REPORT OUTLOOK

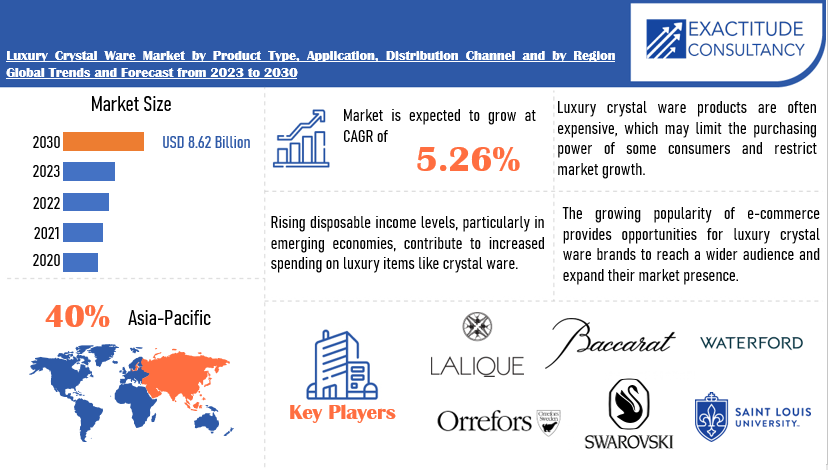

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 8.62 Billion by 2030 | 5.26 % | Asia Pacific |

| by Product Type | by Application | by Distribution Channel |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Luxury Crystal Ware Market Overview

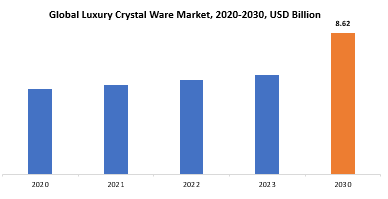

The global luxury crystal ware market is anticipated to grow from USD 6.02 Billion in 2023 to USD 8.62 Billion by 2030, at a CAGR of 5.26 % during the forecast period.

Luxury crystal ware represents the pinnacle of elegance and sophistication in the realm of tableware and decorative items. Crafted from high-quality crystal, typically leaded glass, these pieces exude a timeless allure characterized by clarity, brilliance, and exquisite craftsmanship. Each piece is meticulously formed by skilled artisans who employ traditional techniques honed over centuries, combined with modern innovations to create flawless works of art. The allure of luxury crystal ware lies not only in its stunning aesthetic appeal but also in its practical utility, as these pieces often serve as functional items for dining or as decorative accents to adorn living spaces.

Luxurious crystal ware, such as elaborately etched decanters, sparkling chandeliers, beautiful vases, and finely cut wine glasses, lends an air of refinement and wealth to any environment. These objects have cultural meaning beyond just being beautiful; they stand for commitment to excellent life, money, and prestige. Moreover, the intrinsic qualities of crystal, such its transparency and capacity to refract light, elevate the presentation of food and drinks, adding to the dining or entertaining experience. For individuals who value finer things in life, luxury crystal ware is a sumptuous pleasure that combines artistry, craftsmanship, and utility.

The enduring appeal of luxury crystal ware lies in its association with prestige, exclusivity, and sophistication, catering to consumers who seek to elevate their lifestyle and make a statement of refined taste. Additionally, the growing global affluent population, particularly in emerging markets, fuels demand for luxury goods, including crystal ware, as disposable incomes rise and purchasing power increases. Moreover, the timeless allure of craftsmanship and artisanal traditions adds intrinsic value to luxury crystal ware, appealing to consumers who appreciate the meticulous attention to detail and the heritage behind each piece.

Furthermore, the rising trend towards home entertaining and luxury dining experiences contributes to the demand for exquisite tableware, including crystal glasses, decanters, and serving platters, as consumers seek to create memorable moments and elevate their hospitality. Technological advancements in manufacturing processes also play a role, enabling artisans to push the boundaries of creativity and innovation while maintaining the quality and authenticity of luxury crystal ware. Additionally, collaborations between renowned designers and luxury crystal brands bring fresh perspectives and contemporary designs to the market, appealing to a broader demographic of consumers.

The luxury crystal ware market holds immense significance across cultural, economic, and social spheres. Culturally, these pieces represent a rich heritage of artisanal craftsmanship, embodying refinement and artistic expression. They serve to preserve traditional techniques, ensuring their continued appreciation in a modernized world. Economically, the market provides employment opportunities and drives growth in regions renowned for glass-making expertise, while also generating revenue for luxury brands through demand for high-quality craftsmanship. Socially, luxury crystal ware symbolizes status and taste, often passed down as heirlooms and enhancing social occasions with its elegance, thereby creating lasting connections to heritage and enriching communal experiences.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Type, Distribution Channel, Application and Region |

|

By Product Type |

|

|

By Application |

|

|

By Distribution Channel |

|

|

By Region

|

|

Luxury Crystal Ware Market Segmentation Analysis

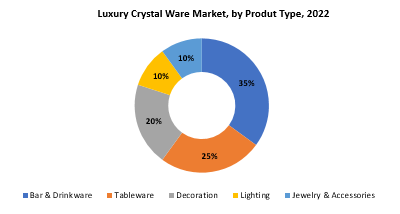

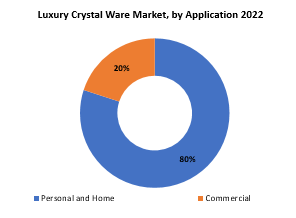

The global Luxury Crystal Ware market is divided into three segments, product type, application, distribution channel and region. By function the market is divided Bar & Drinkware, Tableware, Decoration, Lighting, Jewelry & Accessories. By application the market is classified into Personal and Home, Commercial. By distribution channel the market is classified into Department Stores, Specialty Boutiques, Online Retailers, Direct Sales Channels.

Based on product type, bar & drinkware segment dominating in the luxury crystal ware market. he bar and drinkware segment stands out as a dominant force, captivating consumers with its blend of functionality, elegance, and cultural significance. This segment encompasses a diverse range of products tailored for serving and enjoying beverages, including wine glasses, champagne flutes, whiskey decanters, and cocktail tumblers, among others. The dominance of this segment can be attributed to several factors. Firstly, the global rise in cocktail culture and the growing appreciation for fine spirits have spurred demand for premium drinkware that enhances the sensory experience of consuming beverages.

Luxury crystal barware not only elevates the visual presentation of drinks but also enhances their aroma and taste, thanks to the exceptional clarity and quality of crystal glass. Additionally, the allure of hosting sophisticated cocktail parties and intimate gatherings at home has fueled interest in acquiring exquisite drinkware sets that reflect one’s discerning taste and lifestyle. Moreover, the inherent symbolism attached to luxury crystal drinkware, as a marker of status and refinement, further drives its popularity among affluent consumers who seek to make a statement of luxury in their social engagements. Furthermore, collaborations between luxury brands and renowned designers have injected fresh perspectives and innovative designs into the bar and drinkware segment, attracting a broader audience of connoisseurs and collectors.

Based on application, personal segment dominating in the luxury crystal ware market. the personal segment emerges as a dominant force, reflecting a growing trend towards personalized indulgence and self-expression. This segment encompasses a wide array of luxury crystal products designed for personal use, including perfume bottles, jewelry boxes, vanity sets, and ornamental figurines, among others. As there is a rising demand for luxury goods that cater to individual tastes and lifestyles, allowing consumers to express their unique identities and preferences through finely crafted objects of beauty and utility. Luxury crystal ware in the personal segment offers a means for individuals to adorn their living spaces and accessorize their personal belongings with exquisite pieces that exude elegance and sophistication.

Additionally, the emotional appeal of owning and using luxury crystal items on a daily basis adds to their allure, as they evoke feelings of pleasure, self-indulgence, and a sense of accomplishment. Moreover, the personal segment holds significance as a gifting category, with luxury crystal ware serving as coveted gifts for special occasions such as weddings, anniversaries, and milestone celebrations. The timeless appeal and enduring quality of luxury crystal products make them cherished keepsakes that hold sentimental value for both the giver and the recipient. Furthermore, the personal segment benefits from collaborations between luxury brands and designers, which introduce innovative designs and exclusive collections tailored to the discerning tastes of consumers seeking personalized luxury experiences.

Luxury Crystal Ware Market Dynamics

Driver

Growing interest in home entertaining boosts demand for luxury crystal ware market.

The growing interest in home entertaining has become a significant driver of demand within the luxury crystal ware market, reshaping consumer preferences and purchasing behaviors. This trend reflects a cultural shift towards more intimate and personalized social gatherings, where individuals seek to create memorable experiences within the comfort of their own homes. One of the primary factors fueling this trend is the desire for meaningful social connections and authentic interactions, which are often best cultivated in the relaxed and familiar setting of one’s home. As a result, consumers are increasingly investing in high-quality tableware, drinkware, and decorative accessories to elevate the ambiance and sophistication of their entertaining spaces.

Luxury crystal ware plays a central role in enhancing the dining and entertaining experience, adding an element of elegance, refinement, and visual appeal to the presentation of food and beverages. From intricately cut wine glasses to sparkling decanters and ornate serving platters, each piece of luxury crystal ware serves as a statement of taste, style, and hospitality. The unparalleled clarity and brilliance of crystal glass not only showcase the colors and textures of culinary creations but also elevate the sensory experience by enhancing the aroma and flavor of beverages.

Furthermore, the rise of social media and the sharing economy have contributed to the popularity of home entertaining, as individuals seek to showcase their hosting skills and create Instagram-worthy moments for their guests. The allure of creating curated dining experiences and themed parties has driven demand for luxury crystal ware as consumers aspire to emulate the elegance and sophistication of high-end restaurants and luxury hotels in their own homes.

Restraint

High Cost of luxury crystal ware can hinder the luxury crystal ware market during the forecast period.

Luxury crystal ware is renowned for its exquisite craftsmanship, superior quality materials, and intricate designs, all of which contribute to its elevated price point. This high cost is reflective of the time-intensive manufacturing processes involved, the use of premium materials such as leaded crystal glass, and the skilled craftsmanship required to produce each piece.

One of the primary ways in which the high cost of luxury crystal ware can hinder market growth is by limiting accessibility to a niche segment of affluent consumers. As luxury crystal ware is positioned as a symbol of prestige, sophistication, and status, it often caters to a select demographic of individuals who possess the financial means to afford such indulgences. This exclusivity can potentially narrow the target market and limit the overall demand for luxury crystal ware, especially during periods of economic uncertainty or downturns when consumer discretionary spending may be more cautious.

Additionally, the high cost of luxury crystal ware may deter potential consumers who perceive it as an extravagant or impractical expenditure, particularly in comparison to more affordable alternatives available in the market. As consumers become increasingly discerning and value-conscious, they may prioritize functionality, durability, and value for money over purely aesthetic considerations when making purchasing decisions, thereby opting for less expensive options that offer comparable utility without the premium price tag.

Furthermore, the high cost of luxury crystal ware can also pose challenges for manufacturers and retailers in terms of pricing strategies, distribution channels, and inventory management. Maintaining profitability while ensuring competitive pricing in the face of fluctuating production costs, currency exchange rates, and market demand dynamics requires careful strategic planning and management. Moreover, the luxury crystal ware market may face intensified competition from emerging luxury brands, as well as alternative luxury categories, which offer consumers a wider range of choices and price points.

Opportunities

The rise of e-commerce platforms is projected to boost the demand for luxury crystal ware market.

The rise of e-commerce platforms is poised to significantly boost the demand for the luxury crystal ware market, reshaping the landscape of luxury retailing and consumer purchasing behaviors. E-commerce has emerged as a powerful driver of market growth, offering consumers unparalleled convenience, accessibility, and choice when it comes to shopping for luxury goods, including crystal ware. One of the key advantages of e-commerce platforms is their ability to provide a seamless and personalized shopping experience, allowing consumers to browse, compare, and purchase luxury crystal ware from the comfort of their homes or on-the-go using mobile devices.

Furthermore, e-commerce platforms offer a global reach, enabling luxury crystal ware brands to tap into new markets and target affluent consumers beyond traditional retail channels. This expanded reach is particularly advantageous for niche and artisanal brands that may not have a widespread physical presence but can leverage digital platforms to showcase their unique craftsmanship, heritage, and product offerings to a global audience.

Moreover, e-commerce platforms provide luxury crystal ware brands with valuable insights into consumer preferences, behavior, and purchasing patterns through data analytics and customer profiling. This data-driven approach allows brands to tailor their marketing strategies, product assortments, and pricing strategies to better meet the needs and expectations of their target audience, thereby enhancing customer engagement and loyalty.

In addition, the rise of social commerce and influencer marketing on e-commerce platforms presents new opportunities for luxury crystal ware brands to connect with consumers and drive sales through authentic and engaging content. Influencers and brand ambassadors can showcase luxury crystal ware in aspirational lifestyle settings, inspiring their followers and driving desire for these products.

Luxury Crystal Ware Market Trends

-

Consumers are increasingly seeking unique and personalized luxury items, including crystal ware. Luxury brands are responding to this trend by offering customization options such as engraved monograms, bespoke designs, and limited-edition collections, catering to individual preferences and tastes.

-

There’s a growing awareness and demand for sustainable luxury products, prompting luxury crystal ware brands to adopt environmentally friendly practices. This includes sourcing ethically sourced raw materials, implementing eco-friendly manufacturing processes, and reducing carbon footprints throughout the supply chain.

-

Luxury crystal ware brands are emphasizing their rich heritage and artisanal craftsmanship as key differentiators in a competitive market. Consumers are drawn to the story behind each piece, appreciating the tradition and skill involved in its creation.

-

Consumers are becoming more conscious of the environmental and social impact of their purchases. Luxury crystal ware brands are responding by using sustainable materials and production methods, and sourcing their materials ethically.

-

Technology is playing an increasingly important role in the luxury crystal ware market. For example, some brands are using 3D printing to create innovative and intricate designs, while others are using augmented reality to allow customers to virtually experience products before purchasing them.

-

Luxury crystal ware brands are increasingly focusing on creating experiences for their customers, such as hosting exclusive events and offering workshops on crystal care and appreciation. This helps to build brand loyalty and create a sense of community among customers.

Competitive Landscape

The competitive landscape of the luxury crystal ware market was dynamic, with several prominent companies competing to provide innovative and advanced luxury crystal ware solutions.

- Lalique

- Baccarat

- Waterford

- Orrefors

- Swarovski

- Saint-Louis

- Tiffany & Co.

- Moser

- Steuben

- Daum

- Rogaska

- Kosta Boda

- William Yeoward Crystal

- Lalique

- Royal Doulton

- Edinburgh Crystal

- Nachtmann

- Val Saint Lambert

- Riedel

- Atlantis Crystal

Recent Developments:

-

19 Dec 2023: Lalique is delighted to announce the inscription of glassmaking techniques on UNESCO’s Representative List of Intangible Cultural Heritage of Humanity. This global recognition is an immense source of pride for all its craftspeople and partners.

-

3 May 2023– LALIQUE and PATRÓN Tequila, the world’s number one super-premium tequila, unveil their third remarkable collaboration: PATRÓN en LALIQUE: Serie 3.

Regional Analysis

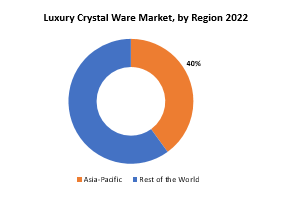

Asia-Pacific accounted for the largest market in the luxury crystal ware market. Asia-Pacific accounted for 40 % market share of the global market value. The Asia-Pacific region has emerged as the largest market in the luxury crystal ware segment, propelled by several key factors that have contributed to its robust growth and dominance. Firstly, the region’s rapid economic development, particularly in countries such as China, Japan, South Korea, and India, has led to a significant expansion of the affluent consumer base with high purchasing power. As disposable incomes rise and lifestyles become more aspirational, consumers in the Asia-Pacific region are increasingly drawn to luxury goods that reflect their status, taste, and sophistication, including luxury crystal ware.

Moreover, the cultural significance of luxury and craftsmanship in many Asian societies further fuels demand for luxury crystal ware. Traditional values of craftsmanship, artistry, and attention to detail resonate strongly with consumers in the region, who value authenticity and heritage in their luxury purchases. Luxury crystal ware, with its rich history of artisanal craftsmanship and intricate designs, holds particular appeal for Asian consumers seeking to express their appreciation for fine craftsmanship and aesthetic beauty.

Additionally, the growing influence of Western luxury brands and lifestyle trends in the Asia-Pacific region has contributed to the popularity of luxury crystal ware among affluent consumers. Western luxury brands have established a strong presence in key Asian markets, leveraging their brand heritage, reputation for quality, and aspirational appeal to attract discerning consumers. Luxury crystal ware, with its association with Western luxury and prestige, aligns well with the aspirational lifestyles of affluent consumers in the region.

In Europe, luxury crystal ware holds a longstanding tradition deeply rooted in the region’s rich history of craftsmanship, artistry, and luxury refinement. Countries such as Italy, France, Germany, and the Czech Republic are renowned for their centuries-old glassmaking traditions, producing some of the world’s most exquisite and sought-after crystal ware. European consumers have a deep appreciation for heritage brands, artisanal craftsmanship, and timeless design aesthetics, making luxury crystal ware a cherished and integral part of their lifestyle and cultural identity. Moreover, Europe’s strong luxury retail infrastructure, comprising iconic department stores, boutique shops, and luxury shopping districts, provides affluent consumers with access to a wide range of luxury crystal ware brands and collections.

The luxury crystal ware market in North America is characterized by its dynamic and diverse consumer base, comprising affluent individuals, celebrities, and luxury enthusiasts from various cultural backgrounds. While North America may not have the same historical legacy in glassmaking as Europe, it boasts a thriving luxury market fueled by innovation, entrepreneurship, and aspirational consumerism. Major cities such as New York, Los Angeles, and Chicago serve as hubs for luxury retailing, attracting affluent shoppers seeking the latest trends and exclusive designer collections. In recent years, North America has witnessed a surge in demand for luxury crystal ware driven by factors such as the growing interest in home entertaining, the rise of online shopping, and the increasing influence of social media and celebrity endorsements.

Target Audience for Luxury Crystal Ware Market

- Luxury Crystal Ware Enthusiasts

- High-End Interior Designers

- Luxury Homeowners

- Upscale Restaurants and Hotels

- Collectors of Fine Tableware

- Event Planners for Exclusive Events

- Luxury Gift Buyers

- Affluent Consumers with Discerning Taste

- Luxury Retailers and Boutiques

- Interior Decorators for Luxury Properties

Segments Covered in the Luxury Crystal Ware Market Report

Luxury Crystal Ware Market by Product Type

- Bar & Drinkware

- Tableware

- Decoration

- Lighting

- Jewelry & Accessories

Luxury Crystal Ware Market by Application

- Personal and Home

- Commercial

Luxury Crystal Ware Market by Distribution Channel

- Department Stores

- Specialty Boutiques

- Online Retailers

- Direct Sales Channels

Luxury Crystal Ware Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Luxury Crystal Ware market over the next 7 years?

- Who are the major players in the Luxury Crystal Ware market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the Luxury Crystal Ware market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Luxury Crystal Ware market?

- What is the current and forecasted size and growth rate of the global Luxury Crystal Ware market?

- What are the key drivers of growth in the Luxury Crystal Ware market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Luxury Crystal Ware market?

- What are the technological advancements and innovations in the Luxury Crystal Ware market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the luxury crystal ware market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Luxury Crystal Ware market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- LUXURY CRYSTAL WARE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON LUXURY CRYSTAL WARE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- LUXURY CRYSTAL WARE MARKET OUTLOOK

- GLOBAL LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- BAR & DRINKWARE

- TABLEWARE

- DECORATION

- LIGHTING

- JEWELRY & ACCESSORIES

- GLOBAL LUXURY CRYSTAL WARE MARKET BY APPLICATION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- PERSONAL AND HOME

- COMMERCIAL

- GLOBAL LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- DEPARTMENT STORES

- SPECIALTY BOUTIQUES

- ONLINE RETAILERS

- DIRECT SALES CHANNELS

- GLOBAL LUXURY CRYSTAL WARE MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- LALIQUE

- BACCARAT

- WATERFORD

- ORREFORS

- SWAROVSKI

- SAINT-LOUIS

- TIFFANY & CO.

- MOSER

- STEUBEN

- DAUM

- ROGASKA

- KOSTA BODA

- WILLIAM YEOWARD CRYSTAL

- LALIQUE

- ROYAL DOULTON

- EDINBURGH CRYSTAL

- NACHTMANN

- VAL SAINT LAMBERT

- RIEDEL

- ATLANTIS CRYSTAL *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 4 GLOBAL LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 6 GLOBAL LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 7 GLOBAL LUXURY CRYSTAL WARE MARKET BY REGION (USD BILLION) 2020-2030

TABLE 8 GLOBAL LUXURY CRYSTAL WARE MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA LUXURY CRYSTAL WARE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA LUXURY CRYSTAL WARE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 13 NORTH AMERICA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 15 NORTH AMERICA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 17 US LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 18 US LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 US LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 20 US LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 21 US LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 22 US LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 23 CANADA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 24 CANADA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 25 CANADA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 26 CANADA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 27 CANADA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 28 CANADA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 29 MEXICO LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 30 MEXICO LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 31 MEXICO LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 32 MEXICO LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 33 MEXICO LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 34 MEXICO LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 35 SOUTH AMERICA LUXURY CRYSTAL WARE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 36 SOUTH AMERICA LUXURY CRYSTAL WARE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 37 SOUTH AMERICA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 38 SOUTH AMERICA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 39 SOUTH AMERICA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 40 SOUTH AMERICA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 41 SOUTH AMERICA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 42 SOUTH AMERICA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 43 BRAZIL LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 44 BRAZIL LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 BRAZIL LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 46 BRAZIL LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 47 BRAZIL LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 48 BRAZIL LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 49 ARGENTINA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 50 ARGENTINA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ARGENTINA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 52 ARGENTINA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 53 ARGENTINA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 54 ARGENTINA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 55 COLOMBIA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 56 COLOMBIA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 57 COLOMBIA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 58 COLOMBIA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 59 COLOMBIA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 60 COLOMBIA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 61 REST OF SOUTH AMERICA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 REST OF SOUTH AMERICA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 65 REST OF SOUTH AMERICA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 66 REST OF SOUTH AMERICA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 67 ASIA-PACIFIC LUXURY CRYSTAL WARE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 68 ASIA-PACIFIC LUXURY CRYSTAL WARE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 69 ASIA-PACIFIC LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 70 ASIA-PACIFIC LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 ASIA-PACIFIC LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 72 ASIA-PACIFIC LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 73 ASIA-PACIFIC LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 74 ASIA-PACIFIC LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 75 INDIA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 76 INDIA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 77 INDIA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 78 INDIA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 79 INDIA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 80 INDIA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 81 CHINA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 82 CHINA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 83 CHINA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 84 CHINA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 85 CHINA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 86 CHINA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 87 JAPAN LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 88 JAPAN LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 JAPAN LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 90 JAPAN LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 91 JAPAN LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 92 JAPAN LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 93 SOUTH KOREA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 94 SOUTH KOREA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 95 SOUTH KOREA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 96 SOUTH KOREA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 97 SOUTH KOREA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 98 SOUTH KOREA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 99 AUSTRALIA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 100 AUSTRALIA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 AUSTRALIA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 102 AUSTRALIA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 103 AUSTRALIA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 104 AUSTRALIA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 105 SOUTH-EAST ASIA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 107 SOUTH-EAST ASIA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 108 SOUTH-EAST ASIA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 109 SOUTH-EAST ASIA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 110 SOUTH-EAST ASIA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF ASIA PACIFIC LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF ASIA PACIFIC LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 114 REST OF ASIA PACIFIC LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 115 REST OF ASIA PACIFIC LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 116 REST OF ASIA PACIFIC LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 117 EUROPE LUXURY CRYSTAL WARE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 118 EUROPE LUXURY CRYSTAL WARE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 119 EUROPE LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 120 EUROPE LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 121 EUROPE LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 122 EUROPE LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 123 EUROPE LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 124 EUROPE LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 125 GERMANY LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 126 GERMANY LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 GERMANY LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 128 GERMANY LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 129 GERMANY LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 130 GERMANY LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 131 UK LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 132 UK LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 133 UK LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 134 UK LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 135 UK LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 136 UK LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 137 FRANCE LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 138 FRANCE LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 139 FRANCE LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 140 FRANCE LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 141 FRANCE LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 142 FRANCE LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 143 ITALY LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 144 ITALY LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 145 ITALY LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 146 ITALY LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 147 ITALY LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 148 ITALY LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 149 SPAIN LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 150 SPAIN LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 151 SPAIN LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 152 SPAIN LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 153 SPAIN LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 154 SPAIN LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 155 RUSSIA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 156 RUSSIA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 157 RUSSIA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 158 RUSSIA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 159 RUSSIA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 160 RUSSIA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 161 REST OF EUROPE LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 162 REST OF EUROPE LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 163 REST OF EUROPE LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 164 REST OF EUROPE LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 165 REST OF EUROPE LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 166 REST OF EUROPE LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA LUXURY CRYSTAL WARE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA LUXURY CRYSTAL WARE MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 170 MIDDLE EAST AND AFRICA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 171 MIDDLE EAST AND AFRICA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 172 MIDDLE EAST AND AFRICA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 173 MIDDLE EAST AND AFRICA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 174 MIDDLE EAST AND AFRICA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 175 UAE LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 176 UAE LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 177 UAE LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 178 UAE LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 179 UAE LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 180 UAE LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 181 SAUDI ARABIA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 182 SAUDI ARABIA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 183 SAUDI ARABIA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 184 SAUDI ARABIA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 185 SAUDI ARABIA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 186 SAUDI ARABIA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 187 SOUTH AFRICA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 188 SOUTH AFRICA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 189 SOUTH AFRICA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 190 SOUTH AFRICA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 191 SOUTH AFRICA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 192 SOUTH AFRICA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 194 REST OF MIDDLE EAST AND AFRICA LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2030

TABLE 195 REST OF MIDDLE EAST AND AFRICA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 196 REST OF MIDDLE EAST AND AFRICA LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (THOUSAND UNITS) 2020-2030

TABLE 197 REST OF MIDDLE EAST AND AFRICA LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 198 REST OF MIDDLE EAST AND AFRICA LUXURY CRYSTAL WARE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2020-2030

FIGURE 10 GLOBAL LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

FIGURE 11 GLOBAL LUXURY CRYSTAL WARE MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL LUXURY CRYSTAL WARE MARKET BY PRODUCT TYPE (USD BILLION) 2022

FIGURE 14 GLOBAL LUXURY CRYSTAL WARE MARKET BY APPLICATION (USD BILLION) 2022

FIGURE 15 GLOBAL LUXURY CRYSTAL WARE MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2022

FIGURE 16 GLOBAL LUXURY CRYSTAL WARE MARKET BY REGION (USD BILLION) 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 LALIQUE: COMPANY SNAPSHOT

FIGURE 19 BACCARAT: COMPANY SNAPSHOT

FIGURE 20 WATERFORD: COMPANY SNAPSHOT

FIGURE 21 ORREFORS: COMPANY SNAPSHOT

FIGURE 22 SWAROVSKI: COMPANY SNAPSHOT

FIGURE 23 SAINT-LOUIS: COMPANY SNAPSHOT

FIGURE 24 TIFFANY & CO.: COMPANY SNAPSHOT

FIGURE 25 MOSER: COMPANY SNAPSHOT

FIGURE 26 STEUBEN: COMPANY SNAPSHOT

FIGURE 27 DAUM: COMPANY SNAPSHOT

FIGURE 28 ROGASKA: COMPANY SNAPSHOT

FIGURE 29 KOSTA BODA: COMPANY SNAPSHOT

FIGURE 30 WILLIAM YEOWARD CRYSTAL: COMPANY SNAPSHOT

FIGURE 31 LALIQUE: COMPANY SNAPSHOT

FIGURE 32 ROYAL DOULTON: COMPANY SNAPSHOT

FIGURE 33 EDINBURGH CRYSTAL: COMPANY SNAPSHOT

FIGURE 34 NACHTMANN: COMPANY SNAPSHOT

FIGURE 35 VAL SAINT LAMBERT: COMPANY SNAPSHOT

FIGURE 36 RIEDEL: COMPANY SNAPSHOT

FIGURE 37 ATLANTIS CRYSTAL: COMPANY SNAPSHOT

FAQ

The global luxury crystal ware market is anticipated to grow from USD 6.02 Billion in 2023 to USD 8.62 Billion by 2030, at a CAGR of 5.26 % during the forecast period.

Asia-Pacific accounted for the largest market in the luxury crystal ware market. Asia-Pacific accounted for 40 % market share of the global market value.

Lalique, Baccarat, Waterford, Orrefors, Swarovski, Saint-Louis, Tiffany & Co., Moser, Steuben, Daum, Rogaska, Kosta Boda, William Yeoward Crystal, Lalique, Royal Doulton, Edinburgh Crystal, Nachtmann, Val Saint Lambert, Riedel, Atlantis Crystal.

Luxury crystal ware brands are increasingly offering customization options, allowing consumers to personalize their purchases with engraved designs, monograms, or bespoke patterns, catering to individual tastes and preferences.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.