REPORT OUTLOOK

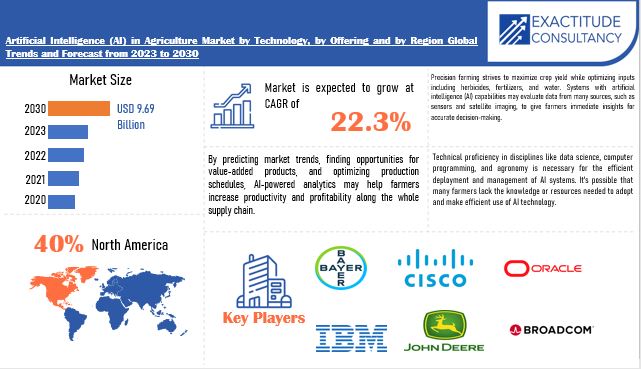

| Market Size | CAGR | Dominating Region |

|---|---|---|

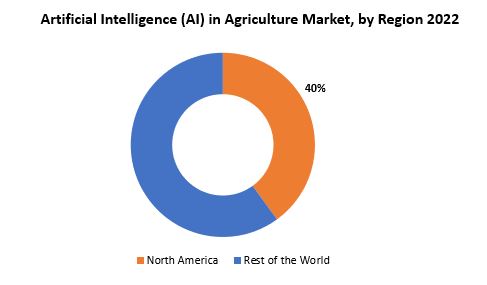

| USD 6.96 billion by 2030 | 22.3% | North America |

| by Technology | by Offering |

|---|---|

|

|

SCOPE OF THE REPORT

Market Overview

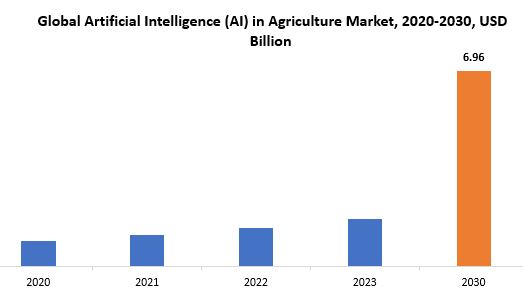

The global artificial intelligence in agriculture market size is projected to grow from USD 1.7 billion in 2023 to USD 6.96 billion by 2030, exhibiting a CAGR of 22.3% during the forecast period.

Artificial Intelligence (AI) in agriculture refers to the application of advanced technologies, particularly AI algorithms and machine learning techniques, to enhance various aspects of farming practices. These include crop monitoring, yield prediction, soil analysis, pest detection and management, irrigation optimization, and automation of farm equipment. The integration of AI in agriculture involves collecting and analyzing extensive datasets from diverse sources like satellites, drones, sensors, and historical records. These data undergo thorough analysis by sophisticated AI algorithms to generate insights and recommendations for farmers. This enables them to make more informed decisions and optimize their farming operations effectively.

For instance, AI-powered crop monitoring systems use satellite imagery to evaluate crop health, identify diseases or nutrient deficiencies early, and suggest appropriate actions. Similarly, predictive models fueled by AI analyze past weather patterns and agricultural data to forecast crop yields, aiding farmers in better planning their harvests and marketing strategies. Furthermore, AI technologies are instrumental in precision agriculture, where sensors and drones equipped with AI algorithms accurately target areas requiring irrigation, fertilization, or pest control. This results in reduced resource wastage and environmental impact. In essence, AI in agriculture offers significant potential to revolutionize the industry by enhancing efficiency, productivity, and sustainability, while simultaneously lowering costs and environmental harm. As technology advances, the integration of AI into farming practices is poised to play a crucial role in addressing food security challenges and meeting the demands of a growing global population.

The importance of artificial intelligence (AI) in agriculture cannot be overstated, as it offers transformative solutions to the sector’s challenges. AI technologies provide numerous benefits critical to improving farming practices. Firstly, AI facilitates precise decision-making by analysing extensive agricultural data from diverse sources like satellites, drones, sensors, and historical records. This enables farmers to gain insights into crop health, soil conditions, weather patterns, and pest outbreaks, empowering them to optimize resource allocation, boost crop yields, and minimize losses. Secondly, AI enables the adoption of precision agriculture methods, allowing farmers to apply inputs like water, fertilizers, and pesticides with unprecedented accuracy, thereby reducing waste and environmental impact. Additionally, AI-driven predictive models assist in forecasting crop yields and market trends, empowering farmers to make informed decisions about planting schedules, harvest timing, and marketing strategies. Furthermore, AI-driven automation streamlines farm operations, leading to enhanced efficiency and labour savings. In conclusion, AI’s potential to address challenges such as food security, sustainability, and climate change makes it an essential tool for the future of agriculture.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Technology, Offering and Region |

|

By Technology |

|

|

By Offering |

|

|

By Region

|

|

Artificial Intelligence (AI) in Agriculture Market Segmentation Analysis

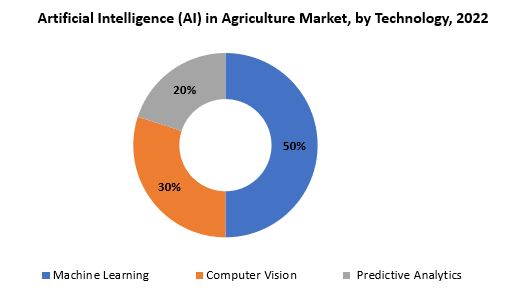

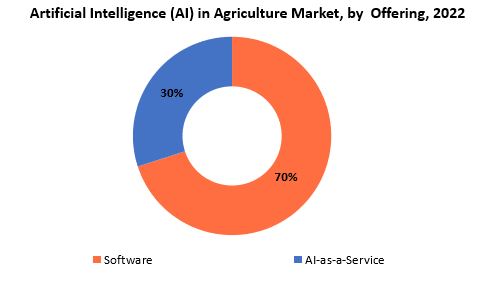

The global artificial intelligence in agriculture market is divided into three segments, by technology, offering and region. By technology, the market is divided into machine learning, computer vision, and predictive analytics. By offering, the market is divided software, AI-as-a-service and by region.

In the agricultural sector, technology serves as a crucial driver for enhancing productivity and efficiency. It is categorized into three primary segments: machine learning, computer vision, and predictive analytics. Machine learning algorithms empower agricultural systems to analyze extensive datasets, learning from patterns to facilitate data-driven decision-making processes. This technology enables farmers to forecast crop yields, determine optimal planting times, and tailor treatments for crops based on individual requirements. By leveraging machine learning, farmers can optimize resource allocation, enhance productivity, and reduce costs and environmental impact. Computer vision technology automates the analysis of visual data, such as images captured by drones or field-installed cameras. This enables real-time monitoring of crop health, early detection of pests and diseases, and assessment of soil conditions. Incorporating computer vision into farming practices enables farmers to promptly identify and address crop issues, thereby minimizing yield losses and improving overall farm management.

Predictive analytics leverages historical and real-time data to forecast future events or trends. In agriculture, predictive analytics aids in anticipating market demand, predicting weather patterns, and optimizing supply chain logistics. By integrating predictive analytics into their operations, farmers can proactively mitigate risks and capitalize on opportunities, ultimately maximizing profitability and sustainability. In summary, the adoption of machine learning, computer vision, and predictive analytics technologies in agriculture represents a significant advancement in modernizing farming practices. These technologies empower farmers with valuable insights and actionable information, enabling them to optimize production processes, improve crop health, and ensure food security amidst the evolving agricultural landscape.

The agricultural market is segmented based on the services it offers, primarily divided into software solutions and AI-as-a-service. Software solutions cater to farmers’ needs by providing a variety of applications and platforms tailored to streamline different aspects of farm management. These software packages encompass crop monitoring systems, yield prediction tools, soil analysis software, and farm management platforms. They enable farmers to gather, analyze, and interpret agricultural data, empowering them to make informed decisions and optimize their farming operations. On the other hand, AI-as-a-service (AIaaS) takes a more specialized approach, providing access to advanced artificial intelligence technologies through subscription-based services. AIaaS providers offer AI-powered algorithms, models, and tools that farmers can seamlessly integrate into their existing systems or applications. This allows farmers to leverage the capabilities of artificial intelligence without the need for extensive in-house expertise or infrastructure. AIaaS offerings may include machine learning models for crop disease detection, computer vision algorithms for pest monitoring, or predictive analytics tools for yield forecasting. In essence, both software solutions and AI-as-a-service offerings play pivotal roles in driving innovation and efficiency in the agricultural sector. While software solutions provide comprehensive platforms for farm management, AIaaS offerings deliver specialized AI capabilities that can enhance decision-making and productivity on the farm. Together, these offerings contribute to advancing modern agriculture, empowering farmers to address challenges related to food security, sustainability, and profitability in an increasingly complex and dynamic landscape.

Artificial Intelligence (AI) in Agriculture Market Dynamics

Driver

Continuous advancements in AI technologies, including machine learning, computer vision, and IoT sensors, are making it more feasible and affordable to implement AI solutions in agriculture.

The ongoing progress in AI technologies, comprising machine learning, computer vision, and the widespread adoption of IoT sensors, is fundamentally reshaping agriculture by rendering the implementation of AI solutions more practical and economically viable. These advancements equip farmers with unparalleled capabilities, fundamentally altering traditional agricultural methodologies. Machine learning algorithms, a subset of AI, possess the ability to process extensive datasets and extract valuable insights to refine agricultural practices. By scrutinizing historical and real-time data pertaining to factors like weather patterns, soil conditions, and crop health, these models furnish farmers with actionable guidance for precision farming. Consequently, precise resource allocation, such as targeted irrigation and fertilization, is achievable, leading to heightened crop yields and resource efficiency. Additionally, computer vision technology plays a pivotal role in crop supervision and management. AI-driven image recognition algorithms can analyze visual data captured by drones, satellites, or ground-based cameras to evaluate crop health, identify diseases, and pinpoint nutrient deficiencies. This facilitates timely intervention and tailored treatments, curbing crop losses and optimizing overall productivity.

The incorporation of IoT sensors further amplifies AI’s potential in agriculture by facilitating real-time data collection and monitoring of environmental variables. These sensors gauge soil moisture levels, temperature, humidity, and other pivotal metrics, furnishing farmers with invaluable insights into crop conditions and environmental dynamics. By leveraging this data alongside AI algorithms, farmers can fine-tune irrigation schedules, devise pest management strategies, and streamline crop harvesting processes. One of AI’s most promising applications in agriculture is automated harvesting. AI-driven robotic systems, equipped with computer vision technology, can autonomously recognize ripe fruits or vegetables, assess their quality, and meticulously harvest them with precision and efficiency. This not only curtails labor costs and dependence on manual labor but also minimizes harvest losses and ensures optimal product quality. In essence, the ongoing advancements in AI technologies, encompassing machine learning, computer vision, and IoT sensors, are democratizing access to innovative solutions in agriculture. These technologies empower farmers to execute tasks such as crop monitoring, pest detection, and automated harvesting with unparalleled accuracy and efficiency, ultimately propelling agriculture towards a more sustainable and productive future.

Restraint

Implementing AI technologies in agriculture often requires significant upfront investment in infrastructure, equipment, and training.

The introduction of AI technologies into agriculture holds tremendous promise for revolutionizing farming methods and boosting productivity. However, a significant obstacle to widespread adoption is the substantial initial investment required. Integrating AI solutions often entails considerable upfront costs for acquiring infrastructure, specialized equipment, and providing training. This financial burden presents a notable challenge, particularly for small-scale farmers or those operating in regions with limited financial resources. Initially, significant capital outlay is necessary to establish the infrastructure supporting AI-driven systems, including computing hardware, sensors, and network connectivity. These foundational elements are essential for gathering, processing, and analyzing the data pivotal for AI applications in agriculture. Moreover, the acquisition and upkeep of specialized equipment such as drones, robotic systems, and IoT devices contribute further to the upfront investment. These technologies facilitate crucial tasks like crop monitoring, precise spraying, and automated harvesting, but their associated procurement and maintenance costs may be prohibitive for farmers facing financial constraints. Furthermore, training personnel to effectively operate and manage AI technologies is paramount for successful implementation. Comprehensive training programs and workshops are essential to equip farmers and agricultural workers with the requisite skills for utilizing AI-driven systems, interpreting data insights, and addressing technical challenges. However, organizing and executing such training endeavors demand additional resources, both in terms of time and finances, which may be scarce for farmers operating within limited budgets.

Opportunities

AI algorithms can analyze data at a granular level to provide personalized recommendations for crop management, tailored to specific soil conditions, weather patterns, and crop varieties.

Tailored crop management is a revolutionary approach in agriculture, facilitated by the analytical capabilities of AI algorithms. These algorithms delve deeply into data, allowing them to provide personalized guidance for managing crops, precisely adapted to the unique soil conditions, weather patterns, and crop varieties.

By harnessing AI technology, farmers can move beyond generalized farming methods and instead embrace strategies customized to suit the distinct characteristics of their land and crops. AI algorithms analyze diverse datasets, including soil composition, moisture levels, temperature variations, and historical weather data. This comprehensive information empowers AI systems to develop a nuanced understanding of the agricultural landscape. Equipped with this detailed knowledge, AI algorithms generate insights and recommendations that are highly specific and targeted. For instance, they can suggest optimal planting schedules, prescribe precise amounts of water and fertilizers based on real-time conditions, and even anticipate potential pest infestations or disease outbreaks before they arise. By accounting for the individual needs and challenges of each field or crop, AI-guided recommendations enable farmers to optimize yields, minimize resource usage, and effectively manage risks. Furthermore, AI enables continuous learning and adaptation, refining its recommendations over time through feedback and new data inputs. As the system accumulates more information and insights from each growing season, it becomes increasingly proficient at fine-tuning its recommendations to achieve superior results. In essence, AI-driven customized crop management marks a significant advancement in agriculture, empowering farmers to leverage data-driven insights for optimizing their practices. By tailoring cultivation strategies to suit the specific requirements of their crops and environments, farmers can enhance productivity, sustainability, and resilience amidst the dynamic challenges of modern agriculture.

Artificial Intelligence (AI) in Agriculture Market Trends

-

AI-powered remote sensing, including drones and satellites, is becoming more common for real-time crop health monitoring and soil analysis.

- AI technologies are increasingly integrated into precision agriculture practices, optimizing resource usage and crop yields.

-

Predictive analytics in agriculture is growing, with AI algorithms forecasting crop yields, market trends, and weather patterns.

-

AI-based solutions provide data-driven recommendations for crop and soil management practices, enhancing productivity and sustainability.

-

AI optimizes agricultural supply chains, improving logistics, reducing waste, and enhancing product traceability.

-

AI-driven automation technologies streamline farm operations, reducing labor costs and addressing labor shortages.

-

Cloud-based AI platforms and services make advanced AI accessible to farmers without significant infrastructure investment.

-

AI integration with IoT devices and Big Data analytics enables real-time monitoring and scalability in agriculture.

-

AI promotes sustainability by optimizing resource use and minimizing environmental impact in farming practices.

Competitive Landscape

The competitive landscape of the artificial intelligence in agriculture market was dynamic, with several prominent companies competing to provide innovative and advanced artificial intelligence in agriculture solutions.

- Ag Leader Technology

- AgEagle Aerial Systems

- AgJunction

- Amazon Web Services Inc.

- Bayer AG

- Blue River Technology

- Broadcom

- Cisco Systems, Inc.

- Climate Corporation

- Deere & Company

- FarmWise

- Gamaya

- Google LLC

- Granular, Inc. (U.S.)

- IBM Corporation

- John Deere

- Mavrx

- Oracle

- FarmBot

Recent Developments:

February 28, 2024— John Deere announces the new C-Series air cart line, providing new options for farmers focused on seeding-time productivity, quality and accuracy.

February 28, 2024 – John Deere Announces See & Spray™ Premium Availability on 2025 Hagie STS Sprayers. John Deere announces the expanded availability of one of its premier technology solutions – See & Spray™ Premium – on model-year 2025 Hagie STS sprayers. Already available as a precision upgrade on select John Deere sprayers, See & Spray Premium is an AI-powered weed-sensing system that activates individual spray nozzles when target weeds are “seen” by boom-mounted cameras.

Regional Analysis

North America stands out as a leading region in the AI in Agriculture market. The region boasts advanced economies with well-established agricultural sectors and a high level of technological adoption. Companies based in the United States and Canada, such as IBM Watson, Microsoft AI for Earth, and John Deere, are at the forefront of developing AI solutions for agriculture. Additionally, North America benefits from significant investments in research and development, robust infrastructure, and a favorable regulatory framework that encourages innovation in AI technologies. Europe is another dominant region in the AI in Agriculture market, characterized by a strong emphasis on sustainability and precision farming practices. Countries like Germany, the Netherlands, and the United Kingdom have thriving agricultural industries and are home to leading AI companies focusing on agriculture. European Union policies and initiatives, such as the Common Agricultural Policy (CAP) and Horizon Europe, support the adoption of AI technologies in agriculture, further fueling market growth.

Asia Pacific is rapidly emerging as a dominant region in the AI in Agriculture market, driven by the increasing adoption of AI technologies in countries like China, Japan, and India. These countries have large agricultural sectors and face challenges related to food security, environmental sustainability, and labor shortages, driving the demand for AI-powered solutions. Moreover, government initiatives and investments in digital agriculture and smart farming technologies contribute to the region’s dominance in the AI in Agriculture market. Overall, while North America, Europe, and Asia Pacific are key players in the AI in Agriculture market, other regions such as Latin America and the Middle East & Africa are also witnessing significant growth opportunities driven by increasing awareness, technological advancements, and the need to address agricultural challenges. As the adoption of AI technologies continues to expand globally, the landscape of the AI in Agriculture market is expected to evolve, with different regions playing pivotal roles in driving innovation and market growth.

Target Audience for Artificial Intelligence (AI) in Agriculture Market

- Research and Development Teams

- Investors and Venture Capitalists

- Marketing Agencies

- Consulting Firms

- Agricultural cooperatives

- Government agricultural departments and agencies

- Agricultural retailers and distributors

- Agricultural research institutions and universities

Segments Covered in the Artificial Intelligence (AI) in Agriculture Market Report

Artificial Intelligence (AI) in Agriculture Market by Technology

- Machine Learning

- Computer Vision

- Predictive Analytics

Artificial Intelligence (AI) in Agriculture Market by Offering

- Software

- AI-as-a-Service

Artificial Intelligence (AI) in Agriculture Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Artificial Intelligence (AI) in Agriculture market over the next 7 years?

- Who are the key market participants in Artificial Intelligence (AI) in Agriculture, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Artificial Intelligence (AI) in Agriculture market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Artificial Intelligence (AI) in Agriculture market?

- What is the current and forecasted size and growth rate of the global Artificial Intelligence (AI) in Agriculture market?

- What are the key drivers of growth in the Artificial Intelligence (AI) in Agriculture market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Artificial Intelligence (AI) in Agriculture market?

- What are the technological advancements and innovations in the Artificial Intelligence (AI) in Agriculture market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Artificial Intelligence (AI) in Agriculture market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Artificial Intelligence (AI) in Agriculture market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET OUTLOOK

- GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY, 2020-2030, (USD BILLION)

- MACHINE LEARNING

- COMPUTER VISION

- PREDICTIVE ANALYTICS

- GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING, 2020-2030, (USD BILLION)

- SOFTWARE

- AI-AS-A-SERVICE

- GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- AG LEADER TECHNOLOGY

- AGEAGLE AERIAL SYSTEMS

- AGJUNCTION

- AMAZON WEB SERVICES INC.

- BAYER AG

- BLUE RIVER TECHNOLOGY

- BROADCOM

- CISCO SYSTEMS, INC.

- CLIMATE CORPORATION

- DEERE & COMPANY

- FARMWISE

- GAMAYA

- GOOGLE LLC

- GRANULAR, INC. (U.S.)

- IBM CORPORATION

- JOHN DEERE

- MAVRX

- ORACLE

- FARMBOT *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 2 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 3 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY REGION (USD BILLION) 2020-2030

TABLE 4 NORTH AMERICA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 7 US ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 8 US ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 9 CANADA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 10 CANADA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 11 MEXICO ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 12 MEXICO ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 13 SOUTH AMERICA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 14 SOUTH AMERICA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 15 SOUTH AMERICA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 16 BRAZIL ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 17 BRAZIL ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 18 ARGENTINA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 19 ARGENTINA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 20 COLOMBIA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 21 COLOMBIA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 22 REST OF SOUTH AMERICA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 23 REST OF SOUTH AMERICA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 24 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 25 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 26 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 27 INDIA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 28 INDIA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 29 CHINA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 30 CHINA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 31 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 32 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 33 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 34 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 35 AUSTRALIA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 36 AUSTRALIA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 37 SOUTH-EAST ASIA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 38 SOUTH-EAST ASIA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 39 REST OF ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 40 REST OF ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 41 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 42 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 43 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 44 GERMANY ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 45 GERMANY ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 46 UK ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 47 UK ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 48 FRANCE ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 49 FRANCE ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 50 ITALY ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 51 ITALY ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 52 SPAIN ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 53 SPAIN ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 54 RUSSIA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 55 RUSSIA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 56 REST OF EUROPE ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 57 REST OF EUROPE ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 58 MIDDLE EAST AND AFRICA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 59 MIDDLE EAST AND AFRICA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 60 MIDDLE EAST AND AFRICA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 61 UAE ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 62 UAE ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 63 SAUDI ARABIA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 64 SAUDI ARABIA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 65 SOUTH AFRICA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 66 SOUTH AFRICA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

TABLE 67 REST OF MIDDLE EAST AND AFRICA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY (USD BILLION) 2020-2030

TABLE 68 REST OF MIDDLE EAST AND AFRICA ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY, USD BILLION, 2022-2030

FIGURE 9 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING, USD BILLION, 2022-2030

FIGURE 10 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY REGION, USD BILLION, 2022-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY TECHNOLOGY, USD BILLION,2022

FIGURE 13 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY OFFERING, USD BILLION,2022

FIGURE 14 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN AGRICULTURE MARKET BY REGION, USD BILLION,2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 AG LEADER TECHNOLOGY: COMPANY SNAPSHOT

FIGURE 17 AGEAGLE AERIAL SYSTEMS: COMPANY SNAPSHOT

FIGURE 18 AGJUNCTION: COMPANY SNAPSHOT

FIGURE 19 AMAZON WEB SERVICES INC.: COMPANY SNAPSHOT

FIGURE 20 BAYER AG: COMPANY SNAPSHOT

FIGURE 21 BLUE RIVER TECHNOLOGY: COMPANY SNAPSHOT

FIGURE 22 BROADCOM: COMPANY SNAPSHOT

FIGURE 23 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

FIGURE 24 CLIMATE CORPORATION: COMPANY SNAPSHOT

FIGURE 25 DEERE & COMPANY: COMPANY SNAPSHOT

FIGURE 26 FARM WISE: COMPANY SNAPSHOT

FIGURE 27 GAMAYA: COMPANY SNAPSHOT

FIGURE 28 GOOGLE LLC: COMPANY SNAPSHOT

FIGURE 29 GRANULAR, INC. (U.S.): COMPANY SNAPSHOT

FIGURE 30 IBM CORPORATION: COMPANY SNAPSHOT

FIGURE 31 JOHN DEERE: COMPANY SNAPSHOT

FIGURE 32 MAVRX: COMPANY SNAPSHOT

FIGURE 33 ORACLE: COMPANY SNAPSHOT

FIGURE 34 FARMBOT: COMPANY SNAPSHOT

FAQ

The global artificial intelligence in agriculture market size is projected to grow from USD 1.7 billion in 2023 to USD 6.96 billion by 2030, exhibiting a CAGR of 22.3% during the forecast period.

North America accounted for the largest market in the artificial intelligence in agriculture market.

AgJunction, Amazon Web Services Inc, Bayer AG, Blue River Technology, Broadcom, Cisco Systems, Climate Corporation, Deere & Company, FarmWise, Gamaya, Google LLC.

Increased collaboration among technology providers, agricultural companies, and research institutions aims to accelerate innovation in AI for agriculture.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.