REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 1,528.28 Million by 2029 | 5.4% | Asia Pacific |

| By Type | By End-User, | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Reactive diluents Market Overview

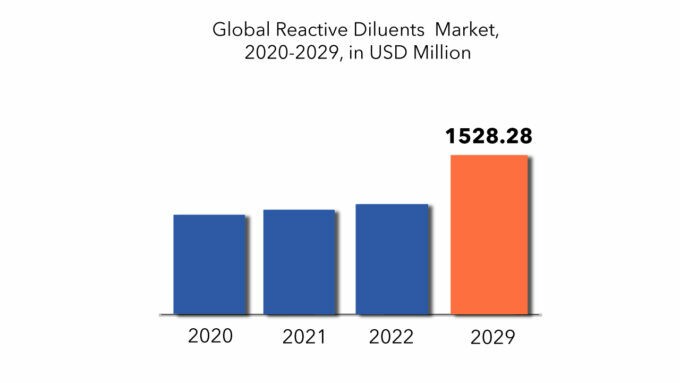

The global reactive diluents market size was USD 952.00 Million in 2020 and is projected to reach USD 1,528.28 Million by 2029, exhibiting a CAGR of 5.4% during the forecast period.

Thinners, also known as reactive diluents, are used to reduce the viscosity of substances. It not only lowers viscosity but also aids in the polymerization of the substance to which it is added. To boost the epoxy resin‘s flexibility and handling qualities, reactive diluents are routinely used.

The reactive diluent is made up of glycidyl ethers derived from short-chain aliphatic alkylphenols or alcohols with a low viscosity. This is used to lower the viscosity of epoxy resins and to make them easier to manage and process in a variety of applications. Reactive diluents also help with qualities including thermal stability, tensile strength, filter loading, and adhesion. Epoxy resins are widely utilized in the production of coatings, paints, composites, adhesives, and sealants. Solvent-based and waterborne coatings and paints both require reactive diluents. The release of volatile organic molecules is reduced by reactive diluents (VOCs).

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million, Kilotons) |

| Segmentation | By Type, By End-User, By Application, By Region |

| By Type

|

|

| By End-User

|

|

| By Application

|

|

| By Region

|

|

Rising demand for reactive diluents across different applications such as paint and coating and composites is a major factor estimated to drive the growth of the potential market in the next 10 years. In addition, rising demand for a reactive diluent in the production of adhesives and sealants is predicted to drive revenue growth in the prospective market over the next ten years.

One of the primary factors driving the growth of the reactive diluents market is the increased use of composite materials around the world. The widespread use of reactive diluents to increase qualities such as impact and tensile strength, filler loading, flexibility, adhesion, and thermal stability, as well as lower volatility and solvent resistance, is propelling the industry forward. The market is also influenced by an increase in demand for the product in adhesives and sealants, polymers and composites, and paints and coatings formulations to reduce the emission of volatile organic compounds (VOC). Furthermore, the market for reactive diluents benefits from rapid industrialization, rising environmental concerns, increased investments, and the expansion of the worldwide construction sector. Moreover, in the forecast period of 2022 to 2029, technological advancements provide profitable opportunities for market players.

On the other hand, the increased usage of low-cost replacements such as phenolic resins, as well as tight rules governing epoxy resin production, are projected to stifle market expansion. The reactive diluents market is expected to be challenged by the unpredictable pricing of epoxy resin raw materials during the forecast period of 2022-2029.

Moreover, rising demand for reactive diluent from the automotive, building & construction, and marine industries is likely to drive the target market’s growth throughout the forecast period. Other factors projected to fuel the prospective market’s growth include rising demand for materials with high mechanical strength, corrosion resistance, and lightweight properties, as well as increased investments in R&D and the development of innovative goods.

However, the increasing usage of low-cost replacements such as phenolic resins, as well as strict regulatory requirements governing the use of epoxy resins, are projected to limit the global market’s growth to some extent.

Reactive diluents Market Segment Analysis

The global reactive diluents market is segmented based on type, end-user, application, and region. By type, the market is classified into aliphatic, aromatic, and cycloaliphatic. By end-user, it is divided into construction, automotive, electrical & electronics, wind energy, and others. By application, it is divided into paints & coatings, composites, adhesives & sealants, and others (electrical casting, electrical encapsulation, and fibers).

By type, the aliphatic type of reactive diluent had the highest market share of 47.0 percent in 2018 and is expected to grow at the fastest rate of 5.1 percent over the projected period. The extensive use of this category across end-user sectors ranging from the automotive to the construction industries has resulted in its high market share. Because this sort of reactive diluent has a high impact strength and is regarded as an effective diluent, it is widely used in a variety of sectors. In addition, when compared to other types of reactive diluents, the segment’s growth rate is aided by its simple manufacturing process and lower raw material costs. During the forecast period, the aromatic type is expected to grow at a significant rate. It is estimated to account for almost 32.0 percent of the market by 2029, with a CAGR of 5.4 percent over the forecast period. Its increasing popularity among end-user industries, such as the construction industry, is attributed to characteristics such as effective chemical resistance. Because of the aforementioned characteristics, it is suitable for application in a variety of end-user sectors, and the expansion of these industries is increasing demand.

By end-user, automobile and construction sectors are two examples of end-user industries that are constantly growing. The growth of the aforementioned end-user sectors is driving up demand for coatings and paintings to protect against the elements while also improving aesthetic appeal. The expansion of the reactive diluent market is aided by the increase in demand for coatings and paintings.

By application, the paints and coatings category led the global market with a share of about 40% in 2019 and is expected to continue dominating the market over the forecast period. In an emerging country, this growth is attributable to increased residential and commercial activities. Furthermore, the rising demand for environmentally friendly and solvent-free anti-corrosive coatings, as well as UV curable coatings and inks, would drive the worldwide reactive diluent market share throughout the projection period.

Reactive diluents Market Players

The reactive diluents market key players include Hexion, Huntsman Corporation, Kukdo Chemica, Aditya Birla Chemicals, Evonik Industries, R. Coats Inks and Resin Pvt. Ltd, Adeka Corporation, Mercury Synthetic Resins, Grasim Industries Ltd., Cargill, Olin Corporation, ASH Chem, Admark Polycoats Pvt Ltd, Champion Adva Mat Private Limited, Hindusthan Speciality Chemicals Limited, Dhingra Plastic, And Plasticisers Private Limited. To increase their market position, these businesses have implemented a variety of growth tactics. These companies are using expansion, new product development, mergers and acquisitions, and collaboration as important growth strategies to improve their product portfolio and geographical presence in order to meet the rising demand for reactive diluents from emerging economies.

Industry News:

- In December 2021: The Bodo Möller Chemie Group, a market leader in reactive diluents, announced that it is strengthening its partnership with Imerys, a French mining company which is a global pioneer in mineral-based speciality solutions for industry.

- In February 2020, Huntsman launched a snap cure VITROX RTM 00410 resin. This new resin will help in the high-volume manufacturing of lightweight and cost-effective composite parts. This new development will help the company meet the customer needs in the composites industry.

Who Should Buy? Or Key stakeholders

- Structural analysis

- Product industries.

- Leading companies.

- Institutional & retail players.

- Investment research firms

- Others

Reactive diluents Market Regional Analysis

The reactive diluents market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

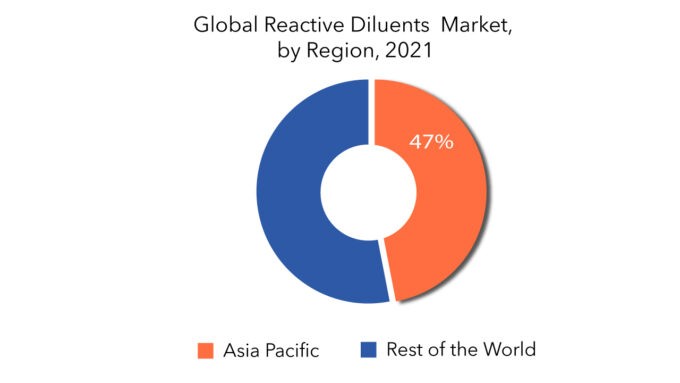

The Asia Pacific is accounted for the highest share of the global reactive diluents market. During the projection period, Asia-Pacific is expected to be the largest and fastest-growing market for reactive diluents, with China, Japan, India, and Australia being the prominent nations with promising growth prospects. The rise of various end-use industries, including construction, automotive, electrical & electronics, and wind-energy, is driving the market, which is producing massive demand for reactive diluents and a big number of reactive diluents manufacturers in the Asia-Pacific region. During the projected period, North America and Europe are expected to offer significant growth prospects.

With a market share of more than 43% in 2019, APAC dominated the reactive diluents market, followed by North America and Europe. The APAC area’s growth is linked to expanding transportation, urbanization, and population, as well as a substantial industrial base throughout the region. Furthermore, the rising renewable energy sector, especially solar and wind energy, in emerging economies of APAC, including China, India, and South Korea, would boost the expansion of the reactive diluent market business in APAC during the projection period, owing to the abundance of sunshine.

Key Market Segments: Reactive Diluent Market

Global Reactive Diluents Market By Type, 2020-2029, (USD Million), (Kilotons)

- Aliphatic

- Aromatic

- Cycloaliphatic

Global Reactive Diluents Market by End-User, 2020-2029, (USD Million), (Kilotons)

- Construction

- Automotive

- Electrical & Electronics

- Wind-Energy

- Others

Global Reactive Diluents Market by Application, 2020-2029, (USD Million), (Kilotons)

- Paints & Coatings

- Composites

- Adhesives & Sealants

- Others (Electrical Casting, Electrical Encapsulation, And Fibres)

Global Reactive Diluents Market by Region, 2020-2029, (USD Million), (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the reactive diluents market?

- What are the key factors influencing the growth of reactive diluents?

- What are the major applications for reactive diluents?

- Who are the major key players in the reactive diluents market?

- Which region will provide more business opportunities for the reactive diluents’ future?

- Which segment holds the maximum share of the reactive diluents market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL REACTIVE DILUENTS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON GLOBAL REACTIVE DILUENTS GLOBAL MARKET

- GLOBAL REACTIVE DILUENTS MARKET OUTLOOK

- GLOBAL REACTIVE DILUENTS MARKET BY TYPE, (USD MILLION) (KILOTONS)

- ALIPHATIC

- AROMATIC

- CYCLOALIPHATIC

- GLOBAL REACTIVE DILUENTS MARKET BY END-USER, (USD MILLION) (KILOTONS)

- CONSTRUCTION

- AUTOMOTIVE

- ELECTRICAL & ELECTRONICS

- WIND-ENERGY

- OTHERS

- GLOBAL REACTIVE DILUENTS MARKET BY APPLICATION, (USD MILLION) (KILOTONS)

- PAINTS & COATINGS

- COMPOSITES

- ADHESIVES & SEALANTS

- OTHERS (ELECTRICAL CASTING, ELECTRICAL ENCAPSULATION, AND FIBRES)

- GLOBAL REACTIVE DILUENTS MARKET BY REGION, (USD MILLION) (KILOTONS)

- INTRODUCTION

- ASIA-PACIFIC

- CHINA

- INDIA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA-PACIFIC

- NORTH AMERICA

- UNITED STATES

- CANADA

- MEXICO

- EUROPE

- GERMANY

- UNITED KINGDOM

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, TYPES OFFERED, RECENT DEVELOPMENTS)

- HEXION

- HUNTSMAN CORPORATION

- KUKDO CHEMICAL

- ADITYA BIRLA CHEMICALS

- EVONIK INDUSTRIES

- COATS INKS AND RESIN PVT. LTD

- ADEKA CORPORATION

- MERCURY SYNTHETIC RESINS

- GRASIM INDUSTRIES LTD.

- CARGILL

- OLIN CORPORATION

- ASH CHEM

- ADMARK POLYCOATS PVT LTD

- CHAMPION ADVA MAT PRIVATE LIMITED

- HINDUSTHAN SPECIALITY CHEMICALS LIMITED,

- DHINGRA PLASTIC AND PLASTISCISERS PRIVATE LIMITED (BUSINESS OVERVIEW, COMPANY SNAPSHOT, TYPES OFFERED, RECENT DEVELOPMENTS) *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 5 GLOBAL REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 7 GLOBAL REACTIVE DILUENTS MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 8 GLOBAL REACTIVE DILUENTS MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA REACTIVE DILUENTS MARKET BY COUNTRY (USD MILLIONS) 2020-2029

TABLE 10 NORTH AMERICA REACTIVE DILUENTS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 11 US REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 12 US REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 13 US REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 14 US REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 15 US REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 16 US REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 17 CANADA REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 18 CANADA REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 19 CANADA REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 20 CANADA REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 21 CANADA REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 22 CANADA REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 23 MEXICO REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 24 MEXICO REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 25 MEXICO REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 26 MEXICO REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 27 MEXICO REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 28 MEXICO REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 29 SOUTH AMERICA REACTIVE DILUENTS MARKET BY COUNTRY (USD MILLIONS) 2020-2029

TABLE 30 SOUTH AMERICA REACTIVE DILUENTS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 31 BRAZIL REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 32 BRAZIL REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 33 BRAZIL REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 34 BRAZIL REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 35 BRAZIL REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 36 BRAZIL REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 37 ARGENTINA REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 38 ARGENTINA REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 39 ARGENTINA REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 40 ARGENTINA REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 41 ARGENTINA REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 42 ARGENTINA REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 43 COLOMBIA REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 44 COLOMBIA REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 45 COLOMBIA REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 46 COLOMBIA REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 47 COLOMBIA REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 48 COLOMBIA REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 49 REST OF SOUTH AMERICA REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 50 REST OF SOUTH AMERICA REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 51 REST OF SOUTH AMERICA REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 52 REST OF SOUTH AMERICA REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 53 REST OF SOUTH AMERICA REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 54 REST OF SOUTH AMERICA REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 55 ASIA-PACIFIC REACTIVE DILUENTS MARKET BY COUNTRY (USD MILLIONS) 2020-2029

TABLE 56 ASIA-PACIFIC REACTIVE DILUENTS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 57 INDIA REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 58 INDIA REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 59 INDIA REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 60 INDIA REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 61 INDIA REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 62 INDIA REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 63 CHINA REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 64 CHINA REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 65 CHINA REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 66 CHINA REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 67 CHINA REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 68 CHINA REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 69 JAPAN REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 70 JAPAN REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 71 JAPAN REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 72 JAPAN REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 73 JAPAN REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 74 JAPAN REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 75 SOUTH KOREA REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 76 SOUTH KOREA REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 77 SOUTH KOREA REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 78 SOUTH KOREA REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 79 SOUTH KOREA REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 80 SOUTH KOREA REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 81 AUSTRALIA REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 82 AUSTRALIA REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 83 AUSTRALIA REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 84 AUSTRALIA REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 85 AUSTRALIA REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 86 AUSTRALIA REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 87 SOUTH-EAST ASIA REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 88 SOUTH-EAST ASIA REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 89 SOUTH-EAST ASIA REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 90 SOUTH-EAST ASIA REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 91 SOUTH-EAST ASIA REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 92 SOUTH-EAST ASIA REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 93 REST OF ASIA PACIFIC REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 94 REST OF ASIA PACIFIC REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 95 REST OF ASIA PACIFIC REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 96 REST OF ASIA PACIFIC REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 97 REST OF ASIA PACIFIC REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 98 REST OF ASIA PACIFIC REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 99 EUROPE REACTIVE DILUENTS MARKET BY COUNTRY (USD MILLIONS) 2020-2029

TABLE 100 EUROPE REACTIVE DILUENTS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 101 GERMANY REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 102 GERMANY REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 103 GERMANY REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 104 GERMANY REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 105 GERMANY REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 106 GERMANY REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 107 UK REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 108 UK REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 109 UK REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 110 UK REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 111 UK REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 112 UK REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 113 FRANCE REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 114 FRANCE REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 115 FRANCE REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 116 FRANCE REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 117 FRANCE REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 118 FRANCE REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 119 ITALY REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 120 ITALY REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 121 ITALY REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 122 ITALY REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 123 ITALY REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 124 ITALY REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 125 SPAIN REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 126 SPAIN REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 127 SPAIN REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 128 SPAIN REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 129 SPAIN REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 130 SPAIN REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 131 RUSSIA REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 132 RUSSIA REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 133 RUSSIA REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 134 RUSSIA REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 135 RUSSIA REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 136 RUSSIA REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 137 REST OF EUROPE REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 138 REST OF EUROPE REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 139 REST OF EUROPE REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 140 REST OF EUROPE REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 141 REST OF EUROPE REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 142 REST OF EUROPE REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 143 MIDDLE EAST AND AFRICA REACTIVE DILUENTS MARKET BY COUNTRY (USD MILLIONS) 2020-2029

TABLE 144 MIDDLE EAST AND AFRICA REACTIVE DILUENTS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 145 UAE REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 146 UAE REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 147 UAE REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 148 UAE REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 149 UAE REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 150 UAE REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 151 SAUDI ARABIA REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 152 SAUDI ARABIA REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 153 SAUDI ARABIA REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 154 SAUDI ARABIA REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 155 SAUDI ARABIA REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 156 SAUDI ARABIA REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 157 SOUTH AFRICA REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 158 SOUTH AFRICA REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 159 SOUTH AFRICA REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 160 SOUTH AFRICA REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 161 SOUTH AFRICA REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 162 SOUTH AFRICA REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 163 REST OF MIDDLE EAST AND AFRICA REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 164 REST OF MIDDLE EAST AND AFRICA REACTIVE DILUENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 165 REST OF MIDDLE EAST AND AFRICA REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

TABLE 166 REST OF MIDDLE EAST AND AFRICA REACTIVE DILUENTS MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 167 REST OF MIDDLE EAST AND AFRICA REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 168 REST OF MIDDLE EAST AND AFRICA REACTIVE DILUENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL REACTIVE DILUENTS MARKET BY TYPE (USD MILLIONS) 2020-2029

FIGURE 9 GLOBAL REACTIVE DILUENTS MARKET BY END-USER (USD MILLIONS) 2020-2029

FIGURE 10 GLOBAL REACTIVE DILUENTS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

FIGURE 11 GLOBAL REACTIVE DILUENTS MARKET BY REGION (USD MILLIONS) 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA REACTIVE DILUENTS MARKET SNAPSHOT

FIGURE 14 EUROPE REACTIVE DILUENTS MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC REACTIVE DILUENTS MARKET SNAPSHOT

FIGURE 16 SOUTH AMERICA REACTIVE DILUENTS MARKET SNAPSHOT

FIGURE 17 MIDDLE EAST & AFRICA REACTIVE DILUENTS MARKET SNAPSHOT

FIGURE 18 HEXION: COMPANY SNAPSHOT

FIGURE 19 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

FIGURE 20 KUKDO CHEMICAL: COMPANY SNAPSHOT

FIGURE 21 ADITYA BIRLA CHEMICALS: COMPANY SNAPSHOT

FIGURE 22 EVONIK INDUSTRIES: COMPANY SNAPSHOT

FIGURE 23 R. COATS INKS AND RESIN PVT. LTD: COMPANY SNAPSHOT

FIGURE 24 ADEKA CORPORATIONS: COMPANY SNAPSHOT

FIGURE 25 MERCURY SYNTHETIC RESINS: COMPANY SNAPSHOT

FIGURE 26 GRASIM INDUSTRIES LTD.: COMPANY SNAPSHOT

FIGURE 27 CARGILL: COMPANY SNAPSHOT

FIGURE 28 OLIN CORPORATIONS: COMPANY SNAPSHOT

FIGURE 29 ASH CHEM: COMPANY SNAPSHOT

FIGURE 30 ADMARK POLYCOATS PVT LTD: COMPANY SNAPSHOT

FIGURE 31 CHAMPION ADVA MAT PRIVATE LIMITED: COMPANY SNAPSHOT

FIGURE 32 HINDUSTHAN SPECIALITY CHEMICALS LIMITED: COMPANY SNAPSHOT

FIGURE 33 DHINGRA PLASTIC AND PLASTISCISERS PRIVATE LIMITED: COMPANY SNAPSHOT

FAQ

The reactive diluents market size had crossed USD 952.00 Million in 2020 and will observe a CAGR of more than 5.4% up to 2029 driven by the increased use of composite materials and increase in demand for the product in adhesives and sealants, polymers, and composites, and paints and coatings.

The Asia Pacific held more than 47% of the reactive diluents market revenue share in 2020 and will witness expansion as the rising of various end-use industries, including construction, automotive, electrical & electronics, and wind energy, and the technological development of reactive diluents accelerates in countries, including China, Japan, India, and Australia.

The upcoming trends are likely rising demand for reactive diluent from the automotive, building & construction, and marine industries boosting market expansion during the projection period

The global reactive diluents market registered a CAGR of 5.4% from 2022 to 2029. Based on type, the aliphatic type of reactive diluent segment is expected to have the biggest market segment was the highest revenue contributor to the market.

The paints and coatings category application segment is also a major driver segment of the global reactive diluents market.

Asia Pacific is accounted for the highest share of the global reactive diluents market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.