Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Farbstoffmarkt nach Form (Pigmente, Farbstoffe, Masterbatches, Farbkonzentrate), Endverbraucher (Verpackung, Bauwesen, Automobil, Textilien, Papier und Druck) und nach Region (Nordamerika, Asien-Pazifik, Südamerika, Europa, Naher Osten und Afrika), globale Trends und Prognose von 2018 bis 2028

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Marktübersicht für Farbstoffe

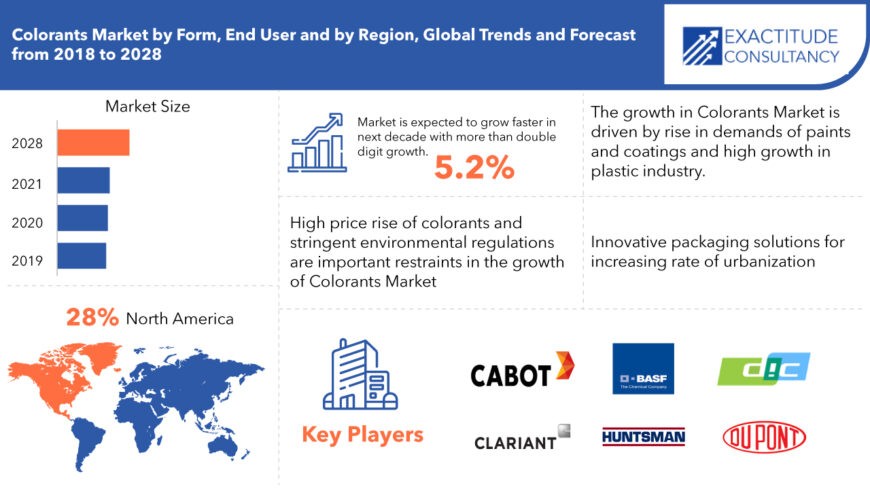

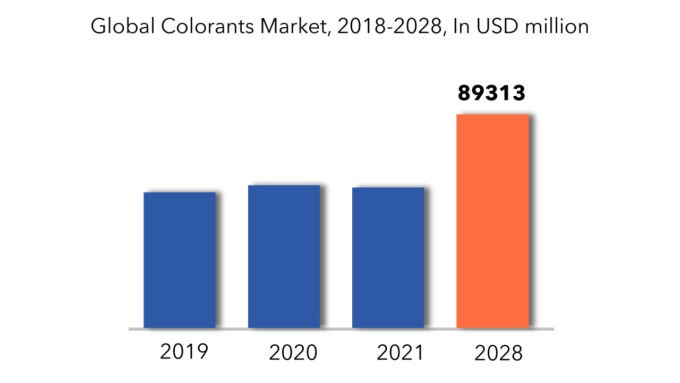

Der globale Markt für Farbstoffe wird voraussichtlich von 2018 bis 2028 um mehr als 5,2 % durchschnittliche jährliche Wachstumsrate wachsen. Es wird erwartet, dass der Markt von etwas über 56 Milliarden USD im Jahr 2018 auf über 89 Milliarden USD im Jahr 2028 ansteigt.

Farbstoffe werden verwendet, um einer Vielzahl von Produkten, darunter Lebensmitteln, Kosmetika , Textilien und Farben , leuchtende Farbtöne zu verleihen. Dadurch wird ihre visuelle Attraktivität erhöht, die Identifizierung erleichtert und die Produktdifferenzierung gefördert. Diese Farbstoffe, ob natürlich oder synthetisch, kommen in unterschiedlichen Formen vor, darunter Farbstoffe, Pigmente und Tinten.

Der globale Farbstoffmarkt ist einem vielschichtigen Regulierungsumfeld unterworfen, das durch eine Reihe regionaler und internationaler Gesetze geprägt ist, die die Produktion, Verwendung und Verbreitung von Farbzusätzen regeln. Zu den namhaften Regulierungsbehörden zählen unter anderem die US-amerikanische Food and Drug Administration (FDA), die Europäische Behörde für Lebensmittelsicherheit (EFSA), die Europäische Chemikalienagentur (ECHA) und die Internationale Organisation für Normung (ISO). Diese Vorschriften dienen in erster Linie dazu, die Sicherheit, Integrität und ordnungsgemäße Kennzeichnung von Farbstoffen zu gewährleisten. Dabei werden Aspekte wie zulässige Bestandteile, maximale Konzentrationsschwellen, Kennzeichnungsanforderungen zur Förderung der Verbrauchertransparenz und Beschränkungen für bestimmte Farbstoffe in bestimmten Anwendungen berücksichtigt. Die Einhaltung dieser Vorschriften ist für Hersteller und Lieferanten unerlässlich, um Zugang zu globalen Märkten zu erhalten. Dies erfordert eine kontinuierliche Überwachung und Anpassung an sich entwickelnde Regulierungslandschaften.

[Bildunterschrift id="attachment_2004" align="aligncenter" width="870"]

Ein grundlegender Impuls für den Farbstoffmarkt ist die steigende Nachfrage in verschiedenen Branchen, darunter Automobil, Verpackung , Bauwesen, Textilien und Kosmetik, die durch eine zunehmende Betonung von Produktunterscheidungskraft, ästhetischer Attraktivität und Markenbekanntheit angetrieben wird. Da Verbraucher weiterhin optisch ansprechende Waren bevorzugen, bemühen sich Hersteller, bahnbrechende Farblösungen zu entwickeln, um die Attraktivität und Marktfähigkeit ihrer Angebote zu steigern. Darüber hinaus haben technologische Fortschritte, insbesondere in der Nanotechnologie und im Digitaldruck, den Horizont und die Anwendbarkeit von Farbstoffen erweitert und hochgradig anpassbare und komplexe Designs ermöglicht.

[Bildunterschrift id="attachment_2008" align="aligncenter" width="629"]

Colorants Market Segment Analysis

The global colorant market by form is segregated into pigments, dyes, masterbatches, and color concentrates. Due to their extensive industrial uses, all the colorants by form have high demand in the market.

Based on the end user industry, the global colorant market is expected to grow more in case of packaging and automotive industry in the forecast period. Other end users are building and construction, textiles, paper and printing.

Colorants Market Players

The important companies in Global Colorants Market are, Clariant, BASF SE, DIC Corporation, Huntsman Corporation, Dupont, Cabot Corporation, Lanxess AG, Avient corporation, Cathay industries, etc.

The market share of top companies is moderate and many suppliers are present in the market. The market is fragmented and good scope for mergers and acquisitions is available. The market is sensitive to price fluctuations. Thus, competitive rivalry is high among the market players.

Who Should Buy? Or Key stakeholders

- Packaging Industry

- Automotive Industry

- Building and Construction

- Textiles

- Paper and Printing

- Others

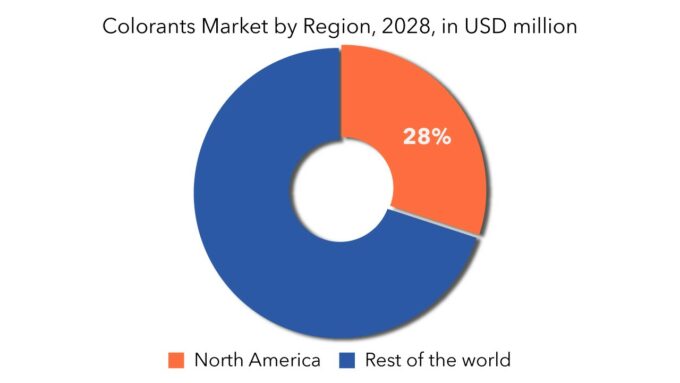

Colorants Market Regional Analysis

Geographically, the global Colorants market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of the MEA

Key Market Segments: Global Colorants Market

Colorants Market by Form, 2018-2028, (In USD Million)- Pugments

- Dyes

- Masterbatches

- Color Concentrates

- Packaging

- Building And Construction

- Automotive

- Textiles

- Paper And Printing

- Others

- North America

- Europe

- Asia Pacific

- South America

- The Middle East And Africa

Key Question Answered

- What is the current market size of this high-growth market?

- What is the overall growth rate?

- What are the key growth areas, applications, end uses, and types?

- Key reasons for the growth

- Challenges for growth

- Who are the important market players in this market?

- What are the key strategies of these players?

- What technological developments are happening in this area?

- UMFANG DES BERICHTS

- MARKTDEFINITION

- FORSCHUNGSZEITPLAN

- MARKTSEGMENTIERUNG

- FORSCHUNGSZIELE

- FORSCHUNGSMETHODIK

- DATENMINING

- Sekundärforschung

- PRIMÄRFORSCHUNG

- RAT VON FACHEXPERTEN

- QUALITÄTSPRÜFUNGEN

- ABSCHLIESSENDE ÜBERPRÜFUNG

- DATENTRIANGULATION

- FORSCHUNGSABLAUF

- DATENQUELLEN

- Berücksichtigung der Währung

- DATENMINING

- ZUSAMMENFASSUNG

- MARKTÜBERSICHT

- GEOGRAPHISCHE ANALYSE DES WELTWEIT AKTUELLEN FARBSTOFFMARKTES

- GLOBALER FARBSTOFFMARKT NACH FORM (MIO. USD)

- GLOBALER FARBSTOFFMARKT NACH ENDNUTZUNGSINDUSTRIE (MIO. USD)

- ZUKÜNFTIGE MARKTMÖGLICHKEITEN

- Globale Marktaufteilung

- MARKTÜBERSICHT

- Marktausblick für Farbstoffe

- Marktausblick

- MARKTTREIBER

- STEIGENDE NACHFRAGE NACH FARBEN UND BESCHICHTUNGEN AUFGRUND DER ZUNEHMENDEN URBANISIERUNG

- Hohes Wachstum in der Kunststoffindustrie und Bedarf an innovativen Verpackungslösungen

- Einschränkungen

- Hoher Preisanstieg bei Farbstoffen

- STRENGE UMWELTVORSCHRIFTEN

- GELEGENHEITEN

- DAS AUFKOMMEN DES 3D-DRUCKS UND SEINE ZUNEHMENDE KOMMERZIALISIERUNG BIETET REICHLICH GELEGENHEIT FÜR DAS WACHSTUM DES FARBEMARKTES

- WACHSTUM DER NACHFRAGE NACH BIO-FARBSTOFFEN UND ORGANISCHEN FARBSTOFFEN

- AUSWIRKUNGEN VON COVID-19 AUF DEN FARBSTOFFMARKT

- Porters Fünf-Kräfte-Analyse

- Drohung durch Ersatz

- Verhandlungsmacht der Käufer

- Verhandlungsmacht der Lieferanten

- Bedrohung durch Neueinsteiger

- WETTBEWERBSRIVALITÄT

- GLOBALER FARBSTOFFMARKT NACH FORM

- ÜBERBLICK

- PIGMENTE

- FARBSTOFFE

- MASTERBATCHES

- FARBKONZENTRATE

- GLOBALER FARBSTOFFMARKT NACH ENDNUTZUNGSINDUSTRIE

- ÜBERBLICK

- VERPACKUNG

- BAU & KONSTRUKTION

- AUTOMOBIL

- TEXTILIEN

- PAPIER & DRUCK

- ANDERE

- GLOBALER FARBSTOFFMARKT NACH GEOGRAPHIE

- ÜBERBLICK

- MARKTSCHÄTZUNGEN UND PROGNOSE FÜR NORDAMERIKA, 2018–2028 (MIO. USD)

- NORDAMERIKANISCHER FARBSTOFFMARKT NACH LÄNDERN

- NORDAMERIKANISCHER FARBSTOFFMARKT NACH LÄNDERN

- NORDAMERIKANISCHER FARBSTOFFMARKT NACH FORM

- NORDAMERIKANISCHER FARBSTOFFMARKT NACH ENDNUTZUNGSINDUSTRIE

- VEREINIGTE STAATEN

- FARBSTOFFMARKT IN DEN USA NACH FORM

- US-FARBSTOFFMARKT NACH ENDNUTZUNGSINDUSTRIE

- KANADA

- KANADISCHER FARBSTOFFMARKT NACH FORM

- KANADISCHER FARBSTOFFMARKT NACH ENDVERWENDUNGSINDUSTRIE

- MEXIKO

- MEXIKO FARBSTOFFMARKT NACH FORM

- MEXIKO: FARBSTOFFMARKT NACH ENDNUTZUNGSINDUSTRIE

- MARKTSCHÄTZUNGEN UND PROGNOSE FÜR EUROPA, 2018 – 2028 (MIO. USD)

- EUROPÄISCHER FARBSTOFFMARKT NACH LÄNDERN

- EUROPÄISCHER FARBSTOFFMARKT NACH FORM

- EUROPÄISCHER FARBSTOFFMARKT NACH ENDNUTZUNGSINDUSTRIE

- DEUTSCHLAND

- DEUTSCHLAND FARBSTOFFMARKT NACH FORM

- DEUTSCHLAND FARBSTOFFMARKT NACH ENDNUTZUNGSINDUSTRIE

- Vereinigtes Königreich

- BRITISCHER FARBSTOFFMARKT NACH FORM

- BRITISCHER FARBSTOFFMARKT NACH ENDVERWENDUNGSBRANCHEN

- FRANKREICH

- FRANKREICH FARBSTOFFMARKT NACH FORM

- FRANKREICH: FARBSTOFFMARKT NACH ENDNUTZUNGSINDUSTRIE

- ITALIEN

- ITALIENISCHER FARBSTOFFMARKT NACH FORM

- ITALIENISCHER FARBSTOFFMARKT NACH ENDNUTZUNGSINDUSTRIE

- RUSSLAND

- RUSSISCHER FARBSTOFFMARKT NACH FORM

- RUSSISCHER FARBSTOFFMARKT NACH ENDNUTZUNGSINDUSTRIE

- SPANIEN

- SPANISCHER FARBSTOFFMARKT NACH FORM

- SPANISCHER FARBSTOFFMARKT NACH ENDNUTZUNGSINDUSTRIE

- RESTLICHES EUROPA

- ÜBRIGES EUROPA: FARBSTOFFMARKT NACH FORM

- ÜBRIGER EUROPÄISCHER FARBSTOFFMARKT NACH ENDNUTZUNGSINDUSTRIE

- SCHÄTZUNGEN UND PROGNOSE FÜR DEN ASIEN-PAZIFIK-MARKT 2018 – 2028 (MIO. USD)

- Asien-Pazifik-Farbstoffmarkt nach Ländern

- Asien-Pazifik-Farbstoffmarkt nach Form

- Asien-Pazifik-Farbstoffmarkt nach Endverbrauchsbranche

- CHINA

- CHINA FARBSTOFFMARKT NACH FORM

- CHINA COLORANTS MARKET BY END-USE INDUSTRY

- JAPAN

- JAPAN COLORANTS MARKET BY FORM

- JAPAN COLORANTS MARKET BY END-USE INDUSTRY

- INDIA

- INDIA COLORANTS MARKET BY FORM

- INDIA COLORANTS MARKET BY END-USE INDUSTRY

- AUSTRALIA

- AUSTRALIA COLORANTS MARKET BY FORM

- AUSTRALIA COLORANTS MARKET BY END-USE INDUSTRY

- SOUTH KOREA

- SOUTH KOREA COLORANTS MARKET BY FORM

- SOUTH KOREA COLORANTS MARKET BY END-USE INDUSTRY

- ASEAN

- ASEAN COLORANTS MARKET BY FORM

- ASEAN COLORANTS MARKET BY END-USE INDUSTRY

- REST OF APAC

- REST OF APAC COLORANTS MARKET BY FORM

- REST OF APAC COLORANTS MARKET BY END-USE INDUSTRY

- MIDDLE EAST AND AFRICA MARKET ESTIMATES AND FORECAST, 2018 – 2028 (USD MILLION)

- MIDDLE EAST AND AFRICA COLORANTS MARKET BY COUNTRY

- MIDDLE EAST AND AFRICA COLORANTS MARKET BY FORM

- MIDDLE EAST AND AFRICA COLORANTS MARKET BY END-USE INDUSTRY

- TURKEY

- TURKEY COLORANTS MARKET BY FORM

- TURKEY COLORANTS MARKET BY END-USE INDUSTRY

- UAE

- UAE COLORANTS MARKET BY FORM

- UAE COLORANTS MARKET BY END-USE INDUSTRY

- SAUDI ARABIA

- SAUDI ARABIA COLORANTS MARKET BY FORM

- SAUDI ARABIA COLORANTS MARKET BY END-USE INDUSTRY

- SOUTH AFRICA

- SOUTH AFRICA COLORANTS MARKET BY FORM

- SOUTH AFRICA COLORANTS MARKET BY END-USE INDUSTRY

- REST OF MEA

- REST OF MEA COLORANTS MARKET BY FORM

- REST OF MEA COLORANTS MARKET BY END-USE INDUSTRY

- SOUTH AMERICA MARKET ESTIMATES AND FORECAST, 2018 – 2028 (USD MILLION)

- SOUTH AMERICA COLORANTS MARKET BY COUNTRY

- SOUTH AMERICA COLORANTS MARKET BY FORM

- SOUTH AMERICA COLORANTS MARKET BY END-USE INDUSTRY

- BRAZIL

- BRAZIL COLORANTS MARKET BY FORM

- BRAZIL COLORANTS MARKET BY END-USE INDUSTRY

- ARGENTINA

- ARGENTINA COLORANTS MARKET BY FORM

- ARGENTINA COLORANTS MARKET BY END-USE INDUSTRY

- REST OF SOUTH AMERICA

- REST OF SOUTH AMERICA COLORANTS MARKET BY FORM

- REST OF SOUTH AMERICA COLORANTS MARKET BY END-USE INDUSTRY

- COMPETITIVE LANDSCAPE

- OVERVIEW

- COMPANY MARKET RANKING

- KEY DEVELOPMENTS

- KEY PLAYERS ANALYSIS

- CLARIANT

- BUSINESS OVERVIEW

- COMPANY SNAPSHOT

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- BASF SE

- BUSINESS OVERVIEW

- COMPANY SNAPSHOT

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- DIC CORPORATION

- BUSINESS OVERVIEW

- COMPANY SNAPSHOT

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- HUNTSMAN CORPORATION

- BUSINESS OVERVIEW

- COMPANY SNAPSHOT

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- DUPONT

- BUSINESS OVERVIEW

- COMPANY SNAPSHOT

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- CABOT CORPORATION

- BUSINESS OVERVIEW

- COMPANY SNAPSHOT

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- LANXESS AG

- BUSINESS OVERVIEW

- COMPANY SNAPSHOT

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- AVIENT CORPORATION

- BUSINESS OVERVIEW

- COMPANY SNAPSHOT

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- CATHAY INDUSTRIES

- BUSINESS OVERVIEW

- COMPANY SNAPSHOT

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- CLARIANT

LIST OF TABLES

TABLE 1 GLOBAL COLORANT MARKET BY FORM, 2018-2028, KILOTONS

TABLE 2 GLOBAL COLORANT MARKET BY FORM, 2018-2028, (USD MILLION)

TABLE 3 GLOBAL COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 4 NORTH AMERICA COLORANTS MARKET, BY COUNTRY, 2018 – 2028, KILOTONS

TABLE 5 NORTH AMERICA COLORANTS MARKET, BY COUNTRY, 2018 – 2028, USD MILLION

TABLE 6 NORTH AMERICA COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 7 NORTH AMERICA COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 8 NORTH AMERICA COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 9 UNITED STATES COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 10 UNITED STATES COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 11 UNITED STATES COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 12 CANADA COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 13 CANADA COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 14 CANADA COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 15 MEXICO COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 16 MEXICO COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 17 MEXICO COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 18 EUROPE COLORANTS MARKET, BY COUNTRY, 2018 – 2028, KILOTONS

TABLE 19 EUROPE COLORANTS MARKET, BY COUNTRY, 2018 – 2028, USD MILLION

TABLE 20 EUROPE COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 21 EUROPE COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 22 EUROPE COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 23 GERMANY COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 24 GERMANY COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 25 GERMANY COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 26 UK COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 27 UK COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 28 UK COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 29 FRANCE COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 30 FRANCE COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 31 FRANCE COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 32 ITALY COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 33 ITALY COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 34 ITALY COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 35 RUSSIA COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 36 RUSSIA COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 37 RUSSIA COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 38 SPAIN COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 39 SPAIN COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 40 SPAIN COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 41 REST OF EUROPE COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 42 REST OF EUROPE COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 43 REST OF EUROPE COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 44 ASIA-PACIFIC COLORANTS MARKET, BY COUNTRY, 2018 – 2028, USD MILLION

TABLE 45 ASIA-PACIFIC COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 46 ASIA-PACIFIC COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 47 ASIA-PACIFIC COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 48 CHINA COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 49 CHINA COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 50 CHINA COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 51 JAPAN COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 52 JAPAN COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 53 JAPAN COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 54 INDIA COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 55 INDIA COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 56 INDIA COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 57 AUSTRALIA COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 58 AUSTRALIA COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 59 AUSTRALIA COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 60 SOUTH KOREA COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 61 SOUTH KOREA COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 62 SOUTH KOREA COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 63 ASEAN COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 64 ASEAN COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 65 ASEAN COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 66 REST OF APAC COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 67 REST OF APAC COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 68 REST OF APAC COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA COLORANTS MARKET, BY COUNTRY, 2018 – 2028, KILOTONS

TABLE 70 MIDDLE EAST AND AFRICA COLORANTS MARKET, BY COUNTRY, 2018 – 2028, USD MILLION

TABLE 71 MIDDLE EAST AND AFRICA COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 72 MIDDLE EAST AND AFRICA COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 73 MIDDLE EAST AND AFRICA COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 74 TURKEY COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 75 TURKEY COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 76 TURKEY COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 77 UAE COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 78 UAE COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 79 UAE COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 80 SAUDI ARABIA COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 81 SAUDI ARABIA COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 82 SAUDI ARABIA COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 83 SOUTH AFRICA COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 84 SOUTH AFRICA COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 85 SOUTH AFRICA COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 86 REST OF MEA COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 87 REST OF MEA COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 88 REST OF MEA COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 89 SOUTH AMERICA COLORANTS MARKET, BY COUNTRY, 2018 – 2028, KILOTONS

TABLE 90 SOUTH AMERICA COLORANTS MARKET, BY COUNTRY, 2018 – 2028, USD MILLION

TABLE 91 SOUTH AMERICA COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 92 SOUTH AMERICA COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 93 SOUTH AMERICA COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 94 BRAZIL COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 95 BRAZIL COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 96 BRAZIL COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 97 ARGENTINA COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 98 ARGENTINA COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 99 ARGENTINA COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

TABLE 100 REST OF SOUTH AMERICA COLORANTS MARKET BY FORM (2018-2028) (KILOTONS)

TABLE 101 REST OF SOUTH AMERICA COLORANTS MARKET BY FORM (2018-2028) (USD MILLIONS)

TABLE 102 REST OF SOUTH AMERICA COLORANTS MARKET BY END-USE INDUSTRY (2018-2028) (USD MILLION)

LIST OF FIGURES

FIGURE 1 RESEARCH TIMELINES

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 DATA TRIANGULATION

FIGURE 4 MARKET RESEARCH FLOW

FIGURE 5 DATA SOURCES

FIGURE 6 GLOBAL COLORANTS MARKET, BY REGION, 2020 (USD MILLION)

FIGURE 7 GLOBAL COLORANTS MARKET, BY FORM, 2018-2028, (USD MILLION)

FIGURE 8 GLOBAL COLORANTS MARKET, BY END-USE INDUSTRY, 2018-2028, (USD MILLION)

FIGURE 9 FUTURE MARKET OPPORTUNITIES

FIGURE 10 ASIA-PACIFIC TO DOMINATE THE MARKET IN 2020

FIGURE 11 MARKET DYNAMICS: DRIVERS, RESTRAINTS AND OPPORTUNITIES

FIGURE 12 CLARIANT: COMPANY SNAPSHOT

FIGURE 13 BASF SF: COMPANY SNAPSHOT

FIGURE 14 DIC CORPORATION: COMPANY SNAPSHOT

FIGURE 15 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

FIGURE 16 DUPONT: COMPANY SNAPSHOT

FIGURE 17 CABOT CORPORATION: COMPANY SNAPSHOT

FIGURE 18 LANXESS: COMPANY SNAPSHOT

FIGURE 19 AVIENT CORPORATION: COMPANY SNAPSHOT

FIGURE 20 CATHAY INDUSTRIES: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te