REPORT OUTLOOK

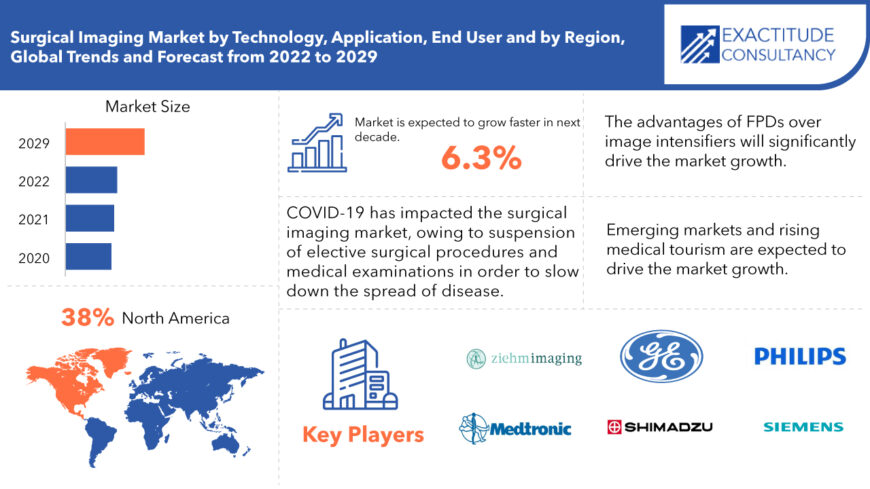

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 3.12 billion | 6.3% | North America |

| by Technology | by Application | by End-Users |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Surgical Imaging Market Overview

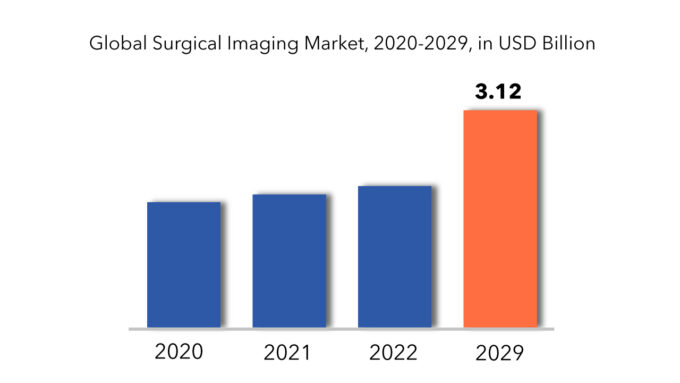

The global Surgical Imaging Market is projected to reach USD 3.12 billion by 2029 from USD 1.8 billion in 2020, at a CAGR of 6.3 % from 2020 to 2029.

The Surgical Imaging Market encompasses an array of medical imaging technologies and systems tailored for use in surgical procedures, aiming to furnish real-time visualization and guidance to surgeons and healthcare practitioners. These imaging modalities are intricately engineered to facilitate precise localization, navigation, and monitoring of surgical interventions, thereby enhancing the accuracy and efficacy of surgical procedures. Among the diverse spectrum of surgical imaging technologies employed, notable examples include fluoroscopy, computed tomography (CT), magnetic resonance imaging (MRI), ultrasound, and intraoperative imaging systems like C-arms and O-arms.

The evolution of C-arms, transitioning from conventional X-ray image intensifier technology to digital flat-panel detectors (FPDs), has heralded significant strides in the domain of surgical imaging. FPDs offer several advantages over their image intensifier counterparts, characterized by their compact dimensions and diminished radiation exposure. Notably, while the resolution may vary across different models, FPDs consistently furnish high-quality digital images, unlike the degradation observed in images produced by aging image intensifiers.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million), (Thousand Unit) |

| Segmentation | By Technology, By Application, By End User, By Region |

| By Technology |

|

| By Application |

|

| By End User |

|

| By Region |

|

Unlike traditional image intensifiers, the image quality of FPDs remains unaltered over prolonged periods of use, exhibiting a broader and more dynamic imaging range. Furthermore, the utilization of FPDs obviates the reduction in field of vision associated with higher magnifications in image intensifiers, thereby affording surgeons greater maneuverability and unimpeded instrument utilization. Additional merits of FPDs include reduced radiation exposure, absence of image distortion, heightened sensitivity, and enhanced patient coverage, factors that have spurred a rising preference for FPD C-arms among hospitals, consequently propelling market expansion.

Surgical Imaging Market Segment Analysis

The global surgical imaging market is segmented based on technology, application, end-user. By technology, the market is bifurcated into image intensifier c-arms, flat panel detector c-arms. At the moment, the at panel detector c-arms segment generates the most revenue and is expected to grow significantly during the forecast period. Some key factors driving the surgical imaging market growth include an increase in demand for flat panel detector c-arms, technological advancements in medical devices, and the wide availability of FPD c-arms. Furthermore, the advantages of flat panel detector c-arms over image intensifier c-arms, such as higher resolution, clarity, contrast, and high efficiency, support market growth.

By application, the market is divided into orthopedic & trauma surgeries, neurosurgeries, cardiovascular surgeries. The orthopedic & trauma surgery segment currently dominates the global market and is expected to remain dominant during the forecast period due to an increase in intraoperative surgical imaging during orthopedic surgery, widespread availability of surgical imaging systems for orthopedic surgery, and an increase in c-arm adoption during orthopedic implantation. Neurosurgery or neurological surgery is expected to have the fastest market growth during the forecast period, owing to an increase in the use of c-arms during neurosurgeries, an increase in the number of neurosurgical hybrid operating rooms, and an increase in the number of target populations.

By end-user, the market is segmented into hospitals, surgery centers. Hospitals have the largest share of the surgical imaging market, but surgery centers are expected to grow at the highest rate. The growing demand for effective disease management, rising surgical procedural volumes in hospitals, and the increasing number of hospitals being built in developing countries all make a significant contribution to this segment’s size.

Surgical Imaging Market Players

The surgical imaging market key players include Ziehm Imaging, Medtronic Plc, General Electric Company, Siemens AG, Koninklijke Philips N.V., Shimadzu Corporation, OrthoScan Inc., Hologic Inc., Eurocolumbus Srl, and Allengers Medical Systems Ltd.

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending in product development, which is fueling revenue generation.

Who Should Buy? Or Key Stakeholders

- Surgical imaging material suppliers

- Healthcare Sector

- Hospital Industry

- Ambulatory Settings Industry

- Research organizations

- Regulatory Authorities

- Others

Key Takeaways

- The global Surgical Imaging Market is projected grow at a CAGR of 6.3%.

- Based on technology, the at panel detector c-arms segment generates the most revenue and is expected to grow significantly.

- Based on application, the orthopedic & trauma surgery segment currently dominates the global market.

- Based on end-user, surgery centers are expected to grow at the highest rate.

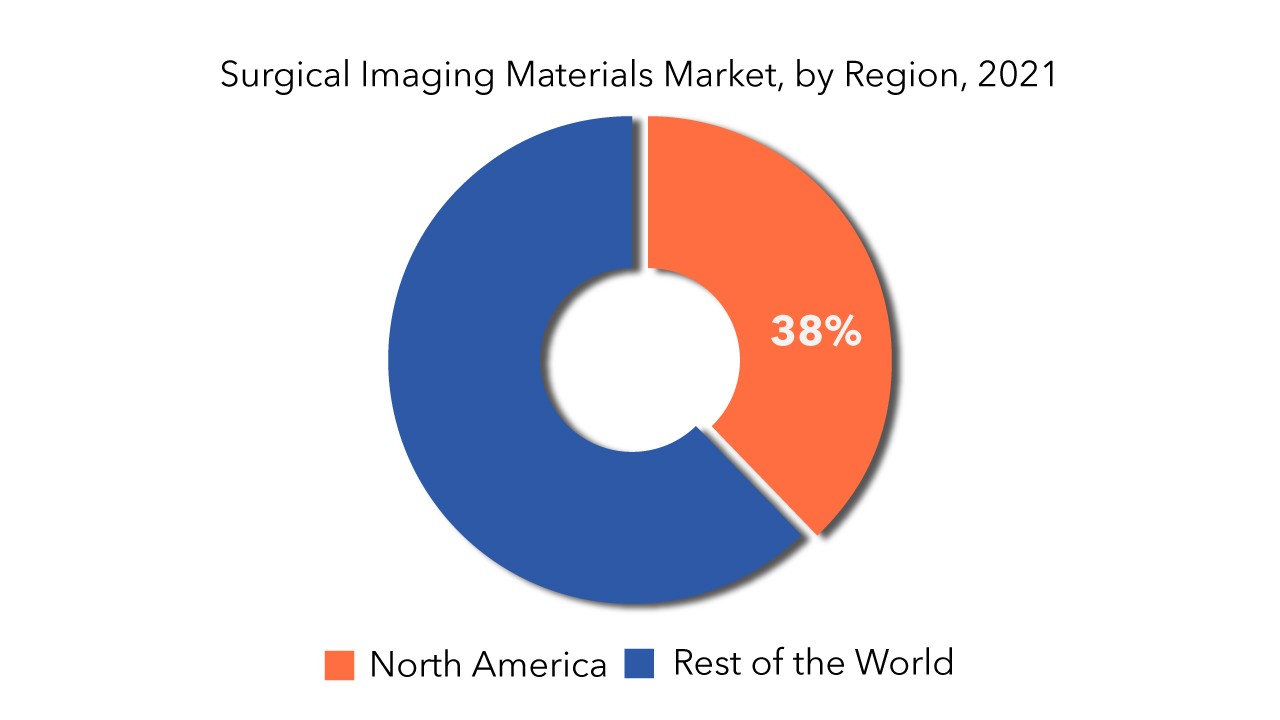

- The largest regional market for surgical imaging systems is North America.

- Integration of artificial intelligence and machine learning algorithms for enhanced surgical guidance and real-time image analysis in surgical imaging systems.

Surgical Imaging Market Regional Analysis

The surgical imaging market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Latin America: includes Brazil, Argentina and Mexico

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The largest regional market for surgical imaging systems is North America, followed by Europe. Increased sports injuries, a well-developed healthcare infrastructure that supports the adoption of advanced surgical imaging technology, and favorable government policies that support the purchase of advanced surgical imaging devices and reimbursement for the same are all driving the surgical imaging market in North America. Meanwhile, APEA is expected to grow as a result of increased awareness and rapidly developing healthcare infrastructure.

According to the american heart association, cardiovascular diseases killed nearly 836,546 people in the United States. Furthermore, the heart-disease & stroke statistical fact sheet 2020 estimates that congenital heart defects will affect at least 40,000 infants in the United States each year. Furthermore, some of the major risk factors, such as smoking, sedentary lifestyle, and high blood pressure, are on the rise in the United States. As a result of advancing technologies, high healthcare expenditure, an ageing demographic trend, evolving epidemiological patterns, and changing patient care strategies, the market for surgical imaging devices in the United States is expected to thrive.

Key Market Segments: Surgical Imaging Market

Surgical Imaging Market by Technology, 2020-2029, (USD Million), (Thousand Units)

- Image Intensifier C-Arms

- Flat Panel Detector C-Arms

Surgical Imaging Market by Application, 2020-2029, (USD Million), (Thousand Units)

- Orthopedic & Trauma Surgeries

- Neurosurgeries

- Cardiovascular Surgeries

Surgical Imaging Market by End-Users, 2020-2029, (USD Million), (Thousand Units)

- Hospitals

- Surgery Centers

Surgical Imaging Market by Region, 2020-2029, (USD Million), (Thousand Units)

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the current size of the surgical imaging market?

- What are the key factors influencing the growth of surgical imaging?

- What are the major applications for surgical imaging?

- Who are the major key players in the surgical imaging market?

- Which region will provide more business opportunities for surgical imaging in future?

- Which segment holds the maximum share of the surgical imaging market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Surgical Imaging Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Surgical Imaging Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Surgical Imaging Market Outlook

- Global Surgical Imaging Market by Technology, 2020-2029, (USD MILLION), (THOUSAND UNITS)

- Image Intensifier C-Arms

- Flat Panel Detector C-Arms

- Global Surgical Imaging Market by Application, 2020-2029, (USD MILLION), (THOUSAND UNITS)

- Orthopedic & Trauma Surgeries

- Neurosurgeries

- Cardiovascular Surgeries

- Global Surgical Imaging Market by End-User,2020-2029, (USD MILLION), (THOUSAND UNITS)

- Hospital

- Surgery Centers

- Global Surgical Imaging Market by Region, 2020-2029, (USD MILLIONS), (THOUSAND UNITS)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

9.1. Ziehm Imaging

9.2. Medtronic Plc

9.3. General Electric Company

9.4. Siemens AG

9.5. Koninklijke Philips N.V.

9.6. Shimadzu Corporation

9.7. OrthoScan Inc.

9.8. Hologic Inc.

9.10. Eurocolumbus Srl

9.11. Allengers Medical Systems Ltd. *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS)2020-2029

TABLE 2 GLOBAL SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 7 GLOBAL SURGICAL IMAGING MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 8 GLOBAL SURGICAL IMAGING MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 9 US SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 10 US SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 11 US SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 12 US SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 13 US SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 14 US SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 15 CANADA SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 16 CANADA SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 17 CANADA SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 18 CANADA SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 19 CANADA SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 20 CANADA SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 21 MEXICO SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 22 MEXICO SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 23 MEXICO SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 24 MEXICO SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 25 MEXICO SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 MEXICO SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 27 BRAZIL SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 28 BRAZIL SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 29 BRAZIL SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 30 BRAZIL SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 31 BRAZIL SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 32 BRAZIL SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 33 ARGENTINA SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 34 ARGENTINA SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 35 ARGENTINA SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 36 ARGENTINA SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 37 ARGENTINA SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 38 ARGENTINA SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 39 COLOMBIA SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 40 COLOMBIA SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 41 COLOMBIA SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 42 COLOMBIA SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 43 COLOMBIA SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 44 COLOMBIA SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 45 REST OF SOUTH AMERICA SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 46 REST OF SOUTH AMERICA SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 47 REST OF SOUTH AMERICA SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 48 REST OF SOUTH AMERICA SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 49 REST OF SOUTH AMERICA SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 REST OF SOUTH AMERICA SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 51 INDIA SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 52 INDIA SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 53 INDIA SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 54 INDIA SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 55 INDIA SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 56 INDIA SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 57 CHINA SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 58 CHINA SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 59 CHINA SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 60 CHINA SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 61 CHINA SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 62 CHINA SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 63 JAPAN SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 64 JAPAN SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 65 JAPAN SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 66 JAPAN SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 67 JAPAN SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 68 JAPAN SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 69 SOUTH KOREA SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 70 SOUTH KOREA SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 71 SOUTH KOREA SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 72 SOUTH KOREA SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 73 SOUTH KOREA SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 74 SOUTH KOREA SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 75 AUSTRALIA SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 76 AUSTRALIA SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 77 AUSTRALIA SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 AUSTRALIA SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 79 AUSTRALIA SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 80 AUSTRALIA SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 81 SOUTH-EAST ASIA SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 82 SOUTH-EAST ASIA SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 83 SOUTH-EAST ASIA SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 84 SOUTH-EAST ASIA SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 85 SOUTH-EAST ASIA SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 86 SOUTH-EAST ASIA SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 87 REST OF ASIA PACIFIC SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 88 REST OF ASIA PACIFIC SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 89 REST OF ASIA PACIFIC SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 90 REST OF ASIA PACIFIC SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 91 REST OF ASIA PACIFIC SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 92 REST OF ASIA PACIFIC SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 93 GERMANY SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 94 GERMANY SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 95 GERMANY SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 96 GERMANY SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 97 GERMANY SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 98 GERMANY SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 99 UK SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 100 UK SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 101 UK SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 102 UK SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 103 UK SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 104 UK SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 105 FRANCE SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 106 FRANCE SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 107 FRANCE SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 108 FRANCE SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 109 FRANCE SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 110 FRANCE SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 111 ITALY SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 112 ITALY SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 113 ITALY SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 114 ITALY SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 115 ITALY SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 116 ITALY SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 117 SPAIN SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 118 SPAIN SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 119 SPAIN SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 120 SPAIN SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 121 SPAIN SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 122 SPAIN SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 123 RUSSIA SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 124 RUSSIA SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 125 RUSSIA SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 126 RUSSIA SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 127 RUSSIA SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 128 RUSSIA SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 129 REST OF EUROPE SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 130 REST OF EUROPE SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 131 REST OF EUROPE SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 132 REST OF EUROPE SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 133 REST OF EUROPE SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 134 REST OF EUROPE SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 135 UAE SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 136 UAE SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 137 UAE SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 138 UAE SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 139 UAE SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 140 UAE SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 141 SAUDI ARABIA SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 142 SAUDI ARABIA SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 143 SAUDI ARABIA SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 144 SAUDI ARABIA SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 145 SAUDI ARABIA SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 146 SAUDI ARABIA SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 147 SOUTH AFRICA SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 148 SOUTH AFRICA SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 149 SOUTH AFRICA SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 150 SOUTH AFRICA SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 151 SOUTH AFRICA SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 152 SOUTH AFRICA SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 153 REST OF MIDDLE EAST AND AFRICA SURGICAL IMAGING MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 154 REST OF MIDDLE EAST AND AFRICA SURGICAL IMAGING MARKET BY TECHNOLOGY (THOUSAND UNITS) 2020-2029

TABLE 155 REST OF MIDDLE EAST AND AFRICA SURGICAL IMAGING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 156 REST OF MIDDLE EAST AND AFRICA SURGICAL IMAGING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 157 REST OF MIDDLE EAST AND AFRICA SURGICAL IMAGING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 158 REST OF MIDDLE EAST AND AFRICA SURGICAL IMAGING MARKET BY END USER (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SURGICAL IMAGING MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 9 GLOBAL SURGICAL IMAGING MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL SURGICAL IMAGING MARKET BY USER TYPE, USD MILLION, 2020-2029

FIGURE 11 GLOBAL SURGICAL IMAGING MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA SURGICAL IMAGING MARKET SNAPSHOT

FIGURE 14 EUROPE SURGICAL IMAGING MARKET SNAPSHOT

FIGURE 15 SOUTH AMERICA SURGICAL IMAGING MARKET SNAPSHOT

FIGURE 16 ASIA PACIFIC SURGICAL IMAGING MARKET SNAPSHOT

FIGURE 17 MIDDLE EAST ASIA AND AFRICA SURGICAL IMAGING MARKET SNAPSHOT

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 ZIEHM IMAGING: COMPANY SNAPSHOT

FIGURE 20 MEDTRONIC PLC: COMPANY SNAPSHOT

FIGURE 21 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

FIGURE 22 SIEMENS AG: COMPANY SNAPSHOT

FIGURE 23 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

FIGURE 24 SHIMADZU CORPORATION: COMPANY SNAPSHOT

FIGURE 25 ORTHOSCAN INC.: COMPANY SNAPSHOT

FIGURE 26 HOLOGIC INC.: COMPANY SNAPSHOT

FIGURE 27 EUROCOLUMBUS SRL: COMPANY SNAPSHOT

FIGURE 28 ALLENGERS MEDICAL SYSTEMS LTD.: COMPANY SNAPSHOT

FAQ

The surgical imaging market size had crossed USD 1.8 Billion in 2020 and will observe a CAGR of more than 6.3 % up to 2029 driven by the rising demand for integrated imaging systems and technological advancements in surgical imaging systems, such as the introduction of new O-arms and G-arms

North America held more than 39% of the surgical imaging market revenue share in 2020 and will witness expansion with the increased sports injuries, a well-developed healthcare infrastructure that supports the adoption of advanced surgical imaging technology, and favorable government policies

The upcoming trends in surgical imaging market are the rising adoption rate of advanced technologies that will provide beneficial opportunities for the surgical imaging market growth.

The orthopedic & trauma surgeries segment is the market’s largest and fastest-growing application segment. This can be attributed to the growing popularity of minimally invasive procedures in orthopedic and trauma surgery, as well as the benefit of 3D navigation in these surgeries via C-arms.

North America is the largest regional market for surgical imaging systems, followed by Europe. Increased sports injuries, a well-developed healthcare infrastructure that encourages the use of advanced surgical imaging technology, and favorable government policies that encourage the purchase of advanced surgical imaging devices are all factors.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.