REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

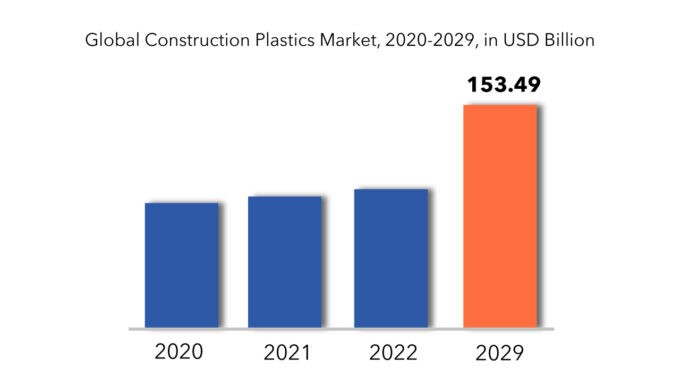

| USD 153.49 billion by 2029 | 7% | APAC |

| By Plastic Types | By Application |

|---|---|

|

|

SCOPE OF THE REPORT

Construction Plastics Market Overview

The global construction plastics market is expected to grow at 7% CAGR from 2022 to 2029. It is expected to reach above 153.49 USD billion by 2029 from 86.09 USD billion in 2020.

Construction plastics is a well-defined term that refers to a plastic polymer that has been chemically processed to produce desired goods for the construction industry. They are utilized in a variety of building applications, including cladding and roof membranes, flooring, flooring and wall coverings, cables, insulation, plumbing, and door and window panels. Plastics are utilized in building and construction due to their durability, scratch resistance, lightweight, high strength, minimal maintenance, and design flexibility. Construction plastics are rot and corrosion resistant, as well as weather resistant. Plastic is also malleable and may be extruded, bent, moulded, and 3D printed. Construction plastics are manufactured using a variety of technologies, including 3D printing, CNC machining, polymer casting, rotational molding, and many more.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million) (Kilotons) |

| Segmentation | By Plastic Type, By Application, By Region |

| By Plastic Type |

|

| By Application |

|

| By Region |

|

Due to their greater cost-effectiveness, weight-to-strength ratio, and simplicity of application, plastics are progressively displacing traditional construction materials. Massive development activity in both the residential and non-residential sectors is proving to be a key driving force for industry expansion. Increasing urbanization, the need to improve and retrofit existing housing structures, and the worldwide emphasis on recycling plastic materials have all fueled research and development of innovative plastic materials for construction.

Furthermore, demand for construction plastics is being driven by an increase in the usage of lightweight materials such as plastics. Also, plastics’ cheap cost in comparison to alternative replacement materials is also a driving element in the expansion of the building plastics industry. Growth in the construction sector, expanding urban population, and changing consumer lifestyles, particularly in emerging regions, are enhancing demand for infrastructure and, as a result, propelling the market growth of construction plastic. Plastic consumption and production are increasing due to rising demand from numerous end-user sectors, advancements in polymer manufacturing technology, and greater knowledge of the benefits of polymers such as durability, corrosion resistance, and high strength. The rising popularity of plastic pipes and tubing systems, which are mostly utilized in construction and on the exterior of buildings, is expected to provide prospective growth opportunities. Even growing bioplastic development for building and construction applications as well as increased usage of recycled plastics in construction is predicted to create attractive market opportunities.

However, strict environmental laws and regulations concerning plastic, since they pose a variety of threats to both the aquatic and terrestrial environments, are hindering market growth. The accumulation of plastic has caused a variety of environmental issues, including water contamination and soil erosion. The availability of substitutes such as metal, fiberglass, and wood are posing a threat to the expansion of the construction plastic industry. This aspect is projected to limit the expansion of the building plastic industry. Demands for circular economies and climate change mitigation are limiting the usage of some types of plastics. The presence of micro- and nano-sized plastics in marine life all around the world is leading to escalating levels of marine pollution. The presence of rigorous laws governing the use of certain plastic materials for building purposes in order to limit environmental deterioration might have an impact on demand for construction plastics.

The COVID-19 pandemic spread throughout the world and that disrupted the supply chain globally. Due to lockdown, the production process of all industries was halted, closed or diverted towards recovering the covid patients and that resulted in significant impact on construction plastics market. Now the world markets have opened-up, the government is boosting the infrastructure development and it is expected to gain potential growth in construction plastics market.

Construction Plastics Market Segment Analysis

The global construction plastics market is segmented by plastic type, application, and region.

Based on plastic type segment, the construction plastics market includes Expanded Polystyrene, Polyethylene, Polypropylene, Polyvinyl Chloride. The polyvinyl chloride is expected to be the market’s biggest segment. Polyvinyl chloride (PVC) is widely utilized in pipe applications because of its qualities such as thermal conductivity, insulation, scratch resistance, durability, design freedom, and flexibility, which are propelling the PVC market. Furthermore, the cost of alternative materials is higher as compared to PVC.

The construction plastics market can be classified based on the application that is Insulation Materials, Windows & Doors, Pipes. In the global construction plastics market, the pipes sector is predicted to account for a large revenue share. Plastic pipes account for more than half of all new pipe installations, accounting for more than half of the yearly tonnage. Plastic pipes are frequently used in plumbing, water supply, fire protection, geothermal piping systems, hydronic heating and cooling, and snow melting. Furthermore, due to their lightweight nature, plastic pipes are simple to install, operate, and maintain. These are extremely adaptable and hence aid in dealing with soil movement.

Construction Plastics Market Market Players

The global construction plastics market key players include DowDuPont, BASF SE, Asahi Kasei Corporation, LyondellBasell Industries Holdings B.V., Borealis AG, Solvay S.A., Saudi Basic Industries Corporation (SABIC), Berry Plastics Corporation, Total S.A., Formosa Plastic Group and others

Various businesses are focusing on organic growth tactics such as new launches, product approvals, and other things like patents and events. Mergers & Acquisitions, partnerships, and collaborations were among the inorganic growth tactics observed in the market. These initiatives such as developing new products and upgrading others, have paved the road for market participants to expand their business. These market players in the construction plastics market are expected to benefit from attractive growth prospects in the future.

Who Should Buy? Or Key Stakeholders

- Government and research organization

- Investors

- Trade Associations

- Chemical Industry

- Construction plastic Manufacturers

- Scientific research organization

- Construction Industry

- Others

Construction Plastics Market Regional Analysis

The construction plastics market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

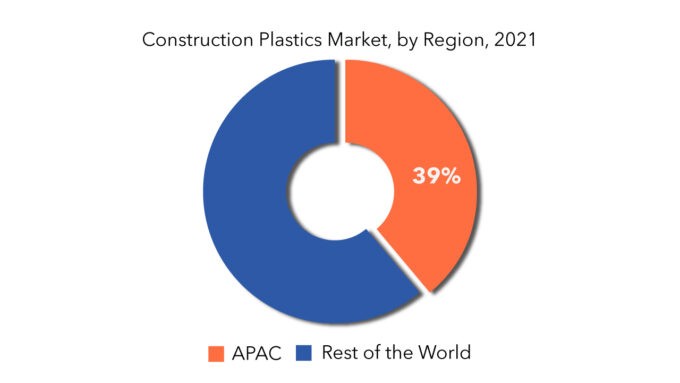

Asia Pacific has a dominating share in the global construction plastics market due to rising demand for plastics in end-users’ industry and increasing infrastructure and construction industry in the emerging nations. Followed by Europe and North American region.

Key Market Segments: Construction Plastics Market

Construction Plastics Market by Plastic Types, 2020-2029, (USD Million) (Kilotons)

- Expanded Polystyrene

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

Construction Plastics Market by Application, 2020-2029, (USD Million) (Kilotons)

- Insulation Materials

- Windows & Doors

- Pipes

Construction Plastics Market by Region, 2020-2029, (USD Million) (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important countries in all regions are covered.

Key Question Answered

- What is the current size of the construction plastics market?

- What are the key factors influencing the growth of construction plastics?

- What is the major end-use industry for construction plastics?

- Who are the major key players in the construction plastics market?

- Which region will provide more business opportunities for construction plastics in future?

- Which segment holds the maximum share of the construction plastics market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Construction Plastics Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Construction Plastics Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Construction Plastics Market Outlook

- Global Construction Plastics Market by Plastic Type

- Expanded Polystyrene

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Global Construction Plastics Market by Application

- Insulation Materials

- Windows & Doors

- Pipes

- Global Construction Plastics Market by Region

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- DOWDUPONT

- BASF SE

- ASAHI KASEI CORPORATION

- LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- BOREALIS AG

- SOLVAY S.A.

- SAUDI BASIC INDUSTRIES CORPORATION (SABIC)

- BERRY PLASTICS CORPORATION

- TOTAL S.A.

- FORMOSA PLASTIC GROUP

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL CONSTRUCTION PLASTICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL CONSTRUCTION PLASTICS MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL CONSTRUCTION PLASTICS MARKET BY REGION (KILOTONS) 2020-2029

TABLE 7 US CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 8 US CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 9 US CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 10 US CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 11 CANADA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 12 CANADA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 13 CANADA CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 14 CANADA CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 15 MEXICO CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 16 MEXICO CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 17 MEXICO CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 18 MEXICO CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 19 BRAZIL CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 20 BRAZIL CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 21 BRAZIL CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 22 BRAZIL CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 23 ARGENTINA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 24 ARGENTINA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 25 ARGENTINA CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 26 ARGENTINA CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 27 COLOMBIA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 28 COLOMBIA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 29 COLOMBIA CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 30 COLOMBIA CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 31 REST OF SOUTH AMERICA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 32 REST OF SOUTH AMERICA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 33 REST OF SOUTH AMERICA CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 34 REST OF SOUTH AMERICA CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 35 INDIA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 36 INDIA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 37 INDIA CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 38 INDIA CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 39 CHINA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 40 CHINA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 41 CHINA CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 42 CHINA CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 43 JAPAN CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 44 JAPAN CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 45 JAPAN CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 46 JAPAN CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 47 SOUTH KOREA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 48 SOUTH KOREA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 49 SOUTH KOREA CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 50 SOUTH KOREA CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 51 AUSTRALIA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 52 AUSTRALIA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 53 AUSTRALIA CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 54 AUSTRALIA CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 55 SOUTH-EAST ASIA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 56 SOUTH-EAST ASIA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 57 SOUTH-EAST ASIA CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 58 SOUTH-EAST ASIA CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 59 REST OF ASIA PACIFIC CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 60 REST OF ASIA PACIFIC CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 61 REST OF ASIA PACIFIC CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 62 REST OF ASIA PACIFIC CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 63 GERMANY CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 64 GERMANY CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 65 GERMANY CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 66 GERMANY CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 67 UK CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 68 UK CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 69 UK CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 70 UK CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 71 FRANCE CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 72 FRANCE CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 73 FRANCE CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 74 FRANCE CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 75 ITALY CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 76 ITALY CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 77 ITALY CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 ITALY CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 SPAIN CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 80 SPAIN CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 81 SPAIN CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 82 SPAIN CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 83 RUSSIA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 84 RUSSIA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 85 RUSSIA CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 86 RUSSIA CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 87 REST OF EUROPE CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 88 REST OF EUROPE CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 89 REST OF EUROPE CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 90 REST OF EUROPE CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 UAE CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 92 UAE CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 93 UAE CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 94 UAE CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 95 SAUDI ARABIA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 96 SAUDI ARABIA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 97 SAUDI ARABIA CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 98 SAUDI ARABIA CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 99 SOUTH AFRICA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 100 SOUTH AFRICA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 101 SOUTH AFRICA CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 102 SOUTH AFRICA CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 REST OF MIDDLE EAST AND AFRICA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (USD MILLIONS) 2020-2029

TABLE 104 REST OF MIDDLE EAST AND AFRICA CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE (KILOTONS) 2020-2029

TABLE 105 REST OF MIDDLE EAST AND AFRICA CONSTRUCTION PLASTICS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 106 REST OF MIDDLE EAST AND AFRICA CONSTRUCTION PLASTICS MARKET BY APPLICATION (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CONSTRUCTION PLASTICS MARKET BY PLASTIC TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL CONSTRUCTION PLASTICS MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL CONSTRUCTION PLASTICS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 NORTH AMERICA CONSTRUCTION PLASTICS MARKET SNAPSHOT

FIGURE 13 EUROPE CONSTRUCTION PLASTICS MARKET SNAPSHOT

FIGURE 14 ASIA PACIFIC CONSTRUCTION PLASTICS MARKET SNAPSHOT

FIGURE 15 SOUTH AMERICA CONSTRUCTION PLASTICS MARKET SNAPSHOT

FIGURE 16 MIDDLE EAST & AFRICA CONSTRUCTION PLASTICS MARKET SNAPSHOT

FIGURE 17 DOWDUPONT: COMPANY SNAPSHOT

FIGURE 18 BASF SE: COMPANY SNAPSHOT

FIGURE 19 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

FIGURE 20 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: COMPANY SNAPSHOT

FIGURE 21 BOREALIS AG: COMPANY SNAPSHOT

FIGURE 22 SOLVAY S.A.: COMPANY SNAPSHOT

FIGURE 23 SAUDI BASIC INDUSTRIES CORPORATION (SABIC): COMPANY SNAPSHOT

FIGURE 24 BERRY PLASTICS CORPORATION: COMPANY SNAPSHOT

FIGURE 25 TOTAL S.A.: COMPANY SNAPSHOT

FIGURE 26 FORMOSA PLASTIC GROUP: COMPANY SNAPSHOT

FAQ

The Construction Plastics market size had crossed USD 1.13 billion in 2020 and will observe a CAGR of more than 7.35% up to 2029 driven by the increase in the construction and building industry as well as recycled usage of plastic.

Asia Pacific accounted for a 39% share of the construction plastics market in 2020 and is expected to maintain its dominance during the forecast period.

Growth in the construction sector as well as advancements in polymer manufacturing technology has driven the growth in the market. Even growing bioplastic development for building and construction applications as well as increased usage of recycled plastics in construction is predicted to create attractive market opportunities. However, strict environmental laws and regulations concerning plastic, since they pose a variety of threats to both the aquatic and terrestrial environments, are hindering market growth.

Rapid industrialization and rising personal disposable incomes in the Asia Pacific area, together with rising demand for plastics from different end-use sectors such as construction, are propelling the Asia Pacific construction plastics market forward, it accounted for a large share of construction plastics market in 2020 and is expected to maintain its dominance during the forecast period.

Due to its rise in infrastructure development as well as huge chemical and polymer manufacturing, Europe is expected to have the highest CAGR in coming years.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.