REPORT OUTLOOK

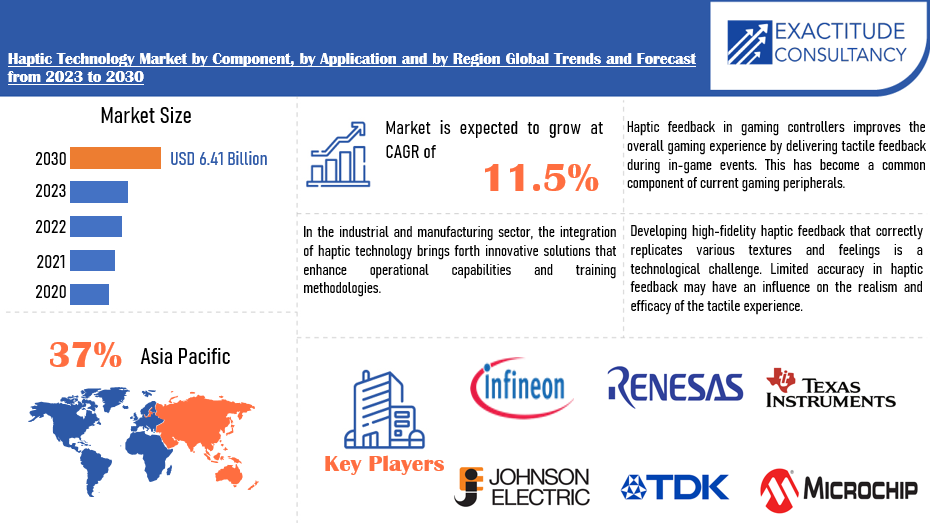

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 6.41 billion by 2030 | 11.5% | Asia Pacific |

| by Component | by Application |

|---|---|

|

|

SCOPE OF THE REPORT

Haptic Technology Market Overview

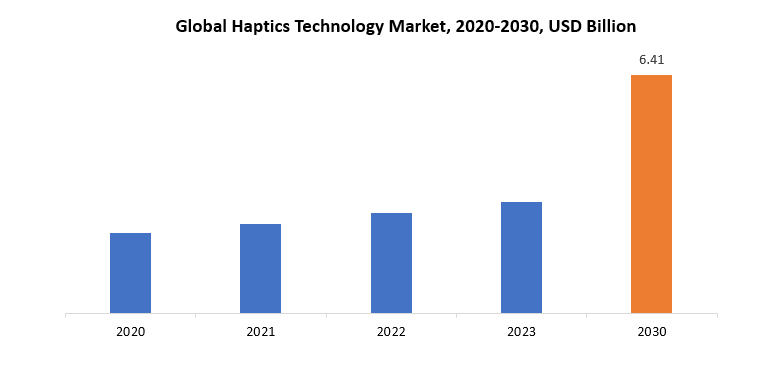

The global haptic technology market size is projected to grow from USD 2.99 billion in 2023 to USD 6.41 billion by 2030, exhibiting a CAGR of 11.5% during the forecast period.

Haptic technology uses tactile feedback to simulate the feeling of touch in electronic devices. The integration of sensors, actuators, and other components is required to provide consumers with a realistic and interactive experience. Haptic feedback, which can manifest as vibrations, movements, or forces, adds a physical layer to digital interactions. Touchscreen devices, game controllers, virtual reality systems, and medical simulators are among the most common uses. Haptic technology improves the entire user experience by including a sensation of touch, making interactions more immersive and intuitive. This technology has the potential to transform a variety of sectors by advancing user interfaces, training simulations, and entertainment experiences.

Haptic technology is important in many sectors because it may improve user experiences and bridge the gap between the digital and real worlds. In consumer electronics, such as smartphones and game consoles, haptic feedback provides a physical layer to interactions, increasing user engagement and making interfaces more intuitive. Haptic technology enhances the immersion and realism of virtual and augmented reality experiences by replicating the feeling of touch. Furthermore, haptic simulations allow for hands-on teaching in domains such as healthcare and education without the requirement for physical presence, promoting skill development in a safe and regulated setting. The significance of haptic technology stems from its ability to transform how humans interact with and interpret digital information, paving the way for novel applications in a variety of sectors.

Demand for haptic technology has continuously increased throughout sectors, driven by a rising emphasis on improving user experiences and introducing more realistic interactions into diverse applications. In consumer electronics, the increasing popularity of smartphones, gaming consoles, and wearable gadgets has spurred the desire for haptic feedback to give consumers with a more engaging and intuitive interface. The growing virtual reality and augmented reality businesses rely largely on haptic technology to create immersive experiences, drawing interest from the entertainment, gaming, and simulation industries. Furthermore, sectors such as healthcare, automotive, and manufacturing recognize the benefits of haptic technology for training simulations, remote operations, and tactile control systems, which adds to its growing demand. As technology, advances and new applications emerge, demand for haptic technology is projected to endure and rise, and fuelled by the continued desire for more realistic and engaging digital experiences.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Component, Application and Region |

|

By Component |

|

|

By Application |

|

|

By Region

|

|

Haptic Technology Market Segmentation Analysis

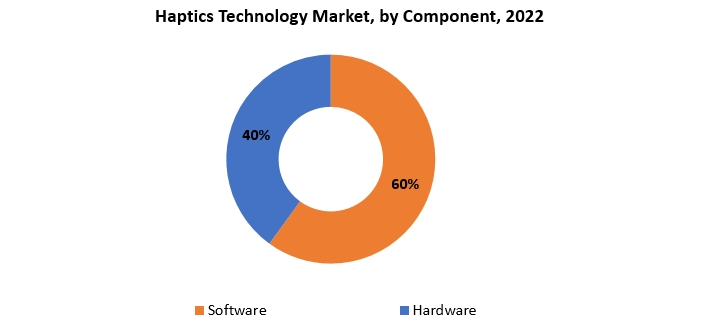

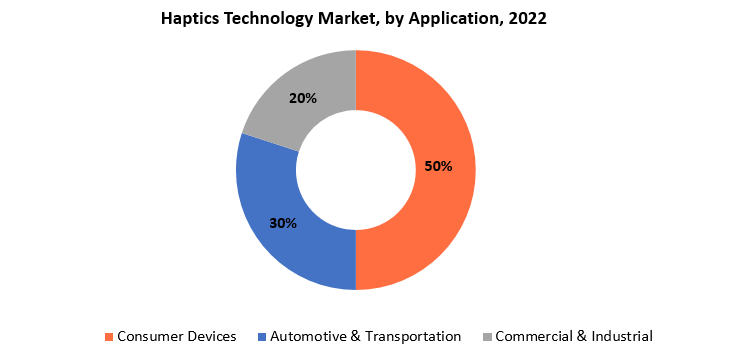

The global haptic technology market is bifurcated three segments, by component, application and region. By component, the market is bifurcated into hardware, software. By application, the market is bifurcated consumer devices, automotive & transportation, commercial & industrial and region.

The haptic technology market is divided into two primary categories: hardware and software. The hardware component includes the actual, physical aspects of haptic systems, such as actuators, sensors, and controllers. Actuators produce tactile feedback, while sensors detect touch and pressure, resulting in a dynamic interaction between the user and the gadget. The hardware is critical for producing realistic and precise haptic sensations, making it an essential component of everything from smartphones and game controllers to medical simulations and vehicle interfaces. On the other hand, the software component includes the programming and algorithms that control the type and reaction of haptic feedback. It is critical for transforming digital information into tactile sensations, resulting in a smooth and immersive user experience. Software customization enables developers to create personalized haptic effects by modifying strength, duration, and patterns to suit various applications. The software component is critical for improving haptic technology across several platforms, guaranteeing interoperability and responsiveness in varied digital settings. In short, haptic technology’s hardware and software components collaborate to provide tactile feedback, improving user experiences in a variety of sectors. The interplay of these components is crucial for the effective application and progress of haptic technology in the changing world of digital interactions.

The haptic technology market is divided into three categories based on application: consumer devices, automotive and transportation, and commercial and industrial. In the consumer products market, haptic technology is widely used in smartphones, game consoles, wearables, and other personal electronics. Tactile feedback improves user interfaces by making interactions more intuitive and engaging, ultimately contributing to a better overall user experience. In the automotive and transportation industries, haptic technology is essential for developing advanced driver assistance systems (ADAS) and in-vehicle interfaces. Haptic feedback is used to deliver tactile sensations to touchscreens, control panels, and navigation systems, hence increasing driver awareness and safety. Haptic feedback can also be used in virtual training simulators for vehicle operators. The commercial and industrial segment of the haptic technology market includes a wide variety of applications. In healthcare, haptic technology is employed in surgical training simulators and medical robotics, allowing practitioners to acquire and enhance their abilities in a realistic virtual environment. In industrial situations, haptic feedback improves accuracy and control for remote operations, maintenance chores, and simulations. Overall, the application segmentation reflects haptic technology’s versatility, as it addresses specific needs and requirements in consumer electronics, automotive innovation, and a wide range of industrial applications, demonstrating its ability to revolutionize user experiences and operational functionalities across industries.

Haptic Technology Market Dynamics

Driver

The increasing adoption of haptic feedback in smartphones, tablets, gaming consoles, and wearables enhances user experience and adds a tactile dimension to digital interactions.

The growing demand for haptic technology in consumer electronics is largely motivated by the need to improve user experiences and provide a physical component to digital interactions. Smartphones, tablets, gaming consoles, and wearables are at the forefront of this movement, including haptic feedback to provide consumers a more immersive and engaging contact with their gadgets. In the world of smartphones and tablets, haptic feedback is an important feature that allows users to experience small vibrations or tactile reactions while interacting with touchscreens. This gives virtual buttons, keyboard inputs, and other on-screen objects a tactile and responsive feel, increasing usability and generating a more enjoyable user experience. Haptic feedback enhances the realism and responsiveness of activities like typing on a virtual keyboard, navigating menus, and playing mobile games. Game consoles make use of haptic technologies to enhance the game experience even more. Advanced haptic feedback in controllers lets players to feel the effect of in-game events including footsteps, explosions, and simulated weapon recoil. This not only improves immersion but also gives important feedback throughout gaming, resulting in higher player engagement.

Restraint

The integration of advanced haptic technology faces a significant restraint in the form of cost constraints.

Implementing haptic feedback systems necessitates significant expenditures in a variety of areas, including specialized hardware components, advanced software algorithms, and the integration of these technologies with current devices. On the hardware front, the incorporation of actuators and sensors capable of providing subtle tactile feedback raises the total manufacturing cost of devices. These components must be not only technologically innovative, but also robust and dependable, matching the quality standards anticipated of consumer electronics. The development and implementation of advanced haptic software algorithms adds to the cost challenges. Creating software that can provide realistic and exact tactile sensations requires extensive study, development, and testing. Furthermore, software integration with current platforms or devices may necessitate changes to the user interface and experience design, raising development expenses. Integration fees add an extra degree of expenditure. Adapting current devices to provide haptic input or developing new goods with haptic capabilities may necessitate modifications in manufacturing processes and supply chains. Manufacturers may need to invest in retooling production processes and educating employees to meet the particular needs of haptic technology. Manufacturers and developers may be hesitant to pass on these additional expenses to end users in areas where consumer electronics is very price-driven, such as smartphones and low-cost products. This hesitation may result in a slower acceptance rate for haptic technology, restricting its use in ordinary consumer gadgets.

Opportunities

Integration of haptic feedback in touchscreens to enhance user experience, providing tactile sensations for interactions like typing, gaming, and navigation.

In the world of consumer electronics, including haptic feedback has substantially improved the user experience, notably in smartphones and tablets. Haptic technology is effortlessly integrated into touchscreens, giving consumers a tactile layer to their engagement. For example, when typing, the tiny vibrations simulate key presses, making the touchscreen keyboard feel more responsive and similar to real keys. Haptic feedback enhances immersion in gaming applications by converting in-game activities into physical feelings, such as weapon recoil or item hit. Furthermore, haptic technology is used in wearables, including smartwatches and fitness trackers. In these devices, haptic feedback serves a variety of purposes. Slight vibrations, allowing for unobtrusive but effective communication, send notifications and notifications to users not just visually or vocally, but also. Haptic technology also allows for virtual touch experiences, which allow users to sense sensations or feedback in response to different interactions. For example, a wristwatch may employ haptic feedback to imitate the sensation of rotating a virtual dial or pressing a button, making the user interface more intuitive and engaging.

Haptic Technology Market Trends

-

The use of haptic feedback in consumer gadgets such as smartphones, gaming controllers, and wearables has grown. Manufacturers aimed to give customers with more immersive and realistic tactile sensations, hence increasing the overall utility of these products.

-

The car industry experienced an increase in the use of haptic technology for touchscreens, infotainment systems, and in-vehicle controls. The goal was to increase driving safety by minimizing visual distractions via tactile input and making interfaces more user-friendly.

-

Haptic technology plays an important part in VR and AR applications, giving consumers a more realistic experience by replicating the feeling of touch. This tendency was especially noticeable in gaming, training simulations, and virtual tours.

-

Haptic technology has made significant progress in the healthcare industry. Surgical training simulators and robotic-assisted operations used haptic input to simulate real-world tactile sensations, which aided in skill development and accuracy.

-

Industries such as manufacturing and maintenance have used haptic feedback for remote operations, training simulations, and machine control. This improved operating efficiency and reduced the likelihood of mistakes.

-

The “Tactile Internet” concept gained momentum by stressing ultra-low latency and excellent dependability in haptic communication. This has consequences for applications that need real-time haptic feedback, such as remote surgery and industrial control systems.

-

Continuous improvements in actuators, sensors, and software algorithms have resulted in increasingly complex and realistic haptic experiences. This involves creating more subtle sensations and improving the precision with which tactile feedback is delivered.

Competitive Landscape

The competitive landscape of the haptic technology market was dynamic, with several prominent companies competing to provide innovative and advanced haptic technology.

- 3D Systems

- AAC Technologies

- Awinic

- D-Box Technologies

- Dialog Semiconductor PLC

- HaptX, Inc.

- Immersion Corporation

- Infineon Technologies AG

- Jahwa Electronics

- Johnson Electric

- Microchip Technology, Inc

- ON Semiconductor Corporation

- Precision Microdrives

- Renesas Electronics Corporation

- Semiconductor Components Industries

- SMK Corporation

- Synaptics Incorporated

- TDK Corporation

- Texas Instruments Incorporated

- Ultraleap Limited

Recent Developments:

November 9, 2023 — TDK offers varistors in SMD design with high surge current capability. TDK Corporation presents two new varistor series in SMD design. The types of both series are available for a wide range of operating voltages from 175 VRMS to 460 VRMS, corresponding to 225 VDC to 615 VDC.

January 30, 2024 – Infineon presents hybrid Time of Flight (hToF): Advanced technology for next-generation smart robots. In collaboration with device manufacturer OMS and pmdtechnologies, an expert in Time of Flight technology, Infineon Technologies AG (FSE: IFX / OTCQX: IFNNY) has developed a new high-resolution camera solution that enables enhanced depth sensing and 3D scene understanding for next-generation smart consumer robots. The new hybrid Time of Flight solution combines two depth-sensing concepts and helps significantly reduce maintenance effort and costs for smart robots.

Regional Analysis

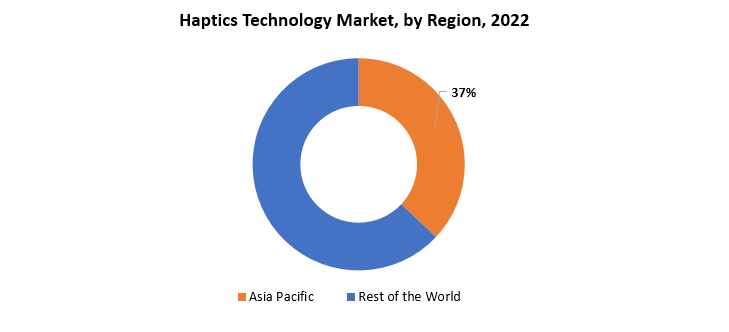

Asia Pacific dominated the market in 2023 and is predicted to have the greatest haptic technology market share throughout the forecast period. The Asia Pacific region is growing as a lively and dynamic center for the Haptic Technology market, owing to rapid technical breakthroughs, a thriving consumer electronics industry, and rising use of immersive experiences in gaming, automotive, and other industries. The region’s industrial and manufacturing industries are implementing haptic feedback devices for remote control of machinery and robotic applications. Haptic technology improves operator control, precision, and safety in a variety of industrial applications. Asia-Pacific countries are investing in medical education and healthcare technologies. Haptic technology is utilized in medical training simulations and surgical robotics to assist medical practitioners learn and improve their abilities.

The European haptic technology market is predicted to expand rapidly. The increased consumer expenditure on technologically sophisticated consumer gadgets is propelling the haptic technology industry in Europe. Touchscreen technology is definitely in great demand in Europe, particularly in retail, consumer, and automotive applications. For example, London-based IGT (International Game Technology) employs a mid-air haptic feedback system to deploy its TRUE 4D games on the Crystal Curve TRUE 4D cabinet. IGT has also combined Ultra haptics mid-air haptic technology, glasses-free TRUE 3D, and gesture recognition technology to create multi-sensory gaming environments.

Target Audience for Haptic Technology Market

- Consumer Electronics Manufacturers

- Automotive Industry

- Gaming and Entertainment Companies

- Virtual Reality (VR) and Augmented Reality (AR) Developers

- Medical Device Manufacturers

- Industrial Automation Companies

- Aerospace and Defense Sector

- Educational Institutions and Training Centers

- Research and Development Organizations

- Accessibility Technology Providers

Segments Covered in the Haptic Technology Market Report

Haptic Technology Market by Component

- Software

- Hardware

Haptic Technology Market by Application

- Consumer Devices

- Automotive & Transportation

- Commercial & Industrial

Haptic Technology Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Haptic Technology Market over the next 7 years?

- Who are the key market participants Haptic Technology, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Haptic Technology Market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Haptic Technology Market?

- What is the current and forecasted size and growth rate of the global Haptic Technology Market?

- What are the key drivers of growth in the Haptic Technology Market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Haptic Technology Market?

- What are the technological advancements and innovations in the Haptic Technology Market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Haptic Technology Market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Haptic Technology Market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- HAPTIC TECHNOLOGY MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON HAPTIC TECHNOLOGY MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- HAPTIC TECHNOLOGY MARKET OUTLOOK

- GLOBAL HAPTIC TECHNOLOGY MARKET BY COMPONENT, 2020-2030, (USD BILLION)

- SOFTWARE

- HARDWARE

- GLOBAL HAPTIC TECHNOLOGY MARKET BY APPLICATION, 2020-2030, (USD BILLION)

- CONSUMER DEVICES

- AUTOMOTIVE & TRANSPORTATION

- COMMERCIAL & INDUSTRIAL

- GLOBAL HAPTIC TECHNOLOGY MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- 3D SYSTEMS

- AAC TECHNOLOGIES

- AWINIC

- D-BOX TECHNOLOGIES

- DIALOG SEMICONDUCTOR PLC

- HAPTX, INC.

- IMMERSION CORPORATION

- INFINEON TECHNOLOGIES AG

- JAHWA ELECTRONICS

- JOHNSON ELECTRIC

- MICROCHIP TECHNOLOGY, INC

- ON SEMICONDUCTOR CORPORATION

- PRECISION MICRODRIVES

- RENESAS ELECTRONICS CORPORATION

- SEMICONDUCTOR COMPONENTS INDUSTRIES

- SMK CORPORATION

- SYNAPTICS INCORPORATED

- TDK CORPORATION

- TEXAS INSTRUMENTS INCORPORATED

- ULTRALEAP LIMITED *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 2 GLOBAL HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 3 GLOBAL HAPTIC TECHNOLOGY MARKET BY REGION (USD BILLION) 2020-2030

TABLE 4 NORTH AMERICA HAPTIC TECHNOLOGY MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 7 US HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 8 US HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 9 CANADA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 10 CANADA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 11 MEXICO HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 12 MEXICO HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 13 SOUTH AMERICA HAPTIC TECHNOLOGY MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 14 SOUTH AMERICA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 15 SOUTH AMERICA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 16 BRAZIL HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 17 BRAZIL HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 18 ARGENTINA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 19 ARGENTINA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 COLOMBIA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 21 COLOMBIA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 22 REST OF SOUTH AMERICA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 23 REST OF SOUTH AMERICA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 24 ASIA-PACIFIC HAPTIC TECHNOLOGY MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 25 ASIA-PACIFIC HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 26 ASIA-PACIFIC HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 27 INDIA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 28 INDIA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 29 CHINA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 30 CHINA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 31 JAPAN HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 32 JAPAN HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 33 SOUTH KOREA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 34 SOUTH KOREA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 35 AUSTRALIA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 36 AUSTRALIA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 37 SOUTH-EAST ASIA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 38 SOUTH-EAST ASIA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 39 REST OF ASIA PACIFIC HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 40 REST OF ASIA PACIFIC HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 41 EUROPE HAPTIC TECHNOLOGY MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 42 EUROPE HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 43 EUROPE HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 44 GERMANY HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 45 GERMANY HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 UK HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 47 UK HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 48 FRANCE HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 49 FRANCE HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 50 ITALY HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 51 ITALY HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 SPAIN HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 53 SPAIN HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 54 RUSSIA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 55 RUSSIA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 56 REST OF EUROPE HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 57 REST OF EUROPE HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 58 MIDDLE EAST AND AFRICA HAPTIC TECHNOLOGY MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 59 MIDDLE EAST AND AFRICA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 60 MIDDLE EAST AND AFRICA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 61 UAE HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 62 UAE HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 63 SAUDI ARABIA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 64 SAUDI ARABIA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 65 SOUTH AFRICA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 66 SOUTH AFRICA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 67 REST OF MIDDLE EAST AND AFRICA HAPTIC TECHNOLOGY MARKET BY COMPONENT (USD BILLION) 2020-2030

TABLE 68 REST OF MIDDLE EAST AND AFRICA HAPTIC TECHNOLOGY MARKET BY APPLICATION (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL HAPTIC TECHNOLOGY MARKET BY COMPONENT, USD BILLION, 2022-2030

FIGURE 9 GLOBAL HAPTIC TECHNOLOGY MARKET BY APPLICATION, USD BILLION, 2022-2030

FIGURE 10 GLOBAL HAPTIC TECHNOLOGY MARKET BY REGION, USD BILLION, 2022-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL HAPTIC TECHNOLOGY MARKET BY COMPONENT, USD BILLION,2022

FIGURE 13 GLOBAL HAPTIC TECHNOLOGY MARKET BY APPLICATION, USD BILLION,2022

FIGURE 14 GLOBAL HAPTIC TECHNOLOGY MARKET BY REGION, USD BILLION,2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 3D SYSTEMS : COMPANY SNAPSHOT

FIGURE 17 AAC TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 18 AWINIC : COMPANY SNAPSHOT

FIGURE 19 D-BOX TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 20 DIALOG SEMICONDUCTOR PLC: COMPANY SNAPSHOT

FIGURE 21 HAPTX, INC.: COMPANY SNAPSHOT

FIGURE 22 IMMERSION CORPORATION: COMPANY SNAPSHOT

FIGURE 23 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

FIGURE 24 JAHWA ELECTRONICS: COMPANY SNAPSHOT

FIGURE 25 JOHNSON ELECTRIC: COMPANY SNAPSHOT

FIGURE 26 MICROCHIP TECHNOLOGY, INC: COMPANY SNAPSHOT

FIGURE 27 ON SEMICONDUCTOR CORPORATION: COMPANY SNAPSHOT

FIGURE 28 PRECISION MICRODRIVES: COMPANY SNAPSHOT

FIGURE 29 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

FIGURE 30 SEMICONDUCTOR COMPONENTS INDUSTRIES: COMPANY SNAPSHOT

FIGURE 31 SMK CORPORATION: COMPANY SNAPSHOT

FIGURE 32 SYNAPTICS INCORPORATED: COMPANY SNAPSHOT

FIGURE 33 TDK CORPORATION: COMPANY SNAPSHOT

FIGURE 34 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

FIGURE 35 ULTRALEAP LIMITED: COMPANY SNAPSHOT

FAQ

The global haptic technology market size is projected to grow from USD 2.99 billion in 2023 to USD 6.41 billion by 2030, exhibiting a CAGR of 11.5% during the forecast period.

Asia Pacific accounted for the largest market in the haptic technology market.

3D Systems, AAC Technologies, Awinic ,D-Box Technologies, Dialog Semiconductor PLC, HaptX, Inc., Immersion Corporation, Infineon Technologies AG, Jahwa Electronics, Johnson Electric, Microchip Technology, Inc, ON Semiconductor Corporation, Precision Microdrives, Renesas Electronics Corporation, Semiconductor Components Industries, SMK Corporation, Synaptics Incorporated, TDK Corporation, Texas Instruments Incorporated, Ultraleap Limited.

There was a greater emphasis on employing haptic technology to improve accessibility for those with visual or hearing disabilities. This includes applications for assistive technology and user interface accessibility.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.