REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 1324.31 million by 2030 | 16.2% | North America |

| by Type | by Application |

|---|---|

|

|

SCOPE OF THE REPORT

Market Overview

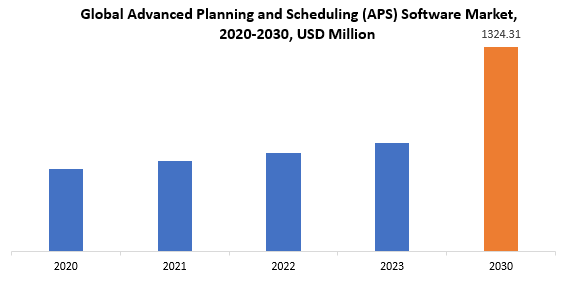

The global advanced planning and scheduling (APS) software market size is projected to grow from USD 701.6 million in 2023 to USD 1324.31 million by 2030, exhibiting a CAGR of 16.2% during the forecast period.

Advanced Planning and Scheduling (APS) software represents a sophisticated solution employed in manufacturing and production settings to enhance planning and scheduling processes. Unlike traditional methods, APS software harnesses algorithms, mathematical models, and data analysis techniques to optimize resource allocation, inventory management, and production sequencing. It considers factors like production capacity, material availability, lead times, and demand forecasts to generate precise schedules that maximize productivity, minimize costs, and fulfill customer needs. This software typically integrates with enterprise resource planning (ERP) systems and other relevant software to access real-time data, enabling informed decision-making and rapid adjustments to evolving circumstances. By furnishing planners and managers with comprehensive insights and actionable suggestions, APS software empowers organizations to enhance operational efficiency, reduce waste, shorten lead times, and bolster competitiveness in today’s dynamic market landscape.

The importance of Advanced Planning and Scheduling (APS) software cannot be overstated, as it fundamentally transforms the management of manufacturing and production operations. By harnessing sophisticated algorithms and data analysis techniques, APS software empowers organizations to streamline their planning and scheduling processes, leading to heightened efficiency, cost reductions, and elevated levels of customer satisfaction. A pivotal feature of APS software is its ability to concurrently consider multiple variables, including production capacity, material availability, and demand forecasts. Through real-time analysis of these factors, APS software generates precise and comprehensive schedules, enabling businesses to make well-informed decisions regarding resource allocation, inventory control, and production sequencing. This precision facilitates downtime minimization, throughput maximization, and agile adaptation to evolving market dynamics. Furthermore, APS software fosters improved coordination across diverse departments and functions within an organization. By offering a centralized platform for planning and scheduling activities, it promotes collaboration, communication, and alignment of objectives, resulting in smoother operations and enhanced productivity levels. In today’s dynamic and competitive business landscape, the ability to optimize production processes and swiftly respond to customer demands is imperative for sustained success. APS software equips organizations with the requisite tools and insights to achieve these goals, positioning them to outperform competitors and maintain a leading edge in their respective industries.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Million) |

| Segmentation | By Type, Application and Region |

|

By Type |

|

|

By Application |

|

| By Region |

|

Advanced Planning and Scheduling (APS) Software Market Segmentation Analysis

The global advanced planning and scheduling (APS) software market is bifurcated three segments, by type, application and region. By type, the market is bifurcated into cloud based, web based. By application, the market is bifurcated large enterprises, SMEs and region.

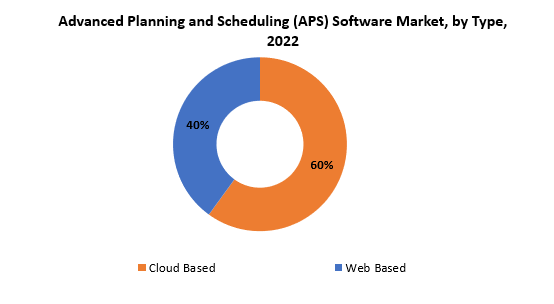

The advanced planning and scheduling (APS) software market is segmented into two main categories: cloud-based and web-based solutions. While the exact distribution of these types can fluctuate based on industry trends and user preferences, a general breakdown could be outlined as follows: Approximately 60% of the market is dominated by cloud-based APS software. This prevalence is driven by factors such as its flexibility, scalability, and cost-efficiency. Cloud-based solutions offer easy deployment, accessibility from any location with internet connectivity, and minimal upfront investment in hardware infrastructure. They often include automatic updates and maintenance, alleviating the burden on IT departments and ensuring access to the latest features. Meanwhile, web-based APS software constitutes around 40% of the market share. Although these solutions also provide internet accessibility, they typically require on-premises installation and maintenance. However, some organizations may prefer web-based options due to privacy concerns or specific regulatory requirements necessitating on-premises hosting. Additionally, certain industries or companies with unique operational needs may opt for web-based solutions offering greater customization or integration capabilities. It is important to recognize that the distribution of cloud-based versus web-based APS software may vary across industries, regions, and company sizes. Moreover, shifts in market dynamics and technological advancements can influence the adoption rates of these solutions over time.

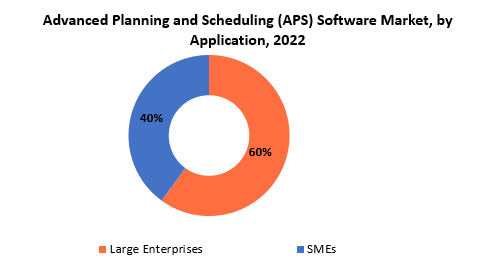

The advanced planning and scheduling (APS) software market is segmented by application into two main categories: large enterprises, small, and medium-sized enterprises (SMEs). The distribution between these categories may vary depending on factors such as organizational needs, budget constraints, and scalability requirements. Large enterprises typically account for a significant portion of the market, representing around 70% of the total share. These organizations have complex and diversified operations with high-volume production processes, extensive supply chains, and substantial resource capacities. As such, they often require advanced planning and scheduling solutions to optimize their production workflows, manage inventory effectively, and meet the demands of a large customer base. Additionally, large enterprises typically have the financial resources to invest in sophisticated APS software solutions that offer comprehensive features, customization options, and enterprise-grade support services.

On the other hand, SMEs make up the remaining 30% of the market share. While they may have smaller-scale operations compared to their larger counterparts, SMEs still benefit significantly from APS software in improving efficiency, reducing costs, and enhancing competitiveness. APS solutions tailored for SMEs often offer streamlined functionalities, user-friendly interfaces, and affordability to align with the unique needs and budget constraints of smaller businesses. Moreover, as technology becomes more accessible and cost-effective, an increasing number of SMEs are recognizing the value of adopting APS software to optimize their production processes and gain a competitive edge in the market. Overall, while large enterprises constitute the majority of APS software users due to their complex operational requirements and greater financial resources, the adoption of APS solutions among SMEs is steadily increasing as they seek ways to improve productivity and remain agile in today’s competitive business landscape.

Advanced Planning and Scheduling (APS) Software Market Dynamics

Driver

The increasing adoption of Industry 4.0 technologies, such as IoT, AI, and big data analytics, is a significant driver for the APS software market.

The increasing adoption of Industry 4.0 technologies, such as IoT, AI, and big data analytics, is a significant driving force propelling the growth of the Advanced Planning and Scheduling (APS) software market. These cutting-edge technologies are reshaping manufacturing and production processes by seamlessly integrating digital systems with physical operations.

Central to this transformation is the convergence of IoT, AI, and big data analytics within APS solutions. IoT-enabled sensors and devices gather real-time data from various points across the production environment, offering unprecedented visibility into operations. This data influx is then processed and analyzed using AI algorithms and advanced analytics tools integrated into APS software. The outcome is a dynamic and interconnected ecosystem where APS solutions can harness real-time data analysis to optimize production planning and scheduling. By leveraging AI-driven insights, manufacturers can proactively identify inefficiencies, anticipate equipment failures through predictive maintenance, and make agile decisions to adapt to evolving production demands. Moreover, the integration of Industry 4.0 technologies empowers APS software to facilitate predictive analytics, enabling organizations to forecast future demand patterns, optimize resource allocation, and enhance overall operational efficiency. This predictive capability empowers manufacturers to stay ahead of the curve, minimize downtime, and maximize productivity while ensuring timely product delivery to meet customer expectations. In essence, Industry 4.0 technologies act as a catalyst for the evolution of APS software, enabling manufacturers to transition towards more data-driven, responsive, and agile production processes. As industries increasingly embrace digital transformation, the synergy between Industry 4.0 technologies and APS solutions will remain pivotal in driving innovation, efficiency, and competitiveness in the manufacturing sector.

Restraint

The initial investment required for implementing APS software can be substantial, particularly for small and medium-sized enterprises (SMEs).

The substantial initial investment required for the implementation of Advanced Planning and Scheduling (APS) software poses a significant challenge, particularly for small and medium-sized enterprises (SMEs). These organizations may find the financial commitment daunting, potentially serving as a deterrent to adopting APS solutions. Specifically for SMEs, the cost considerations associated with implementing APS software can be prohibitive, particularly when financial resources are limited, or when they lack the specialized expertise required for successful implementation. The costs linked with APS implementation encompass various factors, including software licensing fees, hardware infrastructure upgrades, customization and integration expenses, as well as training and support costs. For SMEs operating on tighter budgets, these expenditures may pose a significant barrier to entry, leading to reluctance in adopting APS solutions despite their potential benefits. Moreover, the complexity of APS software implementation often necessitates the involvement of skilled professionals or consultants, further adding to the overall costs. SMEs may encounter difficulty in allocating resources for hiring external expertise, thereby exacerbating the financial burden associated with APS adoption. Consequently, many SMEs might choose to persist with traditional planning methods or less sophisticated software solutions, even though these approaches may be less efficient and effective in optimizing production processes. This hesitancy to invest in APS software due to high implementation costs could impede SMEs’ ability to compete effectively in the market, limiting their potential for growth and innovation. To address this challenge, APS software vendors and service providers could explore strategies such as offering flexible pricing models, providing financing options, or bundling implementation services with software packages to make APS solutions more accessible to SMEs. Additionally, educational initiatives and resources aimed at helping SMEs understand the long-term benefits of APS adoption could help alleviate concerns about upfront costs and encourage greater uptake of these solutions among smaller businesses.

Opportunities

Emerging markets present significant growth opportunities for APS software vendors.

Rapid industrialization, ongoing infrastructure development, and increasing investments in technology adoption collectively create a favorable environment for market expansion in regions such as Asia-Pacific, Latin America, and Africa. In these emerging markets, expanding industrial sectors are experiencing accelerated growth as economies undergo modernization and diversification. With manufacturing activities scaling up to meet the demands of growing populations and expanding consumer markets, the demand for efficient planning and scheduling solutions becomes increasingly urgent. APS software emerges as a valuable asset for businesses seeking to enhance productivity and competitiveness in these evolving landscapes, given its capacity to optimize production processes, streamline supply chains, and boost operational efficiency. Moreover, infrastructure development initiatives, including the construction of transportation networks, logistics hubs, and smart cities, further fuel the need for APS software. These projects offer opportunities for APS vendors to collaborate with government entities, infrastructure developers, and industrial stakeholders, integrating planning and scheduling solutions into large-scale projects to enhance project management capabilities and optimize resource allocation. Furthermore, the rising investments in technology adoption, encompassing digital transformation initiatives and Industry 4.0 strategies, drive the demand for APS software in emerging markets. As businesses increasingly recognize the benefits of digitalizing their operations and leveraging advanced technologies to gain a competitive edge, APS solutions become indispensable for achieving efficiency, agility, and sustainability in manufacturing and production processes. Overall, emerging markets provide fertile ground for APS software vendors to expand their reach and capitalize on growing demand. By aligning with the evolving needs of these dynamic economies, APS vendors can seize opportunities arising from rapid industrialization, infrastructure development, and technological advancements to foster innovation, drive growth, and establish a solid presence in these promising markets.

Advanced Planning and Scheduling (APS) Software Market Trends

-

APS software is becoming more integrated with Industry 4.0 technologies like as IoT, AI, ML, and big data analytics. This connection enables real-time data collecting from linked devices and equipment, resulting in more accurate forecasting, dynamic scheduling, and predictive maintenance.

-

Cloud-based APS solutions are gaining popularity because of its scalability, accessibility, and cost-effectiveness. Organizations are increasingly choosing cloud-based deployments to reap benefits such as lower infrastructure costs, seamless upgrades, and better communication across remote teams.

-

APS software is evolving to accommodate demand-driven planning systems, in which production plans closely match client demand signals. This technique assists firms in reducing lead times, excess inventory, and improving customer satisfaction by ensuring items are accessible when and where they are required.

-

Enhancements to the user experience (UX) are increasingly crucial in APS software. Vendors are focused on simple interfaces, interactive visualization tools, and customisable dashboards to make software more user-friendly and accessible to planners and decision-makers at all levels of the organisation.

-

Sustainability considerations are pushing the development of APS software that promotes ecologically beneficial activities like as improved energy consumption, decreased waste, and eco-friendly procurement selections. Organizations use APS capabilities to reduce their carbon impact and line with corporate sustainability goals.

-

Artificial intelligence and machine learning algorithms are being incorporated with APS software to give increased decision support capabilities. These algorithms evaluate historical data, discover patterns, and offer optimal production schedules, allowing businesses to make data-driven choices and increase operational efficiency.

Competitive Landscape

The competitive landscape of the advanced planning and scheduling software market was dynamic, with several prominent companies competing to provide innovative and advanced advanced planning and scheduling software.

- Anaplan, Inc.

- Aspen Technology, Inc.

- Dassault Systemes

- Demand Solutions

- Epicor Software Corporation

- High Jump

- Infor

- JDA Software

- John Galt Solutions

- Kinaxis Inc.

- LLamasoft

- NetSuite Inc.

- Oracle Corporation

- Plex Systems

- Quintiq

- SAP SE

- Siemens AG

- Slimstock

- SYSPRO

- Tools Group

Recent Developments:

February 20, 2024— Kinaxis® Inc. the leading provider of supply chain management solutions, today announced the expansion of its PartnerLink program to better equip partners to drive end-to-end supply chain orchestration for our joint customers. As new levels of volatility and uncertainty spur unprecedented demand for digital transformation, businesses need access to solutions to deliver agility, predictability and intelligence at an accelerated pace.

February 20, 2024 — Enterprise Communications Platform Bringing real-time communications to its suite of industry cloud applications, Oracle today announced the Enterprise Communications Platform (ECP). By seamlessly connecting Oracle industry applications to networks and IoT devices to extend their value, ECP enables organizations to reimagine how they do business.

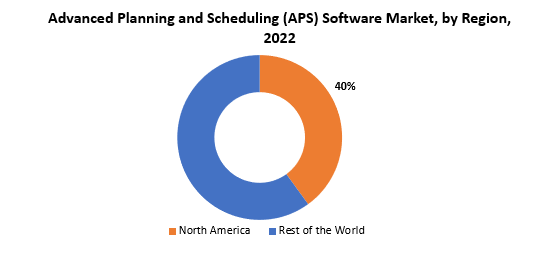

Regional Analysis

North America and Europe emerge as the dominant regions in the Advanced Planning and Scheduling (APS) software market. Renowned for their technological prowess and industrial advancement, these regions witness widespread adoption of APS solutions across diverse sectors. In North America, particularly in the United States, a robust ecosystem of APS software vendors and users thrives, fueled by a dynamic manufacturing landscape spanning industries like automotive, aerospace, and electronics. The region’s advanced infrastructure and emphasis on operational efficiency fuel the demand for APS solutions. Additionally, initiatives around supply chain optimization and digital transformation further propel APS adoption. Likewise, Europe boasts a mature APS software market, with countries such as Germany, the United Kingdom, and France leading the charge. Renowned for engineering excellence, these nations foster an environment conducive to APS software adoption.

Factors such as stringent regulations, rising labor costs, and global competition incentivize European manufacturers to invest in APS technologies for enhanced productivity and customer service. While North America and Europe currently dominate, regions like Asia-Pacific are witnessing rapid growth and are poised to become significant players. With nations like China, Japan, and South Korea investing heavily in industrial automation and digitalization, the APS software market is expected to expand globally. Overall, North America and Europe hold sway in the APS software market, underpinned by technological advancement and industrial maturity. However, the evolving global manufacturing landscape presents opportunities for growth and expansion across regions in the APS software market.

Target Audience for Advanced Planning and Scheduling (APS) Software Market

- Government and Regulatory Bodies

- Investors and Financial Institutions

- Research and Consulting Firms

- Photography and Videography Enthusiasts

- Marketing and Advertising Agencies

- Industry Associations and Organizations

Segments Covered in the Advanced Planning and Scheduling (APS) Software Market Report

Advanced Planning and Scheduling (APS) Software Market by Type

- Cloud Based

- Web Based

Advanced Planning and Scheduling (APS) Software Market by Application

- Large Enterprises

- SMEs

Advanced Planning and Scheduling (APS) Software Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Advanced Planning and Scheduling (APS) Software Market over the next 7 years?

- Who are the key market participants Advanced Planning and Scheduling (APS) Software, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Advanced Planning and Scheduling (APS) Software Market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Advanced Planning and Scheduling (APS) Software Market?

- What is the current and forecasted size and growth rate of the global Advanced Planning and Scheduling (APS) Software Market?

- What are the key drivers of growth in the Advanced Planning and Scheduling (APS) Software Market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Advanced Planning and Scheduling (APS) Software Market?

- What are the technological advancements and innovations in the Advanced Planning and Scheduling (APS) Software Market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Advanced Planning and Scheduling (APS) Software Market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Advanced Planning and Scheduling (APS) Software Market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET OUTLOOK

- GLOBAL ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE, 2020-2030, (USD MILLION)

- CLOUD BASED

- WEB BASED

- GLOBAL ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION, 2020-2030, (USD MILLION)

- LARGE ENTERPRISES

- SMES

- GLOBAL ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY REGION, 2020-2030, (USD MILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ANAPLAN, INC.

- ASPEN TECHNOLOGY, INC.

- DASSAULT SYSTÈMES

- DEMAND SOLUTIONS

- EPICOR SOFTWARE CORPORATION

- HIGHJUMP

- INFOR

- JDA SOFTWARE

- JOHN GALT SOLUTIONS

- KINAXIS INC.

- LLAMASOFT

- NETSUITE INC.

- ORACLE CORPORATION

- PLEX SYSTEMS

- QUINTIQ

- SAP SE

- SIEMENS AG

- SLIMSTOCK

- SYSPRO

- TOOLSGROUP *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 2 GLOBAL ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 3 GLOBAL ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY REGION (USD MILLION) 2020-2030

TABLE 4 NORTH AMERICA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 5 NORTH AMERICA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 6 NORTH AMERICA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 7 US ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 8 US ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 9 CANADA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 10 CANADA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 11 MEXICO ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 12 MEXICO ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 13 SOUTH AMERICA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 14 SOUTH AMERICA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 15 SOUTH AMERICA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 16 BRAZIL ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 17 BRAZIL ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 18 ARGENTINA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 19 ARGENTINA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 20 COLOMBIA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 21 COLOMBIA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 22 REST OF SOUTH AMERICA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 23 REST OF SOUTH AMERICA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 24 ASIA-PACIFIC ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 25 ASIA-PACIFIC ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 26 ASIA-PACIFIC ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 27 INDIA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 28 INDIA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 29 CHINA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 30 CHINA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 31 JAPAN ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 32 JAPAN ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 33 SOUTH KOREA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 34 SOUTH KOREA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 35 AUSTRALIA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 36 AUSTRALIA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 37 SOUTH-EAST ASIA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 38 SOUTH-EAST ASIA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 39 REST OF ASIA PACIFIC ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 40 REST OF ASIA PACIFIC ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 41 EUROPE ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 42 EUROPE ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 43 EUROPE ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 44 GERMANY ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 45 GERMANY ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 46 UK ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 47 UK ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 48 FRANCE ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 49 FRANCE ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 50 ITALY ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 51 ITALY ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 52 SPAIN ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 53 SPAIN ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 54 RUSSIA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 55 RUSSIA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 56 REST OF EUROPE ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 57 REST OF EUROPE ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 58 MIDDLE EAST AND AFRICA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 59 MIDDLE EAST AND AFRICA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 60 MIDDLE EAST AND AFRICA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 61 UAE ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 62 UAE ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 63 SAUDI ARABIA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 64 SAUDI ARABIA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 65 SOUTH AFRICA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 66 SOUTH AFRICA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 67 REST OF MIDDLE EAST AND AFRICA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 68 REST OF MIDDLE EAST AND AFRICA ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION (USD MILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE, USD MILLION, 2022-2030

FIGURE 9 GLOBAL ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION, USD MILLION, 2022-2030

FIGURE 10 GLOBAL ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY REGION, USD MILLION, 2022-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY TYPE, USD MILLION,2022

FIGURE 13 GLOBAL ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY APPLICATION, USD MILLION,2022

FIGURE 14 GLOBAL ADVANCED PLANNING AND SCHEDULING (APS) SOFTWARE MARKET BY REGION, USD MILLION,2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 ANAPLAN, INC.: COMPANY SNAPSHOT

FIGURE 17 ASPEN TECHNOLOGY, INC.: COMPANY SNAPSHOT

FIGURE 18 DASSAULT SYSTÈMES: COMPANY SNAPSHOT

FIGURE 19 DEMAND SOLUTIONS: COMPANY SNAPSHOT

FIGURE 20 EPICOR SOFTWARE CORPORATION: COMPANY SNAPSHOT

FIGURE 21 HIGHJUMP: COMPANY SNAPSHOT

FIGURE 22 INFOR: COMPANY SNAPSHOT

FIGURE 23 JDA SOFTWARE: COMPANY SNAPSHOT

FIGURE 24 JOHN GALT SOLUTIONS: COMPANY SNAPSHOT

FIGURE 25 KINAXIS INC.: COMPANY SNAPSHOT

FIGURE 26 LLAMASOFT : COMPANY SNAPSHOT

FIGURE 27 NETSUITE INC. : COMPANY SNAPSHOT

FIGURE 28 ORACLE CORPORATION: COMPANY SNAPSHOT

FIGURE 29 PLEX SYSTEMS: COMPANY SNAPSHOT

FIGURE 30 QUINTIQ (A SUBSIDIARY OF DASSAULT SYSTÈMES): COMPANY SNAPSHOT

FIGURE 31 SAP SE: COMPANY SNAPSHOT

FIGURE 32 SIEMENS AG: COMPANY SNAPSHOT

FIGURE 33 SLIMSTOCK: COMPANY SNAPSHOT

FIGURE 34 SYSPRO: COMPANY SNAPSHOT

FIGURE 35 TOOLSGROUP: COMPANY SNAPSHOT

FAQ

The global advanced planning and scheduling (APS) software market size is projected to grow from USD 701.6 million in 2023 to USD 1324.31 million by 2030, exhibiting a CAGR of 16.2% during the forecast period.

North America accounted for the largest market in the advanced planning and scheduling software market.

Anaplan, Inc., Aspen Technology, Inc.,Dassault Systèmes, Demand Solutions, Epicor Software Corporation, HighJump ,Infor, JDA Software ,John Galt Solutions, Kinaxis Inc., LLamasoft ,NetSuite Inc. and Others.

The APS software industry is expanding globally, with increased usage across a wide range of sectors and geographic locations. Emerging markets, in particular, are seeing rapid expansion as manufacturers strive to modernize their processes and increase their competitiveness in the global marketplace.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.