Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Tamaño del mercado de dispositivos bucales para la apnea del sueño por tipo de producto (dispositivos de avance mandibular, dispositivos de retención de la lengua, máquina CPAP y otros), por aplicación (hospitales, uso doméstico, clínicas y otros) y por región Tendencias globales y pronóstico de 2022 a 2029

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Descripción general del mercado de dispositivos bucales para la apnea del sueño

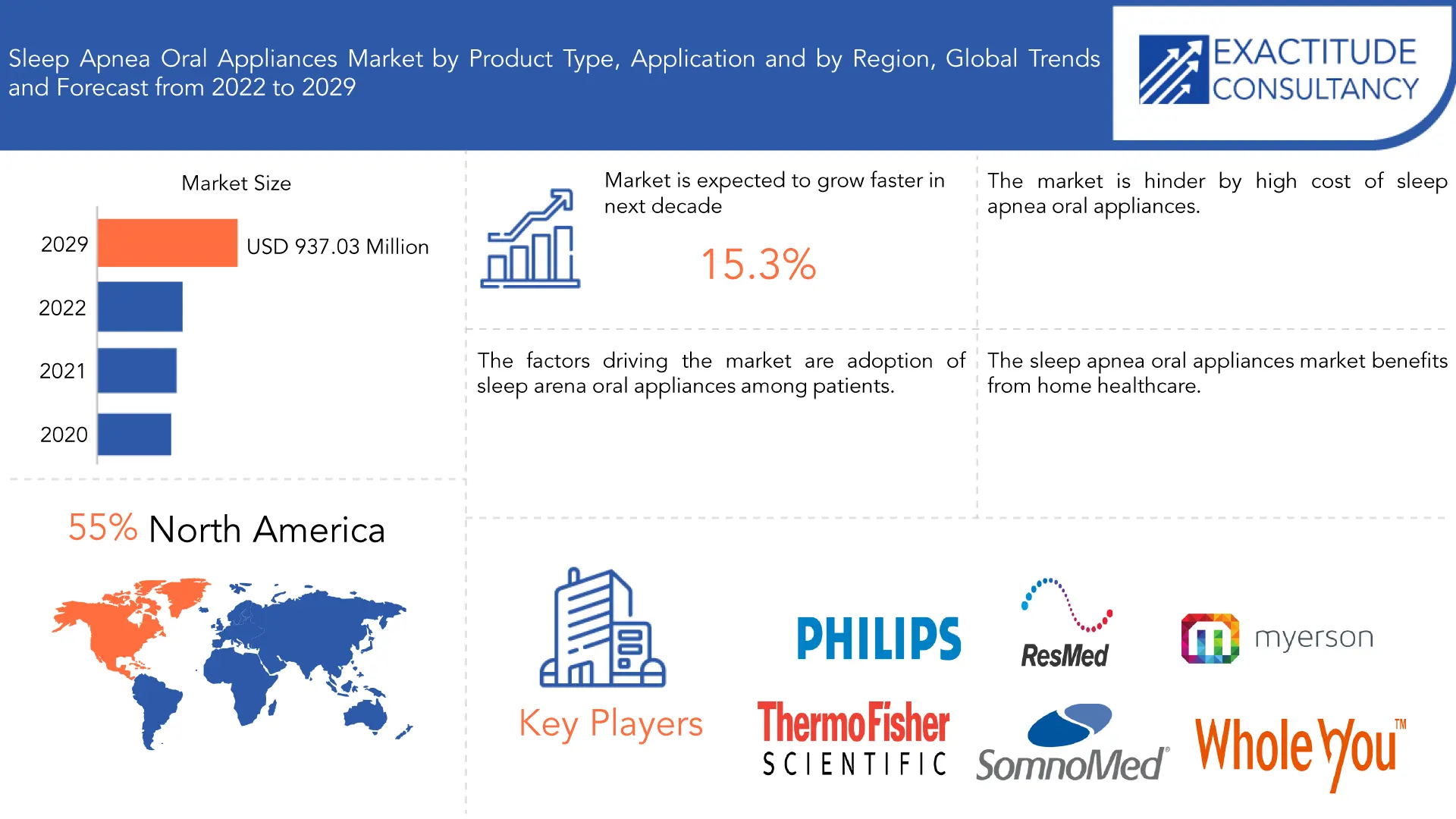

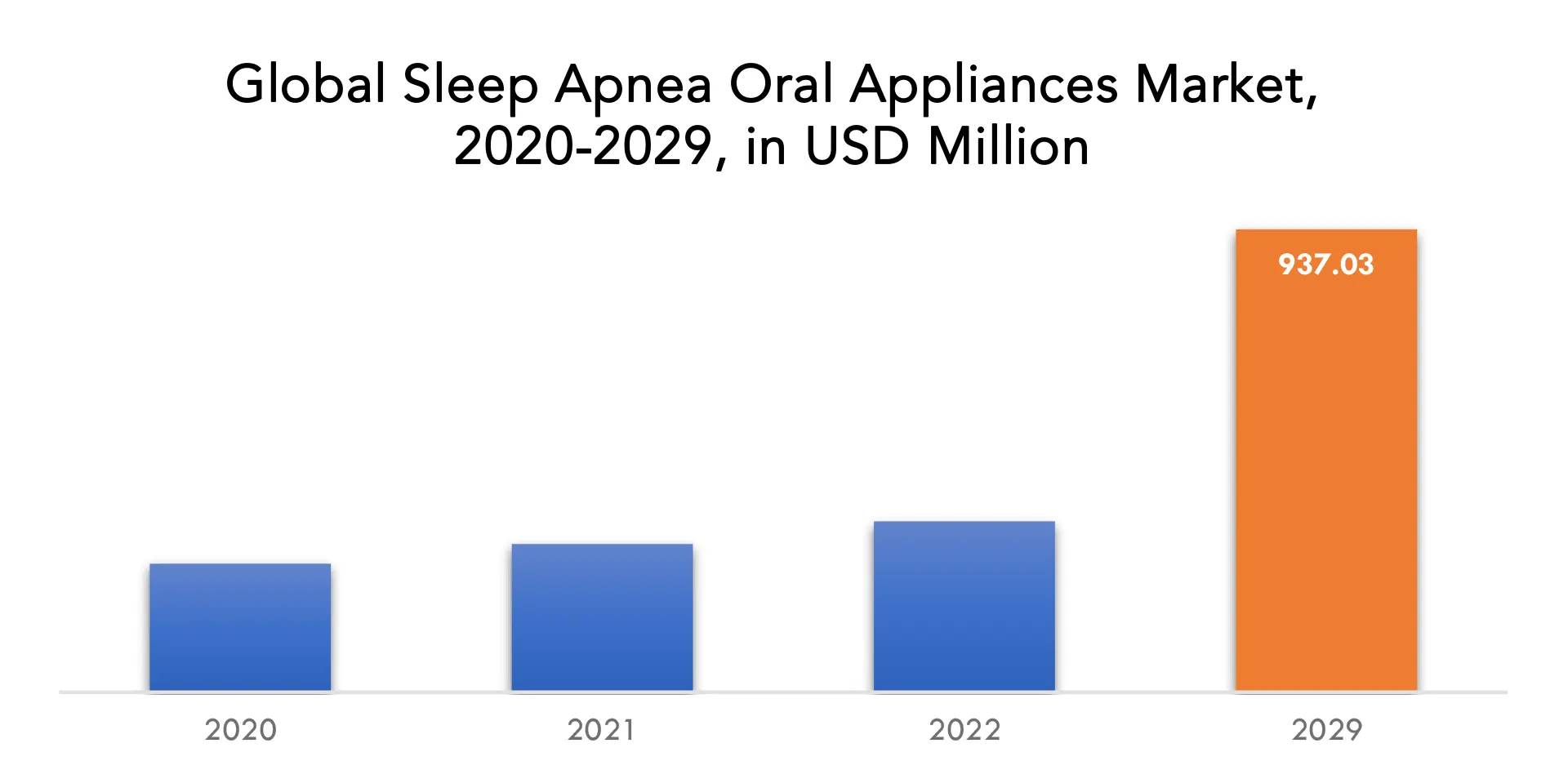

Se espera que el mercado global de dispositivos bucales para la apnea del sueño crezca a una tasa compuesta anual del 15,3 % entre 2022 y 2029, desde USD 260,19 millones en 2020.

Los trastornos del sueño, que afectan a una de cada tres personas en algún momento de su vida, se encuentran entre las afecciones médicas más difíciles. Un trastorno del sueño grave y potencialmente mortal llamado apnea del sueño con frecuencia no se diagnostica ni se trata. Sin embargo, varios programas gubernamentales están ayudando a los pacientes con apnea obstructiva del sueño. Por ejemplo, la Asociación Estadounidense de Apnea del Sueño (ASAA), una organización sin fines de lucro en los Estados Unidos, trabaja para aumentar la conciencia pública sobre la apnea del sueño, promover la investigación del tratamiento y representar las necesidades de quienes padecen esta afección.

Se prevé que crezca de forma positiva como resultado de varios beneficios potenciales que ofrecen la mHealth y la telemedicina en términos de mejorar la gestión y el diagnóstico de la apnea del sueño. Numerosos estudios han demostrado que la adherencia del paciente durante las primeras semanas de tratamiento es un predictor clave del cumplimiento de la CPAP a largo plazo. El seguimiento y el apoyo deben ser rápidos durante todo este tiempo para promover el cumplimiento. La prevalencia de pacientes con apnea del sueño no diagnosticados, el aumento del uso de dispositivos bucales y los avances tecnológicos en los dispositivos para la apnea del sueño son solo algunos de los factores que impulsan el crecimiento del mercado mundial de la apnea del sueño.

| ATRIBUTO | DETALLES |

| Periodo de estudio | 2020-2029 |

| Año base | 2021 |

| Año estimado | 2022 |

| Año pronosticado | 2022-2029 |

| Periodo histórico | 2018-2020 |

| Unidad | Valor (Millones de USD) (Miles de Unidades) |

| Segmentación | Por tipo de producto, por aplicación, por región. |

| Por tipo de producto |

|

| Por aplicación |

|

| Por región |

|

La prevalencia de la obesidad y la hipertensión está aumentando, junto con la incidencia de la apnea del sueño, la población geriátrica está creciendo y la población de pacientes en los países en desarrollo está tomando mayor conciencia de la condición. Uno de los principales factores que impulsa el mercado de dispositivos para la apnea del sueño es el envejecimiento. El riesgo de desarrollar este trastorno es mayor en las personas mayores. Se espera que el porcentaje de la población mundial que tiene 65 años o más aumente del 10% en 2022 al 16% en 2050, según las Perspectivas de población mundial 2022. A nivel mundial, se espera que el número de personas de 65 años o más supere al de las personas menores de 5 años para 2050 y sea aproximadamente igual al de las personas menores de 12 años.

[título id="attachment_23937" align="aligncenter" width="1920"]

Frequently Asked Questions

• What is the worth of global sleep apnea oral appliances market?

The sleep apnea oral appliances market reached USD 260.19 million in 2020 and is expected to grow at a CAGR of more than 15.3% through 2029, owing to the increasing development in the new technology.

• What are the upcoming trends of sleep apnea oral appliances market, globally?

The upcoming trend in the sleep apnea oral appliances market is an opportunity for market growth.

• What is the CAGR of sleep apnea oral appliances market?

The global sleep apnea oral appliances market registered a CAGR of 15.3% from 2022 to 2029.

• Which are the top companies to hold the market share in sleep apnea oral appliances market?

Key players profiled in the report include ResMed, Koninklijke Philips N.V, Myerson Solicitors LLP, Thermo Fisher Scientific Inc, SomnoMed, Whole You, Inc., Panthera Dental, Oventus, Löwenstein Medical Technology GmbH + Co. KG., Fisher & Paykel Healthcare Limited, BMC.

• Which is the largest regional market for sleep apnea oral appliances market?

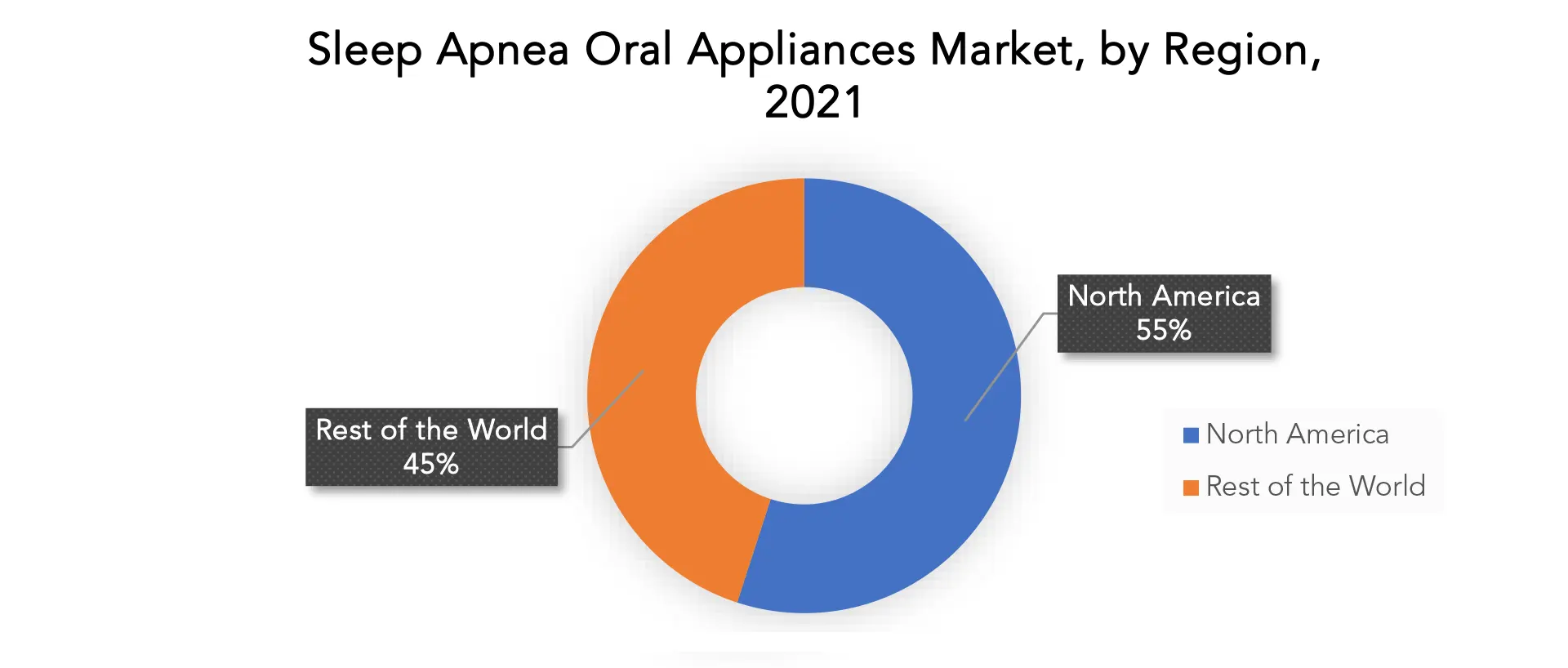

The North America Sleep Apnea Oral Appliances market has largest market share of 55% in 2021. Major factor driving revenue growth in the region is the availability of subsidies and grants by public and private organizations, as well as technologically sophisticated equipment like Elastic Mandibular Advancements (EMA) for simple and early diagnosis as well as treatment of sleep apnea.

Sleep Apnea Oral Appliances Market Segment Analysis

The global market for sleep apnea oral appliances is divided into categories based on product, including CPAP machines, tongue-retaining devices, and mandibular advancement devices. In 2021, tongue-retaining devices continued to hold a stable revenue share of the market. The monobloc oral appliance known as the tongue-retaining device was created specially to treat obstructive sleep apnea (OSAS). This study evaluated the effectiveness of tongue-retention devices as well as how well patients with OSAS tolerated them. Through the course of the night, these devices keep the tongue forward and out of the mouth by encircling it with a soft plastic splint. The majority of insurance plans at least partially cover these devices when they are used to treat OSA, which significantly increases their rate of adoption.

The device type with the largest revenue share in 2021 will be mandibular advancement devices. The ability of Mandibular Advancement Devices (MAD) to lessen snoring and sleep apnea is a key factor boosting the segment's revenue growth. A MAD is a treatment option that patients can try. By briefly moving the jaw and tongue forward, it prevents throat constriction, snoring, and sleep apnea.

The airway is made larger by moving the tongue forward. Some MADs are made to fit the mouth of a specific person and are either semi- or fully customized. Others are marketed as boil-and-bite MADs and sold Over-The-Counter (OTC). Their supple fabrics become more malleable when placed in hot water. Biting down on the flexible mold makes it easier to fit the device. Mandibular Advancement Devices (MADs), which are anti-snoring mouthpieces, work by physically moving the jaw forward to widen the airway.

The most common components of MADs are thermoplastic trays that can be customized to fit your upper and lower teeth, as well as hinges or elastic bands for adjusting the amount of advancement. For people with obstructive sleep apnea (OSA), MADs may be a more comfortable and non-invasive alternative to CPAP therapy.

The global market for sleep apnea oral appliances is divided into hospitals, home use, clinics, and others based on end-use. In 2021, home use maintained a consistent revenue share. Growing consumer awareness of the importance of getting regular check-ups is a key factor fuelling this segment's market revenue. The adoption rate and demand for appropriate products rise as a result of an increase in the number of patients who prefer to use sleep apnea oral appliances at home rather than visit medical facilities for routine check-ups.

Hospitals had the highest revenue share in 2021. The increase in patients with sleep disorders is a significant factor in this segment's market revenue. Hospitals are installing more oral sleep apnea devices as a result of an increase in patient volume, which presents a sizable investment opportunity for market players.

[caption id="attachment_23941" align="aligncenter" width="1920"]

Sleep Apnea Oral Appliances Market Players

Key players involved in Sleep Apnea Oral Appliances market are ResMed, Koninklijke, Philips N.V, Myerson Solicitors LLP, Thermo Fisher Scientific Inc, SomnoMed, Whole You, Inc., Panthera Dental, Oventus, Löwenstein Medical Technology GmbH + Co. KG., Fisher & Paykel Healthcare Limited and BMC. Mergers and acquisitions, joint ventures, capacity expansions, significant distribution, and branding decisions by established industry players to boost market share and regional presence. They are also engaged in continuous R&D activities to develop new Product Types and are focused on expanding the Product Type portfolio. This is expected to increase competition and pose a threat to new market entrants.

Recent developments Dec 21, 2022, Philips provided updated on completed set of test results for first-generation DreamStation sleep therapy devices Nov 22, 2022, Philips Respironics provided update on filed MDRs in connection with the voluntary recall notification/field safety notice* for specific CPAP, BiPAP and mechanical ventilator devices.Who Should Buy? Or Key stakeholders

- Research and development

- Manufacturing

- End Use industries

- Sleep Laboratories & Hospitals

- Government

- Healthcare

- Production Industry and manufacturing

Sleep Apnea Oral Appliances Market Regional Analysis

Geographically, the Sleep Apnea Oral Appliances market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America's sleep apnea oral appliances market had the highest revenue share in 2021. One of the main factors propelling revenue growth in North America is the region's sizable patient population. For instance, the American Sleep Association (ASA) estimates that between 50 and 70 million Americans will experience sleep disorders in 2021. Obstructive sleep apnea affects 25 million people in the US. Due to the urgent need for people to maintain their health and the rising public awareness of the risks associated with sleep apnea, the market is growing quickly in the United States. The availability of subsidies and grants from public and private organizations, as well as technologically advanced equipment like Elastic Mandibular Advancements (EMA) for straightforward and early diagnosis as well as treatment of sleep apnea, are additional significant factors driving revenue growth in North America.

Europe's revenue share remained stable in 2021. The region's revenue growth is anticipated to be fuelled by the regional presence of well-established market players. For instance, Koninklijke Philips of the Netherlands, Löwenstein Medical of Germany, and other businesses are among those making sizable investments in the creation and introduction of sleep apnea oral appliance products in Europe. An increase in investments is anticipated to result in an increase in research and development, which is anticipated to result in the introduction of novel products.

In terms of revenue, Asia Pacific had a modest share in 2021. The region's government and a number of private organisations' responses to the prevalence of sleep apnea are considered to be the main driver of revenue growth in the area. In 2020, 4.15% to 7.51% and 2.15% to 3.21%, respectively, of middle-aged men and women in Asia Pacific were estimated to have symptomatic obstructive sleep apnea (OSA). Numerous governmental and non-governmental organisations are investing in the field as a result of the rising prevalence of sleep apnea in the area. [caption id="attachment_23942" align="aligncenter" width="1920"]

Key Market Segments: Sleep Apnea Oral Appliances Market

Sleep Apnea Oral Appliances Market Product Type, 2020-2029, (USD Million) (Thousand Units)- Mandibular Advancement Devices

- Tongue-Retaining Devices

- CPAP Machine

- Others

- Hospitals

- Home Use

- Clinics

- Others

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new End user

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the sleep apnea oral appliances market over the next 7years?

- Who are the major players in the sleep apnea oral appliances market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the sleep apnea oral appliances market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the sleep apnea oral appliances market?

- What is the current and forecasted size and growth rate of the global sleep apnea oral appliances market?

- What are the key drivers of growth in the sleep apnea oral appliances market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the sleep apnea oral appliances market?

- What are the technological advancements and innovations in the sleep apnea oral appliances market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the sleep apnea oral appliances market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the sleep apnea oral appliances market?

- What are the service offerings and specifications of leading players in the market?

- INTRODUCCIÓN

- DEFINICIÓN DE MERCADO

- SEGMENTACIÓN DEL MERCADO

- CRONOGRAMAS DE INVESTIGACIÓN

- SUPUESTOS Y LIMITACIONES

- METODOLOGÍA DE LA INVESTIGACIÓN

- MINERÍA DE DATOS

- INVESTIGACIÓN SECUNDARIA

- INVESTIGACIÓN PRIMARIA

- ASESORAMIENTO DE EXPERTOS EN LA MATERIA

- CONTROLES DE CALIDAD

- REVISIÓN FINAL

- TRIANGULACIÓN DE DATOS

- ENFOQUE DE ABAJO HACIA ARRIBA

- ENFOQUE DE ARRIBA HACIA ABAJO

- FLUJO DE INVESTIGACIÓN

- FUENTES DE DATOS

- MINERÍA DE DATOS

- RESUMEN EJECUTIVO

- PANORAMA DEL MERCADO

- PERSPECTIVAS DEL MERCADO MUNDIAL DE DISPOSITIVOS BUCAL PARA LA APNEA DEL SUEÑO

- IMPULSORES DEL MERCADO

- RESTRICCIONES DEL MERCADO

- OPORTUNIDADES DE MERCADO

- IMPACTO DEL COVID-19 EN EL MERCADO DE DISPOSITIVOS BUCAL PARA LA APNEA DEL SUEÑO

- MODELO DE LAS CINCO FUERZAS DE PORTER

- AMENAZA DE NUEVOS INGRESANTES

- AMENAZA DE SUSTITUTOS

- PODER DE NEGOCIACIÓN DE LOS PROVEEDORES

- PODER DE NEGOCIACIÓN DE LOS CLIENTES

- GRADO DE COMPETENCIA

- ANÁLISIS DE LA CADENA DE VALOR DE LA INDUSTRIA

- PERSPECTIVAS DEL MERCADO MUNDIAL DE DISPOSITIVOS BUCAL PARA LA APNEA DEL SUEÑO

- MERCADO MUNDIAL DE DISPOSITIVOS BUCAL PARA LA APNEA DEL SUEÑO POR TIPO DE PRODUCTO, 2020-2029, (MILLONES DE USD) (MILES DE UNIDADES)

- DISPOSITIVOS DE AVANCE MANDIBULAR

- DISPOSITIVOS DE RETENCIÓN DE LA LENGUA

- MÁQUINA CPAP

- OTROS

- MERCADO MUNDIAL DE DISPOSITIVOS BUCAL PARA LA APNEA DEL SUEÑO POR APLICACIÓN, 2020-2029, (MILLONES DE USD) (MILES DE UNIDADES)

- HOSPITALES

- USO DOMÉSTICO

- CLÍNICAS

- OTROS

- MERCADO MUNDIAL DE DISPOSITIVOS BUCAL PARA LA APNEA DEL SUEÑO POR REGIÓN, 2020-2029, (MILLONES DE USD) (MILES DE UNIDADES)

- AMÉRICA DEL NORTE

- A NOSOTROS

- CANADÁ

- MÉXICO

- SUDAMERICA

- BRASIL

- ARGENTINA

- COLOMBIA

- RESTO DE SUDAMÉRICA

- EUROPA

- ALEMANIA

- Reino Unido

- FRANCIA

- ITALIA

- ESPAÑA

- RUSIA

- RESTO DE EUROPA

- ASIA PACÍFICO

- INDIA

- PORCELANA

- JAPÓN

- COREA DEL SUR

- AUSTRALIA

- ASIA SUDESTE

- RESTO DE ASIA PACÍFICO

- ORIENTE MEDIO Y ÁFRICA

- Emiratos Árabes Unidos

- ARABIA SAUDITA

- SUDÁFRICA

- RESTO DE ORIENTE MEDIO Y ÁFRICA

- AMÉRICA DEL NORTE

- PERFILES DE EMPRESAS* (DESCRIPCIÓN GENERAL DEL NEGOCIO, RESEÑA DE LA EMPRESA, PRODUCTOS OFRECIDOS, DESARROLLOS RECIENTES)

- RESMED

- CONFIANZA PHILIPS NV

- Abogados Myerson, LLP

- TERMO FISHER CIENTIFIC INC

- Soñoliento

- TODO TU, INC.

- DENTAL DE PANTHERA

- OVENTO

- TECNOLOGÍA MÉDICA LÖWENSTEIN GMBH

- FISHER & PAYKEL HEALTHCARE LIMITED * LA LISTA DE EMPRESAS ES ORIENTATIVA

LISTA DE TABLAS

TABLE 1 GLOBAL SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL SLEEP APNEA ORAL APPLIANCES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 6 GLOBAL SLEEP APNEA ORAL APPLIANCES MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 7 NORTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 9 NORTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 11 NORTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 13 US SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 14 US SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 15 US SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 16 US SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 17 CANADA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 18 CANADA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 19 CANADA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 20 CANADA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 21 MEXICO SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 22 MEXICO SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 23 MEXICO SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 24 MEXICO SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 25 SOUTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 26 SOUTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 27 SOUTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 28 SOUTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 29 SOUTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 30 SOUTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 31 BRAZIL SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 32 BRAZIL SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 33 BRAZIL SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 34 BRAZIL SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 35 ARGENTINA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 36 ARGENTINA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 37 ARGENTINA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 38 ARGENTINA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 39 COLOMBIA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 40 COLOMBIA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 41 COLOMBIA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 42 COLOMBIA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 43 REST OF SOUTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 44 REST OF SOUTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 45 REST OF SOUTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 46 REST OF SOUTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 47 ASIA PACIFIC SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 48 ASIA PACIFIC SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 49 ASIA PACIFIC SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 50 ASIA PACIFIC SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 51 ASIA PACIFIC SLEEP APNEA ORAL APPLIANCES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 52 ASIA PACIFIC SLEEP APNEA ORAL APPLIANCES MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 53 INDIA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 54 INDIA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 55 INDIA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 56 INDIA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 57 CHINA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 58 CHINA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 59 CHINA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 60 CHINA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 61 JAPAN SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 62 JAPAN SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 63 JAPAN SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 64 JAPAN SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 65 SOUTH KOREA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 66 SOUTH KOREA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 67 SOUTH KOREA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 68 SOUTH KOREA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 69 AUSTRALIA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 70 AUSTRALIA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 71 AUSTRALIA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 72 AUSTRALIA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 73 SOUTH EAST ASIA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 74 SOUTH EAST ASIA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 75 SOUTH EAST ASIA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 76 SOUTH EAST ASIA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 77 REST OF ASIA PACIFIC SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 78 REST OF ASIA PACIFIC SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 79 REST OF ASIA PACIFIC SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 80 REST OF ASIA PACIFIC SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 81 EUROPE SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 82 EUROPE SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 83 EUROPE SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 EUROPE SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 85 EUROPE SLEEP APNEA ORAL APPLIANCES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 86 EUROPE SLEEP APNEA ORAL APPLIANCES MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 87 GERMANY SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 88 GERMANY SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 89 GERMANY SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 90 GERMANY SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 91 UK SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 92 UK SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 93 UK SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 94 UK SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 95 FRANCE SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 96 FRANCE SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 97 FRANCE SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 98 FRANCE SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 99 ITALY SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 100 ITALY SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 101 ITALY SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 102 ITALY SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 103 SPAIN SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 104 SPAIN SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 105 SPAIN SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 106 SPAIN SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 107 RUSSIA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 108 RUSSIA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 109 RUSSIA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 110 RUSSIA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 111 REST OF EUROPE SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF EUROPE SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 113 REST OF EUROPE SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 114 REST OF EUROPE SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 115 MIDDLE EAST & AFRICA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 116 MIDDLE EAST & AFRICA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 117 MIDDLE EAST & AFRICA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 118 MIDDLE EAST & AFRICA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 119 MIDDLE EAST & AFRICA SLEEP APNEA ORAL APPLIANCES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 120 MIDDLE EAST & AFRICA SLEEP APNEA ORAL APPLIANCES MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 121 UAE SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 122 UAE SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 123 UAE SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 124 UAE SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 125 SAUDI ARABIA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 126 SAUDI ARABIA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 127 SAUDI ARABIA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 128 SAUDI ARABIA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 129 SOUTH AFRICA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 130 SOUTH AFRICA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 131 SOUTH AFRICA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 132 SOUTH AFRICA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 133 REST OF MIDDLE EAST & AFRICA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 134 REST OF MIDDLE EAST & AFRICA SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (THOUSAND UNITS) 2020-2029

TABLE 135 REST OF MIDDLE EAST & AFRICA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 136 REST OF MIDDLE EAST & AFRICA SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL SLEEP APNEA ORAL APPLIANCES MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL SLEEP APNEA ORAL APPLIANCES MARKET BY PRODUCT TYPE (USD MILLION), 2021

FIGURE 13 GLOBAL SLEEP APNEA ORAL APPLIANCES MARKET BY APPLICATION (USD MILLION), 2021

FIGURE 14 NORTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET SNAPSHOT

FIGURE 15 EUROPE SLEEP APNEA ORAL APPLIANCES MARKET SNAPSHOT

FIGURE 16 SOUTH AMERICA SLEEP APNEA ORAL APPLIANCES MARKET SNAPSHOT

FIGURE 17 ASIA PACIFIC SLEEP APNEA ORAL APPLIANCES MARKET SNAPSHOT

FIGURE 18 MIDDLE EAST ASIA AND AFRICA SLEEP APNEA ORAL APPLIANCES MARKET SNAPSHOT

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 RESMED: COMPANY SNAPSHOT

FIGURE 21 KONINKLIJKE PHILIPS N.V: COMPANY SNAPSHOT

FIGURE 22 MYERSON SOLICITORS LLP: COMPANY SNAPSHOT

FIGURE 23 THERMO FISHER SCIENTIFIC INC: COMPANY SNAPSHOT

FIGURE 24 SOMNOMED: COMPANY SNAPSHOT

FIGURE 25 WHOLE YOU, INC.: COMPANY SNAPSHOT

FIGURE 26 PANTHERA DENTAL: COMPANY SNAPSHOT

FIGURE 27 OVENTUS: COMPANY SNAPSHOT

FIGURE 28 LÖWENSTEIN MEDICAL TECHNOLOGY GMBH: COMPANY SNAPSHOT

FIGURE 29 FISHER & PAYKEL HEALTHCARE LIMITED: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te