Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

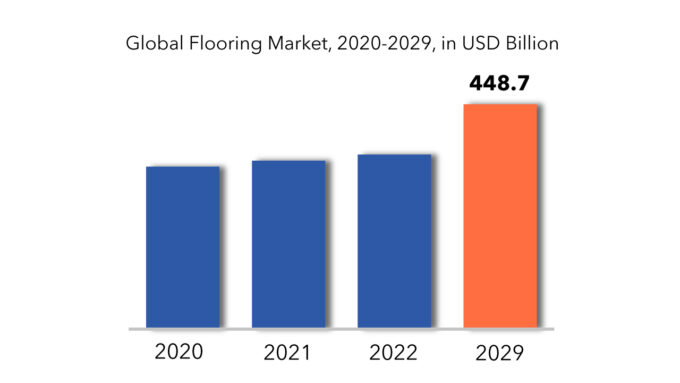

| USD 448.7 billion | 3.68% | Asia Pacific |

| By End-Use, | By Materials | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Flooring Market Overview

The global flooring market is expected to grow at a 3.68% CAGR from 2020 to 2029. It is expected to reach above USD 448.7 billion by 2029 from USD 324.2 billion in 2020.

Flooring serves as a finishing material applied atop a floor or subfloor structure to provide a walking surface, offering characteristics such as scratch, dent, and moisture resistance, along with easy maintenance. Predominantly utilized products encompass ceramic tiles, vinyl tiles, carpets, and laminates, renowned for furnishing floors with smooth, clean, durable, and visually appealing surfaces. These attributes incentivize consumers to incorporate these products in both residential and non-residential building projects, be it for development or renovation purposes. The burgeoning demand for new construction endeavors and the escalating requirements for residential, commercial, and healthcare infrastructures are expected to propel market expansion.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | USD Millions |

| Segmentation | By Material, By End-Use |

| By Material |

|

| By End-Use |

|

| By Region |

|

The upsurge in population engenders a concomitant rise in housing demand, thereby necessitating flooring materials in residential construction ventures, whether in the context of new developments or refurbishments. Additionally, the ongoing urbanization trend drives the construction of various urban infrastructures such as roads, bridges, airports, railway stations, and public spaces, all of which mandate the use of flooring materials, thus fostering market growth.

The global population surge, which surpassed eight billion in the early stages of 2023 and is projected to double by 2050, amplifies the demand for both residential and non-residential construction activities. This demographic expansion and urbanization phenomenon have significantly expanded the construction industry’s footprint, resulting in heightened demand for products such as tiles, carpets, rugs, and hardwood floors, owing to their extensive applicability in construction projects. These products are selected based on specific requirements.

Emerging economies like China, India, and other ASEAN countries have witnessed substantial enhancements in living standards and household purchasing power over recent decades, catalyzing a surge in demand for modern surface coverings, including carpets and rugs. This trend, coupled with increased spending and the burgeoning regional construction sector, is anticipated to spur the initiation of new infrastructure and construction projects during the forecast period.

Flooring Market Segment Analysis

On the basis of end-use, the flooring market is segmented into residential, non-residential. In 2020, the residential application segment led the market, accounting for more than 54% of global revenue. High disposable income levels and an increase in the number of single-family houses in developing economies are two key factors driving the segment growth. The favorable growth of the housing sector in emerging markets such as South Africa, Turkey, India, China, and Middle Eastern countries due to the easy availability of home loans is expected to have a positive impact on segment growth over the forecast period. Furthermore, advancements in installation services are expected to drive the industry’s growth.

Rising demand for highly durable and cost-effective flooring for use in high-traffic commercial areas is expected to drive growth in the commercial application segment over the forecast period. The commercial segment is also being driven by the development of new products and simple installation techniques. Expansion of modern offices and workspaces increased commercial space renovation activity, and rapid industrialization in developing economies are all expected to drive segment growth.

Based on material the flooring market is divided into carpets & rugs, resilient (vinyl, cork, linoleum, rubber, resin), non-resilient (ceramic, stone, wood, laminate)). Due to an increase in residential and commercial construction activities around the world, the non-resilient flooring segment led the market and accounted for more than 61 percent of global revenue in 2020.

Due to the high demand for these products’ excellent water resistance and durability, the segment will maintain its leading position throughout the forecast period. Because of the high demand for these materials in commercial applications such as offices, gyms, fitness centers, hospitality buildings, and others, the resilient flooring segment is expected to grow at the fastest CAGR. Because of their ease of maintenance and noise-reduction capabilities, these products are cost-effective and durable, making them ideal for use in high-traffic residential and commercial areas.

Ceramic and natural stone are popular building materials. In the industrial environment, seamless flooring is used to cover a large floor area with resins and concrete materials. Maintenance and installation of seamless flooring are less expensive compared to its counterparts.

Flooring Market Players

From large companies to small ones, many companies are actively working in the flooring market. These key players include Mohawk Industries, Shaw Industries, Tarkett, Armstrong Flooring, Forbo, Gerflor, Interface Beaulieu International, TOLI Corporation, Milliken & Company, and others.

Companies are mainly in flooring they are competing closely with each other. Innovation is one of the most important key strategies as it has to be for any market. However, companies in the market have also opted for and successfully driven inorganic growth strategies like mergers & acquisitions, and so on.

- In January 2018, Tarkett increased its LVT (Luxury Vinyl Tiles) production capacity in Europe and North America by USD 85.9 million over the next three years to meet the growing demand for vinyl modular flooring. The investment will help to improve the sustainability and efficiency of manufacturing. In the United States, approximately USD 60 million will be invested in two manufacturing facilities in Florence, AL, while in Europe, investments will be made in Poland and Luxembourg.

- In November 2017, Mohawk Industries has agreed to buy Godfrey Hirst Group (Australia), Australia’s largest carpet manufacturer, in order to expand its global operations. Godfrey Hirst’s manufacturing, marketing, and distribution leadership will complement and strengthen Mohawk’s current hard surface distribution and product portfolio. This transaction is expected to be completed in 2018.

Who Should Buy? Or Key Stakeholders

- Suppliers

- Manufacturing companies

- Research institutes

- Others

Key Takeaways:

- The global flooring market is expected to grow at a 3.68% CAGR.

- Based on end-use, the residential application segment led the market, accounting for more than 54% of global revenue.

- Based on material, the non-resilient flooring segment led the market and accounted for more than 61 % of global revenue.

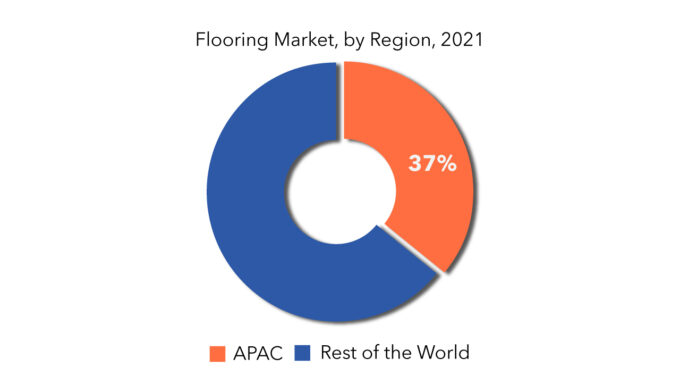

- Asia Pacific shares 37% of the total market.

- Growing preference for sustainable and low-maintenance flooring options driving market demand.

Flooring Market Regional Analysis

The flooring market by region includes Asia-Pacific (APAC), North America, Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

Its major share is occupied by Asia Pacific, North America, and Europe region. Asia Pacific shares 37% of the total market.

Key Market Segments: Flooring Market

Flooring Market by End-Use, 2020-2029, (USD Millions)

- Residential

- Non-Residential

Flooring Market by Materials, 2020-2029, (USD Millions)

- Resilient Flooring

- Vinyl (LVT, VCT, Vinyl Sheet, And Fiberglass)

- Others (Cork, Linoleum, Rubber, And Resin)

- Non-Resilient Flooring

- Ceramic Tiles

- Wood

- Laminate

- Stone

- Others (Bamboo And Terrazzo)

- Carpets & Rugs

Flooring Market by Region, 2020-2029, (USD Millions)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What are the growth opportunities related to the adoption of flooring across major regions in the future?

- What are the new trends and advancements in the flooring market?

- Which product categories are expected to have the highest growth rate in the flooring market?

- Which are the key factors driving the flooring market?

- What will the market growth rate, growth momentum, or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Flooring Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Flooring Market

- Global Flooring Market Outlook

- Global Flooring Market by End-Use, (USD Million)

- Residential

- Non-residential

- Global Flooring Market by Material, (USD Million)

- Resilient flooring

- Vinyl (LVT, VCT, vinyl sheet, and fiberglass)

- Others (Cork, linoleum, rubber, and resin)

- Non-resilient flooring

- Ceramic tiles

- Wood

- Laminate

- Stone

- Others (Bamboo and terrazzo)

- Carpets & rugs

- Global Flooring Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Materials Offered, Recent Developments)

-

- Mohawk Industries

- Shaw Industries

- Tarkett

- Armstrong Flooring

- Forbo

- Gerflor

- Interface

- Beaulieu International

- TOLI Corporation

- Milliken & Company *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 3 GLOBAL FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL FLOORING MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 5 US FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 6 US FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 7 US FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 8 CANADA FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 9 CANADA FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 10 CANADA FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 11 MEXICO FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 12 MEXICO FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 13 MEXICO FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 14 BRAZIL FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 15 BRAZIL FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 16 BRAZIL FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 17 ARGENTINA FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 18 ARGENTINA FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 19 ARGENTINA FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 20 COLOMBIA FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 21 COLOMBIA FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 22 COLOMBIA FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 23 REST OF SOUTH AMERICA FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 24 REST OF SOUTH AMERICA FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 25 REST OF SOUTH AMERICA FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 INDIA FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 27 INDIA FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 28 INDIA FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 29 CHINA FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 30 CHINA FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 31 CHINA FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 32 JAPAN FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 33 JAPAN FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 34 JAPAN FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 35 SOUTH KOREA FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 36 SOUTH KOREA FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 37 SOUTH KOREA FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 38 AUSTRALIA FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 39 AUSTRALIA FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 40 AUSTRALIA FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 41 SOUTH-EAST ASIA FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 42 SOUTH-EAST ASIA FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 43 SOUTH-EAST ASIA FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 44 REST OF ASIA PACIFIC FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 45 REST OF ASIA PACIFIC FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 46 REST OF ASIA PACIFIC FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 47 GERMANY FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 48 GERMANY FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 49 GERMANY FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 UK FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 51 UK FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 52 UK FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 53 FRANCE FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 54 FRANCE FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 55 FRANCE FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 56 ITALY FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 57 ITALY FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 58 ITALY FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 59 SPAIN FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 60 SPAIN FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 61 SPAIN FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 62 RUSSIA FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 63 RUSSIA FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 64 RUSSIA FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 65 REST OF EUROPE FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 66 REST OF EUROPE FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 67 REST OF EUROPE FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 68 UAE FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 69 UAE FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 70 UAE FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 71 SAUDI ARABIA FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 72 SAUDI ARABIA FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 73 SAUDI ARABIA FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 74 SOUTH AFRICA FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 75 SOUTH AFRICA FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 76 SOUTH AFRICA FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 77 REST OF MIDDLE EAST AND AFRICA FLOORING MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 78 REST OF MIDDLE EAST AND AFRICA FLOORING MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 79 REST OF MIDDLE EAST AND AFRICA FLOORING MARKET BY END USER (USD MILLIONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL FLOORING MARKET BY MATERIAL, USD MILLION, 2020-2029

FIGURE 9 GLOBAL FLOORING MARKET BY END-USE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL FLOORING MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 FLOORING MARKET BY REGION 2020

FIGURE 13 MARKET SHARE ANALYSIS

FIGURE 14 MOHAWK INDUSTRIES: COMPANY SNAPSHOT

FIGURE 15 SHAW INDUSTRIES: COMPANY SNAPSHOT

FIGURE 16 TARKET: COMPANY SNAPSHOT

FIGURE 17 ARMSTRONG FLOORING: COMPANY SNAPSHOT

FIGURE 18 FORBO: COMPANY SNAPSHOT

FIGURE 19 GERFLOR: COMPANY SNAPSHOT

FIGURE 20 INTERFACE: COMPANY SNAPSHOT

FIGURE 21 BEAULIEU INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 22 TOLI CORPORATION: COMPANY SNAPSHOT

FIGURE 23 MILLIKEN & COMPANY: COMPANY SNAPSHOT

FAQ

The flooring market is expected to grow at a compound annual growth rate of 3.68% to reach USD 448.7 billion in 2029.

Asia Pacific held more than 37% of the flooring market revenue share in 2020 and will witness expansion with the surging demand for flooring market in countries, including U.S. and Canada.

Due to properties such as low cost, excellent abrasion resistance, and impact resistance, the non-resilient flooring segment dominated the flooring market.

Increased construction spending, as well as a rapidly growing residential and real estate sector, are key factors driving the flooring market’s growth.

The global flooring market registered a CAGR of 3.68% from 2022 to 2029.

The residential segment is projected to be the fastest-growing segment in the flooring market.

Asia Pacific is the largest regional market for the flooring market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.