Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Mercado global de equipos de sinterización selectiva por láser por material (metal y nailon), tipo de láser (láser sólido, láser de gas), aplicación (herramientas, equipos y maquinaria pesada y robótica) e industria de uso final (bienes de consumo, automoción, dispositivos médicos) y región, tendencias globales y pronóstico de 2022 a 2029.

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Descripción general del mercado de equipos de sinterización selectiva por láser

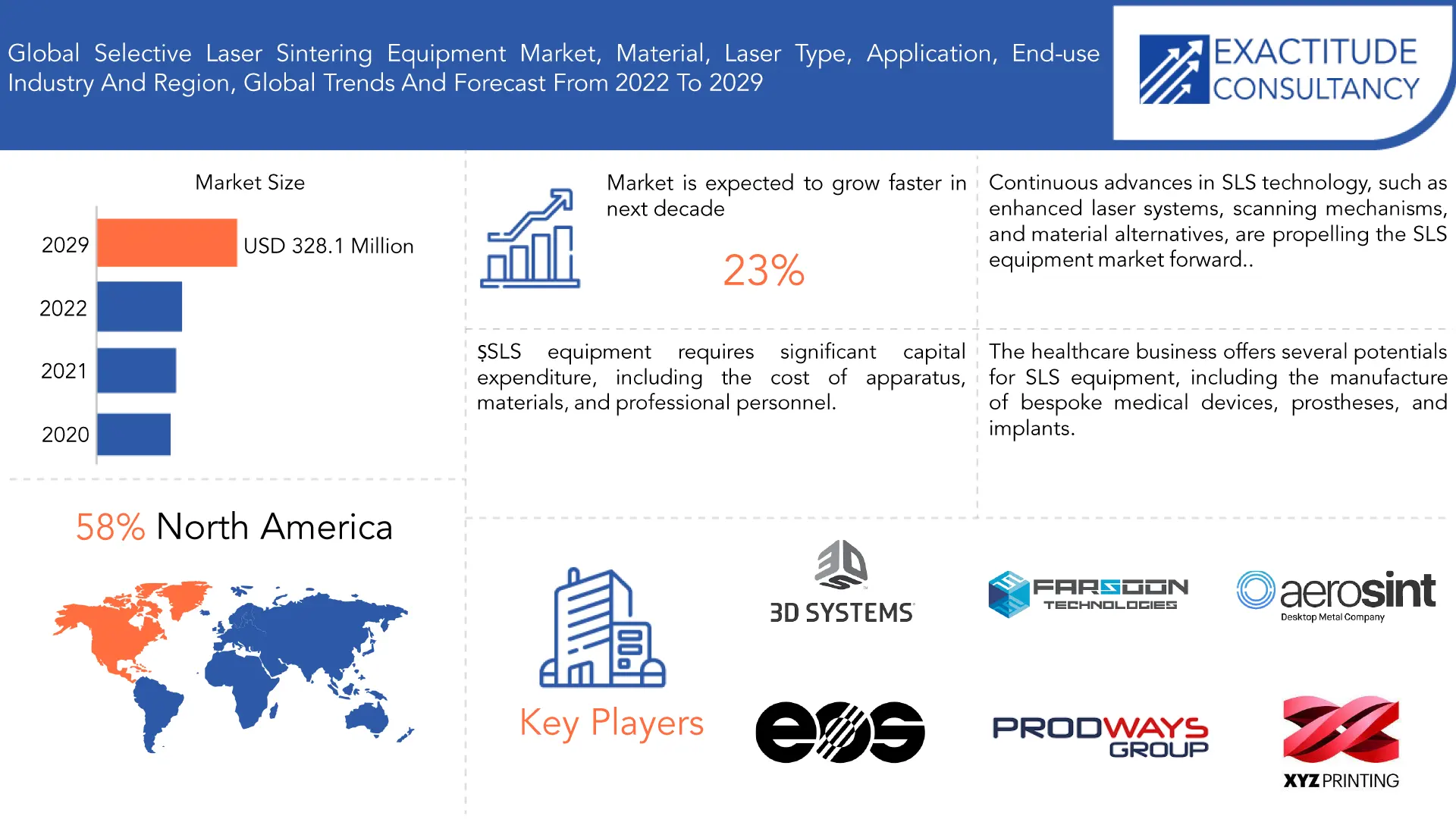

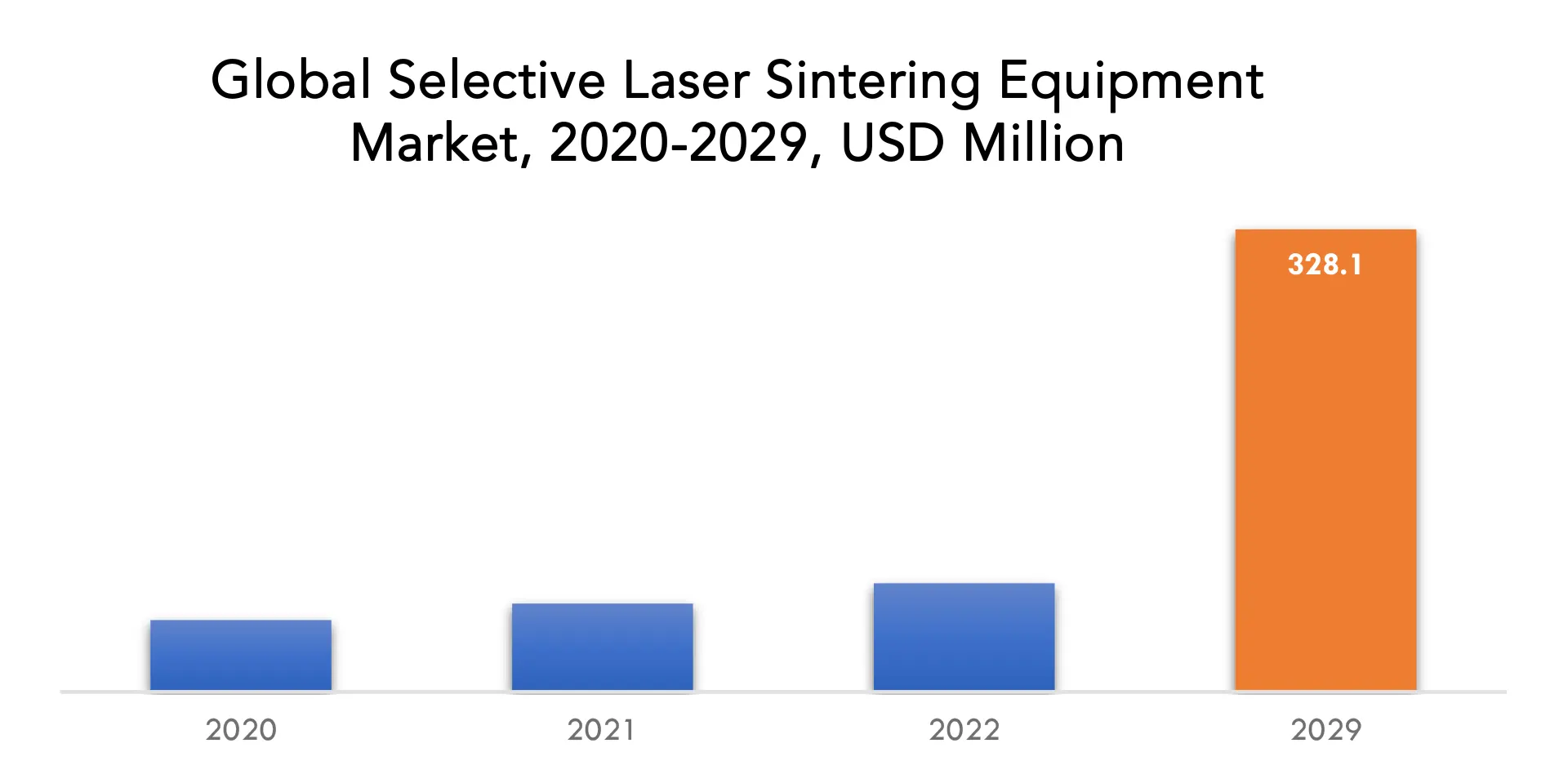

Se espera que el mercado global de equipos de sinterización selectiva por láser crezca a una tasa anual compuesta del 23 % entre 2022 y 2029. Se espera que alcance más de 328,07 millones de dólares en 2029 desde los 50,91 millones de dólares en 2022. El creciente uso de equipos de sinterización selectiva por láser por parte de las industrias aeroespacial y de defensa, la creciente demanda de productos para la implementación de sistemas de control industrial, la creciente modernización de la infraestructura existente con sistemas avanzados y el aumento de las actividades de desarrollo de infraestructura, particularmente en las economías en desarrollo, son los principales factores que contribuyen al crecimiento de la sinterización selectiva por láser. El equipo de sinterización selectiva por láser es un proceso de impresión tridimensional que sinteriza partículas microscópicas de polvo de polímero en una estructura sólida utilizando un láser de alta potencia. El equipo de sinterización selectiva por láser es popular entre los ingenieros y las empresas para la creación de prototipos de componentes poliméricos funcionales y la fabricación de polímeros a pequeña escala. La creciente demanda de las industrias del arte y la moda, así como la mayor atención al desarrollo del diseño de fabricación y la necesidad de lograr la eficacia de la producción, surgirán como importantes factores impulsores del crecimiento del mercado. La creciente demanda de maquinaria pesada, herramientas y fabricación, la creciente adopción de productos por parte de la industria de bienes de consumo, el aumento de las iniciativas gubernamentales para generar conciencia e implementar políticas favorables y la industrialización generalizada exacerbarán el valor de mercado. El aumento del gasto en investigación y desarrollo, la mayor demanda de equipos médicos y de atención médica, en particular en las economías emergentes, y un deseo creciente de una utilización óptima de los recursos allanarán el camino para la expansión del mercado. [caption id="attachment_28023" align="aligncenter" width="1920"]

| ATRIBUTO | DETALLES |

| Periodo de estudio | 2022-2029 |

| Año base | 2021 |

| Año estimado | 2022 |

| Año pronosticado | 2022-2029 |

| Periodo histórico | 2018-2022 |

| Unidad | Valor (Millones de USD), (Miles de Unidades) |

| Segmentación | Por material, tipo de láser, aplicación, industria del usuario final y región. |

| Por material |

|

| Por tipo de láser |

|

| Por aplicación |

|

| Por industria del usuario final |

|

| Por región |

|

Frequently Asked Questions

• What is the worth of the global selective laser sintering equipment market?

The global selective laser sintering equipment market is expected to grow at 23% CAGR from 2022 to 2029. It is expected to reach above USD 328.07 million by 2029 from USD 77.02 million in 2022.

• What are some of the market's driving forces?

The growing use of selective laser sintering equipment by the aerospace and defense industries, surging product demand for the implementation of industrial control systems, rising upgradation of existing infrastructure with advanced systems, and increasing infrastructural development activities, particularly in developing economies, are the major factors contributing to the growth of selective laser sintering.

• Which are the top companies to hold the market share in the selective laser sintering equipment market?

The Selective Laser Sintering Equipment market’s key players include 3D Systems, Inc., EOS GmbH Electro Optical Systems, Farsoon Technologies, Prodways Group, Aerosint, XYZprinting, Inc., Formlabs, Renishaw plc., Sintratec AG, Sharebot srl, DMG MORI CO., LTD., Natural Robotics, Ricoh India Ltd., ZRapidTech, Dynamic tools Pvt. Ltd., Aspect Inc., Red Rock SLS, Proto3000, 3Dnatives, SLM Solutions, Arcam, among others.

• What is the leading application of the selective laser sintering equipment market?

SLS also has a wide range of applications in a variety of industries, including aerospace, military, and automotive. With a paradigm change in space exploration, demand for SLS printing is likely to rise, with a rising number of countries preparing to launch satellites. Several aircraft businesses are implementing the technology to improve manufacturing efficiency. For example, in the field of space flight, NASA and private firms are collaborating to create rocket engines (and even complete rockets in the case of Relativity Space) with fewer parts, which is a critical skill of 3D printing and a technique to minimize manufacturing time and costs.

• Which is the largest regional market for selective laser sintering equipment market?

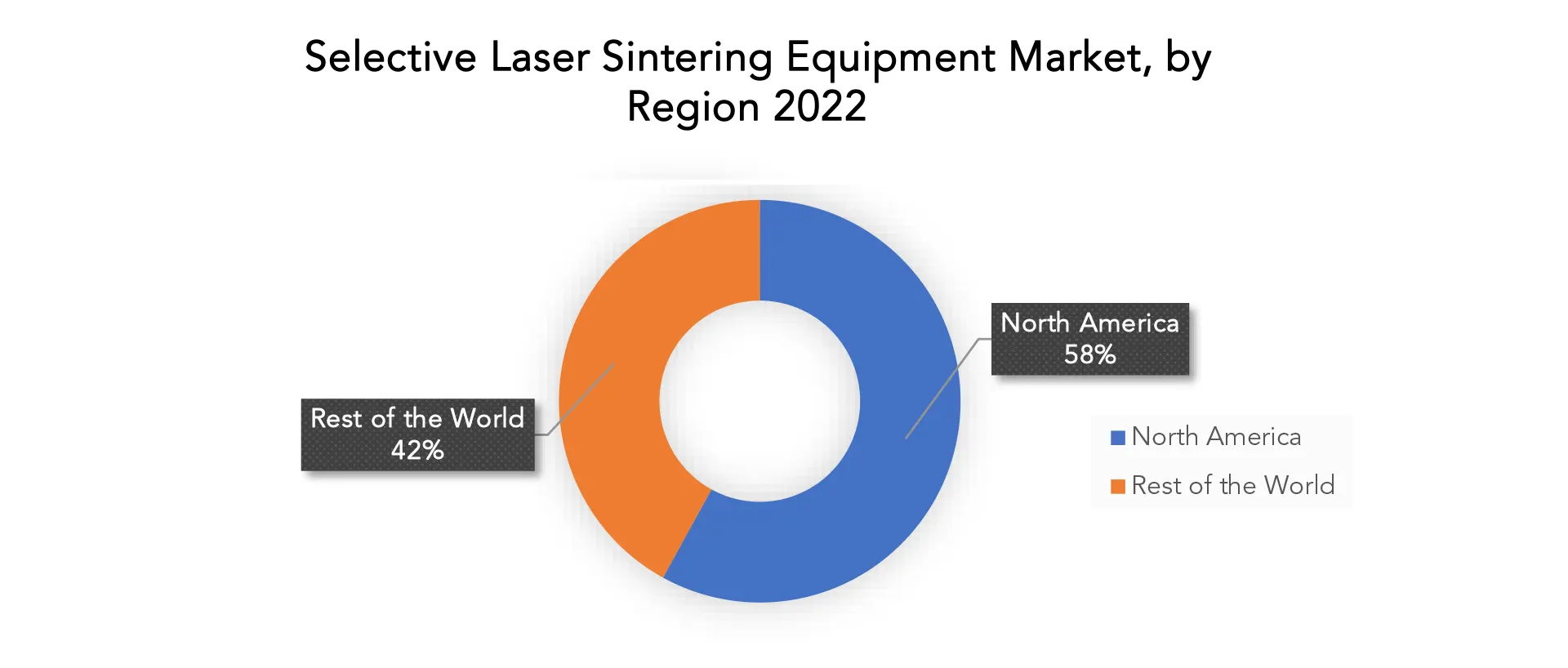

The Markets largest share is in the Asia Pacific region.

Selective Laser Sintering Equipment Market Segment Analysis

The selective laser sintering equipment market is divided into two categories: metal and nylon. Metal is further classified as styrene-based and aluminum-filled. Nylon is further subdivided into three types: durable, glass-filled, and fiber filled. The selective laser sintering equipment market is divided into two categories based on laser type: solid laser and gas laser. Tooling, heavy equipment and machinery, and robotics are some of the applications for selective laser sintering technology. The selective laser sintering equipment market has been divided by end user into consumer goods, art and fashion, automotive, aerospace and aeronautics, and medical devices. SLS uses nylon powder as a raw material to replace the photosensitive resin used in stereolithography. Companies and research groups from all over the world have been recognized as using this material and technology to address issues such as the brittle quality of the resin when exposed to sunlight. Furthermore, SLS is cost- and material-friendly, as it does not require any specific post-printing support system. Furthermore, SLS has increased endurance and may perform as well as working components or prototypes. SLS also has a wide range of applications in a variety of industries, including aerospace, military, and automotive. With a paradigm change in space exploration, demand for SLS printing is likely to rise, with a rising number of countries preparing to launch satellites. Several aircraft businesses are implementing the technology to improve manufacturing efficiency. [caption id="attachment_28042" align="aligncenter" width="1920"]

Selective Laser Sintering Equipment Market Players

The selective laser sintering equipment market’s key players include 3D Systems, Inc., EOS GmbH Electro Optical Systems, Farsoon Technologies, Prodways Group, Aerosint, XYZprinting, Inc., Formlabs, Renishaw plc., Sintratec AG, Sharebot srl, DMG MORI CO., LTD., Natural Robotics, Ricoh India Ltd., ZRapidTech, Dynamic tools Pvt. Ltd., Aspect Inc., Red Rock SLS, Proto3000, 3Dnatives, SLM Solutions, Arcam, among others. For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending on product development, which is fueling revenue generation. Recent Developments:- April 2023 - From Glass to Metal: Explored the Versatility of Selective Powder Deposition. In that binder-free process, the glass and alumina powders were selectively deposited layer by layer inside a die. The glass was deposited in the desired shape, and the alumina was used to surround the glass and acted as a support powder. The machine, designed and sold by Aerosint, clamped the die and moved down the die punch for each layer. The powder deposition location inside the die was defined from a digital design file, similar to any other 3D printing process.

- June 2022 - Aerosint was present at the Hannover Messe. It was the most significant worldwide industrial transformation forum. The globe was at a crossroads in economic and energy policy, one that brought rising energy costs and disturbed supply lines. It required quick responses, particularly in the technology arena. It was a delight for the Aerosint team to meet with the actors of this change and talk and consider how they may increase their actions. They took advantage of the chance to showcase their technologies and the most recent parts. They constantly looked forward to sharing ideas to transform the business.

Who Should Buy? Or Key stakeholders

- Investors

- Food and Beverage industry

- Medical Technology Companies

- Healthcare and personal care firms

- Research Organizations

- Regulatory Authorities

- Institutional & retail players

- Others

Selective Laser Sintering Equipment Market Regional Analysis

The selective laser sintering equipment market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

Selective Laser Sintering Equipment Key Market Segments:

Selective Laser Sintering Equipment Market by Material, 2020-2029, (USD Million), (Thousand Units)- Metal

- Nylon

- Solid Laser

- Gas Laser

- Tooling

- Heavy Equipment & Machinery

- Robotics

- Consumer Goods

- Automobiles

- Medical Devices

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the selective laser sintering equipment market over the next 7 years?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the selective laser sintering equipment market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the selective laser sintering equipment market?

- What are the key drivers of growth in the selective laser sintering equipment market?

- Who are the market’s major players, and what is their market share?

- What are the selective laser sintering equipment market's distribution channels and supply chain dynamics?

- What are the technological advancements and innovations in the selective laser sintering equipment market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the selective laser sintering equipment market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the selective laser sintering equipment market?

- What are the market's product offerings/ service offerings and specifications of leading players?

- What is the pricing trend of selective laser sintering equipment in the market and what is the impact of raw material prices on the price trend?

- INTRODUCCIÓN

- DEFINICIÓN DE MERCADO

- SEGMENTACIÓN DEL MERCADO

- CRONOGRAMAS DE INVESTIGACIÓN

- SUPUESTOS Y LIMITACIONES

- METODOLOGÍA DE LA INVESTIGACIÓN

- MINERÍA DE DATOS

- INVESTIGACIÓN SECUNDARIA

- INVESTIGACIÓN PRIMARIA

- ASESORAMIENTO DE EXPERTOS EN LA MATERIA

- CONTROLES DE CALIDAD

- REVISIÓN FINAL

- TRIANGULACIÓN DE DATOS

- ENFOQUE DE ABAJO HACIA ARRIBA

- ENFOQUE DE ARRIBA HACIA ABAJO

- FLUJO DE INVESTIGACIÓN

- FUENTES DE DATOS

- MINERÍA DE DATOS

- RESUMEN EJECUTIVO

- PANORAMA DEL MERCADO

- PERSPECTIVAS DEL MERCADO MUNDIAL DE EQUIPOS DE SINTERIZACIÓN LÁSER SELECTIVA

- IMPULSORES DEL MERCADO

- RESTRICCIONES DEL MERCADO

- OPORTUNIDADES DE MERCADO

- IMPACTO DEL COVID-19 EN EL MERCADO DE EQUIPOS DE SINTERIZACIÓN LÁSER SELECTIVA

- MODELO DE LAS CINCO FUERZAS DE PORTER

- AMENAZA DE NUEVOS INGRESANTES

- AMENAZA DE SUSTITUTOS

- PODER DE NEGOCIACIÓN DE LOS PROVEEDORES

- PODER DE NEGOCIACIÓN DE LOS CLIENTES

- GRADO DE COMPETENCIA

- ANÁLISIS DE LA CADENA DE VALOR DE LA INDUSTRIA

- PERSPECTIVAS DEL MERCADO MUNDIAL DE EQUIPOS DE SINTERIZACIÓN LÁSER SELECTIVA

- MERCADO GLOBAL DE EQUIPOS DE SINTERIZACIÓN LÁSER SELECTIVA POR MATERIAL, 2020-2029, (MILLONES DE USD), (MILES DE UNIDADES)

- METAL

- NYLON

- MERCADO GLOBAL DE EQUIPOS DE SINTERIZACIÓN SELECTIVA POR LÁSER POR TIPO DE LÁSER, 2020-2029, (MILLONES DE USD), (MILES DE UNIDADES)

- LÁSER SÓLIDO

- LÁSER DE GAS

- GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION, 2020-2029, (USD MILLION), (THOUSAND UNITS)

- TOOLING

- HEAVY EQUIPMENT & MACHINERY

- ROBOTICS

- GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END-USER INDUSTRY, 2020-2029, (USD MILLION), (THOUSAND UNITS)

- CONSUMER GOODS

- AUTOMOBILES

- MEDICAL DEVICES

- GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY REGION, 2020-2029, (USD MILLION), (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- 3D SYSTEMS, INC

- EOS GMBH ELECTRO OPTICAL SYSTEMS

- FARSOON TECHNOLOGIES

- PRODWAYS GROUP

- AEROSINT

- XYZPRINTING, INC

- FORMLABS

- RENISHAW PLC

- SINTRATEC AG

- SHAREBOT SRL

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 2 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 4 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 6 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 7 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 8 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 9 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY REGION (USD MILLION) 2020-2029

TABLE 10 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 11 NORTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 12 NORTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 13 NORTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 14 NORTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 15 NORTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 16 NORTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 17 NORTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 18 NORTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 19 NORTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 20 NORTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 21 US SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 22 US SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 23 US SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 24 US SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 25 US SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 26 US SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 27 US SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 28 US SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 29 CANADA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 30 CANADA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 31 CANADA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 32 CANADA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 33 CANADA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 34 CANADA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 35 CANADA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 36 CANADA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 37 MEXICO SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 38 MEXICO SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 39 MEXICO SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 40 MEXICO SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 41 MEXICO SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 42 MEXICO SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 43 MEXICO SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 44 MEXICO SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 45 SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 46 SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 47 SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 48 SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 49 SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 50 SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 51 SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 52 SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 53 SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 54 SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 55 BRAZIL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 56 BRAZIL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 57 BRAZIL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 58 BRAZIL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 59 BRAZIL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 60 BRAZIL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 61 BRAZIL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 62 BRAZIL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 63 ARGENTINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 64 ARGENTINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 65 ARGENTINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 66 ARGENTINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 67 ARGENTINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 68 ARGENTINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 69 ARGENTINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 70 ARGENTINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 71 COLOMBIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 72 COLOMBIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 73 COLOMBIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 74 COLOMBIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 75 COLOMBIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 76 COLOMBIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 77 COLOMBIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 78 COLOMBIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 79 REST OF SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 80 REST OF SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 81 REST OF SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 82 REST OF SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 83 REST OF SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 84 REST OF SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 85 REST OF SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 86 REST OF SOUTH AMERICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 87 ASIA-PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 88 ASIA-PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 89 ASIA-PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 90 ASIA-PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 91 ASIA-PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 92 ASIA-PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 93 ASIA-PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 94 ASIA-PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-202

TABLE 95 ASIA-PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 96 ASIA-PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 97 INDIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 98 INDIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 99 INDIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 100 INDIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 101 INDIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 102 INDIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 103 INDIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 104 INDIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 105 CHINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 106 CHINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 107 CHINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 108 CHINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 109 CHINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 110 CHINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 111 CHINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 112 CHINA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 113 JAPAN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 114 JAPAN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 115 JAPAN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 116 JAPAN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 117 JAPAN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 118 JAPAN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 119 JAPAN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 120 JAPAN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 121 SOUTH KOREA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 122 SOUTH KOREA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 123 SOUTH KOREA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 124 SOUTH KOREA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 125 SOUTH KOREA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 126 SOUTH KOREA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 127 SOUTH KOREA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 128 SOUTH KOREA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 129 AUSTRALIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 130 AUSTRALIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 131 AUSTRALIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 132 AUSTRALIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 133 AUSTRALIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 134 AUSTRALIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 135 AUSTRALIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 136 AUSTRALIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 137 SOUTH-EAST ASIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 138 SOUTH-EAST ASIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 139 SOUTH-EAST ASIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 140 SOUTH-EAST ASIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 141 SOUTH-EAST ASIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 142 SOUTH-EAST ASIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 143 SOUTH-EAST ASIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 144 SOUTH-EAST ASIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 145 REST OF ASIA PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 146 REST OF ASIA PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 147 REST OF ASIA PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 148 REST OF ASIA PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 149 REST OF ASIA PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 150 REST OF ASIA PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 151 REST OF ASIA PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 152 REST OF ASIA PACIFIC SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 153 EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 154 EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 155 EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 156 EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 157 EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 158 EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 159 EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 160 EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 161 EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 162 EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 163 GERMANY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 164 GERMANY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 165 GERMANY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 166 GERMANY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 167 GERMANY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 168 GERMANY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 169 GERMANY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 170 GERMANY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 171 UK SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 172 UK SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 173 UK SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 174 UK SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 175 UK SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 176 UK SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 177 UK SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 178 UK SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 179 FRANCE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 180 FRANCE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 181 FRANCE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 182 FRANCE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 183 FRANCE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 184 FRANCE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 185 FRANCE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 186 FRANCE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 187 ITALY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 188 ITALY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 189 ITALY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 190 ITALY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 191 ITALY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 192 ITALY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 193 ITALY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 194 ITALY SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 195 SPAIN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 196 SPAIN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 197 SPAIN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 198 SPAIN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 199 SPAIN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 200 SPAIN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 201 SPAIN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 202 SPAIN SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 203 RUSSIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 204 RUSSIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 205 RUSSIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 206 RUSSIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 207 RUSSIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 208 RUSSIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 209 RUSSIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 210 RUSSIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 211 REST OF EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 212 REST OF EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 213 REST OF EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 214 REST OF EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 215 REST OF EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 216 REST OF EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 217 REST OF EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 218 REST OF EUROPE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 229 UAE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 230 UAE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 231 UAE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 232 UAE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 233 UAE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 234 UAE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 235 UAE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 236 UAE SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 237 SAUDI ARABIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 238 SAUDI ARABIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 239 SAUDI ARABIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 240 SAUDI ARABIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 241 SAUDI ARABIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 242 SAUDI ARABIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 243 SAUDI ARABIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 244 SAUDI ARABIA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 245 SOUTH AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 246 SOUTH AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 247 SOUTH AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 248 SOUTH AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 249 SOUTH AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 250 SOUTH AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 251 SOUTH AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-202

TABLE 252 SOUTH AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (USD MILLION) 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL (THOUSAND UNITS) 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (USD MILLION) 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (USD MILLION) 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE (THOUSAND UNITS) 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL, USD MILLION, 2020-2029

FIGURE 9 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 10 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE, USD MILLION, 2020-2029

FIGURE 11 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 12 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY MATERIAL, USD MILLION, 2021

FIGURE 15 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY END USER, USD MILLION, 2021

FIGURE 16 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY LASER TYPE, USD MILLION, 2021

FIGURE 17 GLOBAL SELECTIVE LASER SINTERING EQUIPMENT MARKET BY APPLICATION, USD MILLION, 2021

FIGURE 18 SELECTIVE LASER SINTERING EQUIPMENT MARKET BY REGION, USD MILLION, 2021

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 3D SYSTEMS, INC: COMPANY SNAPSHOT

FIGURE 21 EOS GMBH ELECTRO OPTICAL SYSTEMS: COMPANY SNAPSHOT

FIGURE 22 FARSOON TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 23 PRODWAYS GROUP: COMPANY SNAPSHOT

FIGURE 24 AEROSINT: COMPANY SNAPSHOT

FIGURE 25 XYZ PRINTING, INC: COMPANY SNAPSHOT

FIGURE 26 FORMLABS: COMPANY SNAPSHOT

FIGURE 27 RENISHAW PLC: COMPANY SNAPSHOT

FIGURE 28 SINTRATEC AG: COMPANY SNAPSHOT

FIGURE 29 SHAREBOT SRL: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te