REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

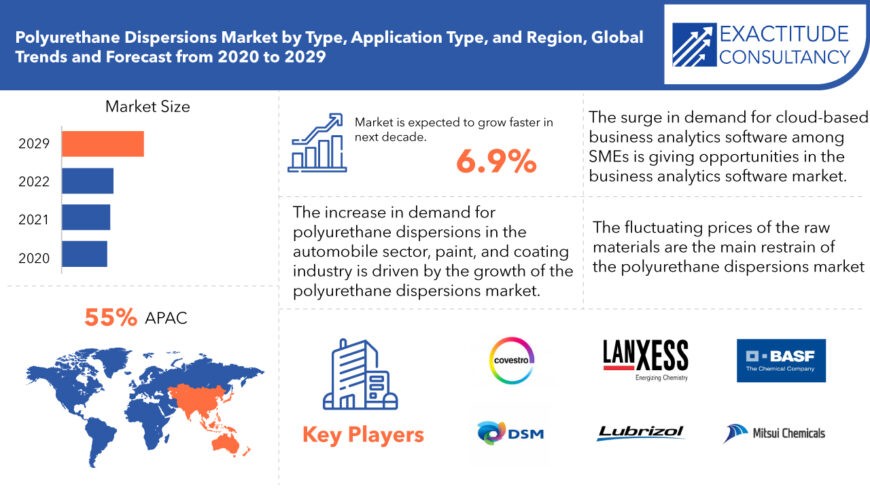

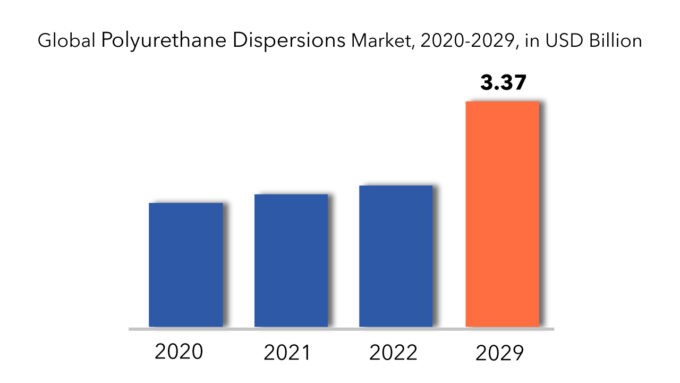

| USD 3.37 Billion by 2029 | 6.9% | APAC |

| By Type | By Application |

|---|---|

|

|

SCOPE OF THE REPORT

Polyurethane Dispersions Market Overview

The global Polyurethane Dispersions market will witness a CAGR of 6.9% for the forecast period of 2022-2029. It is expected to reach above USD 3.37 Billion by 2029 from USD 1.85 Billion in 2020.

Polyurethane dispersions (PUDs) represent aqueous dispersions or emulsions of polyurethane polymers, typically comprising polyurethane particles dispersed in water and stabilized by surfactants or similar dispersing agents. The utilization of PUDs offers numerous advantages over solvent-based polyurethane systems, notably including diminished environmental impact attributable to their waterborne nature, reduced emissions of volatile organic compounds (VOCs), and simplified application processes.

The global textile and leather industries are poised for growth in tandem with escalating demand for their respective products. The textile sector assumes a pivotal role in the economies of Asia-Pacific (APAC) nations, while prominent textile manufacturing hubs include Germany, Portugal, Brazil, and the United States. Concurrently, the leather industry significantly contributes to the expansion of the PUDs market on a global scale, with PUDs finding widespread application in leather surface finishing and witnessing heightened utilization in synthetic leather production. The burgeoning consumption of leather across diverse applications such as handbags, footwear, automotive seat covers, apparel, and related items drives the overall demand for PUDs.

A notable opportunity within the PUDs market arises from the formulation and enforcement of stringent environmental regulations by regulatory authorities across various economies worldwide. The utilization of certain solvents, including NMP, NEP, and DMSO, in PUD manufacturing processes results in elevated VOC emissions, posing environmental concerns. The toxicity associated with such solvents underscores the imperative for transitioning towards environmentally sustainable alternatives.

Regulatory frameworks such as the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) in the European Union (EU) mandate the registration of substances manufactured or imported into the EU, with a primary objective of safeguarding human health and the environment. Moreover, governmental bodies such as Local Air Quality Regulators and the Environmental Protection Agency (EPA) continually assess VOC emissions originating from industries including paints & coatings, leather, and textiles, thereby augmenting market dynamics and presenting new growth avenues for industry participants.

Polyurethane Dispersions Market Segment Analysis

The global polyurethane dispersions market is segmented based on polyurethane dispersions into product, function, application, and by region, and region. By Polyurethane Dispersions product, the market (nickel-base superalloy, nickel base corrosion-resistant alloy, nickel base shape memory alloy, and others), function (heat resistant, corrosion-resistant, high performance, and electronics), application (aerospace & defense, oil & gas, energy & power, automotive, electrical & electronics, food preparation equipment, mobile phones, buildings, and others (power generation equipment, and medical equipment) for a significant share of the overall market. The segment is expected to grow significantly over the forecast period as a result of a combination of high-quality material and efficiency in large-scale projects.

By type water-based polyurethane dispersions and solvent-based polyurethane, dispersions are the two types of polyurethane dispersions on the market. Solvent-free PUDs are the most common form of PUD utilized in end-use sectors like construction, automotive, aerospace, furniture, and so on. Because they are environmentally and user-friendly, the adoption of these forms of PUDs is increasing at a quicker rate. Solvent-free PUDs provide a number of advantages, including the ability to dry quickly, have a long shelf life, and be more UV stable. Paints and coatings, textile finishing, adhesives and sealants, glass fiber sizing, leather finishing, and other external applications benefit from these qualities. Solvent-free PUDs can be used on binders in a variety of applications, including hygiene coatings, insulating coatings, concrete sealers, paper coatings, and printing ink.

In the next five years, the water-based polyurethane dispersions market is expected to be the largest and fastest-growing. Furthermore, water-based polyurethane dispersions are adaptable and eco-friendly coating materials that may be used in a wide range of film hardness and solid content. They have great blocking resistance, weather resistance, long-term flexibility, UV resistance, and high abrasion resistance while containing no free isocyanate residuals.

Based on application, coatings, adhesives & sealants, synthetic leather manufacture, fiberglass sizing, and others are the application types that the market is divided into. During the projection period, synthetic leather production is expected to be the fastest-growing application. The big industrial producers who use synthetic leather in footwear, purses, clothes, automotive, interiors, and other industries are responsible for this expansion. PUD synthetic leather also has a low level of volatile organic compounds and is environmentally friendly. It can produce synthetic leather without using solvents thanks to high-solid polyurethane dispersions. As a result, the growing demand for synthetic leather necessitates a higher volume of polyurethane dispersions, boosting the market for PUDs in this application.

By end-user, in terms of end-users, the furniture industry is expected to capture a significant portion of the polyurethane dispersion market in the future years. Consumers’ increasing discretionary income levels and rising expenditure on home décor are driving the segment’s rise. Consumer demand for innovative, more beautiful furniture solutions is being fueled by evolving interior design trends. Demand for scratch and abrasion-resistant furniture will open up potential opportunities for the sector.

Polyurethane Dispersions Market Players

The polyurethane dispersions market key players include Covestro Ag, Dsm, Basf, Wanhua Chemical Group, Lanxess, Stahl Holding, The Lubrizol Corp, Dow Chemical Company, Huntsman Corporation, Mitsui Chemical, Covestro Ag, Vcm Polyurethanes Pvt. Ltd, Chemtura Corporation. The market players have been on the way to adopting various kinds of organic and inorganic growth strategies, like new product developments and launches, acquisitions, and merger contracts.

To increase their market position, these businesses have implemented a variety of growth tactics. These companies are using expansion, new product development, mergers and acquisitions, and collaboration as important growth strategies to improve their product portfolio and geographical presence to meet the rising demand for Polyurethane Dispersions from emerging economies.

Who Should Buy? Or Key Stakeholders

- Manufacturing companies

- Functional analysis.

- Leading Companies

- Institutional & retail players.

- Investment research firms

- Others

- The global Polyurethane Dispersions market will witness a CAGR of 6.9% for the forecast period.

- Based on type, The solvent-free type is estimated to be the largest market in the overall PUDs during the forecast period.

- Based on application, Paints & coatings is estimated to be the fastest growing application in the overall PUDs market during the forecast period.

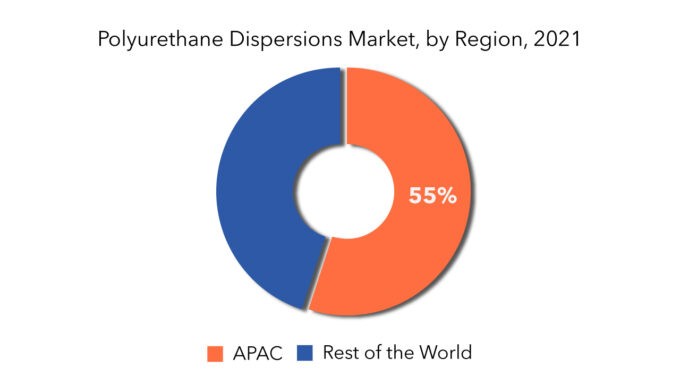

- Based on regional market share Asia Pacific is the fastest growing region in this market.

- The major trend in the Polyurethane Dispersions Market is the increasing demand for environmentally friendly and water-based coatings and adhesives.

Polyurethane Dispersions Market Regional Analysis

The Polyurethane Dispersions market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

Asia-Pacific is the largest market for polyurethane dispersions due to the growing economies and increasing construction projects. Due to the high demand for polyurethane dispersions in the forecast period, Asia-Pacific is leading the polyurethane dispersions market. Japan, South Korea, China, and India are expected to continue to contribute to market growth. In terms of polyurethane dispersions demand, Europe is expected to be the next dominant market, followed by North America, which is expected to maintain its position in the industry.

The Asia Pacific held the largest share with 55% in the polyurethane dispersions market in 2020. The increasing need for polyurethane dispersion in the production of dashboards (door panels, foam to PVC/TPO, headliners) has been driven by the growing automotive industry, primarily in the Asia Pacific and other emerging regions in recent years. Furthermore, various governments favoring policies with cheap labor costs and ease of doing business have aided the region’s automotive sector’s growth, which will drive the polyurethane dispersion market size in the approaching years. The growing number of telecommuters has increased demand for furniture in homes and businesses, which will enhance demand for the substance used in wood treatments and other applications.

The market has been divided worldwide based on region into the North American region, Asia-Pacific region, European region, Latin American region, and the Middle East and African region.

Due to the presence of major key players, Asia-Pacific dominates the polyurethane dispersions market. These major key players adopt various strategies to endure their market position in the polyurethane dispersions market in the global market by going for mergers, and acquisitions, collaborating, setting up a new joint venture, establishing a partnership, developing a new product line, innovating in the existing product, developing a unique production process, and many others to expand their customer base in the untapped market of the Polyurethane Dispersions market all across the globe.

Key Market Segments: Polyurethane Dispersions Market

Global Polyurethane Dispersions Market by Type, 2020-2029, (USD Million) (Kilotons)

- Solvent-Free

- Low-Solvent

Global Polyurethane Dispersions Market by Application, 2020-2029, (USD Million), (Kilotons)

- Paints & Coatings

- Adhesives & Sealants

- Leather Finishing

- Textile Finishing

- Others

Global Polyurethane Dispersions Global Market by Region, 2020-2029, (USD Million), (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the polyurethane dispersions market?

- What are the key factors influencing the growth of polyurethane dispersions?

- What are the major applications for polyurethane dispersions?

- Who are the major key players in the polyurethane dispersions market?

- Which region will provide more business opportunities for polyurethane dispersions in the future?

- Which segment holds the maximum share of the polyurethane dispersions market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions And Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Polyurethane Dispersions Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact Of Covid-19 On POLYURETHANE DISPERSIONSMARKET

- Global Polyurethane Dispersions Market Outlook

- Global Polyurethane Dispersions Market by Type, (USD Million)

- Solvent-free

- Low-solvent

- Global Polyurethane Dispersions Market by application, (USD Million)

- Paints & Coatings

- Adhesives & Sealants

- Leather finishing

- Textile finishing

- Others

- Global Polyurethane Dispersions Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Types Offered, Recent Developments)

- COVESTRO AG

- DSM

- BASF

- WANHUA CHEMICAL GROUP

- LANXESS

- STAHL HOLDING

- THE LUBRIZOL CORP

- DOW CHEMICAL COMPANY

- HUNTSMAN CORPORATION

- MITSUI CHEMICAL

- COVESTRO AG

- VCM POLYURETHANES PVT. LTD

- CHEMTURA CORPORATION *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL POLYURETHANE DISPERSIONS MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL POLYURETHANE DISPERSIONS MARKET BY REGION (KILOTONS) 2020-2029

TABLE 7 NORTH AMERICA POLYURETHANE DISPERSIONS MARKET BY COUNTRY (USD MILLIONS) 2019-2029

TABLE 8 NORTH AMERICA POLYURETHANE DISPERSIONS MARKET BY COUNTRY (KILOTONS) 2019-2029

TABLE 9 US POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 10 US POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 11 US POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 12 US POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 13 CANADA POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 14 CANADA POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 15 CANADA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 16 CANADA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 17 MEXICO POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 18 MEXICO POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 19 MEXICO POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 20 MEXICO POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 21 SOUTH AMERICA POLYURETHANE DISPERSIONS MARKET BY COUNTRY (USD MILLIONS) 2019-2029

TABLE 22 SOUTH AMERICA POLYURETHANE DISPERSIONS MARKET BY COUNTRY (KILOTONS) 2019-2029

TABLE 23 BRAZIL POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 24 BRAZIL POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 25 BRAZIL POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 26 BRAZIL POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 27 ARGENTINA POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 28 ARGENTINA POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 29 ARGENTINA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 30 ARGENTINA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 31 COLOMBIA POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 32 COLOMBIA POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 33 COLOMBIA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 34 COLOMBIA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 35 REST OF SOUTH AMERICA POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 36 REST OF SOUTH AMERICA POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 37 REST OF SOUTH AMERICA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 38 REST OF SOUTH AMERICA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 39 ASIA-PACIFIC POLYURETHANE DISPERSIONS MARKET BY COUNTRY (USD MILLIONS) 2019-2029

TABLE 40 ASIA-PACIFIC POLYURETHANE DISPERSIONS MARKET BY COUNTRY (KILOTONS) 2019-2029

TABLE 41 INDIA POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 42 INDIA POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 43 INDIA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 44 INDIA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 45 CHINA POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 46 CHINA POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 47 CHINA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 48 CHINA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 49 JAPAN POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 50 JAPAN POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 51 JAPAN POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 52 JAPAN POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 53 SOUTH KOREA POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 54 SOUTH KOREA POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 55 SOUTH KOREA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 56 SOUTH KOREA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 57 AUSTRALIA POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 58 AUSTRALIA POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 59 AUSTRALIA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 60 AUSTRALIA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 61 SOUTH-EAST ASIA POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 62 SOUTH-EAST ASIA POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 63 SOUTH-EAST ASIA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 64 SOUTH-EAST ASIA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 65 REST OF ASIA PACIFIC POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 66 REST OF ASIA PACIFIC POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 67 REST OF ASIA PACIFIC POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 68 REST OF ASIA PACIFIC POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 69 EUROPE POLYURETHANE DISPERSIONS MARKET BY COUNTRY (USD MILLIONS) 2019-2029

TABLE 70 EUROPE POLYURETHANE DISPERSIONS MARKET BY COUNTRY (KILOTONS) 2019-2029

TABLE 71 GERMANY POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 72 GERMANY POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 73 GERMANY POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 74 GERMANY POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 75 UK POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 76 UK POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 77 UK POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 UK POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 FRANCE POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 80 FRANCE POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 81 FRANCE POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 82 FRANCE POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 83 ITALY POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 84 ITALY POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 85 ITALY POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 86 ITALY POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 87 SPAIN POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 88 SPAIN POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 89 SPAIN POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 90 SPAIN POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 RUSSIA POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 92 RUSSIA POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 93 RUSSIA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 94 RUSSIA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 95 REST OF EUROPE POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 96 REST OF EUROPE POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 97 REST OF EUROPE POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 98 REST OF EUROPE POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 99 MIDDLE EAST AND AFRICA POLYURETHANE DISPERSIONS MARKET BY COUNTRY (USD MILLIONS) 2019-2029

TABLE 100 MIDDLE EAST AND AFRICA POLYURETHANE DISPERSIONS MARKET BY COUNTRY (KILOTONS) 2019-2029

TABLE 101 UAE POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 102 UAE POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 103 UAE POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 104 UAE POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 105 SAUDI ARABIA POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 106 SAUDI ARABIA POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 107 SAUDI ARABIA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 108 SAUDI ARABIA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 109 SOUTH AFRICA POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 110 SOUTH AFRICA POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 111 SOUTH AFRICA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 112 SOUTH AFRICA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 113 REST OF MIDDLE EAST AND AFRICA POLYURETHANE DISPERSIONS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 114 REST OF MIDDLE EAST AND AFRICA POLYURETHANE DISPERSIONS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 115 REST OF MIDDLE EAST AND AFRICA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 116 REST OF MIDDLE EAST AND AFRICA POLYURETHANE DISPERSIONS MARKET BY APPLICATION (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL POLYURETHANE DISPERSIONS MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL POLYURETHANE DISPERSIONS MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL POLYURETHANE DISPERSIONS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 NORTH AMERICA POLYURETHANE DISPERSIONS MARKET SNAPSHOT

FIGURE 13 EUROPE POLYURETHANE DISPERSIONS MARKET SNAPSHOT

FIGURE 14 ASIA PACIFIC POLYURETHANE DISPERSIONS MARKET SNAPSHOT

FIGURE 15 SOUTH AMERICA POLYURETHANE DISPERSIONS MARKET SNAPSHOT

FIGURE 16 MIDDLE EAST & AFRICA POLYURETHANE DISPERSIONS MARKET SNAPSHOT

FIGURE 17 COVESTRO AG: COMPANY SNAPSHOT

FIGURE 18 DSM: COMPANY SNAPSHOT

FIGURE 19 BASF: COMPANY SNAPSHOT

FIGURE 20 WANHUA CHEMICAL GROUP: COMPANY SNAPSHOT

FIGURE 21 LANXESS: COMPANY SNAPSHOT

FIGURE 22 STAHL HOLDING: COMPANY SNAPSHOT

FIGURE 23 THE LUBRIZOL CORP: COMPANY SNAPSHOT

FIGURE 24 DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 25 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

FIGURE 26 MITSUI CHEMICAL: COMPANY SNAPSHOT

FIGURE 27 COVESTRO AG: COMPANY SNAPSHOT

FIGURE 28 VCM POLYURETHANES PVT. LTD: COMPANY SNAPSHOT

FIGURE 29 CHEMTURA CORPORATION: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.