REPORT OUTLOOK

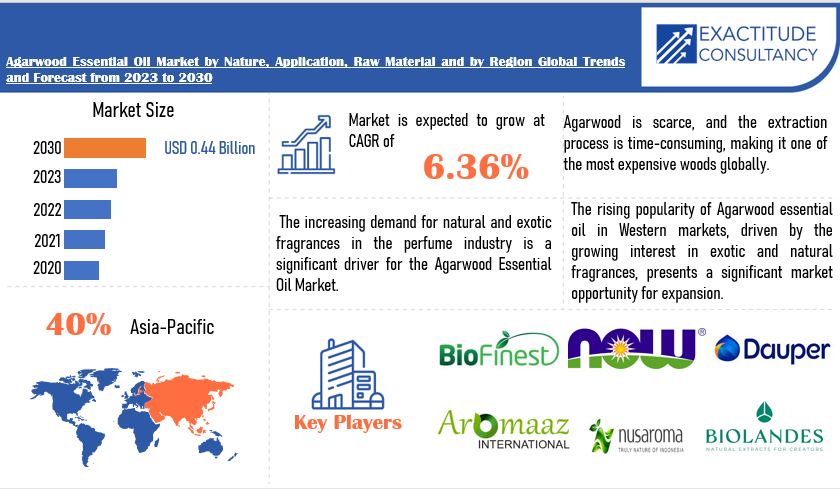

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 0.44 Billion by 2030 | 6.36 % | Asia Pacific |

| by Nature | by Application | by Raw Material |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Agarwood Essential Oil Market Overview

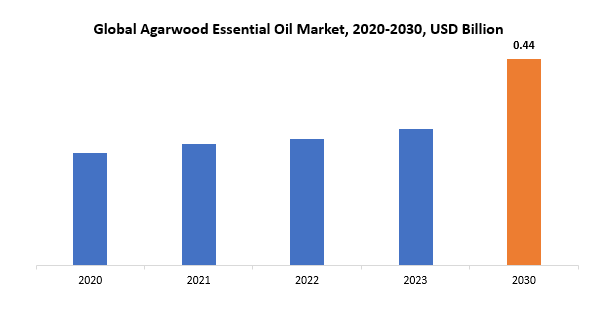

The global agarwood essential oil market is anticipated to grow from USD 0.29 Billion in 2023 to USD 0.44 Billion by 2030, at a CAGR of 6.36 % during the forecast period.

Agarwood essential oil, derived from the resinous heartwood of the Aquilaria tree, is a precious and aromatic substance renowned for its distinctive fragrance and various therapeutic properties. Also known as oud oil or aloeswood oil, it is highly valued in perfumery, traditional medicine, and spiritual practices. The Aquilaria tree produces agarwood as a result of a natural defense mechanism in response to injury or fungal infection. The resin formed within the heartwood undergoes a complex and time-consuming extraction process, involving steam distillation or hydro-distillation, to obtain the precious agarwood essential oil.

The oil is characterized by a rich, warm, and woody scent with balsamic undertones, making it a sought-after ingredient in luxury perfumes. Beyond its aromatic allure, agarwood essential oil is revered for its potential therapeutic benefits, including stress relief, meditation support, and its use in traditional medicines for various ailments. The agarwood essential oil market is influenced by its cultural significance, scarcity, and the meticulous craftsmanship involved in its extraction, positioning it as a symbol of luxury and cultural heritage across diverse communities.

Culturally, agarwood has been revered for centuries in various traditions and spiritual practices, contributing to its symbolic importance. It is often associated with luxury, rituals, and religious ceremonies, making it an integral part of cultural heritage in many regions. Beyond its cultural value, the Agarwood Essential Oil market is crucial in the fragrance and perfumery industry. Agarwood’s distinct and captivating aroma, often referred to as “liquid gold,” positions it as a prized ingredient in the formulation of high-end perfumes and luxury scents. The therapeutic properties attributed to agarwood, including stress relief and relaxation, have fueled its demand in the wellness and aromatherapy sectors. Furthermore, the economic significance of the Agarwood Essential Oil market cannot be overstated. It serves as a source of livelihood for communities involved in agarwood cultivation, extraction, and trade.

The increasing awareness and appreciation for natural and organic products in the beauty and wellness industries have fueled the demand for Agarwood Essential Oil. Consumers are increasingly seeking natural alternatives to synthetic fragrances and are drawn to the unique and exotic aroma of Agarwood. Additionally, the rising disposable income in emerging economies has led to an upsurge in luxury product consumption, with Agarwood Essential Oil being a coveted ingredient in high-end perfumes, cosmetics, and spa products.

Furthermore, the traditional significance of Agarwood in various cultural practices, especially in regions like the Middle East and Asia, has contributed to its popularity. The limited and labor-intensive extraction process of Agarwood Essential Oil, coupled with the scarcity of agarwood-producing trees, has created a supply-demand imbalance, further propelling its market value. The growing interest in aromatherapy and holistic well-being is another factor driving the market, as Agarwood Essential Oil is recognized for its therapeutic properties, including stress relief and relaxation.

As sustainability becomes a crucial consideration in consumer choices, efforts to promote ethical and sustainable harvesting practices in the agarwood industry also contribute to the market’s growth, addressing concerns about overharvesting and illegal trade.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Kilotons) |

| Segmentation | By Nature, Application, Raw Material and Region |

|

By Nature |

|

|

By Application |

|

|

By Raw Material |

|

|

By Region

|

|

Agarwood Essential Oil Market Segmentation Analysis

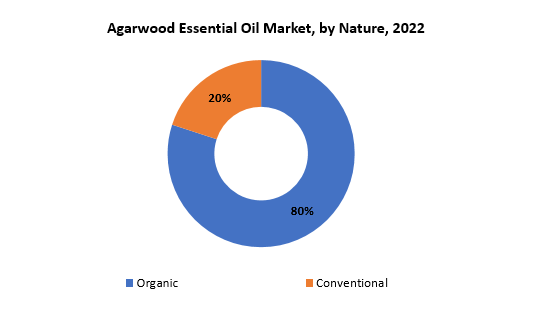

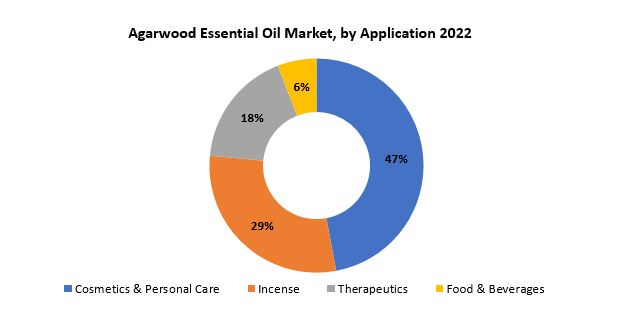

The global Agarwood Essential Oil market is divided into three segments, nature, application, raw material and region. The Agarwood Essential Oil market is classified based on nature, including Organic, Conventional. By application, the market is divided into Cosmetics & Personal Care, Incense, Therapeutics, Food & Beverages, Pharmaceuticals, Others. By raw material the market is classified into Wood, Flowers, Bark, Resin.

Based on nature, organic segment dominating in the agarwood essential oil market. Organic agarwood essential oil is produced without the use of synthetic pesticides, fertilizers, or other chemicals, aligning with the increasing demand for products that are perceived as healthier and environmentally friendly. This segment’s dominance is driven by heightened awareness among consumers about the potential risks associated with synthetic additives and a growing preference for products cultivated in harmony with nature. As consumers seek transparency in sourcing and production, the organic segment not only caters to those valuing purity in their essential oil but also addresses sustainability concerns associated with agarwood harvesting. The certification of organic agarwood essential oil assures consumers of adherence to stringent organic standards, contributing to the segment’s prominence in the market. As the global focus on sustainability and organic living continues to grow, the dominance of the organic segment in the agarwood essential oil market is expected to persist, driven by consumer preferences for ethically sourced and environmentally responsible products.

Conventional extraction techniques, including steam distillation and hydro-distillation, have been the traditional and time-tested means of obtaining agarwood essential oil. These methods involve passing steam or water through the agarwood chips to extract the aromatic compounds, resulting in a rich and authentic essential oil. The conventional approach aligns with the cultural and historical practices associated with agarwood extraction, preserving the traditional craftsmanship that has been passed down through generations. Moreover, this method is well-established, ensuring consistency in the quality and characteristics of the essential oil produced. While there is growing interest in alternative and innovative extraction techniques, the conventional segment maintains its dominance due to its reliability, heritage, and the inherent connection to the cultural significance of agarwood.

Based on application, cosmetics & personal care segment dominating in the agarwood essential oil market. Agarwood Essential Oil is highly valued for its unique and luxurious fragrance, making it a sought-after ingredient in the formulation of various cosmetic and personal care products. The oil’s distinct and exotic aroma adds a premium and exclusive element to perfumes, colognes, and other fragrance products, contributing to its popularity among perfume manufacturers. The cosmetic industry also incorporates Agarwood Essential Oil in skincare products, such as creams, lotions, and serums, for its potential skin benefits and its ability to impart a captivating scent.

The oil’s aromatic properties make it a preferred choice in the formulation of high-end and niche beauty products. Furthermore, the rising consumer preference for natural and exotic ingredients in cosmetics has fueled the demand for Agarwood Essential Oil. Its use in aromatherapy and spa products further enhances its application scope in the personal care sector. The dominance of Agarwood Essential Oil in the cosmetics and personal care segment is expected to persist, driven by the continued consumer interest in premium and natural products with unique olfactory characteristics.

Agarwood Essential Oil Market Dynamics

Driver

Growing demand for natural and organic products is creating a demand for agarwood essential oil market.

The growing demand for natural and organic products is a key driving force behind the increasing prominence of the agarwood essential oil market. Consumers worldwide are increasingly prioritizing products that align with sustainable, eco-friendly, and health-conscious lifestyles. Agarwood essential oil, derived from the aromatic resin of the Aquilaria tree, perfectly fits this demand due to its natural origin and the traditional extraction methods employed. As awareness of the potential health and environmental impacts of synthetic and chemical-laden products rises, there is a discernible shift towards botanical and plant-based alternatives.

Agarwood essential oil, known for its distinctive and luxurious fragrance, offers a natural and exotic appeal that resonates with consumers seeking authenticity and uniqueness in their products. The rising interest in aromatherapy, holistic wellness, and natural perfumery has further propelled the demand for agarwood essential oil. Moreover, the organic segment within the agarwood essential oil market is gaining traction, as consumers increasingly prioritize products free from synthetic pesticides, fertilizers, and chemicals. The organic production methods not only appeal to environmentally conscious consumers but also align with the sustainable and ethical sourcing trends prevalent in the modern market.

Restraint

Sustainability concerns can be a major challenge for the agarwood essential oil market during the forecast period.

Sustainability concerns pose a significant challenge for the agarwood essential oil market during the forecast period. The production of agarwood essential oil is primarily dependent on the resinous heartwood of Aquilaria trees, which are often harvested from wild populations. Overharvesting, illegal logging, and unsustainable extraction practices have raised environmental and ethical concerns. The depletion of wild agarwood resources not only threatens the biodiversity of the ecosystems in which these trees grow but also jeopardizes the livelihoods of local communities reliant on agarwood production. Furthermore, the slow growth rate of Aquilaria trees exacerbates the challenge, as it takes years for the trees to develop the resinous heartwood that produces the sought-after essential oil.

To address these sustainability concerns, there is a growing need for responsible and ethical practices within the agarwood industry. Initiatives promoting sustainable cultivation, such as agroforestry and plantation programs, are gaining importance. Encouraging farmers to cultivate agarwood through sustainable and organic methods can help reduce the pressure on wild populations. Additionally, certifications and traceability mechanisms that guarantee the ethical and environmentally friendly sourcing of agarwood essential oil are becoming increasingly important for consumers and regulatory bodies.

As consumers become more conscientious about the environmental impact of their purchases, the agarwood essential oil market may face scrutiny and market resistance if sustainability concerns are not adequately addressed.

Opportunities

Innovation in product development presents opportunities for the development and promotion of agarwood essential oil market.

Innovation in product development emerges as a key driver for opportunities within the agarwood essential oil market. As consumer preferences evolve and the demand for unique, high-quality products grows, there is a notable space for innovation in the development and promotion of agarwood essential oil. Manufacturers are exploring novel extraction methods, advanced distillation techniques, and sustainable cultivation practices to enhance the quality and purity of agarwood essential oil. Leveraging cutting-edge technologies, such as molecular distillation and cold-press extraction, allows for the preservation of the oil’s delicate aromatic compounds, ensuring a more potent and authentic fragrance.

Furthermore, product diversification and the introduction of agarwood essential oil blends with other botanical extracts or essential oils offer consumers a wider range of choices, catering to various olfactory preferences. Formulating agarwood essential oil into unique blends for use in perfumes, cosmetics, and aromatherapy products opens avenues for market expansion and differentiation. Additionally, incorporating agarwood essential oil into new applications, such as home fragrances, scented candles, and personal care items, broadens its market presence.

Sustainability-focused innovations, such as agroforestry initiatives and organic cultivation practices, not only address environmental concerns but also appeal to eco-conscious consumers. Producers emphasizing traceability, ethical sourcing, and eco-friendly packaging align with the increasing demand for socially responsible and sustainable products.

Agarwood Essential Oil Market Trends

-

There is a growing consumer preference for natural and unique scents in perfumes and personal care products. Agarwood essential oil, with its distinct and exotic fragrance, is gaining popularity among consumers seeking premium and authentic aromatic experiences.

-

Sustainability concerns are driving a shift towards responsible and sustainable practices in the agarwood industry. Companies are increasingly emphasizing sustainable cultivation, ethical harvesting, and traceability in the production of agarwood essential oil to address environmental and social considerations.

-

Manufacturers are expanding their product offerings by creating blends and formulations that incorporate agarwood essential oil with other complementary botanical extracts or essential oils. This trend aims to cater to diverse consumer preferences and applications, such as aromatherapy, skincare, and home fragrances.

-

Ongoing innovations in extraction technologies, including molecular distillation and cold-press extraction, are being explored to enhance the quality and potency of agarwood essential oil. These advanced methods aim to preserve the delicate aromatic compounds more effectively.

-

Agarwood essential oil is gaining traction in niche fragrance markets, including the luxury and high-end perfume segments. Its inclusion in premium fragrances positions it as a coveted and exclusive ingredient.

-

Agarwood essential oil is finding applications in wellness and spa products due to its aromatic properties. Its incorporation in massage oils, relaxation blends, and aromatherapy products is on the rise, aligning with the growing interest in holistic well-being.

Competitive Landscape

The competitive landscape of the Agarwood Essential Oil market was dynamic, with several prominent companies competing to provide innovative and advanced agarwood essential oil solutions.

- Biofinest USA

- NOW Foods

- Dauper S.A.

- Aromaaz International

- Nusaroma

- BIOLANDES SAS

- Hoang Giang Agarwood Ltd.

- Katyani Exports

- Essential Oil Wizardry

- Tien Phuoc Co. Ltd.

- Gritman Essential Oils

- Assam Aromas

- Maruti Natural Fragrances

- Kush Aroma Exports

- Agarwood-Inc

- Hermitage Oils

- Albert Vieille SAS

- G. Industries

- Biomaxx Agri Products

- Hoang Giang Agarwood

Recent Developments:

In 2023: NOW®, the largest independent and family-owned manufacturer of natural products in the U.S. health food store channel, has partnered with recycling expert TerraCycle® to divert NOW’s flexible packaging from landfills. The NOW Recycling Program enables consumers the opportunity to recycle their toothpaste tubes and flexible food and supplement pouches—items not accepted by most municipal recycling programs.

Regional Analysis

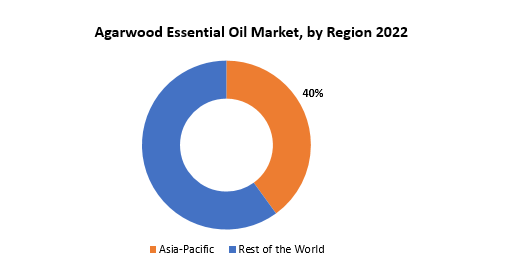

Asia-Pacific accounted for the largest market in the agarwood essential oil market. Asia-Pacific has emerged as the dominant region in the global agarwood essential oil market, primarily due to its historical association with agarwood cultivation, extraction, and traditional uses. The region encompasses key agarwood-producing countries, including Vietnam, Cambodia, Malaysia, Indonesia, and parts of India. These countries have a rich heritage of agarwood cultivation, and the traditional knowledge of agarwood processing has been passed down through generations.

The tropical climates of many Asia-Pacific countries provide ideal conditions for the growth of Aquilaria trees, the primary source of agarwood. The unique environmental factors and soil conditions in this region contribute to the formation of the resinous heartwood in Aquilaria trees, which is crucial for the production of high-quality agarwood essential oil. Moreover, Asia-Pacific has been at the forefront of agarwood trade and commerce, with a well-established supply chain and infrastructure for agarwood cultivation, harvesting, and oil extraction. The region’s cultural significance and historical use of agarwood in traditional medicines, religious ceremonies, and perfumery have sustained a consistent demand for agarwood essential oil.

In recent years, the growing popularity of natural and exotic fragrances, coupled with an increasing awareness of wellness practices, has further boosted the demand for agarwood essential oil in the Asia-Pacific region. The use of agarwood in traditional and alternative medicine, particularly in countries like China and India, has also contributed to its prominence. Additionally, economic factors such as the rising middle-class population with an inclination towards premium and luxury products have driven the demand for agarwood essential oil in the Asia-Pacific market.

In North America, the market for agarwood essential oil has been driven by an increasing awareness of exotic and natural fragrances, wellness trends, and the rising popularity of niche and luxury products. The region has seen a surge in demand for unique scents in perfumes, aromatherapy, and personal care products, prompting the incorporation of agarwood essential oil into these formulations.

In Europe, the agarwood essential oil market has been influenced by a similar trend towards natural and premium fragrances. The European consumer base, known for its sophistication and appreciation of high-quality products, has shown interest in the exclusive and distinctive aroma of agarwood essential oil. Furthermore, the wellness and aromatherapy sectors in Europe have embraced the use of agarwood essential oil in massage oils, relaxation blends, and holistic well-being products.

Target Audience for Agarwood Essential Oil Market

- Perfume and Fragrance Manufacturers

- Cosmetic and Personal Care Product Companies

- Aromatherapy and Wellness Centers

- Spa and Massage Therapy Clinics

- Luxury and Niche Perfume Brands

- Traditional Medicine Practitioners

- Essential Oil Distributors and Retailers

- High-end Skincare Product Manufacturers

- Premium Candle and Incense Producers

Import & Export Data for Agarwood Essential Oil Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the agarwood essential oil market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

-

Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global agarwood essential oil This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

-

Market players: gain insights into the leading players driving the agarwood essential oil From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

-

Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

-

Product breakdown: by segmenting data based on agarwood essential oil Product Types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids government in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Agarwood Essential Oil Market Report

Agarwood Essential Oil Market by Nature

- Organic

- Conventional

Agarwood Essential Oil Market by Application

- Industrial

- Household

Agarwood Essential Oil Market by Raw Material

- Wood

- Flowers

- Bark

- Resin

Agarwood Essential Oil Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the agarwood essential oil market over the next 7 years?

- Who are the major players in the Agarwood Essential Oil market and what is their market share?

- What are the Application industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the agarwood essential oil market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the agarwood essential oil market?

- What is the current and forecasted size and growth rate of the global agarwood essential oil market?

- What are the key drivers of growth in the agarwood essential oil market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the agarwood essential oil market?

- What are the technological advancements and innovations in the agarwood essential oil market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the agarwood essential oil market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the agarwood essential oil market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AGARWOOD ESSENTIAL OIL MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AGARWOOD ESSENTIAL OIL MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AGARWOOD ESSENTIAL OIL MARKET OUTLOOK

- GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY NATURE, 2020-2030, (USD BILLION) (KILOTONS)

- ORGANIC

- CONVENTIONAL

- GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION, 2020-2030, (USD BILLION) (KILOTONS)

- COSMETICS & PERSONAL CARE

- INCENSE

- THERAPEUTICS

- FOOD & BEVERAGES

- PHARMACEUTICALS

- OTHERS

- GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL, 2020-2030, (USD BILLION) (KILOTONS)

- WOOD

- FLOWERS

- BARK

- RESIN

- GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY REGION, 2020-2030, (USD BILLION) (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCT OFFERED, RECENT DEVELOPMENTS)

- BIOFINEST USA

- NOW FOODS

- DAUPER S.A.

- AROMAAZ INTERNATIONAL

- NUSAROMA

- BIOLANDES SAS

- HOANG GIANG AGARWOOD LTD.

- KATYANI EXPORTS

- ESSENTIAL OIL WIZARDRY

- TIEN PHUOC CO. LTD.

- GRITMAN ESSENTIAL OILS

- ASSAM AROMAS

- MARUTI NATURAL FRAGRANCES

- KUSH AROMA EXPORTS

- AGARWOOD-INC

- HERMITAGE OILS

- ALBERT VIEILLE SAS

- G. INDUSTRIES

- BIOMAXX AGRI PRODUCTS

- HOANG GIANG AGARWOOD *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 2 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 3 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 4 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 5 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 6 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 7 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY REGION (USD BILLION) 2020-2030

TABLE 8 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY REGION (KILOTONS) 2020-2030

TABLE 9 NORTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 11 NORTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 13 NORTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 15 NORTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 17 US AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 18 US AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 19 US AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 20 US AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 21 US AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 22 US AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 23 CANADA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 24 CANADA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 25 CANADA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 26 CANADA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 27 CANADA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 28 CANADA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 29 MEXICO AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 30 MEXICO AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 31 MEXICO AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 32 MEXICO AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 33 MEXICO AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 34 MEXICO AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 35 SOUTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 36 SOUTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 37 SOUTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 38 SOUTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 39 SOUTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 40 SOUTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 41 SOUTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 42 SOUTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 43 BRAZIL AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 44 BRAZIL AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 45 BRAZIL AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 46 BRAZIL AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 47 BRAZIL AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 48 BRAZIL AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 49 ARGENTINA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 50 ARGENTINA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 51 ARGENTINA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 52 ARGENTINA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 53 ARGENTINA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 54 ARGENTINA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 55 COLOMBIA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 56 COLOMBIA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 57 COLOMBIA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 58 COLOMBIA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 59 COLOMBIA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 60 COLOMBIA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 61 REST OF SOUTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 63 REST OF SOUTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 65 REST OF SOUTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 66 REST OF SOUTH AMERICA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 67 ASIA-PACIFIC AGARWOOD ESSENTIAL OIL MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 68 ASIA-PACIFIC AGARWOOD ESSENTIAL OIL MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 69 ASIA-PACIFIC AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 70 ASIA-PACIFIC AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 71 ASIA-PACIFIC AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 72 ASIA-PACIFIC AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 73 ASIA-PACIFIC AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 74 ASIA-PACIFIC AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 75 INDIA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 76 INDIA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 77 INDIA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 78 INDIA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 79 INDIA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 80 INDIA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 81 CHINA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 82 CHINA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 83 CHINA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 84 CHINA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 85 CHINA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 86 CHINA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 87 JAPAN AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 88 JAPAN AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 89 JAPAN AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 90 JAPAN AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 91 JAPAN AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 92 JAPAN AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 93 SOUTH KOREA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 94 SOUTH KOREA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 95 SOUTH KOREA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 96 SOUTH KOREA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 97 SOUTH KOREA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 98 SOUTH KOREA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 99 AUSTRALIA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 100 AUSTRALIA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 101 AUSTRALIA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 102 AUSTRALIA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 103 AUSTRALIA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 104 AUSTRALIA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 105 SOUTH-EAST ASIA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 107 SOUTH-EAST ASIA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 108 SOUTH-EAST ASIA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 109 SOUTH-EAST ASIA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 110 SOUTH-EAST ASIA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 111 REST OF ASIA PACIFIC AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 113 REST OF ASIA PACIFIC AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 114 REST OF ASIA PACIFIC AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 115 REST OF ASIA PACIFIC AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 116 REST OF ASIA PACIFIC AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 117 EUROPE AGARWOOD ESSENTIAL OIL MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 118 EUROPE AGARWOOD ESSENTIAL OIL MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 119 EUROPE AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 120 EUROPE AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 121 EUROPE AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 122 EUROPE AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 123 EUROPE AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 124 EUROPE AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 125 GERMANY AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 126 GERMANY AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 127 GERMANY AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 128 GERMANY AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 129 GERMANY AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 130 GERMANY AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 131 UK AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 132 UK AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 133 UK AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 134 UK AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 135 UK AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 136 UK AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 137 FRANCE AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 138 FRANCE AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 139 FRANCE AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 140 FRANCE AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 141 FRANCE AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 142 FRANCE AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 143 ITALY AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 144 ITALY AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 145 ITALY AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 146 ITALY AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 147 ITALY AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 148 ITALY AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 149 SPAIN AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 150 SPAIN AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 151 SPAIN AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 152 SPAIN AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 153 SPAIN AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 154 SPAIN AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 155 RUSSIA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 156 RUSSIA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 157 RUSSIA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 158 RUSSIA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 159 RUSSIA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 160 RUSSIA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 161 REST OF EUROPE AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 162 REST OF EUROPE AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 163 REST OF EUROPE AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 164 REST OF EUROPE AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 165 REST OF EUROPE AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 166 REST OF EUROPE AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA AGARWOOD ESSENTIAL OIL MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA AGARWOOD ESSENTIAL OIL MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 170 MIDDLE EAST AND AFRICA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 171 MIDDLE EAST AND AFRICA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 172 MIDDLE EAST AND AFRICA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 173 MIDDLE EAST AND AFRICA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 174 MIDDLE EAST AND AFRICA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 175 UAE AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 176 UAE AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 177 UAE AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 178 UAE AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 179 UAE AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 180 UAE AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 181 SAUDI ARABIA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 182 SAUDI ARABIA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 183 SAUDI ARABIA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 184 SAUDI ARABIA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 185 SAUDI ARABIA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 186 SAUDI ARABIA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 187 SOUTH AFRICA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 188 SOUTH AFRICA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 189 SOUTH AFRICA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 190 SOUTH AFRICA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 191 SOUTH AFRICA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 192 SOUTH AFRICA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

TABLE 194 REST OF MIDDLE EAST AND AFRICA AGARWOOD ESSENTIAL OIL MARKET BY NATURE (KILOTONS) 2020-2030

TABLE 195 REST OF MIDDLE EAST AND AFRICA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 196 REST OF MIDDLE EAST AND AFRICA AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 197 REST OF MIDDLE EAST AND AFRICA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

TABLE 198 REST OF MIDDLE EAST AND AFRICA AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (KILOTONS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2020-2030

FIGURE 10 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2020-2030

FIGURE 11 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY NATURE (USD BILLION) 2022

FIGURE 14 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY APPLICATION (USD BILLION) 2022

FIGURE 15 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY RAW MATERIAL (USD BILLION) 2022

FIGURE 16 GLOBAL AGARWOOD ESSENTIAL OIL MARKET BY REGION (USD BILLION) 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 BIOFINEST USA: COMPANY SNAPSHOT

FIGURE 19 NOW FOODS: COMPANY SNAPSHOT

FIGURE 20 DAUPER S.A.: COMPANY SNAPSHOT

FIGURE 21 AROMAAZ INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 22 NUSAROMA: COMPANY SNAPSHOT

FIGURE 23 BIOLANDES SAS: COMPANY SNAPSHOT

FIGURE 24 HOANG GIANG AGARWOOD LTD.: COMPANY SNAPSHOT

FIGURE 25 KATYANI EXPORTS: COMPANY SNAPSHOT

FIGURE 26 ESSENTIAL OIL WIZARDRY: COMPANY SNAPSHOT

FIGURE 27 TIEN PHUOC CO. LTD.: COMPANY SNAPSHOT

FIGURE 28 GRITMAN ESSENTIAL OILS: COMPANY SNAPSHOT

FIGURE 29 ASSAM AROMAS: COMPANY SNAPSHOT

FIGURE 30 MARUTI NATURAL FRAGRANCES: COMPANY SNAPSHOT

FIGURE 31 KUSH AROMA EXPORTS: COMPANY SNAPSHOT

FIGURE 32 AGARWOOD-INC: COMPANY SNAPSHOT

FIGURE 33 HERMITAGE OILS: COMPANY SNAPSHOT

FIGURE 34 ALBERT VIEILLE SAS: COMPANY SNAPSHOT

FIGURE 35 A.G. INDUSTRIES: COMPANY SNAPSHOT

FIGURE 36 BIOMAXX AGRI PRODUCTS: COMPANY SNAPSHOT

FIGURE 37 HOANG GIANG AGARWOOD: COMPANY SNAPSHOT

FAQ

The global agarwood essential oil market is anticipated to grow from USD 0.29 Billion in 2023 to USD 0.44 Billion by 2030, at a CAGR of 6.36 % during the forecast period.

Asia-Pacific accounted for the largest market in the agarwood essential oil market. Asia-Pacific accounted for 40 % market share of the global market value.

Biofinest USA, NOW Foods, Dauper S.A., Aromaaz International, Nusaroma, BIOLANDES SAS, Hoang Giang Agarwood Ltd., Katyani Exports, Essential Oil Wizardry, Tien Phuoc Co. Ltd., Gritman Essential Oils, Assam Aromas, Maruti Natural Fragrances, Kush Aroma Exports, Agarwood-Inc, Hermitage Oils, Albert Vieille SAS, A.G. Industries, Biomaxx Agri Products, Hoang Giang Agarwood.

key trends in the agarwood essential oil market include a growing emphasis on sustainability, with increased adoption of responsible cultivation practices and ethical sourcing. Additionally, there’s a trend toward product innovation, where advanced extraction methods and unique formulations, such as blends with other botanical extracts, are gaining traction to cater to diverse consumer preferences.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.