REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

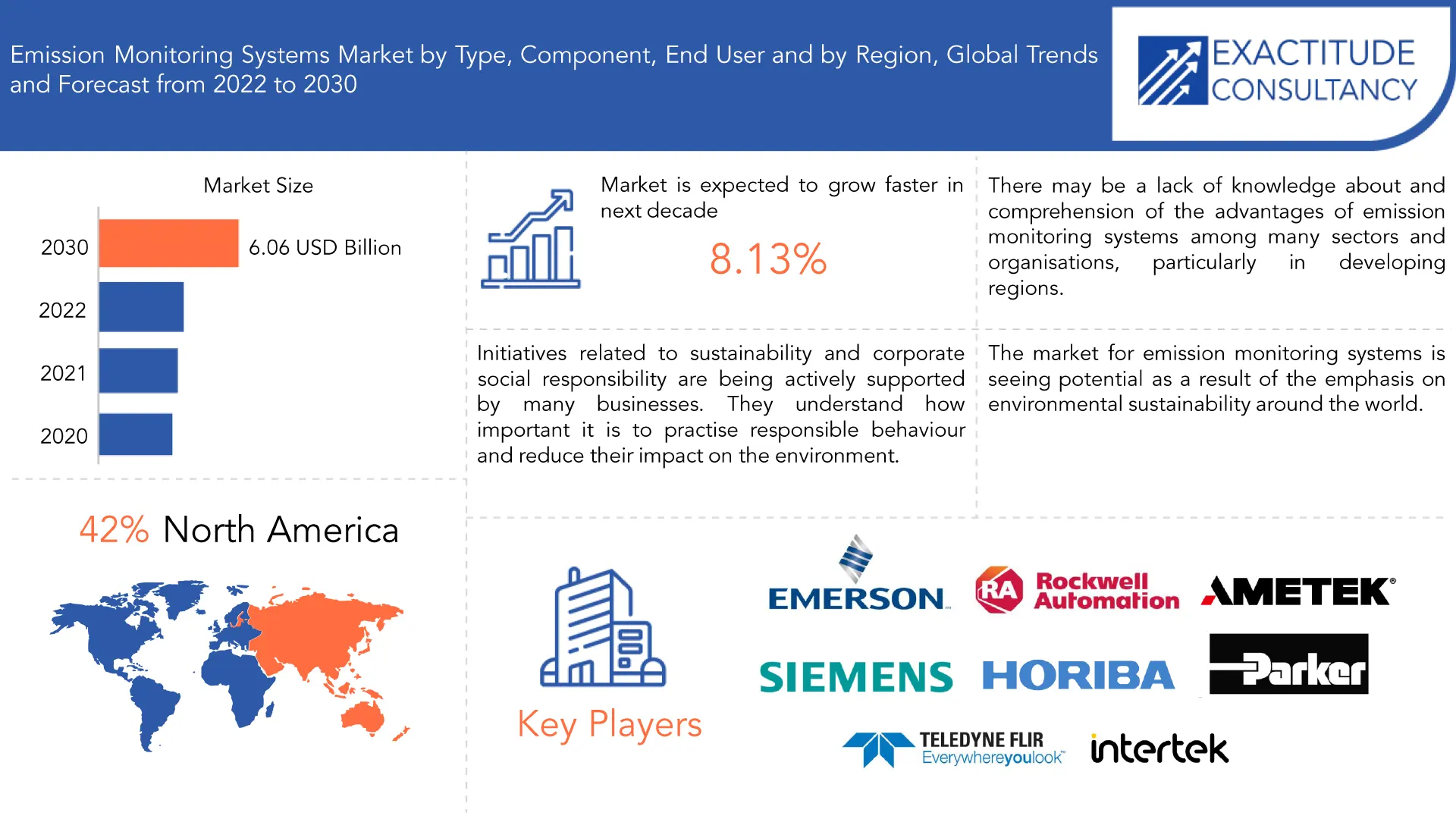

| USD 6.06 Billion by 2029 | 8.13% | North America |

| by Type | by Component | by End User | by Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Emission Monitoring Systems Market Overview

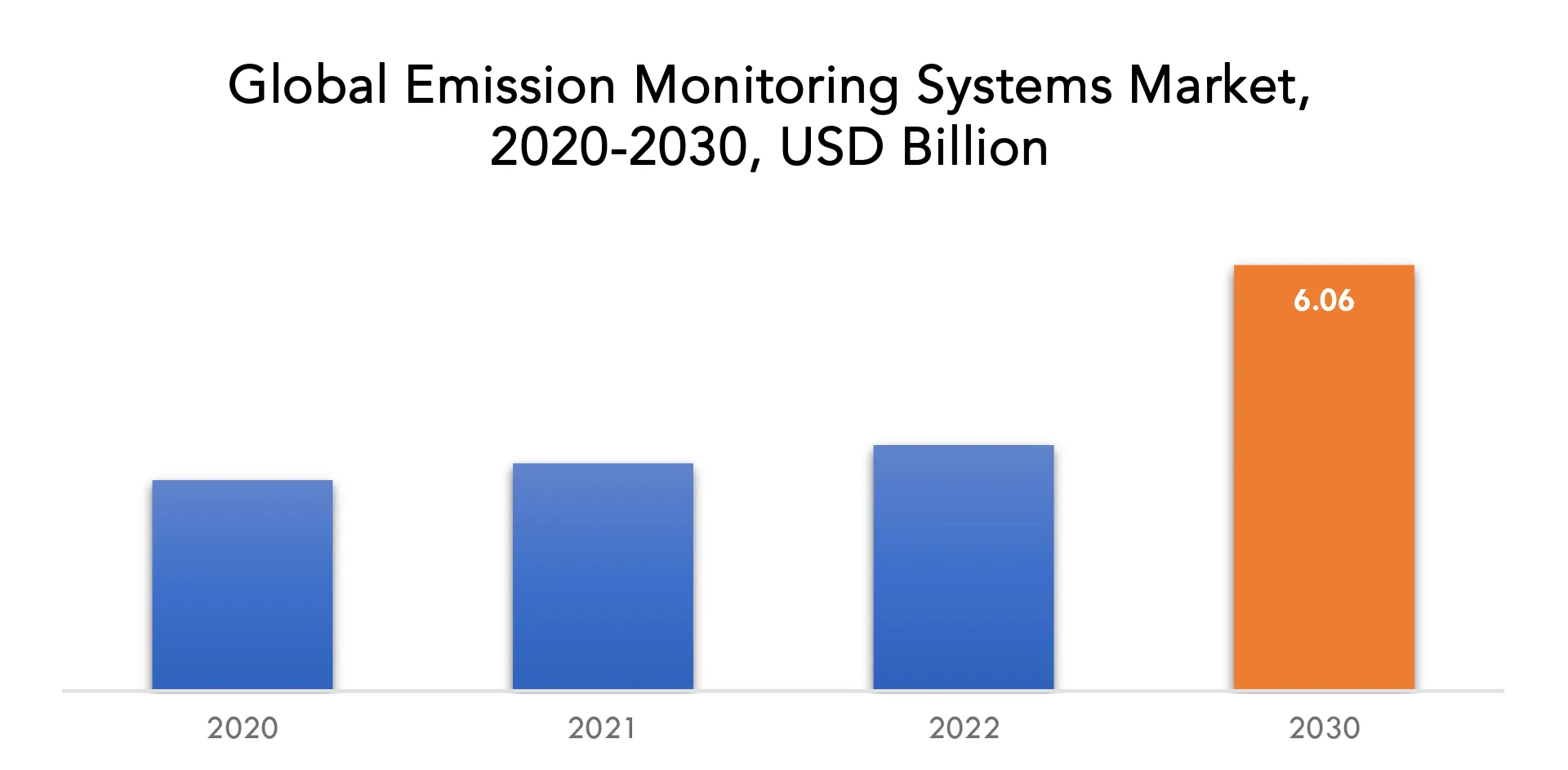

The emission monitoring systems market is expected to grow at 8.13% CAGR from 2021 to 2029. It is expected to reach above USD 6.06 Billion by 2029 from USD 3 Billion in 2020.

The installation of emission monitoring systems in industrial facilities and their intensive use for a variety of industrial objectives to control the emissions released from those industries. The hardware used in emission monitoring systems is diverse and includes things like gas analyzers, filters, and software to record the data produced. The development of the Emission Monitoring System sector has been fueled by the strict laws that are imposed by the governments of various nations, conclaves, and the awareness that organisations in these nations have raised about environmental protection.

During the projected period, rising reliance on coal-fired power plants to produce energy is anticipated to fuel market growth for worldwide emission monitoring systems. Many nations still rely heavily on coal-fired power plants to produce their electricity. Numerous airborne pollutants, including sulphur dioxide, mercury, lead, nitrogen oxides, particulates, and other heavy metals, are released when coal is burned. Injurious health effects from prolonged exposure to these contaminants include breathing problems, brain damage, asthma, heart issues, cancer, and early demise. Since it measures the concentration of harmful gases or particulates generated from the plant and other industrial operations, the emission monitoring system is essential to energy harvesting system. In turn, this guarantees that emission is constrained to allowed standards.

Burning coal releases, a variety of airborne pollutants, such as sulphur dioxide, mercury, lead, nitrogen oxides, particulates, and other heavy metals. Prolonged exposure to these toxins can have harmful health effects, such as breathing difficulties, brain damage, asthma, heart problems, cancer, and early death. The emission monitoring system is essential in reducing carbon emissions as it measures the concentration of toxic gases or particulate matter produced from the plant and other industrial activities. This ensures that emission is limited to permitted criteria in turn. Emission Monitoring System (EMS) market expansion is predicted to be fueled by strict emission laws put into place in Europe and North America. Many countries have implemented stringent guidelines and norms for carbon emissions in industrialized areas like North America and Europe.

The global market for emission monitoring systems has been affected by the COVID-19 pandemic outbreak in both positive and bad ways. The control system can be connected to an emission monitoring system using industry-standard protocols to obtain real-time process data for estimating emissions. Due to the widespread adoption of national lockout policies, the market saw a brief halt in economic activity. However, efficient monitoring and analysis of the environment’s quality has been made possible through emission monitoring systems. In reality, EMS is now being used by numerous organisations and environmental agencies to identify, track, and evaluate environmental pollution levels. As more and more organisations use EMS solutions, the negative effects of COVID-19 are only temporary.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Volume (Thousand Units) |

| Segmentation | By Type, By Component, By End User, By Region |

| By Type

|

|

| By Component

|

|

| By End User

|

|

| By Region

|

|

Emission monitoring systems Market Segment Analysis

The emission monitoring systems market is segmented based on type, component, end user and region.

Based on type, the market is segmented into continuous emission monitoring system (CEMS), predictive emission monitoring system (PEMS). Numerous international environmental regulatory bodies employ the continuous emission monitoring system (CEMS), a piece of well-established technology, to monitor pollutant discharge rates. The predictive emission monitoring system (PEMS), a software-based system, makes use of mathematical or statistical models based on previous operations and emission data generated by plant control systems and current emissions monitoring systems. It is quite accurate and has around half the capital and lifecycle costs. It is less expensive (CEMS) compared to a continuous emission monitoring system.

Based on component, the market is segmented into hardware, software, services. A major share of the market is dominated by the Hardware segment. Depending on the kind, different hardware parts are required for emissions monitoring systems. Since software-based predictive emission monitoring systems are less prevalent in the market for emission monitoring systems, hardware becomes more crucial to the system’s performance. The three subcategories under which the Services segment is classified are installation and deployment, instruction and help, and maintenance of the emission monitoring systems.

Based on end user, the market is segmented into power plant & combustion, oil & gas, chemicals & fertilizers, petrochemicals, refineries, metals & mining, pulp & paper, pharmaceuticals. The Oil & Gas industry holds a major share of the market. As a result of their restricted rates, which were imposed by the government to manage pollution, it is maintained by the emission monitoring system. The expansion of the global infrastructure for the production of natural gas and crude oil, as well as the proliferation of power generation facilities, are driving up demand for the market’s Oil & Gas segment. It is taken care of by the emission monitoring system.

Emission Monitoring Systems Market Players

The emission monitoring systems market Key players include ABB, Emerson Electric Co., AMETEK Inc., Siemens AG, General Electric Company, Rockwell Automation, Inc., Parker Hannifin Corporation, Teledyne Technologies, Inc., Sick AG, Thermo Fisher Scientific Inc., Horiba Ltd., Intertek Group Plc., Envea, Advanced Emissions Solutions Inc., Baker Hughes.

09 September, 2021: Emerson announced the new RosemountTM XE10 Continuous Emissions Monitoring System (CEMS), designed to help industrial plants meet increasingly stringent environmental regulations and evolving sustainability demands.

03 May, 2023: ABB announced completion of acquisition of the Siemens low voltage NEMA motor business.

Who Should Buy? Or Key Stakeholders

- Industrial Organizations

- Environmental Consultants & Service Providers

- Technology Providers

- Government & Regional Agencies

- Research Organizations

- Investors

- Regulatory Authorities

Emission Monitoring Systems Market Regional Analysis

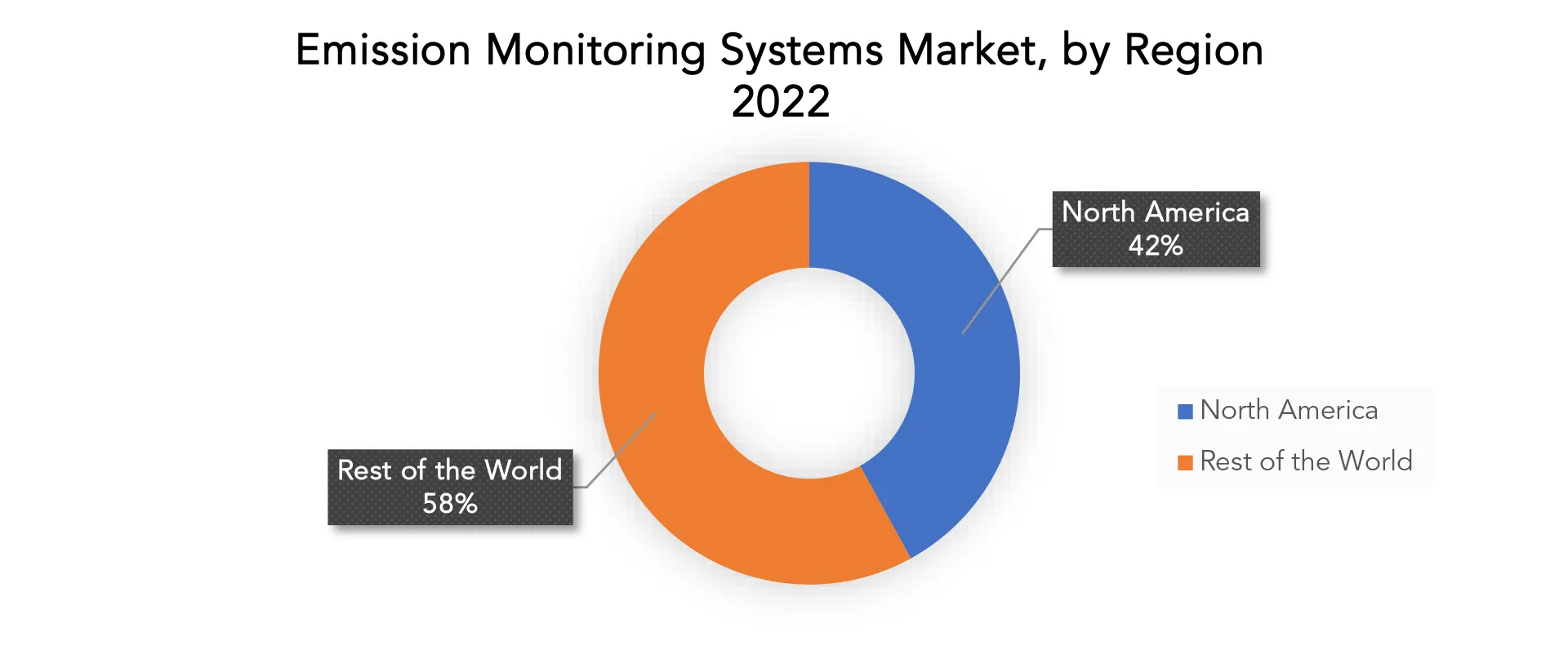

The emission monitoring systems market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America will continue to dominate the Emission Monitoring Systems Market in the estimated period. Environmental regulations that are well-established and strict are in place in North America, and mainly the US, with the goal of regulating and lowering emissions. The adoption of emission monitoring systems across numerous industries has been influenced by these restrictions, including the Clean Air Act and state-specific emission standards. Leading technology companies and creators of pollution monitoring systems can be found in North America. In the area, remote sensing capabilities, data analytics, and monitoring technologies have all advanced significantly. These developments in technology have helped the market in the area expand and gain supremacy. Although North America has dominated the global market for emission monitoring systems, it’s crucial to remember that other areas, including Europe and Asia Pacific, are also expanding significantly and have their own unique market dynamics. Regional supremacy can change depending on elements including local laws, industrial make-up, technological development, and market dynamics.

The Asia Pacific region had the Emission Monitoring Systems Market’s fastest expansion in 2021 and will continue in the projected period. Countries like China, India, and Southeast Asian countries have experienced tremendous industrialization in the Asia Pacific area. Emissions from a number of industries, including manufacturing, transportation, and power generation, have significantly increased as a result of this industrial boom. To ensure adherence to environmental rules and lessen the environmental impact of industrial activities, there has been an increase in demand for emission monitoring systems.

Key Market Segments: Emission Monitoring Systems Market

Emission Monitoring Systems Market by Type, 2020-2029, (USD Billion, Thousand Units)

- Continuous Emission Monitoring System (CEMS)

- Predictive Emission Monitoring System (PEMS)

Emission Monitoring Systems Market by Component, 2020-2029, (USD Billion, Thousand Units)

- Hardware

- Software

- Services

Emission Monitoring Systems Market by End User, 2020-2029, (USD Billion, Thousand Units)

- Power Plant & Combustion

- Oil & Gas

- Chemicals & Fertilizers

- Petrochemicals

- Refineries

- Metals & Mining

- Pulp & Paper

- Pharmaceuticals

Emission Monitoring Systems Market by Region, 2020-2029, (USD Billion, Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing Sales And Market Share

- Developing New Component

- Improving Profitability

- Entering New Markets

- Enhancing Brand Reputation

Key Question Answered

- What is the expected growth rate of the emission monitoring systems market over the next 7 years?

- Who are the major players in the emission monitoring systems market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the emission monitoring systems market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the emission monitoring systems market?

- What is the current and forecasted size and growth rate of the global emission monitoring systems market?

- What are the key drivers of growth in the emission monitoring systems market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the emission monitoring systems market?

- What are the technological advancements and innovations in the emission monitoring systems market and their impact on component development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the emission monitoring systems market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the emission monitoring systems market?

- What are the product offering and specifications of leading players in the market?

- What is the pricing trend of emission monitoring systems in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL EMISSION MONITORING SYSTEMS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON EMISSION MONITORING SYSTEMS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL EMISSION MONITORING SYSTEMS MARKET OUTLOOK

- GLOBAL EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION, THOUSAND UNITS), 2020-2029

- CONTINUOUS EMISSION MONITORING SYSTEM (CEMS)

- PREDICTIVE EMISSION MONITORING SYSTEM (PEMS)

- GLOBAL EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION, THOUSAND UNITS), 2020-2029

- HARDWARE

- SOFTWARE

- SERVICES

- GLOBAL EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION, THOUSAND UNITS), 2020-2029

- POWER PLANT & COMBUSTION

- OIL & GAS

- CHEMICALS & FERTILIZERS

- PETROCHEMICALS

- REFINERIES

- METALS & MINING

- PULP & PAPER

- PHARMACEUTICALS

- GLOBAL EMISSION MONITORING SYSTEMS MARKET BY REGION (USD BILLION, THOUSAND UNITS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ABB

- EMERSON ELECTRIC CO.

- AMETEK INC.

- SIEMENS AG

- GENERAL ELECTRIC COMPANY

- ROCKWELL AUTOMATION, INC.

- PARKER HANNIFIN CORPORATION

- TELEDYNE TECHNOLOGIES, INC.

- SICK AG

- THERMO FISHER SCIENTIFIC INC.

- HORIBA LTD.

- INTERTEK GROUP PLC.

- ENVEA

- ADVANCED EMISSIONS SOLUTIONS INC.

- BAKER HUGHES

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 4 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 6 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 7 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 9 NORTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 11 NORTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 13 NORTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 15 NORTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 17 US EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 18 US EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 19 US EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 20 US EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 21 US EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 22 US EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 23 CANADA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 24 CANADA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 25 CANADA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 26 CANADA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 27 CANADA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 28 CANADA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 29 MEXICO EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 30 MEXICO EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 31 MEXICO EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 32 MEXICO EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 33 MEXICO EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 34 MEXICO EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 35 SOUTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 37 SOUTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 39 SOUTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 41 SOUTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 43 BRAZIL EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 44 BRAZIL EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 45 BRAZIL EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 46 BRAZIL EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 47 BRAZIL EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 48 BRAZIL EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 49 ARGENTINA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 50 ARGENTINA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 51 ARGENTINA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 52 ARGENTINA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 53 ARGENTINA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 54 ARGENTINA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 55 COLOMBIA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 56 COLOMBIA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 57 COLOMBIA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 58 COLOMBIA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 59 COLOMBIA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 60 COLOMBIA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 67 ASIA-PACIFIC EMISSION MONITORING SYSTEMS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC EMISSION MONITORING SYSTEMS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 69 ASIA-PACIFIC EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 71 ASIA-PACIFIC EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 73 ASIA-PACIFIC EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 75 INDIA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 76 INDIA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 77 INDIA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 78 INDIA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 79 INDIA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 80 INDIA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 81 CHINA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 82 CHINA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 83 CHINA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 84 CHINA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 85 CHINA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 86 CHINA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 87 JAPAN EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 88 JAPAN EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 89 JAPAN EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 90 JAPAN EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 91 JAPAN EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 92 JAPAN EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 93 SOUTH KOREA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 95 SOUTH KOREA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 97 SOUTH KOREA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 99 AUSTRALIA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 101 AUSTRALIA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 103 AUSTRALIA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 105 SOUTH-EAST ASIA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 107 SOUTH-EAST ASIA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 109 SOUTH-EAST ASIA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 117 EUROPE EMISSION MONITORING SYSTEMS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE EMISSION MONITORING SYSTEMS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 119 EUROPE EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 120 EUROPE EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 121 EUROPE EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 122 EUROPE EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 123 EUROPE EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 124 EUROPE EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 125 GERMANY EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 126 GERMANY EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 127 GERMANY EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 128 GERMANY EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 129 GERMANY EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 130 GERMANY EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 131 UK EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 132 UK EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 133 UK EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 134 UK EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 135 UK EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 136 UK EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 137 FRANCE EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 138 FRANCE EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 139 FRANCE EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 140 FRANCE EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 141 FRANCE EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 142 FRANCE EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 143 ITALY EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 144 ITALY EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 145 ITALY EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 146 ITALY EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 147 ITALY EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 148 ITALY EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 149 SPAIN EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 150 SPAIN EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 151 SPAIN EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 152 SPAIN EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 153 SPAIN EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 154 SPAIN EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 155 RUSSIA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 156 RUSSIA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 157 RUSSIA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 158 RUSSIA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 159 RUSSIA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 160 RUSSIA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 161 REST OF EUROPE EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 163 REST OF EUROPE EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 165 REST OF EUROPE EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA EMISSION MONITORING SYSTEMS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA EMISSION MONITORING SYSTEMS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 175 UAE EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 176 UAE EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 177 UAE EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 178 UAE EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 179 UAE EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 180 UAE EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 181 SAUDI ARABIA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 183 SAUDI ARABIA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 185 SAUDI ARABIA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 187 SOUTH AFRICA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 189 SOUTH AFRICA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 191 SOUTH AFRICA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA EMISSION MONITORING SYSTEMS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA EMISSION MONITORING SYSTEMS MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA EMISSION MONITORING SYSTEMS MARKET BY COMPONENT (THOUSAND UNITS) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA EMISSION MONITORING SYSTEMS MARKET BY END USER (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA EMISSION MONITORING SYSTEMS MARKET BY END USER (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 3 BOTTOM-UP APPROACH

FIGURE 4 RESEARCH FLOW

FIGURE 5 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 6 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY COMPONENT, USD BILLION, 2020-2029

FIGURE 7 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 8 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 9 PORTER’S FIVE FORCES MODEL

FIGURE 10 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY TYPE, USD BILLION, 2021

FIGURE 11 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY COMPONENT, USD BILLION, 2021

FIGURE 12 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY END USER, USD BILLION, 2021

FIGURE 13 GLOBAL EMISSION MONITORING SYSTEMS MARKET BY REGION, USD BILLION, 2021

FIGURE 14 MARKET SHARE ANALYSIS

FIGURE 15 SICK AG: COMPANY SNAPSHOT

FIGURE 16 ABB: COMPANY SNAPSHOT

FIGURE 17 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

FIGURE 18 AMETEK INC.: COMPANY SNAPSHOT

FIGURE 19 SIEMENS AG: COMPANY SNAPSHOT

FIGURE 20 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

FIGURE 21 ROCKWELL AUTOMATION, INC.: COMPANY SNAPSHOT

FIGURE 22 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT

FIGURE 23 TELEDYNE TECHNOLOGIES, INC.: COMPANY SNAPSHOT

FIGURE 24 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

FIGURE 25 HORIBA LTD.: COMPANY SNAPSHOT

FIGURE 26 INTERTEK GROUP PLC.: COMPANY SNAPSHOT

FIGURE 27 ENVEA: COMPANY SNAPSHOT

FIGURE 28 ADVANCED EMISSIONS SOLUTIONS INC.: COMPANY SNAPSHOT

FIGURE 29 BAKER HUGHES: COMPANY SNAPSHOT

FAQ

The emission monitoring systems market size had crossed USD 3 Billion in 2020 and will observe a CAGR of more than 8.13% up to 2029.

The drivers propelling the growth of the global market for emission monitoring systems include increasing government regulations, rising environmental consciousness, and rising oil & gas and petrochemical usage.

The region’s largest share is in North America. Products manufactured in nations like US and Canada that perform similarly and are inexpensively accessible to the general public have led to the increasing appeal.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.