REPORT OUTLOOK

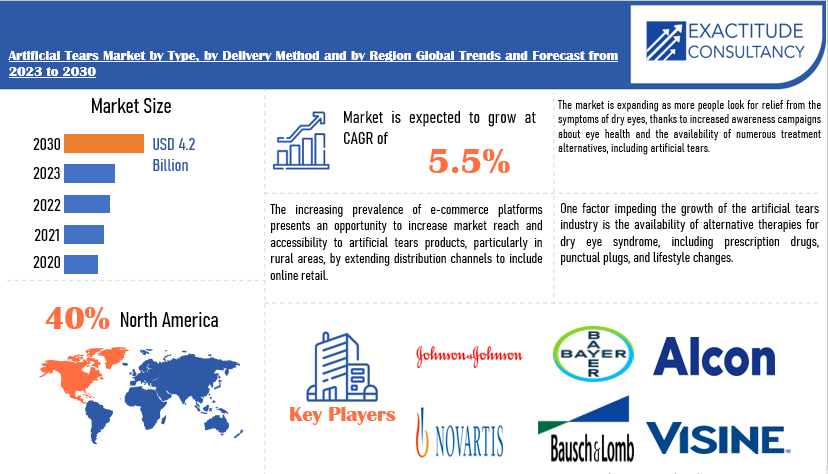

| Market Size | CAGR | Dominating Region |

|---|---|---|

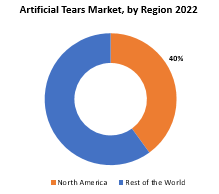

| USD 4.20 billion by 2030 | 5.5% | North America |

| by Type | by Delivery Method |

|---|---|

|

|

SCOPE OF THE REPORT

Artificial Tears Market Overview

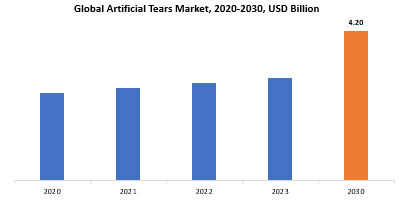

The global artificial tears market size is projected to grow from USD 2.89 billion in 2023 to USD 4.20 billion by 2030, exhibiting a CAGR of 5.5% during the forecast period.

Artificial tears are a form of eye drops or ointments designed to moisturize and lubricate the eye’s surface. They are commonly utilized to alleviate symptoms associated with dry eye syndrome, a condition characterized by inadequate tear production or poor tear quality, resulting in discomfort, irritation, and occasionally blurred vision. Typically composed of a blend of water, electrolytes, and thickening agents, artificial tears aim to replicate the natural composition of tears, thereby offering relief by hydrating the eye. Some formulations may also incorporate preservatives to safeguard against bacterial contamination in multi-dose containers. These products are available over-the-counter in various formulations tailored to different levels of dryness and individual sensitivities. While artificial tears provide temporary relief from dry eye symptoms and are generally considered safe for regular use, individuals with specific eye conditions or allergies should seek advice from a healthcare professional before using them.

The demand for and importance of artificial tears stem from their vital role in managing dry eye syndrome, a prevalent condition affecting millions worldwide. Dry eye syndrome occurs when the eyes fail to produce enough tears or produce tears of poor quality, leading to discomfort, irritation, and vision disturbances. Artificial tears serve as a frontline treatment, providing essential moisture and lubrication to the eye’s surface, thereby alleviating symptoms and improving overall comfort. With rising awareness of the condition and an increasing aging population prone to dry eye, the demand for artificial tears continues to grow. Moreover, in today’s digital age, prolonged screen time exacerbates dry eye symptoms, further fuelling the need for effective lubricating eye drops. The importance of artificial tears extends beyond mere symptom relief; they contribute to preserving ocular health by protecting the cornea and conjunctiva from damage caused by prolonged dryness. Additionally, artificial tears facilitate the maintenance of visual acuity by reducing the incidence of blurred vision associated with dry eye. Their accessibility over-the-counter and diverse formulations tailored to individual needs make artificial tears a convenient and essential solution for managing dry eye symptoms, thereby significantly enhancing the quality of life for those affected by this common ocular condition.

| ATTRIBUTE | DETAILS | ||

| Study period | 2020-2030 | ||

| Base year | 2022 | ||

| Estimated year | 2023 | ||

| Forecasted year | 2023-2030 | ||

| Historical period | 2019-2021 | ||

| Unit | Value (USD Billion) (Thousand Units) | ||

| Segmentation | By Type, Delivery Method and Region | ||

|

By Type |

|

||

|

By Delivery Method |

|

||

|

By Region

|

|

Artificial Tears Market Segmentation Analysis

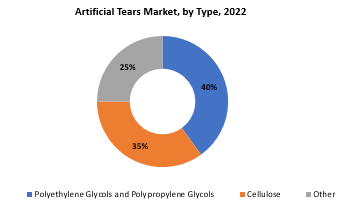

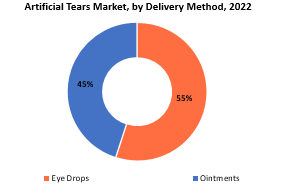

The global artificial tears market is divided into three segments, by type, delivery method and region. By type, the market is divided into polyethylene glycols and polypropylene glycols, cellulose, and others. By delivery method, the market is divided into eye drops, and ointments and by region.

The artificial tears market is segmented into various types, with distinctions including polyethylene glycols (PEGs) and polypropylene glycols (PPGs), cellulose-based formulations, and other miscellaneous variants. PEGs and PPGs represent a significant portion of this market, offering synthetic polymers that emulate the viscosity and lubricating properties of natural tears, providing prolonged relief for moderate to severe dry eye symptoms. Another notable category is cellulose-based artificial tears, which utilize derivatives like hydroxyethyl cellulose or carboxymethyl cellulose to act as lubricants and humectants, enhancing moisture retention on the eye’s surface. These formulations are often recommended for mild to moderate dry eye cases due to their soothing and hydrating effects. Beyond PEGs, PPGs, and cellulose-based options, the market encompasses a range of other formulations tailored to specific needs or preferences. This includes preservative-free variants for sensitive individuals, lipid-based options addressing evaporative dry eye, and specialty products containing additional ingredients like electrolytes or antioxidants to promote ocular health. Overall, the segmentation of the artificial tears market reflects the diverse requirements of individuals experiencing dry eye syndrome, offering a variety of solutions to address different severities and underlying causes. With various types of artificial tears available, patients can find suitable options to alleviate symptoms and enhance overall eye comfort and health.

The artificial tears market is segmented based on delivery method, primarily into eye drops and ointments. Eye drops, commonly used and convenient, come in small bottles with dropper tips for direct instillation onto the eye’s surface. They offer quick absorption, providing immediate relief for dry eye symptoms without leaving residue or heaviness, making them ideal for on-the-go hydration. On the other hand, ointments have a thicker consistency, ensuring prolonged lubrication and moisture retention on the ocular surface. Packaged in tubes or single-use packets, they are applied to the lower eyelid or inner eyelid surface, gradually spreading with blinking. Although ointments may initially blur vision, they offer sustained relief and are often recommended for nighttime or severe dry eye cases requiring longer-lasting hydration. Both eye drops and ointments play vital roles in managing dry eye syndrome, catering to individual preferences and needs. Eye drops offer convenience and rapid relief, while ointments provide extended lubrication, ensuring patients have access to diverse options tailored to their specific symptoms and lifestyles.

Artificial Tears Market Dynamics

Driver

The rising incidence of dry eye syndrome has become a prominent driver for the artificial tears market, with various factors contributing to its increasing prevalence.

The increasing prevalence of dry eye syndrome is a key driving force behind the growth of the artificial tears market. This rise can be attributed to several factors. Firstly, there is a global demographic shift towards older populations, who naturally experience a decrease in tear production, making them more prone to dry eye symptoms. As life expectancy continues to increase and the elderly population expands, the prevalence of dry eye syndrome is expected to follow suit. Additionally, contemporary lifestyles characterized by prolonged screen usage on devices such as smartphones, computers, and tablets contribute significantly to the problem. Extended screen time often leads to reduced blinking and incomplete eyelid closure, hindering the proper distribution of tears across the eye surface. This phenomenon, commonly known as “computer vision syndrome” or “digital eye strain,” affects people of all ages and has become increasingly prevalent in various settings, both professional and recreational. Environmental factors also play a significant role in exacerbating dry eye syndrome. Exposure to dry or windy conditions, air pollution, smoke, and indoor heating or air conditioning systems can all contribute to eye surface dryness and discomfort. Certain occupations or activities that involve prolonged exposure to air-conditioned environments, such as office work or air travel, can further worsen dry eye symptoms. In summary, the combined impact of aging populations, increased screen time, and environmental factors has led to a noticeable uptick in the prevalence of dry eye syndrome globally. This growing awareness of dry eye syndrome, coupled with the aging population demographics, drives the demand for artificial tears as a primary solution for alleviating symptoms and restoring eye comfort. Consequently, the artificial tears market is poised for sustained growth in the foreseeable future.

Restraint

A significant challenge for market participants in the artificial tears sector is navigating the regulatory environment, especially in large regions like the US and Europe.

One of the biggest challenges facing companies in the artificial tears industry is navigating the regulatory environment, especially in large regions like the US and Europe. The strict legal requirements for product approval mean that extensive testing and paperwork are necessary, which means long lead times and large outlays of money. In the United States, the Food and Drug Administration (FDA) oversees the approval process for artificial tears and other ophthalmic products. Manufacturers are required to demonstrate the safety, efficacy, and quality of their offerings through exhaustive clinical trials and regulatory submissions. Similarly, in Europe, the European Medicines Agency (EMA) establishes stringent standards for product approval, ensuring compliance with regulatory guidelines across member states. Meeting these regulatory benchmarks demands meticulous preclinical and clinical investigations, as well as adherence to Good Manufacturing Practices (GMP) to uphold product quality. Additionally, manufacturers must compile comprehensive documentation to substantiate their applications, encompassing details on formulation, stability, manufacturing processes, and packaging. The rigorous regulatory environment not only extends the time to market but also inflates costs associated with product development, testing, and regulatory filings. Consequently, delays in product launches can impede market entry and compromise competitive positioning, allowing rival products to gain ground in the interim. Furthermore, the evolving regulatory landscape and periodic revisions to compliance standards introduce further complexity, necessitating ongoing adaptation and investment in regulatory expertise. In essence, grappling with the stringent regulatory framework in major markets poses significant challenges for artificial tears manufacturers. These challenges, including delays in product introductions and heightened expenses, undercut market competitiveness and profitability. Nevertheless, adherence to regulatory standards remains indispensable in ensuring product safety and efficacy, fostering trust among healthcare professionals and consumers alike.

Opportunities

Manufacturers of artificial tears have a compelling development trajectory due to the unrealized potential in emerging markets.

The burgeoning potential within emerging markets represents a compelling growth avenue for artificial tears manufacturers. These markets, marked by expanding populations, escalating healthcare expenditure, and enhanced accessibility to healthcare services, offer promising opportunities for market expansion and penetration. In developing economies, the rise in disposable incomes and the expanding middle class contribute to increased spending on healthcare. With a growing emphasis on health and wellness, there is a rising demand for ocular health products, including artificial tears, to address prevalent eye conditions like dry eye syndrome. Moreover, the improvement in healthcare infrastructure and better access to medical facilities in these regions further catalyze market growth by facilitating the diagnosis and treatment of ocular ailments. Additionally, demographic shifts such as urbanization and aging populations in emerging markets intensify the prevalence of dry eye syndrome. Urban residents, particularly those engaged in occupations involving prolonged screen exposure, are susceptible to digital eye strain, driving the need for effective remedies like artificial tears. Furthermore, with aging populations, the incidence of age-related conditions such as dry eye syndrome rises, amplifying the demand for therapeutic solutions. For manufacturers aiming to leverage these burgeoning opportunities in emerging markets, navigating unique challenges such as diverse regulatory frameworks, cultural nuances, and varying healthcare infrastructures is essential. Adapting product offerings to meet local preferences and affordability levels while ensuring compliance with regulatory standards is imperative for success in these markets. In summary, the untapped potential in emerging markets, fueled by increasing healthcare expenditure and improving healthcare access, presents significant growth prospects for artificial tears manufacturers. By strategically addressing the distinct needs of these markets and capitalizing on demographic trends, manufacturers can establish a strong presence and foster sustainable growth in emerging economies.

Artificial Tears Market Trends

-

The global demographic is aging, leading to a higher prevalence of dry eye syndrome. This demographic shift is boosting the demand for artificial tears, as older individuals are more susceptible to dry eye due to age-related changes in tear production and composition.

-

Prolonged use of digital devices such as smartphones and computers has resulted in a rise in digital eye strain and related dry eye symptoms. Consequently, there is an increased demand for artificial tears among those experiencing discomfort from extended screen time.

-

Consumers are becoming more aware of potential side effects linked to preservatives in artificial tears, such as irritation or allergic reactions. Hence, there is a growing preference for preservative-free formulations, prompting manufacturers to develop new products to meet this demand.

-

Manufacturers are continuously innovating to create artificial tears with enhanced efficacy, longer-lasting relief, and improved comfort. This includes the development of lipid-based formulations targeting evaporative dry eye and the incorporation of novel ingredients like hyaluronic acid for superior hydration.

-

Artificial tears are becoming more readily available through various channels, including online retail platforms, pharmacies, and specialized eye care centers. This expansion of distribution channels enhances product accessibility and convenience for consumers.

-

Digital health technologies such as smartphone apps and wearable devices are being integrated into dry eye management. These technologies aid individuals in tracking symptoms, monitoring treatment adherence, and receiving personalized recommendations, thereby driving the adoption of artificial tears as part of comprehensive dry eye management strategies.

Competitive Landscape

The competitive landscape of the artificial tears market was dynamic, with several prominent companies competing to provide innovative and advanced artificial tears solutions.

- Allergan

- Bausch + Lomb

- Novartis AG

- Johnson & Johnson

- Alcon

- Santen Pharmaceutical Co., Ltd.

- Ocusoft, Inc.

- Thea Pharmaceuticals

- Akorn Pharmaceuticals

- Similasan Corporation

- Visine

- Prestige Consumer Healthcare Inc.

- Bayer AG

- Ophthalmic Specialty Group

- Rohto Pharmaceutical Co., Ltd.

- TheraTears

- OCuSOFT Inc.

- Scope Ophthalmics Ltd.

- Laboratoires Théa

- SIFI S.p.A.

Recent Developments:

March 20, 2024 – Bayer’s Pharmaceutical Division is set to embark on its next phase of growth, reshaping its executive Leadership Team to become more mission-centric and value focused.

March 04, 2024 –The only one-time gene therapy for treating spinal muscular atrophy (SMA), Zolgensma (onasemnogene abeparvovec), continues to show clinical improvements, according to new data from Novartis.

Regional Analysis

The dominant region in the artificial tears market varies depending on factors such as population demographics, healthcare infrastructure, prevalence of dry eye syndrome, and consumer preferences. However, regions with substantial aging populations, significant digital device usage, and well-established healthcare systems tend to emerge as key players in this market. Historically, North America, particularly the United States, has held a prominent position in the artificial tears market. Factors contributing to this dominance include the relatively high prevalence of dry eye syndrome, driven by aging demographics and widespread digital device usage. Additionally, North America benefits from advanced healthcare infrastructure, extensive research and development efforts, and a high level of consumer awareness regarding ocular health. The presence of major pharmaceutical companies and a robust network of distribution channels further solidifies North America’s leading position in this market.

Europe also commands a significant share in the artificial tears market, with countries like Germany, the United Kingdom, and France playing pivotal roles. Similar to North America, Europe boasts an aging population and widespread access to healthcare services, driving demand for artificial tears. Moreover, increasing awareness of ocular health and the growing popularity of preservative-free formulations contribute to market growth in this region. Asia Pacific is emerging as a rapidly growing market for artificial tears, fueled by factors such as the escalating prevalence of dry eye syndrome, particularly in countries like Japan and South Korea with aging populations. Additionally, rising disposable incomes, expanding healthcare infrastructure, and growing awareness of eye health are driving market expansion in this region. In summary, while North America has traditionally been the dominant region in the artificial tears market, Europe and Asia Pacific offer significant growth opportunities due to demographic shifts, advancements in healthcare, and increasing consumer awareness. However, the dominant region may continue to evolve as market dynamics shift and new trends emerge in the global healthcare landscape.

Target Audience for Artificial Tears Market

- Research and Development Teams

- Investors and Venture Capitalists

- Marketing Agencies

- Consulting Firms

- Medical device manufacturers

- Research and academic institutions

- Government health agencies and regulatory bodies

- Health insurance companies

- Market analysts and research firms

Segments Covered in the Artificial Tears Market Report

Artificial Tears Market by Type

- Polyethylene Glycols and Polypropylene Glycols

- Cellulose

- Other

Artificial Tears Market by Delivery Method

- Eye Drops

- Ointments

Artificial Tears Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Artificial Tears market over the next 7 years?

- Who are the key market participants in Artificial Tears, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Artificial Tears market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Artificial Tears market?

- What is the current and forecasted size and growth rate of the global Artificial Tears market?

- What are the key drivers of growth in the Artificial Tears market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Artificial Tears market?

- What are the technological advancements and innovations in the Artificial Tears market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Artificial Tears market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Artificial Tears market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- ARTIFICIAL TEARS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ARTIFICIAL TEARS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- ARTIFICIAL TEARS MARKET OUTLOOK

- GLOBAL ARTIFICIAL TEARS MARKET BY TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- POLYETHYLENE GLYCOLS AND POLYPROPYLENE GLYCOLS

- CELLULOSE

- OTHER

- GLOBAL ARTIFICIAL TEARS MARKET BY DELIVERY METHOD, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- EYE DROPS

- OINTMENTS

- GLOBAL ARTIFICIAL TEARS MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ALLERGAN

- BAUSCH + LOMB

- NOVARTIS AG

- JOHNSON & JOHNSON

- ALCON

- SANTEN PHARMACEUTICAL CO., LTD.

- OCUSOFT, INC.

- THEA PHARMACEUTICALS

- AKORN PHARMACEUTICALS

- SIMILASAN CORPORATION

- VISINE

- PRESTIGE CONSUMER HEALTHCARE INC.

- BAYER AG

- OPHTHALMIC SPECIALTY GROUP

- ROHTO PHARMACEUTICAL CO., LTD.

- THERATEARS

- OCUSOFT INC.

- SCOPE OPHTHALMICS LTD.

- LABORATOIRES THÉA

- SIFI S.P.A. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 2 GLOBAL ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 4 GLOBAL ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL ARTIFICIAL TEARS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL ARTIFICIAL TEARS MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA ARTIFICIAL TEARS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA ARTIFICIAL TEARS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 13 US ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 14 US ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 15 US ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 16 US ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 18 CANADA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 20 CANADA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 22 MEXICO ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 24 MEXICO ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA ARTIFICIAL TEARS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA ARTIFICIAL TEARS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 32 BRAZIL ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 34 BRAZIL ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 36 ARGENTINA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 38 ARGENTINA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 40 COLOMBIA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 42 COLOMBIA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC ARTIFICIAL TEARS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC ARTIFICIAL TEARS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 54 INDIA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 56 INDIA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 58 CHINA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 60 CHINA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 62 JAPAN ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 64 JAPAN ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE ARTIFICIAL TEARS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE ARTIFICIAL TEARS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 84 EUROPE ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 86 EUROPE ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 88 GERMANY ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 90 GERMANY ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 91 UK ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 92 UK ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 93 UK ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 94 UK ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 96 FRANCE ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 98 FRANCE ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 100 ITALY ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 102 ITALY ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 104 SPAIN ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 106 SPAIN ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 108 RUSSIA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 110 RUSSIA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA ARTIFICIAL TEARS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA ARTIFICIAL TEARS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 121 UAE ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 122 UAE ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 123 UAE ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 124 UAE ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA ARTIFICIAL TEARS MARKET BY DELIVERY METHOD (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA ARTIFICIAL TEARS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA ARTIFICIAL TEARS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ARTIFICIAL TEARS MARKET BY DELIVERY METHOD USD BILLION, 2020-2030

FIGURE 9 GLOBAL ARTIFICIAL TEARS MARKET BY TYPE, USD BILLION, 2020-2030

FIGURE 10 GLOBAL ARTIFICIAL TEARS MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL ARTIFICIAL TEARS MARKET BY DELIVERY METHOD, USD BILLION 2022

FIGURE 13 GLOBAL ARTIFICIAL TEARS MARKET BY TYPE, USD BILLION 2022

FIGURE 14 GLOBAL ARTIFICIAL TEARS MARKET BY REGION, USD BILLION 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 ALLERGAN: COMPANY SNAPSHOT

FIGURE 17 BAUSCH + LOMB: COMPANY SNAPSHOT

FIGURE 18 NOVARTIS AG: COMPANY SNAPSHOT

FIGURE 19 JOHNSON & JOHNSON: COMPANY SNAPSHOT

FIGURE 20 ALCON: COMPANY SNAPSHOT

FIGURE 21 SANTEN PHARMACEUTICAL CO., LTD.: COMPANY SNAPSHOT

FIGURE 22 OCUSOFT, INC.: COMPANY SNAPSHOT

FIGURE 23 THEA PHARMACEUTICALS: COMPANY SNAPSHOT

FIGURE 24 AKORN PHARMACEUTICALS: COMPANY SNAPSHOT

FIGURE 25 SIMILASAN CORPORATION: COMPANY SNAPSHOT

FIGURE 26 VISINE: COMPANY SNAPSHOT

FIGURE 27 PRESTIGE CONSUMER HEALTHCARE INC.: COMPANY SNAPSHOT

FIGURE 28 BAYER AG: COMPANY SNAPSHOT

FIGURE 29 OPHTHALMIC SPECIALTY GROUP: COMPANY SNAPSHOT

FIGURE 30 ROHTO PHARMACEUTICAL CO., LTD.: COMPANY SNAPSHOT

FIGURE 31 THERATEARS: COMPANY SNAPSHOT

FIGURE 32 OCUSOFT INC.: COMPANY SNAPSHOT

FIGURE 33 SCOPE OPHTHALMICS LTD.: COMPANY SNAPSHOT

FIGURE 34 LABORATOIRES THÉA: COMPANY SNAPSHOT

FIGURE 35 SIFI S.P.A.: COMPANY SNAPSHOT

FAQ

The global artificial tears market size is projected to grow from USD 2.89 billion in 2023 to USD 4.20 billion by 2030, exhibiting a CAGR of 5.5% during the forecast period.

North America accounted for the largest market in the artificial tears market.

Allergan, Bausch + Lomb, Novartis AG, Johnson & Johnson, Alcon, Santen Pharmaceutical Co., Ltd.,Ocusoft, Inc., Thea Pharmaceuticals, Akorn Pharmaceuticals, Similasan Corporation, Visine ,Prestige Consumer Healthcare Inc., Bayer AG, Ophthalmic Specialty Group and others.

There is a growing awareness of dry eye syndrome and its impact on ocular health, leading to more individuals seeking diagnosis and treatment. This heightened awareness contributes to the overall growth of the artificial tears market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.