Report Outlook

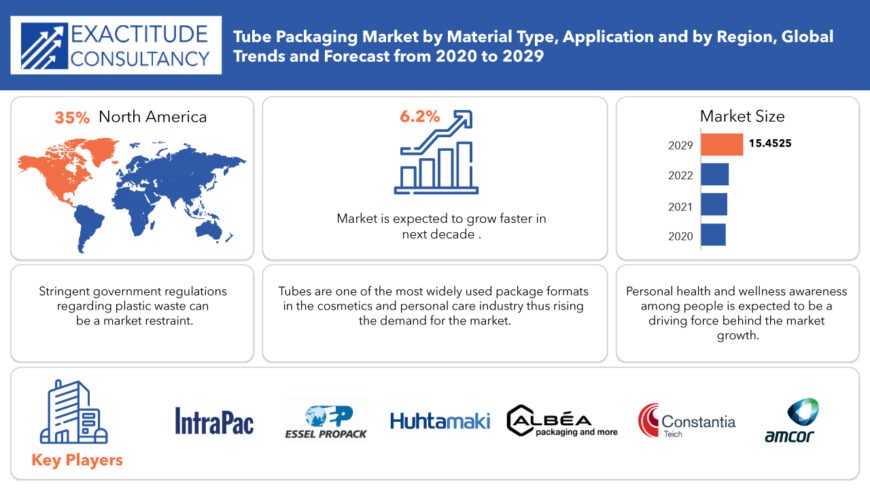

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 15.45 billion | 6.2 % | North America |

| By Material Type | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Tube Packaging Market Overview

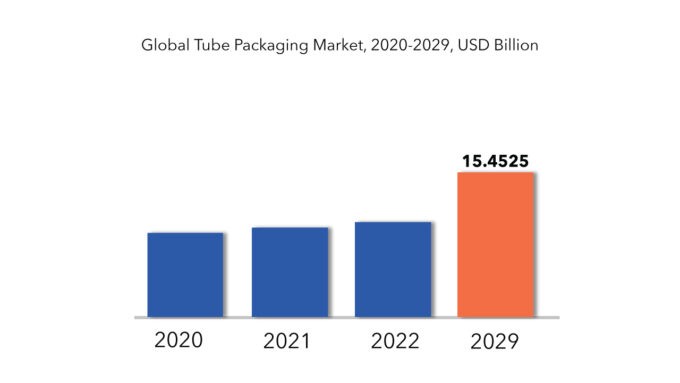

The tube packaging market share was valued at USD 8.99 billion in 2020, and is predicted to reach at USD 15.45 billion in 2029 grow at a CAGR of 6.2 % over the forecast period from 2022-2029.

The rise in demand for innovative packaging, spurred by increasing income levels, presents an opportunity for the tube packaging market. Emerging economies are witnessing significant growth in their middle-class population, driving a surge in demand for convenient and secure packaging solutions. Technological advancements in the packaging sector have led to a shift from rigid to flexible packaging, with new developments such as enhanced barrier properties, smart packaging, digital printing, recyclable materials, and lightweight designs adding value to the industry. Particularly in the cosmetics and toiletries segment, where tubes are extensively utilized, the sector’s growth further amplifies opportunities for the tube packaging market.

Factors such as escalating urbanization, a burgeoning millennial demographic, and rising consumer disposable incomes are pivotal drivers of market expansion. Urbanization facilitates higher disposable incomes and fosters awareness about diverse cosmetic products, creating a fertile ground for market players and significantly boosting demand for tube packaging solutions. Laminated tubes currently dominate the market landscape due to their multi-layered barrier structure, enhancing product shelf-life by offering excellent protection against oxygen, light, and bacteria transfer. Consequently, demand for these tubes is on the rise, driven by their superior protective properties.

Recent announcements by the European Union (EU) and the American Chemical Council’s Plastics Division set ambitious targets for achieving 100% recyclable, reusable, and compostable plastics by 2025 and 2040 in their respective regions. These regulatory initiatives are expected to shape the future of the plastic tube packaging industry, driving adoption of sustainable practices and materials within the sector.

Tube Packaging Market Segment Analysis

The tube packaging market is segmented on the basis of material type, application and region. Based on material, this market is segmented into laminated tubes, aluminums tubes, plastic tubes. Laminated tubes have superior barrier properties and will thus continue to drive the global tube packaging market forward. Tube packaging is used in a variety of industries, including cosmetics and oral care, food and drinks, medicines, and consumer goods. Cosmetics and oral care, followed by pharmaceuticals, are expected to rise rapidly in the future due to improving lifestyles around the world. This can be attributed to growing awareness about health and wellness, coupled with increasing demand for natural, free-from chemicals, and organic products.

Tube Packaging Market Key Players

The major players covered in the tube packaging market report are Amcor plc, ALBEA, Essel Propack Limited, Huhtamäki, Constantia, Sonoco Products Company, VisiPak, Montebello Packaging, Unette Corporation, WWP, Hoffmann Neopac AG, CTL Packaging USA, IntraPac International LLC, VIVA Group, Maynard & Harris Plastics, Unicep and ALLTUB among other domestic and global players. These companies are in close competition and are investing huge in research and development.

- Amcor plc is a global packaging company. It develops and produces flexible packaging, rigid containers, specialty cartons, closures and services for food, beverage, pharmaceutical, medical-device, home and personal-care, and other products.

- ALBEA manufactures the packaging and turnkey beauty solutions you use every day: tubes, lipsticks, mascara, perfume and applicators, as well as accessories, private label ranges and gifts with purchase.

- EPL Limited (formerly Essel Propack Limited) is a global tube-packaging company owned by The Blackstone Group headquartered in Mumbai, India.

Who Should Buy? Or Key stakeholders

- Packaging Industry

- Plastics Industry

- Pharmaceutical Industry

- Cosmetics Manufacturers

- Healthcare Industry

- Investors

- Manufacturing companies

- Scientific Research and Development

- End user companies

- Others

Key Takeaways:

- The tube packaging market is predicted to grow at a CAGR of 6.2 % over the forecast period.

- On the basis of material type, laminated tubes have superior barrier properties and will continue to drive the global tube packaging market forward.

- On the basis of application, pharmaceuticals is expected to rise rapidly in the future.

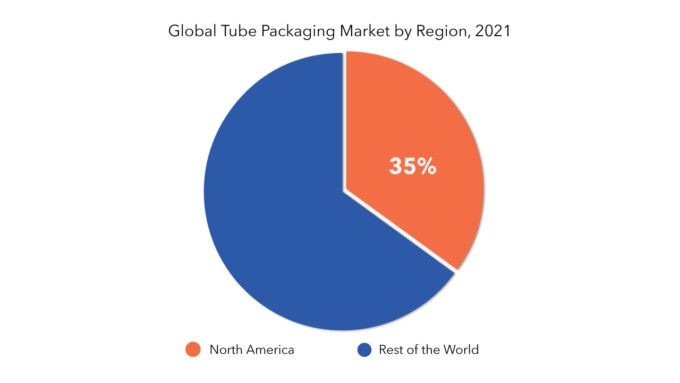

- North America will command the highest share of the market.

- The tube packaging market is experiencing steady growth driven by sustainability concerns and rising demand for convenient, portable packaging solutions.

Tube Packaging Market Regional Analysis

The global tube packaging market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America will command the highest share of the market. The larger market share is due to the presence of well-established personal care and healthcare sectors in the region. Over the projection period, Asia Pacific is expected to be the fastest-growing regional market. India, China, and South Korea are establishing themselves as manufacturing powerhouses in the area. The region’s growth is also aided by rising population and disposable income levels. Market participants in Europe are constantly developing new products to meet the growing demand from a variety of end-user sectors.

Key Market Segments: Tube Packaging Market

Tube Packaging Market By Material Type, 2020-2029, (USD Million) (Thousand Units)

- Laminated

- Aluminum

- Plastic

Tube Packaging Market By Application, 2020-2029, (USD Million) (Thousand Units)

- Oral Care

- Cosmetics

- Pharmaceutical

- Food & Beverage

- Cleaning Products

Tube Packaging Market By Region, 2020-2029, (USD Million) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What are the growth opportunities related to the adoption of tube packaging across major regions in the future?

- What are the new trends and advancements in the tube packaging market?

- Which product categories are expected to have highest growth rate in the tube packaging market?

- Which are the key factors driving the tube packaging market?

- What will the market growth rate, growth momentum or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Tube Packaging Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Tube Packaging Market

- Global Tube Packaging Market Outlook

- Global Tube Packaging Market by Material Type, (USD Million) (Thousand Units)

- Laminated

- Aluminum

- Plastic

- Global Tube Packaging Market by Application, (USD Million) (Thousand Units)

- Oral Care

- Cosmetics

- Pharmaceutical

- Food & Beverage

- Cleaning Products

- Global Tube Packaging Market by Region, (USD Million) (Thousand Units)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Amcor plc

- ALBEA

- Essel Propack Limited

- Huhtamäki

- Constantia

- Sonoco Products Company

- VisiPak

- Montebello Packaging

- Unette Corporation

- WWP

- Hoffmann Neopac AG

- CTL Packaging

- Others *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL TUBE PACKAGING MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL TUBE PACKAGING MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 7 US TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 8 US TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 9 US TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 10 US TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 11 CANADA TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 12 CANADA TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 13 CANADA TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 14 CANADA TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 15 MEXICO TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 16 MEXICO TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 17 MEXICO TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 18 MEXICO TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 19 BRAZIL TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 20 BRAZIL TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 21 BRAZIL TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 22 BRAZIL TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 23 ARGENTINA TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 24 ARGENTINA TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 25 ARGENTINA TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 26 ARGENTINA TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 27 COLOMBIA TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 28 COLOMBIA TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 29 COLOMBIA TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 30 COLOMBIA TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 31 REST OF SOUTH AMERICA TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 32 REST OF SOUTH AMERICA TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 33 REST OF SOUTH AMERICA TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 34 REST OF SOUTH AMERICA TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 35 INDIA TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 36 INDIA TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 37 INDIA TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 38 INDIA TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 39 CHINA TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 40 CHINA TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 41 CHINA TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 42 CHINA TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 43 JAPAN TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 44 JAPAN TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 45 JAPAN TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 46 JAPAN TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 47 SOUTH KOREA TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 48 SOUTH KOREA TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 49 SOUTH KOREA TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 50 SOUTH KOREA TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 51 AUSTRALIA TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 52 AUSTRALIA TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 53 AUSTRALIA TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 54 AUSTRALIA TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 55 SOUTH-EAST ASIA TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 56 SOUTH-EAST ASIA TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 57 SOUTH-EAST ASIA TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 58 SOUTH-EAST ASIA TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 59 REST OF ASIA PACIFIC TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 60 REST OF ASIA PACIFIC TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 61 REST OF ASIA PACIFIC TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 62 REST OF ASIA PACIFIC TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 63 GERMANY TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 64 GERMANY TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 65 GERMANY TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 66 GERMANY TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 67 UK TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 68 UK TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 69 UK TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 70 UK TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 71 FRANCE TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 72 FRANCE TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 73 FRANCE TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 74 FRANCE TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 75 ITALY TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 76 ITALY TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 77 ITALY TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 ITALY TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 79 SPAIN TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 80 SPAIN TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 81 SPAIN TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 82 SPAIN TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 83 RUSSIA TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 84 RUSSIA TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 85 RUSSIA TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 86 RUSSIA TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 87 REST OF EUROPE TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 88 REST OF EUROPE TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 89 REST OF EUROPE TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 90 REST OF EUROPE TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 91 UAE TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 92 UAE TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 93 UAE TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 94 UAE TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 95 SAUDI ARABIA TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 96 SAUDI ARABIA TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 97 SAUDI ARABIA TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 98 SAUDI ARABIA TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 99 SOUTH AFRICA TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 100 SOUTH AFRICA TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 101 SOUTH AFRICA TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 102 SOUTH AFRICA TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 103 REST OF MIDDLE EAST AND AFRICA TUBE PACKAGING MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 104 REST OF MIDDLE EAST AND AFRICA TUBE PACKAGING MARKET BY MATERIAL TYPE (THOUSAND UNITS) 2020-2029

TABLE 105 REST OF MIDDLE EAST AND AFRICA TUBE PACKAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 106 REST OF MIDDLE EAST AND AFRICA TUBE PACKAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL TUBE PACKAGING MARKET BY MATERIAL TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL TUBE PACKAGING MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL TUBE PACKAGING MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL TUBE PACKAGING MARKET BY MATERIAL TYPE 2020

FIGURE 13 GLOBAL TUBE PACKAGING MARKET BY APPLICATION 2020

FIGURE 14 TUBE PACKAGING MARKET BY REGION 2020

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 AMCOR PLC: COMPANY SNAPSHOT

FIGURE 17 ALBEA: COMPANY SNAPSHOT

FIGURE 18 ESSEL PROPACK LIMITED: COMPANY SNAPSHOT

FIGURE 19 HUHTAMÄKI: COMPANY SNAPSHOT

FIGURE 20 CONSTANTIA: COMPANY SNAPSHOT

FIGURE 21 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

FIGURE 22 VISIPAK: COMPANY SNAPSHOT

FIGURE 23 MONTEBELLO PACKAGING: COMPANY SNAPSHOT

FIGURE 24 UNETTE CORPORATION: COMPANY SNAPSHOT

FIGURE 25 WWP: COMPANY SNAPSHOT

FIGURE 26 HOFFMANN NEOPAC AG: COMPANY SNAPSHOT

FIGURE 27 CTL PACKAGING: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.