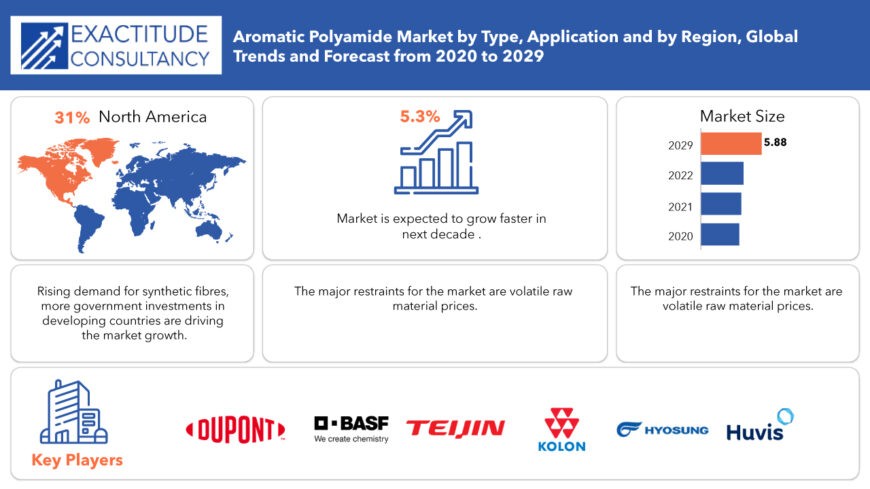

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 5.88 billion | 5.3% | North America |

| By Type | By Application | By Regions |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Aromatic Polyamide Market Overview

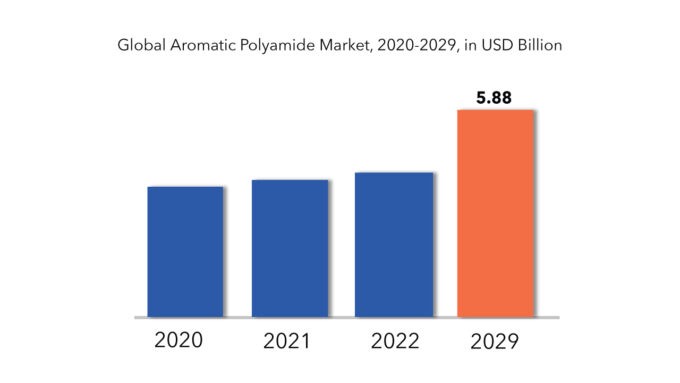

The global aromatic polyamide market size is estimated to be valued at USD 3.7 billion in 2020 and is projected to reach USD 5.88 billion by 2029, recording a CAGR of 5.3%.

The Aromatic Polyamide Market pertains to the production, distribution, and application of aromatic polyamide materials, commonly known as aramids. Aromatic polyamides are synthetic polymers renowned for their exceptional strength, heat resistance, and chemical stability, making them integral in various high-performance applications. These materials are extensively utilized in industries such as aerospace, automotive, electronics, defense, and construction, where durability, reliability, and resistance to extreme conditions are paramount. Aramids find diverse applications including protective clothing, ballistic armor, electrical insulation, gaskets, seals, and high-temperature composites due to their remarkable mechanical properties and thermal stability.

Several factors drive the growth of the Aromatic Polyamide Market. The increasing demand for lightweight and high-strength materials across various end-use industries, particularly in automotive and aerospace sectors, propels the adoption of aromatic polyamides. Additionally, the rising focus on enhancing safety and performance standards in protective apparel and ballistic applications stimulates market growth. Furthermore, the expanding electronics industry, driven by the proliferation of smartphones, tablets, and wearable devices, fuels the demand for aramid-based electrical insulation materials.

The regulatory framework governing the Aromatic Polyamide Market encompasses various national and international regulations and standards aimed at ensuring product safety, environmental sustainability, and quality assurance. Regulatory bodies such as the Environmental Protection Agency (EPA) in the United States, the European Chemicals Agency (ECHA) in Europe, and similar agencies worldwide impose restrictions on the use of certain chemicals and substances in aromatic polyamide production. Additionally, industry standards organizations such as ASTM International and the International Organization for Standardization (ISO) establish guidelines for testing methods, performance criteria, and product certifications to ensure compliance with regulatory requirements and industry best practices in the production and application of aromatic polyamides.

Aromatic Polyamide Market Segment Analysis

On the basis of Type, the market is segmented into Para-Aramid, Meta-Aramid. All hydrogen atoms between two carbonyl groups are replaced by methylene (—CH—) groups in para-Aramid, an aromatic polyamide with amide connections. Condensation polymerization of m-phenylenediamine and terephthaloyl chloride produces para-Aramid.

Meta-Aramid is a polyamide fibre type. Meta-aramid fibres are strong and heat resistant, with qualities similar to Kevlar, making them ideal for protective apparel like firefighter gear and bulletproof vests that need to be light yet also endure high temperatures. They offer a strength-to-weight ratio similar to steel, making them lighter than most other synthetic fabrics used in load-bearing applications such as body armour. It’s employed in the manufacture of bulletproof and stab-proof body armour.

On the basis of Application, the market is segmented into Security and Protection, Optical Fibres, Tire Reinforcement, Electrical Insulation, Rubber Reinforcement, Ropes & Cables, Composites.

Bulletproof vests are made from aromatic polyamide. A bulletproof vest must be able to shield the human body from bullets fired by weapons while still being flexible enough to allow for free mobility without sacrificing the wearer’s comfort. Aromatic polyamide fibres are mixed with other materials like Kevlar or Twaron to produce this combination of characteristics (both aramids). This combination not only makes it stronger, but it also makes it more flexible.

Aromatic polyamide is utilized in optical fibre cable because it is chemically, thermally, and ultraviolet radiation resistant. Alkalis, acids, and solvents are all resistant to it. Aramid fibres are robust at high temperatures, making them ideal for usage as the outer covering material for rocket engines.

Tire reinforcement is made of aromatic polyamide. It boosts tyre strength and flexibility, allowing them to grow in size without sacrificing comfort or safety.

Because of its resistance to flammability, aromatic polyamide is utilized in electrical insulation. It also has a stronger dielectric property than other insulating materials, allowing it to withstand higher voltages.

In the manufacture of rubber reinforcement, aromatic polyamide is employed. Rubber has a number of characteristics, including strong elasticity, heat stability, and flexibility. Aromatic polyamide can improve these properties by acting as a reinforcing agent for better cross-linking with elastomeric materials, resulting in increased strength and resilience under pressure or stress, making it an excellent choice for heavy-duty applications such as construction equipment and farm machinery.

Aromatic Polyamide Market Players

Market players focus on growth strategies, such as new product launches, collaborations, partnerships, operational expansion, mergers & acquisitions, and awareness campaigns. Companies operating the target market can focus on partnerships and collaborations, in order to develop advanced products which in turn create lucrative growth opportunities. Few of the important market players DuPont, BASF SE, Teijin, JSC Kamenskvolokno, Kolon, Hyosung, Huvis, TAYHO, Bluestar and Sinopec Yizheng Chemical Fibre.

Companies are mainly in the developing and they are competing closely with each other. Innovation is one of the most important and key strategy as it has to be for any market. However, companies in the market have also opted and successfully driven inorganic growth strategies like mergers & acquisition and so on.

- November 2020: For engineered plastics, monofilaments, and cable links, Ascend Value Materials introduced many new grades of its HiDura long-chain polyamides. HiDura polyamide 610 and 612 have been developed to provide exceptional dimensional stability and long life with improved chemical, impact and abrasion resistance.

- July 2020: The Board of Directors of BASF India approved the purchase of the company’s 100% interest in BASF Value Polyamides from BASF Nederland B.V. BASF SE and BASF SE. The acquisition of BASF Value Polyamides will reinforce the role of the organization as a leading industry service supplier and increase market penetration to key growth markets.

Who Should Buy? Or Key Stakeholders

- Aromatic polyamide Companies

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Key Takeaways:

- The global aromatic polyamide market is recording a CAGR of 5.3%.

- On the basis of Type, Meta-aramid fibers are expected to be the dominating segment.

- On the basis of Application, Electrical Insulation is expected to be the dominating segment.

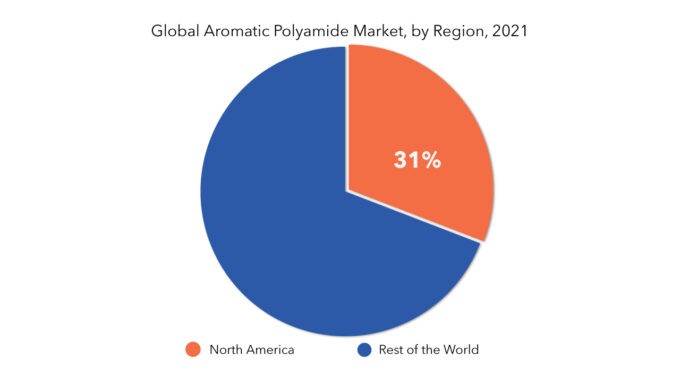

- The major share is expected to be occupied by North America for global aromatic polyamide market.

- The aromatic polyamide market is experiencing steady growth driven by increasing demand from various industries such as automotive, electronics, and aerospace.

Aromatic Polyamide Market Regional Analysis

The aromatic polyamide market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes US, Canada and Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The major share is expected to be occupied by North America for global aromatic polyamide market during the forecast period. The rising use of aromatic polyamide as a reinforcement material, such as tyre wire, has fueled the growth of the North American aromatic polyamide market in recent years. Due to their superior mechanical qualities, this trend is projected to continue across numerous end-user industries, which will favorably impact growth over the projection period. During the forecast period, Latin America is expected to have the highest growth rate. The increasing demand for lightweight automobile parts from automotive firms, as well as the growing tyre sector in countries like Brazil and Argentina, are driving market expansion in this area.

Key Market Segments: Aromatic Polyamide Market

Aromatic Polyamide Market by Type, 2020-2029, (USD Million), (Kilotons)

- Para-Aramid

- Meta-Aramid

Aromatic Polyamide Market by Application, 2020-2029, (USD Million), (Kilotons)

- Security And Protection

- Optical Fibres

- Tire Reinforcement

- Electrical Insulation

- Rubber Reinforcement

- Ropes & Cables

- Composites

Aromatic Polyamide Market by Regions, 2020-2029, (USD Million), (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important countries in all regions are covered.

Key Question Answered

- What is the current market size of this high growth market?

- What is the overall growth rate?

- What are the key growth areas, applications, end uses and types?

- Key reasons for growth

- Challenges for growth

- Who are the important market players in this market?

- What are the key strategies of these players?

- What technological developments are happening in this area?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions And Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Aromatic Polyamide Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact Of Covid-19 On Global Aromatic Polyamide Market

- Global Aromatic Polyamide Market Outlook

- Global Aromatic Polyamide Market by Type, (USD Million) (Kilotons)

- Para-Aramid

- Meta-Aramid

- Global Aromatic Polyamide Market by Application, (USD Million) (Kilotons)

- Security And Protection

- Optical Fibres

- Tire Reinforcement

- Electrical Insulation

- Rubber Reinforcement

- Ropes & Cables

- Composites

- Global Aromatic Polyamide Market by Region, (USD Million) (Kilotons)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Types Offered, Recent Developments)

-

- Dupont

- BASF SE

- Teijin

- JSC Kamenskvolokno

- Kolon

- Hyosung

- Huvis

- TAYHO

- Bluestar

- Sinopec Yizheng Chemical Fibre

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 2 GLOBAL AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 4 GLOBAL AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL AROMATIC POLYAMIDE MARKET BY REGION (USD MILLIONS), 2020-2029

TABLE 6 GLOBAL AROMATIC POLYAMIDE MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA AROMATIC POLYAMIDE MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 8 NORTH AMERICA AROMATIC POLYAMIDE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 9 US AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 10 US AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 11 US AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 12 US AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 13 CANADA AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 14 CANADA AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 15 CANADA AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 16 CANADA AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 MEXICO AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 18 MEXICO AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 19 MEXICO AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 20 MEXICO AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 SOUTH AMERICA AROMATIC POLYAMIDE MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 22 SOUTH AMERICA AROMATIC POLYAMIDE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 23 BRAZIL AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 24 BRAZIL AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 25 BRAZIL AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 26 BRAZIL AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 27 ARGENTINA AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 28 ARGENTINA AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 29 ARGENTINA AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 30 ARGENTINA AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 31 COLOMBIA AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 32 COLOMBIA AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 33 COLOMBIA AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 34 COLOMBIA AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 35 REST OF SOUTH AMERICA AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 36 REST OF SOUTH AMERICA AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 37 REST OF SOUTH AMERICA AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 38 REST OF SOUTH AMERICA AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 ASIA-PACIFIC AROMATIC POLYAMIDE MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 40 ASIA-PACIFIC AROMATIC POLYAMIDE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 41 INDIA AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 42 INDIA AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 43 INDIA AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 44 INDIA AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 45 CHINA AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 46 CHINA AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 47 CHINA AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 48 CHINA AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 49 JAPAN AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 50 JAPAN AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 51 JAPAN AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 52 JAPAN AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 53 SOUTH KOREA AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 54 SOUTH KOREA AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 55 SOUTH KOREA AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 56 SOUTH KOREA AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 57 AUSTRALIA AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 58 AUSTRALIA AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 59 AUSTRALIA AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 60 AUSTRALIA AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 SOUTH-EAST ASIA AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 62 SOUTH-EAST ASIA AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 63 SOUTH-EAST ASIA AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 64 SOUTH-EAST ASIA AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 REST OF ASIA PACIFIC AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 66 REST OF ASIA PACIFIC AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 67 REST OF ASIA PACIFIC AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 68 REST OF ASIA PACIFIC AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 69 EUROPE AROMATIC POLYAMIDE MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 70 EUROPE AROMATIC POLYAMIDE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 71 GERMANY AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 72 GERMANY AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 73 GERMANY AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 74 GERMANY AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 75 UK AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 76 UK AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 77 UK AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 78 UK AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 79 FRANCE AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 80 FRANCE AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 81 FRANCE AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 82 FRANCE AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 83 ITALY AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 84 ITALY AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 85 ITALY AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 86 ITALY AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 87 SPAIN AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 88 SPAIN AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 89 SPAIN AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 90 SPAIN AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 RUSSIA AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 92 RUSSIA AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 93 RUSSIA AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 94 RUSSIA AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 95 REST OF EUROPE AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 96 REST OF EUROPE AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 97 REST OF EUROPE AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 98 REST OF EUROPE AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 MIDDLE EAST AND AFRICA AROMATIC POLYAMIDE MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 100 MIDDLE EAST AND AFRICA AROMATIC POLYAMIDE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 101 UAE AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 102 UAE AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 103 UAE AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 104 UAE AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 105 SAUDI ARABIA AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 106 SAUDI ARABIA AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 107 SAUDI ARABIA AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 108 SAUDI ARABIA AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 109 SOUTH AFRICA AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 110 SOUTH AFRICA AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 111 SOUTH AFRICA AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 112 SOUTH AFRICA AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 113 REST OF MIDDLE EAST AND AFRICA AROMATIC POLYAMIDE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 114 REST OF MIDDLE EAST AND AFRICA AROMATIC POLYAMIDE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 115 REST OF MIDDLE EAST AND AFRICA AROMATIC POLYAMIDE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 116 REST OF MIDDLE EAST AND AFRICA AROMATIC POLYAMIDE MARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AROMATIC POLYAMIDE MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL AROMATIC POLYAMIDE MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL AROMATIC POLYAMIDE MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 MARKET SHARE ANALYSIS

FIGURE 13 DUPONT: COMPANY SNAPSHOT

FIGURE 14 BASF SE: COMPANY SNAPSHOT

FIGURE 15 TEIJIN: COMPANY SNAPSHOT

FIGURE 16 JSC KAMENSKVOLOKNO: COMPANY SNAPSHOT

FIGURE 17 KOLON: COMPANY SNAPSHOT

FIGURE 18 HYOSUNG: COMPANY SNAPSHOT

FIGURE 19 HUVIS: COMPANY SNAPSHOT

FIGURE 20 TAYHO: COMPANY SNAPSHOT

FIGURE 21 BLUESTAR: COMPANY SNAPSHOT

FIGURE 22 SINOPEC YIZHENG CHEMICAL FIBRE: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.