| Market Size | CAGR | Dominating Region |

|---|---|---|

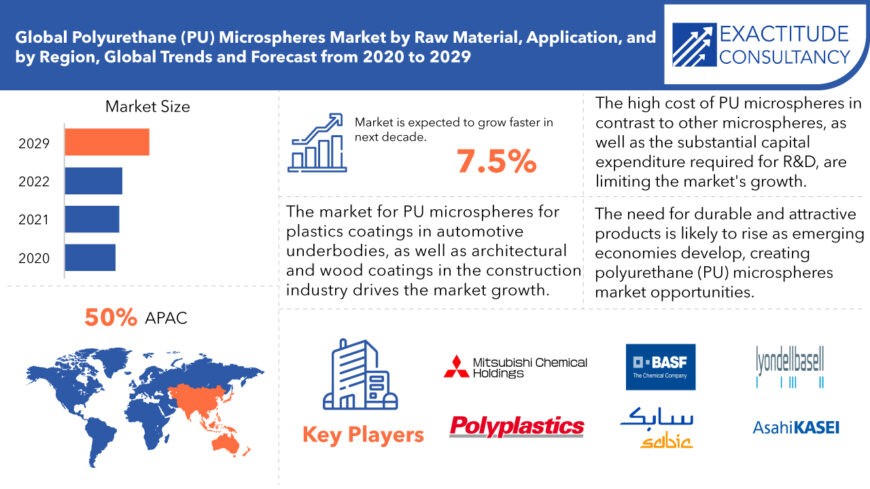

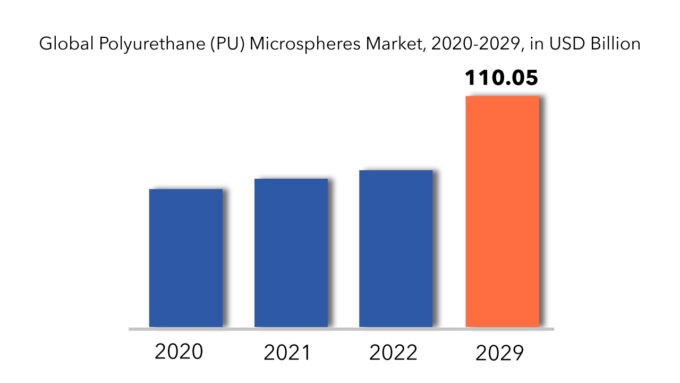

| USD 110.05 Billion | 7.5% | APAC |

| By Raw Material | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Polyurethane (Pu) Microspheres Market Overview

The global polyurethane (PU) microspheres market will witness a CAGR of 7.5% for the forecast period of 2022-2029. It is expected to reach above USD 110.05 Billion by 2029 from USD 65.70 Billion in 2020.

Polyurethane (PU) microspheres exhibit a range of advantageous characteristics, including a narrow particle size distribution, uniform film, and coating thickness, devoid of edge defects and presenting an appealing smooth appearance, consequently driving significant consumption within the paints and coatings segment. The increasing demand for PU-based paints, particularly as a matting agent in wooden floor finishes and architectural coatings, is anticipated to propel growth within the paints and coatings industry.

Moreover, the emergence of advanced technologies for drug delivery and encapsulation in crop protection, alongside a rising need for repositionable adhesives, has resulted in heightened product demand within the pharmaceuticals and agrochemicals industry. The controlled chemical release of biocides, pesticides, and disinfectants facilitated by encapsulation, leading to effective delivery, is poised to further bolster demand in these sectors. Microspheres enable precise delivery of nano-quantities of potent drugs while minimizing drug concentration at non-target sites, thereby influencing drug action in vivo, tissue distribution, and cellular interactions.

The demand for polyurethane microspheres has surged in paint and coating applications due to their superior thickening properties and effectiveness as a matting agent, particularly driving demand in furniture and decor applications. Additionally, the aging population has spurred demand within the pharmaceutical industry, with polyurethane microspheres serving as encapsulants in drugs and medicines. Furthermore, increasing demand within the agricultural sector is expected, particularly for effective delivery of biocides, pesticides, and disinfectants.

However, market growth is impeded by the high investment required in infrastructural setups and the associated operational costs linked with polyurethane microspheres. Nevertheless, advancements in technologies are anticipated to stimulate demand by opening up potential growth opportunities across diverse application areas.

Polyurethane (Pu) Microspheres Market Segment Analysis

The global polyurethane (PU) microspheres market is segmented based on the polyurethane (PU) microspheres into raw material, application, and by region, and region. By polyurethane (PU) microspheres raw material (Methylene Diphenyl Diisocyanate (MDI), Toluene Diisocyanate (TDI)), application (encapsulation, paints and coatings, adhesive films, and cosmetics.) for a significant share of the overall market. The segment is expected to grow significantly over the forecast period as a result of a combination of high-quality material and efficiency in large-scale projects.

By application, the market is divided into five categories: encapsulation, paints & coatings, adhesives, cosmetics, and other applications. In 2020, the encapsulation segment had the greatest market share, and this trend is likely to continue during the forecast period. The need for PU microspheres for encapsulating applications in various end-use sectors such as pharmaceuticals, paints, coatings, and agrochemicals is driving this segment’s growth.

In terms of application, encapsulation dominated the PU microspheres consumption and accounted for the largest share of the PU microspheres market size in terms of value in 2016, owing to its huge consumption from various end-use industries such as pharmaceutical, paints & coatings, and agrochemical industries. So, the leading participants in the encapsulation sector are backward integrated, companies who make PU microspheres on their own create around 70% of the demand. Encapsulate manufacturers tend to create microspheres on their own due to technical feasibility issues such as drug inactivation during fabrication and poor control of drug release rates with active agents.

With a volume of PU microspheres estimated at over 7,000 tons in 2015, encapsulation emerged as the most popular application category. The application segment’s growth is fueled by several of its intrinsic qualities that are desired for a variety of applications, such as controlled medication administration that improves delivery efficiency.

The paints & coatings industry, which is expected to increase at the quickest CAGR of 6.2 percent from 2019 to 2029, offers considerable growth possibilities for PU microspheres. The rising application breadth in numerous application industries such as automotive, construction, and architecture is responsible for the bulk of the segment’s penetration. Over the projection period, the key driving force will be the growing demand for homogeneous thickness and particle size dispersion.

Polyurethane (Pu) Microspheres Market Players

The polyurethane (PU) microspheres market key players include Sabic, Basf Se, Sumitomo Chemicals, Mitsubishi Chemical Holdings Corp, Lyndollbasell Industries N.V, Solvay S.A., Asahi Kasei Chemicals Corp, Polyplastics Co. Ltd, Momentive Performance Material (Mpm) Holding Llc., Heyo Enterprise Co. Ltd., Microchem. The market players have been on the way to adopting various kinds of organic and inorganic growth strategies, like new product developments and launches, acquisitions, and merger contracts.

To increase their market position, these businesses have implemented a variety of growth tactics. These companies are using expansion, new product development, mergers and acquisitions, and collaboration as important growth strategies to improve their product portfolio and geographical presence to meet the rising demand for polyurethane (PU) microspheres from emerging economies.

Industry News:

- May. 31, 2022-Sumitomo Chemical and Newlight Technologies Announce Joint Development Project to Create Automotive and Textile Materials Using a Carbon-Negative*1 Microbe-Produced Biomaterial Called AirCarbonTM

- Jun 20, 2022-Solvay to discontinue Algoflon® PTFE and Hyflon® perfluoropolymers made in Italy

- Solvay, a global market leader in fluorochemistry, has announced it will discontinue its Hyflon® perfluoropolymer and Algoflon® PTFE product lines manufactured with fluorosurfactants at Solvay’s Spinetta Marengo (Alessandria) plant in Italy. Sales for both product families will stop by June 30, 2023.

- June 1, 2022-Asahi Kasei Medical Completes Acquisition of Bionova Scientific, U.S.-based biopharmaceutical CDMO

- Asahi Kasei Medical has completed its acquisition of Bionova Scientific, LLC, a provider of contract process development services and GMP-compliant contract manufacturing services to biopharmaceutical companies as announced on April 19, 2022. The acquisition closed on May 31, 2022 (US Pacific time).

Who Should Buy? Or Key Stakeholders

- Segment analysis

- Functional analysis.

- Leading Companies

- Institutional & retail players.

- Investment research firms

- Others

- The global polyurethane (PU) microspheres market will witness a CAGR of 7.5% for the forecast period.

- Based on raw materials, Methylene Diphenyl Diisocyanate (MDI) is expected to dominate the market in this segment.

- By application, the encapsulation segment had the greatest market share, and this trend is likely to continue during the forecast period.

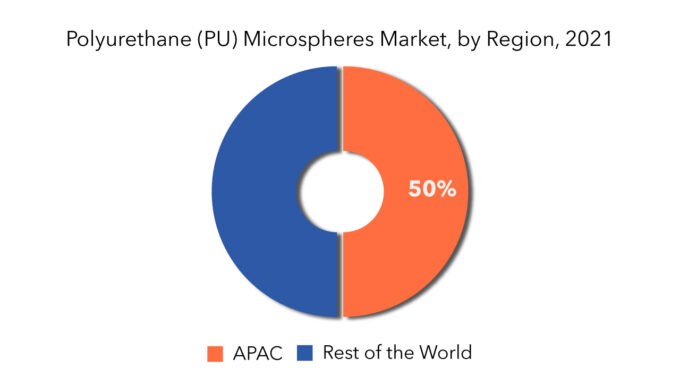

- The highest market share was in the Asia Pacific.

- The major trend in the polyurethane (PU) microspheres market is the increasing demand for lightweight materials in various industries, driving innovation and adoption of PU microspheres for applications such as coatings, adhesives, and composites.

Polyurethane (Pu) Microspheres Market Regional Analysis

The polyurethane (PU) microspheres market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

The highest market share was in the Asia Pacific, followed by Europe and North America. Construction, electronics, and automotive are three of the most important key end-user industries in the Asia Pacific. The Asia Pacific has maintained its supremacy in the global market because of the contributions of growing economies such as India and China. Shortly, the paint and coatings business in developing economies is expected to be the fastest-growing end-user sector in the Asia Pacific. The expansion of the automobile industry in the Asia Pacific is expected to raise demand for PU microspheres shortly. In the Asia Pacific, there is likely to be a strong demand for PU microspheres because of the growing demand for powder coating for various applications.

During the forecast period, Asian nations are predicted to have the greatest growth rate in the Asia-Pacific polyurethane (PU) microspheres market. The rise of main end-use sectors such as construction, electronics, and automotive is driving the Asia-Pacific market. China is Asia’s largest demand hub, accounting for more than half of the region’s overall market volume. Various economic reforms in China over the previous decade have aided the country’s rise to become the world’s largest PU consumer. Europe, being a global center for premium automobiles, has a strong demand for polyurethane (PU) microspheres, making it the largest market in terms of value.

The market has been divided worldwide based on region into the North American region, Asia-Pacific region, European region, Latin American region, and the Middle East and African region.

Due to the presence of major key players, Asia-Pacific dominates the polyurethane (PU) microspheres market. These major key players adopt various strategies to endure their market position in the polyurethane (PU) microspheres market in the global market by going for mergers, and acquisitions, collaborating, setting up a new joint venture, establishing a partnership, developing a new product line, innovating in the existing product, developing a unique production process, and many others to expand their customer base in the untapped market of the polyurethane (PU) microspheres market all across the globe.

Key Market Segments: Polyurethane (Pu) Microspheres Market

Global Polyurethane (PU) Microspheres Market by Raw Material, 2020-2029, (USD Million) (Kilotons)

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diisocyanate (TD)

- Memory Alloy

Global Polyurethane (PU) Microspheres Market by Application, 2020-2029, (USD Million), (Kilotons)

- Encapsulation

- Paints & Coatings

- Adhesives Films

- Cosmetics

- Other Applications

Global Polyurethane (PU) Microspheres Market by Region, 2020-2029, (USD Million), (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the polyurethane (PU) microspheres market?

- What are the key factors influencing the growth of polyurethane (PU) microspheres?

- What are the major applications for polyurethane (PU) microspheres?

- Who are the major key players in the polyurethane (PU) microspheres market?

- Which region will provide more business opportunities for polyurethane (PU) microspheres in the future?

- Which segment holds the maximum share of the polyurethane (PU) microspheres market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions And Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Polyurethane (Pu) Microspheres Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact Of Covid-19 On Polyurethane Dispersions Market

- Global Polyurethane (Pu) Microspheres Market Outlook

- Global Polyurethane (PU) Microspheres Market by Raw Material, (USD Million)

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diisocyanate (TDI)

- Global Polyurethane (PU) Microspheres Market by Application, (USD Million)

- Encapsulation

- Paints & coatings

- Adhesives films

- Cosmetics

- Other applications

- Global POLYURETHANE (PU) MICROSPHERES Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Types Offered, Recent Developments)

- SABIC

- BASF SE

- Sumitomo Chemicals

- Mitsubishi Chemical Holdings Corp

- LyndollBasell Industries N.V

- Solvay S.A

- Asahi Kasei Chemicals Corp

- Polyplastics Co. Ltd

- Momentive Performance Material (MPM) Holding LLC.

- Heyo Enterprise Co. Ltd.

- Microchem *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 3 GLOBAL POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL POLYURETHANE (PU) MICROSPHERES MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL POLYURETHANE (PU) MICROSPHERES MARKET BY REGION (KILOTONS) 2020-2029

TABLE 7 NORTH AMERICA POLYURETHANE (PU) MICROSPHERES MARKET BY COUNTRY (USD MILLIONS) 2020-2029

TABLE 8 NORTH AMERICA POLYURETHANE (PU) MICROSPHERES MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 9 US POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 10 US POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 11 US POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 12 US POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 13 CANADA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 14 CANADA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 15 CANADA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 16 CANADA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 17 MEXICO POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 18 MEXICO POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 19 MEXICO POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 20 MEXICO POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 21 SOUTH AMERICA POLYURETHANE (PU) MICROSPHERES MARKET BY COUNTRY (USD MILLIONS) 2020-2029

TABLE 22 SOUTH AMERICA POLYURETHANE (PU) MICROSPHERES MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 23 BRAZIL POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 24 BRAZIL POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 25 BRAZIL POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 26 BRAZIL POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 27 ARGENTINA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 28 ARGENTINA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 29 ARGENTINA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 30 ARGENTINA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 31 COLOMBIA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 32 COLOMBIA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 33 COLOMBIA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 34 COLOMBIA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 35 REST OF SOUTH AMERICA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 36 REST OF SOUTH AMERICA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 37 REST OF SOUTH AMERICA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 38 REST OF SOUTH AMERICA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 39 ASIA-PACIFIC POLYURETHANE (PU) MICROSPHERES MARKET BY COUNTRY (USD MILLIONS) 2020-2029

TABLE 40 ASIA-PACIFIC POLYURETHANE (PU) MICROSPHERES MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 41 INDIA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 42 INDIA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 43 INDIA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 44 INDIA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 45 CHINA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 46 CHINA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 47 CHINA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 48 CHINA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 49 JAPAN POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 50 JAPAN POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 51 JAPAN POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 52 JAPAN POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 53 SOUTH KOREA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 54 SOUTH KOREA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 55 SOUTH KOREA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 56 SOUTH KOREA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 57 AUSTRALIA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 58 AUSTRALIA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 59 AUSTRALIA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 60 AUSTRALIA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 61 SOUTH-EAST ASIA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 62 SOUTH-EAST ASIA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 63 SOUTH-EAST ASIA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 64 SOUTH-EAST ASIA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 65 REST OF ASIA PACIFIC POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 66 REST OF ASIA PACIFIC POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 67 REST OF ASIA PACIFIC POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 68 REST OF ASIA PACIFIC POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 69 EUROPE POLYURETHANE (PU) MICROSPHERES MARKET BY COUNTRY (USD MILLIONS) 2020-2029

TABLE 70 EUROPE POLYURETHANE (PU) MICROSPHERES MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 71 GERMANY POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 72 GERMANY POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 73 GERMANY POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 74 GERMANY POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 75 UK POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 76 UK POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 77 UK POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 UK POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 FRANCE POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 80 FRANCE POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 81 FRANCE POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 82 FRANCE POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 83 ITALY POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 84 ITALY POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 85 ITALY POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 86 ITALY POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 87 SPAIN POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 88 SPAIN POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 89 SPAIN POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 90 SPAIN POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 RUSSIA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 92 RUSSIA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 93 RUSSIA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 94 RUSSIA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 95 REST OF EUROPE POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 96 REST OF EUROPE POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 97 REST OF EUROPE POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 98 REST OF EUROPE POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 99 MIDDLE EAST AND AFRICA POLYURETHANE (PU) MICROSPHERES MARKET BY COUNTRY (USD MILLIONS) 2020-2029

TABLE 100 MIDDLE EAST AND AFRICA POLYURETHANE (PU) MICROSPHERES MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 101 UAE POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 102 UAE POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 103 UAE POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 104 UAE POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 105 SAUDI ARABIA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 106 SAUDI ARABIA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 107 SAUDI ARABIA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 108 SAUDI ARABIA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 109 SOUTH AFRICA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 110 SOUTH AFRICA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 111 SOUTH AFRICA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 112 SOUTH AFRICA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 113 REST OF MIDDLE EAST AND AFRICA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 114 REST OF MIDDLE EAST AND AFRICA POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL (KILOTONS) 2020-2029

TABLE 115 REST OF MIDDLE EAST AND AFRICA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 116 REST OF MIDDLE EAST AND AFRICA POLYURETHANE (PU) MICROSPHERES MARKET BY APPLICATION (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL, USD MILLION, 2020-2029

FIGURE 9 GLOBAL POLYURETHANE (PU) MICROSPHERES MARKET BY RAW MATERIAL, USD MILLION, 2020-2029

FIGURE 10 GLOBAL POLYURETHANE (PU) MICROSPHERES MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 11 GLOBAL POLYURETHANE (PU) MICROSPHERES MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA POLYURETHANE (PU) MICROSPHERES MARKET SNAPSHOT

FIGURE 14 EUROPE POLYURETHANE (PU) MICROSPHERES MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC POLYURETHANE (PU) MICROSPHERES MARKET SNAPSHOT

FIGURE 16 SOUTH AMERICA POLYURETHANE (PU) MICROSPHERES MARKET SNAPSHOT

FIGURE 17 MIDDLE EAST & AFRICA POLYURETHANE (PU) MICROSPHERES MARKET SNAPSHOT

FIGURE 18 SABIC: COMPANY SNAPSHOT

FIGURE 19 BASF SE: COMPANY SNAPSHOT

FIGURE 20 SUMITOMO CHEMICALS: COMPANY SNAPSHOT

FIGURE 21 MITSUBISHI CHEMICAL HOLDINGS CORP: COMPANY SNAPSHOT

FIGURE 22 LYNDOLLBASELL INDUSTRIES N.V: COMPANY SNAPSHOT

FIGURE 23 SOLVAY S.A: COMPANY SNAPSHOT

FIGURE 24 ASAHI KASEI CHEMICALS CORP: COMPANY SNAPSHOT

FIGURE 25 POLYPLASTICS CO. LTD: COMPANY SNAPSHOT

FIGURE 26 MOMENTIVE PERFORMANCE MATERIAL (MPM) HOLDING LLC.: COMPANY SNAPSHOT

FIGURE 27 HEYO ENTERPRISE CO. LTD.: COMPANY SNAPSHOT

FIGURE 28 MICROCHEM: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.