REPORT OUTLOOK

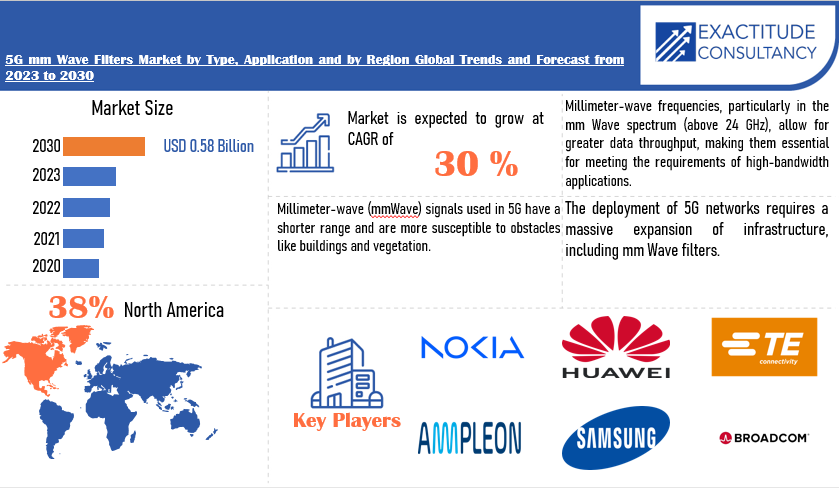

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 0.58 Billion by 2030 | 30 % | North America |

| by Type | by Application |

|---|---|

|

|

SCOPE OF THE REPORT

5G mm Wave Filters Market Overview

The global 5G mm Wave Filters market is anticipated to grow from USD 0.09 Billion in 2023 to USD 0.58 Billion by 2030, at a CAGR of 30 % during the forecast period.

The sector of the telecoms business that is dedicated to the creation, advancement, and implementation of filters intended to function in 5G networks’ millimeter-wave (mmWave) spectrum is known as the 5G mm Wave Filters Market. With the introduction of 5G technology, there is an increasing demand for faster data speeds and more network capacity, and as a result, mmWave frequencies are becoming an essential part of wireless communication systems. To ensure effective communication and reduce interference, mm wave filters are essential in controlling and optimizing the signals within the mm wave bands. The purpose of these filters is to improve the overall performance of 5G networks by selectively allowing certain frequencies to pass through while attenuating or blocking others.

The market comprises various filter types, such as bandpass, low-pass, and high-pass filters, which are specifically designed to fulfill the demands of 5G millimeter-wave communication. The quick rollout of 5G networks throughout the world and the growing incorporation of mmWave technology in a range of applications, including improved mobile broadband, massive machine-type communications, and ultra-reliable low-latency communication, are driving forces behind the 5G mm Wave Filters Market. The demand for mm wave filters that are dependable and efficient is anticipated to increase as network equipment manufacturers and telecommunications operators continue to invest in the development of 5G infrastructure. This will propel advancements and innovations in this niche market.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Type, Application and Region |

| By Type |

|

| By Application |

|

|

By Region

|

|

5G mm Wave Filters Market Segmentation Analysis

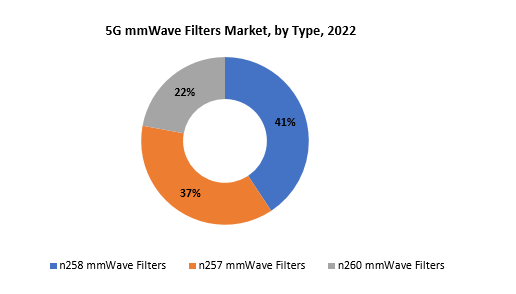

The global 5G mm Wave Filters market is divided into three Type, application and region. By component it is divided as n258 mm Wave Filters, n257, mm Wave Filters, n260 mm Wave Filters, n261 mm Wave Filters. n258 mm Wave Filters holds the largest market share. With separate categories like n258 mm Wave Filters, n257 mm Wave Filters, n260 mm Wave Filters, and n261 mm Wave Filters, the 5G mm Wave Filters Market is further divided based on components.

These abbreviations denote particular mmWave frequency bands that are essential to 5G communication. Every component adds to the overall effectiveness and performance of 5G networks by performing a specific function in controlling the signals within its assigned frequency range. The n258 mm Wave Filters offer precise filtering capabilities for the corresponding band because they are designed to function within a particular frequency range. A more sophisticated understanding of the 5G mm Wave Filters Market is made possible by this division based on components, which enables stakeholders to address particular needs related to various frequency bands. The need for specialized filters made for these particular components is anticipated to increase as the 5G ecosystem develops and grows, spurring innovation and growth in each market segment.

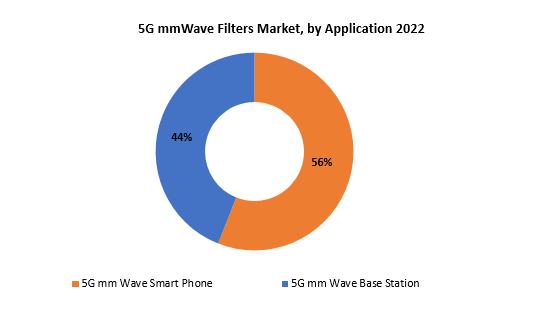

By application it is divided into 5G mm Wave Smart Phone, 5G mm Wave Base Station. In this 5G mm Wave Smart Phone holds the largest market share. Applications are used to classify the 5G mm Wave Filters Market, with a noteworthy distinction between 5G mm Wave Base Stations and 5G mm Wave Smart Phones. With the biggest market share among these applications, 5G mm Wave Smart Phones stand out as the leading category. This demonstrates the important part mmWave filters play in the quickly expanding 5G smartphone market. Filters are essential parts that guarantee effective signal transmission and reception in the mmWave spectrum in the context of 5G mmWave smart phones. mmWave frequencies are becoming more and more necessary for 5G technology to achieve high data speeds and low latency communication, which makes mm Wave Filters essential for 5G smartphone design and production.

The market’s preponderance of 5G mmWave smartphones is a reflection of how widely 5G technology has been adopted by consumers, which has increased demand for smartphones that can utilize mmWave frequencies. 5G-enabled mobile devices benefit from these filters’ improved performance and dependable connectivity, which improves user experience overall. The importance of mmWave filters in consumer electronics is highlighted by the greater market share held by 5G mm Wave Smart Phones, even though 5G mm Wave Base Stations are also essential for building and extending 5G networks. This trend, which highlights the significance of mm Wave Filters in influencing the future of mobile communication, is probably going to continue as 5G networks are deployed globally.

5G mm Wave Filters Market Dynamics

Driver

Millimeter-wave frequencies contribute to lower latency in communication networks.

Millimeter waves have shorter wavelengths compared to lower-frequency bands, and they are more susceptible to atmospheric absorption and obstacles like buildings and trees. As a result, millimeter-wave signals may experience higher path loss and greater signal attenuation, which can affect the overall signal quality and potentially contribute to latency.

Advanced antenna technologies such as beamforming and phased array antennas are frequently used in millimeter-wave networks. These technologies aid in directional signal focus, link quality improvement, and obstacle impact reduction. Small cell deployment is a common practice in millimeter-wave networks. By allowing the network to be more dispersed, small cells can potentially lower latency by shortening the distance that signals must travel. Edge computing is frequently incorporated into 5G networks, including those that use millimeter-wave frequencies, to further reduce latency. By processing data closer to the point of generation, edge computing shortens the time it takes for data to travel between individual devices and centralized data centers.

Restraint

Implementing 5G mm Wave technology requires significant infrastructure investment due to the need for a dense network of small cells and base stations.

The propagation ranges of millimeter-wave signals are shorter, and obstacles can attenuate them more readily. This restriction must be overcome by a dense network of tiny cells. Small cells are radio access nodes for cellular networks that have a small coverage area and low power. In order to provide dependable and consistent coverage in crowded places like stadiums, shopping centers, and urban areas, a large number of small cells are deployed. Millimeter-wave signals lose signal strength over distance more quickly due to higher free-space path loss than lower frequency bands. Because of this, a greater number of base stations are required to adequately cover a given area. For maximum coverage and to reduce signal attenuation, these base stations must be positioned strategically. With the promise of much faster data transfer rates, 5G mmWave technology calls for a reliable and high-capacity backhaul infrastructure.

Because millimeter-wave signals are highly directional, sophisticated antenna technologies are needed to use them effectively. In order to focus the signal in particular directions, massive MIMO (Multiple Input Multiple Output) systems with beamforming capabilities are used, which boosts throughput and enhances network performance overall. The infrastructure becomes more complex and expensive when these technologies are implemented. It takes skill to navigate the intricate site acquisition and zoning procedures involved in deploying a dense network of base stations and small cells. It can take a while to obtain the required licenses and approvals, particularly in crowded cities where issues with safety, aesthetics, and the environment may arise. A scalable and dependable power infrastructure is needed to support the growing number of base stations and small cells. This could entail setting up backup power sources and making sure the network keeps running even when there is power outage.

Opportunities

The implementation of 5G technology extends beyond smartphones to various other devices, forming the backbone of the Internet of Things (IoT).

Comparing 5G to earlier cellular network generations, a much greater number of connected devices per square kilometer is anticipated. This is essential for the Internet of Things (IoT), as many different devices—including sensors, actuators, and smart devices—need to be networked together. The latency of 5G networks is incredibly low, which shortens the time it takes for data to move between devices and the network. This is essential for real-time IoT applications where quick decision-making is required, like autonomous cars, industrial automation, and healthcare. Compared to earlier generations, 5G offers substantially higher data throughput, making it possible to transfer massive amounts of data efficiently. Applications such as remote equipment monitoring, high-definition video surveillance, and other data-intensive Internet of Things use cases can benefit from this.

With the introduction of network slicing in 5G, isolated, virtualized networks customized for particular IoT applications can be built. This makes it possible for various IoT device kinds with various needs—such as high-bandwidth cameras and low-power sensors—to coexist on the same network infrastructure. The extensive deployment of IoT devices—many of which run on batteries or are situated in remote areas—requires 5G networks to be more energy-efficient. The longer battery life of IoT devices is facilitated by this enhanced efficiency. With 5G’s support for mMTC, a huge number of devices can connect at once. This is especially important in Internet of Things scenarios like smart cities, agriculture, and environmental monitoring where a lot of devices need to communicate with each other on a regular basis.

5G mm Wave Filters Market Trends

-

The 5G mm Wave Filters Market has been significantly influenced by the ongoing global rollout of 5G networks. The need for mmWave filters, which are essential for controlling high-frequency signals, is anticipated to increase as telecom firms carry out the expansion of their 5G infrastructure.

-

Higher data transfer rates are becoming more and more necessary as data-intensive applications proliferate. Faster data speeds are made possible by mmWave technology, which is crucial for fulfilling the demands of applications like virtual reality (VR), augmented reality (AR), and high-definition video streaming.

-

One noteworthy trend in consumer electronics is the incorporation of 5G mm Wave Filters, especially in smartphones and other connected devices. There is a growing need for filters that can handle mmWave frequencies as more devices become 5G enabled.

-

The efficiency and performance of millimeter wave filters are being improved by technological developments in filter design and manufacturing processes. This involves creating cutting-edge materials and manufacturing processes to satisfy the demanding specifications of 5G networks.

-

An essential component of the Internet of Things (IoT) and smart city projects is the rollout of 5G networks. In order to support IoT device connectivity requirements and enable the communication infrastructure required for smart city applications, mmWave filters are essential.

-

Industries are investigating the incorporation of 5G technology for enhanced productivity and communication, extending beyond consumer uses. It is expected that as industries adopt 5G for low-latency and high-bandwidth communication, the use of mmWave filters in industrial applications, like manufacturing and automation, will increase.

Competitive Landscape

The competitive landscape of the 5G mm Wave Filters market was dynamic, with several prominent companies competing to provide innovative and advanced 5G mm Wave Filters solutions.

- Qualcomm

- Huawei Technologies

- Nokia Corporation

- Samsung Electronics

- Ericsson

- ZTE Corporation

- Analog Devices, Inc.

- Qorvo, Inc.

- Skyworks Solutions, Inc.

- Murata Manufacturing Co., Ltd.

- Broadcom Inc.

- Infineon Technologies AG

- MACOM Technology Solutions Holdings, Inc.

- Keysight Technologies, Inc.

- Taiyo Yuden Co., Ltd.

- Integrated Device Technology (IDT)

- Fujitsu Limited

- TE Connectivity

- Mitsubishi Electric Corporation

- Ampleon

Recent Developments:

January 25, 2024: China Unicom Beijing and Huawei have successfully deployed a pilot large-scale 5.5G network in Beijing to provide continuous coverage in three key areas, including Beijing Financial Street in the city center, the landmark Beijing Long Distance Call Building, and multipurpose Workers’ Stadium. This first-of-its-kind network is expected to become a benchmark for future 5.5G networks and applications across China thanks to the performance achievements it represents.

January 8, 2024: Samsung Electronics today announced its latest QLED, MICRO LED, OLED and Lifestyle display lineups ahead of CES® 2024. The announcement also served to kick off the AI screen era through the introduction of a next-generation AI processor poised to redefine the perception of smart display capabilities. In addition to bringing improved picture and sound quality, the new lineups provide consumers with AI-powered features secured by Samsung Knox, focusing on inspiring and empowering individual lifestyles.

Regional Analysis

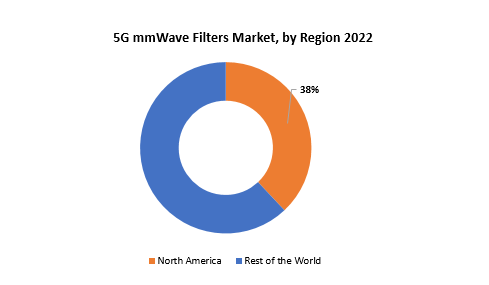

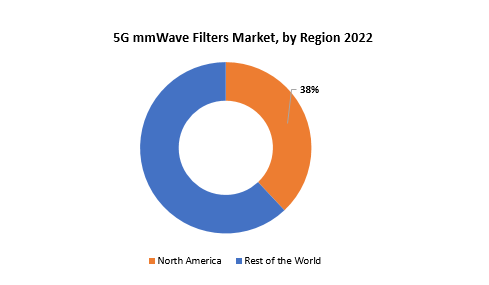

North America accounted for the largest market in the 5G mm Wave Filters market. North America accounted for 38% of the worldwide market value. The extensive use of 5G technology in the region has made North America a major player in the global market for 5G mm wave filters. Especially in the 24 GHz and 28 GHz bands, the millimeter-wave (mmWave) spectrum has been essential for the rollout of 5G networks, which are high-speed and low-latency. An important factor contributing to the growth of 5G mm wave filters in North America is the major telecommunications providers’ aggressive rollout of 5G infrastructure. In order to satisfy the growing demand for faster and more dependable connectivity, these businesses are making significant investments in network upgrades.

Furthermore, the market for millimeter wave filters has been further stimulated by the surge in demand for 5G-enabled devices in North America. The growing number of 5G-capable smartphones, tablets, and other smart devices has increased demand for sophisticated and effective spectrum management filtering solutions. The development of the North American market for 5G mm wave filters has also been significantly influenced by legislative actions and government initiatives. In order to promote competition and innovation among technology providers and to expedite the deployment of 5G networks, policies and strategies for allocating spectrum have been developed.

Target Audience for 5G mm Wave Filters Market

- Telecommunications Service Providers

- Mobile Network Operators

- Equipment Manufacturers

- Wireless Infrastructure Providers

- Semiconductor Companies

- Telecom Regulators

- Government Agencies

- Research and Development Institutions

- Telecommunication Consultants

- Networking Solution Providers

- Mobile Device Manufacturers

- Internet of Things (IoT) Solution Providers

- Satellite Communication Providers

- Broadband Service Providers

Import & Export Data for 5G mm Wave Filters Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the 5G mm Wave Filters market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

-

Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global 5G mm Wave Filters market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

-

Market players: gain insights into the leading players driving the 5G mm Wave Filters trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

-

Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

-

Product breakdown: by segmenting data based on 5G mm Wave Filters types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids government in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the 5G mm Wave Filters Market Report

5G mm Wave Filters Market by Type, 2020-2030, (USD Billion) (Thousand Units)

- n258 mmWave Filters

- n257 mmWave Filters

- n260 mmWave Filters

- n261 mmWave Filters

5G mm Wave Filters Market by Application, 2020-2030, (USD Billion) (Thousand Units)

- 5G mm Wave Smart Phone

- 5G mm Wave Base Station

5G mm Wave Filters Market by Region, 2020-2030, (USD Billion) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the 5G mm Wave Filters market over the next 7 years?

- Who are the major players in the 5G mm Wave Filters market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the 5G mm Wave Filters market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the 5G mm Wave Filters market?

- What is the current and forecasted size and growth rate of the global 5G mm Wave Filters market?

- What are the key drivers of growth in the 5G mm Wave Filters market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the 5G mm Wave Filters market?

- What are the technological advancements and innovations in the 5G mm Wave Filters market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the 5G mm Wave Filters market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the 5G mm Wave Filters market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL 5G MM WAVE FILTERS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON 5G MM WAVE FILTERS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL 5G MM WAVE FILTERS MARKET OUTLOOK

- GLOBAL 5G MM WAVE FILTERS MARKET BY TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- N258 MMWAVE FILTERS

- N257 MMWAVE FILTERS

- N260 MMWAVE FILTERS

- N261 MMWAVE FILTERS

- GLOBAL 5G MM WAVE FILTERS MARKET BY APPLICATION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- 5G MM WAVE SMART PHONE

- 5G MM WAVE BASE STATION

- GLOBAL 5G MM WAVE FILTERS MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, APPLICATION OFFERED, RECENT DEVELOPMENTS)

- QUALCOMM

- HUAWEI TECHNOLOGIES

- NOKIA CORPORATION

- SAMSUNG ELECTRONICS

- ERICSSON

- ZTE CORPORATION

- ANALOG DEVICES, INC.

- QORVO, INC.

- SKYWORKS SOLUTIONS, INC.

- MURATA MANUFACTURING CO., LTD.

- BROADCOM INC.

- INFINEON TECHNOLOGIES AG

- MACOM TECHNOLOGY SOLUTIONS HOLDINGS, INC.

- KEYSIGHT TECHNOLOGIES, INC.

- TAIYO YUDEN CO., LTD.

- INTEGRATED DEVICE TECHNOLOGY (IDT)

- FUJITSU LIMITED

- TE CONNECTIVITY

- MITSUBISHI ELECTRIC CORPORATION

- AMPLEON *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 4 GLOBAL 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL 5G MM WAVE FILTERS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL 5G MM WAVE FILTERS MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA 5G MM WAVE FILTERS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA 5G MM WAVE FILTERS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 13 US 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 14 US 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 15 US 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 16 US 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 18 CANADA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 CANADA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 22 MEXICO 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 24 MEXICO 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA 5G MM WAVE FILTERS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA 5G MM WAVE FILTERS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 32 BRAZIL 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 34 BRAZIL 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 36 ARGENTINA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 38 ARGENTINA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 40 COLOMBIA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 42 COLOMBIA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC 5G MM WAVE FILTERS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC 5G MM WAVE FILTERS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 54 INDIA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 56 INDIA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 58 CHINA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 60 CHINA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 62 JAPAN 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 64 JAPAN 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE 5G MM WAVE FILTERS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE 5G MM WAVE FILTERS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 84 EUROPE 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 86 EUROPE 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 88 GERMANY 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 90 GERMANY 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 91 UK 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 92 UK 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 93 UK 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 94 UK 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 96 FRANCE 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 98 FRANCE 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 100 ITALY 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 102 ITALY 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 104 SPAIN 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 106 SPAIN 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 108 RUSSIA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 110 RUSSIA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA 5G MM WAVE FILTERS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA 5G MM WAVE FILTERS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 121 UAE 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 122 UAE 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 123 UAE 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 124 UAE 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA 5G MM WAVE FILTERS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA 5G MM WAVE FILTERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2020-2030

FIGURE 11 GLOBAL 5G MM WAVE FILTERS MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL 5G MM WAVE FILTERS MARKET BY TYPE (USD BILLION) 2022

FIGURE 14 GLOBAL 5G MM WAVE FILTERS MARKET BY APPLICATION (USD BILLION) 2022

FIGURE 16 GLOBAL 5G MM WAVE FILTERS MARKET BY REGION (USD BILLION) 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 QUALCOMM: COMPANY SNAPSHOT

FIGURE 19 HUAWEI TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 20 NOKIA CORPORATION: COMPANY SNAPSHOT

FIGURE 21 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

FIGURE 22 ERICSSON: COMPANY SNAPSHOT

FIGURE 23 ZTE CORPORATION: COMPANY SNAPSHOT

FIGURE 24 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

FIGURE 25 QORVO, INC.: COMPANY SNAPSHOT

FIGURE 26 SKYWORKS SOLUTIONS, INC.: COMPANY SNAPSHOT

FIGURE 27 MURATA MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

FIGURE 28 BROADCOM INC.: COMPANY SNAPSHOT

FIGURE 29 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

FIGURE 30 MACOM TECHNOLOGY SOLUTIONS HOLDINGS, INC.: COMPANY SNAPSHOT

FIGURE 31 KEYSIGHT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

FIGURE 32 TAIYO YUDEN CO., LTD.: COMPANY SNAPSHOT

FIGURE 33 INTEGRATED DEVICE TECHNOLOGY (IDT): COMPANY SNAPSHOT

FIGURE 34 FUJITSU LIMITED: COMPANY SNAPSHOT

FIGURE 35 TE CONNECTIVITY: COMPANY SNAPSHOT

FIGURE 36 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

FIGURE 37 AMPLEON: COMPANY SNAPSHOT

FIGURE 33 ARM: COMPANY SNAPSHOT

FIGURE 34 ADVANCED MICRO DEVICES (AMD): COMPANY SNAPSHOT

FIGURE 35 RENESAS ELECTRONICS: COMPANY SNAPSHOT

FIGURE 36 MELLANOX TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 37 GRAPHCORE: COMPANY SNAPSHOT

FAQ

The global 5G mm Wave Filters market is anticipated to grow from USD 0.09 Billion in 2023 to USD 0.58 Billion by 2030, at a CAGR of 30 % during the forecast period.

North America accounted for the largest market in the 5G mm Wave Filters market. North America accounted for 38 % market share of the global market value.

Qualcomm, Huawei Technologies, Nokia Corporation, Samsung Electronics, Ericsson, ZTE Corporation, Analog Devices, Inc., Qorvo, Inc., Skyworks Solutions, Inc., Murata Manufacturing Co., Ltd., Broadcom Inc., Infineon Technologies AG

An essential component of the Internet of Things (IoT) and smart city projects is the rollout of 5G networks. In order to support IoT device connectivity requirements and enable the communication infrastructure required for smart city applications, mmWave filters are essential. Industries are investigating the incorporation of 5G technology for enhanced productivity and communication, extending beyond consumer uses. It is expected that as industries adopt 5G for low-latency and high-bandwidth communication, the use of mmWave filters in industrial applications, like manufacturing and automation, will increase.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.