REPORT OUTLOOK

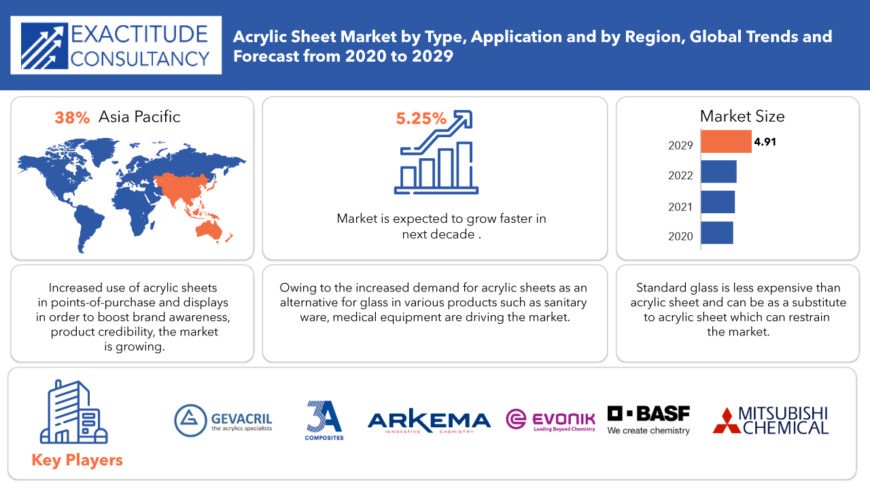

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 4.91 billion by 2029 | 5.25% | Asia Pacific |

| By Type | By Application |

|---|---|

|

|

SCOPE OF THE REPORT

Acrylic Sheets Market Overview

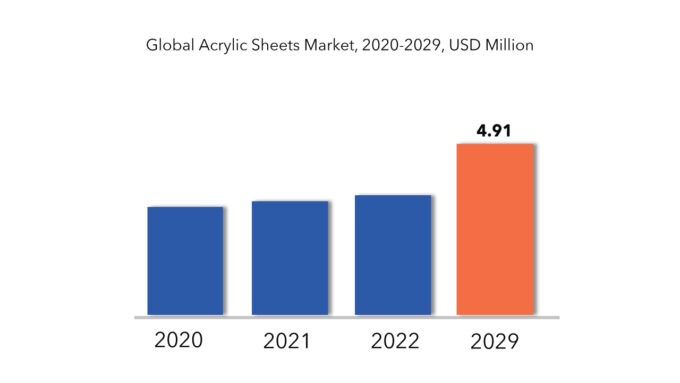

Acrylic sheets market size was valued at USD 3.1 billion in 2020 and is projected to reach USD 4.91 billion by 2029, growing at a CAGR of 5.25% from 2022 to 2029.

Acrylic sheets, also known as acrylic glass or plexiglass, are transparent thermoplastic panels made from polymethyl methacrylate (PMMA) or polymethyl 2-methylpropenoate. They are commonly used as a lightweight and shatter-resistant alternative to glass in various applications. Acrylic sheets offer excellent optical clarity, weather resistance, and impact resistance, making them suitable for use in windows, skylights, signage, displays, protective barriers, and numerous other purposes. They can be easily fabricated, cut, drilled, and shaped to meet specific design requirements, and they come in a wide range of thicknesses, colors, and surface finishes to accommodate different needs. Acrylic sheets are valued for their versatility, durability, and aesthetic appeal across industries such as construction, automotive, retail, and interior design.

The Acrylic Sheets Market is witnessing significant trends and drivers shaping its trajectory. One notable trend is the increasing demand for acrylic sheets in various industries such as construction, automotive, signage, and furniture. These sheets offer a versatile solution with properties like transparency, impact resistance, and weatherability, making them suitable for a wide range of applications. Additionally, advancements in acrylic manufacturing technology have led to the development of specialized acrylic sheets with enhanced features such as UV resistance, scratch resistance, and anti-glare properties, further expanding their utility across different sectors.

Moreover, environmental considerations are driving the adoption of acrylic sheets as a sustainable alternative to traditional materials like glass. Acrylic sheets are lightweight, durable, and recyclable, reducing carbon footprint and waste generation. This aligns with the global focus on sustainability and green practices across industries, propelling the growth of the acrylic sheets market. Furthermore, the increasing use of acrylic sheets in architectural projects for their aesthetic appeal, flexibility in design, and cost-effectiveness is contributing to market expansion, indicating a promising future for the industry.

Acrylic Sheets Market Segment Analysis

The market is broadly bifurcated into type, application and region. Based on type, the market is divided into two types: cell and continuous. The cell acrylic sheet segment is the most popular in the market because it offers the best optical clarity, surface hardness, and molecular weight. Cell acrylic sheets allow for easy customization of colours and distinctive effects. Continuous acrylic sheets are projected to expand significantly. This is the perfect material for skylights, hot tubs, event displays, sign makers, and many more applications.

Based on Application, acrylic sheets have the largest growth potential in the architecture and interior design industry due to its exceptional weather resistance, lightweight, easy manufacture, colourful nature, and high transparency. Furthermore, cast sheets are highly robust, making them ideal for structural glazing applications. Storm and weather-resistant windows, robust skylights, and bulletproof windows can all be made with acrylic sheets.

Acrylic Sheets Market Key Players

The major players covered in the cast acrylic sheets market report are Gevacril, Arkema, BASF SE, Evonik Industries AG, 3A Composites Holding AG, Mitsubishi Chemical Corporation, PT Astari Niagara Internasional, ARISTECH SURFACES LLC, PyraSied Xtreme Acrylic, Spartech LLC, MADREPERLA S.p.a., Ray Chung Acrylic Enterprise Co.Ltd., Acrilex Inc., MARGACIPTA WIRASENTOSA, Polyplastics Co. Ltd. and Limacryl. among other domestic and global players.

Recent Development:

-

Gevacril is a global leading manufacturer of semi-finished cast and extruded acrylic and polycarbonate items. Gevacril cast and extruded tubes, rods, bars, profiles, accessories in PMMA and PC and exports more than 75% of the production capacity to more than 50 countries in the world.

-

Arkema S.A. is a specialty chemicals and advanced materials company headquartered in Colombes, near Paris, France. Created in 2004.

-

Spartech LLC manufactures plastic packaging products. The Company specialty polymer formulations, plastic sheet, rigid barrier packaging, and specialty cast acrylics products.

Who Should Buy? Or Key Stakeholders

- Plastic Industry

- Chemical Industry

- Construction Industry

- Scientific Research and Development

- Investors

- Manufacturing companies

- End user companies

- Others

Key Takeaways:

- Acrylic sheets market is projected to be growing at a CAGR of 5.25%

- Based on type, the cell acrylic sheet segment is the most popular in the market.

- Based on Application, acrylic sheets have the largest growth potential in the market.

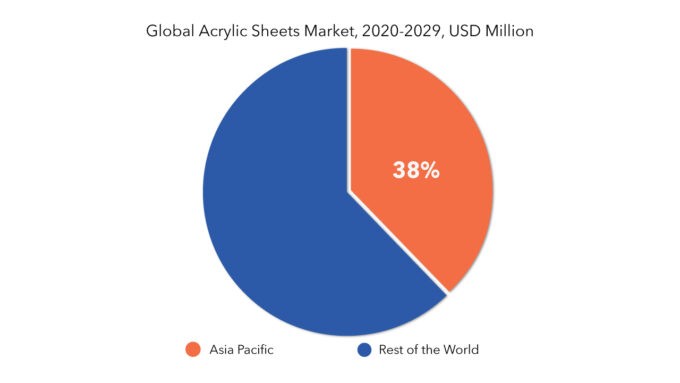

- The largest and fastest-growing market for acrylic sheet is Asia Pacific.

- The Acrylic Foam Tapes Market is witnessing growth due to increased demand in automotive and construction industries for bonding applications.

Acrylic Sheets Market Regional Analysis

The global acrylic sheet market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The largest and fastest-growing market for acrylic sheet is Asia Pacific. APAC’s most important markets are China, India, and Japan, which together account for more than half of the region’s market share. In applications such as medical, food & catering, sanitaryware, architectural & interior design, and signage & display, rising per capita income, rising purchasing power, and increasing urbanisation are likely to drive the acrylic sheet market. Significant retail expansion and rising advertising spending in India, Indonesia, China, and other countries are expected to drive the signs and display application segment market in APAC.

Key Market Segments: Acrylic Sheet Market

Acrylic Sheet Market By Type, 2020-2029, (USD Million) (Kilotons)

- Cell

- Continuous

Acrylic Sheet Market By Application, 2020-2029, (USD Million) (Kilotons)

- Sanitary Ware

- Signage & Display

- Architecture & Interior Design

- Transportation

- Medical

- Food & Catering

Acrylic Sheet Market By Region, 2020-2029, (USD Million) (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What are the growth opportunities related to the adoption of acrylic sheet across major regions in the future?

- What are the new trends and advancements in the acrylic sheet market?

- Which product categories are expected to have highest growth rate in the acrylic sheet market?

- Which are the key factors driving the acrylic sheet market?

- What will the market growth rate, growth momentum or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Acrylic Sheet Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Acrylic Sheet Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Acrylic Sheet Market Outlook

- Global Acrylic Sheet Market by Type (USD Million) (Kilotons)

- Cell

- Continuous

- Global Acrylic Sheet Market by Application (USD Million) (Kilotons)

- Sanitary Ware

- Signage & Display

- Architecture & Interior Design

- Transportation

- Medical

- Food & Catering

- Global Acrylic Sheet Market by Region (USD Million) (Kilotons)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Gevacril

- Arkema

- BASF SE

- Evonik Industries AG

- 3A Composites Holding AG

- Mitsubishi Chemical Corporation

- PT Astari Niagara Internasional

- ARISTECH SURFACES LLC

- Ray Chung Acrylic Enterprise Co.Ltd.

- Acrilex, Inc.

- Others *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL ACRYLIC SHEET MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL ACRYLIC SHEET MARKET BY REGION (KILOTONS) 2020-2029

TABLE 7 US ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 8 US ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 9 US ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 10 US ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 11 CANADA ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 12 CANADA ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 13 CANADA ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 14 CANADA ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 15 MEXICO ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 16 MEXICO ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 17 MEXICO ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 18 MEXICO ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 19 BRAZIL ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 20 BRAZIL ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 21 BRAZIL ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 22 BRAZIL ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 23 ARGENTINA ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 24 ARGENTINA ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 25 ARGENTINA ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 26 ARGENTINA ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 27 COLOMBIA ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 28 COLOMBIA ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 29 COLOMBIA ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 30 COLOMBIA ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 31 REST OF SOUTH AMERICA ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 32 REST OF SOUTH AMERICA ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 33 REST OF SOUTH AMERICA ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 34 REST OF SOUTH AMERICA ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 35 INDIA ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 36 INDIA ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 37 INDIA ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 38 INDIA ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 39 CHINA ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 40 CHINA ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 41 CHINA ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 42 CHINA ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 43 JAPAN ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 44 JAPAN ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 45 JAPAN ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 46 JAPAN ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 47 SOUTH KOREA ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 48 SOUTH KOREA ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 49 SOUTH KOREA ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 50 SOUTH KOREA ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 51 AUSTRALIA ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 52 AUSTRALIA ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 53 AUSTRALIA ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 54 AUSTRALIA ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 55 SOUTH-EAST ASIA ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 56 SOUTH-EAST ASIA ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 57 SOUTH-EAST ASIA ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 58 SOUTH-EAST ASIA ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 59 REST OF ASIA PACIFIC ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 60 REST OF ASIA PACIFIC ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 61 REST OF ASIA PACIFIC ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 62 REST OF ASIA PACIFIC ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 63 GERMANY ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 64 GERMANY ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 65 GERMANY ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 66 GERMANY ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 67 UK ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 68 UK ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 69 UK ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 70 UK ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 71 FRANCE ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 72 FRANCE ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 73 FRANCE ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 74 FRANCE ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 75 ITALY ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 76 ITALY ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 77 ITALY ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 ITALY ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 SPAIN ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 80 SPAIN ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 81 SPAIN ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 82 SPAIN ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 83 RUSSIA ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 84 RUSSIA ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 85 RUSSIA ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 86 RUSSIA ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 87 REST OF EUROPE ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 88 REST OF EUROPE ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 89 REST OF EUROPE ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 90 REST OF EUROPE ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 UAE ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 92 UAE ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 93 UAE ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 94 UAE ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 95 SAUDI ARABIA ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 96 SAUDI ARABIA ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 97 SAUDI ARABIA ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 98 SAUDI ARABIA ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 99 SOUTH AFRICA ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 100 SOUTH AFRICA ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 101 SOUTH AFRICA ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 102 SOUTH AFRICA ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 REST OF MIDDLE EAST AND AFRICA ACRYLIC SHEET MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 104 REST OF MIDDLE EAST AND AFRICA ACRYLIC SHEET MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 105 REST OF MIDDLE EAST AND AFRICA ACRYLIC SHEET MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 106 REST OF MIDDLE EAST AND AFRICA ACRYLIC SHEET MARKET BY APPLICATION (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ACRYLIC SHEET MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL ACRYLIC SHEET MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL ACRYLIC SHEET MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 11 GLOBAL ACRYLIC SHEET MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA ACRYLIC SHEET MARKET SNAPSHOT

FIGURE 14 EUROPE ACRYLIC SHEET MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC ACRYLIC SHEET MARKET SNAPSHOT

FIGURE 16 SOUTH AMERICA ACRYLIC SHEET MARKET SNAPSHOT

FIGURE 17 MIDDLE EAST & AFRICA ACRYLIC SHEET MARKET SNAPSHOT

FIGURE 18 GEVACRIL: COMPANY SNAPSHOT

FIGURE 19 ARKEMA: COMPANY SNAPSHOT

FIGURE 20 BASF SE: COMPANY SNAPSHOT

FIGURE 21 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

FIGURE 22 3A COMPOSITES HOLDING AG: COMPANY SNAPSHOT

FIGURE 23 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

FIGURE 24 PT ASTARI NIAGARA INTERNASIONAL: COMPANY SNAPSHOT

FIGURE 25 ARISTECH SURFACES LLC: COMPANY SNAPSHOT

FIGURE 26 RAY CHUNG ACRYLIC ENTERPRISE CO.LTD.: COMPANY SNAPSHOT

FIGURE 27 ACRILEX, INC.: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.