REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 1,215.2 million | 9.5% | Asia Pacific |

| by Grade | by Application | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Chitosan Market Overview

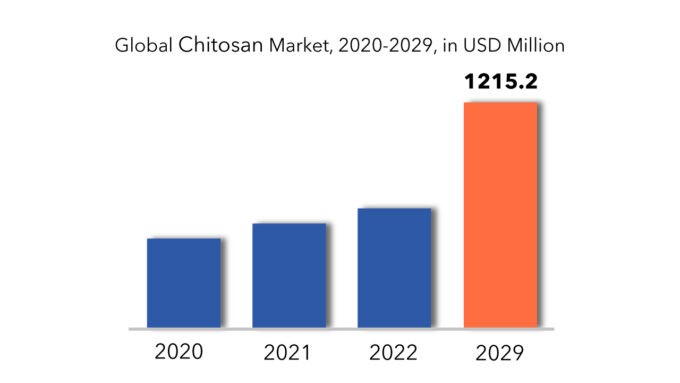

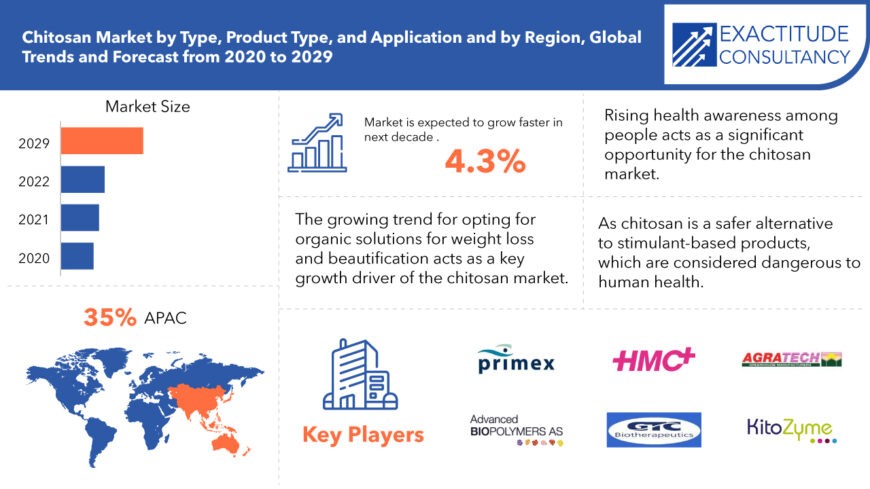

The global chitosan market is expected to grow at 9.5% CAGR from 2020 to 2029. It is expected to reach above USD 1,215.2 million by 2029 from USD 480.5 million in 2020.

Chitosan, a natural fiber derived from Chitin found in the outer shells of shellfish like shrimp, crabs, and lobsters, is increasingly sought after as a dietary supplement for weight loss due to its rich fiber content. Its versatility extends to applications in water treatment facilities, where it effectively absorbs toxic substances, grease, oils, and metals. Moreover, chitosan finds utility in diverse sectors such as food & beverages, agrochemicals, and medical & pharmaceuticals.

Favorable regulatory support from developed economies and growing awareness about its health benefits are expected to drive significant demand for chitosan in the food & beverage industry. The product’s popularity as a food preservative and stabilizer further contributes to market growth. Additionally, its use as a clarifying agent in juices, a thickening agent in beverages, and in packaging food products is projected to fuel demand.

Abundant availability of raw materials, particularly in the Asia-Pacific region, is a key driver for the chitosan market, as it is a prevalent waste product of the fishery industry. Traditionally discarded or used as fertilizers, these materials are now valued sources for chitosan production. Moreover, extensive research conducted on chitosan in recent decades has uncovered its diverse applications in wastewater treatment, pharmaceuticals, and the food & beverage industry.

Efforts by manufacturers and researchers to enhance purity to meet stringent product standards are anticipated to create new opportunities for both existing and emerging market players. Furthermore, increasing demand for chitosan as an antibacterial, anti-cancerous, anti-inflammatory, and anti-fungal agent in pharmaceutical applications is poised to drive further growth in demand.

Chitosan Market Segment Analysis

The most often utilized chitosan grade is industrial grade chitosan. It is utilized as a chemical substitute in a variety of applications, including water treatment, food and drinks, agrochemicals, cosmetics, and medical and pharmaceuticals. The rising usage of chitosan for water treatment, cosmetics, and medical & pharmaceuticals in the Asia Pacific region is likely to drive the expansion of the chitosan market’s industrial-grade segment during the forecast period. Furthermore, the ongoing fast industrialization in China and India is likely to support the expansion of the chitosan market’s industrial-grade sector.

Chitosan is a polysaccharide with N-acetyl-D-glucosamine and D-glucosamine links. It is created by treating shrimp with alkaline compounds such as sodium hydroxide. Chitosan is produced as a byproduct of the fishing business. To increase income streams, key participants in the chitosan market are focused on developing cooperation and collaboration with fisheries producers. Industry participants face hurdles in the chitosan market, such as severe rules on shrimp farming, significant limitations of chitosan products in medicine delivery systems, and so on.

Chitosan Market Players

From large companies to small ones, many companies are actively working in the chitosan market. These key players include Primex ehf, Heppe Medical Chitosan GmbH , Vietnam Food, KitoZyme S.A, Agratech, Advanced Biopolymers AS, BIO21 Co., Ltd, G.T.C. Bio Corporation, Taizhou City Fengrun Biochemical Co., Ltd, Zhejiang Golden-Shell Pharmaceutical Co., Ltd. others.

Companies are mainly Chitosan they are competing closely with each other. Innovation is one of the most important key strategies as it has to be for any market. However, companies in the market have also opted and successfully driven inorganic growth strategies like mergers & acquisitions, and so on.

- In March 2021, in Brazil, the University of Brasilia, in collaboration with the University of Campinas, Brazil, Centro de Pesquisa em Biotecnologia Ltda, Hospital Regional da Asa Norte (HRAN), Hospital da Região Leste (HRL), and Hospital Universitário de Brasília (HUB/UnB), was conducting VESTA clinical trial to assess the effectiveness of a novel respirator with chitosan nanoparticles to reduce the incidence of SARS-CoV-2 infection in healthcare professionals.

- In March 2020, Sebela Pharmaceuticals received approval from the United States Food and Drug Administration (FDA) for Pizensy (lactitol) in the treatment of chronic idiopathic constipation (CIC) in adults. Penny is an osmotic laxative that works by causing the influx of water into the small intestine leading to a laxative effect in the colon.

Who Should Buy? Or Key Stakeholders

- Suppliers

- Manufacturing Companies

- End-user companies

- Research institutes

- Others

Chitosan Market Regional Analysis

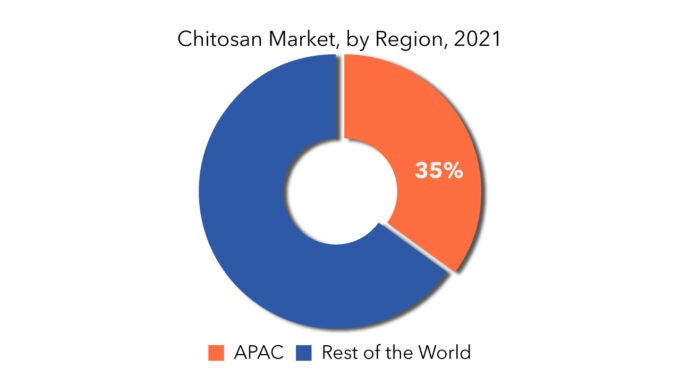

The chitosan market by region includes Asia-Pacific (APAC), North America, Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Its major share is occupied by Asia Pacific, North America, and Europe region. Asia Pacific shares 35% of the total market.

Key Market Segments: Chitosan Market

Chitosan Market by Grade, 2020-2029, (USD Million, Kilotons)

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

Chitosan Market by Application, 2020-2029, (USD Million, Kilotons)

- Water Treatment

- Food & Beverages

- Cosmetics

- Medical & Pharmaceuticals

- Agrochemicals

Chitosan Market by Region, 2020-2029, (USD Million, Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important countries in all regions are covered.

Key Question Answered

- What are the growth opportunities related to the adoption of chitosan across major regions in the future?

- What are the new trends and advancements in the chitosan market?

- Which product categories are expected to have the highest growth rate in the chitosan market?

- Which are the key factors driving the chitosan market?

- What will the market growth rate, growth momentum, or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Chitosan Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Chitosan Market

- Global Chitosan Market Outlook

- Global Chitosan Market by Grade, (USD Million, Kilotons)

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

- Global Chitosan Market by Application, (USD Million, Kilotons)

- Water Treatment

- Food & Beverages

- Cosmetics

- Medical & Pharmaceuticals

- Agrochemicals

- Global Chitosan Market by Region, (USD Million, Kilotons)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

-

- Primex ehf

- Heppe Medical Chitosan GmbH

- Vietnam Food

- KitoZyme S.A

- Agratech iemens

- Advanced Biopolymers AS

- BIO21 Co.Ltd

- T.C. Bio Corporation

- Taizhou City Fengrun Biochemical Co.Ltd

- Zhejiang Golden-Shell Pharmaceutical Co.Ltd.

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 2 GLOBAL CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 3 GLOBAL CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 4 GLOBAL CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL CHITOSAN MARKET BY REGION (USD MILLIONS), 2020-2029

TABLE 6 GLOBAL CHITOSAN MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA CHITOSAN MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 8 NORTH AMERICA CHITOSAN MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 9 US CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 10 US CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 11 US CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 12 US CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 13 CANADA CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 14 CANADA CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 15 CANADA CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 16 CANADA CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 MEXICO CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 18 MEXICO CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 19 MEXICO CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 20 MEXICO CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 SOUTH AMERICA CHITOSAN MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 22 SOUTH AMERICA CHITOSAN MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 23 BRAZIL CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 24 BRAZIL CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 25 BRAZIL CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 26 BRAZIL CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 27 ARGENTINA CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 28 ARGENTINA CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 29 ARGENTINA CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 30 ARGENTINA CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 31 COLOMBIA CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 32 COLOMBIA CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 33 COLOMBIA CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 34 COLOMBIA CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 35 REST OF SOUTH AMERICA CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 36 REST OF SOUTH AMERICA CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 37 REST OF SOUTH AMERICA CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 38 REST OF SOUTH AMERICA CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 ASIA-PACIFIC CHITOSAN MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 40 ASIA-PACIFIC CHITOSAN MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 41 INDIA CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 42 INDIA CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 43 INDIA CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 44 INDIA CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 45 CHINA CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 46 CHINA CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 47 CHINA CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 48 CHINA CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 49 JAPAN CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 50 JAPAN CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 51 JAPAN CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 52 JAPAN CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 53 SOUTH KOREA CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 54 SOUTH KOREA CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 55 SOUTH KOREA CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 56 SOUTH KOREA CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 57 AUSTRALIA CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 58 AUSTRALIA CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 59 AUSTRALIA CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 60 AUSTRALIA CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 SOUTH EAST ASIA CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 62 SOUTH EAST ASIA CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 63 SOUTH EAST ASIA CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 64 SOUTH EAST ASIA CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 REST OF ASIA PACIFIC CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 66 REST OF ASIA PACIFIC CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 67 REST OF ASIA PACIFIC CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 68 REST OF ASIA PACIFIC CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 69 EUROPE CHITOSAN MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 70 EUROPE CHITOSAN MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 71 GERMANY CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 72 GERMANY CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 73 GERMANY CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 74 GERMANY CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 75 UK CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 76 UK CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 77 UK CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 78 UK CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 79 FRANCE CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 80 FRANCE CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 81 FRANCE CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 82 FRANCE CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 83 ITALY CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 84 ITALY CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 85 ITALY CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 86 ITALY CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 87 SPAIN CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 88 SPAIN CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 89 SPAIN CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 90 SPAIN CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 RUSSIA CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 92 RUSSIA CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 93 RUSSIA CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 94 RUSSIA CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 95 REST OF EUROPE CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 96 REST OF EUROPE CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 97 REST OF EUROPE CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 98 REST OF EUROPE CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 MIDDLE EAST AND AFRICA CHITOSAN MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 100 MIDDLE EAST AND AFRICA CHITOSAN MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 101 UAE CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 102 UAE CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 103 UAE CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 104 UAE CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 105 SAUDI ARABIA CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 106 SAUDI ARABIA CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 107 SAUDI ARABIA CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 108 SAUDI ARABIA CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 109 SOUTH AFRICA CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 110 SOUTH AFRICA CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 111 SOUTH AFRICA CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 112 SOUTH AFRICA CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 113 REST OF MIDDLE EAST AND AFRICA CHITOSAN MARKET BY GRADE (USD MILLIONS), 2020-2029

TABLE 114 REST OF MIDDLE EAST AND AFRICA CHITOSAN MARKET BY GRADE (KILOTONS), 2020-2029

TABLE 115 REST OF MIDDLE EAST AND AFRICA CHITOSAN MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 116 REST OF MIDDLE EAST AND AFRICA CHITOSAN MARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CHITOSAN MARKET BY GRADE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL CHITOSAN MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL CHITOSAN MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 CHITOSAN MARKET BY REGION 2020

FIGURE 13 MARKET SHARE ANALYSIS

FIGURE 14 PRIMEX EHF: COMPANY SNAPSHOT

FIGURE 15 HEPPE MEDICAL CHITOSAN GMBH: COMPANY SNAPSHOT

FIGURE 16 VIETNAM FOOD: COMPANY SNAPSHOT

FIGURE 17 KITOZYME S.A: COMPANY SNAPSHOT

FIGURE 18 AGRATECH IEMENS: COMPANY SNAPSHOT

FIGURE 19 ADVANCED BIOPOLYMERS AS: COMPANY SNAPSHOT

FIGURE 20 BIO21 CO.LTD: COMPANY SNAPSHOT

FIGURE 21 G.T.C. BIO CORPORATION: COMPANY SNAPSHOT

FIGURE 22 TAIZHOU CITY FENGRUN BIOCHEMICAL CO.LTD: COMPANY SNAPSHOT

FIGURE 23 ZHEJIANG GOLDEN-SHELL PHARMACEUTICAL CO.LTD. : COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.