Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Mercado de compuestos médicos por tipo de fibra (carbono y cerámica), por aplicación (diagnóstico por imágenes, implantes corporales compuestos, instrumentos quirúrgicos y odontología) y por región, tendencias globales y pronóstico de 2019 a 2028

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Descripción general del mercado de compuestos médicos

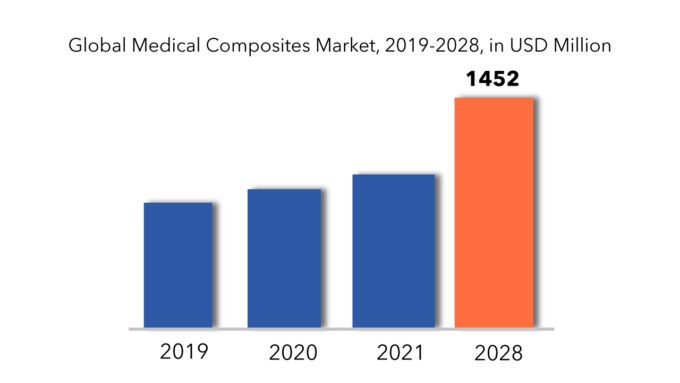

Se espera que el mercado mundial de compuestos médicos crezca a una tasa compuesta anual del 10,3 % entre 2019 y 2028. Se espera que alcance más de USD 1452 millones para 2028 desde USD 789,5 millones en 2019.

Los materiales compuestos médicos están compuestos por una mezcla de dos o más sustancias que poseen atributos físicos y químicos distintivos. Estos materiales compuestos se utilizan en prácticas de diagnóstico, en particular para reducir el peso de los instrumentos de diagnóstico, mejorando así la claridad de las imágenes de las zonas afectadas y facilitando la colocación de pacientes en situaciones poco frecuentes. Los usuarios finales de los materiales compuestos médicos incluyen empresas farmacéuticas, centros de diagnóstico por imágenes, fabricantes de dispositivos médicos , instituciones de investigación y entidades similares.

Los compuestos médicos se integran ampliamente en varias máquinas de rayos X debido a su capacidad para emitir niveles mínimos de radiación. En consecuencia, la demanda de compuestos médicos ha aumentado en el ámbito de las tecnologías de rayos X durante los últimos cinco años. Estos avances tecnológicos en los aparatos de diagnóstico médico han impulsado a los fabricantes a asignar recursos al desarrollo de productos prometedores basados en compuestos médicos.

En aplicaciones quirúrgicas, los compuestos médicos de fibra de carbono son muy utilizados debido a su ligereza y su inercia química. Además, los compuestos médicos que comprenden fibra de carbono sirven como materiales de conjugación adecuados en aplicaciones médicas, presentando una alternativa a las sustancias poliméricas o metálicas.

[título id="attachment_1678" align="aligncenter" width="870"]

Los materiales compuestos se utilizan para diversos fines médicos, como procedimientos quirúrgicos, implantes, prótesis, fabricación de instrumentos y equipos de diagnóstico. Los materiales compuestos avanzados se emplean cada vez más en materiales compuestos médicos, en particular en mesas de diagnóstico por imágenes para pacientes y accesorios utilizados en sistemas de rayos X, resonancia magnética, tomografía por emisión de positrones y tomografía computarizada. Estos materiales compuestos avanzados poseen radiotransparencia y presentan una baja absorción de energía radiante, lo que minimiza la interferencia de la señal y facilita la adquisición de imágenes diagnósticas nítidas. En consecuencia, el uso de materiales compuestos médicos en el diagnóstico por imágenes está en aumento.

El mercado de composites médicos experimentó una desaceleración en 2020 debido a la pandemia de COVID-19. Esta crisis sanitaria mundial afectó profundamente a regiones como América del Norte y Europa. Las medidas para contener la propagación del virus llevaron al cierre temporal de empresas e instalaciones de fabricación, limitaron las operaciones hospitalarias solo a casos de emergencia e impusieron restricciones a los tratamientos dentales.

[título id="attachment_1679" align="alignnone" width="680"]

Medical Composites Market Segment Analysis

Global medical composites market by type includes sodium polyacrylate, polyacrylate/polyacrylamide, copolymers and by application includes personal hygiene, agriculture, medical, industrial, packaging, construction, oil & gas.

Sodium polyacrylate segment to dominate global market.Sodium polyacrylate segment is expected to propelled by its ability to absorb as much as 500 times its mass of water. This segment is extensively used in baby diapers and adult incontinence products. This aspect will boost the growth of sodium polyacrylate segment for Global Mediacal Composites Market.

There is high demand for polyacrylamide coupled with its rising adoption in water treatment, paper-making processes and increased expenditure by manufacturers for launch of the new products are projected to enhance the growth of polyacrylamide segment in near future.

Adult incontinence application segment anticipated to dominate the global market during the forecast period. Growing prevalence of urinary incontinence and overactive bladder in the geriatric peoples. These products have substantial scope in developed regions coupled with increasing hygiene concern into customers. This factor is projected to peddle the growth of adult incontinence application segment over the coming years.

Medical Composites Market Players

Large healthcare companies to small ones, many companies are actively working in the global medical composites market. These key players include, Toray Industries Inc., Dentsply Sirona, Ceramtec, SGL Carbon, Royal Dsm Nv, Ico Tec AG, Idi composites international, Composiflex Inc., 3M, Vermont Composites Inc., and ACP composites inc. are mainly in the device manufacturing and they are competing closely with each other.

Innovation is one of the most important and key strategy as it has to be for any health-related market. However, companies in the market have also opted and successfully driven inorganic growth strategies like mergers & acquisition and so on.

- In 2019, 3M has launched Filtek Universal restorative composites product. This product combines a unique shading system in an innovative material that not only provides efficiency but a highly esthetic and long-lasting result.

- In 2018, Toray Industries Inc. has acquired TenCate Advanced Composites It is a composites division of TenCate BV, for USD 1,091 million. This acquisition has helped the company to grow its market position in the carbon fiber composites market in various end-use industries, like medical.

Who Should Buy? Or Key Stakeholders

- Medical Devices manufacturers

- Medical Composites Suppliers

- Healthcare companies

- Investors

- Manufacturing companies

- End user companies

- Research institutes

- Healthcare

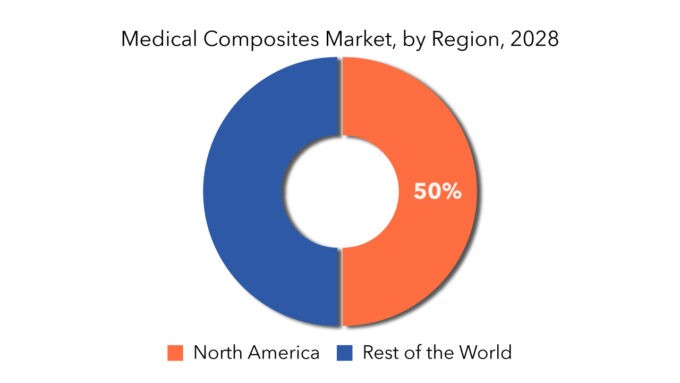

Medical Composites Market Regional Analysis

The global medical composites market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Key Market Segments: Global Medical Composites Market

- Global Medical Composites Market by Fiber Type, 2019-2028, (In USD Million)

- Carbon Fiber

- Ceramic Fiber

- Others

- Global Medical Composites Market by Application, 2019-2028, (In USD Million)

- Diagnostic Imaging

- Composite Body Implants

- Surgical Instruments

- Dental

- Others

- Global Medical Composites Market by Region, 2019-2028, (In USD Million)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What are the growth opportunities related to the adoption of medical composites across major regions in the future?

- What are the new trends and advancements in the medical composites market?

- Which product categories are expected to have highest growth rate in the medical composites market?

- Which are the key factors driving the medical composites market?

- What will the market growth rate, growth momentum or acceleration the market carries during the forecast period?

- INTRODUCCIÓN

- DEFINICIÓN DE MERCADO

- DINÁMICA DEL MERCADO

- SEGMENTACIÓN DEL MERCADO

- CRONOGRAMA DEL INFORME

- ACTORES CLAVE

- METODOLOGÍA DE LA INVESTIGACIÓN

- MINERÍA DE DATOS

- INVESTIGACIÓN SECUNDARIA

- INVESTIGACIÓN PRIMARIA

- ASESORAMIENTO EXPERTO EN LA MATERIA

- CONTROL DE CALIDAD

- REVISIÓN FINAL

- TRIANGULACIÓN DE DATOS

- ENFOQUE DE ABAJO HACIA ARRIBA

- ENFOQUE DE ARRIBA HACIA ABAJO

- FLUJO DE INVESTIGACIÓN

- MINERÍA DE DATOS

- RESUMEN EJECUTIVO

- INTRODUCCIÓN

- MERCADO MUNDIAL DE POLÍMEROS SUPERABSORBENTES POR TIPO

- MERCADO GLOBAL DE POLÍMEROS SUPERABSORBENTES POR APLICACIÓN

- DINÁMICA DEL MERCADO

- CONDUCTORES

- FACTORES QUE AYUDAN AL CRECIMIENTO DEL MERCADO

- RESTRICCIONES

- FACTORES QUE AFECTAN NEGATIVAMENTE EL CRECIMIENTO DEL MERCADO

- CADENA DE VALOR DE LA INDUSTRIA

- FABRICANTE

- DISTRIBUIDOR

- USUARIO FINAL

- MODELO DE LAS CINCO FUERZAS DE PORTER

- AMENAZA DE NUEVOS INGRESANTES

- AMENAZA DE SUSTITUTOS

- PODER DE NEGOCIACIÓN DE LOS PROVEEDORES

- PODER DE NEGOCIACIÓN DE LOS CLIENTES

- GRADO DE COMPETENCIA

- CONDUCTORES

- MERCADO MUNDIAL DE POLÍMEROS SUPERABSORBENTES POR TIPO

- INTRODUCCIÓN

- CARBÓN

- CERÁMICA POLITÉRMICA

- MERCADO MUNDIAL DE POLÍMEROS SUPERABSORBENTES POR TIPO

- INTRODUCCIÓN

- MERCADO GLOBAL DE POLÍMEROS SUPERABSORBENTES POR APLICACIÓN

- INTRODUCCIÓN

- DIAGNÓSTICO POR IMAGEN

- IMPLANTES DE CUERPO COMPUESTO

- INSTRUMENTOS QUIRÚRGICOS

- DENTAL

- MÉDICO

- MERCADO GLOBAL DE POLÍMEROS SUPERABSORBENTES POR APLICACIÓN

- INTRODUCCIÓN

- MERCADO DE POLÍMEROS SUPER ABSORBENTES POR REGIÓN

- INTRODUCCIÓN

- MERCADO MUNDIAL DE POLÍMEROS SUPER ABSORBENTES POR REGIÓN

- AMÉRICA DEL NORTE

- A NOSOTROS

- CANADÁ

- MÉXICO

- SUDAMERICA

- BRASIL

- ARGENTINA

- RESTO DE SUDAMÉRICA

- ASIA-PACÍFICO

- PORCELANA

- JAPÓN

- COREA DEL SUR

- AUSTRALIA

- ASIA SUDESTE

- RESTO DE ASIA PACÍFICO

- EUROPA

- ALEMANIA

- Reino Unido

- FRANCIA

- ITALIA

- ESPAÑA

- RUSIA

- RESTO DE EUROPA

- Emiratos Árabes Unidos

- ARABIA SAUDITA

- SUDÁFRICA

- RESTO DE ORIENTE MEDIO Y ÁFRICA

- PANORAMA COMPETITIVO

- FUSIONES, ADQUISICIONES, EMPRESAS CONJUNTAS, COLABORACIONES Y ACUERDOS

- INICIATIVAS ESTRATÉGICAS

- CUOTA DE MERCADO (%) **/ANÁLISIS DE CLASIFICACIÓN

- ESTRATEGIAS ADOPTADAS POR LOS PRINCIPALES ACTORES

- FUSIONES, ADQUISICIONES, EMPRESAS CONJUNTAS, COLABORACIONES Y ACUERDOS

- PERFILES DE EMPRESAS

- INDUSTRIAS TORAY

- DESCRIPCIÓN GENERAL DEL NEGOCIO

- INSTANTÁNEA DE LA EMPRESA

- PRODUCTOS DE REFERENCIA

- INICIATIVAS ESTRATÉGICAS

- CERAMTEC GMBH

- DESCRIPCIÓN GENERAL DEL NEGOCIO

- INSTANTÁNEA DE LA EMPRESA

- PRODUCTOS DE REFERENCIA

- INICIATIVAS ESTRATÉGICAS

- DENSPLY SIRONA

- DESCRIPCIÓN GENERAL DEL NEGOCIO

- INSTANTÁNEA DE LA EMPRESA

- PRODUCTOS DE REFERENCIA

- INICIATIVAS ESTRATÉGICAS

- REAL DSM NV

- DESCRIPCIÓN GENERAL DEL NEGOCIO

- INSTANTÁNEA DE LA EMPRESA

- PRODUCTOS DE REFERENCIA

- INICIATIVAS ESTRATÉGICAS

- SGL CARBONO

- DESCRIPCIÓN GENERAL DEL NEGOCIO

- INSTANTÁNEA DE LA EMPRESA

- PRODUCTOS DE REFERENCIA

- INICIATIVAS ESTRATÉGICAS

- IDI COMPOSITES INTERNACIONAL

- DESCRIPCIÓN GENERAL DEL NEGOCIO

- INSTANTÁNEA DE LA EMPRESA

- PRODUCTOS DE REFERENCIA

- INICIATIVAS ESTRATÉGICAS

- ICOTEC AG

- DESCRIPCIÓN GENERAL DEL NEGOCIO

- INSTANTÁNEA DE LA EMPRESA

- PRODUCTOS DE REFERENCIA

- INICIATIVAS ESTRATÉGICAS

- COMPOSIFLEX INC.

- DESCRIPCIÓN GENERAL DEL NEGOCIO

- INSTANTÁNEA DE LA EMPRESA

- PRODUCTOS DE REFERENCIA

- INICIATIVAS ESTRATÉGICAS

- COMPUESTOS DE VERMONT INC.

- DESCRIPCIÓN GENERAL DEL NEGOCIO

- INSTANTÁNEA DE LA EMPRESA

- PRODUCTOS DE REFERENCIA

- INICIATIVAS ESTRATÉGICAS

- COMPOSITOS ACP INC.

- DESCRIPCIÓN GENERAL DEL NEGOCIO

- INSTANTÁNEA DE LA EMPRESA

- PRODUCTOS DE REFERENCIA

- INICIATIVAS ESTRATÉGICAS

- INDUSTRIAS TORAY

- OPORTUNIDADES Y TENDENCIAS FUTURAS

- OPORTUNIDADES Y TENDENCIAS DEL MERCADO FUTURO

LISTA DE TABLAS

TABLE 1 GLOBAL MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 2 GLOBAL MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 3 GLOBAL MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 4 GLOBAL MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 5 GLOBAL MEDICAL COMPOSITES MARKET BY REGION (USD MILLIONS), 2019-2028

TABLE 6 GLOBAL MEDICAL COMPOSITES MARKET BY REGION (KILOTONS), 2019-2028

TABLE 7 GLOBAL MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 8 GLOBAL MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 9 GLOBAL MEDICAL COMPOSITES MARKET APPLICATION (USD MILLIONS), 2019-2028

TABLE 10 GLOBAL MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 11 NORTH AMERICA MEDICAL COMPOSITES MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 12 NORTH AMERICA MEDICAL COMPOSITES MARKET BY COUNTRY (KILOTONS), 2019-2028

TABLE 13 NORTH AMERICA MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 14 NORTH AMERICA MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 15 NORTH AMERICA MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 16 NORTH AMERICA MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 17 US MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 18 US MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 19 US MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 20 US MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 21 CANADA MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 22 CANADA MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 23 CANADA MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 24 CANADA MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 25 MEXICO MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 26 MEXICO MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 27 MEXICO MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 28 MEXICO MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 29 SOUTH AMERICA MEDICAL COMPOSITES MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 30 SOUTH AMERICA MEDICAL COMPOSITES MARKET BY COUNTRY (KILOTONS), 2019-2028

TABLE 31 SOUTH AMERICA MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 32 SOUTH AMERICA MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 33 SOUTH AMERICA MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 34 SOUTH AMERICA MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 35 BRAZIL MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 36 BRAZIL MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 37 BRAZIL MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 38 BRAZIL MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 39 ARGENTINA MEDICAL COMPOSITES MARKET BY TTYPE (USD MILLIONS), 2019-2028

TABLE 40 ARGENTINA MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 41 ARGENTINA MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 42 ARGENTINA MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 43 REST OF SOUTH AMERICA MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 44 REST OF SOUTH AMERICA MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 45 REST OF SOUTH AMERICA MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 46 REST OF SOUTH AMERICA MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 47 ASIA-PACIFIC MEDICAL COMPOSITES MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 48 ASIA-PACIFIC MEDICAL COMPOSITES MARKET BY COUNTRY (KILOTONS), 2019-2028

TABLE 49 ASIA PACIFIC MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 50 ASIA PACIFIC MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 51 ASIA PACIFIC MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 52 ASIA PACIFIC MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 53 INDIA MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 54 INDIA MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 55 INDIA MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 56 INDIA MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 57 CHINA MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 58 CHINA MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 59 CHINA MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 60 CHINA MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 61 JAPAN MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 62 JAPAN MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 63 JAPAN MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 64 JAPAN MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 65 SOUTH KOREA MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 66 SOUTH KOREA MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 67 SOUTH KOREA MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 68 SOUTH KOREA MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 69 AUSTRALIA MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 70 AUSTRALIA MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 71 AUSTRALIA MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 72 AUSTRALIA MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 73 SOUTH-EAST ASIA MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 74 SOUTH-EAST ASIA MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 75 SOUTH EAST ASIA MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 76 SOUTH EAST ASIA MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 77 REST OF ASIA PACIFIC MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 78 REST OF ASIA PACIFIC MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 79 REST OF ASIA PACIFIC MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 80 REST OF ASIA PACIFIC MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 81 EUROPE MEDICAL COMPOSITES MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 82 EUROPE MEDICAL COMPOSITES MARKET BY COUNTRY (KILOTONS), 2019-2028

TABLE 83 EUROPE MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 84 EUROPE MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 85 EUROPE MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 86 EUROPE MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 87 GERMANY MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 88 GERMANY MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 89 GERMANY MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 90 GERMANY MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 91 UK MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 92 UK MEDICAL COMPOSITES MARKET BY TYPR (KILOTONS), 2019-2028

TABLE 93 UK MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 94 UK MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 95 FRANCE MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 96 FRANCE MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 97 FRANCE MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 98 FRANCE MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 99 ITALY MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 100 ITALY MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 101 ITALY MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 102 ITALY MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 103 SPAIN MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 104 SPAIN MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 105 SPAIN MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 106 SPAIN MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 107 RUSSIA MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 108 RUSSIA MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 109 RUSSIA MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 110 RUSSIA MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 111 REST OF EUROPE MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 112 REST OF EUROPE MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 113 REST OF EUROPE MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 114 REST OF EUROPE MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 115 UAE MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 116 UAE MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 117 UAE MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 118 UAE MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 119 SAUDI ARABIA MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 120 SAUDI ARABIA MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 121 SAUDI ARABIA MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 122 SAUDI ARABIA MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 123 SOUTH AFRICA MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 124 SOUTH AFRICA MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 125 SOUTH AFRICA MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 126 SOUTH AFRICA MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 127 REST OF MIDDLE EAST AND AFRICA MEDICAL COMPOSITES MARKET BY TYPE (USD MILLIONS), 2019-2028

TABLE 128 REST OF MIDDLE EAST AND AFRICA MEDICAL COMPOSITES MARKET BY TYPE (KILOTONS), 2019-2028

TABLE 129 REST OF MIDDLE EAST AND AFRICA MEDICAL COMPOSITES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 130 REST OF MIDDLE EAST AND AFRICA MEDICAL COMPOSITES MARKET BY APPLICATION (KILOTONS), 2019-2028

List of FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SUPER ABSORBENT POLYMERS MARKET BY TYPE, USD MILLION, 2019-2028

FIGURE 9 GLOBAL SUPER ABSORBENT POLYMERS MARKET BY APPLICATION, USD MILLION, 2019-2028

FIGURE 10 PORTER’S FIVE FORCES MODEL

FIGURE 11 GLOBAL SUPER ABSORBENT POLYMERS MARKET BY TYPE, 2020

FIGURE 1 GLOBAL SUPER ABSORBENT POLYMERS MARKET BY APPLICATION 2020

FIGURE 2 SUPER ABSORBENT POLYMERS MARKET BY REGION 2020

FIGURE 3 MARKET SHARE ANALYSIS

FIGURE 4 TORAY INDUSTRIES: COMPANY SNAPSHOT

FIGURE 5 CERAMTEC GMBH: COMPANY SNAPSHOT

FIGURE 6 DENTSPLY SIRONA: COMPANY SNAPSHOT

FIGURE 7 ROYAL DSM N.V.: COMPANY SNAPSHOT

FIGURE 8 SGL CARBON: COMPANY SNAPSHOT

FIGURE 9 IDI COMPOSITES INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 10 ICOTEC AG: COMPANY SNAPSHOT

FIGURE 11 COMPOSIFLEX INC.: COMPANY SNAPSHOT

FIGURE 12 VERMONT COMPOSITES INC.: COMPANY SNAPSHOT

FIGURE 13 ACP COMPOSITES INC.: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te