Base Year Value ()

CAGR ()

Forecast Year Value ()

Historical Data Period

Largest Region

Forecast Period

Mercado de servicios de detección de colesterol/pruebas de colesterol por tipo de cliente (médicos/proveedores y hospitales, agencias gubernamentales, centros de diagnóstico, pacientes, otros) y región, tendencias globales y pronóstico de 2023 a 2030.

Instant access to hundreds of data points and trends

- Market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

- 100% money back guarantee

Descripción general del mercado de servicios de detección y análisis de colesterol

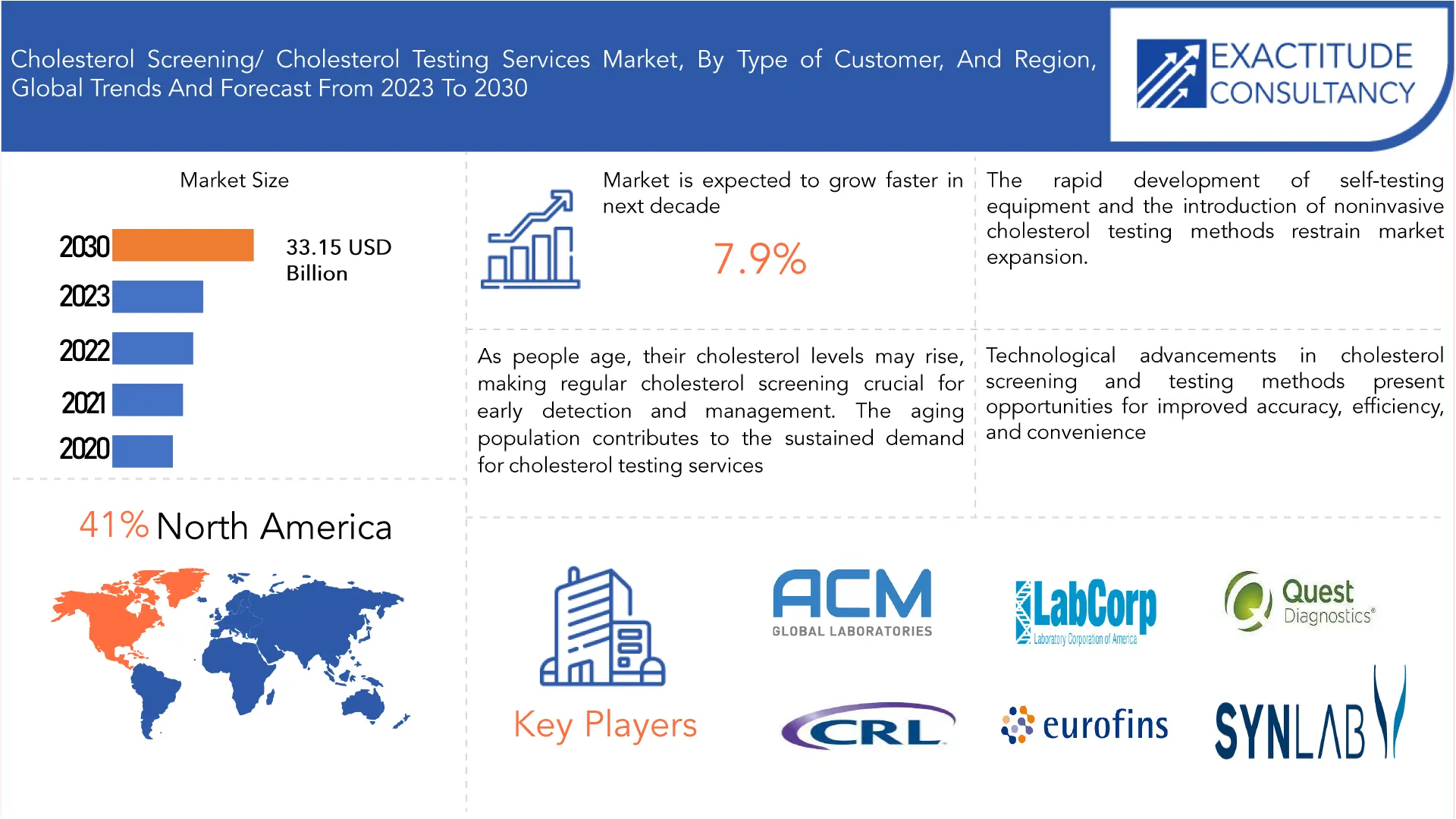

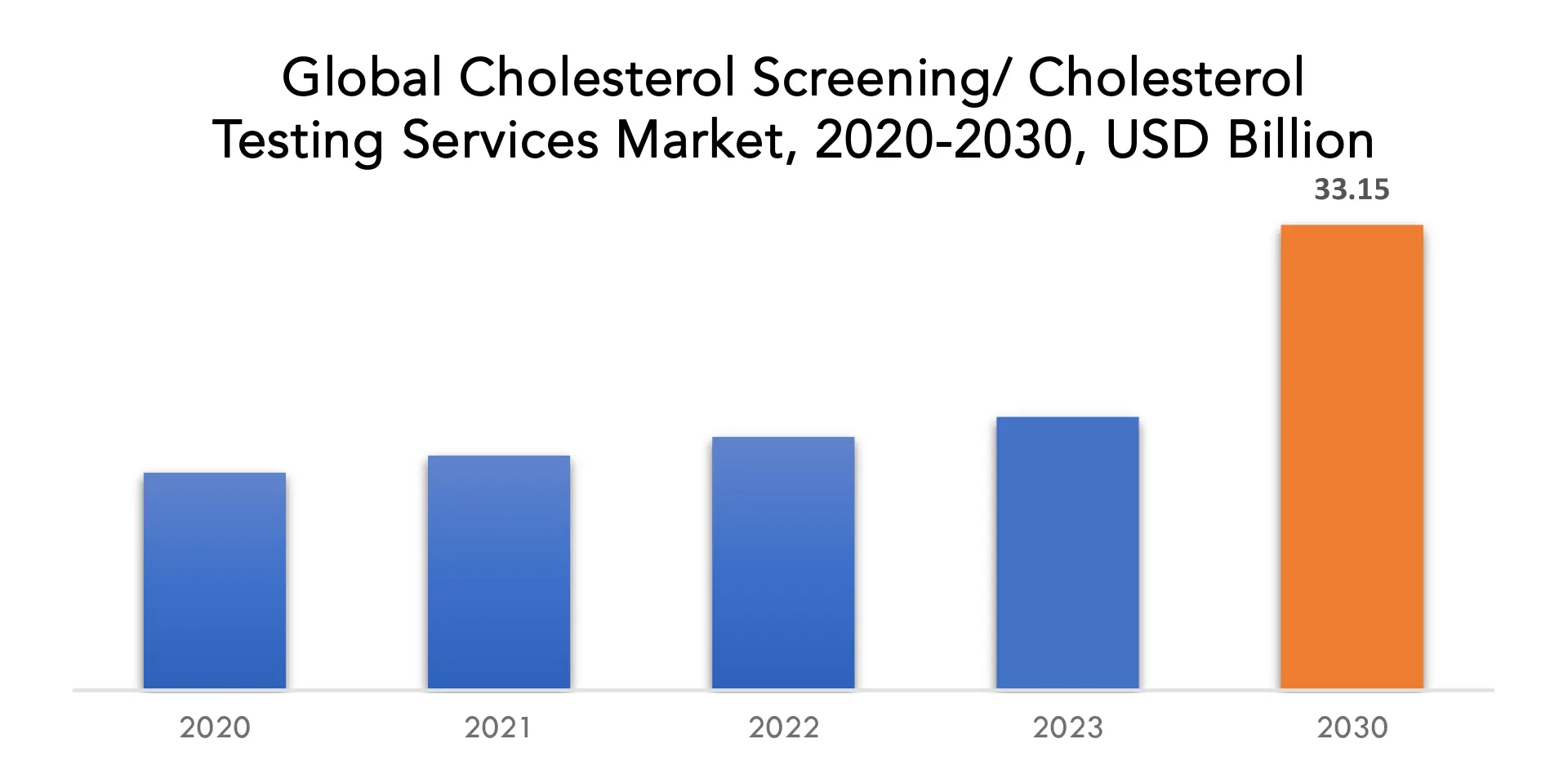

Se espera que el mercado de servicios de detección de colesterol/pruebas de colesterol crezca a una tasa de crecimiento anual compuesta del 7,9% entre 2023 y 2030. Se espera que alcance más de 33 150 millones de dólares en 2030, frente a los 19 470 millones de dólares en 2023. Todas las células de nuestro cuerpo contienen colesterol, una sustancia cerosa y grasa. Si el nivel de colesterol en sangre es demasiado alto, puede unirse a otros componentes de la sangre para producir placa, que se adhiere al revestimiento de las arterias. Otro nombre para una prueba de colesterol completa es panel de lípidos o perfil de lípidos. Su médico puede utilizarlo para evaluar los niveles de colesterol "bueno" y "malo", así como una forma de grasa llamada triglicéridos en la sangre. Con el aumento de la prevalencia de enfermedades cardiovasculares y obesidad, se prevé que el mercado de servicios de pruebas de colesterol a nivel mundial tenga un crecimiento considerable en los próximos años. Además del aumento del conocimiento y la adopción de la atención sanitaria preventiva, otro factor que impulsará el mercado es la preferencia de los médicos por las pruebas de laboratorio en lugar de las pruebas realizadas por uno mismo. Las acciones del gobierno también aumentarán la calidad de las pruebas. Además, la prevalencia de enfermedades cardiovasculares aumentará debido al aumento de la población de personas mayores en todo el mundo. Además, el aumento del gasto en atención médica y el aumento de la conciencia pública sobre las enfermedades cardiovasculares, sus causas, tratamiento y prevención también impulsan el crecimiento del mercado. Los niveles elevados de colesterol crean amenazas para la salud, como un riesgo agudo de accidente cerebrovascular y enfermedades cardíacas, y son responsables de muchas muertes. Los servicios de detección del colesterol permiten la detección temprana de los problemas relacionados con los niveles altos de colesterol, evitando complicaciones y aumentando las posibilidades de supervivencia de los pacientes. Por otro lado, se espera que el rápido crecimiento del mercado de pruebas caseras/autoevaluadas y la aparición de métodos de prueba de colesterol no invasivos limiten el crecimiento de este mercado de servicios de prueba de colesterol hasta cierto punto. [caption id="attachment_30077" align="aligncenter" width="1920"]

| ATRIBUTO | DETALLES |

| Periodo de estudio | 2020-2030 |

| Año base | 2022 |

| Año estimado | 2023 |

| Año pronosticado | 2023-2030 |

| Periodo histórico | 2019-2021 |

| Unidad | Valor (miles de millones de USD) |

| Segmentación | Por tipo de cliente, por región |

| Por tipo de cliente |

|

| Por región |

|

Frequently Asked Questions

What is the worth of cholesterol screening/ cholesterol testing services market?

The cholesterol screening/ cholesterol testing services market is expected to grow at 7.9% CAGR from 2023 to 2030. It is expected to reach above USD 33.15 Billion by 2030 from USD 19.47 Billion in 2023.

What is the size of the North America the cholesterol screening/ cholesterol testing services market?

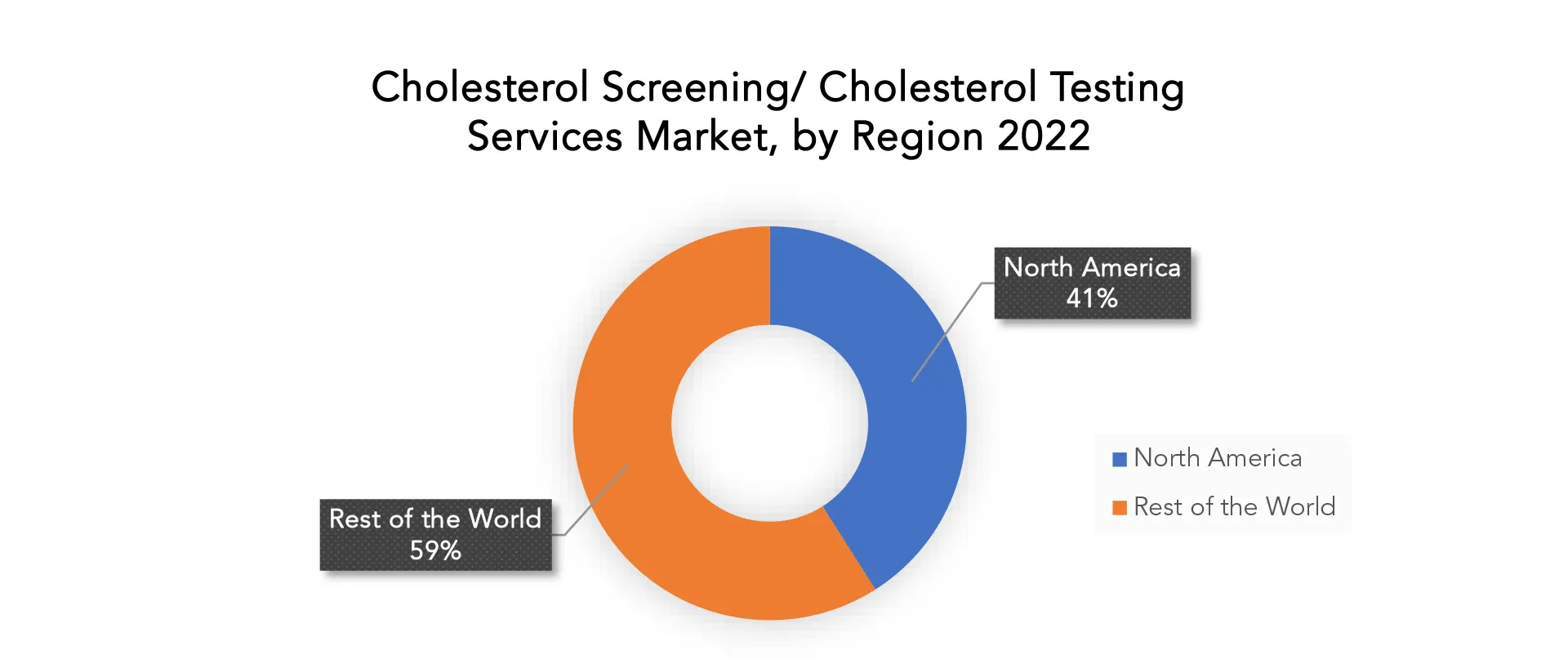

North America held more than 41% of the cholesterol screening/ cholesterol testing services market revenue share in 2022 and will witness expansion in the forecast period.

What are some of the market's driving forces?

The primary driver accelerating the growth of the market for cholesterol testing is the decline in physical activity. Additionally, the market is being driven by the need for better cholesterol management and routine check-ups and screenings. The market for over-the-counter cholesterol test kits is also anticipated to increase as a result of rising electronics miniaturization, which is also projected to play a beneficial role in the creation of self-testing kits.

Which are the top companies to hold the market share in cholesterol screening/ cholesterol testing services market?

The cholesterol screening/ cholesterol testing services market key players include ACM Medical Laboratory, Clinical Reference Laboratory, Inc., Laboratory Corporation of America Holdings, Eurofins Scientific, Quest Diagnostics Incorporated, SYNLAB International GmbH, Fresenius Medical Care Holdings, Inc., Spectra Laboratories Inc., Unilabs, Bio-Reference Laboratories Inc.

What is the leading application of cholesterol screening/ cholesterol testing services market?

Cholesterol screening/ cholesterol testing services market has leading application in diagnostic centers industry.

Which is the largest regional market for cholesterol screening/ cholesterol testing services market?

In terms of market share and revenue, North America now rules the cholesterol testing market and will maintain this dominance during the projection period. This is a result of an increase in the number of elderly people, which has led to an increase in the number of cholesterol patients in this area. The focus will likely shift to clinical diagnostics, particularly cholesterol tests, in order to limit the bad events brought on by diseases like stroke, diabetes, and cardiovascular disease.

Cholesterol Screening/ Cholesterol Testing Services Market Segment Analysis

Cholesterol screening/ cholesterol testing services market is segmented based on type of customer, and region. Based on type of customer, a significant portion of the market was made up of diagnostic centers. Providing patients with a variety of diagnostic tests, such as cholesterol screening, is a specialty of diagnostic centers. These institutions frequently contain cutting-edge laboratories, knowledgeable staff, and specialized tools to carry out various tests quickly and accurately. A few factors have contributed to the rise in popularity of diagnostic centers in recent years. In comparison to hospitals, they typically have lower wait periods and convenient access to diagnostic procedures. Additionally, diagnostic centers might offer specialized services that are just focused on diagnostic testing, enabling them to provide patients seeking cholesterol screening with a streamlined and effective experience. Hospitals and clinics, in addition to diagnostic facilities, are essential in the delivery of services for cholesterol screening and testing. To suit the needs of their patients, these healthcare facilities frequently have their own internal laboratories or may work with other diagnostic facilities. [caption id="attachment_30112" align="aligncenter" width="1920"]

Cholesterol Screening/ Cholesterol Testing Services Market Players

The cholesterol screening/ cholesterol testing services market key players include ACM Medical Laboratory, Clinical Reference Laboratory, Inc., Laboratory Corporation of America Holdings, Eurofins Scientific, Quest Diagnostics Incorporated, SYNLAB International GmbH, Fresenius Medical Care Holdings, Inc., Spectra Laboratories Inc., Unilabs, Bio-Reference Laboratories Inc. Recent News:- On June 2021, ACM Global Laboratories, Inc. is pleased to announced the rebranding of ABS Laboratories to ACM Bioanalytical Services. Founded over two decades ago by Drs. Colin Feyerabend and Mira Doig, ABS Laboratories was purchased by ACM Global Laboratories in 2018 as it expanded its central laboratory testing offerings for clinical trials to include bioanalytical services. ABS Laboratories, now ACM Bioanalytical Services, specialised in complex assay development and validation for the quantification of drugs, metabolites and biomarkers in biological samples used in pharmaceutical research and development.

- On February 2021, Clinical Reference Laboratory (CRL), one of the largest privately held clinical testing laboratories in the U.S., and Walgreens announced that the FDA-authorized CRL Rapid Response COVID-19 Saliva Test is available through Walgreens Find Care®, a digital health platform available on the Walgreens app and Walgreens.com. Sold under CRL's HealthConfirm® brand, the COVID-19 Saliva Test is non-invasive and highly accurate, offered consumers the convenience of self-collecting the test right in their homes without supervision.

Who Should Buy? Or Key stakeholders

- Cholesterol Testing Service Providers

- Cholesterol Testing Kit Manufacturers

- Public and Private Physicians

- Healthcare Institutions (Medical Data Centres)

- Diagnostic & Clinical Laboratories

- Distributors and Suppliers of Cholesterol Testing Kits

- Health Insurance Companies/Payers

- Pharmaceutical Companies

- Employers/Organizations

- Market Research and Consulting Firms

Cholesterol Screening/ Cholesterol Testing Services Market Regional Analysis

The cholesterol screening/ cholesterol testing services market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Key Market Segments: Cholesterol Screening/ Cholesterol Testing Services Market

Cholesterol Screening/ Cholesterol Testing Services Market by Type of Customer, 2020-2030, (USD Billion)- Physicians/Providers and Hospitals

- Government Agencies

- Diagnostic centers

- Patients

- Others

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the cholesterol screening/ cholesterol testing services market over the next 7 years?

- Who are the major players in the cholesterol screening/ cholesterol testing services market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, middle east, and Africa?

- How is the economic environment affecting the cholesterol screening/ cholesterol testing services market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the cholesterol screening/ cholesterol testing services market?

- What is the current and forecasted size and growth rate of the global cholesterol screening/ cholesterol testing services market?

- What are the key drivers of growth in the cholesterol screening/ cholesterol testing services market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the cholesterol screening/ cholesterol testing services market?

- What are the technological advancements and innovations in the cholesterol screening/ cholesterol testing services market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the cholesterol screening/ cholesterol testing services market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the cholesterol screening/ cholesterol testing services market?

- What are the services offerings and specifications of leading players in the market?

- INTRODUCCIÓN

- DEFINICIÓN DE MERCADO

- SEGMENTACIÓN DEL MERCADO

- CRONOGRAMAS DE INVESTIGACIÓN

- SUPUESTOS Y LIMITACIONES

- METODOLOGÍA DE LA INVESTIGACIÓN

- MINERÍA DE DATOS

- INVESTIGACIÓN SECUNDARIA

- INVESTIGACIÓN PRIMARIA

- ASESORAMIENTO DE EXPERTOS EN LA MATERIA

- CONTROLES DE CALIDAD

- REVISIÓN FINAL

- TRIANGULACIÓN DE DATOS

- ENFOQUE DE ABAJO HACIA ARRIBA

- ENFOQUE DE ARRIBA HACIA ABAJO

- FLUJO DE INVESTIGACIÓN

- USUARIOS FINALES DE LOS DATOS

- MINERÍA DE DATOS

- RESUMEN EJECUTIVO

- PANORAMA DEL MERCADO

- PERSPECTIVA DEL MERCADO MUNDIAL DE SERVICIOS DE DETECCIÓN Y ANÁLISIS DE COLESTEROL

- IMPULSORES DEL MERCADO

- RESTRICCIONES DEL MERCADO

- OPORTUNIDADES DE MERCADO

- IMPACTO DEL COVID-19 EN EL MERCADO DE SERVICIOS DE DETECCIÓN Y ANÁLISIS DE COLESTEROL

- MODELO DE LAS CINCO FUERZAS DE PORTER

- AMENAZA DE NUEVOS INGRESANTES

- AMENAZA DE SUSTITUTOS

- PODER DE NEGOCIACIÓN DE LOS PROVEEDORES

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- PERSPECTIVA DEL MERCADO MUNDIAL DE SERVICIOS DE DETECCIÓN Y ANÁLISIS DE COLESTEROL

- GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER OF CUSTOMER, (USD BILLION), 2020-2030

- PHYSICIANS/PROVIDERS AND HOSPITALS

- GOVERNMENT AGENCIES

- DIAGNOSTIC CENTERS

- PATIENTS

- OTHERS

- GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY REGION, (USD BILLION), 2020-2030

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ACM MEDICAL LABORATORY

- CLINICAL REFERENCE LABORATORY, INC.

- LABORATORY CORPORATION OF AMERICA HOLDINGS

- EUROFINS SCIENTIFIC

- QUEST DIAGNOSTICS INCORPORATED

- SYNLAB INTERNATIONAL GMBH

- FRESENIUS MEDICAL CARE HOLDINGS, INC.

- SPECTRA LABORATORIES INC.

- UNILABS

- BIO-REFERENCE LABORATORIES INC.

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 2 GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY REGION (USD BILLION) 2022-2030

TABLE 3 NORTH AMERICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY COUNTRY (USD BILLION) 2022-2030

TABLE 4 NORTH AMERICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 5 US CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 6 CANADA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 7 MEXICO CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 8 SOUTH AMERICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY COUNTRY (USD BILLION) 2022-2030

TABLE 9 SOUTH AMERICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 10 BRAZIL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 11 ARGENTINA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 12 COLOMBIA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 13 REST OF SOUTH AMERICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 14 ASIA-PACIFIC CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY COUNTRY (USD BILLION) 2022-2030

TABLE 15 ASIA-PACIFIC CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 16 INDIA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 17 CHINA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 18 JAPAN CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 19 SOUTH KOREA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 20 AUSTRALIA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 21 SOUTH-EAST ASIA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 22 REST OF ASIA PACIFIC CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 23 EUROPE CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY COUNTRY (USD BILLION) 2022-2030

TABLE 24 EUROPE CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 25 GERMANY CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 26 UK CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 27 FRANCE CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 28 ITALY CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 29 SPAIN CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 30 RUSSIA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 31 REST OF EUROPE CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 32 MIDDLE EAST AND AFRICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY COUNTRY (USD BILLION) 2022-2030

TABLE 33 MIDDLE EAST AND AFRICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 34 UAE CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 35 SAUDI ARABIA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 36 SOUTH AFRICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

TABLE 37 REST OF MIDDLE EAST AND AFRICA CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER (USD BILLION) 2022-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER OF CUSTOMER, USD BILLION, 2020-2030

FIGURE 9 GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 10 GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY TYPE OF CUSTOMER OF CUSTOMER, USD BILLION, 2022

FIGURE 11 GLOBAL CHOLESTEROL SCREENING/ CHOLESTEROL TESTING SERVICES MARKET BY REGION, USD BILLION, 2022

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 MARKET SHARE ANALYSIS

FIGURE 14 ACM MEDICAL LABORATORY: COMPANY SNAPSHOT

FIGURE 15 CLINICAL REFERENCE LABORATORY, INC.: COMPANY SNAPSHOT

FIGURE 16 LABORATORY CORPORATION OF AMERICA HOLDINGS: COMPANY SNAPSHOT

FIGURE 17 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

FIGURE 18 QUEST DIAGNOSTICS INCORPORATED: COMPANY SNAPSHOT

FIGURE 19 SYNLAB INTERNATIONAL GMBH: COMPANY SNAPSHOT

FIGURE 20 FRESENIUS MEDICAL CARE HOLDINGS, INC.: COMPANY SNAPSHOT

FIGURE 21 SPECTRA LABORATORIES INC.: COMPANY SNAPSHOT

FIGURE 22 UNILABS: COMPANY SNAPSHOT

FIGURE 23 BIO-REFERENCE LABORATORIES INC.: COMPANY SNAPSHOT

DOWNLOAD FREE SAMPLE REPORT

License Type

SPEAK WITH OUR ANALYST

Want to know more about the report or any specific requirement?

WANT TO CUSTOMIZE THE REPORT?

Our Clients Speak

We asked them to research ‘ Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te

Yosuke Mitsui

Senior Associate Construction Equipment Sales & Marketing

We asked them to research ‘Equipment market’ all over the world, and their whole arrangement was helpful to us. thehealthanalytics.com insightful analysis and reports contributed to our current analysis and in creating a future strategy. Besides, the te