REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

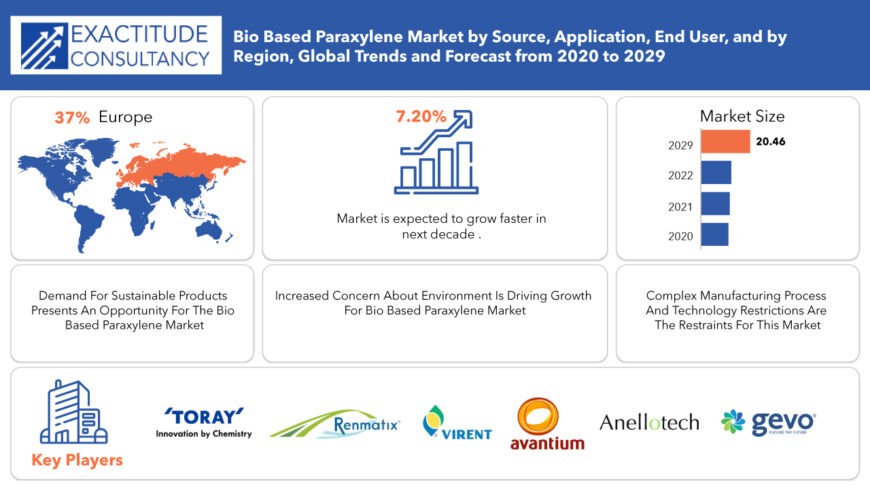

| USD 20.46 billion by 2029 | 7.20% | Europe |

| By Source | By Application | By End-User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Bio-Based Paraxylene Market Overview

The global Bio-Based Paraxylene Market is expected to grow at 7.20% CAGR from 2022 to 2029. It is expected to reach above 20.46 USD billion by 2029 from 11.32 USD billion in 2021.

The bio-based paraxylene market encompasses the production and utilization of paraxylene derived from renewable biomass sources, as opposed to traditional petrochemical feedstocks. Paraxylene is a key chemical in the production of polyethylene terephthalate (PET), widely used in the manufacturing of plastic bottles, packaging materials, and polyester fibers. The market for bio-based paraxylene is witnessing significant growth driven by increasing environmental concerns, rising demand for sustainable alternatives, and technological advancements in biorefinery processes. This shift towards bio-based paraxylene reflects a broader trend towards bio-based chemicals and materials, fueled by the need to reduce carbon emissions and dependence on fossil fuels.

Environmental Protection Agencies (EPA) and their international counterparts establish regulations governing emissions, waste management, and environmental impact assessments. Additionally, bodies like the Food and Drug Administration (FDA) oversee the safety and approval of bio-based paraxylene for applications involving direct or indirect contact with consumables. Occupational Safety and Health Administration (OSHA) regulations ensure safe handling and storage, while International Standards Organizations (ISO) provide guidelines for characterization and analysis. Renewable Energy Directives (RED) and biofuel mandates promote market growth and sustainability, and trade agreements and tariffs may impact import/export dynamics.

However, challenges remain in establishing a robust global regulatory framework that balances environmental objectives with economic considerations and technological feasibility. Issues such as land use competition, food security, lifecycle assessments, and certification schemes require careful consideration to ensure the sustainability and viability of bio-based paraxylene production. Collaboration among governments, industry stakeholders, and non-governmental organizations is essential to address these challenges and promote the transition towards a more sustainable and circular economy.

Bio-Based Paraxylene Market Segment Analysis

The global bio-based paraxylene market is segmented by source, application, end-user, and region.

Based on source segment, the bio-based paraxylene market includes Sugar based Aromatics Stream, Isobutanol source. The PX (para-xylene) is generated from renewable Isobutanol. Also, Isobutanol is used in the production of renewable paraxylene, PET, Isobutanol-based fuel mixes for small engines, and ATJ bio-jet. The primary motivation for creating bio-based isobutene is to produce p-xylene as an intermediary for the PET plastic industry. This opens the door for bio-based isobutanol and bio-based p-xylene to be extracted from the bioplastic production chain and used as solvents. Sugars produced by the saccharification of biopolymers are one sustainable feedstock for renewable C6 aromatic compounds (e.g., cellulose, hemicellulose). Catalytic conversion of these sugars into high-value commercial compounds such as p-xylene can be done. The conversion of 2,5-dimethylfuran (DMF) and ethylene to p-xylene via a Diels-Alder cycloaddition followed by dehydration is the final step in the manufacture of p-xylene from biomass produced glucose.

Based on application segment, the bio-based paraxylene market includes Bio- terephthalic acid (Bio-TPA), Bio-based polyethylene terephthalate (Bio-PET), Polytrimethylene terephthalate (PTT), Polybutylene terephthalate (PBT), and others. The rising demand for Bio-PET soft drink and mineral water bottles is expected to fuel the bio-based paraxylene sector as bio based paraxylene is the primary raw material for production of PET. There is consistent PTA demand in polyester applications and usage in packaging which is also projected to contribute positively to the expansion of bio-based paraxylene. In the near future, the expanding spectrum of application is projected to benefit the worldwide bio-based paraxylene market.

The bio-based paraxylene market can be classified based on the end-users, that is Food & Beverages, Packaging and others. For packaging, PTA is used in large amount along with Beverage industry demanding for PET made bottles or containers. These renewable products can be recycled and disposable and it results into reduction in cost for production. Ultimately less harm to the environment.

Bio-Based Paraxylene Market Players

The global bio-based paraxylene market key players include Virent Inc., Renmatix Inc., Anellotech Inc., Origin Materials, GEVO, Avantium, BASF SE, Toray Industries Inc., and others.

Various businesses are focusing on organic growth tactics such as new launches, product approvals, and other things like patents and events. Mergers & Acquisitions, partnerships, and collaborations were among the inorganic growth tactics observed in the market. These initiatives such as investment and expansion have paved the road for market participants to expand their business and client base. With the goal of achieving sustainability in the worldwide industry, market players in the bio-based paraxylene market are expected to benefit from attractive growth prospects in the future.\

Industry News:

-

April 2021 – Maire Tecnimont, an Italian firm, announced an association of its subsidiaries Tecnimont and Tecnimont SpA had received an engineering, procurement, construction, and commissioning (EPCC) contract from Indian Oil Corporation (IOCL) worth USD 450 million to set up a Paraxylene plant in Paradip, Odisha.

-

January 2021 – Ineos, a leading petrochemical company, announced the completion of the purchase of global Aromatics and Acetyls businesses from BP for approximately USD5 Billion. The transaction was first revealed in late June 2020. The company states the acquisition will expand its geographic reach and portfolio. The businesses by Ineos will be named Ineos Aromatics and Ineos Acetyls.

- In January 2021, INEOS acquired BP’s global aromatics and acetyls business.

-

In August 2020, Indian Oil Corporation Limited planned to invest INR 13,805 crore in purified terephthalic acid (PTA) plant in Paradip of Odisha to manufacture raw materials for the textile sector.

Who Should Buy? Or Key Stakeholders

- Government and research organization

- Investors

- Plastic Industry

- Chemical Industry

- Scientific research organization

- Food & Beverage Industry

- Pharmaceutical Industry and laboratory

Bio-Based Paraxylene Market Regional Analysis

The bio-based paraxylene market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Europe has a dominating share in the global bio-based paraxylene market due to rise in investment in the green economy. Closely followed by North America & Asia Pacific, making development in green technology.

Key Takeaways

- The global Bio-Based Paraxylene Market is expected to grow at 7.20%.

- Based on source segment, Sugar based Aromatics Stream is expected to dominate the market.

- Based on application, The rising demand for Bio-PET soft drink and mineral water bottles is expected to fuel the bio-based paraxylene.

- Based on application, the market is dominated by food and beverages.

- Europe has a dominating share in the global bio-based paraxylene market

- The major market trend in the Bio-Based Paraxylene Market is the shift towards sustainable and eco-friendly alternatives in response to environmental concerns and regulatory pressures.

Key Market Segments: Bio-Based Paraxylene Market

Bio-Based Paraxylene Market by Source, 2020-2029, (USD Million)

- Sugar Based Aromatics Stream

- Isobutanol Source

Bio-Based Paraxylene Market by Application, 2020-2029, (USD Million)

- Bio-Terephthalic Acid (BIO-TPA)

- Bio-Based Polyethylene Terephthalate (BIO-PET)

- Polytrimethylene Terephthalate (PTT)

- Polybutylene Terephthalate (PBT)

Bio-Based Paraxylene Market by End-User, 2020-2029, (USD Million)

- Food & Beverages

- Packaging

- Others

Bio-Based Paraxylene Market by Region, 2020-2029, (USD Million) (Kilo Tons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the current size of the bio-based paraxylene market?

- What are the key factors influencing the growth of bio-based paraxylene?

- What is the major end-use industry for bio-based paraxylene?

- Who are the major key players in the bio-based paraxylene market?

- Which region will provide more business opportunities for bio-based paraxylene in future?

- Which segment holds the maximum share of the bio-based paraxylene market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Bio Based Paraxylene Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Bio Based Paraxylene Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Bio Based Paraxylene Market Outlook

- Global Bio Based Paraxylene Market by Source (USD Million) (Kilo tons)

- Sugar based Aromatics stream

- Isobutanol source

- Global Bio Based Paraxylene Market by Application (USD Million) (Kilo tons)

- Bio-terephthalic acid (Bio-TPA)

- Bio-based polyethylene terephthalate (Bio-PET)

- Polytrimethylene terephthalate (PTT)

- Polybutylene terephthalate (PBT)

- Other

- Global Bio Based Paraxylene Market by End-Users (USD Million) (Kilo tons)

- Food & Beverages

- Packaging

- Other

- Global Bio Based Paraxylene Market by Region

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- VIRENT INC.

- RENMATIX INC.

- ANELLOTECH INC.

- ORIGIN MATERIALS

- GEVO

- AVANTIUM

- BASF SE

- TORAY INDUSTRIES INC. *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 3 GLOBAL BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 7 GLOBAL BIO BASED PARAXYLENE MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 8 GLOBAL BIO BASED PARAXYLENE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 US BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 10 US BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 11 US BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 12 US BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 13 US BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 14 US BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 15 CANADA BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 16 CANADA BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 17 CANADA BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 18 CANADA BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 19 CANADA BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 20 CANADA BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 21 MEXICO BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 22 MEXICO BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 23 MEXICO BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 24 MEXICO BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 25 MEXICO BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 MEXICO BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 27 BRAZIL BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 28 BRAZIL BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 29 BRAZIL BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 30 BRAZIL BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 31 BRAZIL BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 32 BRAZIL BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 33 ARGENTINA BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 34 ARGENTINA BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 35 ARGENTINA BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 36 ARGENTINA BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 37 ARGENTINA BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 38 ARGENTINA BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 39 COLOMBIA BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 40 COLOMBIA BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 41 COLOMBIA BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 42 COLOMBIA BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 43 COLOMBIA BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 44 COLOMBIA BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 45 REST OF SOUTH AMERICA BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 46 REST OF SOUTH AMERICA BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 47 REST OF SOUTH AMERICA BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 48 REST OF SOUTH AMERICA BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 49 REST OF SOUTH AMERICA BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 REST OF SOUTH AMERICA BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 51 INDIA BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 52 INDIA BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 53 INDIA BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 54 INDIA BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 55 INDIA BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 56 INDIA BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 57 CHINA BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 58 CHINA BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 59 CHINA BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 60 CHINA BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 61 CHINA BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 62 CHINA BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 63 JAPAN BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 64 JAPAN BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 65 JAPAN BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 66 JAPAN BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 67 JAPAN BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 68 JAPAN BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 69 SOUTH KOREA BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 70 SOUTH KOREA BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 71 SOUTH KOREA BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 72 SOUTH KOREA BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 73 SOUTH KOREA BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 74 SOUTH KOREA BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 75 AUSTRALIA BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 76 AUSTRALIA BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 77 AUSTRALIA BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 AUSTRALIA BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 AUSTRALIA BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 80 AUSTRALIA BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 81 SOUTH-EAST ASIA BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 82 SOUTH-EAST ASIA BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 83 SOUTH-EAST ASIA BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 84 SOUTH-EAST ASIA BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 85 SOUTH-EAST ASIA BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 86 SOUTH-EAST ASIA BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 87 REST OF ASIA PACIFIC BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 88 REST OF ASIA PACIFIC BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 89 REST OF ASIA PACIFIC BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 90 REST OF ASIA PACIFIC BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 REST OF ASIA PACIFIC BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 92 REST OF ASIA PACIFIC BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 93 GERMANY BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 94 GERMANY BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 95 GERMANY BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 96 GERMANY BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 97 GERMANY BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 98 GERMANY BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 99 UK BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 100 UK BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 101 UK BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 102 UK BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 UK BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 104 UK BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 105 FRANCE BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 106 FRANCE BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 107 FRANCE BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 108 FRANCE BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 109 FRANCE BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 110 FRANCE BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 111 ITALY BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 112 ITALY BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 113 ITALY BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 114 ITALY BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 115 ITALY BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 116 ITALY BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 117 SPAIN BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 118 SPAIN BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 119 SPAIN BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 120 SPAIN BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 121 SPAIN BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 122 SPAIN BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 123 RUSSIA BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 124 RUSSIA BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 125 RUSSIA BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 126 RUSSIA BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 127 RUSSIA BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 128 RUSSIA BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 129 REST OF EUROPE BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 130 REST OF EUROPE BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 131 REST OF EUROPE BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 132 REST OF EUROPE BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 133 REST OF EUROPE BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 134 REST OF EUROPE BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 135 UAE BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 136 UAE BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 137 UAE BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 138 UAE BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 139 UAE BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 140 UAE BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 141 SAUDI ARABIA BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 142 SAUDI ARABIA BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 143 SAUDI ARABIA BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 144 SAUDI ARABIA BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 145 SAUDI ARABIA BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 146 SAUDI ARABIA BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 147 SOUTH AFRICA BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 148 SOUTH AFRICA BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 149 SOUTH AFRICA BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 150 SOUTH AFRICA BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 151 SOUTH AFRICA BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 152 SOUTH AFRICA BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 153 REST OF MIDDLE EAST AND AFRICA BIO BASED PARAXYLENE MARKET BY SOURCE (USD MILLIONS) 2020-2029

TABLE 154 REST OF MIDDLE EAST AND AFRICA BIO BASED PARAXYLENE MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 155 REST OF MIDDLE EAST AND AFRICA BIO BASED PARAXYLENE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 156 REST OF MIDDLE EAST AND AFRICA BIO BASED PARAXYLENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 157 REST OF MIDDLE EAST AND AFRICA BIO BASED PARAXYLENE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 158 REST OF MIDDLE EAST AND AFRICA BIO BASED PARAXYLENE MARKET BY END USER (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BIO BASED PARAXYLENE MARKET BY SOURCE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL BIO BASED PARAXYLENE MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL BIO BASED PARAXYLENE MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 11 GLOBAL BIO BASED PARAXYLENE MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA BIO BASED PARAXYLENE MARKET SNAPSHOT

FIGURE 14 EUROPE BIO BASED PARAXYLENE MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC BIO BASED PARAXYLENE MARKET SNAPSHOT

FIGURE 16 SOUTH AMERICA BIO BASED PARAXYLENE MARKET SNAPSHOT

FIGURE 17 MIDDLE EAST & AFRICA BIO BASED PARAXYLENE MARKET SNAPSHOT

FIGURE 18 VIRENT INC.: COMPANY SNAPSHOT

FIGURE 19 RENMATIX INC.: COMPANY SNAPSHOT

FIGURE 20 ANELLOTECH INC.: COMPANY SNAPSHOT

FIGURE 21 ORIGIN MATERIALS: COMPANY SNAPSHOT

FIGURE 22 GEVO: COMPANY SNAPSHOT

FIGURE 23 AVANTIUM: COMPANY SNAPSHOT

FIGURE 24 BASF SE: COMPANY SNAPSHOT

FIGURE 25 TORAY INDUSTRIES INC.: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.