REPORT OUTLOOK

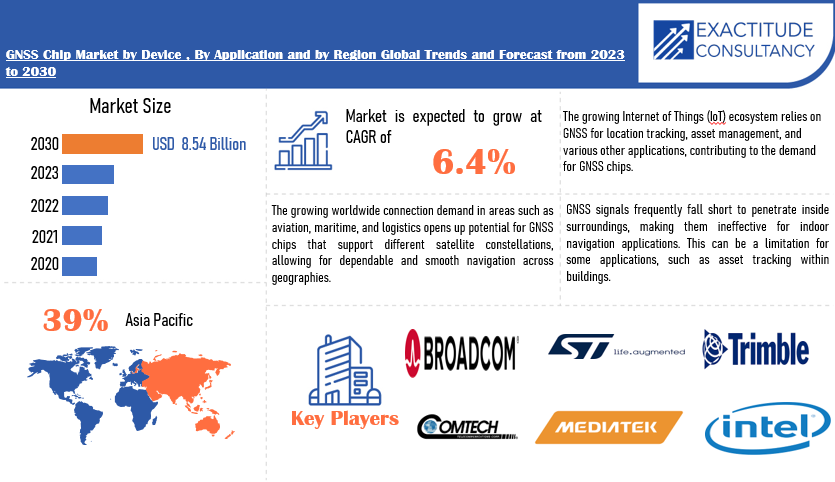

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 8.54 billion | 6.4% | Asia Pacific |

| by Device | by Application |

|---|---|

|

|

SCOPE OF THE REPORT

GNSS Chip Market Overview

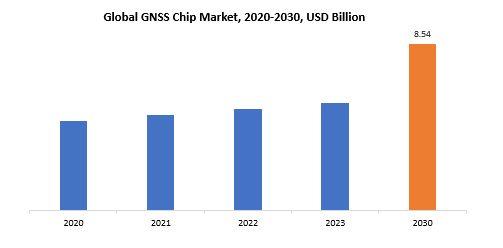

The global GNSS chip market size is projected to grow from USD 5.53 billion in 2023 to USD 8.54 billion by 2030, exhibiting a CAGR of 6.4% during the forecast period.

The GNSS (global navigation satellite system) chip market is the industry that develops, manufactures, and distributes semiconductor chips for global navigation satellite systems. GNSS chips play an important role in allowing accurate location and navigation services by receiving signals from satellite constellations such as GPS (Global Positioning System), GLONASS (Global Navigation Satellite System), Galileo, and BeiDou. These chips are essential components of many products, including smartphones, vehicle navigation systems, wearables, and other location-based applications. The market includes a variety of technologies designed to improve the positioning accuracy, power efficiency, and overall performance of GNSS-enabled devices. With rising demand for location-based services in sectors like as transportation, agriculture, and logistics, the GNSS chip market is expected to expand as it continues to evolve and satisfy the changing needs of various applications.

The GNSS (worldwide Navigation Satellite System) chip market is critical in the present technological scene because it plays a critical role in allowing accurate and dependable worldwide positioning. GNSS chips are crucial components in a variety of devices, including smartphones, navigation systems, and IoT (Internet of Things) devices, since they provide precise location information required for navigation, tracking, and location-based applications. GNSS technology increases efficiency, safety, and operational precision in areas such as transportation, agriculture, and logistics. Furthermore, emergency services, disaster response, and military applications all rely significantly on GNSS for precise location. The GNSS Chip Market’s ongoing innovation and development contribute to the evolution of new technologies such as self-driving cars and smart cities, underscoring its important role in determining the future of networked, location-aware systems. As our dependence on location-based services rises, the GNSS Chip Market plays an important role in fostering improvements that benefit many industries and enhance overall connectivity and functioning.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Device, Application and Region |

|

By Device |

|

|

By Application |

|

|

By Region

|

|

GNSS Chip Market Segmentation Analysis

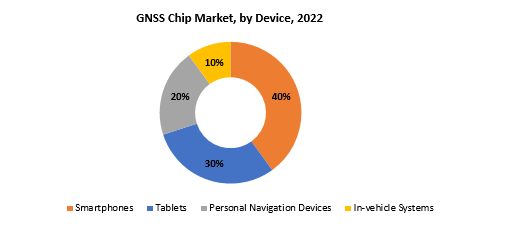

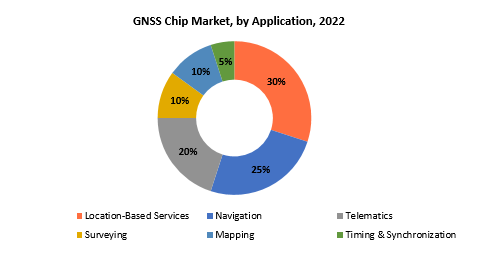

The global GNSS chip market is bifurcated three segments, by device, application and region. By device type, the market is bifurcated into smartphones, tablets, personal navigation devices, in-vehicle systems. By application, the market is bifurcated location-based services, navigation, telematics, surveying, mapping, timing & synchronization and region.

The GNSS (global navigation satellite system) chip market is divided into device types, which include smartphones, tablets, personal navigation devices, and in-vehicle systems. In smartphones, GNSS chips are critical for providing precise location services, powering navigation apps, location-based services, and geotagging capabilities. Tablets use GNSS technology for similar purposes, increasing their usefulness in navigation, travel, and location-aware apps. Personal navigation systems, which are designed specifically for navigation purposes, rely largely on GNSS chips to give users with exact position information. GNSS chips are used in car systems such as automobile navigation systems to provide precise mapping, real-time traffic updates, and enhanced driver aid functions. Each component highlights the numerous uses of GNSS technology, demonstrating its adaptability to suit the location-based demands of various devices. As the need for location-aware services increases across different device categories, the GNSS Chip Market continues to play an important role in fostering innovation and efficiency in navigation and positioning capabilities for a wide variety of consumer and industrial applications.

The GNSS (global navigation satellite system) chip market is divided into several application sectors, including location-based services, navigation, telematics, surveying, mapping, and timing and synchronization. Location-based services benefit from GNSS chips because they provide users with real-time, precise positioning data for applications like location tracking, geofencing, and proximity-based alerts. In navigation, GNSS technology is critical for supplying accurate and dependable position data for route planning and guiding, with applications in automobile, aircraft, and marine navigation systems. Telematics systems, which are typically found in cars, use GNSS chips to track and monitor fleet movements, therefore boosting efficiency and safety. Surveying and mapping applications depend significantly on GNSS technology for high-precision location, allowing experts in sectors such as construction, agriculture, and environmental monitoring to perform precise surveys and generate comprehensive maps. Timing and synchronization applications rely on GNSS chips to maintain perfect timekeeping, which is crucial in industries such as telecommunications, finance, and power distribution. The various uses of GNSS technology across these areas demonstrate its adaptability and importance in supplying precise position information to a wide variety of businesses. As technology advances, the GNSS chip market plays an important role in expanding these applications, contributing to improved functionality, efficiency, and innovation across a variety of industries.

GNSS Chip Market Dynamics

Driver

The increasing adoption of location-based services across various industries such as automotive, agriculture, logistics, and IoT drives the demand for GNSS chips.

The increased demand for Location-Based Services (LBS) has accelerated the deployment of Global Navigation Satellite System (GNSS) chips across a wide range of sectors. LBS use GNSS technology to give real-time and exact position information, with a wide range of applications in industries such as automotive, agriculture, logistics, and the Internet of Things. In the automobile sector, GNSS chips allow navigation systems, improve vehicle tracking, and assist upcoming technologies like self-driving cars. In agriculture, GNSS is used for precision farming, allowing farmers to maximize crop management using exact position data. Logistics organizations use GNSS for efficient fleet management, route optimization, and real-time cargo tracking. Furthermore, the usage of GNSS in IoT devices enables location-aware services, which improves user experience and functionality. As the need for LBS continues to expand across various industries, the requirement for dependable and high-performance GNSS chips will grow, driving innovation and breakthroughs in location-based technology.

Restraint

GNSS chips may have relatively high power consumption, which can be a constraint in applications where power efficiency is crucial, such as in portable and battery-powered devices.

The issue of excessive power consumption in certain GNSS processors is a significant limitation, especially in applications where power efficiency is critical, such as portable and battery-powered devices. GNSS technology relies on constant receiving of signals from satellite constellations to establish accurate position and navigation accuracy. However, certain GNSS chips may require a large amount of power to function continuously. High power consumption in portable and battery-powered devices can shorten battery life and, as a result, diminish device usefulness. This constraint is especially important in applications like as smartphones, wearables, and IoT devices, where long-lasting battery life is required for flawless user experiences. Efforts to overcome this difficulty include developing low-power GNSS chips and optimizing power management algorithms. Manufacturers are attempting to create processors that strike a compromise between performance and energy economy, allowing for longer battery life while maintaining the precision and dependability of location-based services. Furthermore, advances in semiconductor technology lead to the development of more power-efficient GNSS applications.

Opportunities

The increasing development and deployment of autonomous vehicles present a significant opportunity for GNSS chip manufacturers.

The growing demand for self-driving cars creates a substantial and attractive potential for GNSS chip producers. Autonomous cars, which function without human interference, rely significantly on modern technology for accurate navigation and decision-making. GNSS chips are critical in this scenario because they provide precise and dependable location data, which is required for autonomous cars to operate safely and efficiently. In the field of autonomous driving, GNSS technology is used to detect the vehicle’s actual location, navigate complicated road networks, and aid in real-time decision-making. GNSS-enabled sensors and receivers assist cars in perceiving their surroundings and developing a full picture of the environment, including the identification of lanes, obstructions, and other key navigational aspects. As the automotive sector moves toward wider deployment of self-driving cars, the need for high-performance GNSS chips is projected to rise. These chips must provide not only exact position information, but also be resistant to possible threats such as signal interference, urban canyons, and inclement weather. The potential for GNSS chipmakers is to provide solutions that match the strict criteria of the autonomous car ecosystem. Advancements in GNSS technology, including as multi-constellation and multi-frequency capabilities, are critical to improving accuracy and dependability in a variety of driving circumstances. Furthermore, integrating GNSS technology with other sensor systems, such as LiDAR and radar, helps to construct robust and complete autonomous driving solutions. Manufacturers in the GNSS chip industry have the potential to make substantial contributions to the development of safe and efficient autonomous vehicles. By addressing the special demands of self-driving cars, GNSS chipmakers may place themselves at the forefront of an expanding sector in which precise location remains a cornerstone for the future of mobility.

GNSS Chip Market Trends

-

GNSS receivers have increasingly been constructed to work with signals from many satellite constellations, such as GPS, GLONASS, Galileo, and BeiDou. This multi-constellation support seeks to increase accuracy, dependability, and coverage, particularly in demanding circumstances.

-

Dual-frequency GNSS chips were becoming popular. These devices can receive signals at both L1 and L5 frequencies, providing improved accuracy, especially in urban canyons and locations with strong interference. This development was crucial for applications that required great accuracy, such as self-driving vehicles and precision agriculture.

-

GNSS technology was increasingly being integrated into a variety of Internet of Things (IoT) devices. This includes applications like as asset tracking, smart cities, wearables, and other connected devices, which helped to grow the GNSS Chip Market.

-

Power consumption has remained an important factor in the development of GNSS processors, particularly for battery-powered devices such as smartphones and wearables. Efforts were made to improve power efficiency while keeping positioning precision.

-

As autonomous driving technology advanced, GNSS chips became increasingly important in supplying accurate location information for navigation and precise positioning. The GNSS technology in this context has to fulfill the car industry’s demanding criteria.

- Augmentation systems and assisted GNSS technologies were being progressively used to improve GNSS performance in difficult settings. This includes the inclusion of new data sources or signals to improve accuracy and dependability.

- There was a tendency toward downsizing and integration of GNSS chips, which made them smaller and more power-efficient. This was especially relevant for wearable devices and other applications where size and power were limited.

Competitive Landscape

The competitive landscape of the GNSS chip market was dynamic, with several prominent companies competing to provide innovative and advanced GNSS chip.

- Broadcom Limited

- ComNav Technology Ltd.

- Comtech Telecommunications Corp.

- Furuno Electric Co., Ltd.

- Harxon Corporation

- Hemisphere GNSS Inc.

- Intel Corporation

- Mediatek Inc.

- NavIC Semiconductor Pvt Ltd

- Navika Electronics

- OriginGPS Ltd.

- Qualcomm Incorporated

- Quectel Wireless Solutions Co., Ltd.

- Rohde & Schwarz GmbH & Co KG

- Septentrio N.V.

- Skyworks Solutions

- Sony Semiconductor Solutions Corporation

- STMicroelectronics N.V.

- Topcon Positioning Systems

- Trimble Inc.

- U-Blox Holding AG

Recent Developments:

November 30, 2023- Tech conglomerate Broadcom (AVGO.O), opens new tab added artificial intelligence features to a new version of one of its flagship networking chips, the company said on Thursday, aiming to help move information around data centres more efficiently.

September 7, 2023 – Foxconn Technology Group is teaming up with STMicroelectronics NV for a bid to build a semiconductor factory in India, seeking state backing to broaden its footprint in the South Asian country.

Regional Analysis

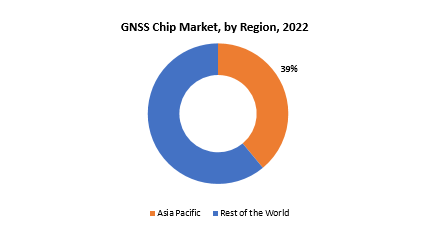

The Asia Pacific region now dominates the GNSS chip industry and is projected to continue its dominance for the foreseeable future. These sectors are large users of GNSS chips, and Asia Pacific is a key production base for both. China, India, and Japan are all seeing considerable expansion in these industries, resulting in increased demand for GNSS chips. Many governments in the region are significantly investing in GNSS technology, opening up new potential for chip makers. For example, the Chinese government is creating its own BeiDou satellite navigation system, which is projected to drive up demand for BeiDou-compatible GNSS chips. As disposable incomes rise in the region, more people are able to afford devices that use GNSS chips, such as smartphones, wearables, and connected cars.

Europe is another major region, with the European Union’s Galileo satellite navigation system playing a role in the GNSS business. European enterprises have been instrumental in the development of GNSS technology and applications, increasing the region’s market importance.

Target Audience for GNSS Chip Market

- Consumer Electronics Manufacturers

- Automotive Industry

- IoT (Internet of Things) Device Manufacturers

- Agriculture and Precision Farming

- Surveying and Mapping Professionals

- Telecommunications and Timing Industries

- Defense and Aerospace

- Emergency Services and Public Safety

- Navigation and Location-Based Service Providers

- Technology and Semiconductor Manufacturers

- Research and Development Entities

Segments Covered in the GNSS Chip Market Report

GNSS Chip Market by Device

- Smartphones

- Tablets

- Personal Navigation Devices

- In-Vehicle Systems

GNSS Chip Market by Application

- Location-Based Services

- Navigation

- Telematics

- Surveying, Mapping

- Timing & Synchronization

GNSS Chip Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the GNSS Chip Market over the next 7 years?

- Who are the key market participants GNSS Chip, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the GNSS Chip Market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the GNSS Chip Market?

- What is the current and forecasted size and growth rate of the global GNSS Chip Market?

- What are the key drivers of growth in the GNSS Chip Market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the GNSS Chip Market?

- What are the technological advancements and innovations in the GNSS Chip Market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the GNSS Chip Market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the GNSS Chip Market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GNSS CHIP MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON GNSS CHIP MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GNSS CHIP MARKET OUTLOOK

- GLOBAL GNSS CHIP MARKET BY DEVICE, 2020-2030, (USD BILLION)

- SMARTPHONES

- TABLETS

- PERSONAL NAVIGATION DEVICES

- IN-VEHICLE SYSTEMS

- GLOBAL GNSS CHIP MARKET BY APPLICATION, 2020-2030, (USD BILLION)

- LOCATION-BASED SERVICES

- NAVIGATION

- TELEMATICS

- SURVEYING

- MAPPING

- TIMING & SYNCHRONIZATION

- GLOBAL GNSS CHIP MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BROADCOM LIMITED

- COMNAV TECHNOLOGY LTD.

- COMTECH TELECOMMUNICATIONS CORP.

- FURUNO ELECTRIC CO., LTD.

- HARXON CORPORATION

- HEMISPHERE GNSS INC.

- INTEL CORPORATION (US)

- MEDIATEK INC.

- NAVIC SEMICONDUCTOR PVT LTD

- NAVIKA ELECTRONICS

- ORIGINGPS LTD.

- QUALCOMM INCORPORATED

- QUECTEL WIRELESS SOLUTIONS CO., LTD.

- ROHDE & SCHWARZ GMBH & CO KG

- SEPTENTRIO N.V.

- SKYWORKS SOLUTIONS

- SONY SEMICONDUCTOR SOLUTIONS CORPORATION

- STMICROELECTRONICS N.V.

- TOPCON POSITIONING SYSTEMS

- TRIMBLE INC.

- U-BLOX HOLDING AG *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 2 GLOBAL GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 3 GLOBAL GNSS CHIP MARKET BY REGION (USD BILLION) 2020-2030

TABLE 4 NORTH AMERICA GNSS CHIP MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 7 US GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 8 US GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 9 CANADA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 10 CANADA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 11 MEXICO GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 12 MEXICO GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 13 SOUTH AMERICA GNSS CHIP MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 14 SOUTH AMERICA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 15 SOUTH AMERICA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 16 BRAZIL GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 17 BRAZIL GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 18 ARGENTINA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 19 ARGENTINA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 COLOMBIA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 21 COLOMBIA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 22 REST OF SOUTH AMERICA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 23 REST OF SOUTH AMERICA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 24 ASIA-PACIFIC GNSS CHIP MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 25 ASIA-PACIFIC GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 26 ASIA-PACIFIC GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 27 INDIA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 28 INDIA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 29 CHINA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 30 CHINA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 31 JAPAN GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 32 JAPAN GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 33 SOUTH KOREA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 34 SOUTH KOREA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 35 AUSTRALIA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 36 AUSTRALIA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 37 SOUTH-EAST ASIA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 38 SOUTH-EAST ASIA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 39 REST OF ASIA PACIFIC GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 40 REST OF ASIA PACIFIC GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 41 EUROPE GNSS CHIP MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 42 EUROPE GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 43 EUROPE GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 44 GERMANY GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 45 GERMANY GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 UK GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 47 UK GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 48 FRANCE GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 49 FRANCE GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 50 ITALY GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 51 ITALY GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 SPAIN GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 53 SPAIN GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 54 RUSSIA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 55 RUSSIA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 56 REST OF EUROPE GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 57 REST OF EUROPE GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 58 MIDDLE EAST AND AFRICA GNSS CHIP MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 59 MIDDLE EAST AND AFRICA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 60 MIDDLE EAST AND AFRICA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 61 UAE GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 62 UAE GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 63 SAUDI ARABIA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 64 SAUDI ARABIA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 65 SOUTH AFRICA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 66 SOUTH AFRICA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 67 REST OF MIDDLE EAST AND AFRICA GNSS CHIP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 68 REST OF MIDDLE EAST AND AFRICA GNSS CHIP MARKET BY APPLICATION (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL GNSS CHIP MARKET BY DEVICE, USD BILLION, 2022-2030

FIGURE 9 GLOBAL GNSS CHIP MARKET BY APPLICATION, USD BILLION, 2022-2030

FIGURE 10 GLOBAL GNSS CHIP MARKET BY REGION, USD BILLION, 2022-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL GNSS CHIP MARKET BY DEVICE, USD BILLION,2022

FIGURE 13 GLOBAL GNSS CHIP MARKET BY APPLICATION, USD BILLION,2022

FIGURE 14 GLOBAL GNSS CHIP MARKET BY REGION, USD BILLION,2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 BROADCOM LIMITED: COMPANY SNAPSHOT

FIGURE 17 COMNAV TECHNOLOGY LTD.: COMPANY SNAPSHOT

FIGURE 18 COMTECH TELECOMMUNICATIONS CORP.: COMPANY SNAPSHOT

FIGURE 19 FURUNO ELECTRIC CO., LTD.: COMPANY SNAPSHOT

FIGURE 20 HARXON CORPORATION: COMPANY SNAPSHOT

FIGURE 21 HEMISPHERE GNSS INC.: COMPANY SNAPSHOT

FIGURE 22 INTEL CORPORATION (US): COMPANY SNAPSHOT

FIGURE 23 MEDIATEK INC.: COMPANY SNAPSHOT

FIGURE 24 NAVIC SEMICONDUCTOR PVT LTD: COMPANY SNAPSHOT

FIGURE 25 NAVIKA ELECTRONICS: COMPANY SNAPSHOT

FIGURE 26 ORIGINGPS LTD.: COMPANY SNAPSHOT

FIGURE 27 QUALCOMM INCORPORATED: COMPANY SNAPSHOT

FIGURE 28 QUECTEL WIRELESS SOLUTIONS CO., LTD.: COMPANY SNAPSHOT

FIGURE 29 ROHDE & SCHWARZ GMBH & CO KG: COMPANY SNAPSHOT

FIGURE 30 SEPTENTRIO N.V.: COMPANY SNAPSHOT

FIGURE 31 SKYWORKS SOLUTIONS: COMPANY SNAPSHOT

FIGURE 32 SONY SEMICONDUCTOR SOLUTIONS CORPORATION: COMPANY SNAPSHOT

FIGURE 33 STMICROELECTRONICS N.V.: COMPANY SNAPSHOT

FIGURE 34 TOPCON POSITIONING SYSTEMS: COMPANY SNAPSHOT

FIGURE 35 TRIMBLE INC.: COMPANY SNAPSHOT

FIGURE 36 U-BLOX HOLDING AG: COMPANY SNAPSHOT

FAQ

The global GNSS chip market size is projected to grow from USD 5.53 billion in 2023 to USD 8.54 billion by 2030, exhibiting a CAGR of 6.4% during the forecast period.

Asia Pacific accounted for the largest market in the GNSS chip market.

Broadcom Limited, ComNav Technology Ltd., Comtech Telecommunications Corp.,Furuno Electric Co., Ltd., Harxon Corporation, Hemisphere GNSS Inc., Intel Corporation.

As GNSS technology became more integrated into critical infrastructure and applications, there was an increased emphasis on maintaining signal security and resilience. Measures were being considered to reduce any vulnerabilities and threats.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.