REPORT OUTLOOK

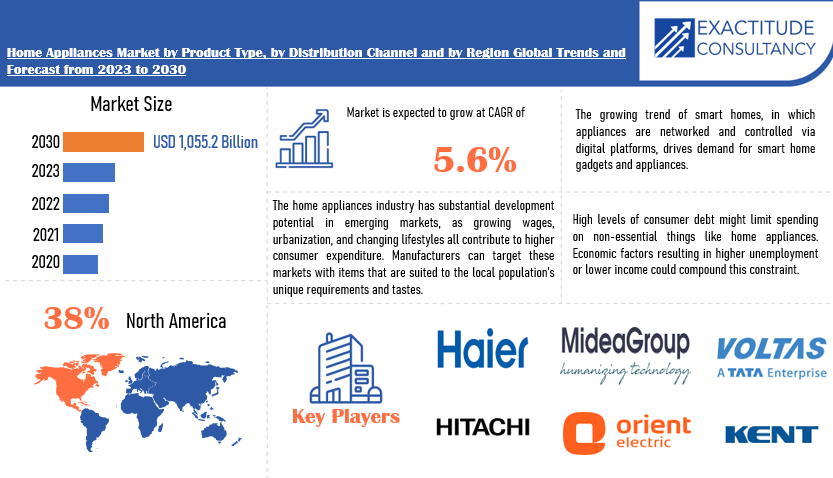

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 1055.2 billion by 2030 | 5.6% | North America |

| by Product Type | by Distribution Channel |

|---|---|

|

|

SCOPE OF THE REPORT

Market Overview

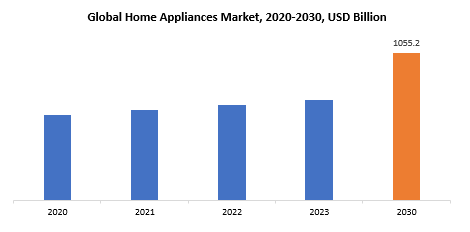

The global home appliances market size is projected to grow from USD 720.59 billion in 2023 to USD 1,055.2 billion by 2030, exhibiting a CAGR of 5.6% during the forecast period.

Home appliances are electrical or mechanical equipment that are meant to do various home activities, making living easier and more efficient. In the home, these gadgets are commonly used for cooking, cleaning, cooling, heating, and entertainment. Refrigerators, washing machines, dishwashers, stoves, vacuum cleaners, air conditioners, televisions, and other appliances are examples of household items. These appliances’ major goal is to reduce household duties, save time, and improve general comfort and well-being. Home appliances improve as technology progresses, introducing smart features and energy-efficient technologies to satisfy modern households’ evolving demands.

Home appliances play an important part in modern living by increasing convenience, efficiency, and general well-being for individuals and families. These technologies simplify daily routines, helping people to better manage their time and energy. For example, kitchen facilities such as refrigerators and ovens make food storage and preparation easier, but washing machines automate clothing cleaning, eliminating the need for physical work. Air conditioners and heaters in the home improve living conditions by controlling the climate. Vacuum cleaners and dishwashers also help to maintain hygiene and cleanliness. Home appliances are important because they may improve people’s quality of life, encourage a healthier and more pleasant living environment, and help families run smoothly. The range of household appliances is vast, and it continues to expand as technology advances and lifestyle patterns shift. As civilizations evolve, there is a greater need for inventive and effective solutions to domestic responsibilities. The scope includes a wide range of items, including smart refrigerators and ovens, laundry equipment such as sophisticated washing machines, and smart home systems that connect several devices for smooth automation. Energy efficiency and sustainability are increasingly important components of the scope, with an emphasis on eco-friendly equipment. Furthermore, the addition of artificial intelligence and connection elements has broadened the scope to encompass smart homes, in which equipment may be managed remotely and communicate with one another. As customer requirements change, the breadth of home appliances is projected to expand further, driven by a mix of technical innovation, environmental concerns, and a desire for more convenience in daily life.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Product Type, Distribution Channel and Region |

|

By Product Type |

|

By Distribution Channel |

|

|

By Region

|

|

Home Appliances Market Segmentation Analysis

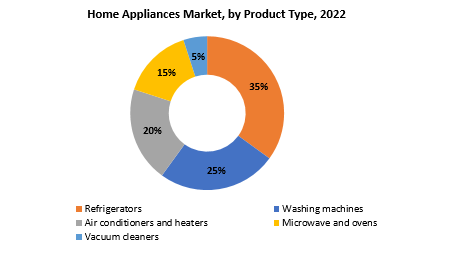

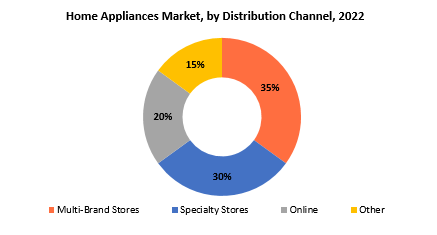

The global home appliances market is bifurcated three segments, by product type, distribution channel and region. By product type, the market is bifurcated into refrigerators, washing machines, air conditioners and heaters, microwave and oven, vacuum cleaners, and others. By distribution channel, the market is bifurcated multi-brand stores, specialty stores, online, and other and region.

The home appliances market is divided into several product categories to represent the diverse demands and tastes of customers. Refrigerators are an essential kitchen device that store and preserve food efficiently. Washing machines make it easier and faster to do laundry. Air conditioners and heaters help to regulate temperature and provide comfort in a variety of weather circumstances. Microwaves and ovens adapt to culinary needs, allowing for rapid and efficient food preparation. Vacuum cleaners meet the requirement for cleanliness by automating the process of floor and carpet cleaning. These primary product categories make up the foundation of the home appliances industry, each serving a unique household purpose. Beyond these, the “others” category includes a variety of smaller appliances and developing technologies that help to improve household efficiency and convenience. This segmentation enables manufacturers to adapt their offers to satisfy the varying needs of consumers looking for solutions to various elements of home management and lifestyle improvement.

The home appliances industry is divided into distribution channels to give consumers with a variety of ways to purchase these items. Multi-brand stores, which function as traditional retail storefronts, provide a diverse range of household appliances from several manufacturers under one roof. These businesses serve a diverse consumer base, offering a one-stop shopping experience for anyone looking for a range of appliances. In contrast, specialty stores concentrate in certain types of home appliances or brands, offering a more focused and curated variety to clients with specific tastes. In recent years, the internet distribution channel has gained popularity, allowing users to browse, compare, and purchase home appliances from the comfort of their own homes. Online platforms provide a wide selection of items, customer feedback, and low price, making them a popular choice among tech-savvy and time-conscious consumers. The “other” category includes alternative distribution methods, such as direct sales from manufacturers or third-party distributors. This category may also include outlets such as home improvement or department stores that sell home appliances alongside other products. This large distribution channel segmentation reflects the changing consumer landscape, in which people may select from a variety of alternatives based on their interests, shopping patterns, and the amount of expertise they require when purchasing home appliances.

Home Appliances Market Dynamics

Driver

Technological advancements have been instrumental in shaping the landscape of the home appliances market.

The incorporation of cutting-edge technology has changed traditional home equipment into complex, intelligent appliances, affecting customer behavior and driving market development. The addition of smart features, such as connection and remote control capabilities, has transformed how people interact with their household appliances. The Internet of Things (IoT) has enabled appliances such as refrigerators, washing machines, and ovens to be easily connected into smart home ecosystems, allowing users to monitor and manage them remotely via mobile devices or voice commands. Improved connection not only adds convenience, but it also promotes a more linked and efficient living environment. Consumers are increasingly lured to appliances with user-friendly interfaces, real-time data, and the option to change settings based on personal tastes. This move toward smart home solutions is consistent with the rising need for a connected lifestyle in which device synergy leads to a more simplified and automated home management experience. Furthermore, better energy efficiency is an important part of technical improvements in household appliances. Manufacturers are introducing new features and materials to cut energy usage, harmonizing with global sustainability goals and responding to customer concerns about environmental effect. Energy-efficient appliances not only appeal to environmentally aware consumers, but they also save money in the end, making them more appealing in the market.

Restraint

The upfront cost of certain technologically advanced or energy-efficient appliances can be a significant deterrent for price-sensitive consumers.

The high initial prices associated with certain technological or energy-efficient appliances are a significant barrier in the home appliances industry. While these appliances frequently promise revolutionary features and long-term benefits like as energy savings, the initial investment might be prohibitively expensive, especially for price-sensitive customers. The initial cost barrier works as a disincentive, restricting the adoption of modern appliances by a large percentage of the customer base. Consumers, particularly those on low budgets, may value instant cost above the potential long-term savings provided by energy-efficient models. This tendency is especially strong in marketplaces where economic conditions and family incomes play a significant impact in purchase decisions. The concept of increased prices might induce potential consumers to choose more traditional, less costly versions, even if they have lesser energy efficiency or fewer sophisticated features. Manufacturers and merchants are aware of this dynamic and frequently struggle with the requirement to find a balance between providing cutting-edge technology and remaining affordable. Strategies like as financing alternatives, government incentives for energy-efficient purchases, and promotional pricing can all assist to reduce the impact of high upfront costs. However, these methods may not totally alleviate the difficulty, particularly in areas where economic conditions are unpredictable or consumer understanding of long-term savings is low.

Opportunities

The increasing trend towards smart homes provides an opportunity for home appliance manufacturers to develop and integrate smart features into their products.

The growing trend of smart homes provides a big opportunity for home appliance makers to reconfigure and improve their product offerings. As technology becomes more integrated into everyday life, people are embracing the notion of smart homes, creating a need for appliances that go beyond standard functionality. This move allows manufacturers to build and implement smart features into their goods, altering how people interact with household appliances. Smart home integration involves creating equipment that can be operated remotely, typically via smartphone applications or voice-activated assistants. This degree of connection enables customers to monitor, manage, and change their appliances’ settings from nearly anywhere, making daily activities more convenient. Consumers, for example, may alter the temperature of their smart thermostats, start the washing cycle on their washing machines, or check the contents of their smart refrigerators with a simple screen tap or voice command. Automation is an important aspect of smart home integration, allowing equipment to react to human behavior and preferences. Smart appliances can detect usage patterns and modify settings for energy savings or user comfort. This not only improves convenience, but it also helps to save energy, which is consistent with the increased emphasis on sustainability.

Home Appliances Market Trends

-

Smart technologies are increasingly being integrated into residential equipment. Smart refrigerators, stoves, washing machines, and other appliances that can be operated remotely via smartphone applications or voice commands are becoming increasingly common. This trend is likely to continue, as people demand greater connection and automation in their homes.

-

With a rising emphasis on environmental issues, there is a greater need for energy-efficient and eco-friendly appliances. Manufacturers are using cutting-edge technology to reduce energy usage and the environmental effect of their goods.

-

The online home appliance sale channel has grown significantly. Consumers value the ease of exploring, comparing pricing, and purchasing online. E-commerce platforms give a variety of options and frequently include consumer feedback, which contribute to the popularity of the online market.

-

Consumers are increasingly interested in personalized and configurable appliances that match their unique demands and tastes. This includes modular kitchen equipment, color customization, and individual settings in smart gadgets.

-

In response to rising health concerns, several household appliances, particularly kitchen equipment, are being developed with features that encourage better living. This includes air purifiers, water purifiers, and equipment that cater to certain food preferences or cooking methods.

-

With the increase of urban life and smaller living areas, there is a demand for compact and multi-functional appliances. This includes appliances with multi-purpose capabilities or space-saving designs.

-

Washing machines with modern features like steam cleaning, quicker cycles, and increased energy economy are becoming increasingly popular. Furthermore, appliances with smart diagnostics to detect problems and recommend maintenance have grown more common.

Competitive Landscape

The competitive landscape of the home appliances market was dynamic, with several prominent companies competing to provide innovative and advanced home appliances.

- Bajaj Electricals Ltd

- Blue Star Ltd

- Electrolux AB

- Eureka Forbes Ltd

- Godrej Group

- Haier Inc.

- Hitachi

- Hoover Candy Group

- IFB Home Appliances

- IRobot

- Kent

- Koninklijke Philips N.V

- LG Electronics

- Midea Group

- Orient Electric

- Panasonic Holdings Corporation

- Samsung Electronics Co. Ltd.

- Videocon Industries Limited

- Voltas Ltd

- Whirlpool Corporation

Recent Developments:

August 29, 2023 – Global appliance company Electrolux Group – under its premium brand AEG – is showcasing, for the first time, its most energy-efficient models at IFA 2023: the AEG EcoLine. AEG EcoLine is a dedicated selection, presented in-store and online, of the company is most energy efficient appliances covering all major product categories and aimed at helping consumers to reduce climate impact while providing high-quality performance.

January 30, 2024 – LG Electronics has been named the 2023 Most Electronics Supporting Partner in Gaming in Nigeria by Gameitnaija.

Regional Analysis

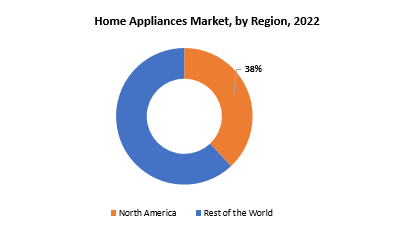

North America is largely driven by huge imports of various appliances, such refrigerators and washing machines in the United States and Canada, which sustain the consumption rate of this equipment. It is the world’s largest regional economy and is expected to be an important region in the global economy for the near future, mostly for the development of new technology. Consumers’ strong buying power, increased adoption of smart devices, and considerable consumer demand for linked home appliances will drive IoT-based appliance consumption in the area.

Asia-Pacific had the highest revenue share in 2021, topping 35.0%, owing to rising demand for jet spray washing machines in emerging markets such as India and China. People in nations such as China, Japan, and India have a high consumption value for home appliances, resulting in increased income from tiny domestic appliances in the area. According to the China Household Electrical Appliances Association, domestic retail sales of home appliances in China exceeded USD 62,280.0 million in the first half of 2019. Furthermore, the region’s growing middle-class population, paired with rising kitchen appliance penetration, is likely to boost market expansion. A surge in major and minor home appliance use in Japan is expected to drive market growth.

Target Audience for Home Appliances Market

- Households with Growing Families

- Tech-Savvy Consumers

- Eco-Conscious Consumers

- Urban Dwellers with Limited Space

- Homeowners Renovating or Upgrading

- Busy Professionals and Working Individuals

- Health-Conscious Individuals

- Consumers Seeking Customization

- Elderly Population with Specific Needs

- Consumers Looking for Smart Home Integration

Segments Covered in the Home Appliances Market Report

Home Appliances Market by Product Type

- Refrigerators

- Washing machines

- Air conditioners and heaters

- Microwave and ovens

- Vacuum cleaners

Home Appliances Market by Distribution Channel

- Multi-Brand Stores

- Specialty Stores

- Online

- Other

Home Appliances Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Home Appliances Market over the next 7 years?

- Who are the key market participants Home Appliances, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Home Appliances Market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Home Appliances Market?

- What is the current and forecasted size and growth rate of the global Home Appliances Market?

- What are the key drivers of growth in the Home Appliances Market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Home Appliances Market?

- What are the technological advancements and innovations in the Home Appliances Market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Home Appliances Market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Home Appliances Market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- HOME APPLIANCES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON HOME APPLIANCES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- HOME APPLIANCES MARKET OUTLOOK

- GLOBAL HOME APPLIANCES MARKET BY PRODUCT TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- REFRIGERATORS

- WASHING MACHINES

- AIR CONDITIONERS AND HEATERS

- MICROWAVE AND OVENS

- VACUUM CLEANERS

- GLOBAL HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- MULTI-BRAND STORES

- SPECIALTY STORES

- ONLINE

- OTHER

- GLOBAL HOME APPLIANCES MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BAJAJ ELECTRICALS LTD

- BLUE STAR LTD

- ELECTROLUX AB

- EUREKA FORBES LTD

- GODREJ GROUP

- HAIER INC.

- HITACHI

- HOOVER CANDY GROUP

- IFB HOME APPLIANCES

- IROBOT

- KENT

- KONINKLIJKE PHILIPS N.V

- LG ELECTRONICS

- MIDEA GROUP

- ORIENT ELECTRIC

- PANASONIC HOLDINGS CORPORATION

- SAMSUNG ELECTRONICS CO. LTD.

- VIDEOCON INDUSTRIES LIMITED

- VOLTAS LTD

- WHIRLPOOL CORPORATION *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 4 GLOBAL HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL HOME APPLIANCES MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL HOME APPLIANCES MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA HOME APPLIANCES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA HOME APPLIANCES MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 13 US HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 14 US HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 15 US HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 16 US HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 18 CANADA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 20 CANADA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 22 MEXICO HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 24 MEXICO HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA HOME APPLIANCES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA HOME APPLIANCES MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 32 BRAZIL HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 34 BRAZIL HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 36 ARGENTINA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 38 ARGENTINA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 40 COLOMBIA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 42 COLOMBIA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC HOME APPLIANCES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC HOME APPLIANCES MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 54 INDIA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 56 INDIA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 58 CHINA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 60 CHINA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 62 JAPAN HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 64 JAPAN HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE HOME APPLIANCES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE HOME APPLIANCES MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 84 EUROPE HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 86 EUROPE HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 88 GERMANY HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 90 GERMANY HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 91 UK HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 92 UK HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 93 UK HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 94 UK HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 96 FRANCE HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 98 FRANCE HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 100 ITALY HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 102 ITALY HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 104 SPAIN HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 106 SPAIN HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 108 RUSSIA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 110 RUSSIA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA HOME APPLIANCES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA HOME APPLIANCES MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 121 UAE HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 122 UAE HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 123 UAE HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 124 UAE HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA HOME APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA HOME APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL HOME APPLIANCES MARKET BY PRODUCT TYPE USD BILLION, 2020-2030

FIGURE 9 GLOBAL HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL, USD BILLION, 2020-2030

FIGURE 10 GLOBAL HOME APPLIANCES MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL HOME APPLIANCES MARKET BY PRODUCT TYPE, USD BILLION 2022

FIGURE 13 GLOBAL HOME APPLIANCES MARKET BY DISTRIBUTION CHANNEL, USD BILLION 2022

FIGURE 14 GLOBAL HOME APPLIANCES MARKET BY REGION, USD BILLION 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 BAJAJ ELECTRICALS LTD: COMPANY SNAPSHOT

FIGURE 17 BLUE STAR LTD: COMPANY SNAPSHOT

FIGURE 18 ELECTROLUX AB: COMPANY SNAPSHOT

FIGURE 19 EUREKA FORBES LTD: COMPANY SNAPSHOT

FIGURE 20 GODREJ GROUP: COMPANY SNAPSHOT

FIGURE 21 HAIER INC.: COMPANY SNAPSHOT

FIGURE 22 HITACHI: COMPANY SNAPSHOT

FIGURE 23 HOOVER CANDY GROUP: COMPANY SNAPSHOT

FIGURE 24 IFB HOME APPLIANCES: COMPANY SNAPSHOT

FIGURE 25 IROBOT: COMPANY SNAPSHOT

FIGURE 26 KENT: COMPANY SNAPSHOT

FIGURE 27 KONINKLIJKE PHILIPS N.V: COMPANY SNAPSHOT

FIGURE 28 LG ELECTRONICS: COMPANY SNAPSHOT

FIGURE 29 MIDEA GROUP: COMPANY SNAPSHOT

FIGURE 30 ORIENT ELECTRIC: COMPANY SNAPSHOT

FIGURE 31 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

FIGURE 32 SAMSUNG ELECTRONICS CO. LTD: COMPANY SNAPSHOT

FIGURE 33 VIDEOCON INDUSTRIES LIMITED: COMPANY SNAPSHOT

FIGURE 34 VOLTAS LTD: COMPANY SNAPSHOT

FIGURE 35 WHIRLPOOL CORPORATION: COMPANY SNAPSHOT

FAQ

The global home appliances market size is projected to grow from USD 720.59 billion in 2023 to USD 1055.2 billion by 2030, exhibiting a CAGR of 5.6% during the forecast period.

North America accounted for the largest market in the home appliances market.

Bajaj Electricals Ltd, Blue Star Ltd, Electrolux AB, Eureka Forbes Ltd, Godrej Group, Haier Inc., Hitachi, Hoover Candy Group, IFB Home Appliances, IRobot, KENT, Koninklijke Philips N.V,LG Electronics, Midea Group, Orient Electric, Panasonic Holdings Corporation ,Samsung Electronics Co. Ltd. ,Videocon Industries Limited, Voltas Ltd, Whirlpool Corporation.

Some appliances combine multiple functions, such as ovens that can also steam cook or refrigerators that include built-in beverage dispensers. These hybrid appliances attempt to provide convenience and adaptability.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.