REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

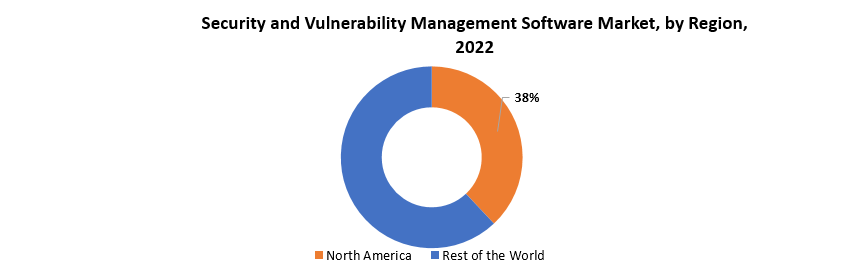

| USD 37.96 billion by 2030 | 6.8% | North America |

| by Deployment Mode | by Organization Size |

|---|---|

|

|

SCOPE OF THE REPORT

Market Overview

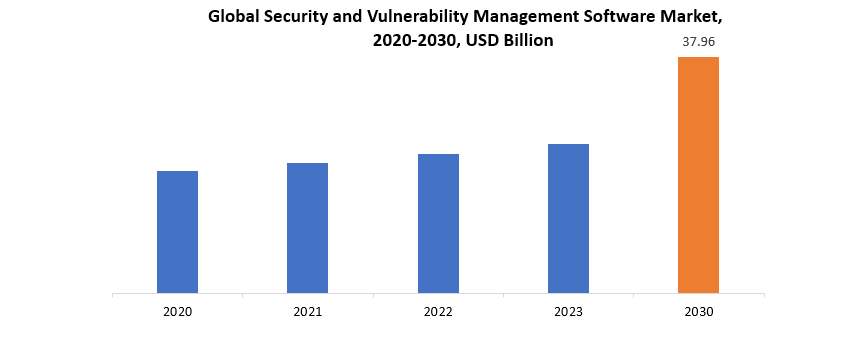

The global security and vulnerability management software market size is projected to grow from USD 23.95 billion in 2023 to USD 37.96 billion by 2030, exhibiting a CAGR of 6.8% during the forecast period.

Security and vulnerability management software is a specialized set of tools that assist businesses in identifying, assessing, and mitigating possible security risks and vulnerabilities inside their information technology infrastructure. These software solutions are critical for proactively protecting systems, networks, and applications from cyber-attacks. The program generally contains capabilities like vulnerability scanning, which is the automatic discovery of faults or weaknesses in software, setups, or systems. It also makes it easier to identify possible security concerns by assessing and ranking detected vulnerabilities according to their severity. Furthermore, these solutions frequently include patch management functionality, which assists businesses in deploying and managing updates and patches to fix vulnerabilities and increase their security posture.

Security and vulnerability management software helps maintain a proactive safety record by continually monitoring and evaluating the ever-changing threat landscape. These solutions help to improve overall cybersecurity resilience by allowing companies to discover and repair vulnerabilities quickly, lowering the chance of security breaches, and assuring a more strong defence against prospective assaults. Security and vulnerability management because cyber-attacks are becoming more advanced, software is critical in today’s digital world. It is critical to businesses’ ability to maintain a proactive and resilient defence against possible security breaches. These software solutions are critical for finding and analysing vulnerabilities in IT systems, networks, and apps, allowing enterprises to prioritize and resolve flaws before bad actors exploit them. By conducting frequent vulnerability scans and assessments, this program gives a full view of an organization’s security posture. It enables firms to keep ahead of emerging attacks and fortify their systems against increasing cyber hazards. The software’s ability to automate vulnerability identification and optimize the patch management process is critical in today’s dynamic and fast-paced cybersecurity environment. Furthermore, security and vulnerability management software helps firms comply with industry requirements and standards while cultivating a security culture and adhering to best practices. In essence, these technologies are critical for risk mitigation, sensitive data protection, and the integrity and confidentiality of digital assets, making them an essential component of any strong cybersecurity strategy.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Deployment Mode, Organization Size and Region |

|

By Deployment Mode |

|

|

By Organization Size |

|

|

By Region

|

|

Security and Vulnerability Management Software Market Segmentation Analysis

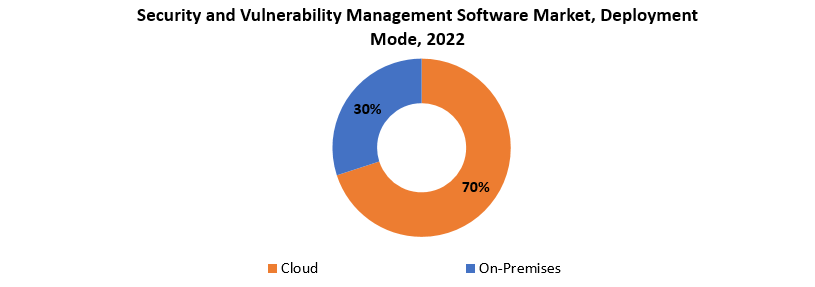

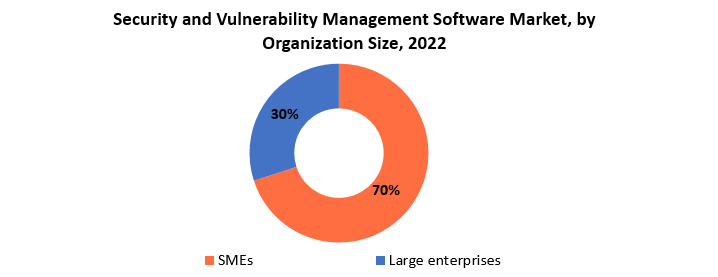

The global security and vulnerability management software market is bifurcated three segments, by deployment mode, organization size and region. By deployment mode, the market is bifurcated into cloud and on-premises. By organization size, the market is bifurcated SMEs and large enterprises and region.

Cloud and on-premises deployments provide two different methods to deploying software solutions, including security and vulnerability management. The cloud deployment strategy places the program on remote servers managed by a third-party cloud service provider. This solution provides scalability, flexibility, and accessibility by enabling enterprises to access and administer security and vulnerability monitoring software via the internet. Cloud deployments are frequently faster to build, have lower infrastructure costs, and include automated upgrades, making them desirable to enterprises looking for agility and efficiency. On the other hand, on-premises deployment involves installing and operating security and vulnerability management software on the organization’s own physical gear and servers. This method gives enterprises more control over their infrastructure, allowing them to manage and safeguard data on their premises. On-premises solutions are frequently selected by enterprises that have special regulatory compliance needs, tight data governance rules, or desire to maintain direct control over their security architecture. The decision between cloud and on-premises deployment is influenced by corporate choices, regulatory concerns, data sensitivity, and scalability needs. While cloud deployments give flexibility and cost savings, on-premises solutions enable more control and customization. The market’s division into several deployment options responds to enterprises’ diverse needs and preferences for managing their security and vulnerability solutions.

The security and vulnerability management software industry is divided into two categories depending on organization size: Small and Medium-sized Enterprises (SMEs) and Large Enterprises. Small and medium-sized firms (SMEs) are often businesses with fewer employees and more efficient operations, whereas big enterprises include organizations with a huge staff and complicated structures. The division takes into account the unique demands and resources of these various sized entities. Security and vulnerability management software frequently solves the difficulty of limited IT resources in SMEs by delivering scalable, cost-effective, and easy-to-deploy solutions. These firms may emphasis user-friendly interfaces and automation in order to handle cybersecurity more efficiently without requiring considerable in-house knowledge. The objective is to provide SMEs with comprehensive security solutions that are adapted to their scale and operational needs. Large companies, on the other hand, require security and vulnerability management solutions capable of handling the complexity and volume of their systems. These solutions may include sophisticated functionality, bespoke setups, and interfaces with other enterprise-level security products. Large corporations frequently seek comprehensive security measures that are compatible with their organizational structure and regulatory requirements. By segmenting the market based on organization size, security and vulnerability management software providers can better cater to the specific demands and constraints of both SMEs and large enterprises, ensuring that businesses of varying sizes have access to tailored cybersecurity solutions that align with their unique operational landscapes.

Security and Vulnerability Management Software Market Dynamics

Driver

The rising frequency and sophistication of cyber threats drive the demand for security and vulnerability management solutions.

The increasing frequency and sophistication of cyber-attacks has created a greater demand for security and vulnerability management solutions across enterprises. Businesses in today’s digital ecosystem confront an ever-increasing number of possible hazards, ranging from basic malware to more sinister attacks like ransomware and data breaches. The growing interconnection of systems, along with the growth of digital technology, generates a large attack surface that cybercriminals may exploit. Organizations understand the need of protecting their digital assets and sensitive information from these emerging dangers. Malicious actors constantly change their tactics, approaches, and processes, making it critical for enterprises to implement proactive and comprehensive security measures. Security and vulnerability management solutions play an important role in this situation because they provide a systematic way to finding, prioritizing, and mitigating possible vulnerabilities throughout an organization’s IT architecture. As cyber-attacks become more complex and targeted, enterprises recognize the crucial need of staying ahead of the cybersecurity curve. A successful cyber assault can cause financial losses, operational difficulties, and reputational harm. This awareness has pushed firms to invest in comprehensive security strategies, focusing on security and vulnerability management software. These technologies assist organizations in not only detecting vulnerabilities in their systems, but also assessing the possible effect of these flaws on their entire security posture. Organizations may greatly minimize their risk of falling victim to cyber-attacks by identifying and correcting weaknesses proactively. The need to strengthen cybersecurity defenses has become a strategic priority for businesses of all sizes and industries, demonstrating a shared commitment to maintaining the integrity, confidentiality, and availability of digital assets in an increasingly dangerous online environment.

Restraint

The complexity of integration can pose challenges, especially for organizations with diverse technology stacks.

Implementing security and vulnerability management solutions is a vital step for firms looking to strengthen their cybersecurity posture. However, this approach is not without its problems, with one of the most significant being the complexity and integration challenges connected with these solutions. Organizations usually operate varied and complex IT infrastructures, employing a variety of technologies and security tools to meet unique requirements. It might be difficult to integrate security and vulnerability management systems into an already established ecosystem. The complexity stems from the necessity to provide seamless interoperability with a wide range of software, hardware, and network configurations. The integration process necessitates careful consideration of interoperability between the new security solution and current technologies, such as firewalls, antivirus software, and intrusion prevention systems. Achieving a seamless integration frequently necessitates a thorough grasp of the organization’s unique technical landscape, which necessitates specialized knowledge and time-consuming preparation. Furthermore, implementing security and vulnerability management systems may need substantial resource allocation, both in terms of financial investment and qualified staff. The requirement for specialist cybersecurity knowledge, along with possible interruptions during the integration phase, can tax an organization’s resources and disrupt day-to-day operations. The integration difficulty becomes more evident for firms that have legacy systems or have experienced many technological transformations. Legacy systems may lack essential interfaces or compatibility features, necessitating more work to bridge the gap between old and modern technology.

Opportunities

Increasing awareness of cybersecurity threats and the importance of proactive security measures presents an opportunity for the growth of the Security and Vulnerability Management Software market.

The growing awareness of cybersecurity dangers has fueled the expansion of the Security and Vulnerability Management Software market. As enterprises across sectors face the ever-changing world of cyber threats, there is a growing realization of the crucial need of proactive security measures to protect digital assets and sensitive information.

In an era where cyber assaults are becoming more sophisticated and widespread, enterprises have prioritized the construction of strong security postures. This increased awareness extends to corporate leadership, IT professionals, and even end users, all of whom play an important part in keeping a safe digital environment. As enterprises become more aware of the scale of cyber risks, the security and vulnerability management software market is poised to profit from increased usage. Decision-makers recognize that reactive tactics are insufficient in the face of quickly changing threats, and there is an increasing knowledge of the proactive actions required to discover, analyze, and mitigate vulnerabilities before they can be exploited. The use of security and vulnerability management solutions is consistent with a strategic objective to strengthen cybersecurity defenses broadly. These technologies enable businesses to undertake frequent vulnerability assessments, prioritize possible risks, and proactively remedy security flaws. The emphasis on proactive security measures is both a response to present dangers and a forward-thinking strategy for anticipating and mitigating potential problems. Furthermore, legal frameworks and industry standards are highlighting the significance of strong cybersecurity measures. Organizations are motivated not only by the need to secure their assets and ensure operational continuity, but also by the need to comply with strict data protection and privacy rules.

Security and Vulnerability Management Software Market Trends

-

The rising frequency and sophistication of cyberattacks has prompted a greater emphasis on cybersecurity. Organizations in a variety of sectors are increasing their investment in security and vulnerability management solutions to secure their digital assets.

-

Cloud-based security and vulnerability management solutions continue to gain popularity. Cloud deployment provides scalability, flexibility, and simplicity of access, making it appealing to businesses seeking agile and effective cybersecurity solutions.

-

The use of AI and ML technologies in security systems improves the capacity to detect and respond to developing threats in real time. These tools may automate threat analysis, detect trends, and improve overall security posture.

-

The ever-changing regulatory landscape is prompting enterprises to embrace security solutions that help them comply with industry-specific legislation and standards. Compliance restrictions frequently affect the features and capabilities of security and vulnerability management systems.

-

The adoption of Zero Trust security frameworks, which presume that threats can exist both within and outside the network, has resulted in a greater emphasis on continuous monitoring, rigorous access rules, and full verification of all users and devices.

-

Understanding and analyzing user activity on an organization’s network is becoming increasingly important for spotting insider threats and unusual behaviors. UBA capabilities are being integrated with security products to improve threat detection.

-

Integrating security into the DevOps process is becoming increasingly popular. This entails including security measures early in the development process, which fosters a proactive and collaborative approach to security.

Competitive Landscape

The competitive landscape of the security and vulnerability management software market was dynamic, with several prominent companies competing to provide innovative and advanced security and vulnerability management software.

- IBM

- Alert Logic

- AlienVault

- BeyondTrust

- Check Point Software Technologies

- Cisco Systems

- Core Security

- FireEye

- Fortinet

- F-Secure Corporation

- ManageEngine

- McAfee

- Qualys

- Rapid7

- SolarWinds

- Splunk

- Symantec

- Tenable

- Tripwire

- Trustwave

Recent Developments:

January 24, 2024 — New Smart Agent for Cisco App Dynamics Dramatically Simplifies the Installation, Configuration and Upgrade of Application and Infrastructure Agents. Cisco (NASDAQ: CSCO) today launched Smart Agent for Cisco App Dynamics, enabling agent lifecycle management, dramatically simplifying application instrumentation for full-stack observability through intelligent agent automation and management, and helping customers on board new applications faster. Customers can identify out-of-date agents and upgrade them in minutes with an easy-to-use centralized agent management user interface.

Jan 23, 2024 – Use of misconfigured, outdated and end-of-life products can and is resulting in massive vulnerabilities in global network infrastructure security, causing disruptions to both businesses and consumers. A new white paper released today from the Network Resilience Coalition, an alliance composed of technology providers, security experts, and network operators, offers recommendations on how vendors and users of networking products can collaborate to improve the overall security of networks..

Regional Analysis

The North America, in particular, is a key participant in the cybersecurity sector. The region is home to a high number of cybersecurity firms, as well as several enterprises that spend extensively in advanced security solutions. The increasing degree of digitization across businesses, along with the continual danger of cyberattacks, has resulted in strong demand for security and vulnerability management software in North America. Businesses in this area are progressively employing security and vulnerability management solutions to enable data security, prevent cyber-attacks and commercial espionage, and ensure data security and privacy in order to support business continuity.

European countries such as the United Kingdom and Germany have also made significant contributions to the security software sector. The European Union’s General Data Protection Regulation (GDPR) has prompted regional firms to invest in strong cybersecurity measures. The presence of a strong industrial base, financial institutions, and rising awareness of cybersecurity risks all contribute to the need for security solutions in Europe.

Target Audience for Security and Vulnerability Management Software Market

- Consumers

- Home Automation Enthusiasts

- Small Businesses

- Enterprises

- Government Agencies

- Retailers

- Transportation Industry

- Healthcare Institutions

- Education Sector

- Smart City Initiatives

- Industrial Sector

- Hospitality Industry

- Technology and IT Companies

Segments Covered in the Security and Vulnerability Management Software Market Report

Security and Vulnerability Management Software Market by Deployment Mode

- Cloud

- On-Premises

Security and Vulnerability Management Software Market by Organization Size

- SMEs

- Large enterprises

Security and Vulnerability Management Software Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Security and Vulnerability Management Software Market over the next 7 years?

- Who are the key market participants Security and Vulnerability Management Software, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Security and Vulnerability Management Software Market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Security and Vulnerability Management Software Market?

- What is the current and forecasted size and growth rate of the global Security and Vulnerability Management Software Market?

- What are the key drivers of growth in the Security and Vulnerability Management Software Market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Security and Vulnerability Management Software Market?

- What are the technological advancements and innovations in the Security and Vulnerability Management Software Market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Security and Vulnerability Management Software Market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Security and Vulnerability Management Software Market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET OUTLOOK

- GLOBAL SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE, 2020-2030, (USD BILLION)

- CLOUD

- ON-PREMISES

- GLOBAL SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE, 2020-2030, (USD BILLION)

- SMES

- LARGE ENTERPRISES

- GLOBAL SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- IBM

- ALERT LOGIC

- ALIENVAULT

- BEYONDTRUST

- CHECK POINT SOFTWARE TECHNOLOGIES

- CISCO SYSTEMS

- CORE SECURITY

- FIREEYE

- FORTINET

- F-SECURE CORPORATION

- MANAGEENGINE

- MCAFEE

- QUALYS

- RAPID7

- SOLARWINDS

- SPLUNK

- SYMANTEC

- TENABLE

- TRIPWIRE

- TRUSTWAVE *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 2 GLOBAL SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 3 GLOBAL SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY REGION (USD BILLION) 2020-2030

TABLE 4 NORTH AMERICA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 7 US SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 8 US SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 9 CANADA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 10 CANADA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 11 MEXICO SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 12 MEXICO SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 13 SOUTH AMERICA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 14 SOUTH AMERICA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 15 SOUTH AMERICA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 16 BRAZIL SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 17 BRAZIL SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 18 ARGENTINA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 19 ARGENTINA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 20 COLOMBIA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 21 COLOMBIA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 22 REST OF SOUTH AMERICA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 23 REST OF SOUTH AMERICA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 24 ASIA-PACIFIC SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 25 ASIA-PACIFIC SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 26 ASIA-PACIFIC SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 27 INDIA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 28 INDIA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 29 CHINA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 30 CHINA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 31 JAPAN SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 32 JAPAN SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 33 SOUTH KOREA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 34 SOUTH KOREA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 35 AUSTRALIA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 36 AUSTRALIA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 37 SOUTH-EAST ASIA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 38 SOUTH-EAST ASIA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 39 REST OF ASIA PACIFIC SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 40 REST OF ASIA PACIFIC SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 41 EUROPE SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 42 EUROPE SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 43 EUROPE SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 44 GERMANY SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 45 GERMANY SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 46 UK SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 47 UK SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 48 FRANCE SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 49 FRANCE SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 50 ITALY SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 51 ITALY SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 52 SPAIN SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 53 SPAIN SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 54 RUSSIA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 55 RUSSIA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 56 REST OF EUROPE SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 57 REST OF EUROPE SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 58 MIDDLE EAST AND AFRICA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 59 MIDDLE EAST AND AFRICA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 60 MIDDLE EAST AND AFRICA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 61 UAE SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 62 UAE SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 63 SAUDI ARABIA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 64 SAUDI ARABIA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 65 SOUTH AFRICA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 66 SOUTH AFRICA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

TABLE 67 REST OF MIDDLE EAST AND AFRICA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE (USD BILLION) 2020-2030

TABLE 68 REST OF MIDDLE EAST AND AFRICA SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE, USD BILLION, 2022-2030

FIGURE 9 GLOBAL SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE, USD BILLION, 2022-2030

FIGURE 10 GLOBAL SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY REGION, USD BILLION, 2022-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT MODE, USD BILLION,2022

FIGURE 13 GLOBAL SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY ORGANIZATION SIZE, USD BILLION,2022

FIGURE 14 GLOBAL SECURITY AND VULNERABILITY MANAGEMENT SOFTWARE MARKET BY REGION, USD BILLION,2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 IBM: COMPANY SNAPSHOT

FIGURE 17 ALERT LOGIC: COMPANY SNAPSHOT

FIGURE 18 ALIENVAULT: COMPANY SNAPSHOT

FIGURE 19 BEYONDTRUST: COMPANY SNAPSHOT

FIGURE 20 CHECK POINT SOFTWARE TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 21 CISCO SYSTEMS: COMPANY SNAPSHOT

FIGURE 22 CORE SECURITY: COMPANY SNAPSHOT

FIGURE 23 FIREEYE: COMPANY SNAPSHOT

FIGURE 24 FORTINET: COMPANY SNAPSHOT

FIGURE 25 F-SECURE CORPORATION: COMPANY SNAPSHOT

FIGURE 26 MANAGEENGINE: COMPANY SNAPSHOT

FIGURE 27 MCAFEE: COMPANY SNAPSHOT

FIGURE 28 QUALYS: COMPANY SNAPSHOT

FIGURE 29 RAPID7: COMPANY SNAPSHOT

FIGURE 30 SOLARWINDS: COMPANY SNAPSHOT

FIGURE 31 SPLUNK: COMPANY SNAPSHOT

FIGURE 32 SYMANTEC: COMPANY SNAPSHOT

FIGURE 33 TENABLE: COMPANY SNAPSHOT

FIGURE 34 TRIPWIRE: COMPANY SNAPSHOT

FIGURE 35 TRUSTWAVE: COMPANY SNAPSHOT

FAQ

The global security and vulnerability management software market size is projected to grow from USD 23.95 billion in 2023 to USD 37.96 billion by 2030, exhibiting a CAGR of 6.8% during the forecast period.

North America accounted for the largest market in the security and vulnerability management software market.

IBM, Alert Logic, Alien Vault , Beyond Trust, Check Point Software Technologies, Cisco Systems, Core Security, FireEye ,Fortinet, F-Secure Corporation, Manage Engine, McAfee, Qualys,Rapid7, Solar Winds, Splunk, Symantec, Tenable, Tripwire ,Trustwave.

With the introduction of supply chain threats, enterprises are prioritizing vendor relationship security. Security and vulnerability management technologies are being used to identify and mitigate the risks associated with third-party connections.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.