REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

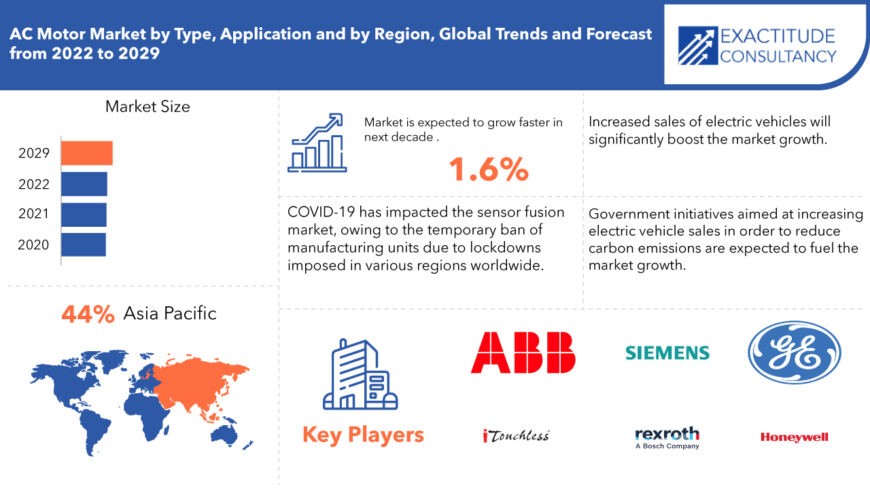

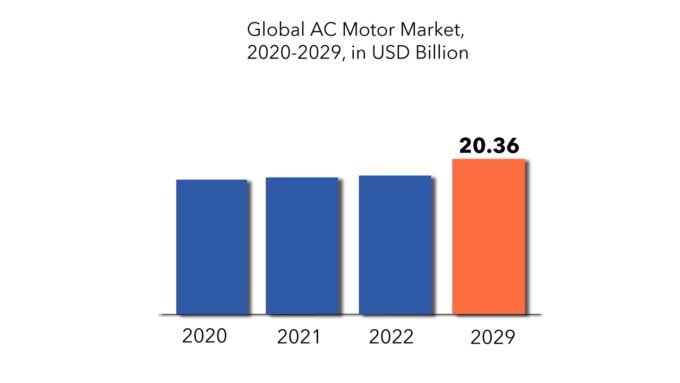

| USD 20.36 billion | 17.65% | Asia Pacific |

| By Type | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

AC Motor Market Overview

The global AC motor market is expected to grow at a 1.6 % CAGR from 2023 to 2029. It is expected to reach above USD 20.36 billion by 2029 from USD 17.65 billion in 2020.

AC motors are electric motors that are powered by alternating current (AC). The AC motor is typically composed of two basic parts: an outside stationary stator with coils supplied with alternating current to produce a rotating magnetic field, known as the stator, and an inside rotor attached to the output shaft that produces a second rotating magnetic field and output kinetic energy, known as the rotor. The development of energy-efficient systems to alleviate rising concerns about energy consumption and carbon emissions is expected to drive the global AC motors market. Companies are focusing on research activities to provide green solutions for their technologies and processes as the world’s population grows, environmental problems worsen, and energy shortages emerge. The reduction of carbon dioxide emissions in energy-efficient motors, as well as the provision of a healthier environment, are expected to be major market drivers.

Consumer appliance manufacturers are also driving up demand for energy-efficient AC motors. Energy star ratings for consumer appliances have compelled these OEMs to use more energy-efficient motors in their products. These manufacturers, in turn, demand higher efficiency AC motors from manufacturers, ultimately benefiting the market. Rising electricity prices and stringent electricity consumption standards are expected to drive up demand for energy-efficient AC motors in the near future.

| ATTRIBUTE | DETAILS |

| Study period | 2023-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Thousand Unit) |

| Segmentation | By Type, By Application, By Region |

| By Type

|

|

| By Application |

|

| By Region

|

|

Demand for consumer goods such as air conditioners, heating, ventilation, and cooling equipment, refrigerators, and washing machines may significantly drive the market. AC motors are used in compressors, small pumps, and robots in the manufacturing sector, which consumes the most energy. Furthermore, various standards and regulations imposed by governments in various countries, combined with specific parameters defined by organizations such as the IEA and NEMA, may compel the replacement of existing standard motors in various sectors, thereby increasing market demand.

Furthermore, stringent design and manufacturing standards to improve the efficiency of AC motors may encourage global manufacturers to develop energy-efficient motors, significantly fueling the market. Furthermore, increased production of home appliances, motor vehicles, and other motor-driven systems may have a positive impact on market expansion. Besides, government incentives to implement high and premium efficiency AC motors in order to reduce the financial burden on both consumers and governments are expected to boost the market.

The covid-19 outbreak forced the temporary closure of several vehicle and component manufacturing facilities. This is impeding the expansion of the automotive industry. However, with the gradual removal of vehicle lockdowns in several countries, demand for vehicles has increased slightly, which is expected to drive market growth during the forecast period.

AC Motor Market Segment Analysis

The global AC motor market is segmented based on type, application. By type, the market is bifurcated into synchronous motor and induction motor. A synchronous motor is an alternating current motor whose rotor rotation is synchronized with the frequency of the supply current. That is, the rotor’s rotation period is equal to the rotating field of the machine it is inside. Synchronous and induction motors are the most common types of three-phase motors. An electrical field is created when three-phase electric conductors are placed in specific geometrical positions. The synchronous speed is the rotational speed of the rotating magnetic field. Because the rotor of a PM rotor synchronous motor is made of permanent magnets, the designs are free of slip characteristics and operate precisely at the frequency specified by the drive.

By application, the market is divided into commercial, industrial and medical. The motor vehicle market, on the other hand, is expected to grow significantly, followed by the heating/cooling and machinery markets. This could be attributed to rising demand for electric and hybrid vehicles, as well as increased residential and commercial construction globally. Because of the presence of numerous global and regional players, the AC motors market is highly fragmented.

AC Motor Market Players

The AC motor market key players include ABB Ltd., iTouchless, Honeywell International Inc., Bosch Rexroth Ag, General Electric, Siemens AG, Regal Beloit, Simplehuman LLC, Crompton Greaves Power Efficiency Corporation, and WEG Industries.

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending in product development, which is fueling revenue generation.

Who Should Buy? Or Key stakeholders

- Automotive & Transportation Manufacturers

- Automotive Companies

- Industrial Supplier

- Motor Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

AC Motor Market Regional Analysis

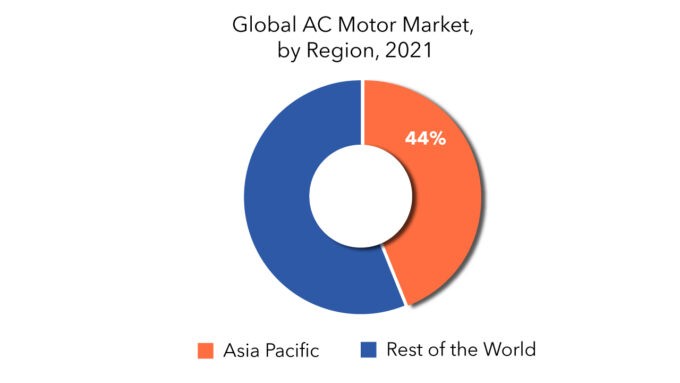

The AC motor market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The Asia Pacific region is expected to grow significantly in the coming years as a result of rising purchasing power, continuous production of AC motor-driven applications, and developing economies in India, China, Malaysia, and Indonesia. Government initiatives and incentives, combined with rising electricity consumption, are expected to drive the North American and European markets. Furthermore, several incentive programs in the United States and Europe for early replacement of inefficient electric motors may increase demand for energy-efficient AC motors. However, due to the relocation of manufacturing plants for several automobiles and electronic appliances to Asian countries, this region may not experience exponential growth.

Key Market Segments: AC motor Market

Ac Motor Market by Type, 2023-2029, (USD Billion), (Thousand Units)

- Synchronous Motor

- Induction Motor

Ac Motor Market By Application, 2023-2029, (USD Billion), (Thousand Units)

- Commercial

- Industrial

- Medical

Ac Motor Market by Region, 2023-2029, (USD Billion), (Thousand Units)

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the AC motor market?

- What are the key factors influencing the growth of AC motor?

- What are the major applications for AC motor?

- Who are the major key players in the AC motor market?

- Which region will provide more business opportunities for AC motor in future?

- Which segment holds the maximum share of the AC motor market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AC MOTOR MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AC MOTOR MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AC MOTOR MARKET OUTLOOK

- GLOBAL AC MOTOR MARKET BY TYPE, 2020-2029, (USD MILLIONS), (THOUSAND UNIT)

- SYNCHRONOUS MOTOR

- INDUCTION MOTOR

- GLOBAL AC MOTOR MARKET BY APPLICATION, 2020-2029, (USD MILLION), (THOUSAND UNIT)

- COMMERCIAL

- INDUSTRIAL

- MEDICAL

- GLOBAL AC MOTOR MARKET BY REGION, 2020-2029, (USD MILLION), (THOUSAND UNIT)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

-

-

- ABB LTD.

- ITOUCHLESS

- HONEYWELL INTERNATIONAL INC.

- GENERAL ELECTRIC

- BOSCH REXROTH AG

- SIEMENS AG

- REGAL BELOIT

- SIMPLEHUMAN LLC

- CROMPTON GREAVES POWER EFFICIENCY CORPORATION

- WEG INDUSTRIES *THE COMPANY LIST IS INDICATIVE

-

LIST OF TABLES

TABLE 1 GLOBAL AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 3 GLOBAL AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 5 GLOBAL AC MOTOR MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL AC MOTOR MARKET BY REGION (THOUSAND UNIT) 2020-2029

TABLE 7 US AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 8 US AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 9 US AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 10 US AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 11 CANADA AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 12 CANADA AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 13 CANADA AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 14 CANADA AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 15 MEXICO AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 16 MEXICO AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 17 MEXICO AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 18 MEXICO AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 19 BRAZIL AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 20 BRAZIL AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 21 BRAZIL AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 22 BRAZIL AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 23 ARGENTINA AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 24 ARGENTINA AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 25 ARGENTINA AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 26 ARGENTINA AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 27 COLOMBIA AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 28 COLOMBIA AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 29 COLOMBIA AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 30 COLOMBIA AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 31 REST OF SOUTH AMERICA AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 32 REST OF SOUTH AMERICA AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 33 REST OF SOUTH AMERICA AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 34 REST OF SOUTH AMERICA AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 35 INDIA AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 36 INDIA AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 37 INDIA AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 38 INDIA AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 39 CHINA AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 40 CHINA AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 41 CHINA AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 42 CHINA AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 43 JAPAN AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 44 JAPAN AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 45 JAPAN AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 46 JAPAN AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 47 SOUTH KOREA AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 48 SOUTH KOREA AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 49 SOUTH KOREA AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 50 SOUTH KOREA AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 51 AUSTRALIA AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 52 AUSTRALIA AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 53 AUSTRALIA AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 54 AUSTRALIA AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 55 SOUTH-EAST ASIA AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 56 SOUTH-EAST ASIA AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 57 SOUTH-EAST ASIA AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 58 SOUTH-EAST ASIA AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 59 REST OF ASIA PACIFIC AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 60 REST OF ASIA PACIFIC AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 61 REST OF ASIA PACIFIC AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 62 REST OF ASIA PACIFIC AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 63 GERMANY AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 64 GERMANY AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 65 GERMANY AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 66 GERMANY AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 67 UK AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 68 UK AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 69 UK AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 70 UK AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 71 FRANCE AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 72 FRANCE AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 73 FRANCE AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 74 FRANCE AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 75 ITALY AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 76 ITALY AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 77 ITALY AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 ITALY AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 79 SPAIN AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 80 SPAIN AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 81 SPAIN AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 82 SPAIN AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 83 RUSSIA AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 84 RUSSIA AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 85 RUSSIA AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 86 RUSSIA AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 87 REST OF EUROPE AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 88 REST OF EUROPE AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 89 REST OF EUROPE AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 90 REST OF EUROPE AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 91 UAE AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 92 UAE AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 93 UAE AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 94 UAE AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 95 SAUDI ARABIA AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 96 SAUDI ARABIA AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 97 SAUDI ARABIA AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 98 SAUDI ARABIA AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 99 SOUTH AFRICA AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 100 SOUTH AFRICA AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 101 SOUTH AFRICA AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 102 SOUTH AFRICA AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

TABLE 103 REST OF MIDDLE EAST AND AFRICA AC MOTOR MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 104 REST OF MIDDLE EAST AND AFRICA AC MOTOR MARKET BY TYPE (THOUSAND UNIT) 2020-2029

TABLE 105 REST OF MIDDLE EAST AND AFRICA AC MOTOR MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 106 REST OF MIDDLE EAST AND AFRICA AC MOTOR MARKET BY APPLICATION (THOUSAND UNIT) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AC MOTOR MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL AC MOTOR MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL AC MOTOR MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 NORTH AMERICA AC MOTOR MARKET SNAPSHOT

FIGURE 13 EUROPE AC MOTOR MARKET SNAPSHOT

FIGURE 14 SOUTH AMERICA AC MOTOR MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC AC MOTOR MARKET SNAPSHOT

FIGURE 16 MIDDLE EAST ASIA AND AFRICA AC MOTOR MARKET SNAPSHOT

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 ABB LTD.: COMPANY SNAPSHOT

FIGURE 19 ITOUCHLESS: COMPANY SNAPSHOT

FIGURE 20 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 21 GENERAL ELECTRIC: COMPANY SNAPSHOT

FIGURE 22 BOSCH REXROTH AG: COMPANY SNAPSHOT

FIGURE 23 SIEMENS AG: COMPANY SNAPSHOT

FIGURE 24 REGAL BELOIT: COMPANY SNAPSHOT

FIGURE 25 SIMPLEHUMAN LLC: COMPANY SNAPSHOT

FIGURE 26 CROMPTON GREAVES POWER EFFICIENCY CORPORATION: COMPANY SNAPSHOT

FIGURE 27 WEG INDUSTRIES: COMPANY SNAPSHOT

FAQ

The AC motor market size had crossed USD 17.65 billion in 2020 and will observe a CAGR of more than 1.6 % up to 2029 driven by the development of energy-efficient systems to alleviate rising concerns about energy consumption and carbon emissions

Asia Pacific held more than 44% of the AC motor market revenue share in 2020 and will witness expansion with the rising purchasing power, continuous production of AC motor-driven applications, and developing economies in India, China, Malaysia, and Indonesia

Companies are focusing on research activities to provide green solutions for their technologies and processes as the world’s population grows, environmental problems worsen, and energy shortages emerge.

In contrast, the motor vehicle market is expected to grow significantly, followed by the heating/cooling and machinery markets. This could be attributed to increased global residential and commercial construction, as well as rising demand for electric and hybrid vehicles. The AC motors market is highly fragmented due to the presence of numerous global and regional players.

As a result of rising purchasing power, continuous production of AC motor-driven applications, and developing economies in India, China, Malaysia, and Indonesia, the Asia Pacific region is expected to grow significantly in the coming years. The North American and European markets are expected to be driven by government initiatives and incentives, as well as rising electricity consumption.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.