REPORT OUTLOOK

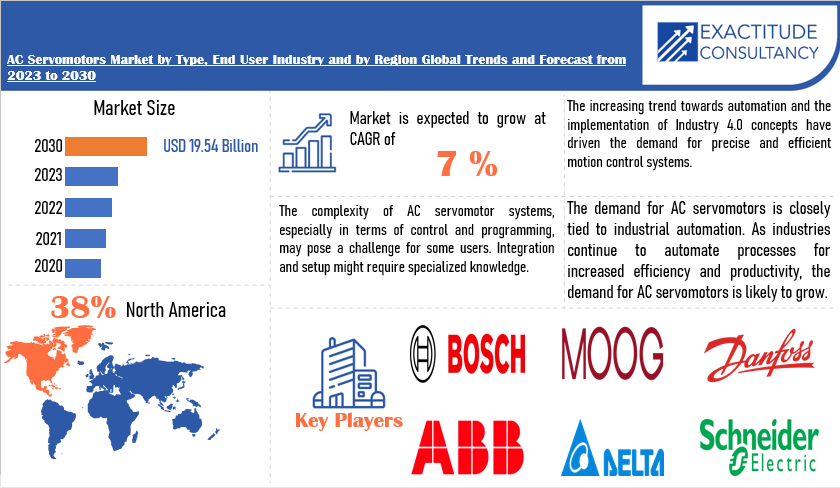

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 19.54 Billion by 2030 | 40 % | North America |

| by Type | by End User |

|---|---|

|

|

SCOPE OF THE REPORT

AC Servomotors Market Overview

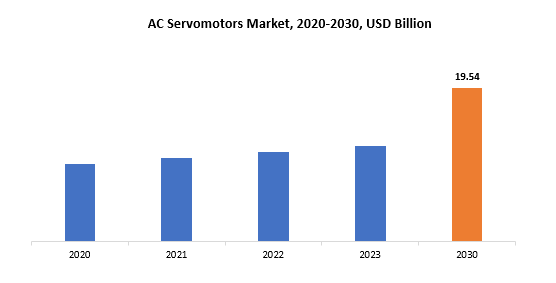

The global AC Servomotors market is anticipated to grow from USD 12.17 Billion in 2023 to USD 19.54 Billion by 2030, at a CAGR of 40 % during the forecast period.

AC servomotors are specialized motors used in industrial machinery, robotics, and automation systems, among other applications, that require precise control and efficient operation. Servomotors, as opposed to ordinary AC motors, have sophisticated control systems and sensors that allow them to precisely position or move industrial parts with extreme responsiveness. The remarkable accuracy with which AC servomotors can retain a given position or velocity makes them indispensable components in applications where dependability and precision are critical. These motors are frequently used in automated systems, robotics, and CNC machining, among other applications where precise motion control is necessary for best results.

The growing need for automation in a variety of industries has led to a notable expansion in the market for AC servomotors. The demand for dependable and high-performing servomotors has increased as industrial processes grow more intricate and exact. Furthermore, the increased functionality and adaptability of AC servomotors can be attributed to technological developments in sensor technology, control algorithms, and communication protocols. The market for AC servomotors is expected to grow significantly due to the growing adoption of automation and robotics in the automotive, aerospace, and electronics industries, which aim to increase production and efficiency. Moreover, it is anticipated that the continuous trend towards Industry 4.0, which is defined by the incorporation of smart technologies and connectivity in production processes, would increase demand for AC servomotors.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Type, End User Industry and Region |

| By Type |

|

| By End User Industry |

|

|

By Region

|

|

AC Servomotors Market Segmentation Analysis

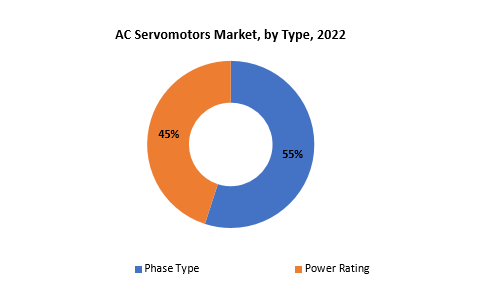

The global AC Servomotors market is divided into three type, end user industry and region. By component it is divided as Phase Type, Power Rating. Industrial automation, Semiconductor and electronics, Automotive, Food and beverage, Healthcare holds the largest market share. Phase type—an electrical input configuration—is one of the key components used to classify components in the market for AC servomotors. Typically, three-phase or single-phase AC servomotor variants are available. In industrial situations where more power and efficiency are required, three-phase servomotors are favored over single-phase servomotors, which are appropriate for applications where a simpler power source is available. Phase type selection is based on the particular needs of the application, and market segmentation guarantees that a wide variety of electrical configurations can be served.

The power rating of the AC servomotors serves as the basis for yet another important component classification. The amount of electrical power that a motor can manage and transform into mechanical output is known as its power rating. To satisfy the various demands of various applications, AC servomotors are available in a range of power ratings. High-power servomotors are made for demanding industrial processes that require reliable performance, whilst low-power servomotors are appropriate for smaller-scale jobs and applications with lesser energy requirements. The efficiency and efficacy of the entire arrangement are increased by this segmentation, which enables customers to select the proper power rating based on the unique power requirements of their systems. A more comprehensive view of the AC servomotors market is made possible by these component categories based on phase type and power rating.

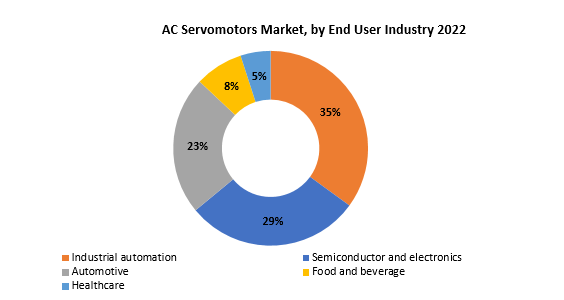

By end user industry it is divided into Industrial automation, Semiconductor and electronics, Automotive, Food and beverage, Healthcare. In this Industrial automation holds the largest market share. One of the main end markets for AC servomotors is industrial automation. These motors are essential to the precise movement and control of automated manufacturing operations. Conveyor systems, pick-and-place devices, robotic arms, and other automated machinery are examples of applications. In industrial automation applications, the great precision and responsiveness of AC servomotors lead to increased efficiency and accuracy. Precision motion control is critical to the semiconductor and electronics industries’ manufacturing operations, including wafer handling, precise cutting, and equipment testing. In these applications, AC servomotors are widely used to ensure precise positioning and movement of parts that are essential to the manufacturing of semiconductors and electronic devices.

AC servomotors are used in the automotive sector for a variety of purposes, such as precision control in automobile production processes and robotic assembly lines. By automating processes like welding, painting, and assembling, these motors improve manufacturing efficiency and quality assurance. Automotive testing equipment also uses AC servomotors. AC servomotors are used in conveyor systems, packaging machines, and other automation solutions in the food and beverage industry. Their accuracy and dependability support precise process control in filling, sealing, and packaging. In this industry, hygienic design and adherence to food safety regulations are crucial factors.

AC Servomotors Market Dynamics

Driver

AC servomotors are known for their high efficiency and precise control, which makes them attractive in applications where energy efficiency is a priority.

Because AC servomotors can convert a significant portion of electrical input power into mechanical output power, they frequently have excellent efficiency ratings. This efficiency is essential for cutting down on energy use and lowering heat production while the machine is operating. Accurate torque, position, and speed control is provided by AC servomotors. This accuracy makes it possible to control motion precisely and effectively in a variety of applications. An important factor in overall energy efficiency is the capacity to react fast and precisely to variations in load or speed requirements. Variable speed operation is a feature of AC servomotors, which allow them to adapt to the demands of various tasks. By adjusting the motor’s output to the required load, this function allows for energy savings in situations where constant speed operation is not required.

Regenerative braking refers to the ability of certain AC servomotors to recover and repurpose energy during braking or deceleration. The fact that this feature restores electricity to the electrical system instead of releasing it as heat helps to reduce energy consumption. Less energy is lost as heat thanks to the accurate control and high efficiency of AC servomotors. Reducing heat generation not only saves energy but also contributes to a cooler working environment—a factor that might be significant in some applications. Energy efficiency is a common consideration in the design of AC servomotors, leading manufacturers to include advanced technologies such enhanced magnet materials, minimized friction, and optimized winding patterns. The overall energy savings are facilitated by these design considerations.

Restraint

AC servomotors can be relatively expensive compared to other types of motors, which may limit their adoption in cost-sensitive applications.

High-performance materials, feedback mechanisms, and precise control systems are just a few examples of the cutting-edge technologies that are frequently used in AC servomotors. Although these qualities add to their greater performance, they may also raise production costs. The exceptional precision, accuracy, and dynamic reactivity of AC servomotors are well known. Higher production costs may result from the need for more complex designs and tighter manufacturing tolerances in order to achieve these performance attributes. Encoders and resolvers are common feedback devices used by AC servomotors to provide accurate position and speed feedback. The total cost of the motor system may increase due to the cost of these feedback devices.

In order to satisfy particular needs, some applications could call for special customisation of AC servomotors. Costs associated with customization may be higher than those of off-the-shelf motor alternatives. The performance and longevity of AC servomotors are influenced by the materials they are made of as well as their construction. Superior building and material quality may raise production costs. Research and development expenditures are necessary to create state-of-the-art AC servomotor technology, and these costs are frequently reflected in product prices.

Opportunities

AC servomotors are utilized in various applications within the renewable energy sector, such as wind turbines and solar tracking systems.

AC servomotors are used in wind turbines to control the pitch of the turbine blades. This control is necessary to ensure effective energy capture, prevent damage to the turbine during strong wind events, and optimize the angle of the blades in response to changing wind conditions. Wind turbines also use AC servomotors in their yaw control systems. In order to maximize energy extraction, this entails turning the entire turbine so that it faces the wind. In solar power plants and installations, solar tracking systems use AC servomotors to move mirrors or solar panels in order to track the sun’s movement. By optimizing solar panel exposure to sunlight throughout the day, this tracking increases energy generation.

Solar panels may be tilted and elevated to receive the most amount of sunshine at different times of the day and year thanks to the usage of AC servomotors. AC servomotors are essential parts of wind turbine and solar tracking functions in various renewable energy projects, particularly hybrid systems that mix solar and wind power. For these renewable energy applications, AC servomotor accuracy and precision are essential. Precise control makes it possible to position solar panels or turbine blades optimally, which improves the renewable energy system’s overall performance and efficiency. In these applications, reliability is critical since any errors in positioning or control can have a direct effect on the amount of energy produced and the equipment’s lifespan.

AC Servomotors Market Trends

-

The continued evolution of Industry 4.0 and the emphasis on smart manufacturing have been driving the demand for AC Servomotors. For automated industrial processes to be controlled precisely and effectively, these motors are essential.

-

One of the main trends in the market for AC servomotors is still energy economy. Energy-efficient solutions are becoming more and more important for manufacturers and end users to adopt in order to satisfy sustainability goals and save operating costs.

-

AC Servomotors are increasingly integrating Internet of Things (IoT) and connection functions. This improves overall system performance and lowers downtime by enabling real-time monitoring, diagnostics, and predictive maintenance.

-

Demand for AC Servomotors, particularly in electric propulsion systems, has increased due to the increasing use of electric vehicles (EVs).

-

The increased responsiveness and performance of AC servomotors are a result of continuous improvements in motor control technology, which also include the use of sophisticated algorithms and control systems. This is especially crucial for applications requiring great precision and fast reaction times.

-

End users are looking more and more for AC Servomotor solutions that are specifically suited to their needs. In response, producers are providing a variety of goods with different features to satisfy the wide range of demands from sectors including manufacturing, robotics, and aerospace.

-

The need for AC Servomotors that can function flawlessly with these collaborative systems is being driven by the emergence of collaborative robots, or cobots. These motors are necessary in human-robot collaborative contexts to achieve the necessary safety and precision.

Competitive Landscape

The competitive landscape of the AC Servomotors market was dynamic, with several prominent companies competing to provide innovative and advanced AC Servomotors solutions.

- ABB Ltd

- Rockwell Automation, Inc.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Yaskawa Electric Corporation

- Bosch Rexroth AG

- Parker Hannifin Corporation

- Emerson Electric Co.

- Nidec Corporation

- Danfoss A/S

- Moog Inc.

- Fuji Electric Co., Ltd.

- Delta Electronics, Inc.

- Beckhoff Automation GmbH & Co. KG

- Kollmorgen Corporation

- Oriental Motor Co., Ltd.

- Lenze SE

- Bonfiglioli Riduttori S.p.A.

- WEG S.A.

Recent Developments:

January 29, 2024: ABB and Norwegian Cruise Line Holdings (NCLH) have signed a long-term partnership agreement to accelerate the decarbonization and digitalization of the Norwegian Cruise Line (NCL) fleet. Targeting increased safety and efficiency, the agreement covers 14 existing ships and a further four vessels due for delivery from 2025 to 2028.

May 15, 2023: Bosch Limited, a leading supplier of technology and services, and pioneers in accident research, today released India’s first comprehensive study analysing pedestrian behaviour in India during the 7th UN Road Safety Week. The report aims to understand the characteristics of pedestrian crashes in India and to identify counter-measures that can improve road safety in India. The report reveals that pedestrian crashes are a major safety concern in India, with about one in every ten traffic-related fatalities in the country being a pedestrian. In 2021, The Ministry of Road Transport & Highways (MoRTH) registered 68,053 pedestrian crashes in 2021, which contributed to 16.5% of the total accidents that year.

Regional Analysis

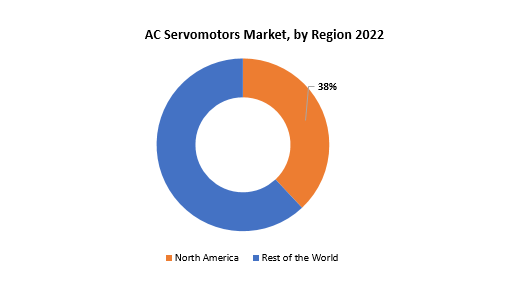

North America accounted for the largest market in the AC Servomotors market. North America accounted for 38% of the worldwide market value. The requirement for precise control in a variety of applications, growing industrial automation, and the adoption of cutting-edge manufacturing technologies have all contributed to the North American AC Servomotors market’s steady rise. The automotive, aerospace, electronics, and industrial sectors are among the major businesses that are heavily represented in the region and use AC servomotors. The focus on energy efficiency and the expanding trend toward the adoption of clever and energy-efficient solutions are some of the factors propelling the market in North America. AC Servomotors are ideal for applications where energy management is a top concern because of their great efficiency and ability to deliver precise control.

The need for AC servomotors is largely driven by the automobile industry, since these motors are widely utilized in robotic systems, assembly lines, and other automated operations in manufacturing facilities. The market is expanding as a result of the growing popularity of electric vehicles (EVs) and the advancement of advanced driver-assistance systems (ADAS). Furthermore, the need for AC Servomotors has been significantly fueled by the aerospace and defense sector in North America, particularly in applications such as unmanned aerial vehicles (UAVs), precision-guided weapons, and aerospace manufacturing processes. The market for AC servomotors in North America has seen technical improvements recently, such as the incorporation of smart features, communication protocols, and Internet of Things (IoT) connectivity.

Target Audience for AC Servomotors Market

- Industrial Automation Companies

- Robotics Manufacturers

- Aerospace Industry

- Automotive Manufacturers

- Energy Sector

- Packaging Machinery Manufacturers

- Medical Equipment Manufacturers

- Printing Industry

- Textile Machinery Manufacturers

- Material Handling Equipment Manufacturers

- HVAC System Manufacturers

- Defense and Military Applications

Import & Export Data for AC Servomotors Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the AC Servomotors market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

-

Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global AC Servomotors market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

-

Market players: gain insights into the leading players driving the AC Servomotors trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

-

Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

-

Product breakdown: by segmenting data based on AC Servomotors types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids government in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the AC Servomotors Market Report

AC Servomotors Market by Type, 2020-2030, (USD Billion) (Thousand Units)

- Phase Type

- Power Rating

AC Servomotors Market by End User Industry, 2020-2030, (USD Billion) (Thousand Units)

- Industrial automation

- Semiconductor and electronics

- Automotive

- Food and beverage

- Healthcare

AC Servomotors Market by Region, 2020-2030, (USD Billion) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the AC Servomotors market over the next 7 years?

- Who are the major players in the AC Servomotors market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the AC Servomotors market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the AC Servomotors market?

- What is the current and forecasted size and growth rate of the global AC Servomotors market?

- What are the key drivers of growth in the AC Servomotors market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the AC Servomotors market?

- What are the technological advancements and innovations in the AC Servomotors market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the AC Servomotors market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the AC Servomotors market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AC SERVOMOTORS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AC SERVOMOTORS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AC SERVOMOTORS MARKET OUTLOOK

- GLOBAL AC SERVOMOTORS MARKET BY TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- PHASE TYPE

- POWER RATING

- GLOBAL AC SERVOMOTORS MARKET BY END USER INDUSTRY, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- INDUSTRIAL AUTOMATION

- SEMICONDUCTOR AND ELECTRONICS

- AUTOMOTIVE

- FOOD AND BEVERAGE

- HEALTHCARE

- GLOBAL AC SERVOMOTORS MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, END USER INDUSTRY OFFERED, RECENT DEVELOPMENTS)

- ABB LTD

- ROCKWELL AUTOMATION, INC.

- SCHNEIDER ELECTRIC SE

- MITSUBISHI ELECTRIC CORPORATION

- YASKAWA ELECTRIC CORPORATION

- BOSCH REXROTH AG

- PARKER HANNIFIN CORPORATION

- EMERSON ELECTRIC CO.

- NIDEC CORPORATION

- DANFOSS A/S

- MOOG INC.

- FUJI ELECTRIC CO., LTD.

- DELTA ELECTRONICS, INC.

- BECKHOFF AUTOMATION GMBH & CO. KG

- KOLLMORGEN CORPORATION

- ORIENTAL MOTOR CO., LTD.

- LENZE SE

- BONFIGLIOLI RIDUTTORI S.P.A.

- WEG S.A. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 4 GLOBAL AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL AC SERVOMOTORS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL AC SERVOMOTORS MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA AC SERVOMOTORS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA AC SERVOMOTORS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 13 US AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 14 US AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 15 US AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 16 US AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 18 CANADA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 20 CANADA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 22 MEXICO AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 24 MEXICO AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA AC SERVOMOTORS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA AC SERVOMOTORS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 32 BRAZIL AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 34 BRAZIL AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 36 ARGENTINA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 38 ARGENTINA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 40 COLOMBIA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 42 COLOMBIA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC AC SERVOMOTORS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC AC SERVOMOTORS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 54 INDIA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 56 INDIA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 58 CHINA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 60 CHINA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 62 JAPAN AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 64 JAPAN AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE AC SERVOMOTORS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE AC SERVOMOTORS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 84 EUROPE AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 86 EUROPE AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 88 GERMANY AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 90 GERMANY AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 91 UK AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 92 UK AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 93 UK AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 94 UK AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 96 FRANCE AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 98 FRANCE AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 100 ITALY AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 102 ITALY AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 104 SPAIN AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 106 SPAIN AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 108 RUSSIA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 110 RUSSIA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA AC SERVOMOTORS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA AC SERVOMOTORS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 121 UAE AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 122 UAE AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 123 UAE AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 124 UAE AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA AC SERVOMOTORS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA AC SERVOMOTORS MARKET BY END USER INDUSTRY (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2020-2030

FIGURE 11 GLOBAL AC SERVOMOTORS MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL AC SERVOMOTORS MARKET BY TYPE (USD BILLION) 2022

FIGURE 14 GLOBAL AC SERVOMOTORS MARKET BY END USER INDUSTRY (USD BILLION) 2022

FIGURE 16 GLOBAL AC SERVOMOTORS MARKET BY REGION (USD BILLION) 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 ABB LTD: COMPANY SNAPSHOT

FIGURE 19 ROCKWELL AUTOMATION, INC.: COMPANY SNAPSHOT

FIGURE 20 SCHNEIDER ELECTRIC SE: COMPANY SNAPSHOT

FIGURE 21 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

FIGURE 22 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

FIGURE 23 BOSCH REXROTH AG: COMPANY SNAPSHOT

FIGURE 24 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT

FIGURE 25 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

FIGURE 26 NIDEC CORPORATION: COMPANY SNAPSHOT

FIGURE 27 DANFOSS A/S: COMPANY SNAPSHOT

FIGURE 28 MOOG INC.: COMPANY SNAPSHOT

FIGURE 29 FUJI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

FIGURE 30 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

FIGURE 31 BECKHOFF AUTOMATION GMBH & CO. KG: COMPANY SNAPSHOT

FIGURE 32 KOLLMORGEN CORPORATION: COMPANY SNAPSHOT

FIGURE 33 ORIENTAL MOTOR CO., LTD.: COMPANY SNAPSHOT

FIGURE 34 LENZE SE: COMPANY SNAPSHOT

FIGURE 35 BONFIGLIOLI RIDUTTORI S.P.A.: COMPANY SNAPSHOT

FIGURE 36 WEG S.A.: COMPANY SNAPSHOT

FAQ

The global AC Servomotors market is anticipated to grow from USD 12.17 Billion in 2023 to USD 19.54 Billion by 2030, at a CAGR of 40 % during the forecast period.

North America accounted for the largest market in the AC Servomotors market. North America accounted for 38 % market share of the global market value.

ABB Ltd,Rockwell Automation, Inc.,Schneider Electric SE,Mitsubishi Electric Corporation,Yaskawa Electric Corporation,Bosch Rexroth AG,Parker Hannifin Corporation,Emerson Electric Co.,Nidec Corporation,Danfoss A/S,WEG S.A.

The increased responsiveness and performance of AC servomotors are a result of continuous improvements in motor control technology, which also include the use of sophisticated algorithms and control systems. This is especially crucial for applications requiring great precision and fast reaction times. End users are looking more and more for AC Servomotor solutions that are specifically suited to their needs. In response, producers are providing a variety of goods with different features to satisfy the wide range of demands from sectors including manufacturing, robotics, and aerospace.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.