Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Mercado de diagnóstico de sepsis por producto (medios de hemocultivo, reactivos, ensayos, instrumentos, software), método (diagnóstico automatizado, diagnóstico convencional), tipo de prueba (laboratorio, POC), patógeno (bacteriano, viral, fúngico), tecnología (hemocultivo, microbiología, PCR, secuenciación, biomarcadores, microfluídica, inmunoensayos), usuario final (hospital, laboratorio de patología, laboratorios de investigación e institutos académicos) y región (Norteamérica, Europa, Asia Pacífico, Sudamérica, Oriente Medio y África), tendencias globales y pronóstico de 2022 a 2029

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Descripción general del mercado de diagnóstico de sepsis

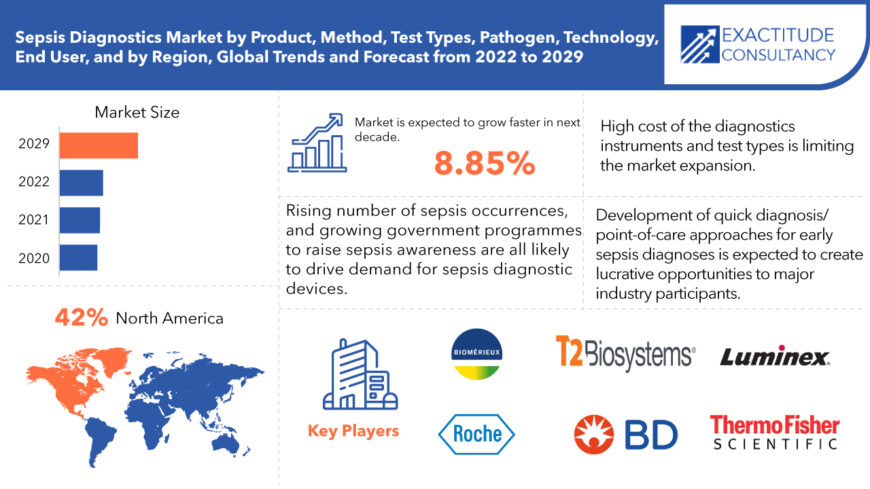

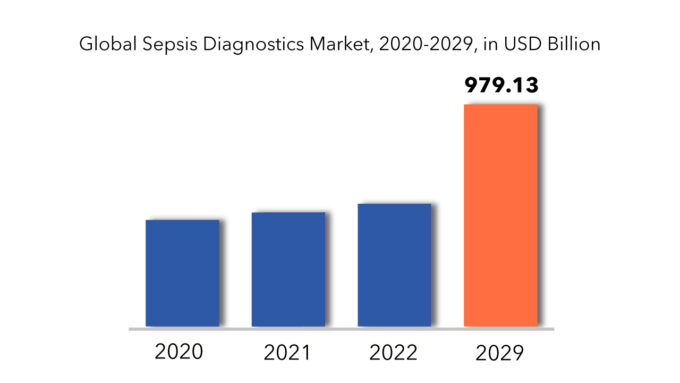

Se espera que el mercado mundial de diagnóstico de sepsis crezca a una tasa anual compuesta del 8,85 % entre 2022 y 2029. Se espera que alcance más de 979,13 millones de dólares en 2029 desde los 469,22 millones de dólares en 2020.

La sepsis es una enfermedad potencialmente mortal que se produce cuando el sistema inmunitario del cuerpo destruye sus propios tejidos en respuesta a una infección. Cuando los sistemas del cuerpo que luchan contra las infecciones se activan, los órganos funcionan mal y de manera inadecuada. La sepsis puede provocar un choque séptico, que es una caída abrupta de la presión arterial que puede provocar daños graves en los órganos e incluso la muerte. El tratamiento con antibióticos y líquidos intravenosos lo antes posible mejora las posibilidades de supervivencia.

Además, la creciente financiación pública y privada para las actividades de investigación de diagnóstico de la sepsis, la creciente carga de enfermedades infecciosas, el creciente número de casos de sepsis y el aumento de los programas gubernamentales para aumentar la conciencia sobre la sepsis probablemente impulsarán la demanda de dispositivos de diagnóstico de la sepsis. Se prevé que el mercado de diagnóstico de la sepsis se desarrolle significativamente durante el período de pronóstico, debido a un aumento en la carga de sepsis y un aumento en la población geriátrica mundial. Los principales impulsores del crecimiento del mercado incluyen un aumento en la financiación gubernamental para los esfuerzos de investigación relacionados con la sepsis, así como un aumento en la prevalencia de enfermedades infecciosas. Por otro lado, se espera que el desarrollo de enfoques de diagnóstico rápido/punto de atención para diagnósticos tempranos de sepsis cree oportunidades lucrativas para los principales participantes de la industria durante todo el período de proyección.

| ATRIBUTO | DETALLES |

| Periodo de estudio | 2020-2029 |

| Año base | 2021 |

| Año estimado | 2022 |

| Año pronosticado | 2022-2029 |

| Periodo histórico | 2018-2020 |

| Unidad | Valor (millones de USD) |

| Segmentación | Por producto, por método, por tipo de prueba, por patógeno, por tecnología, por usuario final, por región |

| Por producto |

|

| Por método |

|

| Por tipo de prueba |

|

| Por patógeno |

|

| Por tecnología |

|

| Por el usuario final |

|

| Por región |

|

Sin embargo, el alto costo de los instrumentos de diagnóstico automatizados limita la expansión del mercado. La sepsis es una enfermedad potencialmente mortal que debe ser detectada y tratada lo antes posible por expertos en atención médica capacitados. En todo el mundo, existe una escasez crónica de expertos competentes; solo la mitad de los pacientes con sepsis grave que son trasladados por el sistema EMS cuentan con un paramédico. La escasez de paramédicos calificados tiene un impacto en todas las fases de la atención al paciente, incluida la concienciación de la sepsis, la evaluación de los pacientes para detectar la presencia de sepsis y la toma de decisiones adecuadas sobre el tratamiento.

La pandemia de COVID-19 se extendió por todo el mundo y eso interrumpió la cadena de suministro a nivel mundial. Debido al cierre, el proceso de producción de todas las industrias se detuvo, cerró o desvió hacia la recuperación de los pacientes de COVID y eso resultó en una disminución de la demanda de diagnósticos de sepsis en el mercado. La industria de las cámaras médicas ha sufrido como resultado de los retrasos en los procedimientos médicos y las cirugías. A medida que los mercados mundiales se han abierto, se están enfocando en tener más cámaras para la supervisión y se espera que ganen un crecimiento potencial en el mercado de diagnóstico de sepsis.

[título id="attachment_10024" align="aligncenter" width="870"]

Frequently Asked Questions

• What is the worth of the Sepsis Diagnostics market

The Sepsis Diagnostics market size had crossed USD 32.50 million in 2020 and will observe a CAGR of more than 8.85% up to 2029 driven by the rise in sepsis diseases and diagnostic surgeries in healthcare industry.

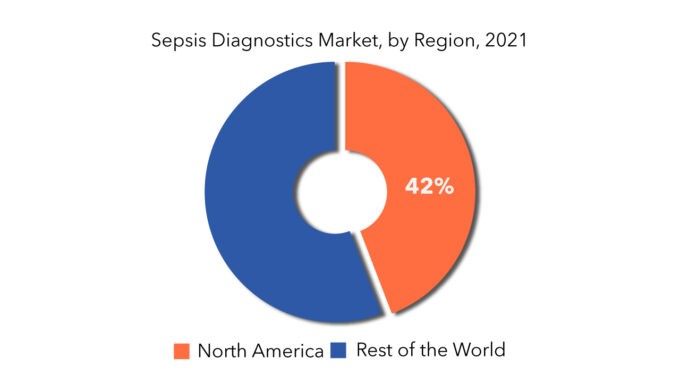

• What is the size of the North America Sepsis Diagnostics industry?

North America accounted for a 42% share of the sepsis diagnostics market in 2020 and is expected to maintain its dominance during the forecast period.

• What are the challenges, drivers and opportunities for the Sepsis Diagnostics market?

Rising number of sepsis occurrences, and growing government programmes to raise sepsis awareness are all likely to drive demand for sepsis diagnostic devices and thus market growth. Development of quick diagnosis/point-of-care approaches for early sepsis diagnoses is expected to create lucrative opportunities to major industry participants. But the high cost of automated diagnostics instruments limits the market expansion.

• Which are the top companies to hold the market share in Sepsis Diagnostics market?

bioMérieux, Becton, Dickinson and Company, Danaher Corporation, T2 Biosystems, Luminex, Roche Diagnostics, Thermo Fisher Scientific, Bruker Corporation, Abbott Laboratories, Immunexpress, Axis-Shield Diagnostics, Quidel Corporation, and others., are among the leading players in the global sepsis diagnostics market.

• Which is the largest regional market for Sepsis Diagnostics Market?

Presence of a highly developed healthcare system, high adoption of innovative sepsis diagnostic technologies among medical professionals, a rising number of surgical procedures, in the North American region, it accounted for a large share of sepsis diagnostics market in 2020 and is expected to maintain its dominance during the forecast period.

• Which region is expected to have the fastest growth rate within the forecast period?

Due to its large patient population, increasing sepsis diagnostics usage in healthcare industry, as well as the rise in geriatric population, Asia-Pacific is expected to have the highest CAGR in coming years.

Sepsis Diagnostics Market Segment Analysis

The global sepsis diagnostics market is segmented by product, method, test type, pathogen, technology, end user and region.

Based on product segment, the sepsis diagnostics market includes Blood Culture Media, Reagents, Assay, Instruments, Software. During the projection period, the blood culture media segment had the greatest market share. This proportion may be ascribed to the increasing use of blood culture media for the diagnosis of sepsis by hospitals and pathology labs, as well as an increase in the market availability of blood culture media.

The sepsis diagnostics market can be classified based on the method, that is Automated Diagnostics, Conventional Diagnostics. Due to the greater cost of automated diagnostics equipment, the traditional diagnostics segment currently leads the market and is likely to stay dominant over the forecast period.

Based on test type segment, the sepsis diagnostics market includes Lab, POC. The laboratory testing segment now leads the market and is projected to do so for the foreseeable future. This is due to the fact that lab testing is more accurate than point-of-care testing for detecting sepsis. Furthermore, the increased dependence of patients and clinicians on laboratory testing drives the growth of the sepsis diagnostic market.

The sepsis diagnostics market can be classified based on the pathogen, that is Bacterial, Viral, Fungal. The bacterial sepsis category held the greatest market share. This increase can be ascribed to an increase in bacterial sepsis cases, an increase in surgical operations, and an increase in the prevalence of HAIs.

Based on technology segment, the sepsis diagnostics market includes Blood Culture, Microbiology, PCR, Sequencing, Biomarkers, Microfluidics, Immunoassays. The blood culture segment held the greatest market share. This proportion can be ascribed to the inexpensive cost of microbiology techniques as well as the widespread usage of blood culture methods for sepsis diagnosis.

Based on end-user segment, the sepsis diagnostics market includes Hospital, Pathology Lab, Research Laboratories & Academic Institutes. The hospitals and specialty clinics have the biggest share of the sepsis diagnostics market. The larger share of this segment can be attributed to the high prevalence of sepsis, as well as the large number of fatalities caused by the illness, the increasing number of patients hospitalized with sepsis, and in-house hospital laboratories performing a large number of blood culture tests to identify blood stream infections (BSIs caused by bacteria, fungi/yeast, or viruses).

[caption id="attachment_10025" align="alignleft" width="680"]

Sepsis Diagnostics Market Players

The global sepsis diagnostics market key players include bioMérieux, Becton, Dickinson and Company, Danaher Corporation, T2 Biosystems, Luminex, Roche Diagnostics, Thermo Fisher Scientific, Bruker Corporation, Abbott Laboratories, Immunexpress, Axis-Shield Diagnostics, Quidel Corporation, and others.

Various businesses are focusing on organic growth tactics such as new launches, product approvals, and other things like patents and events. Mergers & Acquisitions, partnerships, and collaborations were among the inorganic growth tactics observed in the market. These initiatives such as developing new products and upgrading others, have paved the road for market participants to expand their business. These market players in the sepsis diagnostics market are expected to benefit from attractive growth prospects in the future.

April 12th 2022-bioMérieux, a world leader in the field of in vitro diagnostics, announces that it has entered into an agreement to acquire Specific Diagnostics, a privately held U.S. based company that has developed a rapid antimicrobial susceptibility test (AST) system that delivers phenotypic AST directly from positive blood cultures.Who Should Buy? Or Key Stakeholders

- Government and research organization

- Investors

- Trade Associations

- Pathology labs/Clinics

- Scientific research organization

- Healthcare Industry

Sepsis Diagnostics Market Regional Analysis

The sepsis diagnostics market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America has a dominating share in the global sepsis diagnostics market due to well established healthcare industry, rising prevalence of sepsis diseases and diagnostic procedures. Followed by Asia Pacific & Europe, owing to rise in technology advancements, as well as investments by government in funding the healthcare industry and devices.

[caption id="attachment_10026" align="alignleft" width="680"]

Key Market Segments: Sepsis Diagnostics Market

Sepsis Diagnostics Market by Product, 2020-2029, (USD Million)- Blood Culture Media

- Reagents

- Assay

- Instruments

- Software

- Automated Diagnostics

- Conventional Diagnostics

- Lab

- POC

- Bacterial

- Viral

- Fungal

- Blood Culture

- Microbiology

- PCR

- Sequencing

- Biomarkers

- Microfluidics

- Immunoassays

- Hospital

- Pathology Lab

- Research Laboratories & Academic Institutes

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the current size of the sepsis diagnostics market?

- What are the key factors influencing the growth of sepsis diagnostics?

- What is the major end-use industry for sepsis diagnostics?

- Who are the major key players in the sepsis diagnostics market?

- Which region will provide more business opportunities for sepsis diagnostics in future?

- Which segment holds the maximum share of the sepsis diagnostics market?

- Introducción

- Definición de mercado

- Segmentación del mercado

- Cronología de la investigación

- Supuestos y limitaciones

- Metodología de la investigación

- Minería de datos

- Investigación secundaria

- Investigación primaria

- Asesoramiento de expertos en la materia

- Controles de calidad

- Revisión final

- Triangulación de datos

- Enfoque de abajo hacia arriba

- Enfoque de arriba hacia abajo

- Flujo de investigación

- Fuentes de datos

- Minería de datos

- Resumen ejecutivo

- Descripción general del mercado

- Perspectivas del mercado mundial de diagnóstico de sepsis

- Factores impulsores del mercado

- Restricciones del mercado

- Oportunidades de mercado

- Impacto de la COVID-19 en el mercado de diagnóstico de sepsis

- Modelo de las cinco fuerzas de Porter

- Amenaza de nuevos participantes

- Amenaza de sustitutos

- Poder de negociación de los proveedores

- Poder de negociación de los clientes

- Grado de competencia

- Análisis de la cadena de valor de la industria

- Perspectivas del mercado mundial de diagnóstico de sepsis

- Mercado mundial de diagnóstico de sepsis por producto (millones de USD)

- Reactivos

- Ensayo

- Instrumentos

- Software

- Mercado mundial de diagnóstico de sepsis por método (millones de USD)

- Diagnóstico automatizado

- Diagnóstico convencional

- Mercado mundial de diagnóstico de sepsis por tipo de prueba (millones de USD)

- Laboratorio

- POC

- Mercado mundial de diagnóstico de sepsis por patógeno (millones de USD)

- Bacteriano

- Viral

- Hongo

- Mercado mundial de diagnóstico de sepsis por tecnología (millones de USD)

- Microbiología

- PCR

- Secuenciación

- Biomarcadores

- Microfluídica

- Inmunoensayos

- Mercado mundial de diagnóstico de sepsis por usuario final (millones de USD)

- Hospital

- Laboratorio de patología

- Laboratorios de investigación e institutos académicos

- Mercado mundial de diagnóstico de sepsis por región (millones de USD)

- América del norte

- A NOSOTROS

- Canadá

- México

- Sudamerica

- Brasil

- Argentina

- Colombia

- Resto de Sudamérica

- Europa

- Alemania

- Reino Unido

- Francia

- Italia

- España

- Rusia

- Resto de Europa

- Asia Pacífico

- India

- Porcelana

- Japón

- Corea del Sur

- Australia

- Sudeste asiático

- Resto de Asia Pacífico

- Oriente Medio y África

- Emiratos Árabes Unidos

- Arabia Saudita

- Sudáfrica

- Resto de Oriente Medio y África

- América del norte

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Biomérieux

- Becton, Dickinson And Company

- Danaher Corporation

- T2 Biosystems

- Luminex

- Roche Diagnostics

- Thermo Fisher Scientific

- Bruker Corporation

- Abbott Laboratories

- Immunexpress

- Axis-Shield Diagnostics

- Quidel Corporation *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 3 GLOBAL SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 5 GLOBAL SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 7 GLOBAL SEPSIS DIAGNOSTICS MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 8 US SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 9 US SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 10 US SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 11 US SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 12 US SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 13 US SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 14 CANADA SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 15 CANADA SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 16 CANADA SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 17 CANADA SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 18 CANADA SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 19 CANADA SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 20 MEXICO SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 21 MEXICO SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 22 MEXICO SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 23 MEXICO SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 24 MEXICO SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 25 MEXICO SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 BRAZIL SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 27 BRAZIL SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 28 BRAZIL SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 29 BRAZIL SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 30 BRAZIL SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 31 BRAZIL SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 32 ARGENTINA SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 33 ARGENTINA SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 34 ARGENTINA SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 35 ARGENTINA SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 36 ARGENTINA SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 37 ARGENTINA SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 38 COLOMBIA SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 39 COLOMBIA SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 40 COLOMBIA SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 41 COLOMBIA SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 42 COLOMBIA SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 43 COLOMBIA SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 44 REST OF SOUTH AMERICA SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 45 REST OF SOUTH AMERICA SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 46 REST OF SOUTH AMERICA SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 47 REST OF SOUTH AMERICA SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 48 REST OF SOUTH AMERICA SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 49 REST OF SOUTH AMERICA SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 INDIA SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 51 INDIA SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 52 INDIA SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 53 INDIA SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 54 INDIA SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 55 INDIA SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 56 CHINA SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 57 CHINA SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 58 CHINA SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 59 CHINA SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 60 CHINA SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 61 CHINA SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 62 JAPAN SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 63 JAPAN SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 64 JAPAN SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 65 JAPAN SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 66 JAPAN SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 67 JAPAN SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 68 SOUTH KOREA SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 69 SOUTH KOREA SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 70 SOUTH KOREA SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 71 SOUTH KOREA SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 72 SOUTH KOREA SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 73 SOUTH KOREA SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 74 AUSTRALIA SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 75 AUSTRALIA SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 76 AUSTRALIA SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 77 AUSTRALIA SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 78 AUSTRALIA SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 79 AUSTRALIA SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 80 SOUTH-EAST ASIA SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 81 SOUTH-EAST ASIA SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 82 SOUTH-EAST ASIA SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 83 SOUTH-EAST ASIA SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 84 SOUTH-EAST ASIA SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 85 SOUTH-EAST ASIA SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 86 REST OF ASIA PACIFIC SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 87 REST OF ASIA PACIFIC SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 88 REST OF ASIA PACIFIC SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 89 REST OF ASIA PACIFIC SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 90 REST OF ASIA PACIFIC SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 91 REST OF ASIA PACIFIC SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 92 GERMANY SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 93 GERMANY SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 94 GERMANY SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 95 GERMANY SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 96 GERMANY SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 97 GERMANY SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 98 UK SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 99 UK SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 100 UK SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 101 UK SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 102 UK SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 103 UK SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 104 FRANCE SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 105 FRANCE SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 106 FRANCE SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 107 FRANCE SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 108 FRANCE SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 109 FRANCE SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 110 ITALY SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 111 ITALY SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 112 ITALY SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 113 ITALY SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 114 ITALY SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 115 ITALY SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 116 SPAIN SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 117 SPAIN SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 118 SPAIN SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 119 SPAIN SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 120 SPAIN SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 121 SPAIN SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 122 RUSSIA SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 123 RUSSIA SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 124 RUSSIA SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 125 RUSSIA SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 126 RUSSIA SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 127 RUSSIA SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 128 REST OF EUROPE SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 129 REST OF EUROPE SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 130 REST OF EUROPE SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 131 REST OF EUROPE SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 132 REST OF EUROPE SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 133 REST OF EUROPE SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 134 UAE SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 135 UAE SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 136 UAE SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 137 UAE SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 138 UAE SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 139 UAE SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 140 SAUDI ARABIA SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 141 SAUDI ARABIA SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 142 SAUDI ARABIA SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 143 SAUDI ARABIA SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 144 SAUDI ARABIA SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 145 SAUDI ARABIA SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 146 SOUTH AFRICA SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 147 SOUTH AFRICA SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 148 SOUTH AFRICA SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 149 SOUTH AFRICA SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 150 SOUTH AFRICA SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 151 SOUTH AFRICA SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 152 REST OF MIDDLE EAST AND AFRICA SEPSIS DIAGNOSTICS MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 153 REST OF MIDDLE EAST AND AFRICA SEPSIS DIAGNOSTICS MARKET BY METHOD (USD MILLIONS) 2020-2029

TABLE 154 REST OF MIDDLE EAST AND AFRICA SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (USD MILLIONS) 2020-2029

TABLE 155 REST OF MIDDLE EAST AND AFRICA SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (USD MILLIONS) 2020-2029

TABLE 156 REST OF MIDDLE EAST AND AFRICA SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 157 REST OF MIDDLE EAST AND AFRICA SEPSIS DIAGNOSTICS MARKET BY END USER (USD MILLIONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SEPSIS DIAGNOSTICS MARKET BY PRODUCT, USD MILLION, 2020-2029

FIGURE 9 GLOBAL SEPSIS DIAGNOSTICS MARKET BY METHOD, USD MILLION, 2020-2029

FIGURE 10 GLOBAL SEPSIS DIAGNOSTICS MARKET BY TEST TYPE, USD MILLION, 2020-2029

FIGURE 11 GLOBAL SEPSIS DIAGNOSTICS MARKET BY PATHOGEN, USD MILLION, 2020-2029

FIGURE 12 GLOBAL SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 13 GLOBAL SEPSIS DIAGNOSTICS MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 14 GLOBAL SEPSIS DIAGNOSTICS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 15 PORTER’S FIVE FORCES MODEL

FIGURE 16 NORTH AMERICA SEPSIS DIAGNOSTICS MARKET SNAPSHOT

FIGURE 17 EUROPE SEPSIS DIAGNOSTICS MARKET SNAPSHOT

FIGURE 18 ASIA PACIFIC SEPSIS DIAGNOSTICS MARKET SNAPSHOT

FIGURE 19 SOUTH AMERICA SEPSIS DIAGNOSTICS MARKET SNAPSHOT

FIGURE 20 MIDDLE EAST & AFRICA SEPSIS DIAGNOSTICS MARKET SNAPSHOT

FIGURE 21 BIOMÉRIEUX: COMPANY SNAPSHOT

FIGURE 22 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT

FIGURE 23 DANAHER CORPORATION: COMPANY SNAPSHOT

FIGURE 24 T2 BIOSYSTEMS: COMPANY SNAPSHOT

FIGURE 25 LUMINEX: COMPANY SNAPSHOT

FIGURE 26 ROCHE DIAGNOSTICS: COMPANY SNAPSHOT

FIGURE 27 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT

FIGURE 28 BRUKER CORPORATION: COMPANY SNAPSHOT

FIGURE 29 ABBOTT LABORATORIES: COMPANY SNAPSHOT

FIGURE 30 IMMUNEXPRESS: COMPANY SNAPSHOT

FIGURE 31 AXIS-SHIELD DIAGNOSTICS: COMPANY SNAPSHOT

FIGURE 32 QUIDEL CORPORATION: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te