REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 3.37 Billion by 2030 | 6 % | North America |

| by Application | by End User Industry |

|---|---|

|

|

SCOPE OF THE REPORT

Nitrile Rubber (NBR) Market Overview

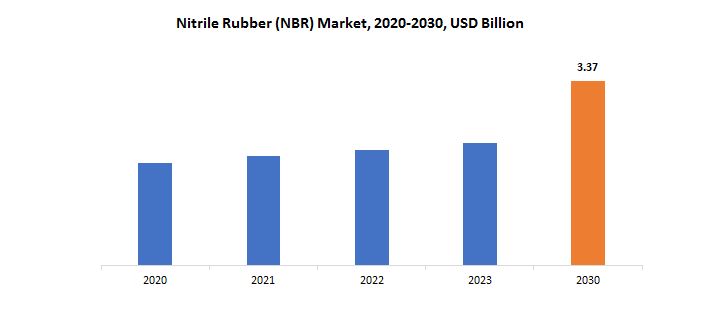

The global Nitrile Rubber (NBR) market is anticipated to grow from USD 2.24 Billion in 2023 to USD 3.37 Billion by 2030, at a CAGR of 6 % during the forecast period.

The global industry centred on the production, distribution, and use of nitrile rubber, also referred to as acrylonitrile-butadiene rubber, is referred to as the Nitrile Rubber (NBR) market. Acrylonitrile and butadiene combine to form NBR, a synthetic rubber copolymer renowned for its exceptional resistance to fuel, oil, and other chemicals in addition to its flexibility and durability. This market is important for a number of industries, including the automotive, industrial, oil and gas, and medical sectors. NBR is used in these industries to make a wide range of products, including hoses, gloves, gaskets, seals, and O-rings.

Nitrile rubber is in high demand because of its special qualities, which make it the material of choice for applications requiring resistance to chemicals and harsh environments. In particular, the automotive industry uses a lot of NBR in the production of parts that can withstand contact with automotive fluids. The demand for NBR in the manufacturing of protective equipment, such as gloves and seals, in the industrial and medical sectors has also increased due to the growing emphasis on safety and hygiene. Regulations, the state of the economy as a whole, and technological developments are some of the variables that impact market dynamics. The Nitrile Rubber market is characterized by intense competition due to strict quality and environmental regulations, as well as innovations in NBR formulations and manufacturing processes.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Application, End User Industry and Region |

| By Application |

|

| By End User Industry |

|

|

By Region

|

|

Nitrile Rubber (NBR) Market Segmentation Analysis

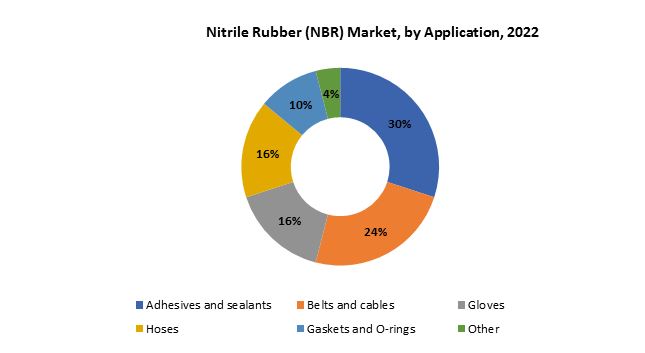

The Nitrile Rubber (NBR) market is divided into three segments, by application, end user industry and region. By application it is divided as Adhesives and sealants, Belts and cables, Gloves, Hoses, Gaskets and O-rings, Others. Adhesives and sealants holds largest market share. The market for nitrile rubber (NBR) demonstrates adaptability with its range of uses, each meeting distinct industrial requirements. NBR’s adhesive qualities and chemical resistance make it the perfect choice for bonding materials in a variety of industries, and adhesives and sealants constitute a sizeable portion of the market. Applications in manufacturing, automotive, and construction are included in this. Cables and belts make up yet another crucial NBR application area. Rubber is a favoured material for conveyor belt and cable manufacturing due to its strength, flexibility, and resistance to chemicals and oil, which enhances the dependability and efficiency of industrial processes. The NBR market’s gloves segment has experienced significant expansion, particularly in the industrial and medical sectors.

Another important application that benefits from NBR’s resistance to oil and fuel and resilience to abrasion is hoses. Because of this, NBR hoses can be used in industrial, oil and gas, and automotive applications, guaranteeing the efficient and safe transfer of fluids. O-rings and gaskets are essential components of sealing applications in many different industries. NBR is a preferred material for gaskets and O-rings because of its superior sealing qualities and resistance to chemicals and oils. This ensures tight and dependable seals in a variety of environments. Applications that NBR finds useful but may not be as clearly classified are included in the “Others” category. This could include a range of specialized uses in several industries that make use of NBR’s special qualities, demonstrating how versatile this synthetic rubber is in meeting a variety of needs.

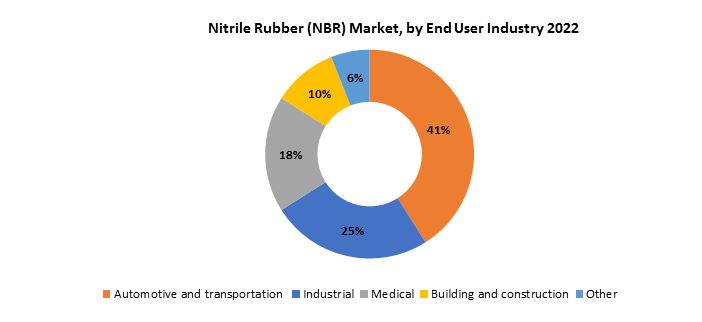

By End User it is divided into Automotive and transportation, Industrial, Medical, Building and construction, Others. In this Automotive and transportation holds the largest market share. One of the main end markets for NBR is the automotive and transportation industries. Because of its characteristics, including its resistance to fuel and oil, NBR is an essential material used in the production of many automotive parts. NBR is utilized in the manufacturing of gaskets, hoses, O-rings, seals, and other parts that improve the performance and longevity of automobiles. An additional important end-user of NBR is the industrial sector. It is the perfect material for a variety of industrial applications because of its flexibility, resistance to chemicals, and abrasion resistance. Gaskets, hoses, belts, and other parts that are essential to industrial processes and machinery are made of NBR.

NBR is widely used in the medical industry, especially when making gloves. NBR gloves’ chemical resistance qualifies them for use in medical settings where contamination protection is essential, enhancing patient and healthcare worker safety. In order to ensure the longevity and functionality of structures, the building and construction sector also uses NBR for applications like gaskets, seals, and other components that need to be resistant to environmental conditions. Additional end-user segments where NBR is relevant but may not be as clearly categorized are included in the “Others” category. This could include specialized uses in a range of sectors that profit from NBR’s special qualities.

Nitrile Rubber (NBR) Market Dynamics

Driver

NBR’s resistance to oil and fuel makes it a preferred material in the oil and gas industry for seals, gaskets, and hoses.

Because of its exceptional resistance to oils and fuels, NBR is frequently used in the oil and gas industry to manufacture seals. When petroleum-based materials are present, seals are essential for stopping leaks and preserving the integrity of systems and equipment. NBR gaskets are used in the oil and gas industry for a number of purposes. These gaskets offer a dependable and long-lasting seal between two surfaces, assisting in the prevention of leaks and guaranteeing the appropriate operation of valves, pipelines, and other machinery. The oil and gas industry uses NBR in the manufacturing of hoses and tubing for the transportation of fuel and oil. The material can be used to transfer petroleum-based fluids without deteriorating because of its resistance to oils.

The production of expansion joints for use in pipelines and other systems in the infrastructure supporting the oil and gas industry uses NBR. The transportation and processing of hydrocarbons are linked with harsh and caustic conditions that these joints must endure. NBR is a recommended option for sealing and gasketing applications in the oil and gas industry due to its cost-effectiveness and consistent performance in the presence of oils and fuels.

Restraint

Stringent environmental regulations or increased demand for eco-friendly alternatives might pose challenges for the NBR market.

Petrochemicals are used in the production of NBR, which could lead to emissions and other environmental pollutants. Stricter laws designed to lower pollution and industrial emissions might make it more expensive for NBR producers to comply. Because rubber materials don’t biodegrade, there may be issues with how to dispose of them, including NBR. Proper waste management techniques may be mandated by environmental regulations, which could result in higher costs for manufacturers and end users. The need for materials with less of an impact on the environment is rising as environmental consciousness grows. Alternatives that are bio-based or made of renewable resources might become more well-liked as businesses and consumers look for more environmentally friendly solutions. Recyclability of materials is becoming more and more crucial.

Selecting materials and products with less of an impact on the environment is the goal of some industries and government agencies that implement green procurement policies. If NBR manufacturers’ products don’t comply with these policies, they might encounter difficulties. Products that are better for the environment are becoming more and more popular. The market may give businesses that promote environmentally friendly materials a competitive advantage, which could influence consumer goods demand for NBR. Sustainable and environmentally friendly alternatives are being developed as a result of advancements in material science. These materials might gain market share if they can perform on par with or better than NBR.

Opportunities

NBR’s resistance to oil and fuel makes it an ideal material for use in oil and gas exploration equipment, seals, and gaskets.

Equipment used in oil and gas exploration uses a lot of seals and gaskets made of NBR. These parts support the preservation of a tight seal in crucial locations, stopping leaks and guaranteeing the effective operation of machinery. Drilling equipment like blowout preventers, valves, and pumps use NBR gaskets and seals. Its ability to withstand oil and fuel is essential in these high-temperature, high-pressure settings. NBR is used as seals and parts in downhole tools and equipment that are used in logging, drilling, and other downhole operations. The durability and dependability of these instruments depend heavily on its resistance to oil. Hoses and tubing for oilfield applications are made using NBR.

NBR gaskets and seals are frequently used in wellheads, which are essential parts of oil and gas wells. These parts have to be resilient to the severe environment at the wellhead, which includes exposure to fuel and oil. Because of its superior oil resistance, NBR can be used to make packer elements, which are used to isolate and seal various wellbore sections. Preserving the integrity of the well and avoiding fluid migration between formations depend on this. Because NBR components are resistant to oil and fuel, they are frequently used in hydraulic systems, seals, and gaskets of vehicles used in oil and gas exploration, such as drilling rigs and exploration platforms.

Nitrile Rubber (NBR) Market Trends

-

Because of its superior resistance to oil and fuel, nitrile rubber is becoming more and more in demand in the automotive industry. NBR is frequently used to produce gaskets, hoses, and seals, which improves the longevity and performance of automobiles.

-

The abrasion resistance and extreme temperature tolerance of NBR make it ideal for a wide range of industrial applications, which has made the industrial sector a major driver of the market.

-

In the oil and gas sector, NBR is frequently used for seals and other parts that need to be resistant to hydrocarbons. There is a growing need for NBR in vital applications due to the energy sector’s ongoing developments, especially in shale gas exploration.

-

There have been attempts to innovate and improve products for the NBR market. Manufacturers are working on developing NBR variants with enhanced properties, such as improved heat resistance, flexibility, and chemical resistance, to meet the evolving needs of end-users across different industries.

-

The NBR market has experienced difficulties because of disruptions in global supply chains, just like many other industries. Shortages of raw materials, traffic jams, and geopolitical concerns have affected NBR production and distribution, changing the dynamics of the market.

-

Industries are searching for more sustainable materials as environmental issues are becoming more widely recognized. Even though NBR is a synthetic rubber, the NBR market may be becoming more interested in creating environmentally friendly substitutes or recycling programs in order to address environmental concerns.

Competitive Landscape

The competitive landscape of the Nitrile Rubber (NBR) market was dynamic, with several prominent companies competing to provide innovative and advanced Nitrile Rubber (NBR) solutions.

- Lanxess AG

- Zeon Corporation

- Kumho Petrochemical Co., Ltd.

- JSR Corporation

- Sibur

- PetroChina Company Limited

- LG Chem

- OMNOVA Solutions Inc.

- ARLANXEO

- Versalis S.p.A.

- Nantex Industry Co., Ltd.

- Synthos S.A.

- Nitriflex

- Taprath Polymers Pvt. Ltd.

- Emerald Performance Materials

- Apcotex Industries Limited

- Sinopec

- Goodyear Chemical

- TSRC Corporation

- Kumho Mitsui Chemicals, Inc.

Recent Developments:

February 07, 2023: LG Chem has secured a long-term cathode material supply contract with General Motors (GM), worth KRW 25 trillion. LG Chem aims to bolster cooperation with GM in the North American market by utilizing its cathode plant in Tennessee, U.S. as a production hub for the global battery material market. A long-term supply contract to commence from 2026 through 2035, LG Chem will supply GM more than 500,000 tons of cathode materials enough to power 5 million units of high-performance pure EVs with a range of 500km on a single charge.

October 14, 2022: China Petroleum & Chemical Corporation (HKG: 0386, “Sinopec”) has successfully produced China’s first batch of large tow carbon fiber at the company’s production base in Shanghai, making the company the first in the country and fourth in the world to possess large tow carbon fiber technology.

Regional Analysis

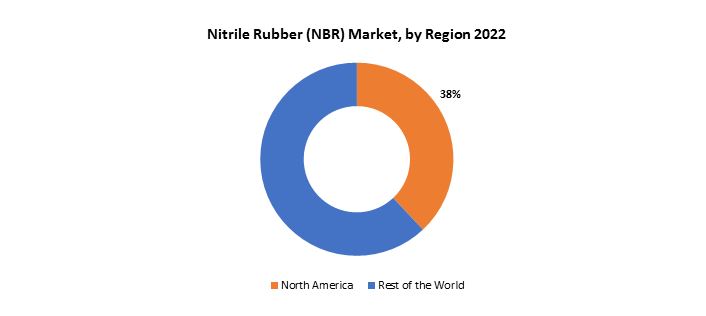

North America accounted for the largest market in the Nitrile Rubber (NBR) market. North America accounted for 38% of the worldwide market value. Due to a number of factors that support the rising demand for this adaptable synthetic rubber, the nitrile rubber (NBR) market in North America is expanding and developing significantly. NBR is a preferred material in industries like automotive, aerospace, and oil and gas because of its well-known superior oil and fuel resistance. The automotive industry in North America is a major driver of the non-resist rubber (NBR) market due to its widespread usage in the manufacturing of gaskets, hoses, seals, and other automotive components that improve the longevity and functionality of automobiles. Furthermore, the automotive industry has adopted NBR at a faster rate due to the strict regulations in North America regarding emissions and fuel efficiency.

The material’s ability to resist chemicals and oils meets industry standards for dependable parts that can survive challenging operating environments. As long as regulations and environmental concerns continue to influence the region’s automotive industry, this trend is probably here to stay. The North American industrial sector is yet another important factor propelling the NBR market. The material is perfect for use in machinery, equipment, and manufacturing processes because of its abrasion resistance and capacity to withstand high temperatures. The United States and Canada in particular have a strong industrial infrastructure, which supports the ongoing need for NBR in a range of manufacturing applications.

Target Audience for Nitrile Rubber (NBR) Market

- Automotive industry

- Aerospace industry

- Oil and gas sector

- Medical equipment manufacturers

- Construction industry

- Chemical processing industry

- Electronics manufacturing

- Industrial machinery manufacturers

- Pharmaceutical industry

- Food processing industry

- Marine industry

- Mining operations

Import & Export Data for Nitrile Rubber (NBR) Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Nitrile Rubber (NBR) market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

-

Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Nitrile Rubber (NBR) market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

-

Market players: gain insights into the leading players driving the Nitrile Rubber (NBR) trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

-

Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

-

Product breakdown: by segmenting data based on Nitrile Rubber (NBR) types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids government in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Nitrile Rubber (NBR) Market Report

Nitrile Rubber (NBR) Market by Application, 2020-2030, (USD Billion) (Thousand Units)

- Adhesives and sealants

- Belts and cables

- Gloves

- Hoses

- Gaskets and O-rings

- Other

Nitrile Rubber (NBR) Market by End User Industry, 2020-2030, (USD Billion) (Thousand Units)

- Automotive and transportation

- Industrial

- Medical

- Building and construction

- Other

Nitrile Rubber (NBR) Market by Region, 2020-2030, (USD Billion) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Nitrile Rubber (NBR) market over the next 7 years?

- Who are the major players in the Nitrile Rubber (NBR) market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the Nitrile Rubber (NBR) market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Nitrile Rubber (NBR) market?

- What is the current and forecasted size and growth rate of the global Nitrile Rubber (NBR) market?

- What are the key drivers of growth in the Nitrile Rubber (NBR) market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Nitrile Rubber (NBR) market?

- What are the technological advancements and innovations in the Nitrile Rubber (NBR) market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Nitrile Rubber (NBR) market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Nitrile Rubber (NBR) market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL NITRILE RUBBER (NBR) MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON NITRILE RUBBER (NBR) MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL NITRILE RUBBER (NBR) MARKET OUTLOOK

- GLOBAL NITRILE RUBBER (NBR) MARKET BY APPLICATION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- ADHESIVES AND SEALANTS

- BELTS AND CABLES

- GLOVES

- HOSES

- GASKETS AND O-RINGS

- OTHER

- GLOBAL NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- AUTOMOTIVE AND TRANSPORTATION

- INDUSTRIAL

- MEDICAL

- BUILDING AND CONSTRUCTION

- OTHER

- GLOBAL NITRILE RUBBER (NBR) MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

-

COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, APPLICATION OFFERED, RECENT DEVELOPMENTS)

- LANXESS AG

- ZEON CORPORATION

- KUMHO PETROCHEMICAL CO., LTD.

- JSR CORPORATION

- SIBUR

- PETROCHINA COMPANY LIMITED

- LG CHEM

- OMNOVA SOLUTIONS INC.

- ARLANXEO

- VERSALIS S.P.A.

- NANTEX INDUSTRY CO., LTD.

- SYNTHOS S.A.

- NITRIFLEX

- TAPRATH POLYMERS PVT. LTD.

- EMERALD PERFORMANCE MATERIALS

- APCOTEX INDUSTRIES LIMITED

- SINOPEC

- GOODYEAR CHEMICAL

- TSRC CORPORATION

- KUMHO MITSUI CHEMICALS, INC. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 2 GLOBAL NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 4 GLOBAL NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL NITRILE RUBBER (NBR) MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL NITRILE RUBBER (NBR) MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA NITRILE RUBBER (NBR) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA NITRILE RUBBER (NBR) MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 13 US NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 14 US NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 15 US NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 16 US NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 18 CANADA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 20 CANADA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 22 MEXICO NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 24 MEXICO NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA NITRILE RUBBER (NBR) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA NITRILE RUBBER (NBR) MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 32 BRAZIL NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 34 BRAZIL NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 36 ARGENTINA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 38 ARGENTINA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 40 COLOMBIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 42 COLOMBIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC NITRILE RUBBER (NBR) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC NITRILE RUBBER (NBR) MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 54 INDIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 56 INDIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 58 CHINA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 60 CHINA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 62 JAPAN NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 64 JAPAN NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE NITRILE RUBBER (NBR) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE NITRILE RUBBER (NBR) MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 84 EUROPE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 86 EUROPE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 88 GERMANY NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 90 GERMANY NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 91 UK NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 92 UK NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 93 UK NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 94 UK NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 96 FRANCE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 98 FRANCE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 100 ITALY NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 102 ITALY NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 104 SPAIN NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 106 SPAIN NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 108 RUSSIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 110 RUSSIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA NITRILE RUBBER (NBR) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA NITRILE RUBBER (NBR) MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 121 UAE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 122 UAE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 123 UAE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 124 UAE NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

FIGURE 9 GLOBAL NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

FIGURE 11 GLOBAL NITRILE RUBBER (NBR) MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2022

FIGURE 14 GLOBAL NITRILE RUBBER (NBR) MARKET BY END USER INDUSTRY (USD BILLION) 2022

FIGURE 16 GLOBAL NITRILE RUBBER (NBR) MARKET BY REGION (USD BILLION) 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 LANXESS AG: COMPANY SNAPSHOT

FIGURE 19 ZEON CORPORATION: COMPANY SNAPSHOT

FIGURE 20 KUMHO PETROCHEMICAL CO., LTD.: COMPANY SNAPSHOT

FIGURE 21 JSR CORPORATION: COMPANY SNAPSHOT

FIGURE 22 SIBUR: COMPANY SNAPSHOT

FIGURE 23 PETROCHINA COMPANY LIMITED: COMPANY SNAPSHOT

FIGURE 24 LG CHEM: COMPANY SNAPSHOT

FIGURE 25 OMNOVA SOLUTIONS INC.: COMPANY SNAPSHOT

FIGURE 26 ARLANXEO: COMPANY SNAPSHOT

FIGURE 27 VERSALIS S.P.A.: COMPANY SNAPSHOT

FIGURE 28 NANTEX INDUSTRY CO., LTD.: COMPANY SNAPSHOT

FIGURE 29 SYNTHOS S.A.: COMPANY SNAPSHOT

FIGURE 30 NITRIFLEX: COMPANY SNAPSHOT

FIGURE 31 TAPRATH POLYMERS PVT. LTD.: COMPANY SNAPSHOT

FIGURE 32 EMERALD PERFORMANCE MATERIALS: COMPANY SNAPSHOT

FIGURE 33 APCOTEX INDUSTRIES LIMITED: COMPANY SNAPSHOT

FIGURE 34 SINOPEC: COMPANY SNAPSHOT

FIGURE 35 GOODYEAR CHEMICAL: COMPANY SNAPSHOT

FIGURE 36 TSRC CORPORATION: COMPANY SNAPSHOT

FIGURE 37 KUMHO MITSUI CHEMICALS, INC.: COMPANY SNAPSHOT

FAQ

The global Nitrile Rubber (NBR) market is anticipated to grow from USD 2.24 Billion in 2023 to USD 3.37 Billion by 2030, at a CAGR of 6 % during the forecast period.

North America accounted for the largest market in the Nitrile Rubber (NBR) market. North America accounted for 38 % market share of the global market value.

Lanxess AG, Zeon Corporation, Kumho Petrochemical Co., Ltd., JSR Corporation, Sibur, PetroChina Company Limited, LG Chem, OMNOVA Solutions Inc., ARLANXEO, Versalis S.p.A., Nantex Industry

In the oil and gas sector, NBR is frequently used for seals and other parts that need to be resistant to hydrocarbons. There is a growing need for NBR in vital applications due to the energy sector’s ongoing developments, especially in shale gas exploration. There have been attempts to innovate and improve products for the NBR market. Manufacturers are working on developing NBR variants with enhanced properties, such as improved heat resistance, flexibility, and chemical resistance, to meet the evolving needs of end-users across different industries.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.