REPORT OUTLOOK

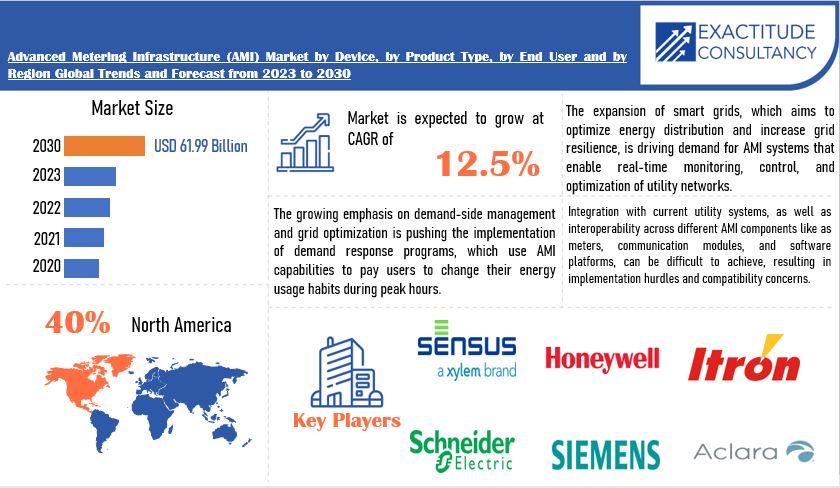

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 61.99 billion by 2030 | 12.5% | North America |

| by Device | by Product Type | by End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Advanced Metering Infrastructure (AMI) Market Overview

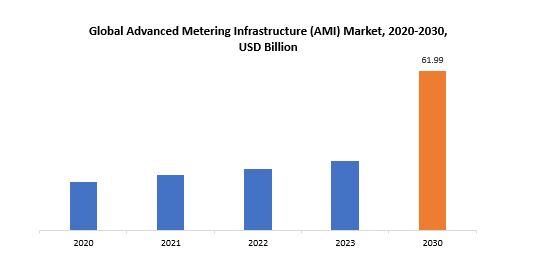

The global advanced metering infrastructure (AMI) market size is projected to grow from USD 27.18 billion in 2023 to USD 61.99 billion by 2030, exhibiting a CAGR of 12.5% during the forecast period.

Advanced Metering Infrastructure (AMI) is a contemporary system designed to measure, gather, and manage energy consumption data more effectively. Unlike conventional meters, which rely on manual readings and offer limited insights, AMI utilizes sophisticated technologies like smart meters, communication networks, and data management systems to establish bi-directional communication between utility providers and consumers. By installing smart meters at customers’ premises, energy usage is recorded at regular intervals and securely transmitted to utility companies either in real-time or at scheduled intervals. This facilitates utilities in monitoring consumption patterns accurately, remotely controlling service connections, promptly diagnosing issues, and implementing demand-response initiatives. Moreover, AMI empowers consumers by granting access to detailed information regarding their energy usage, thereby promoting greater awareness and enabling informed decisions to optimize consumption and lower expenses. Overall, AMI signifies a substantial leap forward in the efficiency, dependability, and sustainability of energy management systems.

Advanced Metering Infrastructure (AMI) is profoundly significant due to its transformative influence on energy management systems. By substituting traditional meters with smart meters and integrating communication networks and data management systems, AMI fundamentally alters the approach to measuring, monitoring, and controlling energy consumption. Its importance stems from several factors. Firstly, AMI furnishes utilities with real-time or interval-based data on energy usage, facilitating a deeper understanding of consumption patterns, identification of inefficiencies, and optimization of operations. Secondly, it enhances billing accuracy by eliminating the need for estimated readings, ensuring fairness and transparency in billing practices. Moreover, AMI empowers consumers by granting them access to comprehensive information about their energy usage, fostering heightened awareness and enabling informed decisions to curtail consumption and reduce costs. This increased transparency also creates opportunities for consumers to engage in demand-response initiatives and contribute to broader energy efficiency endeavours. Additionally, AMI supports the seamless integration of renewable energy sources and enables utilities to better manage grid stability and peak demand through advanced analytics and control mechanisms. In essence, the adoption of AMI represents a pivotal stride towards establishing smarter, more resilient, and sustainable energy infrastructure for the future.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Device, Product Type, End User and Region |

|

By Device |

|

|

By Product Type |

|

By End User |

|

|

By Region

|

|

Advanced Metering Infrastructure (AMI) Market Segmentation Analysis

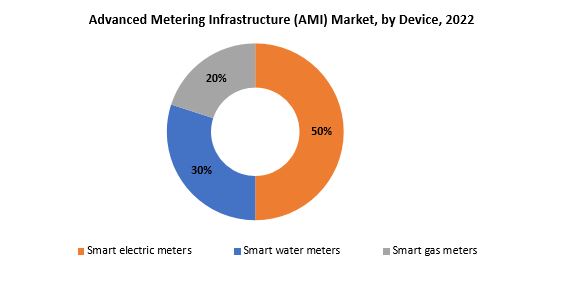

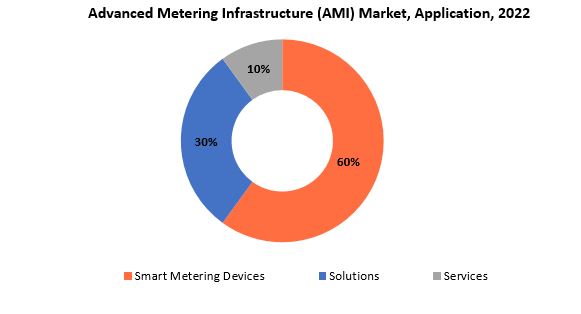

The global advanced metering infrastructure market is bifurcated three segments, by device, product type and region. By device, the market is bifurcated into smart electric meters, smart water meters, smart gas meters. By product type, the market is bifurcated smart metering devices, solutions, and services and region.

The Advanced Metering Infrastructure (AMI) market is divided by device into three primary segments: smart electric meters, smart water meters, and smart gas meters. Smart electric meters are advanced instruments that accurately monitor and record electricity consumption in real-time, offering utilities and consumers precise insights into usage patterns. These meters enable bi-directional communication between utilities and consumers, facilitating remote meter readings, outage detection, and demand-response initiatives. Similarly, smart water meters offer-sophisticated capabilities for monitoring water usage. These meters track water consumption with precision, allowing utilities to detect leaks, manage water distribution more efficiently, and promote water conservation among consumers. Utilizing remote data transmission, smart water meters streamline meter-reading processes and enhance operational efficiency for water utilities. Smart gas meters represent another vital component of the AMI market, delivering analogous benefits to their electric and water counterparts. These meters enable utilities to accurately monitor gas consumption, promptly detect anomalies such as leaks, and optimize distribution networks. With remote communication capabilities, smart gas meters enhance billing accuracy and enable utilities to swiftly address maintenance requirements and safety issues.

In essence, the widespread adoption of smart meters across electric, water, and gas sectors is propelling the advancement of AMI, improving the efficiency, reliability, and sustainability of utility services. By providing real-time data insights and enabling remote management, these devices empower both utilities and consumers to make informed decisions, optimize resource utilization, and contribute to the development of smarter, more resilient infrastructure systems.

The Advanced Metering Infrastructure (AMI) market is divided by product type into three primary segments: smart metering devices, solutions, and services. Smart metering devices encompass the physical hardware, such as smart electric meters, smart water meters, and smart gas meters, deployed for accurate utility consumption monitoring. Equipped with features like real-time data collection and remote communication, these devices enable efficient interaction between utilities and consumers. AMI solutions constitute the software and technological frameworks essential for managing and analyzing the data collected by smart metering devices. These solutions include meter data management systems, communication networks, analytics platforms, and customer engagement tools, facilitating utilities in processing vast amounts of meter data and extracting actionable insights to streamline operations. Furthermore, the AMI market includes various services aimed at supporting the implementation, operation, and maintenance of smart metering infrastructure. Vendors and service providers to ensure the smooth deployment and effective utilization of smart metering solutions provide these services, such as consulting, installation, integration, training, and ongoing support. Collectively, smart metering devices, solutions, and services play a pivotal role in modernizing and transforming utility operations, enhancing efficiency, reliability, and sustainability. Through advanced technologies and data-driven insights, utilities can optimize resource management, enhance service delivery, and empower consumers to make informed decisions regarding their energy and water consumption. Embracing smart metering solutions represents a significant stride toward building smarter and more resilient infrastructure systems for the future.

Advanced Metering Infrastructure (AMI) Market Dynamics

Driver

Growing emphasis on energy conservation and efficiency is propelling the adoption of AMI systems as they enable utilities and consumers to monitor and manage energy consumption more effectively.

The increasing focus on energy conservation and efficiency has spurred a significant push towards adopting Advanced Metering Infrastructure (AMI) systems. These systems allow utilities and consumers to closely monitor and effectively manage energy consumption in real-time. By deploying smart meters equipped with advanced sensors and communication capabilities, utilities can gain invaluable insights into energy usage patterns across their networks. This detailed data enables utilities to improve billing accuracy, pinpoint inefficiencies, and proactively maintain infrastructure. For consumers, AMI systems offer greater control over energy usage through access to detailed consumption information and interactive tools. Real-time feedback and personalized insights empower consumers to make informed decisions about energy consumption, identify areas for savings, and adjust their behavior accordingly. Additionally, features like time-of-use pricing and demand response programs encourage consumers to shift energy usage to off-peak hours, ultimately reducing strain on the grid and lowering overall energy costs. The adoption of AMI systems aligns with broader energy efficiency goals, such as reducing carbon emissions, optimizing resource utilization, and enhancing grid reliability. By optimizing energy usage and minimizing waste, AMI contributes to the sustainability objectives of utilities and governments, while also offering cost-saving opportunities for consumers. Moreover, the data generated by AMI systems serves as a valuable resource for utilities, policymakers, and energy analysts. Advanced analytics and machine learning algorithms can uncover actionable insights from the vast amounts of data collected, facilitating predictive maintenance, load forecasting, and grid optimization. This data-driven approach not only enhances the efficiency and reliability of energy infrastructure but also facilitates the integration of renewable energy sources and the advancement of smart grid technologies. In summary, the growing emphasis on energy conservation and efficiency underscores the critical role of AMI systems in modernizing energy management practices. By enabling utilities and consumers to monitor and manage energy consumption more effectively, AMI contributes to a more sustainable, resilient, and cost-effective energy landscape. With increasing prioritization of energy efficiency initiatives, the adoption of AMI systems is poised to accelerate, driving positive environmental, economic, and societal benefits.

Restraint

The upfront investment required for deploying AMI infrastructure, including smart meters, communication networks, and data management systems, can be substantial, posing a barrier to adoption, particularly for smaller utilities.

The substantial upfront investment necessary for implementing Advanced Metering Infrastructure (AMI) infrastructure, comprising smart meters, communication networks, and data management systems, presents a significant obstacle, especially for smaller utilities. This financial hurdle often discourages widespread adoption of AMI technology. AMI infrastructure deployment entails various components, each demanding substantial capital outlay. Smart meters, pivotal to AMI systems, are equipped with advanced sensors and communication capabilities, rendering them pricier than traditional meters. Additionally, establishing reliable and secure communication networks to transmit data adds to the initial expenditure. These networks frequently necessitate infrastructure upgrades or the adoption of new technologies, like wireless communication protocols or broadband connections. Furthermore, the implementation of sophisticated data management systems is imperative for collecting, storing, and analyzing the vast data streams generated by AMI systems. These systems require specialized software and hardware infrastructure, alongside skilled personnel for effective operation and maintenance. For smaller utilities with limited resources and budgets, these upfront costs can pose a formidable barrier, impeding their ability to invest in AMI technology. Moreover, the return on investment (ROI) from AMI deployments may not materialize immediately, compounding the financial burden. While AMI systems offer long-term benefits such as enhanced billing accuracy, reduced operational costs, and heightened customer engagement, realizing these advantages often demands time and sustained investment. Despite these challenges, the potential benefits of AMI technology—enhanced operational efficiency; improved service reliability, and elevated customer satisfaction—are compelling. Thus, surmounting the obstacle of high initial costs necessitates innovative financing mechanisms, like public-private partnerships, grants, subsidies, or performance-based incentives, to democratize AMI deployments and make them more utilities that are accessible to smaller.

In conclusion, although the high upfront costs associated with implementing AMI infrastructure pose a significant challenge, particularly for smaller utilities, addressing this issue is crucial for unlocking the full transformative potential of AMI technology. Through targeted financing solutions and collaborative efforts among stakeholders, utilities can overcome financial constraints and harness the myriad benefits offered by AMI systems.

Opportunities

The wealth of data produced by Advanced Metering Infrastructure (AMI) systems creates opportunities for utilities to diversify their revenue streams by offering value-added services.

The extensive data output of Advanced Metering Infrastructure (AMI) systems opens doors for utilities to expand their revenue streams through the provision of value-added services. This practice, known as data monetization, involves utilizing insights gleaned from AMI data to offer innovative solutions and customized experiences to consumers. AMI systems capture a wealth of information regarding energy consumption behaviors, equipment efficiency, and customer usage patterns in real-time. Utilities can harness this data to develop energy analytics platforms that deliver actionable insights to consumers, empowering them to optimize their energy usage and reduce costs. By furnishing personalized recommendations and energy-saving strategies based on individual consumption patterns, utilities can enhance customer engagement and satisfaction. Furthermore, AMI data empowers utilities to institute demand response initiatives, incentivizing customers to modify their energy usage during peak periods. By leveraging insights from AMI systems to anticipate and manage fluctuations in demand, utilities can optimize grid operations, alleviate strain on infrastructure, and sidestep expensive peak-time energy procurements. These demand response programs not only benefit utilities by bolstering grid reliability and efficiency but also provide customers with avenues to lower their energy expenses through participation. Additionally, utilities can introduce tailored energy management solutions that empower customers to manage their energy consumption effectively. By analyzing AMI data alongside contextual factors like weather conditions and occupancy patterns, utilities can develop customized energy management strategies for customers.

These strategies might include suggestions for energy-efficient appliances, home automation systems, or renewable energy alternatives, further enhancing customer satisfaction and allegiance. Through data monetization endeavors, utilities can unlock fresh revenue streams and set themselves apart in an increasingly competitive market. By delivering value-added services that capitalize on the extensive data produced by AMI systems, utilities can fortify customer relationships, stimulate customer acquisition and retention, and establish supplementary revenue channels beyond conventional energy sales. In essence, data monetization provides utilities with a pathway to capitalize on the vast potential of AMI systems. By offering energy analytics, demand response programs, and personalized energy management solutions, utilities can deliver value to customers while broadening their revenue streams and maintaining a leading position in a swiftly evolving energy sector.

Advanced Metering Infrastructure (AMI) Market Trends

-

Integration with smart grid technology is a major trend. AMI technologies are rapidly being combined with distribution automation, demand response, and grid analytics systems to improve grid efficiency and reliability.

-

There is an increasing emphasis on using data analytics and artificial intelligence (AI) to derive useful insights from the massive amounts of data generated by smart meters. Utilities use sophisticated analytics to optimize operations, forecast equipment breakdowns, and enhance customer service.

-

With the growing number of connected devices in AMI networks, cybersecurity has become a key problem. Utilities are investing in comprehensive cybersecurity solutions to safeguard smart metering equipment from cyber-attacks while also ensuring data accuracy and confidentiality.

-

Utilities are increasingly concentrating on educating and enabling customers to make educated decisions about their energy consumption. Smart meters allow for real-time monitoring of use, and utilities are giving consumers with usage data and tools to help them manage their energy consumption more effectively.

-

Demand response programs, made possible by AMI technology, are gaining momentum as utilities seek to regulate peak demand and balance the grid. Smart meters enable utilities to connect with consumers in real time and execute demand response measures to lower load during times of high demand.

-

Regulatory regulations and incentives continue to encourage the use of AMI technologies. Many areas have enacted rules mandating utilities to install smart meters in order to increase efficiency, cut energy usage, and fulfil sustainability targets.

-

The internet of things (IoT) is becoming increasingly significant in AMI implementations. Utilities are investigating IoT technology and connectivity solutions to provide seamless communication between smart meters, sensors, and other grid equipment.

-

AMI installations are in line with sustainability objectives because they allow utilities to decrease energy losses, optimize resource allocation, and facilitate the integration of renewable energy sources into the grid.

Competitive Landscape

The competitive landscape of the advanced metering infrastructure market was dynamic, with several prominent companies competing to provide innovative and advanced metering infrastructure market.

- Aclara Technologies LLC

- ADD Grup

- Apator SA

- Badger Meter, Inc

- Circutor SA

- Diehl Metering GmbH

- EDMI Limited

- Elster Group GmbH

- Holley Technology Ltd.

- Honeywell International Inc.

- Iskraemeco

- Itron Inc.

- Kamstrup A/S

- Landis+Gyr

- Schneider Electric SE

- Sensus

- Siemens AG

- Silver Spring Networks

- Trilliant Holdings, Inc.

- Zenner International GmbH & Co. KG

Recent Developments:

December 12, 2023 — Xylem Unveils New Residential Electric Meter with Advanced Grid Edge Capabilities. The new Stratus IQ+™ electricity meter from Sensus, a Xylem brand, is taking the grid to next-level smart. Its powerful processor and expanded data set options allow utilities to pull more system diagnostics than ever before, giving them a robust health check of their distribution system and heightened awareness of customer electricity usage.

Feb. 14, 2024 — Itron, Inc. (NASDAQ: ITRI), which is innovating new ways for utilities and cities to manage energy and water, today announced a new brand identity reflecting the company’s evolution and a new era of delivering enhanced intelligence to create a more resourceful world. The new brand identity reflects Itron’s commitment to creating new efficiencies, connecting communities, encouraging sustainability and increasing resourcefulness.

Regional Analysis

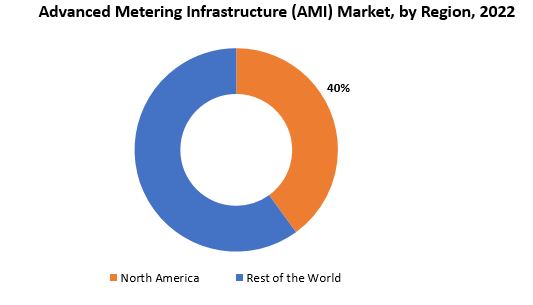

The dominant region in the Advanced Metering Infrastructure (AMI) market tends to vary based on factors like technological progress, regulatory policies, and infrastructure development. However, in recent years, North America has emerged as a primary contender in this sector. This dominance can be attributed to several factors. Firstly, North America boasts a leading position in technological innovation, with significant investments from major utility companies aimed at upgrading infrastructure for enhanced grid reliability, decreased energy losses, and improved operational efficiency. Additionally, regulatory measures within North America, including mandates for smart meter deployment and demand response program implementation, have accelerated the adoption of AMI solutions.

Moreover, the region’s mature energy market and high levels of consumer familiarity and acceptance of smart meter technologies have further fueled the widespread integration of AMI solutions. Overall, North America’s leadership in technological advancement, supportive regulatory landscape, and robust utility infrastructure collectively establish it as a dominant force in the Advanced Metering Infrastructure (AMI) market.

Target Audience for Advanced Metering Infrastructure (AMI) Market

- Consulting firms

- Research organizations and academic institutions

- Investors and financial institutions

- Smart grid solution providers

- System integrators

- Metering infrastructure developers

- Market research firms

Segments Covered in the Advanced Metering Infrastructure (AMI) Market Report

Advanced Metering Infrastructure (AMI) Market by Device

- Smart electric meters

- Smart water meters

- Smart gas meters

Advanced Metering Infrastructure (AMI) Market by Product Type

- Smart Metering Devices

- Solutions

- Services

Advanced Metering Infrastructure (AMI) Market by End User

- Residential

- Commercials

- Industrial

Advanced Metering Infrastructure (AMI) Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Advanced Metering Infrastructure (AMI) Market over the next 7 years?

- Who are the key market participants Advanced Metering Infrastructure (AMI) Market, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Advanced Metering Infrastructure (AMI) Market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Advanced Metering Infrastructure (AMI) Market?

- What is the current and forecasted size and growth rate of the global Advanced Metering Infrastructure (AMI) Market?

- What are the key drivers of growth in the Advanced Metering Infrastructure (AMI) Market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Advanced Metering Infrastructure (AMI) Market?

- What are the technological advancements and innovations in the Advanced Metering Infrastructure (AMI) Market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Advanced Metering Infrastructure (AMI) Market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Advanced Metering Infrastructure (AMI) Market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ADVANCED METERING INFRASTRUCTURE (AMI) MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET OUTLOOK

- GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE, 2020-2030, (USD BILLION)

- SMART ELECTRIC METERS

- SMART WATER METERS

- SMART GAS METERS

- GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE, 2020-2030, (USD BILLION)

- SMART METERING DEVICES

- SOLUTIONS

- SERVICES

- GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER, 2020-2030, (USD BILLION)

- RESIDENTIAL

- COMMERCIALS

- INDUSTRIAL

- GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ACLARA TECHNOLOGIES LLC

- ADD GRUP

- APATOR SA

- BADGER METER, INC.

- CIRCUTOR SA

- DIEHL METERING GMBH

- EDMI LIMITED

- ELSTER GROUP GMBH

- HOLLEY TECHNOLOGY LTD.

- HONEYWELL INTERNATIONAL INC.

- ISKRAEMECO

- ITRON INC.

- KAMSTRUP A/S

- LANDIS+GYR

- SCHNEIDER ELECTRIC SE

- SENSUS

- SIEMENS AG

- SILVER SPRING NETWORKS

- TRILLIANT HOLDINGS, INC.

- ZENNER INTERNATIONAL GMBH & CO. KG

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 2 GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 3 GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 4 GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY REGION (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 10 US ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 11 US ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 12 CANADA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 13 CANADA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 14 CANADA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 15 MEXICO ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 16 MEXICO ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 17 MEXICO ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 23 BRAZIL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 24 BRAZIL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 25 ARGENTINA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 26 ARGENTINA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 27 ARGENTINA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 28 COLOMBIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 29 COLOMBIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 30 COLOMBIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 39 INDIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 40 INDIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 41 CHINA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 42 CHINA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 43 CHINA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 44 JAPAN ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 45 JAPAN ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 46 JAPAN ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 59 EUROPE ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 60 EUROPE ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 61 EUROPE ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 62 EUROPE ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 64 GERMANY ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 65 GERMANY ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 66 UK ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 67 UK ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 68 UK ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 69 FRANCE ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 70 FRANCE ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 71 FRANCE ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 72 ITALY ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 73 ITALY ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 74 ITALY ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 75 SPAIN ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 76 SPAIN ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 77 SPAIN ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 78 RUSSIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 79 RUSSIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 80 RUSSIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 89 UAE ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 90 UAE ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

FIGURE 10 GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2020-2030

FIGURE 11 GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY DEVICE (USD BILLION) 2022

FIGURE 14 GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY PRODUCT TYPE (USD BILLION) 2022

FIGURE 15 GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY END USER (USD BILLION) 2022

FIGURE 16 GLOBAL ADVANCED METERING INFRASTRUCTURE (AMI) MARKET BY REGION (USD BILLION) 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 ACLARA TECHNOLOGIES LLC: COMPANY SNAPSHOT

FIGURE 19 ADD GRUP: COMPANY SNAPSHOT

FIGURE 20 APATOR SA: COMPANY SNAPSHOT

FIGURE 21 BADGER METER, INC.: COMPANY SNAPSHOT

FIGURE 22 CIRCUTOR SA: COMPANY SNAPSHOT

FIGURE 23 DIEHL METERING GMBH: COMPANY SNAPSHOT

FIGURE 24 EDMI LIMITED: COMPANY SNAPSHOT

FIGURE 25 ELSTER GROUP GMBH (OWNED BY HONEYWELL INTERNATIONAL INC.): COMPANY SNAPSHOT

FIGURE 26 HOLLEY TECHNOLOGY LTD.: COMPANY SNAPSHOT

FIGURE 27 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 28 ISKRAEMECO (ISKRAEMECO GROUP): COMPANY SNAPSHOT

FIGURE 29 ITRON INC.: COMPANY SNAPSHOT

FIGURE 30 KAMSTRUP A/S: COMPANY SNAPSHOT

FIGURE 31 LANDIS+GYR: COMPANY SNAPSHOT

FIGURE 32 SCHNEIDER ELECTRIC SE: COMPANY SNAPSHOT

FIGURE 33 SENSUS (XYLEM INC.): COMPANY SNAPSHOT

FIGURE 34 SIEMENS AG: COMPANY SNAPSHOT

FIGURE 35 SILVER SPRING NETWORKS (ITRON INC.): COMPANY SNAPSHOT

FIGURE 36 TRILLIANT HOLDINGS, INC: COMPANY SNAPSHOT

FIGURE 37 ZENNER INTERNATIONAL GMBH & CO. KG: COMPANY SNAPSHOT

FAQ

The global advanced metering infrastructure (AMI) market size is projected to grow from USD 27.18 billion in 2023 to USD 61.99 billion by 2030, exhibiting a CAGR of 12.5% during the forecast period.

North America accounted for the largest market in the advanced metering infrastructure (AMI) market.

Aclara Technologies LLC,ADD Grup, Apator SA, Badger Meter, Inc.,Circutor SA, Diehl Metering GmbH, EDMI Limited, Elster Group GmbH (owned by Honeywell International Inc.),Holley Technology Ltd., Honeywell International Inc., Iskraemeco, Itron Inc.,Kamstrup A/S and Others.

The usage of AMI technology is quickly increasing in emerging nations, driven by urbanization, industrialization, and the need to upgrade outdated infrastructure. Governments and utilities in these locations are investing in AMI deployments to increase energy efficiency and meet rising demand.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.