| Market Size | CAGR | Dominating Region |

|---|---|---|

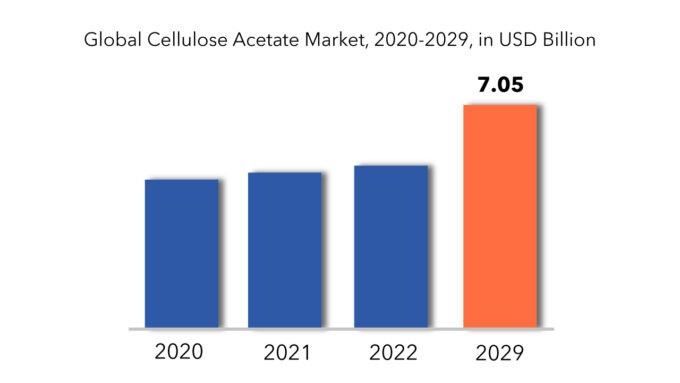

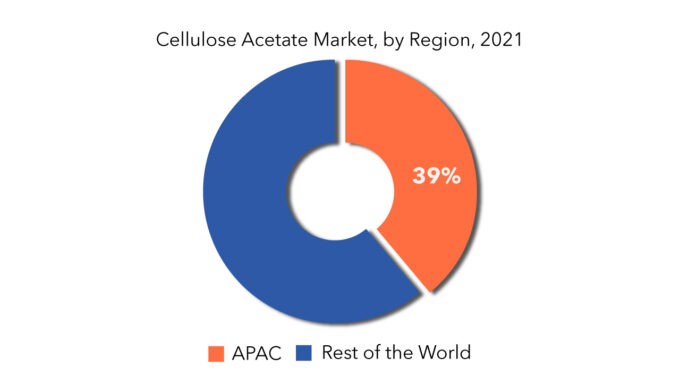

| USD 7.05 billion | 4.6% | APAC |

| By Type | By Product | By Application | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Cellulose Acetate Market Overview

The global cellulose acetate market is expected to grow at 4.6% CAGR from 2022 to 2029. It is expected to reach above USD 7.05 billion by 2029 from USD 4.7 billion in 2020.

Cellulose acetate is a chemical product produced by the reaction of cellulose with acetic acid and acetic anhydride in the presence of a catalyst (sulphuric acid). Cellulose acetate is biodegradable and is used as a replacement of plastics in various industries. The product is primarily used in the production of cigarette filter tow, as it helps in removing tar and nicotine while maintaining favorable taste to the smoker. Rising number of smokers, particularly in emerging markets such as China and India represent a key factor driving the market. Cellulose Acetate Fiber are used widely in furnishings and home bedding as well as in women apparels. Furnishings & home bedding such as upholstery, carpets, linen, bedspreads, curtains, others are produced with the use of these Fibers.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Type, By Product, By Application, By Region |

| By Type |

|

| By Product |

|

| By Application |

|

| By Region |

|

The changing trends in the fashion industry is preferably one of the major factors responsible for the growth of the global cellulose acetate market. Cellulose acetate is considered to be suitable for textile application as it is comfortable and absorbent as well as can be easily dyed in many different colors. Therefore, increase in demand in the clothing sector due to changes in preferences of the consumers in order to keep themselves trendy and upgraded to the ongoing fashion changes has created a surge in demand and is responsible for the robust growth of the textiles and apparel industry. The rising demand for environmentally friendly, biodegradable, cost-effective, and versatile cellulose acetate is also expected to boost the market growth. Cellulose acetate, which is used as a natural plastic is predicted to grow during the forecast period owing to its characteristics such as strong durability, glistened shine, lustrous texture, and high transparency. For instance, in November 2020, Celanese company launched ‘Blueridge’, a cellulose acetate product line that can be used to make objects like straws that are backyard compostable and broadly biodegradable.

Rise in demand for cellulose acetate by materials and packaging industry is the root cause for fueling up the market growth rate. Rising demand for cellulose acetate in the manufacturing of spectacle frames and growth and expansion of various end user verticals in the emerging economies will also directly and positively impact the growth rate of the market. Rising awareness about the benefits such as eco-friendliness, biodegradability, cost-efficiency, and versatility, rising expenditure for research and development proficiencies by the major companies, upsurge in the rate of industrialization and growing focus on the technological advancements and modernization in the production techniques will further carve the way for the growth of the market.

With increasing population, living standard and per capita income, the number of smokers particularly in the emerging economies such as China and India are rising at an exponential rate. Now since the cellulose acetate is primarily used in production of cigarette filter which helps in removing tar and nicotine to maintain the flavor and taste to the smoker, the market of cellulose acetate is expanding.

Cellulose Acetate Market Segment Analysis

The global cellulose acetate market is segmented based on type, product, application and region. Based on type, the cellulose acetate market is segmented into fiber and plastic. The fiber segment dominated the cellulose acetate market, accounting for the largest share of the overall cellulose acetate market in 2020. The demand for fiber-based cellulose acetates in the textile industries is majorly leading to market growth.

Cellulose acetate fiber, one of the earliest synthetic fibers, is based on cotton or tree pulp cellulose. These “cellulosic fibers” have been replaced in many applications by cheaper Petro-based fibers (nylon and polyester) in recent decades.

Based on product, the cellulose acetate market is segmented into cellulose acetate filament, cellulose ester plastics, cellulose acetate tow, cellulose acetate flakes and others. Cellulose plastics are bioplastics manufactured using cellulose or derivatives of cellulose. Cellulose plastics are manufactured using softwood trees as the basic raw material. Barks of the tree are separated and can be used as an energy source in the production. Cellulose acetate tow is a biobased cellulosic fiber, that is biodegradable in soil and under industrial and home composting conditions. Cellulose acetate flake is mostly consumed in one major application-the production of cellulose acetate fibers for conversion into cigarette filter tow and textile fibers. Cellulose acetate fibers account for the large majority of world consumption of cellulose acetate flake in 2019.

Based on application, the Cellulose acetate market is segmented into cigarette filters, textiles and apparel, photographic films, tapes and labels, extrusion & molding, film and sheet castings, surface coatings, spectacle frames, packaging, filtration, water treatment and others. textiles and apparel Therefore, increase in demand in the clothing sector due to changes in preferences of the consumers in order to keep themselves trendy and upgraded to the ongoing fashion changes has created a surge in demand and is responsible for the robust growth of the textiles and apparel industry. Cigarette filters is one of the major applications of cellulose acetate in the market. Due to its amazing filtration properties, cellulose acetate has prevailed as the filter material of choice. It also possesses superior biodegradability, which offers an advantage considering its impact on the environment.

Cellulose Acetate Market Players

The cellulose acetate market key players include BASF SE, Kemira, Ecolab, Solenis, Mitsubishi Chemical Holdings Corporation, Akzo Nobel N.V., Sappi Europe SA, Baker Hughes Company, Solvay, Dow, SNF, SUEZ, Eastman Chemical Company, Celanese Corporation, Chembond Chemicals Limited, China Tobacco., Samco, Daicel Corporation, VASU Chemicals LLP, Merck KGaA, Rayonier Advanced Materials.

To increase their market position, these businesses have implemented a variety of growth tactics. These companies are using expansion, new product development, mergers and acquisitions, and collaboration as important growth strategies to improve their product portfolio and geographical presence in order to meet the rising demand for cellulose acetate from emerging economies.

Who Should Buy? Or Key Stakeholders

- Chemicals

- Chemicals & Materials

- Institutional & retail players.

- Investment research firms

- Others

Cellulose Acetate Market Regional Analysis

The cellulose acetate market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Asia-Pacific dominates the cellulose acetate market owing to the growing demand for cellulose acetate from various end-use industries, increase in the research and development activities, favorable investment policies by the government in order to promote industrial growth, high economic growth in the emerging countries, growing textile and apparel, cigarette filters, and other applications, abundant availability of raw materials and rising investments by various public and private manufacturers in Asia Pacific.

Key Market Segments: Cellulose Acetate Market

Cellulose Acetate Market by Type, 2020-2029, (USD Million), (Thousand Units)

- Fibre

- Plastic

Cellulose Acetate Market by Product, 2020-2029, (USD Million), (Thousand Units)

- Cellulose Acetate Filament

- Cellulose Ester Plastics

- Cellulose Acetate Tow

- Cellulose Acetate Flakes

- Others

Cellulose Acetate Market by Application, 2020-2029, (USD Million), (Thousand Units)

- Cigarette Filters

- Textiles And Apparel

- Photographic Films

- Tapes And Labels

- Extrusion & Molding

- Film And Sheet Castings

- Surface Coatings

- Spectacle Frames

- Packaging

- Filtration

- Water Treatment

- Others

Cellulose Acetate Market by Region, 2020-2029, (USD Million), (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the cellulose acetate market?

- What are the key factors influencing the growth of cellulose acetate?

- What are the major applications for cellulose acetate?

- Who are the major key players in the cellulose acetate market?

- Which region will provide more business opportunities for cellulose acetate in future?

- Which segment holds the maximum share of the cellulose acetate market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Cellulose Acetate Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Cellulose Acetate Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Cellulose Acetate Market Outlook

- Global Cellulose Acetate Market by Type

- Fibre

- Plastics

- Global Cellulose Acetate Market by Product

- Cellulose Acetate Filament

- Cellulose Ester Plastics

- Cellulose Acetate Tow

- Cellulose Acetate Flakes

- Others

- Global Cellulose Acetate Market by Application

- Cigarette Filters

- Textiles and Apparel

- Photographic Films

- Tapes and Labels

- Extrusion & Molding

- Film and Sheet Castings

- Surface Coatings

- Spectacle Frames

- Packaging, Filtration

- Water treatment

- Others

- Global Cellulose Acetate Market by Region

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

-

- BASF SE

- Kemira

- Ecolab

- Solenis

- Mitsubishi Chemical Holdings Corporation

- Akzo Nobel N.V.

- Sappi Europe SA

- Baker Hughes Company

- Solvay

- Dow

- SNF

- SUEZ

- Eastman Chemical Company

- Celanese Corporation

- Chembond Chemicals Limited

- China Tobacco

- Samco

- Daicel Corporation

- VASU Chemicals LLP

- Merck KGaA

- Rayonier Advanced Materials.

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 2 GLOBAL CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 4 GLOBAL CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 6 GLOBAL CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL CELLULOSE ACETATE MARKET BY REGION (USD MILLIONS), 2020-2029

TABLE 8 GLOBAL CELLULOSE ACETATE MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 10 NORTH AMERICA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 12 NORTH AMERICA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 13 NORTH AMERICA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 14 NORTH AMERICA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 15 US CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 16 US CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 17 US CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 18 US CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 19 US CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 20 US CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 21 CANADA CELLULOSE ACETATE MARKET BY TYPE (MILLIONS), 2020-2029

TABLE 22 CANADA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 23 CANADA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 24 CANADA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 25 CANADA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 26 CANADA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 27 MEXICO CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 28 MEXICO CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 29 MEXICO CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 30 MEXICO CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 31 MEXICO CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 32 MEXICO CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 33 SOUTH AMERICA CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 34 SOUTH AMERICA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 35 SOUTH AMERICA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 36 SOUTH AMERICA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 37 SOUTH AMERICA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 38 SOUTH AMERICA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 39 BRAZIL CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 40 BRAZIL CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 BRAZIL CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 42 BRAZIL CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 43 BRAZIL CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 44 BRAZIL CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 45 ARGENTINA CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 46 ARGENTINA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 47 ARGENTINA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 48 ARGENTINA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 49 ARGENTINA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 50 ARGENTINA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 51 COLOMBIA CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 52 COLOMBIA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 53 COLOMBIA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 54 COLOMBIA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 55 COLOMBIA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 56 COLOMBIA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 57 REST OF SOUTH AMERICA CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 58 REST OF SOUTH AMERICA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 REST OF SOUTH AMERICA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 60 REST OF SOUTH AMERICA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 61 REST OF SOUTH AMERICA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 62 REST OF SOUTH AMERICA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 63 ASIA-PACIFIC CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 64 ASIA-PACIFIC CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 65 ASIA-PACIFIC CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 66 ASIA-PACIFIC CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 67 ASIA-PACIFIC CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 68 ASIA-PACIFIC CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 69 INDIA CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 70 INDIA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 71 INDIA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 72 INDIA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 73 INDIA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 74 INDIA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 75 CHINA CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 76 CHINA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 77 CHINA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 78 CHINA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 79 CHINA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 80 CHINA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 81 JAPAN CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 82 JAPAN CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 83 JAPAN CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 84 JAPAN CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 85 JAPAN CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 86 JAPAN CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 87 SOUTH KOREA CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 88 SOUTH KOREA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 SOUTH KOREA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 90 SOUTH KOREA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 91 SOUTH KOREA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 92 SOUTH KOREA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 93 AUSTRALIA CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 94 AUSTRALIA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 95 AUSTRALIA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 96 AUSTRALIA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 97 AUSTRALIA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 98 AUSTRALIA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 99 SOUTH EAST ASIA CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 100 SOUTH EAST ASIA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 101 SOUTH EAST ASIA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 102 SOUTH EAST ASIA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 103 SOUTH EAST ASIA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 104 SOUTH EAST ASIA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 105 REST OF ASIA PACIFIC CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 106 REST OF ASIA PACIFIC CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 107 REST OF ASIA PACIFIC CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 108 REST OF ASIA PACIFIC CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 109 REST OF ASIA PACIFIC CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 110 REST OF ASIA PACIFIC CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 111 EUROPE CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 112 EUROPE CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 113 EUROPE CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 114 EUROPE CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 115 EUROPE CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 116 EUROPE CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 117 GERMANY CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 118 GERMANY CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 119 GERMANY CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 120 GERMANY CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 121 GERMANY CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 122 GERMANY CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 123 UK CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 124 UK CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 125 UK CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 126 UK CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 127 UK CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 128 UK CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 129 FRANCE CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 130 FRANCE CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 131 FRANCE CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 132 FRANCE CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 133 FRANCE CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 134 FRANCE CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 135 ITALY CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 136 ITALY CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 137 ITALY CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 138 ITALY CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 139 ITALY CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 140 ITALY CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 141 SPAIN CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 142 SPAIN CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 143 SPAIN CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 144 SPAIN CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 145 SPAIN CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 146 SPAIN CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 147 RUSSIA CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 148 RUSSIA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 149 RUSSIA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 150 RUSSIA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 151 RUSSIA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 152 RUSSIA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 153 REST OF EUROPE CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 154 REST OF EUROPE CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 155 REST OF EUROPE CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 156 REST OF EUROPE CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 157 REST OF EUROPE CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 158 REST OF EUROPE CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 159 MIDDLE EAST AND AFRICA CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 160 MIDDLE EAST AND AFRICA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 161 MIDDLE EAST AND AFRICA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 162 MIDDLE EAST AND AFRICA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 163 MIDDLE EAST AND AFRICA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 164 MIDDLE EAST AND AFRICA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 165 UAE CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 166 UAE CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 167 UAE CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 168 UAE CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 169 UAE CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 170 UAE CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 171 SAUDI ARABIA CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 172 SAUDI ARABIA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 173 SAUDI ARABIA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 174 SAUDI ARABIA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 175 SAUDI ARABIA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 176 SAUDI ARABIA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 177 SOUTH AFRICA CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 178 SOUTH AFRICA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 179 SOUTH AFRICA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 180 SOUTH AFRICA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 181 SOUTH AFRICA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 182 SOUTH AFRICA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 183 REST OF MIDDLE EAST AND AFRICA CELLULOSE ACETATE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 184 REST OF MIDDLE EAST AND AFRICA CELLULOSE ACETATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 185 REST OF MIDDLE EAST AND AFRICA CELLULOSE ACETATE MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 186 REST OF MIDDLE EAST AND AFRICA CELLULOSE ACETATE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 187 REST OF MIDDLE EAST AND AFRICA CELLULOSE ACETATE MARKET BY PRODUCT (USD MILLIONS), 2020-2029

TABLE 188 REST OF MIDDLE EAST AND AFRICA CELLULOSE ACETATE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CELLULOSE ACETATE MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL CELLULOSE ACETATE MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL CELLULOSE ACETATE MARKET BY PRODUCT, USD MILLION, 2020-2029

FIGURE 11 GLOBAL CELLULOSE ACETATE MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 CELLULOSE ACETATE MARKET BY REGION 2021

FIGURE 14 MARKET SHARE ANALYSIS

FIGURE 15 BASF SE: COMPANY SNAPSHOT

FIGURE 16 KEMIRA: COMPANY SNAPSHOT

FIGURE 17 ECOLAB: COMPANY SNAPSHOT

FIGURE 18 SOLENIS: COMPANY SNAPSHOT

FIGURE 19 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: COMPANY SNAPSHOT

FIGURE 20 AKZO NOBEL N.V.: COMPANY SNAPSHOT

FIGURE 21 SAPPI EUROPE SA: COMPANY SNAPSHOT

FIGURE 22 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

FIGURE 23 SOLVAY: COMPANY SNAPSHOT

FIGURE 24 DOW: COMPANY SNAPSHOT

FIGURE 25 SNF: COMPANY SNAPSHOT

FIGURE 26 SUEZ: COMPANY SNAPSHOT

FIGURE 27 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 28 CELANESE CORPORATION: COMPANY SNAPSHOT

FIGURE 29 CHEMBOND CHEMICALS LIMITED: COMPANY SNAPSHOT

FIGURE 30 CHINA TOBACCO: COMPANY SNAPSHOT

FIGURE 31 SAMCO: COMPANY SNAPSHOT

FIGURE 32 DAICEL CORPORATION: COMPANY SNAPSHOT

FIGURE 33 VASU CHEMICALS LLP: COMPANY SNAPSHOT

FIGURE 34 MERCK KGAA: COMPANY SNAPSHOT

FIGURE 35 RAYONIER ADVANCED MATERIALS: COMPANY SNAPSHOT

FAQ

The cellulose acetate market size had crossed USD 4.7 billion in 2020 and will observe a CAGR of more than 4.6% up to 2029 driven by the rising demand in growing textiles and apparels industry.

Asia-Pacific held more than 39% of the cellulose acetate market revenue share in 2020 due to the growing demand for cellulose acetate from various end-use industries, increase in the research and development activities, favorable investment policies by the government in order to promote industrial growth, high economic growth in the emerging countries.

The upcoming trends in cellulose acetate market is the upsurge in the rate of industrialization and growing focus on the technological advancements and modernization in the production techniques.

The global cellulose acetate market registered a CAGR of 4.6% from 2022 to 2029. The fiber segment was the highest revenue contributor to the market, with 1.56 billion in 2020, and is estimated to reach 2.04 billion by 2029, with a CAGR of 4%.

Leading application of cellulose acetate market are textiles and apparel. textiles and apparel.

Asia-Pacific is expected to hold the largest market share in terms of revenue, during the forecast period. The growth is attributed to the growing demand for cellulose acetate from various end-use industries, increase in the research and development activities, favorable investment policies by the government in order to promote industrial growth, high economic growth in the emerging countries.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.