REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

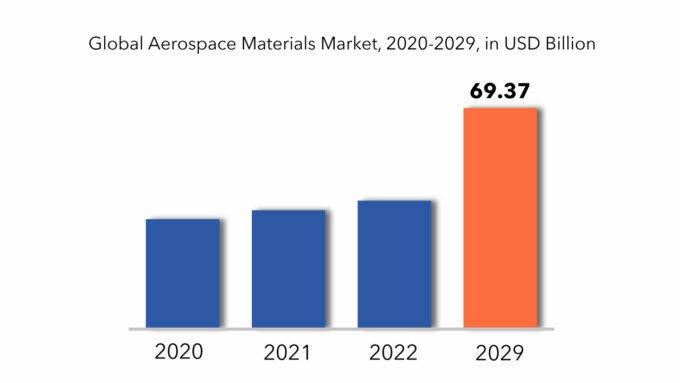

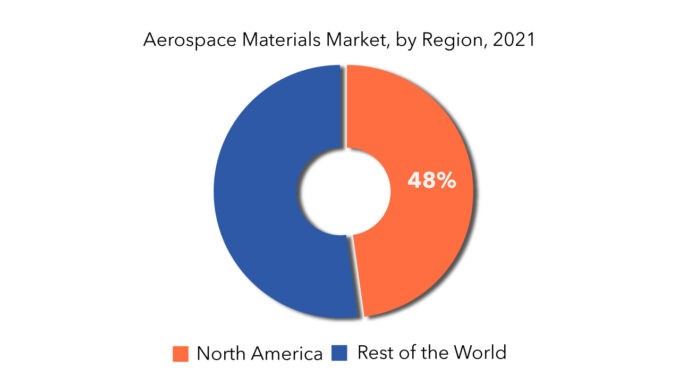

| USD 69.37 billion by 2029 | 8.1% | North America |

| By Type | By Aircraft Type |

|---|---|

|

|

SCOPE OF THE REPORT

Aerospace Materials Market Overview

The global Aerospace Materials Market is projected to reach USD 69.37 billion by 2029 from USD 34.41 billion in 2020, at a CAGR of 8.1% from 2022 to 2029.

Aerospace materials are substances used by aircraft OEMs and component manufacturers to construct various aircraft parts. The materials used in aeroplane construction have been evolving over time. Earlier flights were made of ash and spruce, with muslin covering the wings, whereas today’s airliners are largely made of aluminium, with some steel structure. Aluminum is lightweight and inexpensive, especially when compared to other composites; therefore it can provide the aeroplane with useful updated features. Greater demand for new aircraft, technological advancements, increased aircraft size, and a high replacement rate are the primary drivers for the Global Aerospace Materials Market to grow. Composite materials, aluminium alloys, and titanium alloys are employed in aeroplane construction. However, as the use of composite materials and titanium alloys expands in the new modern world of aeroplanes, demand for these materials is projected to rise in the near future. By adding sensors into composite materials, several Aerospace material vendors are highlighted in the creation of smart composite materials.

Nanocellulose, for example, contains micro-fibrillated cellulose with a very small fiber diameter, allowing Fiber Bragg grating sensors to be inserted for internal strain measurement. This cutting-edge technology aids in the detection of any material damage within sensor range.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) (Kilotons) |

| Segmentation | By Type, By Aircraft Type |

| By Type

|

|

| By Aircraft Type

|

|

| By Region

|

|

For increased revenue growth, the Aerospace Materials Market has a significant demand for more lightweight materials in aircraft components and part manufacture. When compared to materials like iron, alloys, steel, brass, and others, lightweight materials like plastics and composites are substantially lighter. Reducing the weight of aeroplane components can result in significant fuel consumption cost reductions. Furthermore, when compared to steel, plastic materials perform far better in chemically demanding situations, extending the structural frame’s longevity and reducing costly repairs due to metal component corrosion.

Carbon fiber cost reductions and advancements in advanced software tools for aerospace composites are also potential growth drivers for the market. The aerospace sector is growing on a daily basis as a result of rising air traffic in emerging nations, a growing middle-class population, and a desire for new-generation fuel-efficient aircraft. The demand for aircraft materials is likely to rise as a result of this growth. The Aerospace Materials Market is growing due to a surge in demand for composites for aeroplane parts due to their superior strength and heat-bearing capabilities. The aerospace industry’s demand for aerospace materials is increasing as aircraft production increases. Developing countries are embracing composite-based, fuel-efficient aeroplane engines. The aircraft’s operational costs are reduced as a result of the higher fuel economy. The aerospace industry’s latest technology will also boost market expansion. The growth-promoting factor is large-scale research to develop alternatives for metal alloys to overcome their limits. The utilisation of contemporary manufacturing materials will significantly improve aeroplane fuel efficiency and durability. Furthermore, the utilisation of composites and Nano fibers in the manufacture of aerospace materials will revolutionise the aviation sector.

Aerospace Materials Market Segment Analysis

The aerospace materials market is divided into aluminum alloys, steel alloys, titanium alloys, superalloys, composite materials based on type. In the worldwide aerospace material industry, aluminium alloys have the majority of the market share. For different commercial aeroplanes, aluminium is used to manufacture around 80% of the body parts. Aluminum’s advantages, such as its light weight, high strength, corrosion resistance, and heat resistance, make it a popular choice. Composites, on the other hand, are becoming more popular as new aircraft manufacturing materials in both next generation aircraft and the global market. Composite materials outperform aluminium and other metal alloys in terms of corrosion resistance and resistance to metal fatigue cracking.

The market is divided into commercial aircraft, military aircraft, business and general aviation, helicopters based on aircraft type. The commercial aircraft market category is the most popular. The widespread usage of these aircraft for a variety of reasons, such as cargo transport and passenger travel, creates enormous demand. Commercial aircraft account for roughly 75% of overall material use. The demand for commercial aircraft is increasing due to an increase in air passengers and a need for low-cost air travel.

Aerospace Materials Market Players

The major players operating in the global aerospace materials industry include Global Titanium Inc, AMETEK Inc, ArcelorMittal, NSSMC Group, Supreme Engineering Ltd, AMG Advanced Metallurgical Group, Allegheny, Incorporated (ATI), Precision Castparts Corp, Mpecial Metals, Doncasters Group Ltd. The presence of established industry players and is characterized by mergers and acquisitions, joint ventures, capacity expansions, substantial distribution, and branding decisions to improve market share and regional presence. Also, they are involved in continuous R&D activities to develop new products as well as are focused on expanding the product portfolio. This is expected to intensify competition and pose a potential threat to the new players entering the market.

Who Should Buy? Or Key stakeholders

- Research and development

- Manufacturing

- End Use industries

- Aviation sector

- Aerospace materials suppliers

- Others.

Aerospace Materials Market Regional Analysis

Geographically, the aerospace materials market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America is expected to hold the largest share of the global aerospace materials market. The increased predominance of aircraft manufacturers in this region explains this supremacy. Furthermore, considerable air trade and air travel within this region can help increase growth. In addition, the government’s large investment in the air defence system creates a large demand for aerospace materials. Europe is the aerospace materials market’s second-largest regional market. The presence of aircraft manufacturers in France, Germany, and the United Kingdom indicates a favourable response to growth. Furthermore, people’s high disposable income and propensity for air travel drive demand. The fastest-growing regional category is Asia Pacific. The growing demand for aeroplanes is being driven by a large client base for air travel and increased flight operations. A considerable rise in military air activities would also help to enhance growth.

Key Market Segments: Aerospace Materials Market

Aerospace Materials Market by Type, 2020-2029, (USD Million) (Kilotons)

- Aluminum Alloys

- Steel Alloys

- Titanium Alloys

- Superalloys

- Composite Materials

Aerospace Materials Market by Aircraft Type, 2020-2029, (USD Million) (Kilotons)

- Commercial Aircraft

- Military Aircraft

- Business And General Aviation

- Helicopters

Aerospace Materials Market by Regions, 2020-2029, (USD Million) (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the current scenario of the global aerospace materials market?

- What are the emerging technologies for the development of aerospace materials devices?

- What are the historical size and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to up their market shares?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AEROSPACE MATERIALS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AEROSPACE MATERIALS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AEROSPACE MATERIALS MARKET OUTLOOK

- GLOBAL AEROSPACE MATERIALS MARKET BY TYPE (USD MILLION) (KILOTONS)

- ALUMINUM ALLOYS

- STEEL ALLOYS

- TITANIUM ALLOYS

- SUPERALLOYS

- COMPOSITE MATERIALS

- GLOBAL AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLION) (KILOTONS)

- COMMERCIAL AIRCRAFT

- MILITARY AIRCRAFT

- BUSINESS AND GENERAL AVIATION

- HELICOPTERS

- GLOBAL AEROSPACE MATERIALS MARKET BY REGION (USD MILLION) (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- GLOBAL TITANIUM INC

- AMETEK INC

- ARCELORMITTAL

- NSSMC GROUP

- SUPREME ENGINEERING LTD

- AMG ADVANCED METALLURGICAL GROUP

- ALLEGHENY

- INCORPORATED (ATI)

- PRECISION CASTPARTS CORP *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 5 GLOBAL AEROSPACE MATERIALS MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL AEROSPACE MATERIALS MARKET BY REGION (KILOTONS) 2020-2029

TABLE 7 US AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 8 US AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 9 US AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 10 US AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 11 CANADA AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 12 CANADA AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 13 CANADA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 14 CANADA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 15 MEXICO AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 16 MEXICO AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 17 MEXICO AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 18 MEXICO AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 19 BRAZIL AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 20 BRAZIL AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 21 BRAZIL AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 22 BRAZIL AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 23 ARGENTINA AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 24 ARGENTINA AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 25 ARGENTINA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 26 ARGENTINA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 27 COLOMBIA AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 28 COLOMBIA AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 29 COLOMBIA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 30 COLOMBIA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 31 REST OF SOUTH AMERICA AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 32 REST OF SOUTH AMERICA AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 33 REST OF SOUTH AMERICA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 34 REST OF SOUTH AMERICA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 35 INDIA AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 36 INDIA AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 37 INDIA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 38 INDIA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 39 CHINA AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 40 CHINA AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 41 CHINA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 42 CHINA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 43 JAPAN AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 44 JAPAN AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 45 JAPAN AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 46 JAPAN AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 47 SOUTH KOREA AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 48 SOUTH KOREA AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 49 SOUTH KOREA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 50 SOUTH KOREA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 51 AUSTRALIA AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 52 AUSTRALIA AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 53 AUSTRALIA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 54 AUSTRALIA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 55 SOUTH-EAST ASIA AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 56 SOUTH-EAST ASIA AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 57 SOUTH-EAST ASIA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 58 SOUTH-EAST ASIA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 59 REST OF ASIA PACIFIC AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 60 REST OF ASIA PACIFIC AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 61 REST OF ASIA PACIFIC AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 62 REST OF ASIA PACIFIC AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 63 GERMANY AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 64 GERMANY AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 65 GERMANY AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 66 GERMANY AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 67 UK AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 68 UK AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 69 UK AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 70 UK AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 71 FRANCE AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 72 FRANCE AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 73 FRANCE AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 74 FRANCE AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 75 ITALY AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 76 ITALY AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 77 ITALY AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 78 ITALY AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 79 SPAIN AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 80 SPAIN AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 81 SPAIN AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 82 SPAIN AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 83 RUSSIA AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 84 RUSSIA AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 85 RUSSIA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 86 RUSSIA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 87 REST OF EUROPE AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 88 REST OF EUROPE AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 89 REST OF EUROPE AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 90 REST OF EUROPE AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 91 UAE AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 92 UAE AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 93 UAE AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 94 UAE AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 95 SAUDI ARABIA AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 96 SAUDI ARABIA AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 97 SAUDI ARABIA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 98 SAUDI ARABIA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 99 SOUTH AFRICA AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 100 SOUTH AFRICA AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 101 SOUTH AFRICA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 102 SOUTH AFRICA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 103 REST OF MIDDLE EAST AND AFRICA AEROSPACE MATERIALS MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 104 REST OF MIDDLE EAST AND AFRICA AEROSPACE MATERIALS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 105 REST OF MIDDLE EAST AND AFRICA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (USD MILLIONS) 2020-2029

TABLE 106 REST OF MIDDLE EAST AND AFRICA AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AEROSPACE MATERIALS MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL AEROSPACE MATERIALS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL AEROSPACE MATERIALS MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 13 GLOBAL AEROSPACE MATERIALS MARKET BY AIRCRAFT TYPE, USD MILLION2020-2029

FIGURE 14 AEROSPACE MATERIALS MARKET BY REGION 2020

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 GLOBAL TITANIUM INC: COMPANY SNAPSHOT

FIGURE 17 AMETEK INC: COMPANY SNAPSHOT

FIGURE 18 ARCELORMITTAL: COMPANY SNAPSHOT

FIGURE 19 NSSMC GROUP: COMPANY SNAPSHOT

FIGURE 20 SUPREME ENGINEERING LTD: COMPANY SNAPSHOT

FIGURE 21 AMG ADVANCED METALLURGICAL GROUP: COMPANY SNAPSHOT

FIGURE 22 ALLEGHENY: COMPANY SNAPSHOT

FIGURE 23 INCORPORATED (ATI): COMPANY SNAPSHOT

FIGURE 24 PRECISION CASTPARTS CORP: COMPANY SNAPSHOT

FAQ

The Aerospace Materials market size had crossed USD 34.41 Billion in 2020 and will observe a CAGR of more than 8.1% up to 2029 driven by the high demand for aircrafts from emerging economies and low-cost carriers.

The upcoming trend in Aerospace Materials market is growing UAV market generating demand for an aerospace material is an opportunity for market growth.

The global Aerospace Materials market registered a CAGR of 8.1% from 2022 to 2029. The aircraft type segment was the highest revenue contributor to the market.

North America is the largest regional market with 48% of share owning to the increased predominance of aircraft manufacturers in this region explains this supremacy.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.