REPORT OUTLOOK

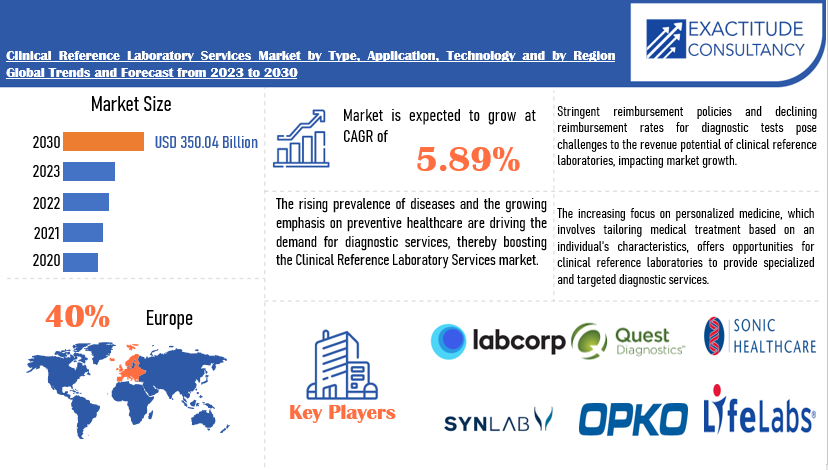

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 350.04 Billion by 2030 | 5.89 % | Europe |

| by Type | by Technology | by Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Clinical Reference Laboratory Services Market Overview

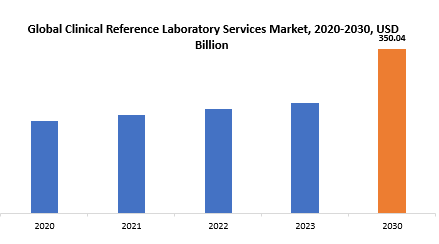

The global clinical reference laboratory services market is anticipated to grow from USD 234.49 Billion in 2023 to USD 350.04 Billion by 2030, at a CAGR of 5.89 % during the forecast period.

Clinical reference laboratories play an important role in the healthcare business by offering a wide range of diagnostic and testing services to help with the identification, diagnosis, and monitoring of various medical disorders. These laboratories are specialized facilities with cutting-edge equipment and staffed by highly qualified experts such as pathologists, medical technologists, and lab technicians.

Clinical reference laboratories provide a comprehensive range of tests, including blood tests, urine analysis, genetic testing, microbiology, and other specialist diagnostic procedures. These laboratories help healthcare professionals, such as hospitals, clinics, and physicians, make educated decisions about patient treatment. Clinical reference laboratories’ data help to shape treatment approaches, illness management methods, and overall patient well-being. Furthermore, these laboratories frequently conduct research and development efforts to expand diagnostic skills, which contributes to the ongoing advancement of medical diagnostics and healthcare outcomes.

Clinical reference laboratories provide a wide range of diagnostic procedures, including blood tests, molecular diagnostics, pathology, and genetic testing, which help in the early diagnosis and monitoring of a variety of medical disorders. The market’s relevance is highlighted by its capacity to provide physicians, hospitals, and clinics with consistent and high-quality laboratory findings, allowing them to personalize therapies to particular patient needs. Furthermore, clinical reference laboratories help to improve public health by assisting with the surveillance and monitoring of infectious illnesses and developing health trends. Technological improvements, the rising frequency of chronic illnesses, and the growing need for individualized medication all contribute to the market’s steady expansion.

The increased frequency of chronic illnesses such as diabetes, cardiovascular ailments, and cancer has created a greater demand for diagnostic tests to aid in early diagnosis and management. Furthermore, an aging global population adds to an increase in age-related disorders, driving up the demand for diagnostic services. Advances in medical technology and diagnostic procedures drive the industry ahead, as novel tests and approaches improve diagnostic accuracy and efficiency. The rising trend toward customized medicine, which depends significantly on genetic and molecular diagnostics, also helps to drive the Clinical Reference Laboratory Services market. Furthermore, the global emphasis on preventative healthcare and frequent health check-ups raises the demand for routine diagnostic tests.

As healthcare providers appreciate the value of precise and specialized diagnostic testing, clinical reference laboratories play an important role in providing this need. Continuous improvements in diagnostic technology, such as molecular diagnostics and genetic testing, drive the increase of testing capabilities available at these laboratories. Another key factor is the aging of the world population, which increases the frequency of chronic illnesses and necessitates more diagnostic testing for early identification and treatment. Furthermore, the increasing complexity of diagnostic testing, which necessitates specialized technology and knowledge, is leading healthcare practitioners to rely on external clinical reference laboratories.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Type, Technology , Application and Region |

|

By Type |

|

|

By Technology |

|

|

By Application |

|

|

By Region

|

|

Clinical Reference Laboratory Services Market Segmentation Analysis

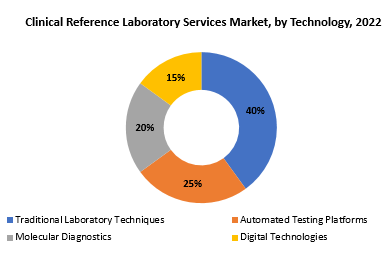

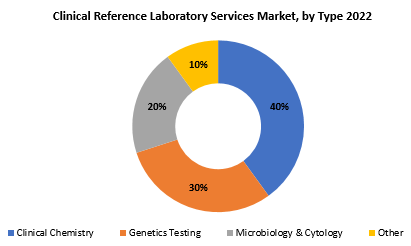

The global Clinical Reference Laboratory Services market is divided into three segments, Type, Technology, Application and region. By Type the market is divided Clinical Chemistry, Genetics Testing, Microbiology & Cytology, Other. By Application the market is classified into Clinics, Hospitals, Independent Laboratory. By Technology the market is classified into Traditional Laboratory Techniques, Automated Testing Platforms, Molecular Diagnostics, Digital Technologies.

Based on technology, traditional laboratory techniques segment dominating in the clinical reference laboratory services market. The traditional laboratory techniques category continues to dominate the Clinical Reference Laboratory Services market in terms of technology. This dominance stems from the historical dependence on traditional diagnostic procedures, which include a wide range of laboratory techniques such as microscopy, culture-based tests, and biochemical analysis. For decades, traditional procedures have served as the foundation for clinical diagnostics, delivering essential insights into a variety of health markers. While technological improvements have resulted in novel diagnostic approaches, conventional techniques remain essential for normal diagnostic operations, notably the examination of blood samples, tissue specimens, and physiological fluids.

These procedures, which are distinguished by their dependability and defined protocols, are commonly used for routine tests such as complete blood counts, urinalysis, and basic metabolic panels. Furthermore, these methods serve as standards for quality control in clinical laboratories. The prevalence of traditional laboratory techniques emphasizes the ongoing importance of foundational diagnostic methods in the overall landscape of Clinical Reference Laboratory Services, where a combination of traditional and cutting-edge technologies is required to meet the diverse diagnostic needs of patients and healthcare providers.

Automation has significantly transformed clinical laboratories, streamlining processes and enhancing efficiency. Automated testing platforms involve the use of robotics and advanced instrumentation to perform high-throughput testing with precision and speed, reducing human error and increasing throughput. Molecular diagnostics involve the analysis of genetic material at the molecular level, including DNA and RNA. Techniques such as polymerase chain reaction (PCR) and nucleic acid sequencing enable the detection of genetic variations, infectious agents, and biomarkers associated with various diseases, offering a high level of sensitivity and specificity.

Based on type, clinical chemistry segment dominating in the clinical reference laboratory services market. Clinical chemistry is an investigation of blood and physiological fluids to determine various biochemical components and metabolic indicators, which provides critical insights into an individual’s general health. This section includes a wide range of regular tests such as blood glucose levels, lipid profiles, liver function tests, and electrolyte research.

Clinical chemistry testing is essential for identifying and monitoring a variety of medical problems, including diabetes, cardiovascular diseases, and liver disorders. The clinical chemistry segment’s dominance can be linked to the tests’ ubiquitous and routine character, which is critical for both illness diagnosis and preventative healthcare. Furthermore, improvements in automated testing platforms and digital technologies have increased the efficiency and accuracy of clinical chemistry testing, boosting its position in the Clinical Reference Laboratory Services market.

Genetics testing is a vital component of clinical reference laboratory services, involving the analysis of an individual’s genetic material (DNA and RNA) to identify variations and mutations. It plays a crucial role in assessing the risk of inherited disorders, understanding the genetic basis of diseases, and guiding personalized treatment plans. This testing encompasses a broad spectrum, including carrier screening, predictive testing for hereditary conditions, pharmacogenomics for optimized drug therapies, and cancer genetics testing for risk assessment and targeted treatments.

Microbiology and cytology testing form another essential pillar of clinical reference laboratory services, focusing on the examination of microorganisms and cells. Microbiology testing involves the identification of bacteria, viruses, fungi, and parasites to diagnose infectious diseases, while cytology examines individual cells, particularly in cancer screening and diagnosis.

Clinical Reference Laboratory Services Market Dynamics

Driver

Increasing prevalence of chronic diseases acts as a significant driver for the clinical reference laboratory services market.

The clinical reference laboratory services market is expanding rapidly, driven mostly by the rising frequency of chronic illnesses. The global growth in chronic ailments such as diabetes, cardiovascular disease, cancer, and autoimmune disorders has increased the need for enhanced diagnostic services provided by clinical reference laboratories. These laboratories are critical in the early identification, correct diagnosis, and continuing monitoring of chronic illnesses using a variety of procedures such as genetics testing, clinical chemistry, and molecular diagnostics.

The worldwide burden of chronic illnesses rises as a result of variables such as aging populations, sedentary lifestyles, and dietary changes, clinical reference labs’ comprehensive and specialized diagnostic solutions become increasingly important. These laboratories’ capacity to deliver a wide range of tests, interpret complicated data, and provide vital insights into illness development places them at the forefront of modern healthcare. The rising frequency of chronic illnesses not only fuels the expansion of the clinical reference laboratory services market, but also emphasizes the critical role these services play in meeting the changing healthcare demands of communities globally.

Restraint

Data privacy concerns adoption can hinder the clinical reference laboratory services market during the forecast period.

Concerns about data privacy will significantly impede the growth of the clinical reference laboratory services market during the projected period. Clinical reference laboratories manage sensitive and personal health information, including genetic data, which is kept strictly secret and confidential. The rising digitalization of healthcare operations, as well as the preservation of patient data in electronic health records, raises worries about the information’s security and privacy. Patients and healthcare professionals are becoming more careful about how their medical information is gathered, handled, and distributed. High-profile data breaches and rising cyber threats in the healthcare industry have exacerbated these worries.

Compliance with severe data privacy rules, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe, is critical, but it may be difficult for clinical reference laboratories. Implementing sophisticated cybersecurity protections, encryption methods, and secure data-sharing frameworks complicates operations and raises compliance costs. Addressing data privacy concerns necessitates not just technology expenditures, but also continuous efforts to educate stakeholders, create transparent data management policies, and ensure legal compliance.

Opportunities

Development of new diagnostic tests is projected to boost the demand for clinical reference laboratory services market.

Advances in medical research, molecular biology, and genomics have led to an unprecedented surge in the identification of biomarkers, genetic variations, and molecular abnormalities associated with various diseases. This wealth of knowledge has paved the way for the creation of innovative and highly specific diagnostic tests that offer enhanced accuracy and early detection capabilities. The development of novel tests spans a wide spectrum, including cutting-edge genetics testing, molecular diagnostics, and specialized clinical chemistry assays.

These tests not only enable the diagnosis of diseases at earlier stages but also contribute to the personalization of treatment plans, paving the way for precision medicine. Clinical reference laboratories, with their expertise in conducting complex and specialized tests, are at the forefront of incorporating these innovations into their service offerings. The ability to offer a diverse portfolio of state-of-the-art diagnostic tests positions clinical reference laboratory services as indispensable partners in the evolving landscape of healthcare. The projected surge in demand is not only driven by the increasing prevalence of diseases but also by the continuous quest for more accurate, efficient, and personalized diagnostic solutions that meet the evolving needs of patients and healthcare providers.

Clinical Reference Laboratory Services Market Trends

-

The field of molecular diagnostics continues to witness significant advancements, with an increasing focus on precision medicine.

-

Molecular techniques, such as next-generation sequencing (NGS) and polymerase chain reaction (PCR), are being increasingly integrated into clinical reference laboratory services for more accurate and personalized diagnostics.

-

Liquid biopsy, a non-invasive diagnostic approach that analyzes biomarkers in blood or other bodily fluids, is gaining prominence.

-

Clinical reference laboratories are incorporating liquid biopsy techniques for cancer screening, monitoring treatment response, and detecting minimal residual disease.

-

The demand for rapid and on-site testing solutions is driving the expansion of point-of-care testing within clinical reference laboratory services.

-

AI and machine learning are being increasingly utilized to analyze large datasets generated by clinical reference laboratories.

-

The adoption of telepathology allows pathologists to remotely analyze pathology slides, enabling collaboration and consultations across different locations.

-

The increasing digitalization of healthcare data, there is a growing emphasis on cybersecurity within clinical reference laboratory services. Ensuring the protection of sensitive patient information from cyber threats is a critical consideration.

Competitive Landscape

The competitive landscape of the clinical reference laboratory services market was dynamic, with several prominent companies competing to provide innovative and advanced clinical reference laboratory services solutions.

- Laboratory Corporation of America (LabCorp)

- Quest Diagnostics

- Sonic Healthcare

- SYNLAB International

- OPKO Health

- LifeLabs Medical Laboratory Services

- Acibadem Labmed Laboratory

- Kingmed Diagnostics

- ACM Medical Laboratory

- Clinical Reference Laboratory

- DIAN Diagnostics

- Exact Sciences

- Eurofins Scientific

- Enzo Biochem

- Adicon Clinical Laboratories

- Lal PathLabs

- BML Laboratories

- American Pathology Partners

- ViraCor-IBT Laboratories

- Spectra Laboratories

Recent Developments:

-

10, 2024: Labcorp, a global leader of innovative and comprehensive laboratory services, and Hawthorne Effect, Inc., a complete clinical trials solution integrating technology, are pleased to announce a strategic collaboration to advance decentralized clinical trial capabilities for pharma, biotech and medical device sponsors seeking to increase patient diversity and inclusion, decrease site burden, and accelerate enrollment and clinical study timelines.

-

17, 2024– Fitbit and Quest Diagnostics (NYSE: DGX), the world’s leading provider of diagnostic information services, announced a collaboration to study the potential of wearable devices to improve metabolic health, which influences risk of developing several diseases, including diabetes and heart disease.

Regional Analysis

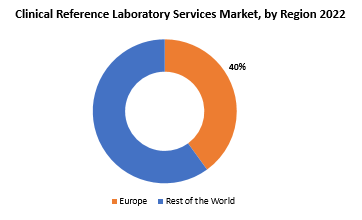

Europe accounted for the largest market in the clinical reference laboratory services market. Europe accounted for 40 % market share of the global market value. Europe boasts a highly developed healthcare infrastructure, characterized by advanced medical facilities, a well-established network of clinical laboratories, and a robust regulatory framework. The region’s commitment to healthcare innovation and research is reflected in its adoption of cutting-edge diagnostic technologies and molecular testing methodologies, positioning clinical reference laboratories at the forefront of medical diagnostics.

Additionally, the European population’s growing awareness of preventive healthcare, coupled with an aging demographic, has resulted in an increased demand for sophisticated diagnostic services provided by clinical reference laboratories. The prevalence of chronic diseases in the region has further amplified the need for accurate and comprehensive diagnostic testing. Stringent regulatory standards, such as those set by the European Medicines Agency (EMA) and adherence to data protection regulations under the General Data Protection Regulation (GDPR), contribute to the reliability and quality assurance of clinical reference laboratory services in Europe.

The Asia-Pacific region is experiencing robust growth in the clinical reference laboratory services market, driven by several factors. The region’s large and diverse population, coupled with a rising awareness of preventive healthcare, is fostering increased demand for diagnostic testing services. Economic development and improvements in healthcare infrastructure in countries like China, India, and Japan are further contributing to the expansion of clinical reference laboratory services. The prevalence of infectious diseases, a growing burden of chronic conditions, and the need for early disease detection are fueling the demand for a wide array of diagnostic tests.

Europe, with its well-established healthcare systems and emphasis on research and development, has positioned itself as a leader in the clinical reference laboratory services market. The region benefits from a high level of technological adoption, a comprehensive regulatory framework, and a strong network of clinical laboratories. The aging population in Europe contributes to an increased demand for diagnostic services, especially for chronic diseases prevalent in older demographics. Europe’s commitment to personalized medicine and precision diagnostics is evident in the incorporation of advanced technologies, including molecular diagnostics and genetics testing, into clinical reference laboratory services.

Target Audience for Clinical Reference Laboratory Services Market

- Healthcare Providers

- Pharmaceutical and Biotechnology Companies

- Diagnostic Laboratories

- Government and Regulatory Bodies

- Health Insurance Companies

- Academic and Research Institutions

- Patients and Patient Advocacy Groups

- Technology Providers

- Investors and Financial Institutions

- Industry Associations

- Telehealth and Telemedicine Providers

- Global Health Organizations

- Biobanks and Biorepositories

- CROs (Contract Research Organizations)

- Technology and Service Integrators

Segments Covered in the Clinical Reference Laboratory Services Market Report

Clinical Reference Laboratory Services Market by Type

- Clinical Chemistry

- Genetics Testing

- Microbiology & Cytology

- Other

Clinical Reference Laboratory Services Market by Technology

- Traditional Laboratory Techniques

- Automated Testing Platforms

- Molecular Diagnostics

- Digital Technologies

Clinical Reference Laboratory Services Market by Application

- Clinics

- Hospitals

- Independent Laboratory

Clinical Reference Laboratory Services Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Clinical Reference Laboratory Services market over the next 7 years?

- Who are the major players in the Clinical Reference Laboratory Services market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the Clinical Reference Laboratory Services market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Clinical Reference Laboratory Services market?

- What is the current and forecasted size and growth rate of the global Clinical Reference Laboratory Services market?

- What are the key drivers of growth in the Clinical Reference Laboratory Services market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Clinical Reference Laboratory Services market?

- What are the technological advancements and innovations in the Clinical Reference Laboratory Services market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the clinical reference laboratory services market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Clinical Reference Laboratory Services market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON CLINICAL REFERENCE LABORATORY SERVICES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- TECHNOLOGY VALUE CHAIN ANALYSIS

- GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET OUTLOOK

- GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE, 2020-2030, (USD BILLION)

- CLINICAL CHEMISTRY

- GENETICS TESTING

- MICROBIOLOGY & CYTOLOGY

- OTHER

- GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION, 2020-2030, (USD BILLION)

- CLINICS

- HOSPITALS

- INDEPENDENT LABORATORY

- GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY, 2020-2030, (USD BILLION)

- TRADITIONAL LABORATORY TECHNIQUES

- AUTOMATED TESTING PLATFORMS

- MOLECULAR DIAGNOSTICS

- DIGITAL TECHNOLOGIES

- GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- LABORATORY CORPORATION OF AMERICA (LABCORP)

- QUEST DIAGNOSTICS

- SONIC HEALTHCARE

- SYNLAB INTERNATIONAL

- OPKO HEALTH

- LIFELABS MEDICAL LABORATORY SERVICES

- ACIBADEM LABMED LABORATORY

- KINGMED DIAGNOSTICS

- ACM MEDICAL LABORATORY

- CLINICAL REFERENCE LABORATORY

- DIAN DIAGNOSTICS

- EXACT SCIENCES

- EUROFINS SCIENTIFIC

- ENZO BIOCHEM

- ADICON CLINICAL LABORATORIES

- LAL PATHLABS

- BML LABORATORIES

- AMERICAN PATHOLOGY PARTNERS

- VIRACOR-IBT LABORATORIES

- SPECTRA LABORATORIES

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 3 GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 4 GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY REGION (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 10 US CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 11 US CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 12 CANADA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 13 CANADA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 14 CANADA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 15 MEXICO CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 16 MEXICO CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 17 MEXICO CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 23 BRAZIL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 24 BRAZIL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 25 ARGENTINA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 26 ARGENTINA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 27 ARGENTINA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 28 COLOMBIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 29 COLOMBIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 30 COLOMBIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC CLINICAL REFERENCE LABORATORY SERVICES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 39 INDIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 40 INDIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 41 CHINA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 42 CHINA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 43 CHINA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 44 JAPAN CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 45 JAPAN CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 JAPAN CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 59 EUROPE CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 60 EUROPE CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 61 EUROPE CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 62 EUROPE CLINICAL REFERENCE LABORATORY SERVICES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 64 GERMANY CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 65 GERMANY CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 66 UK CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 67 UK CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 68 UK CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 69 FRANCE CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 70 FRANCE CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 71 FRANCE CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 72 ITALY CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 73 ITALY CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 74 ITALY CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 75 SPAIN CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 76 SPAIN CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 77 SPAIN CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 78 RUSSIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 79 RUSSIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 80 RUSSIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 89 UAE CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 90 UAE CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2020-2030

FIGURE 10 GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

FIGURE 11 GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TYPE (USD BILLION) 2022

FIGURE 14 GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY APPLICATION (USD BILLION) 2022

FIGURE 15 GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY TECHNOLOGY (USD BILLION) 2022

FIGURE 16 GLOBAL CLINICAL REFERENCE LABORATORY SERVICES MARKET BY REGION (USD BILLION) 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 LABORATORY CORPORATION OF AMERICA (LABCORP): COMPANY SNAPSHOT

FIGURE 19 QUEST DIAGNOSTICS: COMPANY SNAPSHOT

FIGURE 20 SONIC HEALTHCARE: COMPANY SNAPSHOT

FIGURE 21 SYNLAB INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 22 OPKO HEALTH: COMPANY SNAPSHOT

FIGURE 23 LIFELABS MEDICAL LABORATORY SERVICES: COMPANY SNAPSHOT

FIGURE 24 ACIBADEM LABMED LABORATORY: COMPANY SNAPSHOT

FIGURE 25 KINGMED DIAGNOSTICS: COMPANY SNAPSHOT

FIGURE 26 ACM MEDICAL LABORATORY: COMPANY SNAPSHOT

FIGURE 27 CLINICAL REFERENCE LABORATORY: COMPANY SNAPSHOT

FIGURE 28 DIAN DIAGNOSTICS: COMPANY SNAPSHOT

FIGURE 29 EXACT SCIENCES: COMPANY SNAPSHOT

FIGURE 30 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

FIGURE 31 ENZO BIOCHEM: COMPANY SNAPSHOT

FIGURE 32 ADICON CLINICAL LABORATORIES: COMPANY SNAPSHOT

FIGURE 33 LAL PATHLABS: COMPANY SNAPSHOT

FIGURE 34 BML LABORATORIES: COMPANY SNAPSHOT

FIGURE 35 AMERICAN PATHOLOGY PARTNERS: COMPANY SNAPSHOT

FIGURE 36 VIRACOR-IBT LABORATORIES: COMPANY SNAPSHOT

FIGURE 37 SPECTRA LABORATORIES: COMPANY SNAPSHOT

FAQ

The global clinical reference laboratory services market is anticipated to grow from USD 234.49 Billion in 2023 to USD 350.04 Billion by 2030, at a CAGR of 5.89 % during the forecast period.

Europe accounted for the largest market in the clinical reference laboratory services market. Europe accounted for 40 % market share of the global market value.

Laboratory Corporation of America (LabCorp), Quest Diagnostics, Sonic Healthcare, SYNLAB International, OPKO Health, LifeLabs Medical Laboratory Services, Acibadem Labmed Laboratory, Kingmed Diagnostics, ACM Medical Laboratory, Clinical Reference Laboratory, DIAN Diagnostics, Exact Sciences, Eurofins Scientific, Enzo Biochem, Adicon Clinical Laboratories, Lal PathLabs, BML Laboratories, American Pathology Partners, ViraCor-IBT Laboratories, Spectra Laboratories.

The clinical reference laboratory services market includes the increasing focus on molecular diagnostics and genetics testing, the rise of liquid biopsy for non-invasive cancer screening, and the integration of artificial intelligence (AI) for data analysis and interpretation. Additionally, there is a growing emphasis on expanding point-of-care testing, fostering collaborations for research and development, and addressing data privacy concerns to ensure the secure handling of sensitive patient information.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.