling the global market forward.

Restraint

High cost of the air fryers and availability of limited recipes can hinder the market growth.

The market for air fryers may encounter obstacles in its expansion, chiefly related to the high price of these devices. The initial outlay needed to buy air fryers may turn away budget-conscious customers, which would prevent broad adoption. There’s also the problem of just having a small selection of recipes made especially for air fryers. A lack of gastronomic diversity could be seen negatively by certain customers, which could reduce the market’s attractiveness. Even though air fryers can cook a wide variety of foods, resolving the pricing issue and increasing the number of air fryer recipes available may be crucial to overcome these obstacles. In order to possibly mitigate these challenges and promote wider consumer awareness, manufacturers and culinary experts may play a critical role in teaching customers about the long-term cost savings and variety of cooking options provided by air fryers.

Opportunities

Manufacturers of home appliances have been compelled by the growing demand for air fryers to invest more in R&D to produce more creative models.

Manufacturers of household appliances are focusing more on research and development (R&D) to produce more cutting-edge and inventive models in response to the growing demand for air fryers. The need for healthy cooking options among consumers and the versatility of air fryers have created a competitive market that forces producers to set their products apart. R&D expenditures are focused on improving attributes including energy efficiency, smart technology integration, and precise cooking. Key areas of innovation include creative models with a variety of culinary functions, presets that may be customized, and user-friendly interfaces. Manufacturers understand that in order to stay ahead of the curve in a dynamic industry and adapt to changing customer tastes, constant innovations are necessary. The industry’s dedication to producing state-of-the-art air fryers that not only meet the needs of growing demand but also offer unique features to capture a broader market share.

Air Fryer Market Trends

-

Smart Technology Integration: The incorporation of smart technology into air fryers, enabling users to control and monitor cooking remotely through mobile apps or voice commands.

-

Multipurpose Functionality: Manufacturers are focusing on developing air fryers with additional cooking functions, such as baking, grilling, roasting, and dehydrating, expanding their versatility in the kitchen.

-

Compact and Portable Designs: A trend towards more compact and portable air fryer models to accommodate smaller kitchens and meet the needs of consumers with limited counter space.

-

Increased Health and Wellness Features: Air fryers are being marketed with a stronger emphasis on health and wellness, including features like built-in air purifiers and specific cooking presets for healthier recipes.

-

Affordability Initiatives: Some brands are working on introducing more budget-friendly air fryer models, aiming to make this technology more accessible to a broader consumer base.

-

Integration with Smart Kitchen Ecosystems: Air fryers are increasingly being designed to integrate with broader smart kitchen ecosystems, connecting with other appliances and technologies for seamless cooking experiences.

Competitive Landscape

The competitive landscape of the Air Fryer market was dynamic, with several prominent companies competing to provide innovative and Air Fryer.

- Koninklijke Philips N.V.

- Tatung Company of America, Inc.

- De’Longhi America Inc.

- Ming’s Mark Inc.

- Groupe SEB

- Avalon Bay

- Bajaj Electricals Limited

- American Micronic Instruments

- Mayer

- Gorenje

- Avalon Bay

- GoWISE USA

- Tefal

- Bigboss

- Vonshef

- Cozyna

- Living Basix

- Homeleader

- Rosewill

- Glip

Recent Developments:

18 January 2023 – Royal Philips (NYSE: PHG, AEX: PHIA), a global leader in health technology, and Masimo (NASDAQ: MASI), a global medical technology company, announced an expansion of their partnership to augment patient monitoring capabilities in home telehealth applications with the Masimo W1™ advanced health tracking watch. The W1 will integrate with Philips’s enterprise patient monitoring ecosystem to advance the forefront of telemonitoring and telehealth.

09 February 2022 – Bajaj Electricals Limited (BEL) and Mahindra Logistics Limited (MLL) announced signing an agreement for innovative logistics optimisation and outsourcing arrangement. This deal is a complete end-to-end redesign and outsourcing of Bajaj Electricals’ entire logistics by Mahindra Logistics, with the twin objectives of achieving enhanced and industry-best service levels, coupled with a logistics cost saving in excess of 25 percent. The total contract value, of this one-of-its-kind deal in the Indian Logistics industry, will be in excess of INR 1,000 crores over the next five years and is the outcome of a unique and collaborative solution.

Regional Analysis

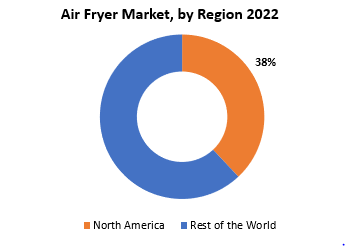

North America maintained its leading position in the world air fryer market in 2022, accounting for an astounding 38% of market revenue. A strong culinary culture, the increasing popularity of healthy cooking techniques among consumers, and the expanding importance of handy kitchen gadgets are all contributing causes to this supremacy. Customers in the area have demonstrated a strong preference for cutting-edge kitchen appliances, such as air fryers, which are becoming more and more well-liked for their capacity to produce tasty, crispy food with little to no oil consumption. Their broad appeal has also been aided by marketing campaigns that highlight health-conscious tendencies and the adaptability of air fryers. The dominance of the North American market demonstrates how adaptable the area is to changing consumer tastes and the ongoing need for kitchen equipment that support healthy lifestyle choices.

The market for air fryers is expected to grow rapidly in the Asia Pacific area. One of the biggest users of technology is the Asia Pacific market, which is anticipated to develop significantly in the next years. The market for air fryers is rising due to a variety of causes, including rising disposable income, an increase in the number of people moving to cities, and the growing impact of healthier diets among younger consumers. China, India, and Japan are among the nations that purchase the most kitchen appliances. Europe’s market data are being supplemented by the existence of prominent air fryer firms and an increase in investments in R&D for new products. The majority of homes in Europe are using air fryers as a result of the growing emphasis on health and wellness and rise in preference for quick cooking methods. Additionally, growth in disposable income is boosting demand for air fryers with advanced features and capabilities in the region.

Target Audience for Air Fryer Market

- Residential Consumers

- Commercial Kitchens

- Restaurants

- Hotels

- Hospitals

- Foodservice Industry

- Culinary Professionals

- Health-conscious Consumers

- Tech-savvy Consumers

- Kitchen Appliance Retailers

- E-commerce Platforms

- Appliance Manufacturers

Import & Export Data for Air Fryer Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Air Fryer market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

-

Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Air Fryer market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

-

Market players: gain insights into the leading players driving the pet relaxant trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

-

Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

-

Product breakdown: by segmenting data based on Air Fryer types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids governments in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Air Fryer Market Report

By Product Type:

- Digital Air Fryer

- Manual Air Fryer

- Multifunctional Air Fryer

- Compact Air Fryer

- Large-Capacity Air Fryer

By Distribution Channel:

- Online Retailers

- Supermarkets/Hypermarkets

- Specialty Stores

- Direct Sales

By Component

- Air Fryer Oven

- Air Fryer Toaster Oven

- Air Fryer Basket

By Wattage

- Below 1200 Watt

- 1200-1500 Watt

- 1500-1800 Watt

By End-User:

- Residential

- Commercial (Restaurants, Hotels, etc.)

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

Middle East & Africa

Key Question Answered

- What is the expected growth rate of the Air Fryer market over the next 7 years?

- Who are the major players in the Air Fryer market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and Africa?

- How is the economic environment affecting the Air Fryer market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Air Fryer market?

- What is the current and forecasted size and growth rate of the Air Fryer market?

- What are the key drivers of growth in the Air Fryer market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Air Fryer market?

- What are the technological advancements and innovations in the Air Fryer market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Air Fryer market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Air Fryer market?

- What is the product offered and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- TYPES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET OUTLOOK

- GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE, 2020-2030, (USD BILLION)

- ENGINE MAINTENANCE

- COMPONENTS MAINTENANCE

- AIRFRAME HEAVY MAINTENANCE

- OTHER

- GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL, 2020-2030, (USD BILLION)

- DIRECT CHANNEL

- DISTRIBUTION CHANNEL

- GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY APPLICATION, 2020-2030, (USD BILLION)

- CIVIL & COMMERCIAL

- MILITARY

- GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- LUFTHANSA TECHNIK

- GE AVIATION

- AFI KLM E&M

- ST AEROSPACE

- MTU MAINTENANCE

- AAR CORP.

- ROLLS-ROYCE

- SR TECHNICS (MUBADALA AEROSPACE)

- SIA ENGINEERING

- DELTA TECHOPS

- HAECO

- JAL ENGINEERING

- AMECO BEIJING

- TAP M&E

- ANA

- BRITISH AIRWAYS ENGINEERING

- KOREAN AIR

- IBERIA MAINTENANCE

- THE BOEING COMPANY

- UNITED TECHNOLOGIES CORPORATION *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 3 GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 4 GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY REGIONS (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 10 US AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 11 US AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 12 CANADA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 13 CANADA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 14 CANADA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 15 MEXICO AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 16 MEXICO AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 17 MEXICO AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 23 BRAZIL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 24 BRAZIL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 25 ARGENTINA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 26 ARGENTINA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 27 ARGENTINA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 28 COLOMBIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 29 COLOMBIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 30 COLOMBIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 39 INDIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 40 INDIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 41 CHINA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 42 CHINA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 43 CHINA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 44 JAPAN AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 45 JAPAN AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 46 JAPAN AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 59 EUROPE AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 60 EUROPE AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 61 EUROPE AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 62 EUROPE AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 64 GERMANY AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 65 GERMANY AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 66 UK AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 67 UK AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 68 UK AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 69 FRANCE AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 70 FRANCE AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 71 FRANCE AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 72 ITALY AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 73 ITALY AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 74 ITALY AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 75 SPAIN AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 76 SPAIN AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 77 SPAIN AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 78 RUSSIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 79 RUSSIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 80 RUSSIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 89 UAE AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 90 UAE AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-203

TABLE 94 SOUTH AFRICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-203

TABLE 97 REST OF MIDDLE EAST AND AFRICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY SALES CHANNEL (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE MARKET BY END USER (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE BY TYPE, USD BILLION, 2020-2030

FIGURE 9 GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE BY SALES CHANNEL, USD BILLION, 2020-2030

FIGURE 10 GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE BY END USER, USD BILLION, 2020-2030

FIGURE 11 GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE BY REGION, USD BILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE BY TYPE, USD BILLION, 2022

FIGURE 14 GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE BY SALES CHANNEL, USD BILLION, 2022

FIGURE 15 GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE BY END USER, USD BILLION, 2022

FIGURE 16 GLOBAL AIRCRAFT AND AIRCRAFT PARTS MANUFACTURING AND REPAIR & MAINTENANCE BY REGION, USD BILLION, 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 LUFTHANSA TECHNIK: COMPANY SNAPSHOT

FIGURE 19 GE AVIATION: COMPANY SNAPSHOT

FIGURE 20 AFI KLM E&M: COMPANY SNAPSHOT

FIGURE 21 ST AEROSPACE: COMPANY SNAPSHOT

FIGURE 22 MTU MAINTENANCE: COMPANY SNAPSHOT

FIGURE 23 AAR CORP.: COMPANY SNAPSHOT

FIGURE 24 ROLLS-ROYCE: COMPANY SNAPSHOT

FIGURE 25 SR TECHNICS (MUBADALA AEROSPACE): COMPANY SNAPSHOT

FIGURE 26 SIA ENGINEERING: COMPANY SNAPSHOT

FIGURE 27 DELTA TECHOPS: COMPANY SNAPSHOT

FIGURE 28 HAECO: COMPANY SNAPSHOT

FIGURE 29 JAL ENGINEERING: COMPANY SNAPSHOT

FIGURE 30 AMECO BEIJING: COMPANY SNAPSHOT

FIGURE 31 TAP M&E: COMPANY SNAPSHOT

FIGURE 32 ANA: COMPANY SNAPSHOT

FIGURE 33 BRITISH AIRWAYS ENGINEERING: COMPANY SNAPSHOT

FIGURE 34 KOREAN AIR: COMPANY SNAPSHOT

FIGURE 35 IBERIA MAINTENANCE: COMPANY SNAPSHOT

FIGURE 36 THE BOEING COMPANY: COMPANY SNAPSHOT

FIGURE 37 UNITED TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

FAQ

The global air fryer market is anticipated to grow from USD 1.71 Billion in 2023 to USD 2.84 Billion by 2030, at a CAGR of 7.58% during the forecast period.

North America accounted for the largest market in the Air Fryer market. North America accounted for 38% market share of the global market value.

Koninklijke Philips N.V., Tatung Company of America, Inc., De’Longhi America Inc., Ming’s Mark Inc., Groupe SEB, Avalon Bay, Bajaj Electricals Limited, American Micronic Instruments, Mayer, Gorenje, Avalon Bay, GoWISE USA, Tefal, Bigboss, Vonshef, Cozyna, Living Basix, Homeleader, Rosewill, Glip

Air fryers are being marketed with a stronger emphasis on health and wellness, including features like built-in air purifiers and specific cooking presets for healthier recipes.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.