REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

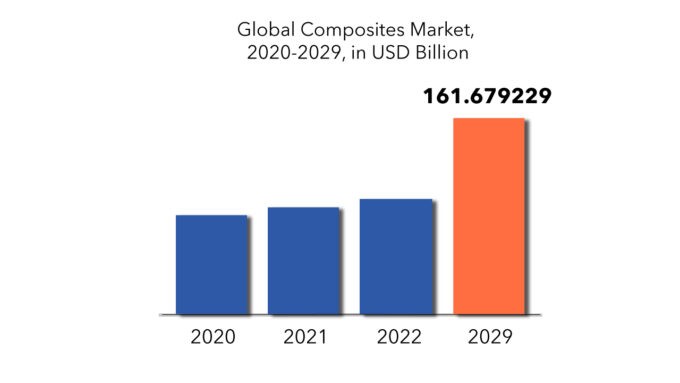

| USD 161.68 billion by 2029 | 7.9% | Asia Pacific |

| By Fiber Type | By Resin Type | By Manufacturing Process | By End-Use Industry |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Composites Market Overview

The global composites market is expected to grow at 7.9% CAGR from 2022 to 2029. It is expected to reach above USD 161.68 billion by 2029 from USD 81.56 billion in 2020.

Composite materials are manufactured by joining two or more materials with distinct characteristics together without blending or dissolving them. Composites tend to have the following characteristics like high strength; high modulus; low density; excellent resistance to fatigue, creep, creep rupture, corrosion, and wear; and low coefficient of thermal expansion (CTE).

Increasing demand for lightweight materials and fuel-efficient vehicles in the transportation industry, rising carbon fiber usage in wind blades, surging applications from construction and infrastructure appliances, and rising demand for glass fiber-reinforced composite pipes in sewage and water management are some of the factors that will boost the composites market’s growth over the forecast period.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Fiber Type, By Resin Type, By Manufacturing Process, By End Use Industry |

| By Fiber Type |

|

| By Resin Type |

|

| By Manufacturing Process |

|

| By End-Use Industry |

|

| By Region |

|

Rising applications from emerging economies in the wind and transportation sectors, adoption of natural composites, lower carbon fiber costs, and more awareness due to tight government regulations will all create new opportunities for the composites market’s growth over the forecast period. Furthermore, cyclic sectors such as automotive, pipe and tanks, and building and infrastructure are predicted to increase fast as a result of the rapid economic growth and industrialization in emerging nations, fueling demand for GFRP and CFRP.

In the projected term, high manufacturing and processing costs, recycling issues, and a lack of standardization are some of the factors restraining the composites market’s growth.

The high cost of composites has been a major source of worry as their use in structural applications has grown. Composites’ true potential has yet to be realized because to high R&D expenses, high production prices, and longer cycle times. Many applications of aircraft composites have been developed, however commercialization of these applications has yet to begin due to high costs. Developing low-cost technologies is a serious challenge for all researchers and important industries due to high R&D costs.

COVID-19 has had a negative impact on composites demand around the world due to a drop in demand from numerous end-use sectors. Aerospace and defense, being one of the largest users of composites, has seen the worst and most immediate effects of the epidemic. The airline industry has suffered the most as a result of the border closures, both international and domestic. This has had a significant impact on composites demand.

Composites Market Segment Analysis

On the basis of fiber type, the composites market is segmented into Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites. Based on resin type, the composites market is segmented into Thermoset Composites, Thermoplastic Composites Based on the manufacturing process, the composites market is segmented into Lay-Up Process, Filament Winding Process, Injection Molding Process, Pultrusion Process, Compression Molding Process, Resin Transfer Molding (RTM) Process, Other.

On the basis of end-use industry, the market is bifurcated into Transportation, Aerospace & Defence, Wind Energy, Construction & Infrastructure, Pipe & Tank, Marine, Electrical & Electronics, Others.

Carbon fiber composites hold the largest market share in the market growth. Carbon fiber reinforced polymers (CFRPs) are among the most popular products in the global composites market, because of their characteristics such as high tensile strength, fatigue resistance, and modulus. Due to its increased performance in severe environments, CFRP has a wide range of applications in aviation and component manufacture. To have the motive of lighter aircraft with lower fuel consumption, the industry is embracing composite materials. Due to their high demand in the aviation manufacturing industry, CFRPs are the primary revenue generators for companies in the worldwide composites market.

In the resin type segment, Thermoset led the composites industry. Because of their stiff interlinking molecular structure, inert chemical composition, and resistance to ultraviolet and chemical attacks, thermoset composites are extremely durable and low maintenance.

In the lay-up process, the orientation of the fibers can be changed as needed so that they can absorb the maximum amount of stress. This is a low-cost technology with benefits such as rapid fiber and resin deposition and ease of use. The lay-up method is most commonly employed to create basic enclosures and lightweight structural panels. The aerospace and defense, construction and infrastructure, wind energy, and marine end-use industries all have a high need for it.

Filament winding process is projected to experience the highest Compound Annual Growth Rate (CAGR) in the foreseeable future.

The filament winding process is experiencing a significant rise in demand within the composites manufacturing sector, evident from its impressive Compound Annual Growth Rate (CAGR). This technique, widely recognized for its effectiveness and flexibility, consists of placing continuous fibers such as carbon or glass onto a rotating mandrel in a specific arrangement. The composite structures that are produced have great strength-to-weight ratios, resistance to corrosion, and long-lasting durability, making them very ideal for various applications in multiple industries. Filament winding is experiencing rapid growth primarily due to its widespread utilization across industries such as aerospace, automotive, marine, and energy. Filament wound components, known for their lightweight design and structural integrity, are utilized in the aerospace sector for rocket motor casings, aircraft fuselages, and wings. In the same way, filament-wound tanks and pressure vessels are gaining popularity in the automotive sector for purposes like fuel storage and hydrogen fuel cell technology, enhancing fuel efficiency and environmental sustainability. In addition, filament-wound composite pipes and tanks play a crucial role in renewable energy by being key elements in the construction of solar panel structures and wind turbine blades, aiding in the efficient production and storage of clean energy. Ongoing advancements in automation, robotics, and material innovations continue to bolster the growth trajectory of the filament winding industry, offering producers enhanced efficiency, precision, and scalability.

Under the end-use industry segment, the usage of composites in the automotive and transportation industries is important due to the weight savings for a given level of strength. The automobile and rail industries are focusing on reduced vehicle weight and improving efficiency. Composites provide benefits to the transportation industry, such as fuel and cost savings, because the components are substantially lower in weight, allowing for increased fuel efficiency. Automobiles, motorcycles, and bicycles all use composite materials. Numerous sports vehicles achieve an exciting sense of speed through the use of long-lasting and lightweight composite materials such as carbon fiber. The chassis of various two-wheelers and cycles are made of composites. Furthermore, the expanding electrification of vehicles to replace traditional fuels has increased the use of composites in the automobile industry significantly.

Composites Market Players

The key players in the global composites market are Owens Corning, Toray Industries, Inc., Teijin Limited, Mitsubishi Chemical Holdings Corporation, Hexcel Corporation, SGL Group, Nippon Electrical Glass Co. Ltd., Huntsman International LLC., and Solvay.

These companies have adopted various organic as well as inorganic growth strategies to strengthen their position in the market. New product development, merger & acquisition, and expansion were among the key growth strategies adopted by these leading players to enhance their product offering and regional presence and meet the growing demand for Composites in the emerging economies

Recent Development:

In 2021, Hexcel Corporation reported that a lightweight camera drone built with Hexcel HexPly carbon fiber prepregs has successfully completed its maiden flight. A team of students from the University of Applied Sciences Upper Austria in Wels built the composite drone with composite materials supplied by Hexcel Neumarkt in Austria.

March 5, 2024 – Toray Industries, Inc., announced today that it has developed a diaper-embedded urination sensor that notifies caregivers when changes are necessary. In developing this sensor, the company used a technology to form semiconductor circuits on a flexible film that employs high-performance semiconductive carbon nanotubes composites

Feburary 15, 2024 – Toray Industries, Inc. is pleased to announce today that French subsidiary Toray Carbon Fibers Europe S.A., Italian subsidiaries Composites Materials (Italy) s.r.l. and Delta-Preg S.p.A., German subsidiary euro advanced carbon fiber composites GmbH, Hungarian subsidiary Zoltek Zrt., and UK and Dutch subsidiary Toray Advanced Composites are exhibiting 5 booths at JEC World 2024 from March 5 to 7 at Paris-Nord Villepinte, France. Toray Group will feature the full range of TORAYCA™ and Zoltek carbon fibers, prepregs, Advanced Towpreg and composite materials used in aerospace, automotive, sports and leisure, green energy and a broad range of industrial markets.

Oct 24, 2023 – Solvay, a leading global supplier of specialty materials, has announced the launch of SolvaLite® 716 FR, an innovative fast-curing epoxy prepreg system designed for a wide range of structural parts and reinforcements in premium battery electric vehicles (BEVs).

SolvaLite® 716 FR is primarily targeted at flame-retardant battery enclosure applications for premium and super-premium BEVs. It has a dry glass transition temperature (Tg) of 145°C (293 °F) and has shown to outperform aluminum and discontinuous fiber composites in practical UL 2596 flammability tests by providing protection at a wall thickness of 2mm. Beyond the automotive industry, the new material also opens up a wide potential for other components where fire safety is key to meeting general UL94 V-0 specifications.

Who Should Buy? Or Key Stakeholders

- Chemicals & Materials manufacturers

- Composites suppliers

- Investors

- Manufacturing companies

- End user companies

- Research institutes

- Others

Composites Market Regional Analysis

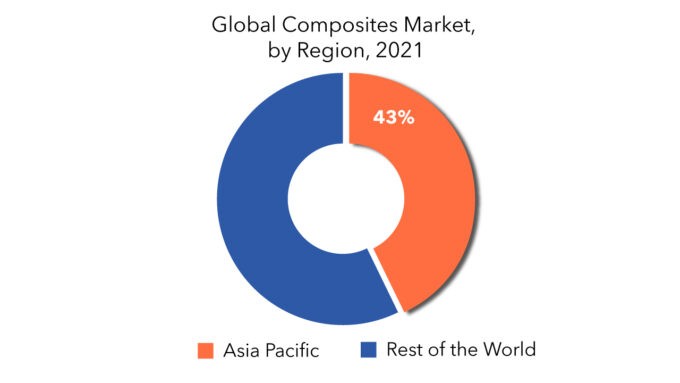

The global composites market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

APAC holds the largest share in the market growth due to increased demand for decorative concrete from China, Japan, India, and other countries, APAC is the largest composite consumer. Construction, automotive and transportation, aerospace and defense, and wind energy are among the major end-use industries for composites in the APAC market. Some of the primary reasons driving the composites market in APAC Are technological advancements, regulatory policies, and government requirements.

Key Market Segments: Global Composites Market

Global Composites Market by Fiber Type, 2020-2029, (USD Million) (Kilotons)

- Glass Fiber Composites

- Carbon Fiber Composites

- Natural Fiber Composites

Global Composites Market by Resin Type, 2020-2029, (USD Million) (Kilotons)

- Thermoset Composites

- Thermoplastic Composites

Global Composites Market by Manufacturing Process, 2020-2029, (USD Million) (Kilotons)

- Lay-Up Process

- Filament Winding Process

- Injection Molding Process

- Pultrusion Process

- Compression Molding Process

- Resin Transfer Molding (Rtm) Process

- Other

Global Composites Market By End-Use Industry, 2020-2029, (USD Million) (Kilotons)

- Transportation

- Aerospace & Defense

- Wind Energy

- Construction & Infrastructure

- Pipe & Tank

- Marine

- Electrical & Electronics

- Others

Global Composites Market by Region, 2020-2029, (USD Million) (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What are the growth opportunities related to the adoption of the composites market across major regions in the future?

- What are the new trends and advancements in the composites market?

- Which product categories are expected to have highest growth rate in the composites market?

- Which are the key factors driving the composites market?

- What will the market growth rate, growth momentum or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Composites Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Composites Market

- Global Composites Market Outlook

- Global Composites Market by Fiber Type, (USD Million) (Kilotons)

- Glass Fiber Composites

- Carbon Fiber Composites

- Natural Fiber Composites

- Global Composites Market by Resin Type, (USD Million) (Kilotons)

- Thermoset Composites

- Thermoplastic Composites

- Global Composites Market by Manufacturing Process, (USD Million) (Kilotons)

- Lay-Up Process

- Filament Winding Process

- Injection Molding Process

- Pultrusion Process

- Compression Molding Process

- Resin Transfer Molding (RTM) Process

- Global Composites Market by End-Use Industry, (USD Million) (Kilotons)

- Transportation

- Aerospace & Defense

- Wind Energy

- Construction & Infrastructure

- Pipe & Tank

- Marine

- Electrical & Electronics

- Others

- Global Composites Market by Region, (USD Million) (Kilotons)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle- East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle- East and Africa

- Company Profiles* (Business Overview, Company Snapshot, product Types Offered, Recent Developments)

- Owens Corning

- Toray Industries, Inc.

- Teijin Limited

- Mitsubishi Chemical Holdings Corporation

- Hexcel Corporation

- SGL Group

- Nippon Electrical Glass Co. Ltd.

- Huntsman International LLC.

- Solvay *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 2 GLOBAL COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 4 GLOBAL COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 5 GLOBAL COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 6 GLOBAL COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 7 GLOBAL COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 8 GLOBAL COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 9 GLOBAL COMPOSITES BY REGION (USD MILLIONS), 2020-2029

TABLE 10 GLOBAL COMPOSITES BY REGION (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA COMPOSITES BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 12 NORTH AMERICA COMPOSITES BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 NORTH AMERICA COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 14 NORTH AMERICA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 15 NORTH AMERICA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 16 NORTH AMERICA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 17 NORTH AMERICA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 18 NORTH AMERICA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 19 NORTH AMERICA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 20 NORTH AMERICA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 21 US COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 22 US COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 23 US COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 24 US COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 25 US COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 26 US COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 27 US COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 28 US COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 29 CANADA COMPOSITES BY FIBER TYPE (MILLIONS), 2020-2029

TABLE 30 CANADA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 31 CANADA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 32 CANADA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 33 CANADA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 34 CANADA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 35 CANADA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 36 CANADA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 37 MEXICO COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 38 MEXICO COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 39 MEXICO COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 40 MEXICO COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 41 MEXICO COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 42 MEXICO COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 43 MEXICO COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 44 MEXICO COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 45 SOUTH AMERICA COMPOSITES BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 46 SOUTH AMERICA COMPOSITES BY COUNTRY (KILOTONS), 2020-2029

TABLE 47 SOUTH AMERICA COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 48 SOUTH AMERICA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 49 SOUTH AMERICA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 50 SOUTH AMERICA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 51 SOUTH AMERICA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 52 SOUTH AMERICA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 53 SOUTH AMERICA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 54 SOUTH AMERICA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 55 BRAZIL COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 56 BRAZIL COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 57 BRAZIL COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 58 BRAZIL COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 59 BRAZIL COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 60 BRAZIL COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 61 BRAZIL COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 62 BRAZIL COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 63 ARGENTINA COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 64 ARGENTINA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 65 ARGENTINA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 66 ARGENTINA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 67 ARGENTINA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 68 ARGENTINA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 69 ARGENTINA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 70 ARGENTINA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 71 COLOMBIA COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 72 COLOMBIA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 73 COLOMBIA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 74 COLOMBIA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 75 COLOMBIA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 76 COLOMBIA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 77 COLOMBIA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 78 COLOMBIA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 79 REST OF SOUTH AMERICA COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 80 REST OF SOUTH AMERICA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 81 REST OF SOUTH AMERICA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 82 REST OF SOUTH AMERICA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 83 REST OF SOUTH AMERICA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 84 REST OF SOUTH AMERICA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 85 REST OF SOUTH AMERICA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 86 REST OF SOUTH AMERICA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 87 ASIA-PACIFIC COMPOSITES BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 88 ASIA-PACIFIC COMPOSITES BY COUNTRY (KILOTONS), 2020-2029

TABLE 89 ASIA-PACIFIC COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 90 ASIA-PACIFIC COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 91 ASIA-PACIFIC COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 92 ASIA-PACIFIC COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 93 ASIA-PACIFIC COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 94 ASIA-PACIFIC COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 95 ASIA-PACIFIC COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 96 ASIA-PACIFIC COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 97 INDIA COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 98 INDIA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 99 INDIA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 100 INDIA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 101 INDIA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 102 INDIA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 103 INDIA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 104 INDIA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 105 CHINA COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 106 CHINA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 107 CHINA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 108 CHINA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 109 CHINA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 110 CHINA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 111 CHINA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 112 CHINA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 113 JAPAN COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 114 JAPAN COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 115 JAPAN COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 116 JAPAN COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 117 JAPAN COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 118 JAPAN COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 119 JAPAN COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 120 JAPAN COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 121 SOUTH KOREA COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 122 SOUTH KOREA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 123 SOUTH KOREA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 124 SOUTH KOREA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 125 SOUTH KOREA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 126 SOUTH KOREA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 127 SOUTH KOREA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 128 SOUTH KOREA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 129 AUSTRALIA COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 130 AUSTRALIA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 131 AUSTRALIA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 132 AUSTRALIA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 133 AUSTRALIA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 134 AUSTRALIA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 135 AUSTRALIA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 136 AUSTRALIA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 137 SOUTH EAST ASIA COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 138 SOUTH EAST ASIA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 139 SOUTH EAST ASIA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 140 SOUTH EAST ASIA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 141 SOUTH EAST ASIA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 142 SOUTH EAST ASIA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 143 SOUTH EAST ASIA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 144 SOUTH EAST ASIA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 145 REST OF ASIA PACIFIC COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 146 REST OF ASIA PACIFIC COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 147 REST OF ASIA PACIFIC COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 148 REST OF ASIA PACIFIC COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 149 REST OF ASIA PACIFIC COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 150 REST OF ASIA PACIFIC COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 151 REST OF ASIA PACIFIC COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 152 REST OF ASIA PACIFIC COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 153 EUROPE COMPOSITES BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 154 EUROPE COMPOSITES BY COUNTRY (KILOTONS), 2020-2029

TABLE 155 EUROPE COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 156 EUROPE COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 157 EUROPE COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 158 EUROPE COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 159 EUROPE COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 160 EUROPE COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 161 EUROPE COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 162 EUROPE COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 163 GERMANY COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 164 GERMANY COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 165 GERMANY COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 166 GERMANY COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 167 GERMANY COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 168 GERMANY COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 169 GERMANY COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 170 GERMANY COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 171 UK COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 172 UK COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 173 UK COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 174 UK COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 175 UK COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 176 UK COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 177 UK COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 178 UK COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 179 FRANCE COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 180 FRANCE COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 181 FRANCE COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 182 FRANCE COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 183 FRANCE COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 184 FRANCE COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 185 FRANCE COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 186 FRANCE COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 187 ITALY COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 188 ITALY COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 189 ITALY COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 190 ITALY COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 191 ITALY COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 192 ITALY COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 193 ITALY COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 194 ITALY COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 195 SPAIN COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 196 SPAIN COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 197 SPAIN COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 198 SPAIN COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 199 SPAIN COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 200 SPAIN COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 201 SPAIN COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 202 SPAIN COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 203 RUSSIA COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 204 RUSSIA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 205 RUSSIA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 206 RUSSIA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 207 RUSSIA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 208 RUSSIA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 209 RUSSIA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 210 RUSSIA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 211 REST OF EUROPE COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 212 REST OF EUROPE COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 213 REST OF EUROPE COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 214 REST OF EUROPE COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 215 REST OF EUROPE COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 216 REST OF EUROPE COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 217 REST OF EUROPE COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 218 REST OF EUROPE COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA COMPOSITES BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA COMPOSITES BY COUNTRY (KILOTONS), 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 229 UAE COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 230 UAE COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 231 UAE COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 232 UAE COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 233 UAE COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 234 UAE COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 235 UAE COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 236 UAE COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 237 SAUDI ARABIA COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 238 SAUDI ARABIA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 239 SAUDI ARABIA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 240 SAUDI ARABIA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 241 SAUDI ARABIA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 242 SAUDI ARABIA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 243 SAUDI ARABIA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 244 SAUDI ARABIA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 245 SOUTH AFRICA COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 246 SOUTH AFRICA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 247 SOUTH AFRICA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 248 SOUTH AFRICA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 249 SOUTH AFRICA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 250 SOUTH AFRICA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 251 SOUTH AFRICA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 252 SOUTH AFRICA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA COMPOSITES BY FIBER TYPE (USD MILLIONS), 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA COMPOSITES BY FIBER TYPE (KILOTONS), 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA COMPOSITES BY RESIN TYPE (USD MILLIONS), 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA COMPOSITES BY RESIN TYPE (KILOTONS), 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA COMPOSITES BY MANUFACTURING PROCESS (USD MILLIONS), 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA COMPOSITES BY MANUFACTURING PROCESS (KILOTONS), 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA COMPOSITES BY END-USE INDUSTRY (USD MILLIONS), 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA COMPOSITES BY END-USE INDUSTRY (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL COMPOSITES MARKET BY FIBER TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL COMPOSITES MARKET BY RESIN TYPE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL COMPOSITES MARKET BY MANUFACTURING PROCESS, USD MILLION, 2020-2029

FIGURE 10 GLOBAL COMPOSITES MARKET BY END-USE INDUSTRY, USD MILLION, 2020-2029

FIGURE 11 GLOBAL COMPOSITES MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 8 GLOBAL COMPOSITES MARKET BY FIBER TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL COMPOSITES MARKET BY RESIN TYPE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL COMPOSITES MARKET BY MANUFACTURING PROCESS, USD MILLION, 2020-2029

FIGURE 10 GLOBAL COMPOSITES MARKET BY END-USE INDUSTRY, USD MILLION, 2020-2029

FIGURE 11 GLOBAL COMPOSITES MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 17 COMPOSITES MARKET BY REGION 2021

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 OWENS CORNING: COMPANY SNAPSHOT

FIGURE 20 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

FIGURE 21 TEIJIN LIMITED: COMPANY SNAPSHOT

FIGURE 22 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: COMPANY SNAPSHOT

FIGURE 23 HEXCEL CORPORATION: COMPANY SNAPSHOT

FIGURE 24 SGL GROUP: COMPANY SNAPSHOT

FIGURE 25 NIPPON ELECTRICAL GLASS CO. LTD: COMPANY SNAPSHOT

FIGURE 26 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

FIGURE 27 SOLVAY: COMPANY SNAPSHOT

FAQ

The composites market size had crossed 81.56 billion in 2020 and will observe a CAGR of more than 5% up to 2029 driven by Increasing demand for lightweight materials and fuel-efficient vehicles in the transportation industry.

North America held more than 20% of the composites market revenue share in 2020 and is growing because of the Construction, automotive and transportation industry.

The upcoming trends in composites market is in the textile and apparel industry.

The global composites market registered a CAGR of 7.9 % from 2022 to 2029. The glass fiber composites segment was the highest revenue contributor to the market.

The have usage in lightweight and fuel-efficient vehicles in the transportation industry.

APAC is the largest regional market for composites market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.