REPORT OUTLOOK

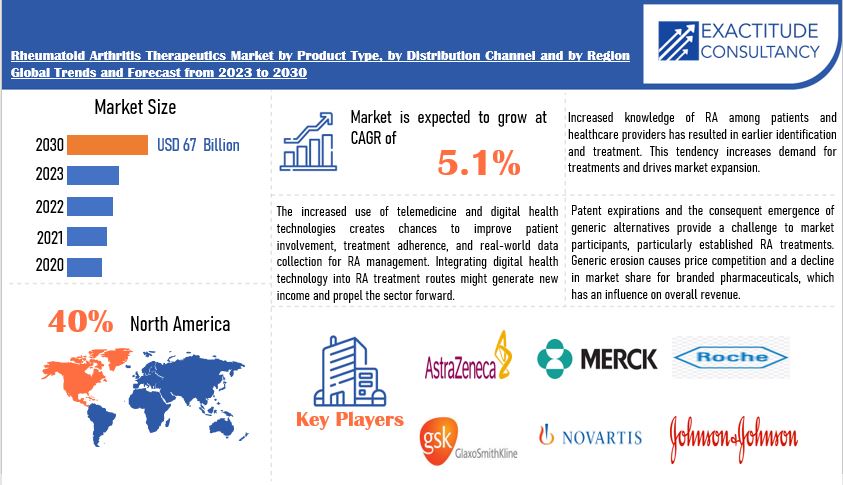

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 67 billion by 2030 | 5.1% | North America |

| by Product Type | by Distribution Channels |

|---|---|

|

|

SCOPE OF THE REPORT

Market Overview

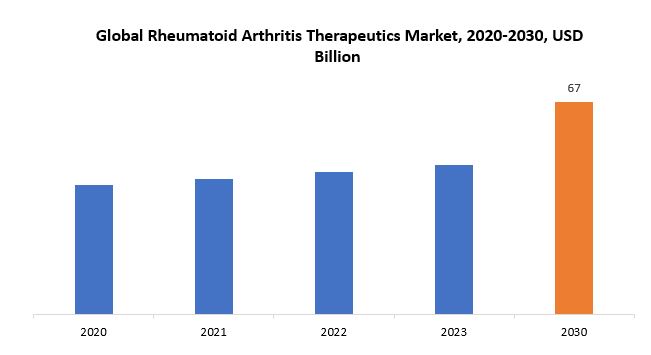

The global rheumatoid arthritis therapeutics market size is projected to grow from USD 47.30 billion in 2023 to USD 67 billion by 2030, exhibiting a CAGR of 5.1% during the forecast period.

Rheumatoid arthritis (RA) therapeutics are medical treatments and interventions designed to manage the symptoms and progression of rheumatoid arthritis, a chronic autoimmune disease that primarily affects the joints. RA therapies comprise a complex strategy that includes medication, physical therapy, lifestyle adjustments, and occasionally surgery. The primary goal of rheumatoid arthritis therapeutics is to alleviate pain, reduce inflammation, slow down joint damage, improve joint function, and enhance the overall quality of life for individuals living with RA. Medications commonly used in rheumatoid arthritis therapeutics include nonsteroidal anti-inflammatory drugs (NSAIDs), corticosteroids, disease-modifying antirheumatic drugs (DMARDs), and biologic agents. NSAIDs help to relieve pain and reduce inflammation, while corticosteroids provide rapid relief of symptoms during RA flares. DMARDs are crucial in managing RA as they work to slow down the progression of the disease by targeting the underlying autoimmune process. Biologic agents, a type of DMARD, are genetically engineered proteins that target specific immune components involved in RA.

Physical therapy plays a significant part in RA treatments by concentrating on activities to increase joint flexibility, strength, and function. Occupational therapy helps individuals with RA to adapt their daily activities and routines to minimize stress on the joints and maximize independence.

Rheumatoid arthritis (RA) therapeutics holds immense importance in effectively managing a complex autoimmune disease that can significantly affect an individual’s quality of life. By employing various therapeutic interventions, RA treatment aims to alleviate symptoms, reduce inflammation, slow disease progression, and preserve joint function. This holistic approach is crucial in managing the different symptoms of RA, which can vary from joint pain and stiffness to systemic issues affecting organs such as the heart and lungs. One of the primary goals of RA therapeutics is pain management, as RA can cause chronic discomfort and limit mobility. Pain and inflammation can be decreased with the use of drugs such as NSAIDs, corticosteroids, DMARDs, and biologic agents, allowing people to live an active lifestyle and do everyday tasks more easily. Furthermore, by treating the underlying autoimmune process, DMARDs and biologics serve to slow down joint degeneration, maintaining joint function and avoiding disability. In addition to pharmacological interventions, RA therapeutics include physical and occupational therapy, which are important in improving joint flexibility, strength, and overall function. These therapies enable people with RA to better manage their condition, adjust their daily activities, and maintain their independence. Lifestyle changes such as exercise, weight management, and quitting smoking help to manage RA by promoting overall health and well-being.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Product Type, Distribution Channel and Region |

|

By Product Type |

|

|

By Distribution Channel |

|

|

By Region

|

|

Rheumatoid Arthritis Therapeutics Market Segmentation Analysis

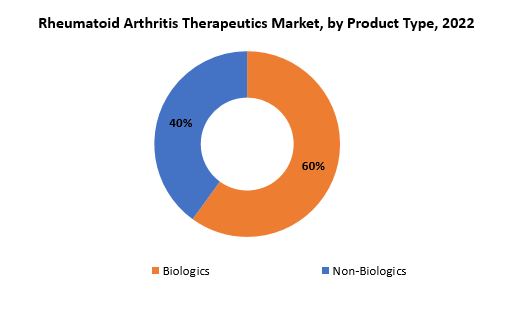

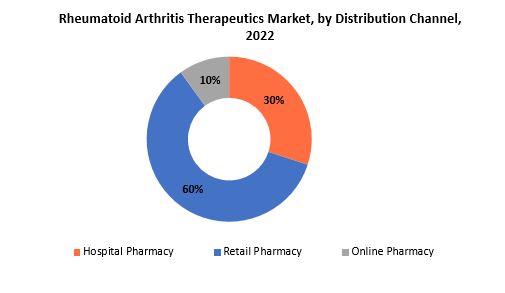

The global rheumatoid arthritis therapeutics market is bifurcated three segments, by product type, distribution channels and region. By product type, the market is bifurcated into biologics, non-biologics. By distribution channels, the market is bifurcated hospital pharmacy, retail pharmacy, online pharmacy and region.

The market for rheumatoid arthritis therapies is often divided into two categories: biologics and non-biologics. Biologics are drugs made from live organisms or their components that target particular molecules involved in the inflammatory process of rheumatoid arthritis (RA). These medications are usually monoclonal antibodies or fusion proteins that specifically block critical inflammatory pathways like TNF-alpha, IL-6, or B cells. Biologics are frequently used in patients who have not responded satisfactorily to standard disease-modifying antirheumatic medications (DMARDs). They are more expensive, but they may provide better effectiveness and fewer adverse effects for some RA patients. Non-biologics are classic DMARDs and other small molecule medicines used to treat rheumatoid arthritis. These include methotrexate, sulfasalazine, hydroxychloroquine, and leflunomide, among others. Non-biologic DMARDs act by inhibiting the immune system and lowering inflammation, but through fewer specific methods than biologics. These medications are frequently regarded first-line therapy for RA because to their proven effectiveness, low cost, and broad availability. Non-biologics can be used alone or in conjunction with biologics or other non-biologic DMARDs to achieve optimum disease management in RA patients. Overall, the rheumatoid arthritis therapeutics market is divided into biologics and non-biologics, reflecting the wide range of therapy choices for this chronic inflammatory illness.

Distribution channels are critical conduits for rheumatoid arthritis medicines, allowing drugs and treatments to reach people living with this chronic illness. These channels are often divided into three categories: hospital pharmacies, retail pharmacies, and internet pharmacies, with each performing a unique function in improving access to RA therapies. Hospital pharmacies play an important role inside medical facilities, ensuring that patients undergoing rigorous treatments or receiving inpatient care have prompt access to vital pharmaceuticals. They serve an important role in administering specialty rheumatoid arthritis medicines, notably intravenous infusions and high-potency drugs needed for acute flare-ups. Hospital pharmacies also allow healthcare providers to closely evaluate patients’ responses to therapy and alter medicines as necessary. Retail pharmacies, including chain and independent establishments, are widely available to outpatients with rheumatoid arthritis. These pharmacies provide patients with convenience and flexibility, allowing them to fill prescriptions, purchase over-the-counter drugs, and seek expert assistance from pharmacists in their local areas. Retail pharmacies play an important role in preserving RA patients’ continuity of treatment by allowing routine prescription refills and offering advice on medication adherence and potential adverse effects.

With the rise of e-commerce and digital health platforms, internet pharmacies have emerged as a rapidly growing distribution route for rheumatoid arthritis treatments. In conclusion, the division of the rheumatoid arthritis treatments market into hospital, retail, and online pharmacy channels highlights the different demands and preferences of people living with RA. By efficiently exploiting these distribution channels, healthcare professionals and pharmaceutical firms may improve the accessibility, cost, and quality of RA medications, thereby improving patient outcomes and overall autoimmune disease management.

Rheumatoid Arthritis Therapeutics Market Dynamics

Driver

The growing prevalence of RA globally is a significant driver for the market.

The global prevalence of Rheumatoid Arthritis (RA) is increasing, which is a primary driver of the RA treatments industry. Several causes contribute to its rising prevalence, making it a serious public health problem. One noteworthy aspect is the aging population demographic change that is taking place in several nations. As people age, their chance of acquiring RA increases, resulting in a higher number of persons impacted by the condition. Sedentary lifestyles, which involve little physical exercise and lengthy periods of sitting, are also becoming increasingly common in modern culture. A lack of exercise and mobility can aggravate inflammatory processes in the body, potentially causing or aggravating RA symptoms. Environmental factors contribute to the increasing prevalence of RA. Pollution, chemical exposure, and dietary choices can all have an impact on the immune system’s reaction, making people more vulnerable to autoimmune illnesses like RA. Furthermore, shifting dietary patterns, such as eating processed foods with high levels of sugar and harmful fats, may lead to inflammation and immunological dysregulation, increasing the incidence of RA. The combined influence of these variables emphasizes the critical need for effective treatments to control and relieve RA symptoms. With a rising population impacted by the condition, there is a greater need for novel therapies that can give comfort, decrease disease progression, and enhance patients’ overall quality of life. Consequently, pharmaceutical companies and researchers are compelled to invest in the development of novel drugs and therapies to meet this demand and address the expanding market for RA therapeutics. Overall, the increasing prevalence of RA serves as a compelling driver for advancements in treatment modalities and the growth of the RA therapeutics market.

Restraint

The high cost of biologic therapies for Rheumatoid Arthritis (RA) presents a substantial barrier to market expansion, particularly in emerging economies and among underinsured populations.

Biologic drugs, which are derived from living organisms and designed to target specific components of the immune system involved in RA, have revolutionized the treatment landscape for this chronic autoimmune disease. However, their innovative nature and complex manufacturing processes result in significantly higher prices compared to traditional non-biologic treatments. This exorbitant cost poses considerable challenges for patients, healthcare systems, and pharmaceutical companies alike. In emerging economies where access to healthcare resources is limited and out-of-pocket expenses are a significant burden for patients, the high cost of biologics can render these life-changing therapies unattainable for many individuals suffering from RA. Even in more developed regions with comprehensive insurance coverage, co-payments and deductibles associated with biologic treatments can place a strain on patients’ finances, potentially deterring them from seeking or adhering to treatment. Moreover, the high cost of biologic therapies hampers market expansion by limiting the addressable patient population and constraining the adoption of these innovative treatments. Pharmaceutical companies face challenges in achieving widespread market penetration and generating sufficient revenue to offset the substantial research and development costs associated with biologics. Additionally, the presence of biosimilar alternatives, though intended to lower costs through competition, often provides only modest reductions in price, further perpetuating the affordability issue.

Opportunities

The advent of precision medicine and biomarker-based diagnostics presents opportunities for the development of personalized treatment regimens tailored to individual RA patients.

The rise of customized medicine methods, driven by improvements in precision medicine and biomarker-based diagnostics, promises a revolutionary potential in the therapeutic landscape for Rheumatoid Arthritis (RA). Unlike traditional one-size-fits-all treatments, personalized medicine strives to customize medical therapies to the unique characteristics of each patient, including their genetic composition, molecular profile, and clinical symptoms of the illness. Biomarker-based diagnostics are critical for developing customized therapy regimens for RA. By identifying specific biomarkers associated with disease activity, progression, and therapy response, healthcare providers can better stratify patients into distinct subgroups with varying treatment needs. Certain biomarkers, for example, may indicate a higher chance of biologic therapy response, whereas others may signal a propensity to certain side events or disease complications. With this information, practitioners may make better educated judgments about therapeutic agents, dose regimens, and treatment durations, therefore improving results for individual patients. The use of personalised medicine techniques in RA has the potential to transform therapy paradigms and considerably enhance clinical outcomes. By adapting therapies to each patient’s unique biological traits, personalized medicine reduces the chance of treatment failure, adverse events, and wasteful healthcare costs. Patients are more likely to experience symptom relief, disease remission, and long-term functional ability, all of which improve their overall quality of life and treatment satisfaction.

Rheumatoid Arthritis Therapeutics Market Trends

-

Biologic drugs, particularly TNF inhibitors like Humira (adalimumab), Enbrel (etanercept), and Remicade (infliximab), had been dominating the RA therapeutics market. These drugs target specific components of the immune system involved in RA inflammation and had shown significant efficacy in managing symptoms and inhibiting disease progression.

-

With patents on several biologic medicines expiring, the market witnessed the emergence of biosimilar, which are less expensive copies of these biologics. Biosimilar provided affordable options for patients, healthcare providers, and payers while keeping comparable effectiveness and safety characteristics.

-

Advances in understanding the genetic and molecular underpinnings of RA prompted the development of tailored therapy techniques. Treatment was tailored based on specific patient features, such as genetic markers or biomarkers, with the goal of improving therapeutic success while minimizing side effects.

-

Researchers and clinicians investigated the efficacy of combining several types of RA treatments, such as biologics with traditional disease-modifying antirheumatic drugs (DMARDs) or JAK inhibitors with biologics. Combination medicines were designed to improve effectiveness, disease control, and maybe lower the chance of drug resistance.

-

Early diagnosis and therapy beginning in RA were becoming increasingly important in order to avoid irreparable joint damage and disability. Early intervention treatments sought to establish remission or minimal disease activity in patients, hence improving long-term outcomes and quality of life.

-

Patient-centric care techniques, such as shared decision-making between patients and healthcare practitioners, as well as patient education and support programs, have grown in prominence. Empowering patients to actively engage in their treatment decisions and management increased treatment adherence and overall results.

Competitive Landscape

The competitive landscape of the rheumatoid arthritis therapeutics market was dynamic, with several prominent companies competing to provide innovative and advanced rheumatoid arthritis therapeutics.

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca PLC

- Boehringer Ingelheim International GmbH

- Bristol Myers Squibb

- Celgene Corporation

- Eli Lilly and Company

- Gilead Sciences, Inc.

- GlaxoSmithKline plc

- Johnson & Johnson

- Merck & Co., Inc.

- Mitsubishi Tanabe Pharma Corporation

- Novartis AG

- Pfizer Inc.

- Regeneron Pharmaceuticals, Inc.

- Roche Holding AG

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- UCB S.A.

Recent Developments:

Feb. 12, 2024 — AbbVie announced today that it has completed its acquisition of ImmunoGen (NASDAQ: IMGN). With the completion of the acquisition, ImmunoGen is now part of AbbVie.”Together with ImmunoGen, we have the potential to continue redefining the standard of care for those living with cancer,” said Robert A. Michael, president and chief operating officer, AbbVie.

February 2, 2024 – Positive high-level results from Japan Phase III trial of acoramidis in adults with transthyretin-mediated amyloid cardiomyopathy (ATTR-CM) showed consistency with global ATTRibute-CM Phase III trial.

Regional Analysis

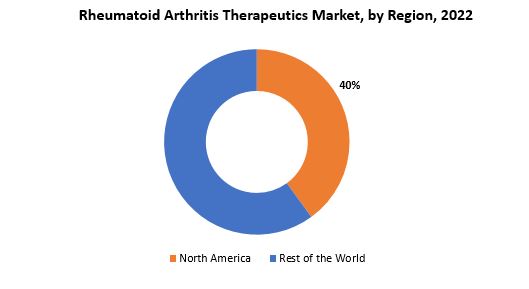

North America has been the dominant region in the RA therapies industry. A number of important elements contribute to its supremacy. For starters, North America has sophisticated healthcare infrastructure and a strong regulatory framework, which allows for quick medication development, approval, and market access. Second, the area is home to numerous big pharmaceutical firms with significant R&D skills that are always inventing and launching novel treatments for RA. Furthermore, the high frequency of rheumatoid arthritis in nations such as the United States and Canada creates a huge demand for effective treatments.

Furthermore, favorable reimbursement policies and widespread acceptance of biologic medications, especially in the United States, contribute to North America’s dominance in the RA treatments industry. However, it is important to note that other areas, such as Europe and Asia-Pacific, are seeing significant expansion in the RA treatments market, owing to increased awareness, improved healthcare infrastructure, and rising patient populations. As the global burden of rheumatoid arthritis rises, regions throughout the world are projected to play an increasingly important role in determining the RA treatment landscape.

Target Audience for Rheumatoid Arthritis Therapeutics Market

- Rheumatologists

- General Practitioners (GPs) with an interest in rheumatology

- Pharmacists

- Patients diagnosed with rheumatoid arthritis

- Caregivers of rheumatoid arthritis patients

- Healthcare providers specializing in autoimmune diseases

- Researchers and scientists in the field of rheumatology

- Pharmaceutical companies developing rheumatoid arthritis medications

- Health insurance companies

- Government health agencies and regulatory bodies

Segments Covered in the Rheumatoid Arthritis Therapeutics Market Report

Rheumatoid Arthritis Therapeutics Market by Product Type

- Biologics

- Non-Biologics

Rheumatoid Arthritis Therapeutics Market by Distribution Channels

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Rheumatoid Arthritis Therapeutics Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Rheumatoid Arthritis Therapeutics Market over the next 7 years?

- Who are the key market participants Rheumatoid Arthritis Therapeutics, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Rheumatoid Arthritis Therapeutics Market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Rheumatoid Arthritis Therapeutics Market?

- What is the current and forecasted size and growth rate of the global Rheumatoid Arthritis Therapeutics Market?

- What are the key drivers of growth in the Rheumatoid Arthritis Therapeutics Market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Rheumatoid Arthritis Therapeutics Market?

- What are the technological advancements and innovations in the Rheumatoid Arthritis Therapeutics Market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Rheumatoid Arthritis Therapeutics Market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Rheumatoid Arthritis Therapeutics Market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- RHEUMATOID ARTHRITIS THERAPEUTICS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON RHEUMATOID ARTHRITIS THERAPEUTICS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- RHEUMATOID ARTHRITIS THERAPEUTICS MARKET OUTLOOK

- GLOBAL RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE, 2020-2030, (USD BILLION)

- BIOLOGICS

- NON-BIOLOGICS

- GLOBAL RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL, 2020-2030, (USD BILLION)

- HOSPITAL PHARMACY

- RETAIL PHARMACY

- ONLINE PHARMACY

- GLOBAL RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ABBVIE INC.

- AMGEN INC.

- ASTRAZENECA PLC

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- BRISTOL MYERS SQUIBB

- CELGENE CORPORATION

- ELI LILLY AND COMPANY

- GILEAD SCIENCES, INC.

- GLAXOSMITHKLINE PLC

- JOHNSON & JOHNSON

- MERCK & CO., INC.

- MITSUBISHI TANABE PHARMA CORPORATION

- NOVARTIS AG

- PFIZER INC.

- REGENERON PHARMACEUTICALS, INC.

- ROCHE HOLDING AG

- SANOFI S.A.

- TAKEDA PHARMACEUTICAL COMPANY LIMITED

- UCB S.A

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 3 GLOBAL RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 4 NORTH AMERICA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 7 US RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 8 US RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 9 CANADA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 10 CANADA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 11 MEXICO RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 12 MEXICO RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 13 SOUTH AMERICA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 14 SOUTH AMERICA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 15 SOUTH AMERICA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 16 BRAZIL RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 17 BRAZIL RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 18 ARGENTINA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 19 ARGENTINA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 20 COLOMBIA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 21 COLOMBIA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 22 REST OF SOUTH AMERICA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 23 REST OF SOUTH AMERICA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 24 ASIA-PACIFIC RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 25 ASIA-PACIFIC RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 26 ASIA-PACIFIC RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 27 INDIA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 28 INDIA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 29 CHINA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 30 CHINA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 31 JAPAN RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 32 JAPAN RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 33 SOUTH KOREA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 34 SOUTH KOREA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 35 AUSTRALIA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 36 AUSTRALIA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 37 SOUTH-EAST ASIA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 38 SOUTH-EAST ASIA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 39 REST OF ASIA PACIFIC RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 40 REST OF ASIA PACIFIC RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 41 EUROPE RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 42 EUROPE RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 43 EUROPE RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 44 GERMANY RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 45 GERMANY RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 46 UK RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 47 UK RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 48 FRANCE RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 49 FRANCE RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 50 ITALY RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 51 ITALY RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 52 SPAIN RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 53 SPAIN RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 54 RUSSIA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 55 RUSSIA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 56 REST OF EUROPE RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 57 REST OF EUROPE RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 58 MIDDLE EAST AND AFRICA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 59 MIDDLE EAST AND AFRICA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 60 MIDDLE EAST AND AFRICA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 61 UAE RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 62 UAE RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 63 SAUDI ARABIA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 64 SAUDI ARABIA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 65 SOUTH AFRICA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 66 SOUTH AFRICA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 67 REST OF MIDDLE EAST AND AFRICA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 68 REST OF MIDDLE EAST AND AFRICA RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE, USD BILLION, 2022-2030

FIGURE 9 GLOBAL RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL, USD BILLION, 2022-2030

FIGURE 10 GLOBAL RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY REGION, USD BILLION, 2022-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY PRODUCT TYPE, USD BILLION,2022

FIGURE 13 GLOBAL RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY DISTRIBUTION CHANNEL, USD BILLION,2022

FIGURE 14 GLOBAL RHEUMATOID ARTHRITIS THERAPEUTICS MARKET BY REGION, USD BILLION,2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 ABBVIE INC: COMPANY SNAPSHOT

FIGURE 17 AMGEN INC.: COMPANY SNAPSHOT

FIGURE 18 ASTRAZENECA PLC: COMPANY SNAPSHOT

FIGURE 19 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: COMPANY SNAPSHOT

FIGURE 20 BRISTOL MYERS SQUIBB: COMPANY SNAPSHOT

FIGURE 21 CELGENE CORPORATION : COMPANY SNAPSHOT

FIGURE 22 ELI LILLY AND COMPANY: COMPANY SNAPSHOT

FIGURE 23 GILEAD SCIENCES, INC.: COMPANY SNAPSHOT

FIGURE 24 GLAXOSMITHKLINE PLC: COMPANY SNAPSHOT

FIGURE 25 JOHNSON & JOHNSON: COMPANY SNAPSHOT

FIGURE 26 MERCK & CO., INC.: COMPANY SNAPSHOT

FIGURE 27 MITSUBISHI TANABE PHARMA CORPORATION: COMPANY SNAPSHOT

FIGURE 28 NOVARTIS AG: COMPANY SNAPSHOT

FIGURE 29 PFIZER INC.: COMPANY SNAPSHOT

FIGURE 30 REGENERON PHARMACEUTICALS, INC.: COMPANY SNAPSHOT

FIGURE 31 ROCHE HOLDING AG: COMPANY SNAPSHOT

FIGURE 32 SANOFI S.A.: COMPANY SNAPSHOT

FIGURE 33 TAKEDA PHARMACEUTICAL COMPANY LIMITED: COMPANY SNAPSHOT

FIGURE 34 UCB S.A.: COMPANY SNAPSHOT

FAQ

The global rheumatoid arthritis therapeutics market size is projected to grow from USD 47.30 billion in 2023 to USD 67 billion by 2030, exhibiting a CAGR of 5.1% during the forecast period.

North America accounted for the largest market in the rheumatoid arthritis therapeutics market.

AbbVie Inc., Amgen Inc., AstraZeneca PLC, Boehringer Ingelheim International GmbH, Bristol Myers Squibb, Celgene Corporation ,Eli Lilly and Company, Gilead Sciences, Inc., GlaxoSmithKline plc, Johnson & Johnson and Others.

Ongoing research is aimed at finding potential treatment targets and mechanisms involved in RA pathogenesis. This includes looking at immune cell interactions, cytokine signaling pathways, and the function of the microbiome in RA development and progression

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.