REPORT OUTLOOK

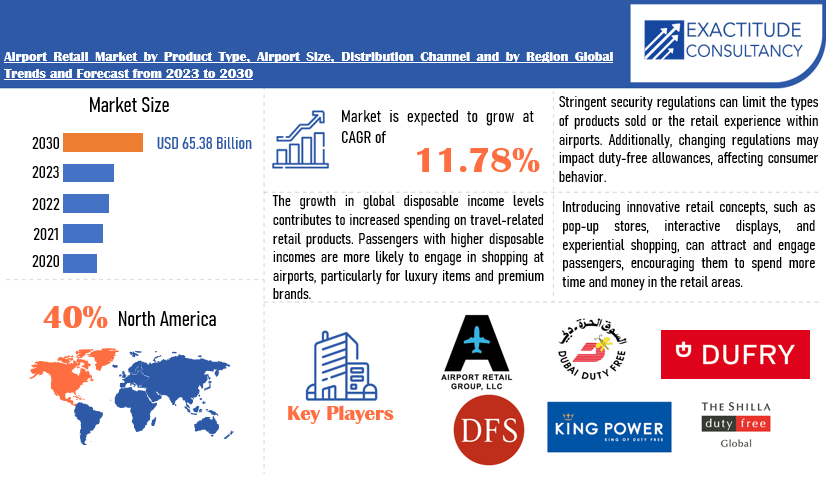

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 65.38 Billion by 2030 | 11.78 % | North America |

| by Product Type | by Distribution Channel |

|---|---|

|

|

SCOPE OF THE REPORT

Airport Retail Market Overview

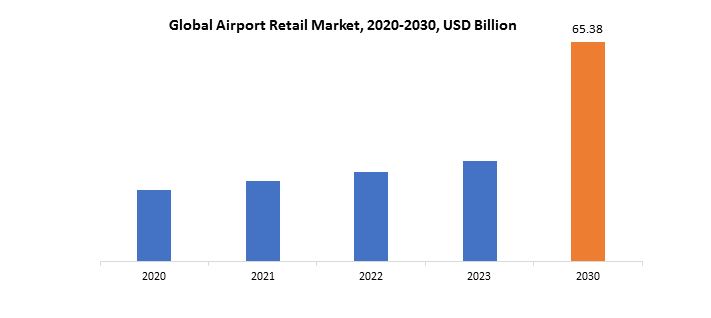

The global airport retail market is anticipated to grow from USD 29.99 Billion in 2023 to USD 65.38Billion by 2030, at a CAGR of 11.78 % during the forecast period.

Airport retail refers to the commercial activities and services offered within airport terminals to cater to the needs and preferences of travelers. This unique retail environment has evolved beyond the traditional duty-free shops to encompass a diverse range of products and services, creating a dynamic and competitive marketplace. Airports have become strategic locations for retailers to tap into a captive and diverse customer base, as passengers from various regions and backgrounds pass through these hubs. The retail offerings in airports typically include a mix of luxury brands, fashion boutiques, electronics stores, duty-free shops, convenience stores, and food and beverage outlets. The goal is to enhance the overall passenger experience by providing a convenient and enjoyable shopping environment.

The layout of airport retail spaces is carefully designed to optimize foot traffic and encourage impulse purchases. Duty-free shops, in particular, capitalize on the absence of certain taxes, making goods more attractive to international travelers. Additionally, airport retailers often employ marketing strategies to target specific demographic groups, taking into account factors such as travel purpose, destination, and flight times. The integration of technology, such as interactive displays and mobile apps, enhances the shopping experience and allows for personalized promotions.

Beyond traditional retail, airports also offer a variety of services, including currency exchange, travel agencies, spa and wellness centers, and business lounges. These services contribute to the overall convenience and comfort of passengers during their time at the airport. Moreover, the evolution of e-commerce and online shopping has prompted many airport retailers to establish a digital presence, allowing passengers to pre-order and collect items at the airport or even have them delivered directly to their destination.

The increasing global travel trend, driven by rising disposable incomes and a growing middle class, contributes significantly to the expansion of airport retail. As more people travel for business and leisure, airports become prime locations for retailers to tap into a diverse and captive consumer base. Moreover, the growth of international tourism plays a crucial role in shaping the airport retail market. Duty-free shops, in particular, benefit from tax exemptions, making products more appealing to international travelers seeking tax-free purchases. Airports are strategically positioned to cater to the preferences of these diverse passenger demographics, offering a wide range of products from luxury brands to locally sourced items.

Technological advancements also play a pivotal role in driving the airport retail market. The integration of digital platforms, mobile apps, and e-commerce facilitates seamless shopping experiences for travelers. Pre-ordering, online payment, and in-app promotions enhance convenience and encourage passengers to engage in retail activities during their airport stay. Furthermore, airports are increasingly focusing on creating aesthetically pleasing and engaging retail spaces. Innovative and well-designed layouts, along with the incorporation of interactive displays and digital signage, enhance the overall shopping experience. Airports are evolving into more than just transportation hubs; they are becoming lifestyle destinations, and retail is a key element in shaping this transformation.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Product Type, Airport Size,Distribution Channeland Region |

| By Product Type |

|

| By Airport Size |

|

| By Distribution Channel |

|

|

By Region

|

|

Airport Retail Market Segmentation Analysis

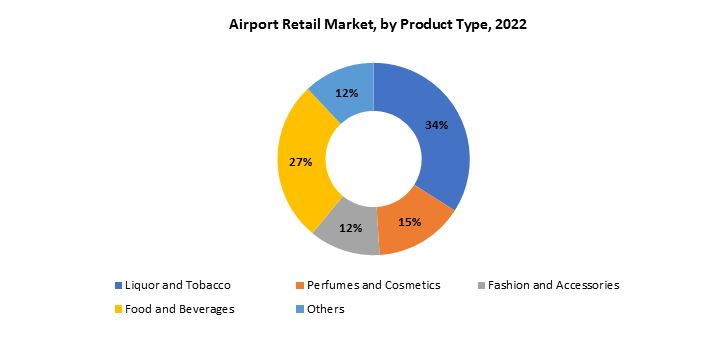

The global Airport Retail market is divided into three segments, product type, airport size, distribution channeland region. By product typethe market is divided Liquor and Tobacco, Perfumes and Cosmetics, Fashion and Accessories, Food and Beverages, Others. By Airport Sizethe market is classified into Large Airport, Medium Airport, Small Airport.By distribution channel the market is divided into Direct Retailer, Convenience Store, Specialty Retailer, Departmental Store.

Based onproduct type,liquor and tobacco segment dominating in the airport retailmarket. The liquor and tobacco segment stands out as a dominant force in the airport retail market, consistently proving to be a key revenue generator for both retailers and airports alike. This prominence is largely attributed to the unique dynamics of airport shopping, particularly in the realm of duty-free purchases. Liquor and tobacco products benefit significantly from the tax exemptions and reduced duties offered in airport duty-free shops, making them more attractive to international travelers seeking cost-effective and tax-free options.

The allure of exclusive and premium alcohol and tobacco brands further contributes to the segment’s dominance. Many airports strategically position their liquor and tobacco shops to showcase a wide array of international and luxury products, creating an enticing shopping experience for passengers. Travelers often perceive airports as ideal locations to purchase specialty or high-end spirits, wines, and cigars, which are sometimes challenging to find in regular retail outlets.

Additionally, the gifting culture associated with liquor and tobacco products adds to their popularity in airport retail. Duty-free shops offer travelers the opportunity to buy gifts for friends, family, or business associates, with the added advantage of cost savings due to tax exemptions. The segment capitalizes on the convenience factor, as passengers can conveniently pick up last-minute gifts without the hassle of navigating through city-center stores.

The liquor and tobacco segment’s dominance is also influenced by the ritualistic nature of travel, where passengers may indulge in shopping for celebratory items or unique products during their journey. Airport retailers strategically leverage this aspect by curating an extensive selection of premium and exclusive liquor and tobacco options, creating a sense of exclusivity and novelty that further entices travelers.

Based onairport size,large airport segment dominating in the airport retailmarket.Large airports, often classified as major international hubs and mega airports, accommodate millions of passengers annually, creating a vast and diverse consumer base for retailers. The sheer scale of these airports allows for expansive and sophisticated retail infrastructure, featuring a wide array of shopping options ranging from luxury boutiques and flagship stores to extensive duty-free outlets.

The primary factor contributing to the dominance of large airports in the retail market is the high passenger footfall. The substantial number of travelers passing through these airports provides retailers with a significantly larger customer base, enabling them to tap into diverse demographics and consumer preferences. This creates an environment conducive to the establishment of flagship stores for renowned brands, offering a unique opportunity to showcase and sell high-end products to a global audience.

Furthermore, large airports often boast substantial commercial spaces, allowing for the creation of sophisticated and aesthetically pleasing retail environments. Retailers in these spaces can leverage advanced design concepts, interactive displays, and innovative marketing strategies to enhance the overall shopping experience for passengers. The extensive duty-free areas in large airports, made possible by higher passenger numbers, also attract international travelers seeking tax-free purchases on a wide range of products.

Additionally, the strategic importance of large airports as global transit points makes them attractive locations for retailers aiming to gain international visibility and expand their market reach. The dominance of the large airport segment in the retail market underscores the correlation between passenger volume and commercial success, with retailers strategically aligning their offerings to cater to the preferences and expectations of the diverse clientele passing through these major transportation hubs.

Airport Retail Market Dynamics

Driver

Rising disposable incomes in developing countries will lead to a higher spending capacity among travelers, benefitting airport retail market growth.

The rising disposable incomes in developing countries herald a significant boon for the airport retail market, as they contribute to a considerable increase in the spending capacity of travelers. As individuals in these regions experience improved economic conditions and greater financial stability, their ability to allocate discretionary funds for travel-related expenses, including retail purchases at airports, sees a noteworthy surge. This phenomenon is particularly evident in emerging economies across Asia, Africa, and Latin America, where expanding middle-class populations are increasingly engaging in international and domestic travel. The higher spending capacity among these travelers translates into a heightened demand for a diverse range of products offered within airport retail spaces. Luxury goods, premium brands, and other discretionary items become more accessible, leading to increased sales and revenue for airport retailers. This trend not only stimulates the airport retail market but also reinforces the airports’ role as dynamic commercial hubs catering to the evolving preferences and purchasing power of a growing number of affluent travelers from developing economies.

Restraint

Competition from online retailpose challenges airport retail market.

The airport retail market faces formidable challenges from the relentless growth of online retail, posing a multifaceted threat to the traditional brick-and-mortar model. As e-commerce platforms continue to offer a convenient, diverse, and often more competitively priced array of products, travelers are increasingly inclined to shift their purchasing behaviors towards online channels. The ease of browsing, comparing, and purchasing from the comfort of one’s home or on-the-go presents a stark contrast to the time constraints and limitations inherent in airport shopping.

Furthermore, online retailers leverage targeted digital marketing, personalized recommendations, and loyalty programs, engaging customers in a way that challenges the unique shopping experience airports strive to provide. The emergence of duty-free online shopping platforms further intensifies competition, allowing consumers to access tax-free goods without the constraints of airport visits. Airport retailers must navigate this landscape by embracing digital transformation, enhancing the in-store experience, and leveraging the advantages of immediacy and exclusivity to counterbalance the convenience offered by online competitors. Addressing the challenges posed by online retail is crucial for airport businesses to remain resilient and competitive in an evolving global marketplace.

Opportunities

Shifting consumer preferences present opportunities for airport retail market.

The evolving landscape of consumer preferences presents dynamic opportunities for the airport retail market. As travelers become more discerning and value experiential retail, airports can capitalize on this shift by curating unique and engaging shopping experiences. There is a growing demand for authenticity, sustainability, and locally sourced products, prompting airports to diversify their retail offerings and align with these preferences. The rise of conscious consumerism opens avenues for airport retailers to highlight eco-friendly brands, ethical practices, and products with a compelling narrative.

Additionally, the demand for tech-savvy solutions and seamless shopping experiences provides an opportunity for airports to integrate digital technologies, such as mobile apps, virtual reality, and contactless payments. As consumers increasingly seek personalized interactions, airports can leverage data analytics to tailor promotions and loyalty programs, fostering a sense of exclusivity and connection with their audience. The adoption of innovative retail concepts, pop-up stores, and collaborations with niche or luxury brands further enriches the shopping environment. By adapting to changing consumer preferences, airport retailers have the potential to create vibrant, customer-centric spaces that not only meet but exceed traveler expectations, ultimately driving growth in the airport retail market.

Airport Retail Market Trends

-

Increased adoption of digital technologies such as mobile apps, augmented reality, and contactless payments to enhance the overall shopping experience and provide travelers with convenient, personalized, and seamless transactions.

-

Growing emphasis on sustainability with airports and retailers prioritizing eco-friendly practices, offering products with environmentally friendly packaging, and showcasing locally sourced or ethically produced items to align with consumer preferences.

-

Introduction of innovative retail concepts, such as virtual storefronts, interactive displays, and pop-up shops, creating dynamic and engaging shopping environments within airport terminals.

-

The duty-free sector continues to thrive, particularly in the Asia-Pacific region, attracting passengers with tax-free luxury items, exclusive collaborations, and high-end brands.

-

Integration of sophisticated digital marketing strategies and personalized promotions through mobile apps to target specific customer segments and enhance brand loyalty.

-

A rising trend in offering health and wellness products, including organic snacks, nutritional supplements, and travel-related health items, reflecting a growing awareness of well-being among travelers.

Competitive Landscape

The competitive landscape of the airport retail market was dynamic, with several prominent companies competing to provide innovative and advanced airport retailsolutions.

- Airport Retail Group LLC

- Dubai Duty Free

- Dufry AG

- DFS Group Ltd.

- King Power International

- The Shilla Duty Free

- China Duty Free Group Co., Ltd.

- Heinemann SE & Co. KG

- Japan Airport Terminal Co., Ltd.

- Flemingo International

- Lagardère Travel Retail

- LS Travel Retail

- Stellar Partners, Inc.

- Aer Rianta International cpt

- Duty Free Americas

- Duty Free Shoppers Ltd.

- Lotte Duty Free

- Autogrill

- Capi-Lux

- Rianta International

Recent Developments:

- 25 August 2023: – Heinemann Australia launched Australian luxury resort wear brand CAMILLA into airport duty-free at its Sydney Airport store through a new pop-up activation. This is Heinemann’s first major fashion launch since it unveiled its new premium and luxury space and brand offering in Sydney Airport’s international terminal.

- January 03, 2024: – Dubai Duty Free, one of the world’s largest travel retail operators, announced its partnership with Alipay+ to power a seamless travel and checkout experience for international visitors.

Regional Analysis

North America accounted for the largest market in the airport retail market. North America accounted for 40 % market share of the global market value. North America stands as the largest and most influential market in the airport retail sector, driven by the region’s robust air travel infrastructure, high passenger volumes, and consumer spending habits. Major international airports, such as those in the United States and Canada, serve as bustling hubs for domestic and international travelers, presenting a lucrative landscape for a diverse range of retail offerings.

The affluent consumer base in North America contributes significantly to the thriving sales of luxury goods within airport retail spaces. Airports like JFK International Airport in New York and Los Angeles International Airport showcase an extensive array of retail options, from renowned global brands to local and niche products, reflecting the diverse preferences of the region’s travelers. The strategic positioning of North American airports as key transit points on global routes ensures a constant influx of passengers, providing ample opportunities for retailers to showcase and sell their products. The region’s commitment to innovative retail concepts, digital technologies, and diverse product offerings further solidifies North America’s dominance in the vibrant and lucrative airport retail market.

In Europe, renowned for its major international airports like Heathrow, Amsterdam Schiphol, and Frankfurt Airport, travelers encounter an extensive array of retail offerings, ranging from iconic luxury brands to locally curated products. The European consumer base, known for its discerning taste and penchant for high-quality goods, shapes the market, driving a thriving segment of premium and luxury items within airport retail spaces. Moreover, Europe places a notable emphasis on sustainability, influencing the availability of eco-friendly and ethically sourced products in airport retail.

In Asia-Pacific, the airport retail market experiences unparalleled growth, buoyed by the region’s burgeoning middle class and the surge in outbound tourism. Airports such as Beijing Capital International, Tokyo Haneda, and Changi Airport in Singapore are global leaders in passenger traffic and innovation, offering passengers a comprehensive and diverse shopping experience. The Asia-Pacific region distinguishes itself through a blend of traditional craftsmanship and cutting-edge technology in its retail spaces, setting trends for interactive shopping experiences and digital integration. The duty-free sector thrives in Asia-Pacific, attracting both domestic and international travelers with an array of tax-free offerings, further contributing to the region’s prominence in the global airport retail market.

Target Audience for Airport Retail Market

- Airport Retailers

- Retail Investors

- Airport Authorities

- Market Analysts

- Retail Industry Professionals

- Brand Owners

- Consumer Goods Manufacturers

- Airport Management Companies

- Financial Institutions

- Government Agencies

Segments Covered in the Airport Retail Market Report

Airport Retail Market by Product Type

- Liquor and Tobacco

- Perfumes and Cosmetics

- Fashion and Accessories

- Food and Beverages

- Others

Airport Retail Market by Airport Size

- Large Airport

- Medium Airport

- Small Airport

Airport Retail Market by Distribution Channel

- Direct Retailer

- Convenience Store

- Specialty Retailer

- Departmental Store

Airport Retail Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the airport retailmarket over the next 7 years?

- Who are the major players in the Airport Retail market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the Airport Retail market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Airport Retail market?

- What is the current and forecasted size and growth rate of the global Airport Retail market?

- What are the key drivers of growth in the Airport Retail market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Airport Retail market?

- What are the technological advancements and innovations in the Airport Retail market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the airport retail market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Airport Retail market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AIRPORT RETAIL MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AIRPORT RETAIL MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- DISTRIBUTION CHANNEL VALUE CHAIN ANALYSIS

- GLOBAL AIRPORT RETAIL MARKET OUTLOOK

- GLOBAL AIRPORT RETAIL MARKET BY PRODUCT TYPE, 2020-2030, (USD BILLION)

- LIQUOR AND TOBACCO

- PERFUMES AND COSMETICS

- FASHION AND ACCESSORIES

- FOOD AND BEVERAGES

- OTHERS

- GLOBAL AIRPORT RETAIL MARKET BY AIRPORT SIZE, 2020-2030, (USD BILLION)

- LARGE AIRPORT

- MEDIUM AIRPORT

- SMALL AIRPORT

- GLOBAL AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL, 2020-2030, (USD BILLION)

- DIRECT RETAILER

- CONVENIENCE STORE

- SPECIALTY RETAILER

- DEPARTMENTAL STORE

- GLOBAL AIRPORT RETAIL MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- AIRPORT RETAIL GROUP LLC

- DUBAI DUTY FREE

- DUFRY AG

- DFS GROUP LTD.

- KING POWER INTERNATIONAL

- THE SHILLA DUTY FREE

- CHINA DUTY FREE GROUP CO., LTD.

- HEINEMANN SE & CO. KG

- JAPAN AIRPORT TERMINAL CO., LTD.

- FLEMINGO INTERNATIONAL

- LAGARDÈRE TRAVEL RETAIL

- LS TRAVEL RETAIL

- STELLAR PARTNERS, INC.

- AER RIANTA INTERNATIONAL CPT

- DUTY FREE AMERICAS

- DUTY FREE SHOPPERS LTD.

- LOTTE DUTY FREE

- AUTOGRILL

- CAPI-LUX

- RIANTA INTERNATIONAL *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 3 GLOBAL AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 4 GLOBAL AIRPORT RETAIL MARKET BY REGION (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA AIRPORT RETAIL MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 10 US AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 11 US AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 12 CANADA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 13 CANADA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 14 CANADA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 15 MEXICO AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 16 MEXICO AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 17 MEXICO AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA AIRPORT RETAIL MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 23 BRAZIL AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 24 BRAZIL AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 25 ARGENTINA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 26 ARGENTINA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 27 ARGENTINA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 28 COLOMBIA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 29 COLOMBIA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 30 COLOMBIA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC AIRPORT RETAIL MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 39 INDIA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 40 INDIA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 41 CHINA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 42 CHINA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 43 CHINA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 44 JAPAN AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 45 JAPAN AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 46 JAPAN AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 59 EUROPE AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 60 EUROPE AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 61 EUROPE AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 62 EUROPE AIRPORT RETAIL MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 64 GERMANY AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 65 GERMANY AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 66 UK AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 67 UK AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 68 UK AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 69 FRANCE AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 70 FRANCE AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 71 FRANCE AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 72 ITALY AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 73 ITALY AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 74 ITALY AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 75 SPAIN AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 76 SPAIN AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 77 SPAIN AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 78 RUSSIA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 79 RUSSIA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 80 RUSSIA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA AIRPORT RETAIL MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 89 UAE AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 90 UAE AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2020-2030

FIGURE 10 GLOBAL AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2020-2030

FIGURE 11 GLOBAL AIRPORT RETAIL MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL AIRPORT RETAIL MARKET BY PRODUCT TYPE (USD BILLION) 2022

FIGURE 14 GLOBAL AIRPORT RETAIL MARKET BY AIRPORT SIZE (USD BILLION) 2022

FIGURE 15 GLOBAL AIRPORT RETAIL MARKET BY DISTRIBUTION CHANNEL (USD BILLION) 2022

FIGURE 16 GLOBAL AIRPORT RETAIL MARKET BY REGION (USD BILLION) 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 AIRPORT RETAIL GROUP LLC: COMPANY SNAPSHOT

FIGURE 19 DUBAI DUTY FREE: COMPANY SNAPSHOT

FIGURE 20 DUFRY AG: COMPANY SNAPSHOT

FIGURE 21 DFS GROUP LTD.: COMPANY SNAPSHOT

FIGURE 22 KING POWER INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 23 THE SHILLA DUTY FREE: COMPANY SNAPSHOT

FIGURE 24 CHINA DUTY FREE GROUP CO., LTD.: COMPANY SNAPSHOT

FIGURE 25 GEBR. HEINEMANN SE & CO. KG: COMPANY SNAPSHOT

FIGURE 26 JAPAN AIRPORT TERMINAL CO., LTD.: COMPANY SNAPSHOT

FIGURE 27 FLEMINGO INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 28 LAGARDÈRE TRAVEL RETAIL: COMPANY SNAPSHOT

FIGURE 29 LS TRAVEL RETAIL: COMPANY SNAPSHOT

FIGURE 30 STELLAR PARTNERS, INC.: COMPANY SNAPSHOT

FIGURE 31 AER RIANTA INTERNATIONAL CPT: COMPANY SNAPSHOT

FIGURE 32 DUTY FREE AMERICAS: COMPANY SNAPSHOT

FIGURE 33 DUTY FREE SHOPPERS LTD.: COMPANY SNAPSHOT

FIGURE 34 LOTTE DUTY FREE: COMPANY SNAPSHOT

FIGURE 35 AUTOGRILL: COMPANY SNAPSHOT

FIGURE 36 CAPI-LUX: COMPANY SNAPSHOT

FIGURE 37 RIANTA INTERNATIONAL: COMPANY SNAPSHOT

FAQ

The global airport retail market is anticipated to grow from USD 29.99 Billion in 2023 to USD 65.38 Billion by 2030, at a CAGR of 11.78 % during the forecast period.

North America accounted for the largest market in the airport retail market. North America accounted for 40 % market share of the global market value.

Airport Retail Group LLC, Dubai Duty Free, Dufry AG, DFS Group Ltd., King Power International, The Shilla Duty Free, China Duty Free Group Co., Ltd., Gebr. Heinemann SE & Co. KG, Japan Airport Terminal Co., Ltd., Flemingo International, Lagardère Travel Retail, LS Travel Retail, Stellar Partners, Inc., Aer Rianta International cpt, Duty Free Americas, Duty Free Shoppers Ltd., Lotte Duty Free, Autogrill, Capi-Lux, Rianta International

Key trends in the airport retail market include the integration of digital technologies, such as mobile apps and contactless payments, to enhance customer experiences, and a growing focus on sustainable and locally sourced products to align with evolving consumer preferences for eco-friendly and unique offerings. Additionally, there is a rising trend towards creating immersive shopping environments and curating exclusive collaborations with luxury and niche brands to elevate the overall airport retail experience.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.