REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 1494.93 Billion by 2030 | 14.50 % | North America |

| by Deployment | by Channel | Type of User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Advertising Platform Market Overview

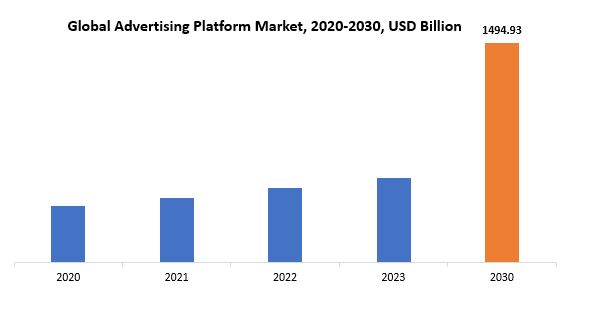

The global advertising platform market is anticipated to grow from USD 579.40 Billion in 2023 to USD 1494.93 Billion by 2030, at a CAGR of 14.50 % during the forecast period.

An advertising platform functions as a comprehensive digital ecosystem that streamlines the creation, management, and optimization of online advertising campaigns. Serving as a centralized hub, it interconnects advertisers, publishers, and various stakeholders within the digital advertising landscape. Through these platforms, businesses can implement targeted and strategic marketing initiatives across diverse channels such as display advertising, social media, search engines, native advertising, and video platforms.

These platforms often integrate sophisticated tools for audience targeting, analytics, and real-time bidding, enabling advertisers to precisely reach their desired demographics. Simultaneously, on the publisher side, these platforms provide opportunities to monetize digital spaces by facilitating the sale of ad inventory. At the core of advertising platforms is their capacity to automate and streamline the entire advertising process, promoting efficiency, data-driven decision-making, and the optimization of ad performance. With ongoing technological advancements, advertising platforms continue to be instrumental in shaping the digital marketing landscape, equipping businesses with essential tools to navigate and thrive in the dynamic and competitive online advertising realm.

The proliferation of digitalization and the widespread adoption of online channels for various activities contribute significantly. As consumers spend more time online, advertisers seek advanced platforms to target and engage their audiences effectively. The increasing complexity of the digital advertising ecosystem necessitates sophisticated solutions, and advertising platforms serve as comprehensive tools to manage the intricacies of online campaigns. These platforms offer features such as real-time bidding, audience segmentation, and analytics, providing advertisers with the capabilities to refine their strategies.

The rise of e-commerce and the digital economy amplifies the demand for targeted advertising. Advertisers leverage advertising platforms to reach specific demographics, enhance user engagement, and drive conversions, especially in the competitive realm of online commerce. Furthermore, the prevalence of data-driven decision-making plays a pivotal role. Advertising platforms harness data analytics to offer insights into consumer behavior, allowing advertisers to make informed and strategic choices. The integration of artificial intelligence and machine learning enhances targeting precision and optimization capabilities.

Furthermore, the prevalence of data-driven decision-making plays a pivotal role. Advertising platforms harness data analytics to offer insights into consumer behavior, allowing advertisers to make informed and strategic choices. The integration of artificial intelligence and machine learning enhances targeting precision and optimization capabilities. The dynamic nature of consumer preferences and the need for personalized marketing contribute to the adoption of advertising platforms. These platforms empower advertisers to tailor their messages based on individual preferences, thereby enhancing the overall effectiveness of campaigns.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Deployment Model, Channel, Size and Type of User and Region |

|

By Deployment Model |

|

|

By Channel |

|

|

By Size and Type of User |

|

|

By Region

|

|

Advertising Platform Market Segmentation Analysis

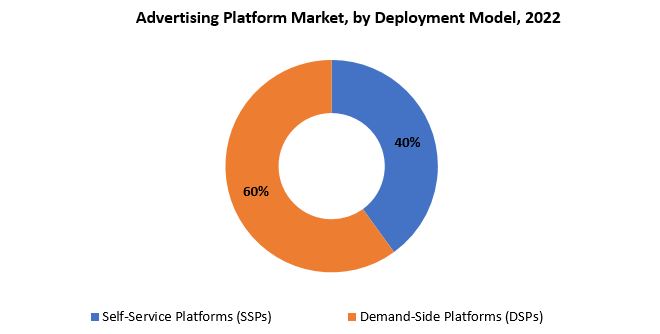

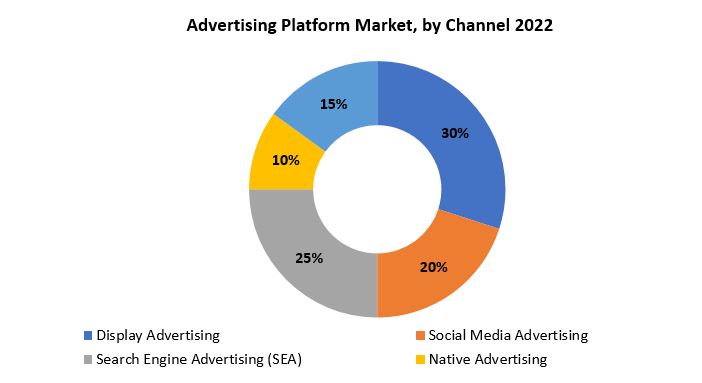

The global Advertising Platform market is divided into three segments, deployment model, Size and Type of User, Channel and region. By deployment model the market is divided Self-Service Platforms (SSPs), Demand-Side Platforms (DSPs). By Channel the market is classified into Display Advertising, Social Media Advertising, Search Engine Advertising (SEA), Native Advertising, Video Advertising. By Enterprise Platforms, Small and Medium-Sized Business (SMB) Platforms, Agency Trading Desks (ATDs).

Based on deployment model, demand-side platforms (DSPs) segment dominating in the advertising platform market. DSPs play a pivotal role in automating and optimizing the buying process for advertisers, providing a centralized platform to purchase ad inventory across various channels in real-time. This level of automation ensures efficient targeting, allowing advertisers to reach their desired audiences with precision and speed. DSPs integrate sophisticated algorithms and data-driven insights, enabling advertisers to make informed decisions about ad placements and bid values.

The key strengths of DSPs lie in their ability to streamline and simplify the complexities of programmatic advertising. Advertisers leverage DSPs to manage and optimize multiple campaigns simultaneously, maximizing reach and impact. The granular targeting capabilities offered by DSPs enable advertisers to define specific audience segments, refine their strategies, and allocate budgets effectively. Moreover, DSPs facilitate transparency and control in the ad buying process. Advertisers have access to real-time analytics, performance metrics, and campaign insights, empowering them to assess the effectiveness of their campaigns and make data-driven adjustments in real-time. This transparency enhances accountability and ensures a more accountable return on investment (ROI) for advertisers.

Based on channel, display advertising segment dominating in the advertising platform market. Display advertising involves the visual presentation of promotional content across various online channels, including websites, social media platforms, and apps. Advertising platforms specializing in display advertising play a pivotal role in facilitating the creation, management, and optimization of visual campaigns. The dominance of display advertising within advertising platforms is the visual appeal and engagement it offers. Display ads leverage compelling visuals, graphics, and multimedia elements to capture the attention of the target audience. This visual richness enables advertisers to convey their brand messages more creatively and effectively, fostering brand awareness and recognition.

Additionally, the versatility of display advertising contributes to its prominence. Advertisers can deploy a diverse range of ad formats, including banner ads, rich media ads, interstitials, and video ads, tailoring their approach to suit specific campaign goals. The flexibility to experiment with different formats allows advertisers to craft visually appealing and impactful campaigns that resonate with their target audience. Furthermore, the ability to precisely target and retarget audiences enhances the effectiveness of display advertising. Advertising platforms specializing in display ads leverage advanced targeting mechanisms, such as demographic segmentation, behavioral targeting, and contextual targeting, to ensure that ads are delivered to the most relevant audience segments. The integration of real-time bidding (RTB) further optimizes the ad buying process, enabling advertisers to bid for ad impressions in real-time based on the specific criteria of their target audience.

Advertising Platform Market Dynamics

Driver

The more users spending time online and on mobile devices, the demand for online advertising through platforms increases.

The escalating demand for online advertising platforms is intricately linked to the burgeoning trend of users spending an increasing amount of time online, particularly on mobile devices. As digital technology permeates every facet of modern life, individuals find themselves immersed in online activities, from social media engagement to content consumption and e-commerce transactions. This shift in consumer behavior creates a vast and diverse digital landscape, providing advertisers with a dynamic platform to connect with their target audiences. Online advertising platforms play a pivotal role in capitalizing on this trend by offering a centralized and efficient means for advertisers to deploy targeted campaigns across various digital channels.

With users seamlessly transitioning between websites, apps, and social media platforms, advertisers recognize the need for a comprehensive and integrated approach. These platforms facilitate precise audience targeting, leveraging data analytics and user behavior insights to deliver personalized and relevant advertisements. Moreover, the mobile-centric nature of contemporary online interactions emphasizes the importance of responsive and mobile-friendly ad formats, which advertising platforms adeptly provide. Advertisers, recognizing the immense potential to engage users where they spend a significant portion of their time, fuel the demand for online advertising platforms to ensure strategic and impactful digital marketing endeavors. As the digital realm continues to evolve, the symbiotic relationship between user behavior, online engagement, and the demand for advertising platforms solidifies, shaping the landscape of contemporary advertising strategies.

Restraint

Increasing user concerns about data privacy and regulations like GDPR and CCPA pose challenges for data collection and targeting practices.

The growing apprehensions among users regarding data privacy, coupled with the implementation of stringent regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), present substantial challenges for data collection and targeting practices in the realm of online advertising. Users are becoming more vigilant about how their personal information is handled, demanding greater transparency, and exercising increased control over their data. The GDPR and CCPA impose strict guidelines on businesses, requiring them to obtain explicit consent before collecting and processing user data and to provide clear information on how that data will be used.

For advertising platforms, this translates into a paradigm shift in data management practices. Traditional methods of extensive data collection for targeted advertising now face constraints, compelling platforms to adapt to privacy-centric approaches. Advertisers must navigate the intricate landscape of user consent, ensuring that data is collected ethically and in compliance with regulations. The challenge lies in finding innovative ways to deliver personalized and relevant content while respecting users’ privacy preferences and adhering to the evolving legal frameworks.

Opportunities

<

strong>The increasing number of connected devices like smart TVs and wearables creates new advertising opportunities and demands for platform adaptation.

The surge in connected devices, ranging from smart TVs to wearables, marks a transformative era in advertising, bringing forth both opportunities and challenges that call for platform adaptation. The widespread adoption of these devices has transformed user behavior, creating a multi-device ecosystem where individuals seamlessly move between various screens in their daily lives. This shift necessitates advertising platforms to evolve concurrently, adjusting to the distinctive characteristics and contexts of each device.

Smart TVs offer a larger canvas for immersive content, while wearables enable personalized and context-aware interactions. Platforms must adjust their strategies to leverage the potential of these devices, utilizing the generated data for highly targeted and contextually relevant ad experiences. This adaptation involves optimizing ad formats for diverse screen sizes and interfaces, along with creating innovative approaches to engage users across their interconnected digital environment. With the ongoing growth of the Internet of Things (IoT), advertising platforms face the challenge of navigating cross-device targeting complexities, ensuring a unified and smooth user experience.

Advertising Platform Market Trends

-

The continued growth of programmatic advertising remained a significant trend. Programmatic advertising, driven by automation and data-driven decision-making, allows advertisers to optimize targeting and efficiently manage ad placements.

-

Advertisers showed a growing interest in native advertising formats, which seamlessly blend with the content of the platform. Native ads tend to be less disruptive and more engaging for users.

-

Video content continued to gain popularity, leading to an increased focus on video advertising across various platforms. Short-form videos, in particular, witnessed widespread adoption.

-

With a surge in mobile device usage, advertising platforms increasingly prioritized a mobile-first approach. Advertisers sought to create ad formats that are mobile-friendly and offer a seamless experience on smaller screens.

-

Heightened concerns about data privacy led to an increased focus on compliance with regulations such as GDPR and CCPA. Advertisers and platforms worked on transparent data practices and obtaining user consent.

-

AI and machine learning played a crucial role in optimizing ad targeting, personalization, and overall campaign performance. Ad platforms leveraged AI to analyze data and make real-time adjustments.

Competitive Landscape

The competitive landscape of the advertising platform market was dynamic, with several prominent companies competing to provide innovative and advanced advertising platform solutions.

- net

- Snapchat Ads

- Epom

- Primis

- Microsoft Ads

- InMobi Audience Targeting

- Amazon Ads

- Spotify Ads

- Perpetua

- LinkedIn Ads

- AdRoll

- Apple Search Ads (ASA)

- Yahoo Ad Tech

- Twitter Business

- Taboola

- SXM Media

- Facebook (Meta)

- TikTok Ads

- ClickAdu

Recent Developments:

-

August 16, 2023: InMobi, a leading provider of content monetization and marketing technologies that help businesses fuel growth, announced the acquisition of Quantcast Choice, a consent management platform (CMP) designed to help publishers seamlessly align with the rapidly changing global privacy regulations.

-

October 18, 2023: – InMobi, a leading provider of marketing and monetization technologies in collaboration with Microsoft Advertising has unveiled key insights from its annual guide to seasonal digital marketing. The study, India’s 2023 Festive Trends Decoded revealed how brands can leverage the power of search and omnichannel solutions to create a unique marketing strategy and maximise their impact by better connecting with their audiences.

Regional Analysis

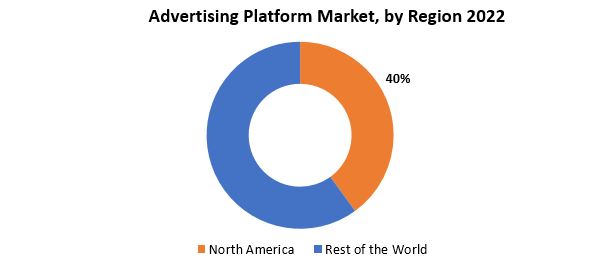

North America accounted for the largest market in the advertising platform market. North America accounted for 40 % market share of the global market value. North America has consistently stood as the epicenter of the advertising platform market, holding the largest share due to a confluence of factors that define its dominant position. The region’s advanced technological infrastructure, high internet penetration rates, and widespread digital literacy contribute significantly to the robust advertising ecosystem.

The United States, in particular, plays a pivotal role as a major hub for technology and advertising innovation. Leading global tech giants and advertising platforms are headquartered in the region, shaping the landscape with cutting-edge solutions and services. Moreover, North America boasts a flourishing e-commerce landscape, and the presence of numerous established and emerging businesses fuels the demand for sophisticated advertising tools. The region’s diverse consumer base and substantial spending power make it an attractive market for advertisers seeking to target specific demographics.

Additionally, North America’s stringent yet well-defined regulatory environment, including privacy standards and data protection laws, fosters a sense of trust among users, which is crucial for successful advertising endeavors. The continuous influx of investments in digital advertising technologies and the propensity for early adoption of novel trends further solidify North America’s position as the dominant force in the advertising platform market.

In Europe, a blend of established economies and emerging markets creates a vibrant ecosystem for advertising platforms. Countries like the United Kingdom, Germany, and France serve as major hubs for digital innovation, with a sophisticated advertising industry that emphasizes creativity and consumer engagement. The European market is characterized by a strong emphasis on data privacy and compliance, aligning with stringent regulations such as GDPR. This focus on user protection shapes the advertising strategies, with an increasing emphasis on transparent data practices and user consent.

Asia-Pacific stands as a dynamic and rapidly evolving market, fueled by the expansive digital transformation across countries like China, India, and Southeast Asian nations. The region is home to a massive and diverse consumer base, with varying levels of digital maturity. Mobile-first approaches dominate in Asia-Pacific, with a surge in smartphone adoption driving mobile advertising strategies. E-commerce, social media, and video content consumption play pivotal roles in shaping the advertising landscape across the region. In particular, the influence of tech giants in China and the innovation-driven markets in Southeast Asia contribute to the region’s dynamic nature.

Target Audience for Advertising Platform Market

- Market Researchers

- Business Analysts

- Advertising Industry Consultants

- Investment Analysts

- Advertising Platform Providers

- Government Agencies

- Academic Researchers

- Industry Associations

- Market Regulators

- Financial Institutions

Segments Covered in the Advertising Platform Market Report

Advertising Platform Market by Deployment Model

- Self-Service Platforms (SSPs)

- Demand-Side Platforms (DSPs)

Advertising Platform Market by Channel

- Display Advertising

- Social Media Advertising

- Search Engine Advertising (SEA)

- Native Advertising

- Video Advertising

Advertising Platform Market by Size and Type of User

- Enterprise Platforms

- Small and Medium-Sized Business (SMB) Platforms

- Agency Trading Desks (ATDs)

Advertising Platform Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the advertising platform market over the next 7 years?

- Who are the major players in the Advertising Platform market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the Advertising Platform market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Advertising Platform market?

- What is the current and forecasted size and growth rate of the global Advertising Platform market?

- What are the key drivers of growth in the Advertising Platform market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Advertising Platform market?

- What are the technological advancements and innovations in the Advertising Platform market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the advertising platform market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Advertising Platform market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ADVERTISING PLATFORM MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ADVERTISING PLATFORM MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- SIZE AND TYPE OF USER VALUE CHAIN ANALYSIS

- GLOBAL ADVERTISING PLATFORM MARKET OUTLOOK

- GLOBAL ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL, 2020-2030, (USD BILLION)

- SELF-SERVICE PLATFORMS (SSPS)

- DEMAND-SIDE PLATFORMS (DSPS)

- GLOBAL ADVERTISING PLATFORM MARKET BY CHANNEL, 2020-2030, (USD BILLION)

- DISPLAY ADVERTISING

- SOCIAL MEDIA ADVERTISING

- SEARCH ENGINE ADVERTISING (SEA)

- NATIVE ADVERTISING

- VIDEO ADVERTISING

- GLOBAL ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER, 2020-2030, (USD BILLION)

- ENTERPRISE PLATFORMS

- SMALL AND MEDIUM-SIZED BUSINESS (SMB) PLATFORMS

- AGENCY TRADING DESKS (ATDS)

- GLOBAL ADVERTISING PLATFORM MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- NET

- SNAPCHAT ADS

- EPOM

- PRIMIS

- MICROSOFT ADS

- INMOBI AUDIENCE TARGETING

- AMAZON ADS

- SPOTIFY ADS

- PERPETUA

- LINKEDIN ADS

- ADROLL

- APPLE SEARCH ADS (ASA)

- YAHOO AD TECH

- TWITTER BUSINESS

- TABOOLA

- SXM MEDIA

- FACEBOOK (META)

- TIKTOK ADS

- CLICKADU *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 2 GLOBAL ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 3 GLOBAL ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 4 GLOBAL ADVERTISING PLATFORM MARKET BY REGION (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA ADVERTISING PLATFORM MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 10 US ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 11 US ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 12 CANADA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 13 CANADA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 14 CANADA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 15 MEXICO ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 16 MEXICO ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 17 MEXICO ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA ADVERTISING PLATFORM MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 23 BRAZIL ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 24 BRAZIL ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 25 ARGENTINA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 26 ARGENTINA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 27 ARGENTINA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 28 COLOMBIA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 29 COLOMBIA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 30 COLOMBIA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC ADVERTISING PLATFORM MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 39 INDIA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 40 INDIA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 41 CHINA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 42 CHINA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 43 CHINA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 44 JAPAN ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 45 JAPAN ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 46 JAPAN ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 59 EUROPE ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 60 EUROPE ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 61 EUROPE ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 62 EUROPE ADVERTISING PLATFORM MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 64 GERMANY ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 65 GERMANY ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 66 UK ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 67 UK ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 68 UK ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 69 FRANCE ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 70 FRANCE ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 71 FRANCE ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 72 ITALY ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 73 ITALY ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 74 ITALY ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 75 SPAIN ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 76 SPAIN ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 77 SPAIN ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 78 RUSSIA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 79 RUSSIA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 80 RUSSIA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA ADVERTISING PLATFORM MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 89 UAE ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 90 UAE ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2020-2030

FIGURE 9 GLOBAL ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2020-2030

FIGURE 10 GLOBAL ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2020-2030

FIGURE 11 GLOBAL ADVERTISING PLATFORM MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL ADVERTISING PLATFORM MARKET BY DEPLOYMENT MODEL (USD BILLION) 2022

FIGURE 14 GLOBAL ADVERTISING PLATFORM MARKET BY CHANNEL (USD BILLION) 2022

FIGURE 15 GLOBAL ADVERTISING PLATFORM MARKET BY SIZE AND TYPE OF USER (USD BILLION) 2022

FIGURE 16 GLOBAL ADVERTISING PLATFORM MARKET BY REGION (USD BILLION) 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 MEDIA.NET: COMPANY SNAPSHOT

FIGURE 19 SNAPCHAT ADS: COMPANY SNAPSHOT

FIGURE 20 EPOM: COMPANY SNAPSHOT

FIGURE 21 PRIMIS: COMPANY SNAPSHOT

FIGURE 22 MICROSOFT ADS: COMPANY SNAPSHOT

FIGURE 23 INMOBI AUDIENCE TARGETING: COMPANY SNAPSHOT

FIGURE 24 AMAZON ADS: COMPANY SNAPSHOT

FIGURE 25 SPOTIFY ADS: COMPANY SNAPSHOT

FIGURE 26 PERPETUA: COMPANY SNAPSHOT

FIGURE 27 LINKEDIN ADS: COMPANY SNAPSHOT

FIGURE 28 ADROLL: COMPANY SNAPSHOT

FIGURE 29 APPLE SEARCH ADS (ASA): COMPANY SNAPSHOT

FIGURE 30 GOOGLE: COMPANY SNAPSHOT

FIGURE 31 YAHOO AD TECH: COMPANY SNAPSHOT

FIGURE 32 TWITTER BUSINESS: COMPANY SNAPSHOT

FIGURE 33 TABOOLA: COMPANY SNAPSHOT

FIGURE 34 SXM MEDIA: COMPANY SNAPSHOT

FIGURE 35 FACEBOOK (META): COMPANY SNAPSHOT

FIGURE 36 TIKTOK ADS: COMPANY SNAPSHOT

FIGURE 37 CLICKADU: COMPANY SNAPSHOT

FAQ

The global advertising platform market is anticipated to grow from USD 579.40 Billion in 2023 to USD 1494.93 Billion by 2030, at a CAGR of 14.50 % during the forecast period.

North America accounted for the largest market in the advertising platform market. North America accounted for 40 % market share of the global market value.

Bayer CropScience, LLC, Cargill, Inc., The Monsanto Company, Syngenta Crop Protection, Nestlé S.A., Wilmer International Limited, Associated British Foods PLC, Brasil Agro, Bunge Limited, Cairo Poultry Company, CHS, Inc., LT Foods, Ltd., Nutrien, Deere & Company, BASF SE, CNH Industrial N. V., The Archer-Daniels-Midland Company, ABP Food Group, COFCO Corporation, Unilever plc.

Key trends in the advertising platform market include a growing emphasis on sustainable and eco-friendly activewear, the integration of technology for enhanced performance, and the rise of athleisure, where activewear seamlessly transitions into casual wear. Additionally, personalized and inclusive sizing options are becoming more prevalent as brands strive to cater to a diverse range of body types and preferences, reflecting a shift towards inclusivity and body positivity in the industry.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.