REPORT OUTLOOK

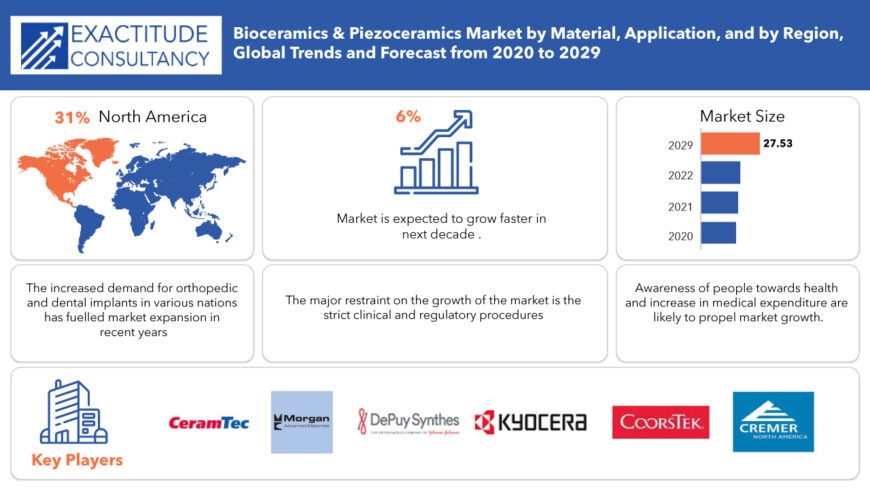

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 27.54 billion | 6% | North America |

| By Material | By Applications | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Bioceramics and Piezoceramics Market Overview

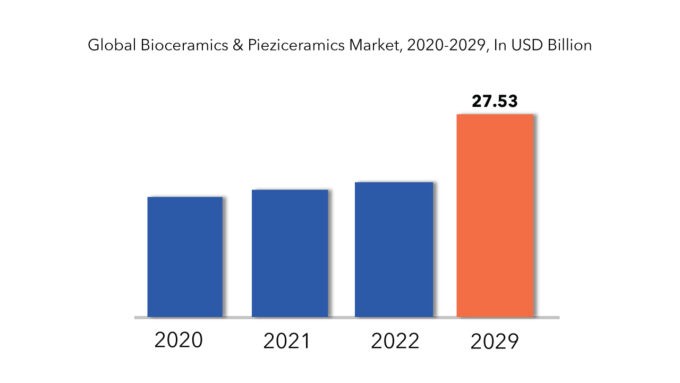

The Bioceramics and piezoceramics market share is expected to grow 6% CAGR from 2022 to 2029. It is expected to reach above USD 27.54 billion by 2029 from USD 16.3 billion in 2020.

The bioceramics and piezoceramics market encompasses a diverse array of ceramic materials specifically engineered for biomedical applications, ranging from bone implants to dental prosthetics. Bioceramics, known for their biocompatibility and bioactivity, play a crucial role in orthopedic and dental surgeries, offering solutions for bone regeneration and restoration. Piezoceramics, on the other hand, exhibit unique piezoelectric properties, making them valuable components in medical devices such as ultrasound transducers and sensors for diagnostic and therapeutic purposes. The convergence of advancements in material science and biomedical engineering has fueled the growth of this market, driven by the increasing demand for innovative solutions in healthcare.

A primary driver propelling the bioceramics and piezoceramics market forward is the growing prevalence of musculoskeletal disorders and dental conditions, coupled with an aging population worldwide. With an increasing number of individuals seeking orthopedic interventions and dental treatments, there is a parallel surge in demand for bioceramic implants and dental ceramics. Moreover, the expanding scope of applications for piezoceramics in medical devices, particularly in diagnostic imaging and therapeutic equipment, further augments market growth. Additionally, ongoing research efforts aimed at enhancing the mechanical properties, biocompatibility, and functionality of these ceramic materials contribute to their widespread adoption across various healthcare sectors.

In the regulatory landscape, the bioceramics and piezoceramics market operates within a framework governed by stringent standards and guidelines to ensure product safety, efficacy, and quality. Regulatory bodies such as the Food and Drug Administration (FDA) in the United States and the European Medicines Agency (EMA) in Europe impose rigorous requirements on the development, manufacturing, and marketing of biomedical ceramics. Compliance with these regulations is imperative for market players to obtain approvals and certifications necessary for commercialization.

Because zirconia (ZrO2) and alumina (Al2O3) are chemically stable, they are the most extensively utilized bio-inert ceramics in the medical field. Because they are biocompatible, non-toxic, non-inflammatory, non-allergic, non-carcinogenic, and bio-functional, bio-inert ceramics are employed in bone tissue applications. As the need for end-use applications like as dental and orthopaedic implants grows, these ceramics are the most common form of medical ceramic material. There are three other types of ceramics that are frequently utilized in addition to bio-inert ceramics. Bio-active, bio-resorbable, and piezoceramic materials are among them. In many applications, these ceramics are often referred to as fine ceramics.

It is clear that developing ceramic-based devices is a time-consuming and expensive process. Medical gadgets that are implanted inside the body must also undergo clinical testing. These issues are putting a brake on the market’s expansion.

Bioceramics and Piezoceramics Market Segment Analysis

On the basis of material, the bioceramics and piezoceramics market is segmented into Bio-Inert, Bio-Active, & Bio-Resorbable Ceramics, Piezo Ceramics.

On the basis of applications, the market of bioceramics and piezoceramics are segmented into Dental & Orthopedic Implants, Surgical, & Diagnostic instruments, Implantable Electronic Devices.

Bio inert ceramics are alumina and zirconia. They are used in total hip prostheses and in tooth implants. Previously surgical metals alloys are used for such processes but they get replaced by bio-inert ceramics as later have better properties. The main advantage of using ceramics over metals is that they have lower wear rates at the articulating surfaces and release very low concentrations of inert wear particles. Excessive wear rates can contribute to loosening and eventual implantation failure.

Bio active ceramics are grouped as calcium phosphate ceramics, bioactive glasses, and glass-ceramics. Calcium phosphates are the major constituents of bone minerals. Bioactive glasses or bioglass particularly help in repairing and replacing diseased or damaged bones. Bioglass can bond to soft tissue as well as a bone to heal the wound or injury. Glass-ceramics are used in some compression load-bearing applications, such as vertebral prostheses and iliac crest replacement.

In dentistry, bioceramics are used for dental implants and root canal treatments. They are also used for Scaffolds, bone grafts, and covering material for dental implants.

The orthopedic sector of Bioglass is mainly influenced by the old age population. Changes in the global old population will open up prospects for biomedical treatments such as bone grafting and dental surgery. The enormous senior population has grown substantially in the last 20 years, resulting in an increase in the number of tissue and spinal procedures. Bioglass fibers can successfully adhere to both hard and soft tissues. Furthermore, it has the potential to improve the success rate of bone replacements by activating the release of nutrients that aid in bone regeneration. Bioglass fibers dissolve actively in tissues and activate ion-releasing processes to induce new bone forms, enhancing their usage in biomedical services such as restorative fillings. Furthermore, as people get older, they face a variety of dangers, including dental and orthopedic issues. Many bioglass fibre market prospects and uses are likely to accelerate due to rapid technological advancements in bone-grafting engineering.

Bioceramics are used in surgical and diagnostic instruments such as suture welding, aspirators, nebulizers, and ultrasonic cleaners. Piezoceramics are everywhere in medical devices, they are part of medical and dental hand pieces.

Bioceramics and Piezoceramics Market Key Players

Some of the key players in the bioceramics and piezoceramics market are CeramTec GmbH, Morgan Advanced Materials, DePuy Synthes, Kyocera Corporation, CoorsTek Inc., Zimmer-Biomet holdings Inc., Nobel Biocare, Peter Cremer North America, Carotino Group, Procter & Gamble (P&G) Chemicals, Klk Oleo, NGK Spark Plug Co., Ltd., Saint–Gobain Ceramic Materials, H.C. Starck GmbH and Others.

To increase their market position, these businesses have implemented a variety of growth tactics. These companies are using expansion, new product development, mergers and acquisitions, and collaboration as important growth strategies to improve their product portfolio and geographical presence in order to meet the rising demand from emerging economies.

- CoorsTek CeraSurf is a state-of-the-art material used for ceramic bearing surfaces in total hip arthroplasty

Who Should Buy? Or Key stakeholders

- Manufacturers

- Traders

- Distributors

- Suppliers

- R&D institutions

- Environment, Health and Safety Professionals

- Healthcare industry

- Government and Research Organization

- Investors

- Others

Bioceramics and Piezoceramics Market Regional Analysis

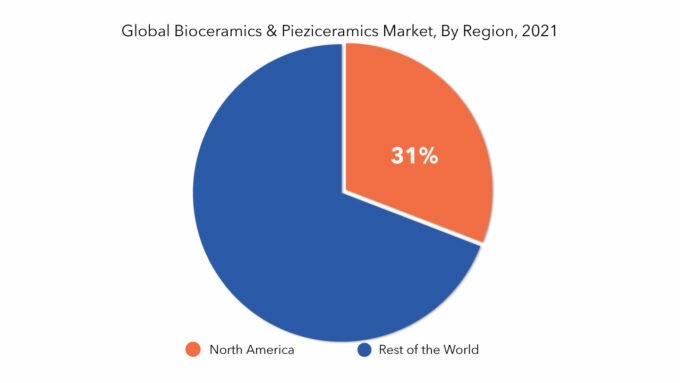

The Bioceramics and Piezoceramics Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

The Asia Pacific holds a significant share of the global bioceramics and piezoceramics market owing to many healthcare policies and development of the healthcare industry of China, India, Japan, Indonesia, and South Korea. The market of this region is driven by growth in awareness about health, an increase in healthcare expenditures, an increasing number of populations, rapid urbanization, improving the lifestyle of the people, etc. There is an increase in the utilization of bioceramics and piezoceramics in dental implants, surgical and diagnostic instruments, orthopedic implants and others in these countries. The factors that are driving the market growth in this region are competitive manufacturing costs, end-use applications, and a high economy. The European and North American markets are also growing for the above reasons.

Key Takeaways

- The Bioceramics and piezoceramics market share is expected to grow 6% CAGR.

- Based on material, Bio-Resorbable Ceramics is expected to dominate the market.

- Based on application, Dental is expected to dominate the market.

- The Asia Pacific holds a significant share of the global bioceramics and piezoceramics market.

- One major market trend in the Bioceramics and Piezoceramics Market is the increasing demand for advanced healthcare solutions driving the growth of bioceramics for medical applications and piezoceramics for diverse technological advancements.

Key Market Segments: Bioceramics and Piezoceramics

Bioceramics And Piezoceramics Market By Material, 2020-2029, (USD Billion) (Kilotons)

- Bio-Inert

- Bio-Active

- Bio-Resorbable Ceramics

- Piezoceramics

Bioceramics And Piezoceramics Market By Applications, 2020 -2029, (USD Billion) (Kilotons)

- Dental

- Orthopedic Implants

- Surgical

- Diagnostic Instrument

- Implantable Electronic Devices

Bioceramics And Piezoceramics Market By Region, 2020-2029, (USD Million) (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What will the market size be in 2021 and what will the growth rate be?

- What are the key market trends?

- What is driving this market?

- Who are the key vendors in this market space?

- What is the major end-use industry?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Bioceramics & Piezoceramics Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Bioceramics & Piezoceramics Market

- Global Bioceramics & Piezoceramics Market Outlook

- Global Bioceramics & Piezoceramics Market by Material, (USD Million) (Kilotons)

- Bio-Inert

- Bio-Active, & Bio-Resorbable Ceramics

- Piezo Ceramics

- Global Bioceramics & Piezoceramics Market by Application, (USD Million) (Kilotons)

- Dental & Orthopedic Implants

- Surgical, & Diagnostic Instrument

- Implantable Electronic Devices

- Global Bioceramics & Piezoceramics Market by Region, (USD Million) (Kilotons)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle- East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle- East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- CeramTec GmbH

- Morgan Advanced Materials

- DePuy Synthes

- Kyocera Corporation

- CoorsTek Inc.

- Zimmer-Biomet holdings Inc.

- Nobel Biocare

- NGK Spark Plug Co., Ltd.

- Saint–Gobain Ceramic Materials

- C. Starck GmbH

- Others *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 2 GLOBAL BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 3 GLOBALBIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 4 GLOBAL BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL BIOCERAMICS & PIEZOCERAMICS MARKET BY REGION (USD MILLIONS), 2020-2029

TABLE 6 GLOBAL BIOCERAMICS & PIEZOCERAMICS MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 8 NORTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 10 NORTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 12 NORTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 13 US BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 14 US BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 15 US BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 16 US BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 CANADA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (MILLIONS), 2020-2029

TABLE 18 CANADA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 19 CANADA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 20 CANADA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 MEXICO BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 22 MEXICO BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 23 MEXICO BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 24 MEXICO BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 25 SOUTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 26 SOUTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 27 SOUTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 28 SOUTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 30 SOUTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 31 BRAZIL BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 32 BRAZIL BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 33 BRAZIL BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 34 BRAZIL BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 35 ARGENTINA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 36 ARGENTINA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 37 ARGENTINA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 38 ARGENTINA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 COLOMBIA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 40 COLOMBIA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 41 COLOMBIA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 42 COLOMBIA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 44 REST OF SOUTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 46 REST OF SOUTH AMERICA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 ASIA-PACIFIC BIOCERAMICS & PIEZOCERAMICS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 48 ASIA-PACIFIC BIOCERAMICS & PIEZOCERAMICS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 49 ASIA-PACIFIC BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 50 ASIA-PACIFIC BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 51 ASIA-PACIFIC BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 52 ASIA-PACIFIC BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 53 INDIA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 54 INDIA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 55 INDIA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 56 INDIA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 57 CHINA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 58 CHINA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 59 CHINA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLION), 2020-2029

TABLE 60 CHINA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 JAPAN BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 62 JAPAN BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 63 JAPAN BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLION), 2020-2029

TABLE 64 JAPAN BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 SOUTH KOREA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 66 SOUTH KOREA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 67 SOUTH KOREA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL USD MILLION), 2020-2029

TABLE 68 SOUTH KOREA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 69 AUSTRALIA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 70 AUSTRALIA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 71 AUSTRALIA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLION), 2020-2029

TABLE 72 AUSTRALIA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 73 SOUTH EAST ASIA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 75 SOUTH EAST ASIA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 81 EUROPE BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 82 EUROPE BIOCERAMICS & PIEZOCERAMICS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 83 EUROPE BIOCERAMICS & PIEZOCERAMICS MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 84 EUROPE BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 85 EUROPE BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLION ), 2020-2029

TABLE 86 EUROPE BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 87 GERMANY BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION USD MILLION), 2020-2029

TABLE 88 GERMANY BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 89 GERMANY BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLION), 2020-2029

TABLE 90 GERMANY BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 91 UK BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 92 UK BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 93 UK BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 94 UK BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 95 FRANCE BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 96 FRANCE BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 97 FRANCE BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLION), 2020-2029

TABLE 98 FRANCE BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 ITALY BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 100 ITALY BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 101 ITALY BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLION), 2020-2029

TABLE 102 ITALY BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 SPAIN BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 104 SPAIN BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 105 SPAIN BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLION), 2020-2029

TABLE 106 SPAIN BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 107 RUSSIA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 108 RUSSIA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 109 RUSSIA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLION), 2020-2029

TABLE 110 RUSSIA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 112 REST OF EUROPE BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 114 REST OF EUROPE BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA BIOCERAMICS & PIEZOCERAMICS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA BIOCERAMICS & PIEZOCERAMICS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 121 UAE BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 122 UAE BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 123 UAE BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 124 UAE BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 126 SAUDI ARABIA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 128 SAUDI ARABIA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 130 SOUTH AFRICA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 132 SOUTH AFRICA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (USD MILLIONS), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL, USD MILLION, KILOTONS 2020-2029

FIGURE 9 GLOBAL BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION USD MILLION, KILOTONS 2020-2029

FIGURE 10 GLOBAL BIOCERAMICS & PIEZOCERAMICS MARKET BY REGION, USD MILLION, KILOTONS 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL BIOCERAMICS & PIEZOCERAMICS MARKET BY MATERIAL, USD MILLION, KILOTONS 2020-2029

FIGURE 13 GLOBAL BIOCERAMICS & PIEZOCERAMICS MARKET BY APPLICATION, USD MILLION, KILOTONS 2020-2029

FIGURE 14 GLOBAL BIOCERAMICS & PIEZOCERAMICS MARKET BY REGION, USD MILLION, KILOTONS 2020-2029

FIGURE 15 GLOBAL BIOCERAMICS & PIEZOCERAMICS MARKET BY REGION 2021

FIGURE 16 MARKET SHARE ANALYSIS

FIGURE 17 CERAMTEC GMBH: COMPANY SNAPSHOT

FIGURE 18 MORGAN ADVANCED MATERIALS: COMPANY SNAPSHOT

FIGURE 19 DEPUYT SENTHES: COMPANY SNAPSHOT

FIGURE 20 KYOCERA CORPORATION: COMPANY SNAPSHOT

FIGURE 21 COORSTEK INC.: COMPANY SNAPSHOT

FIGURE 22 ZIMMER-BIOMET HOLDINGS INC.: COMPANY SNAPSHOT

FIGURE 23 NGK SPARK PLUG CO., LTD.: COMPANY SNAPSHOT

FIGURE 24 SAINT–GOBAIN CERAMIC MATERIALS: COMPANY SNAPSHOT

FIGURE 25 H.C. STARCK GMBH: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.