REPORT OUTLOOK

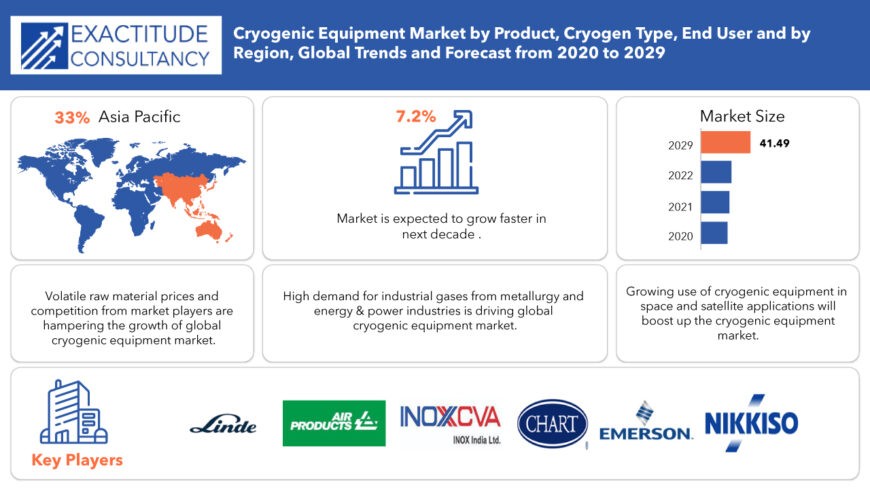

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 41.5 billion | 7.2% | Asia Pacific |

| by Product | by Cryogen Type | by End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Cryogenic Equipment Market Overview

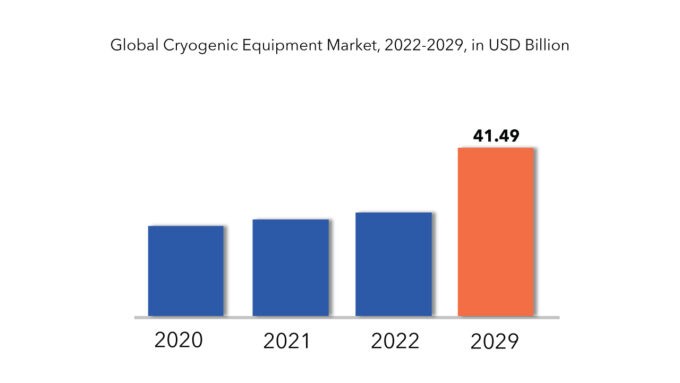

The global cryogenic equipment market is expected to grow at more than 7.2% CAGR from 2022 to 2029. It is expected to reach above USD 41.5 billion by 2029 from USD 22.19 billion in 2020.

Cryogenic apparatus finds predominant utility within the oil and gas sector primarily for the conveyance and containment of Liquefied Natural Gas (LNG) and industrial gases during industrial operations. The expansion of the manufacturing sector assumes a pivotal role in economic advancement, coupled with a burgeoning consciousness toward the cultivation of clean energy reservoirs. These determinants significantly bolster market expansion. Moreover, escalating investments in LNG-powered facilities and the escalating requisites within the transportation and storage sectors propel market growth.

Within the metallurgical domain, procedures such as metal forming/smelting, fabrication, welding, and combustion necessitate industrial gases such as oxygen, nitrogen, argon, and hydrogen, with oxygen and nitrogen prominently featured among them. Cryogenic forms of these gases are indispensable for precise temperature modulation and augmenting operational efficacy. Varied types of cryogenic apparatus, encompassing storage tanks and distribution networks, are indispensable for the manipulation and provision of these gases in their liquefied state. The superior operational efficiency and economic viability of cryogenic systems position them as the preferred choice within metallurgical applications.

According to the World Steel Association (WSA), approximately 73% of worldwide steel production relies on the oxygen process (Basic Oxygen Process). Oxygen gas, in tandem with cryogenic apparatus, is frequently deployed in steel manufacturing and processing to refine operational efficiency and output quality. During steelmaking, oxygen infusion into molten iron within blast furnaces fosters combustion and expedites impurity elimination, thereby elevating steel quality. Cryogenic equipment is instrumental in storing and administering liquid oxygen, ensuring meticulous control over the injection process. Besides the aforementioned catalysts, ongoing research endeavors and innovative pursuits directed towards the formulation of high-strength alloys, highly conductive materials for electric motors deployable in Electric Vehicles (EVs), robust metals for industrial purposes, and advanced composites like highly conductive carbon nanotubes aimed at augmenting electrical energy transmission efficiency, alongside novel corrosion mitigation measures tailored for marine and offshore applications, are poised to further drive the demand for cryogenic apparatus within the metallurgical sector.

Cryogenic Equipment Market Segment Analysis

On the basis of product, the global cryogenic equipment market has been segmented as tanks, valves, vaporizers, pumps and others. Other equipment includes pipes, regulators, freezers, dewar, strainers, samplers, heat exchangers, leak detection equipment, dispensers, and accessories (manifolds, fittings, vacuum jacketed/insulated piping, hoses, connections). The tanks are estimated to have the largest market share. Increasing LNG production and high demand for industrial gases is expected to drive the equipment segment, which consequently increases the demand for cryogenic equipment.

The valve segment holds the second largest share due to wide applications in freezing such as production, transportation, and storage of liquefied gases. It is mostly used in LNG liquefaction plants, gas production plants, receiving terminals, and cargo systems. The increasing application of vaporizers for vaporization of LNG in base-load and peak shaving in regasification facilities across end-use industries is set to drive the growth of this segment during till 2029. The pump segment is growing at a faster pace owing to the high and ultra-high vacuum applications from the oil & gas, metallurgy, and chemical industry. Hence, the growing application of these equipment across vertical industries would accelerate the demand.

Based on cryogen type, the cryogenic equipment market is divided as nitrogen, oxygen, argon, LNG, and others. The LNG segment is exhibiting the largest market portion owing to its wide application areas such as storage, transportation, fueling, processing, and others. It is also used in power generation, metallurgy, manufacturing, locomotives, ships, and other industries. Other cryogenic gases include helium, nitrous oxide, ethylene, and carbon dioxide. LNG segment holds the largest share in the cryogenic equipment market, followed by Nitrogen. Rising demand for hydrogen fuel cells and cleaner energy is expected to drive the cryogen segment of the cryogenic equipment market during the forecast period.

Based on end users, market can be classified as metallurgy, energy & power, chemical, electronics, transportation, and others. Other end-users include healthcare, aerospace, and food & beverages (F&B) industries. Metallurgy is expected to hold the largest market share in 2021 and have highest growth rate in the forecast period.

The chemical & petrochemical industry is expected to experience considerable growth owing to application in oxidation processes, coal gasification, sulfur recovery units, regeneration of catalysts, cooling reactors, and other applications. Increasing transportation and storage of LNG for the oil & gas industry and LNG-based power plants can boost the market growth. Hence, an increase in the application of cryogenics from the oil & gas and chemical & petrochemical industry upticks the market till 2028.The growing energy & oil demands and technological advancements is expected to boost the segment in the forecast period.

Cryogenic Equipment Market Players

The market is highly competitive with presence of large number of players with strong production capacities. Strategic activities of key players including, production capacity expansion, new product launches and strategic agreements will differentiate themselves in the longer run.

Due to the presence of several players, the market has strong competition. Some of the major players in the market are Linde plc, Air Liquide, Air Products Inc, Chart Industries and Parker Hannifin Corp.

Who Should Buy? Or Key Stakeholders

- Research Centers

- Transportation

- Metal industries

- Energy & Power manufacturer

- Chemical industries

- Electronics industries

- Government Organizations

- Investors

- Others

Key Takeaways:

- The global cryogenic equipment market is expected to grow at more than 7.2% CAGR.

- On the basis of product, the tanks are estimated to have the largest market share.

- Based on cryogen type, the LNG segment is exhibiting the largest market portion.

- Based on end users, Metallurgy is expected to hold the largest market share.

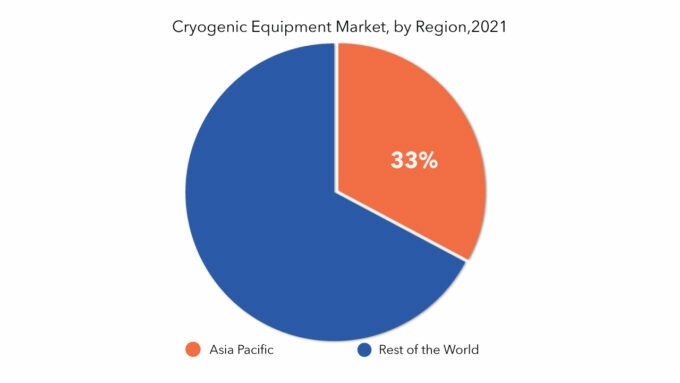

- The Asia Pacific region is estimated to be the largest market for the cryogenic equipment market.

- The major trend in the Cryogenic Equipment Market is the increasing demand for liquefied natural gas (LNG) infrastructure development and expansion.

Cryogenic Equipment Market Regional Analysis

The cryogenic equipment market by region includes North America, Europe, Asia-Pacific (APAC), South America, and Middle East & Africa (MEA). The Asia Pacific region is estimated to be the largest market for the cryogenic equipment market, followed by north America. The Asia Pacific region is projected to be the fastest-growing market during the forecast period.

Asia Pacific will hold the largest GDP (Gross Domestic Product) owing to rapidly changing consumer behavior, supportive policies to achieve sustainable development and investment in industrial infrastructure. A significant increase in power demand and the growing awareness of renewable power generation propels the need for gas-based power plants, which drives the demand for the product.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Key Market Segments: Cryogenic Equipment Market

Cryogenic Equipment Market by Product, 2022-2029, (USD Million, Thousand Units)

- Tanks

- Valves

- Vaporizers

- Pumps

- Other Equipment

Cryogenic Equipment Market by Cryogen Type, 2022-2029, (USD Million, Thousand Units)

- Nitrogen

- Oxygen

- Argon

- LNG

- Hydrogen

- Other Cryogen

Cryogenic Equipment Market by End User, 2022-2029, (USD Million, Thousand Units)

- Energy & Power

- Chemical

- Metallurgy

- Electronics

- Transportation

- Other End-Use Industries

Cryogenic Equipment Market by Region, 2022-2029, (USD Million, Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries in All Regions Are Covered (Total Country Profiles 25)

Key Question Answered

- Who are the major players in the cryogenic equipment market?

- What are the regional growth trends and the largest revenue-generating regions in the cryogenic equipment market?

- What are the major drivers and challenges in the cryogenic equipment market?

- What are the major cryogen type segments in the cryogenic equipment market?

- What are the major end users in the cryogenic equipment market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions And Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Products

- Data Mining

- Executive Summary

- Market Overview

- Global Cryogenic Equipment Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact Of Covid-19 On Global Cryogenic Equipment Market

- Global Cryogenic Equipment Market Outlook

- Global Cryogenic Equipment Market by Product, (USD Million, Thousand units)

- Tanks

- Valves

- Vaporizers

- Pumps

- Other Equipment

- Global Cryogenic Equipment Market by Cryogen Type, (USD Million, Thousand Units)

- Nitrogen

- Oxygen

- Argon

- LNG

- Hydrogen

- Other Cryogen

- Global Cryogenic Equipment Market by End User, (USD Million, Thousand Units)

- Energy & Power

- Chemical

- Metallurgy

- Electronics

- Transportation

- Other End-Use Industries

- Global Cryogenic Equipment Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Linde plc

- Air Liquide

- Air Products Inc

- Chart Industries

- PARKER HANNIFIN CORP

- Flowserve Corporation

- SHI Cryogenics Group

- Emerson Electric Co.

- Sulzer Ltd

- Nikkiso Co.

- Taylor-Wharton

- Wessington Cryogenics

- PHPK Technologies

- INOX India Pvt Ltd

- Acme Cryo

- Fives SAS

- Cryofab

- Shell-n-Tube

- Beijing Tianhai Cryogenic Equipment Co., Ltd.

- Herose GmbH

- Others *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 2 GLOBAL CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 4 GLOBAL CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 6 GLOBAL CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL CRYOGENIC EQUIPMENT MARKET BY REGION (USD MILLION), 2020-2029

TABLE 8 GLOBAL CRYOGENIC EQUIPMENT MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA CRYOGENIC EQUIPMENT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 10 NORTH AMERICA CRYOGENIC EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 11 US CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 12 US CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 13 US CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 14 US CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 15 US CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 16 US CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 17 CANADA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 18 CANADA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 19 CANADA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 20 CANADA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 21 CANADA CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 22 CANADA CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 23 MEXICO CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 24 MEXICO CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 25 MEXICO CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 26 MEXICO CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 27 MEXICO CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 28 MEXICO CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 29 SOUTH AMERICA CRYOGENIC EQUIPMENT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 30 SOUTH AMERICA CRYOGENIC EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 31 BRAZIL CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 32 BRAZIL CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 33 BRAZIL CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 34 BRAZIL CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 35 BRAZIL CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 36 BRAZIL CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 37 ARGENTINA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 38 ARGENTINA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 39 ARGENTINA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 40 ARGENTINA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 ARGENTINA CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 42 ARGENTINA CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 43 COLOMBIA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 44 COLOMBIA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 45 COLOMBIA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 46 COLOMBIA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 47 COLOMBIA CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 48 COLOMBIA CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 49 REST OF SOUTH AMERICA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 50 REST OF SOUTH AMERICA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 51 REST OF SOUTH AMERICA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 52 REST OF SOUTH AMERICA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 53 REST OF SOUTH AMERICA CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 54 REST OF SOUTH AMERICA CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 55 ASIA-PACIFIC CRYOGENIC EQUIPMENT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 56 ASIA-PACIFIC CRYOGENIC EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 57 INDIA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 58 INDIA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 59 INDIA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 60 INDIA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 61 INDIA CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 62 INDIA CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 63 CHINA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 64 CHINA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 65 CHINA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 66 CHINA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 67 CHINA CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 68 CHINA CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 69 JAPAN CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 70 JAPAN CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 71 JAPAN CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 72 JAPAN CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 73 JAPAN CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 74 JAPAN CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 75 SOUTH KOREA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 76 SOUTH KOREA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 77 SOUTH KOREA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 78 SOUTH KOREA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 79 SOUTH KOREA CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 80 SOUTH KOREA SANITARYWARE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 81 AUSTRALIA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 82 AUSTRALIA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 83 AUSTRALIA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 84 AUSTRALIA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 85 AUSTRALIA CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 86 AUSTRALIA SANITARYWARE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 87 SOUTH EAST ASIA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 88 SOUTH EAST ASIA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 89 SOUTH EAST ASIA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 90 SOUTH EAST ASIA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 91 SOUTH EAST ASIA CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 92 SOUTH EAST ASIA CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 93 REST OF ASIA PACIFIC CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 94 REST OF ASIA PACIFIC CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 95 REST OF ASIA PACIFIC CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 96 REST OF ASIA PACIFIC CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 REST OF ASIA PACIFIC CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 98 REST OF ASIA PACIFIC CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 99 EUROPE CRYOGENIC EQUIPMENT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 100 EUROPE CRYOGENIC EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 101 GERMANY CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 102 GERMANY CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 103 GERMANY CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 104 GERMANY CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 105 GERMANY CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 106 GERMANY CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 107 UK CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 108 UK CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 109 UK CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 110 UK CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 111 UK CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 112 UK CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 113 FRANCE CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 114 FRANCE CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 115 FRANCE CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 116 FRANCE CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 117 FRANCE CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 118 FRANCE CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 119 ITALY CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 120 ITALY CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 121 ITALY CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 122 ITALY CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 123 ITALY CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 124 ITALY SANITARYWARE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 125 SPAIN CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 126 SPAIN CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 127 SPAIN CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 128 SPAIN CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 129 SPAIN CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 130 SPAIN SANITARYWARE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 131 RUSSIA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 132 RUSSIA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 133 RUSSIA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 134 RUSSIA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 135 RUSSIA CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 136 RUSSIA CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 137 REST OF EUROPE CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 138 REST OF EUROPE CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 139 REST OF EUROPE CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 140 REST OF EUROPE CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 141 REST OF EUROPE CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 142 REST OF EUROPE CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 143 MIDDLE EAST AND AFRICA CRYOGENIC EQUIPMENT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 144 MIDDLE EAST AND AFRICA CRYOGENIC EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 145 UAE CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 146 UAE CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 147 UAE CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 148 UAE CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 149 UAE CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 150 UAE CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 151 SAUDI ARABIA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 152 SAUDI ARABIA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 153 SAUDI ARABIA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 154 SAUDI ARABIA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 155 SAUDI ARABIA CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 156 SAUDI ARABIA CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 157 SOUTH AFRICA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 158 SOUTH AFRICA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 159 SOUTH AFRICA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 160 SOUTH AFRICA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 161 SOUTH AFRICA CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 162 SOUTH AFRICA CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 163 REST OF MIDDLE EAST & AFRICA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 164 REST OF MIDDLE EAST & AFRICA CRYOGENIC EQUIPMENT MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 165 REST OF MIDDLE EAST & AFRICA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (USD MILLION), 2020-2029

TABLE 166 REST OF MIDDLE EAST & AFRICA CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE (THOUSAND UNITS), 2020-2029

TABLE 167 REST OF MIDDLE EAST & AFRICA CRYOGENIC EQUIPMENT MARKET BY END USER (USD MILLION), 2020-2029

TABLE 168 REST OF MIDDLE EAST & AFRICA CRYOGENIC EQUIPMENT MARKET BY END USER (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CRYOGENIC EQUIPMENT MARKET BY PRODUCT, USD MILLION, THOUSAND UNITS, 2020-2029

FIGURE 9 GLOBAL CRYOGENIC EQUIPMENT MARKET BY END USER, USD MILLION, THOUSAND UNITS, 2020-2029

FIGURE 10 GLOBAL CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE USD MILLION, THOUSAND UNITS, 2020-2029

FIGURE 11 GLOBAL CRYOGENIC EQUIPMENT MARKET BY REGION, USD MILLION, THOUSAND UNITS, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL CRYOGENIC EQUIPMENT MARKET BY PRODUCT, USD MILLION, THOUSAND UNITS, 2020-2029

FIGURE 14 GLOBAL CRYOGENIC EQUIPMENT MARKET BY END USER, USD MILLION, THOUSAND UNITS, 2020-2029

FIGURE 15 GLOBAL CRYOGENIC EQUIPMENT MARKET BY CRYOGEN TYPE USD MILLION, THOUSAND UNITS, 2020-2029

FIGURE 16 GLOBAL CRYOGENIC EQUIPMENT MARKET BY REGION, USD MILLION, THOUSAND UNITS, 2020-2029

FIGURE 17 CRYOGENIC EQUIPMENT MARKET BY REGION 2021

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 LINDE PLC: COMPANY SNAPSHOT

FIGURE 20 CHART INDUSTRIES: COMPANY SNAPSHOT

FIGURE 21 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

FIGURE 22 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

FIGURE 23 SHI CRYOGENICS GROUP: COMPANY SNAPSHOT

FIGURE 24 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

FIGURE 25 INOX INDIA PVT LTD: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.