REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 30.88 billion | 5.3% | Asia Pacific |

| By Component | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Industrial Refrigeration Market Overview

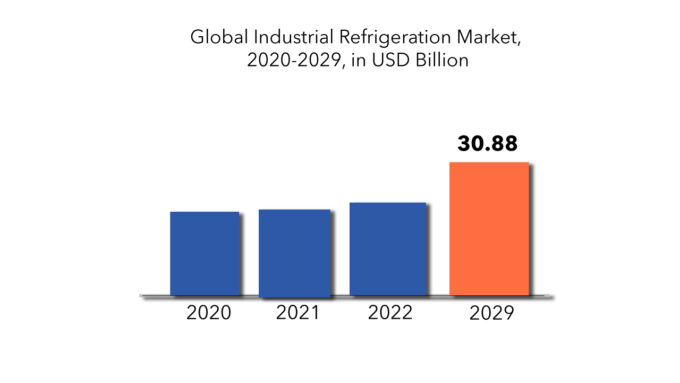

The global industrial refrigeration market is expected to grow at 5.3 % CAGR from 2020 to 2029. It is expected to reach above USD 30.88 billion by 2029 from USD 19.4 billion in 2020.

Large-scale cooling systems, such as those used in dairy processing, cold food storage, ice rinks, and beverage production, are known as industrial refrigeration. As a result, the industrial refrigeration business is always evolving and innovating. Compressor, evaporator, condenser, controls and other components make up the majority of industrial refrigeration. The industrial refrigeration system employs cutting-edge and cutting-edge manufacturing techniques to assist extend product life and lower energy costs. Factors driving the growth of the industrial refrigeration market include rising demand for innovative and compact refrigeration systems, increased government support to strengthen cold chain infrastructure in developing countries, and a growing preference for environmentally friendly refrigerant-based refrigeration systems due to stringent regulatory policies.

Due to rising consumption of packaged & processed food & beverages in emerging nations and the avoidance of rotting of semi-processed food & drinks, the need for industrial refrigeration systems in the FMCG industry is driving the market’s growth. Furthermore, the market is growing due to an increase in the trend of updating cold storage systems across emerging economies. Clinics, pharmacies, hospitals, and diagnostic centers have a growing demand for secure storage of medication molecules and blood derivatives, which is boosting the market worldwide. Industrial refrigeration systems are driving demand in the healthcare sector because of their lower energy consumption and maintenance costs, accurate temperature control, and 24/7 remote monitoring systems.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons) |

| Segmentation | By Component, By Application, By Region |

|

By Component

|

|

|

By Application

|

|

|

By Region

|

|

Increased use of natural refrigerants such as carbon dioxide (CO2), ammonia (NH3), and other natural refrigerants has helped to minimize hazardous gas emissions that contribute to global warming. As public knowledge of detrimental dangers has grown, manufacturers have changed their focus from the thermodynamic properties of refrigerants to their ozone depletion potential (ODP) and global warming potential (GWP). As a result, in recent years, there has been an increase in global demand for natural refrigerant-based industrial equipment. Natural refrigerants are being widely adopted by industry leaders as a step toward social responsibility in order to reduce ozone layer depletion.

The strong growth in the industrial refrigeration systems market can be attributed to the e-commerce industry’s good outlook. Major retailers are increasing their presence in the e-commerce sector, giving the industry a boost. E-commerce enterprises have been pushed to invest in innovative industrial refrigeration systems as the demand for frozen foods and beverages has grown.

covid-19 has had a significant impact on the operations of industrial refrigeration manufacturers, as well as their suppliers and distributors. In the medium term, the decline in export shipments, project delays, and poor domestic demand for industrial refrigeration in contrast to pre-covid-19 levels is likely to negatively impact and slightly stagnant demand for industrial refrigeration. On the other hand, due to the requirement for vaccine preservation in huge quantities to restrict the spread of the virus, the deployment of refrigerated transportation systems exploded at this time.

Industrial Refrigeration Market Segment Analysis

The global industrial refrigeration market is segmented based on component, application. By component, the market is bifurcated into controls, compressor, condenser, evaporator. By component, controls in the industrial refrigeration market are expected to grow at the fastest rate throughout the forecast period. Controls in industrial refrigeration help to optimize efficiency, automate temperature controls, and make adjustments based on requirements. Control systems can also be utilized to automate defrost cycles at different times, which saves a lot of electricity. Additionally, firms are heavily spending in R&D efforts to improve the efficiency of industrial systems and minimize operational costs, which is projected to drive the controls market during the forecast period.

By application, the market is divided into chemical & petrochemicals, fruit & vegetable processing, refrigerated warehouse. Chemical and petrochemical processes, notably the handling and processing of commodities like oil, gas, and other chemical compounds, are exceedingly difficult. To manufacture the final product, several procedures and operations in these applications necessitate the removal of heat and refrigeration. Crystallization and condensation are examples of these processes. Similarly, to preserve and maintain product integrity, the pharmaceutical sector relies on refrigerated or temperature-controlled equipment. The increasing demand for industrial cold storage facilities to keep medications and vaccines is a crucial driver driving growth in chemical, petrochemical, and pharmaceutical applications.

Industrial Refrigeration Market Players

The industrial refrigeration market key players include Carrier, Daikin Industries, Ltd., Danfoss Group, Emerson Electric Co., Evapco, Inc., GEA Group AG, Johnson Controls, Ingersoll Rand, LU-VE Group, Mayekawa Mfg. Co. Ltd

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending in product development, which is fueling revenue generation.

Who Should Buy? Or Key Stakeholders

- Industrial refrigeration Supplier

- Raw Materials Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Industrial Refrigeration Market Regional Analysis

The industrial refrigeration market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

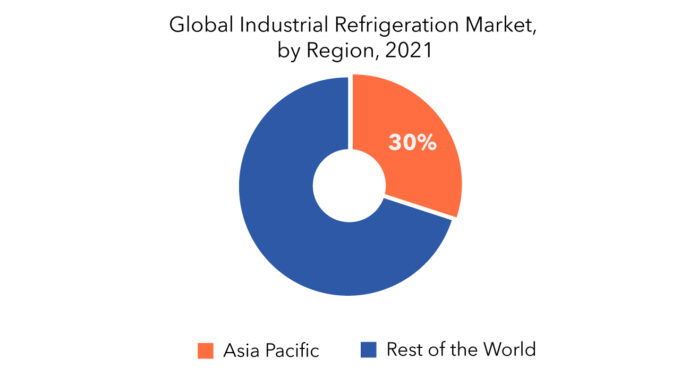

During the projected period, APAC is expected to be the fastest-growing industrial refrigeration market. The market’s expansion can be ascribed to the region’s burgeoning pharmaceutical industry, as well as government subsidies for enhancing cold chain and preservation facilities. In APAC countries like India, China, and Japan, refrigeration storage capacity is increasing.

Additionally, governments in a number of APAC countries support the Montreal Protocol plan to phase out ecologically damaging refrigerants, opening up a slew of prospects for natural refrigerant-based refrigeration system providers. As a result, government attempts to improve cold chain management systems are likely to be a major driver of industrial refrigeration growth in the APAC area.

Key Market Segments: Industrial Refrigeration Market

Industrial Refrigeration Market by Component, 2020-2029, (USD Billion), (Kilotons)

- Controls

- Compressor

- Condensor

- Evaporator

Industrial Refrigeration Market by Application, 2020-2029, (USD Billion), (Kilotons)

- Chemicals & Petrochemicals

- Fruit & Vegetable Processing

- Refrigerated Warehouse

Industrial Refrigeration Market by Region, 2020-2029, (USD Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East And Africa

Important countries in all regions are covered.

Key Question Answered

- What is the current size of the industrial refrigeration market?

- What are the key factors influencing the growth of industrial refrigeration?

- What are the major applications for industrial refrigeration?

- Who are the major key players in the industrial refrigeration market?

- Which region will provide more business opportunities for industrial refrigeration in future?

- Which segment holds the maximum share of the industrial refrigeration market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Industrial Refrigeration Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Industrial Refrigeration Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Industrial Refrigeration Market Outlook

- Global Industrial Refrigeration Market by Component, 2020-2029, (USD MILLIONS), (KILOTONS)

- Controls

- Compressor

- Condenser

- Evaporator

- Global Industrial Refrigeration Market by Application, 2020-2029, (USD MILLION), (KILOTONS)

- Chemicals & Petrochemicals

- Fruit & Vegetable Processing

- Refrigerated Warehouse

- Global Industrial Refrigeration Market by Region, 2020-2029, (USD MILLION), (KILOTONS)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

-

- Carrier

- Daikin Industries

- Danfoss Group

- Emerson Electric Co.

- Evapco

- GEA Group AG

- Johnson Controls

- Ingersoll Rand

- LU-VE Group

- Mayekawa Mfg. Co. Ltd

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 3 GLOBAL INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL INDUSTRIAL REFRIGERATION MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL INDUSTRIAL REFRIGERATION MARKET BY REGION (KILOTONS) 2020-2029

TABLE 7 US INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 8 US INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 9 US INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 10 US INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 11 CANADA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 12 CANADA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 13 CANADA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 14 CANADA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 15 MEXICO INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 16 MEXICO INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 17 MEXICO INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 18 MEXICO INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 19 BRAZIL INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 20 BRAZIL INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 21 BRAZIL INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 22 BRAZIL INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 23 ARGENTINA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 24 ARGENTINA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 25 ARGENTINA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 26 ARGENTINA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 27 COLOMBIA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 28 COLOMBIA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 29 COLOMBIA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 30 COLOMBIA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 31 REST OF SOUTH AMERICA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 32 REST OF SOUTH AMERICA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 33 REST OF SOUTH AMERICA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 34 REST OF SOUTH AMERICA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 35 INDIA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 36 INDIA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 37 INDIA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 38 INDIA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 39 CHINA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 40 CHINA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 41 CHINA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 42 CHINA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 43 JAPAN INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 44 JAPAN INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 45 JAPAN INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 46 JAPAN INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 47 SOUTH KOREA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 48 SOUTH KOREA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 49 SOUTH KOREA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 50 SOUTH KOREA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 51 AUSTRALIA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 52 AUSTRALIA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 53 AUSTRALIA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 54 AUSTRALIA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 55 SOUTH-EAST ASIA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 56 SOUTH-EAST ASIA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 57 SOUTH-EAST ASIA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 58 SOUTH-EAST ASIA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 59 REST OF ASIA PACIFIC INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 60 REST OF ASIA PACIFIC INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 61 REST OF ASIA PACIFIC INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 62 REST OF ASIA PACIFIC INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 63 GERMANY INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 64 GERMANY INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 65 GERMANY INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 66 GERMANY INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 67 UK INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 68 UK INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 69 UK INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 70 UK INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 71 FRANCE INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 72 FRANCE INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 73 FRANCE INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 74 FRANCE INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 75 ITALY INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 76 ITALY INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 77 ITALY INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 ITALY INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 SPAIN INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 80 SPAIN INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 81 SPAIN INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 82 SPAIN INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 83 RUSSIA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 84 RUSSIA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 85 RUSSIA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 86 RUSSIA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 87 REST OF EUROPE INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 88 REST OF EUROPE INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 89 REST OF EUROPE INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 90 REST OF EUROPE INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 UAE INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 92 UAE INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 93 UAE INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 94 UAE INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 95 SAUDI ARABIA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 96 SAUDI ARABIA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 97 SAUDI ARABIA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 98 SAUDI ARABIA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 99 SOUTH AFRICA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 100 SOUTH AFRICA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 101 SOUTH AFRICA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 102 SOUTH AFRICA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT (USD MILLIONS) 2020-2029

TABLE 104 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL REFRIGERATION MARKET BY COMPONENT(KILOTONS) 2020-2029

TABLE 105 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 106 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL REFRIGERATION MARKET BY APPLICATION (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL INDUSTRIAL REFRIGERATION MARKET BY COMPONENT, USD MILLION, 2020-2029

FIGURE 9 GLOBAL INDUSTRIAL REFRIGERATION MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL INDUSTRIAL REFRIGERATION MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 NORTH AMERICA INDUSTRIAL REFRIGERATION MARKET SNAPSHOT

FIGURE 13 EUROPE INDUSTRIAL REFRIGERATION MARKET SNAPSHOT

FIGURE 14 SOUTH AMERICA INDUSTRIAL REFRIGERATION MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC INDUSTRIAL REFRIGERATION MARKET SNAPSHOT

FIGURE 16 MIDDLE EAST ASIA AND AFRICA INDUSTRIAL REFRIGERATION MARKET SNAPSHOT

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 CARRIER: COMPANY SNAPSHOT

FIGURE 19 DAIKIN INDUSTRIES: COMPANY SNAPSHOT

FIGURE 20 DANFOSS GROUP: COMPANY SNAPSHOT

FIGURE 21 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

FIGURE 22 EVAPCO: COMPANY SNAPSHOT

FIGURE 23 GEA GROUP AG: COMPANY SNAPSHOT

FIGURE 24 JOHNSON CONTROLS: COMPANY SNAPSHOT

FIGURE 25 INGERSOLL RAND: COMPANY SNAPSHOT

FIGURE 26 LU-VE GROUP: COMPANY SNAPSHOT

FIGURE 27 MAYEKAWA MFG. CO. LTD: COMPANY SNAPSHOT

FAQ

The industrial refrigeration market size had crossed USD 19.4 billion in 2020 and will observe a CAGR of more than 5.3 % up to 2029 driven by the growth of the industrial refrigeration market include rising demand for innovative and compact refrigeration systems, increased government support to strengthen cold chain infrastructure in developing countries, and a growing preference for environmentally friendly refrigerant-based refrigeration systems.

Asia Pacific held more than 30% of the industrial refrigeration market revenue share in 2020 and will witness expansion with the burgeoning pharmaceutical industry, as well as government subsidies for enhancing cold chain and preservation facilities.

Factors such as rising demand for innovative and compact refrigeration systems, increased government support to strengthen cold chain infrastructure in developing countries, and a growing preference for environmentally friendly refrigerant-based refrigeration systems due to stringent regulatory policies are all contributing to this trend.

Chemical and petrochemical processes, notably the handling and processing of commodities like oil, gas, and other chemical compounds, are exceedingly difficult. To manufacture the final product, several procedures and operations in these applications necessitate the removal of heat and refrigeration.

The region’s largest share is in Asia Pacific. The growth is attributed to the government incentives for improving cold chain and preservation facilities, as well as a rising pharmaceutical industry.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.